In this article we will discuss about the procedure for valuation of rights issue of shares with the help of numerical problems.

In order to make a rights issue the company, when making the offer, must detail the reasons for the issue, the terms of the offer, the capital structure of the company at the time of issue, the future prospects for the company, and forecasts of future dividends. The number of shares needs to buy under the pre-emptive right by the existing shareholders in proportion to their existing shares held is set by the board of directors.

The ratio is determined using a simple calculation:

Where, N = Number of rights needed to buy one new share

ADVERTISEMENTS:

The rights issue has to be priced in a way to make it attractive to existing shareholders and it must, therefore, be priced below the current market price for the shares. However, the price must not be set too low, due to the adverse effects on earnings per share. Thus in calculating the number of shares to issue to raise a given sum, account is taken of the resulting reduction of earnings per share at various issue prices.

In practice, the most common pricing mechanism is to apply a discount of 15-20% to the current market price. When a rights issue is announced, all existing shareholders have the right to subscribe for new shares, and so there are rights attached to the existing shares.

The shares are therefore described as being ‘cum-rights (with rights attached) and are traded cum rights. On the first day of dealings in the newly issued shares, the rights no longer exist and the old shares are now ‘ex-rights’ (without rights attached).

ADVERTISEMENTS:

The theoretical value of the right can be calculated by applying the following formula:

Where,

R = Theoretical value of Right

ADVERTISEMENTS:

M = Market price per share before rights issue (i.e., cum-right market price of a share)

S = Rights issue subscription price per share

N = Number of existing shares required to get a rights share

After the announcement of a rights issue, there is a tendency for share prices to fall, although the extent and duration of the fall may depend on the number of shareholders and the size of their holdings. This temporary fall is due to uncertainty in the market about the consequences of the issue, with respect to further profits, earnings and dividends.

ADVERTISEMENTS:

After the issue has actually been made, the market price per share will normally fall, because there are more shares in issue and the new shares were issued at a discount price. The ‘cum-right’ price is higher than the ‘ex- right’ price of the shares since the former includes the ‘value of right’ also.

Problem 1:

A share of American Tourister Ltd. is trading at Rs.50 per share is offered at a subscription price of Rs.35 per share. Calculate the value of right of the share assuming the number of rights needed to buy one share is 5.

Solution:

After the stock goes ex-rights, its price is reduced by an amount equal to the value of the right. This is done because an investor who buys the stock as of this date does not get a right with it, and therefore, need not pay for it.

The theoretical ex-rights value of a share is computed by using the following formula:

Where, P = Theoretical ex-rights value of share

ADVERTISEMENTS:

S = Rights issue price

M = Market price before rights issue

R = No. of rights shares issued

N = No. of existing shares

ADVERTISEMENTS:

Problem 2:

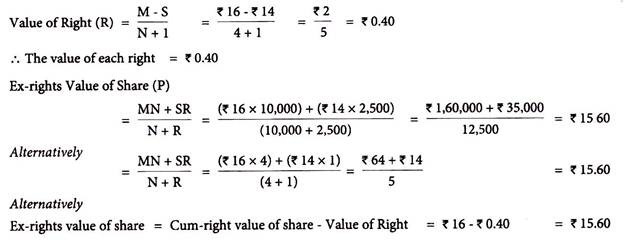

Broad ford Ltd. has a share capital of 10,000 Equity shares of Rs.10 each having a market value of Rs.16 per share. The company raises funds through rights issue by offering one new share for every four shares hold at a price of Rs.14. You are required to calculate the value of right as well as the ex-rights value of a share.

Solution:

Problem 3:

Sun Pharma Ltd. has 1,00,000 equity shares outstanding and it plans to issue 20,000 new shares, then the number of rights needed to buy each new share is 5 (i.e., 1,00,000/20,000).

ADVERTISEMENTS:

An investor who owns 4,000 shares (4 per cent) of the company’s shares would have enough rights to buy 800 (i.e. 4,000/5) of the new shares. Upon subscribing to the new issue, the investor would own 4,800 shares, or 4% of the total 1,20,000 shares now outstanding. The investor’s proportionate ownership is maintained.

Problem 4:

Kotek Ltd. decides to issue one right share for every two share held. The right shares are priced at Rs.30 each and the present cum-right price of the company’s share in the stock exchange is Rs.45. Calculate the fair value of the right.

Solution:

Value of right = Cum-right price – Ex-right price = Rs.45 – Rs.40 = Rs.5

ADVERTISEMENTS:

Problem 5:

AD Softex Ltd. decides to issue right share for every two shares held. The right shares are priced at Rs.30 each and the present cum-right price of AD Softex Ltd. share in the stock exchange is Rs.45. Calculate the theoretical ex-rights fair value per share.

Solution:

Where,

N = No. of existing shares required for a right share i.e. 2

ADVERTISEMENTS:

PO = Cum rights price per share i.e. Rs.45

S = Price at which rights shares are issued i.e. Rs.30

Problem 6:

Cipla Ltd. announced a rights issue of four shares of Rs.100 each at a premium of 160% for every five shares held by the existing shareholders. The market value of the shares at the time of rights issue is Rs.395. What is the value of right?

Solution:

Where,

r = Number of rights issued = 4

N = Number of equity shares = 5

M = Market price = Rs.395

S = Issue price of rights = Rs.100 + (Rs.100 × 160%) = Rs.260

Problem 7:

ADVERTISEMENTS:

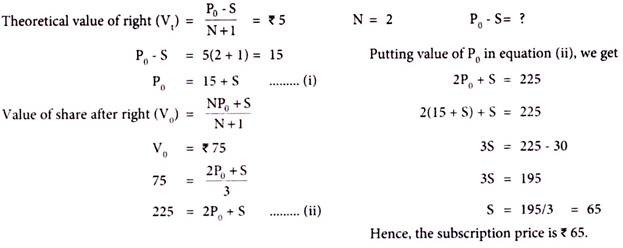

The value of a share of Morton Ltd. after right issue was found to be Rs.75. The theoretical value of the right is Rs.5. The number of existing shares required for a rights share is 2. Calculate the subscription price at which rights were issued.

Solution:

Problem 8:

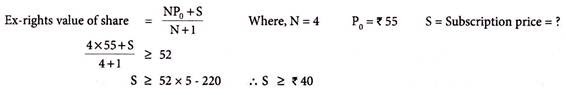

The current price of a share of Ronex Ltd. is Rs.55. The company is planning to issue one right share for every four equity shares. If the company targets that the ex-rights value of a share shall not fall below Rs.52, calculate the minimum subscription price for one rights share.

Solution:

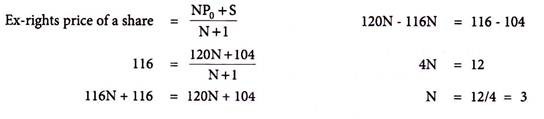

Problem 9:

The current price of a share of Veta Ltd. is Rs.120. The company is planning to go for rights issue. The subscription price for one rights share is proposed to be Rs.104. If the company targets that ex-rights value of a share shall not fall below Rs.116, what are the number of existing shares required for one rights share?