Everything you need to know about the the concept of wages in HRM (with minimum wages calculation).

Wages may be used to describe one of the several concepts, including wage rates, straight time average hourly earnings, gross average hourly earnings, weekly earnings, weekly take home pay and annual earnings.

Money paid to the workers is considered as wages. The wage is the payment made to the workers for placing their skill and energy at the disposal of the employer.

The method of use of that skill and energy is being at the employer’s discretion and amount to the payment being in accordance with the terms stipulated in a contract of service. Various terms that are currently in use in the payment system are wages, pay, compensation and earnings.

ADVERTISEMENTS:

In this article we will discuss about the various concepts of wages. Learn about:- 1. Statutory Wages 2. Basic Wages 3. Minimum Wages 4. Fair Wages 5. Living Wages 6. Need Based Wages 7. Money Wages and Real Wages.

Learn about the Concept of Wages (with Minimum Wages Calculation) in HRM

Concept of Wages – Statutory, Basic, Minimum, Fair, Living, Need Based, Money and Real Wages

The term wages may be used to describe one of the several concepts, including wage rates, straight time average hourly earnings, gross average hourly earnings, weekly earnings, weekly take home pay and annual earnings. Money paid to the workers is considered as wages.

The wage is the payment made to the workers for placing their skill and energy at the disposal of the employer. The method of use of that skill and energy is being at the employer’s discretion and amount to the payment being in accordance with the terms stipulated in a contract of service. Various terms that are currently in use in the payment system are wages, pay, compensation and earnings.

Concept # 1. Statutory Wages:

By it, we mean the minimum amount of wages which should essentially be given to the workers as per the provisions of the Minimum Wages Act, 1948. It is the wage determined according to the procedure prescribed by the relevant provisions of the Minimum Wages Act, 1948.

ADVERTISEMENTS:

Once the rates of such wages are fixed, it is the obligation of the employer to pay them, regardless of his ability to pay. Such wages are required to be fixed in certain employments where “sweated” labour is prevalent, or where there is a great chance of exploitation of labour.

Concept # 2. Basic Wages:

This minimum wage is fixed through judicial pronouncement, awards, industrial tribunals and labour courts. The employers are essentially to give this minimum wage to the workers. Bare or Basic Minimum Wage is the wage, which is to be fixed in accordance with the awards and judicial pronouncements of Industrial Tribunals, National Tribunals and Labour Courts. They are obligatory on the part of employers.

Concept # 3. Minimum Wages:

A minimum wage is one which has to be paid by an employer to his workers irrespective of his ability to pay. According to the Fair Wage Committee, “Minimum wage is the wage which must provide not only for the bare sustenance of life, but for the preservation of the efficiency of the workers. For this purpose, minimum wage must provide some measure of education, medical requirements and amenities.”

Subsequent to the committee’s report, Government enacted legal provisions regarding minimum wages under the Minimum Wages Act. 1948. This Act does not define the concept of minimum wages but empowers the Central Government as well as State Governments to fix minimum wages from time to time. Wherever this Act applies, the payment of minimum wages is mandatory.

ADVERTISEMENTS:

The concept of minimum wages has developed due to different standards in different countries. In Indian context, minimum wage means the minimum amount which an employer thinks necessary for the sustenance of life and preservation of the efficiency of the worker.

Minimum wage legislation is the main labour legislation for the workers in unorganized sector. In India, the policy on wage determination had been to fix minimum wages in sweating employments and to promote fair wage agreements in the organized industries.

Wages in the organized sector are determined through negotiations and settlements between employer and employees. On the other hand, in unorganized sector, where labour is vulnerable to exploitation due to illiteracy and does not have effective bargaining power, the intervention of the Government becomes necessary.

The Minimum Wage Act, 1948 provides for fixation and enforcement of minimum wages in respect of schedule employments to prevent sweating or exploitation of labour through payment of low wages. The main objective of the Act is to ensure a minimum subsistence wage for workers.

ADVERTISEMENTS:

The Act requires the appropriate government to fix minimum rates of wages in respect of employment specified in the schedule and review and revise the minimum rates of wages at intervals not exceeding five years.

Once a minimum wage is fixed according to the provisions of the Act, it is not open to the employer to plead his inability to pay the said wages to his employees.

The minimum wage rate may be:

(a) Time rate,

ADVERTISEMENTS:

(b) Piece rate,

(c) Guaranteed time rate, and

(d) Overtime rate.

The Act provides different minimum wage rates may be fixed for:

ADVERTISEMENTS:

(a) Different scheduled employments,

(b) Different works in the same employment,

(c) Adult, adolescent and children,

(d) Different locations, or

ADVERTISEMENTS:

(e) Male and female.

Such minimum wage may also be fixed by:

(a) An hour,

(b) Day,

(c) Month, or

(d) Any other period as may be prescribed by the notified authority.

ADVERTISEMENTS:

In order to protect the minimum wages against inflation, the concept of linking it to the rise in the consumer price index was recommended at the labour ministers’ conference in 1988. Since then, the concept of Variable Dearness Allowance (VDA) linked to consumer price index has been introduced.

The VDA is revised twice a year in April and October. The Centre has already made provision in respect of all scheduled employments in the central sphere. 22 states and Union Territories have adopted VDA as a component of minimum wage.

The fixation of minimum wage in India depends upon various factors like socio-economic and agro-climatic conditions, prices of essential commodities, paying capacity and the local factors influencing the wage rate. For this reason, the minimum wages vary across the country.

Objectives of Minimum Wage:

i. To prevent exploitation of workers and secure a wage equal to work load.

ii. To raise the wages in the industries where the wages are low, thus prevent sweating in industry.

ADVERTISEMENTS:

iii. To promote peace in industry by guaranteeing a wage rate this will enable them to meet their minimum requirements.

iv. Raise the standards of living and efficiency of workers.

Concept # 4. Fair Wages:

The Government of India appointed a Fair Wages Committee in 1948 to determine the principles on which fair wages should be based and to suggest the lines on which those principles should be applied. The concept of fair wage is linked with the capacity of the industry to pay.

The committee has defined fair wage as follows:

“Fair wage is the wage which is above the minimum wage but below the living wage. The lower limit of the fair wage is obviously the minimum wage; the upper limit is to be set by the capacity of the industry to pay.”

Thus the fair wages depends upon the following factors:

ADVERTISEMENTS:

(a) Minimum Wages

(b) Capacity of the industry to pay

(c) Prevailing rates of wages in the same or similar occupations in the same or neighbouring localities

(d) Productivity of labour

(e) Level of national income and its distribution

(f) The place of the industry in the economy of the country

Concept # 5. Living Wages:

ADVERTISEMENTS:

According to the report of Fair Wage Committee, “The living wage should enable the male earner to provide for himself and his family not merely the bare essentials of food, clothing and shelter, but also a measure of frugal comfort including education for children, protection against ill health, requirements of essential social needs and a measure of insurance against the more important misfortunes including old age.”

According to the Committee on Fair Wages, the living wage represents the highest level of the wages and includes all amenities which a citizen living in a modern civilized society is to expect when the economy of the country is sufficiently advanced and the employer is able to meet the expanding aspirations of his workers. The living wage should be fixed keeping in view the national income and the capacity of the industry to pay.

The Constitution of India envisages a just and humane society and accordingly gives place to the concept of living wage in the chapter on Directive Principles of State Policy. The Minimum Wages Act, 1948 is based on Article 43 of the Constitution of India which states that, “The State shall endeavour to secure by suitable legislation or economic organisation or in any other way to all workers, agricultural, industrial or otherwise, work, a living wage conditions of work ensuring a decent standard of life and full enjoyment of leisure and social and cultural opportunities”.

Living wage is determined keeping in view the national income and paying capacity of industrial sector. The Committee also observed that since the national income did not support the payment of living wage. It should be implemented in three phases.

In the initial stage, the wages to be paid to the entire working class were to be established and stabilized. In the second phase, fair wages were to be established in the community and industry. In the final phase, the working class was to be paid the living wage.

Concept # 6. Need Based Wages:

The Indian Labour Conference at its 15th session held at New Delhi in July, 1957 suggested that minimum wage fixation should be need based. In the absence of any criteria stipulated for fixing the minimum wage in the Minimum Wages Act, the Indian Labour Conference in 1957 had said that the following norms should be taken into account while fixing the minimum wage.

ADVERTISEMENTS:

The norms for fixing minimum wage rate are:

(a) Three consumption units per earner,

(b) Minimum food requirement of 2,700 calories per average Indian adult,

(c) Cloth requirement of 72 yards per annum per family,

(d) Rent corresponding to the minimum area provided under the Government’s Industrial Housing Scheme and

(e) Fuel, lighting and other miscellaneous items of expenditure to constitute 20 per cent of the total minimum wage

(f) Children education, medical requirement, minimum recreation including festivals/ ceremonies and provision for old age, marriage, etc. should further constitute 25% of the total minimum wage.

Computation of Minimum Wages:

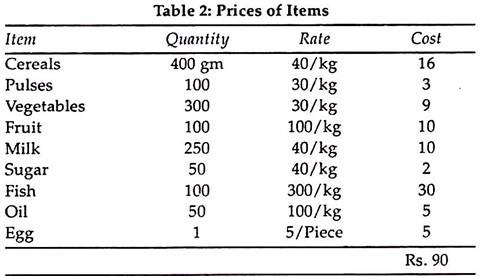

Let us assume the prices of following:

For 3000 calories, required amount is Rs. 90.

For 2700 calories, required amount is = (90 x 2700)/3000 = Rs.81

(i) 81 x 3 persons x 30 days = Rs. 7,290

(ii) Let us assume the following prices of cloth i.e Rs.200/ yard = 200 x 72 = Rs.14, 400

Therefore, monthly expenses is = Rs.14, 400 /12 = Rs.1,200

(iii) Let us assume the Government rate for housing for this category of employees in the nearby industrial area is Rs.2, 000.

(iv) Fuel, lighting and other miscellaneous items of expenditure

= (Rs. 7,290 + Rs. 1,200+ Rs. 2,000) x 20% = Rs. 2,098

(v) Children education, medical requirement, minimum recreation including festivals/ ceremonies and provision for old age, marriage, etc.

= (Rs. 7,290 + Rs. 1,200 + Rs. 2,000) x 25% = Rs. 2,622.50

Therefore, the minimum wage will be = (Rs. 7,290 + Rs. 1, 200 + Rs.2, 000 + Rs. 2,098 + Rs. 2,622.50) = Rs. 15,210.50.

Concept # 7. Money Wages and Real Wages:

There are two types of wages that can be paid viz. Money Wage and Real Wage. Money wages or nominal wages are wages that are paid to a person regardless of the inflation rate in the market. Many companies use this method to pay their employees.

Money wages include the whole salary package of the employee such as basic salary plus any additional benefits that are provided by the company or institution. Money wages do not take into consideration the purchasing power and the employee receives the amount that is promised to him when he/she is hired. Raise in money wages are also solely dependent on the employer rather than economic conditions of the country or the purchasing power of an employee.

Real wages are wages that take into consideration the inflation rate. Real wages are wages that determine the purchasing power of the individual or how much goods the salary can buy. Real wages can also be defined as the amount of goods and services that can be bought from the individual’s wages after taking inflation into account.

According to J.L. Hanson, “Real wages is the wages in terms of the goods and services that can be bought with them.” This shows that real wages show the purchasing power of the person.

Real wages indirectly affect the money wages, since as real wages rise, they may force employee to demand a higher money wage. Money wages may or may not affect real wage, but higher money wages can increase the cost of living which could indirectly affect the real wage.

Formula:

The formula to calculate a real wage is relatively simple. Let’s see how we can do it with the consumer price index (CPI), which is readily available online from the Indian Bureau of Labour and Statistics.

The consumer price index is one of several indexes of consumer goods and services that keep track of changes in the price level. You can determine whether prices are rising or falling year over year by reviewing the numbers.

You can use the following formula, along with the CPI, to calculate real wages:

Real Wage = (Old Wage x New CPI)/Old CPI

Example:

Imagine that in 2010, your nominal wage was Rs. 18.00 per hour and you received a 2% pay increase in 2011, making your nominal wage Rs. 18.36 per hour. The consumer price index for 2010 was Rs. 218.056 and in 2011, it was Rs. 224.939. What was your real wage?

Real Wage = (Old Wage x New CPI)/Old

CPI Real Wage = (18 x 224.939)/218.056

Real Wage = 4,048.902/218.056

Real Wage = Rs. 18.57

Concept of Wages – Statutory, Bare and Minimum Wage Concept

Wage Management is of great significance in the study of Personnel Management. How much wages he paid to the employees, has been a debatable question. Wage is like a pivot round which labour problems revolve. It is pretty difficult to determine wage-rate. The entrepreneur is keen to pay minimum possible wage to the labourers while the labourers want to get maximum wage from the entrepreneur. To bring about synthesis between the satisfaction of the labourers and interests of the employers is what is called determination of wage.

Historically, satisfaction of the workers and interest of the employees both have been open to question.

Different opinions on this issue have led to the emergence of the following concepts:

(i) Concept of Statutory Minimum Wages.

(ii) Bare or Minimum Wage Concept.

(iii) Concept of Minimum Wage.

(iv) Concept of Fair Wage.

(v) Concept of Living Wage.

A more detailed study of these concepts is as under:

(1) Statutory Minimum Wages:

According to this concept wages are so determined by the employers as to conform to the provisions of Minimum Wages Act 1948. Under the Act, minimum wages are determined so that no labour is paid less than the minimum fixed nor is he exploited. The employer has got to pay statutory minimum wages, irrespective of his capacity to pay.

(2) Bare or Minimum Wage Concept:

It is that wage-rate which is determined by judicial pronouncements, Awards, Industrial Tribunals, Labour Courts and National Tribunals. The employer is legally bound to pay this amount.

(3) Minimum Wage Concept:

The term “minimum wage” means least possible or lowest wage. It is that rate of wage, less than which is neither paid nor accepted. Under minimum wage concept, main objective of Minimum Wage Act 1948 was to keep the labour class satisfied and to maintain industrial peace in the country. Minimum wage implies that wage-rate which is essential to maintain standard of living, health, social dignity and efficiency of the concerned labourers.

While determining minimum wage, it must be taken into account that its amount should be such as to meet the bare necessities of life and also provide such facilities to the employees as are essential to maintain their efficiency.

According to All India Employers Organisation, “That rate of wage which satisfies the physical needs of the worker and his family, is called minimum wage.”

From humanitarian as also from legal point of view labourers must get minimum wages as it checks their exploitation and also eliminates inefficient employers.

Concept of Wages – With Factors, Difficulties and Principles

Concept # 1. Minimum Wages:

Concept of minimum wages is an old concept. In 1928, a resolution was passed by International Labour Conference that all member countries should take necessary steps in the direction of determining minimum wages. It was also recommended in this resolution that in those industries where to regulate wages provisions for collective bargaining and bi-partite machinery exist, and wage rate is very low, there should be set-up machinery for determining minimum wage.

In 1928, Royal Commission on Labour also made recommendation to the effect that minimum wages be fixed in India.

Minimum Wage refers to that lowest amount which a labourer must get legally or that least possible limit of wage which is fixed by an act of legislation. It is that amount of wage less than which will not be accepted by the labourer nor paid by the employer. According to employer point of view, minimum wage is that wage which fulfils the bare physical needs of the labourer and his family. But it is a narrow definition.

In the words of Fair Wage Committee, “The ‘Minimum Wage’ must provide not merely for the bare sustenance of the life but for the preservation of the efficiency of the worker by providing for some measure of education, medical requirements and amenities. It is the absolute minimum below which the wages should not fall.” It is a broad definition of minimum wage. According to it, minimum wage is a must for satisfying the necessaries of life of the workers. With it, the worker can maintain his efficiency.

