Strategy refers to the basic goals and objectives of the organisation, the major programmes of action chosen to reach these goals and objectives and major pattern of resource allocation used to relate the organisation to its environment.

According to Chandler, “Strategy is the determination of the basic long-term goals and objectives of an enterprise and the adoption of courses of action and the allocation of resources necessary to carry out these goals and objectives”.

Some of the types of strategies are:- 1. Corporate Strategies 2. Directional Strategy 3. Functional Strategies 4. Operating Strategy 5. Defensive Strategy 6. Expansion Strategy.

Some of the directional strategies are:- 1. Growth Strategy 2. Stability Strategy 3. Retrenchment Strategy 4. Combination Strategy.

ADVERTISEMENTS:

Some of the other types strategies are:- 1. Planned Strategy 2. Entrepreneurial Strategy 3. Ideological Strategy 4. Umbrella Strategy 5. Process Strategy 6. Disconnected Strategy 7. Consensus Strategy 8. Imposed Strategy.

In recent times, three more strategies have gained popularity namely: 1. Joint Ventures 2. Strategic Alliances 3. Consortia.

Types of Strategies

Types of Strategies – Growth Strategy, Stability Strategy, Retrenchment Strategy and Combination Strategy

Strategy may be defined as an integrative, comprehensive plot designed to achieve particular objective. It presupposes internal and external environment analysis. Strategy formulation or development of alternatives is done in the light of certain factors such as current status of the company, level of market in which it operates, available of opportunities, etc.

Broadly speaking, strategy planners have the following variants/types of strategies available:

Type # 1. Growth Strategy:

ADVERTISEMENTS:

Growth strategy, signifies decisions of management to lift up from the existing level of operations. Various decisions of the company reflecting the adoption of growth strategy are increasing the market share, raising the standards or levels of objectives, increasing the sales revenue, increasing the market of operations, expanding the existing product line or expanding business through mergers and acquisitions. Adoption of growth strategy is an indicator of organisational prosperity and success.

The basic reasons underlying adoption of growth strategies are given below:

1. Source of Strength – A company which is consistently growing is often perceived to be a preferable company vis-a-vis a company which is not expanding. It is a vicious cycle, growing company attracting better management which in return bringing growth for the company.

2. Necessary for Survival – Stagnancy is only short-lived. In a volatile and competitive environment where changes are very radical, survival of companies is possible only if they pace up with the environmental changes. Companies should be very prompt in tapping up the opportunities and overcoming the threats.

ADVERTISEMENTS:

3. Rewarding Phenomenon – Growth strategy is adopted when company foresees the possibility of progress. This in turn leads to fetching of higher returns and increased pay packages.

4. Motivational Factor – Being an employee of a growing company gives a lot of motivation and satisfaction to the employees. Growth of the company takes due care of basic and recognition needs of the personnel. Besides, growth is perceived as a source of inspiration to work more as it is rewarding.

Growth implies stepping up of company from the existing level of its operations by way of market share, product line, sales revenue, etc.

ADVERTISEMENTS:

This expansion is done by adoption of growth strategy which may have following variants:

1. Internal/Intensive Growth Strategy:

Internal growth strategy, as the name indicates, is a strategy adopted for growth of the company through internal rearrangement of resources or upliftment of standards and objectives. Internal growth strategy is also known as intensive growth strategy.

Following are the various ways through which internal growth strategy may be adopted:

ADVERTISEMENTS:

i. Expansion:

Expansion refers to increasing the sales of the company by way of increasing the market share, sales revenue and product variations of the existing product line or products. The very purpose of expansion is to tap the opportunities posit by the external environment, efficient utilisation of the resources and brings competitive advantage.

Any business can be expanded through:

a. Market Penetration Strategy – This strategy aims at selling the existing products in the existing markets only. In this strategy, various other methods to penetrate into the market is adopted such as – price reduction, increase promotional activities, increase distribution network, etc.

ADVERTISEMENTS:

b. Market Development Strategy – This strategy involves increasing the sales of existing products by exploring new markets. Market deployment strategy is primarily helpful when the product has reached a saturation point in a particular market and hence aims at reaching new customers in new geographical areas. New markets may be local or international markets.

c. Product Development Strategy – This strategy involves making certain changes in the existing product and selling in the same market. This may be carried out by bringing in more uses of the same product, varying the size of the product, bringing in more alternatives of the same product, etc.

ii. