After reading this article you will learn about:- 1. Meaning of Wage Incentive Plan 2. Requirements of Wage Incentive Plan 3. Characteristic 4. Chief Objects 5. Components.

Contents:

- Meaning of Wage Incentive Plan

- Requirements of Wage Incentive Plan

- Characteristic of Wage Incentive Plan

- Chief Objects of Wage Incentive Plan

- Components of Wage Incentive Plan

1. Meaning of Wage Incentive Plan:

It is said that ‘Piece rate’ affects quality but increases production, ‘time rate’ improves quality but affects production. A system of wage payment which would maintain both quality and quantity is called Incentive Wage Plan and it is naturally a judicious combination of both basic systems of wage payments, viz,.Time and Piece Wages.

2. Requirements of Wage Incentive Plan:

Most incentive plans involve:

(i) Measurement of the amount of work done (management measures it);

(ii) Establishment of quota or standard output or the norm on the basis of which the incentive has to be worked out; and

(iii) Utilisation of a formula for relating pay to production or performance, i.e., setting up of a suitable rate of incentive, which may be subject to modification in the light of actual experience.

The quota or the norms of production fixed as a basis of wage incentive should neither be to high nor too low. If it is too high, it will be pre-judicial to labour and acceptance by trade union would be difficult. If it is too low, it would not be worthwhile for management to introduce the incentive scheme as the wage bill will be large, while productivity will be low.

3. Characteristic of Incentive Wage Plan:

The characteristics of incentive wage plan are stated below:

i. Meet Approval of Management, Workers and Trade Union:

All the interested parties must accept, support and co-operate in the Incentive Plan. In the absence of employee support, the programme of incentive will rest on a shaky foundation. The plan should be formulated through discussion and participation between management (lower level supervisors) and labour (union officials). Workers should get full explanations and they should be trained by the management for ensuring smooth working of the plan.

ii. O. & M. Studies:

Before a work standard is established, a standardised procedure or method should be evolved on the basis of organisation and methods analysis (O & M) of each operation. Employees must be taught how to perform the work according to the optimum or standard methods and procedure.

iii. Work Standard:

The norm or standard upon which wage incentive is based should be fixed through careful work measurement devices, e.g., Time and Motion Studies, Work Sampling, Standard Data, etc. Work Standard is usually measured in time.

iv. Guaranteed Base Wage:

Normally the base rate is determined by job evaluation. We can have differential base rates reflecting properly differences in skill, effort, responsibility and job conditions. The employee should be assured of a certain minimum wage irrespective of output which may be dropped due to the circumstances beyond his control. Base rate of compensation incorporates the desirable advantage of time wage in Incentive Plan, viz., security of income.

v. No Unwarranted Rate Cutting:

The work standard or quota, in time or money per unit, must be guaranteed by management against unilateral and unwarranted rate cutting. The practice of rate cutting by the employers at their will during the early days of scientific management killed the very purpose of Incentive Plan, viz., higher productivity and lower unit cost of labour.

A change in the work standard is justifiable only when there is a change in the method, tooling, equipment or design of the product.

vi. Easy Calculation of Earnings:

An Incentive Plan should facilitate ready and easy calculation of the employee’s earnings. This will build up the confidence and trust in the programme. Complexity is one of the basic drawbacks of many incentive plans. Management should try to simplify it as far as possible.

vii. Grievance Procedure:

An incentive plan of wage payment should have effective grievance procedure to deal with complaints and dissatisfaction ventilated by employees. The work standard or the incentive rate may be too tight rates difficult to meet can be adjusted through grievance procedure.

Unless mutual confidence and good relationship exist between management and labour in a business unit, the chances of full success of a new incentive system are very poor.

4. Chief Objects of Incentive System:

A wage incentive plan is usually adopted to realise the following objectives:

1. Increase in Productivity.

2. Reduction in Labour Cost

3. Improvement in Efficiency.

4. Rise in Employee’s Earnings.

5. Higher Employee Morale.

6. Better Labour-Management Relations.

Incentive factor alone can remove the glaring disadvantages of time wage; at the same time, wage element of guaranteed minimum base wage in the incentive plan can remove the basic drawback of piece wage. Thus, under incentive system both quantity and quality of output clan be duly secured by the management.

5. Components of Incentive Plan:

1. Establishment of standard output task or quota on which incentive earnings are based Time and Motion Studies.

2. An hourly or base or standard rate of compensation, e.g., Rs. 5/- per hour, for similar jobs put on incentive Job Evaluation Technique.

3. Incentive or Bonus or premium rate for extra output of higher efficiency.

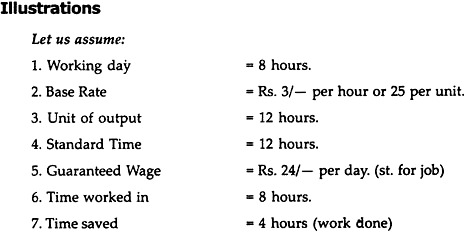

A firm can devise its own incentive plan with base rate using four basic elements:

(i) Unit of output,

(ii) Time saved,

(iii) Time worked and

(iv) Standard time.

1.100 Per Cent Time Premium Plan:

1. Guaranteed base rate received by the worker even if he fails to meet standard performance.

2. Earnings are directly proportional to production above the standard. Worker gets Rs. 36/- (Rs.8 ×3 + Rs.4 × 3, i.e., Rs.36/-)

As his efficiency is 150 per cent he would get 50 per cent more remuneration. Entire benefit of efficiency or time saved is passed on to the worker. There is no gain sharing as such.

2. Rowan Plan:

Efficiency percentage Time Saved/Standard Time

In our case 4/12 = 33. 33%

Guaranteed wage = Rs.24/-

Bonus = 1/3 of Rs.24/-, i.e., 8/-

Total wage under Rowan Plan = Rs.32/-

1. It involved variable sharing arrangement that changed continuously as output increased.

2. It is used when performance standard is very poor and management wants automatic break upon the total income. No employee can double his wages, howsoever efficient he may be.

3. Rowan Plan was difficult to understand and did not generate employee support.

3. Halsey Plan:

1. It is a 50-50 Bonus Plan.

2. It was devised before Time and Motion Studies; hence it was based upon past performance or Time Wage.

3. In our case, worker will get Rs.8 × 3 (Rs.24/-) + 4x3x2/2 (Rs.6/-) or in all Rs.30/-. He is paid a bonus of 50 per cent times his hourly wage rate multiplied by the time saved. Note that under 100 per cent Efficiency Bonus worker would be paid for 100 per cent of the time saved.

4. Halsey Plan is to prevent the worker from running away with the rate.

4. Bedaux Plan:

1. Worker will get 75 per cent Time Saving Bonus.

2. 25 per cent is given to other management personnel, e.g., supervisor, set-up man who made standard possible.

3. In our, case, he will get Rs.24 (8 x 3) + Rs.9 (4 x 3 x %), i.e., Rs.33/- only.

5. Gannt Task and Bonus Plan:

1. It guarantees hourly base rate. Substandard worker gets guaranteed wage.

2. It is simple, easily understandable and it can be easily introduced.

3. It offers both Security and Incentive (handsome bonus).

4. It also facilitates planning and supervision.

5. It becomes a piece rate when workers exceed the standard.

6. For less than 100 per cent efficiency, there is no Bonus. But for 100 per cent efficiency we have 20 per cent Bonus.

Efficient Worker gets wages on the piece rate. Beyond the standard time fixer1, the piece rate is on the diminishing scale. Hence, no speeding-up of work is allowed.

In our example, if the employee does not meet the standard, he gets Rs.24/- per day; if he does 8 standard hours of work during this 8 hours-day he gets value of this (Rs.24/-) + a bonus of 20 per cent of Rs.24/-, i.e., Rs.28.80 (20 per cent bonus for 100 per cent performance). The bonus is fixed generally from 20 to 50 per cent of the time allowed and not time saved.

6. Taylor’s Differential Piece Rate Plan:

It provides two piece rates:

(a) A lower rate when the output is below the standard amount or quota and the performance is average or below the average.

(b) A higher rate of payment when the worker exceeds or equals the standard output. The standard output is fixed after careful analysis and study. It penalizes rather severely those who are not able to attain the standard.

Illustration:

Standard output = 40 units per hour. 1st rate for output below 40 units = 30 paise per unit. If a worker produces 39 units, he will get only Rs.11. 70 (39 × 30). 2nd Rate for output of 40 units and above may be, say 40 paise per unit.

If a worker produces 40 units, he will get Rs.16/-, i.e., if he produces just one more unit, he will have Rs.4. 30 increase in his remuneration.

The differential piece rate gives a premium on efficiency and can certainly secure higher productivity. But it is very harsh for those who are a little less efficient, i.e., who are just on the marginal output. It is not a practical method and Trade Unions cannot accept such a plan as it breaks the solidarity of labour.

7. Scanlon Plan:

The Scanlon Plan has two parts:

1. A plant-wide wage incentive arrangement for which the standard is set by accounting methods and not by time study.

2. Cost-cutting campaign through Union-Management co-operation.

It is a good device for raising productivity. It allows sharing of gain due to rise in productivity by all employees. The problem of production and efficiency is solved through a unique suggestion plan.

8. Emerson’s Efficiency Plan:

It provides a sliding scale of bonuses. For efficiency below 66. 66 per cent only, Time Wage and ho bonus At 66. 66 per cent efficiency — Time Wage +1 per cent of day wage. At 90 per cent efficiency — Time Wage + 10 per cent of day wage. At 100 per cent or more efficiency — Time Wage + 20 per cent of day wage.

Illustration:

Standard Time is 8 hours:

If a worker does it in 16 hours his efficiency is only 50 per cent; if he does it in 4 hours, his efficiency will be 200 per cent if he is able to do it in just 8 hours, his efficiency will be 100 per cent.

If the standard output is 80 units in 8 hours and daily wage is Rs.25/- per day, and if the worker produces only 80 units in 8 hours, he will get Rs.25/- + 20 per cent of Rs.25/-, i.e., Rs.25 + Rs.5/-= Rs.30/- for 8 hours work.

If he needs 12 hours to produce 80 units, his efficiency is only 66. 66 per cent and he will get Rs.37. 50/- for 12 hours work, i.e., time wage for 1 ½ days.

Advantages of Emerson’s Plan:

1. It is easy to understand.

2. It is suitable for beginners.

3. It gives incentive for skilled and efficient workers.

4. Calculations are logical as we have a fair basis for incentive to produce more.

5. It can be applied to both individuals as well as group of workers.

However, it has one drawback. Once you reach the standard efficiency, i.e., 100 per cent, further incentive is very mild. Hence, it is unsuited for ambitious workers.