It includes provision for education, medical requirements and allied facilities. Efficiency of labour very much depends upon his wages. If wage-determination is left to the employers, they can exploit the workers. It is to check this exploitation that fixation of minimum wage becomes inevitable. In our country Minimum Wages Act 1948 has been passed with the objectives of saving the workers from exploitation, increasing their efficiency, improving their standard of living, increasing production and promoting labour welfare.

The Act has authorised the government to fix wages of the labourers engaged in scheduled employments. There is a provision for reviewing and amending its rate after every 5 years. Minimum wages must be paid in these scheduled employments irrespective of the ability of the industry to pay the same.

In this context, Supreme Court in a judgment delivered in the case of Reptakos Brett and Co. Ltd. vs. Management pronounced that an employer has no right to get work from the labourers nor is he justified in running the industry if he cannot pay minimum wages to the labourers.

In the 15th session of Indian Labour Conference 1957 it was suggested that minimum wages must be need-based.

The session set the following standards for determining need-based minimum wages:

(i) For the purpose of determining minimum wage, in a standard working-labour family three consumption units be included. In other words, in the family of a labourer, besides the bread-winner, three other dependents be included. Income earned by wife, children and adolescents is not to be included.

(ii) There should be provision of minimum 2700 calories (as per Dr. Aykroyd) of food for every adult member of the family.

(iii) Need for Cloth be calculated at the rate of 8 yards of cloth per person per year. Thus an average labour family of 4 members would need 32 yards of cloth per year.

(iv) Regarding housing, the minimum rent charged by the government from low income group for the house in any area under subsidised Industrial Housing Scheme, the same will be payable to the labourer under minimum wage fixation scheme.

(v) 20% of the total expenditure will be reckoned as expenditure on fuel, light and other miscellaneous expenses for the purpose of fixation of minimum wages.

At the time of determining minimum wages, above standards be taken into account. According to the Conference, while fixing Need Based Minimum Wage, paying capacity of the industry should also be taken into consideration.

In 1978, Bhoothalingam Committee on Wages, Income and Prices also made an attempt to determine minimum wages at national level.

Keeping in view the differences in wages of the labourers and the paying capacity of the industry, National Labour Commission, suggested minimum wages be fixed at the regional level. It is not possible to determine minimum wages at the national level. Thus, minimum wages be determined separately for each industry and state according to their paying capacity.

Minimum Wage Rates:

Under Minimum Wage Act 1948, government can fix wage rates as follows:

(1) For payment of wages according to time, “Minimum Time Rate”.

(2) For payment of wages according to work, “Minimum Piece Rate”.

(3) Guarantee Rate – It is that minimum rate which is paid to such labourers as are employed on piece-rate but wages are determined on time-rate.

(4) Overtime-Rate – Minimum rate fixed for extra work done by the labourers is called overtime rate. This rate applies to all kinds of employees, whether employed on time-rate or piece-rate.

(5) Different Wage Rates – It refers to that minimum rate which is fixed for different categories of workers working in the same scheduled employment i.e. old, young, child and fresher.

Principles of Minimum Wages:

Following principles are taken into account while determining minimum wages:

(a) Principle of Fair Wage:

It means that wage rate of employees with equal efficiency and experience working in the same industry should be equal.

(b) Firm’s Capacity to Pay:

At the time of fixing minimum wage-rate it should be taken into consideration whether it is within the capacity of the firm or industry to pay. Because, it can have far-reaching consequences. Lack of capacity to pay minimum wages may lead to closure of the industry and thus cause unemployment. Thus the entire economy cannot remain unaffected.

(c) Standard of Living Principle of Wage:

While determining the rate of minimum wage, basic necessaries of the labourers (food, clothing and shelter) must be kept in view. Standard of living or cost of living is different at different places. A given amount of minimum wage at all places is not fair. With change in the standard of living of the labourers rates of minimum wage at all places is not fair. With change in the standard of living of the labourers rates of minimum wages must also be changed or modified accordingly.

Difficulties in Determining the Minimum Wages:

What should be the minimum wage? It is usually difficult to decide and many problems do arise in this context.

The same are described as under:

(a) Lack of Base Level:

First problem of determining the minimum wage is that of base level. If low wage rate is taken as base level to determine minimum wage, this will cause dissatisfaction among the labourers and if high wage-rate is taken as base level it will definitely benefit unskilled labourers but skilled and competent labourers will not be able to take full advantage of their skill and efficiency; besides this, the industrialist also faces loss.

(b) Demands of Workers and Firm’s Capacity to Pay:

Another vexatious problem of fixing minimum wage relates to the demands of the workers. Labourer always demands high wage rate but the employer takes into account firm’s capacity to pay, because high wage payment implies loss to the firm. Under the circumstances, minimum wage determination should be based on national living standard.

(c) Cost of Living Index:

Cost of living undergoes change along with change in time and place. To fix minimum wage rate it is essential to take price-level into account. It necessitates cost of living indexes. Thus, such indexes are constructed from time to time and minimum wage-rates are amended accordingly.

(d) Difference in Efficiency of the Labourers:

Difference in efficiency among the labourers is another problem to be faced in determining minimum wages. Some labourers are exceedingly efficient and skillful as against the others. Justice demands that all the labourers be not treated at the same level while determining minimum wage. Thus, difference in minimum wage between skilled and unskilled labourers and between trained and untrained labourers is natural.

Concept # 2. Fair Wages:

It should be the objective of each industry to pay living wage to its labourers. Payment of living wage may not be possible in under-developed and developing countries. So much so that even all developed countries have not yet been able to achieve this objective completely.

Wages are influenced by the paying capacity of the industry or the wages paid by the industry of the same nature in that area or in other places. To determine such a rate of wage by the industry as is fair from the point of view of payment is called fair wage.

In simple words, that rate of wage is called fair wage which is equal to the wage rate paid to other labourers working in similar industry and are also paid at the same rate, in other similar industries, in that area.

According to Committee on Fair Wage 1949, fair wage is a wage determined in between minimum wage and living wage. Minimum wage is the lowest limit of Fair Wage and its highest limit is set by the paying capacity of the industry.

Factors which determine fair wages are:

(i) The productivity of labour.

(ii) The prevailing rates of wages.

(iii) The level of National Income and its distribution.

(iv) The place of the industry in the economy of the country.

Committee on Fair Wages has expressed the following views on the payment of fair wages:

(i) Initially, fair wages should be the same as prevail in the area at present. However, level of this wage can be raised later on according to the capacity of the Industry to pay.

(ii) Wages determined by collective bargaining, arbitration and adjudication may be treated as mere primary wage. If the capacity of an industry to pay is more, then this rate of wage may also be treated as fair wage.

(iii) Lower limit of fair wage should be equal to minimum wage and its objective should be to earn living wage.

Concept # 3. Living Wage:

It is that wage which motivates the labourers to increase productivity, keeping the quality of the product intact. Article 43 of the Directive Principles of State Policy of the Indian Constitution States- “State shall endeavour to secure all workers a living wage.”

While determining living wage, following provisions must be kept in view:

(1) Basic necessities of the workers (Food, Clothing and Shelter).

(2) Proper comforts to the workers, such as-

(i) Education of the children

(ii) Protection against sickness

(iii) Satisfaction of social needs

(iv) Insurance against old-age and uncertain future and provision of necessary funds as security measure.

(3) Development and entertainment of workers themselves.

In the words of Justice Higgins of Australian Common Wealth Court of Conciliation, “Living wage is a wage sufficient to ensure to workman food, shelter, clothing, frugal comfort, provision for evil days, etc. as well as regard for the skill of an artisan if he is one.”

Fixation of Living Wage depends upon the following factors:

(i) Bargaining Capacity of the workers.

(ii) Capacity of the Industry to pay.

(iii) Level of national income.

(iv) Effect of wage-rise in one industry on nearest other industries.

(v) Productivity of the workers.

(vi) Place of industry in national economy.

(vii) Prevailing wage-rates, etc.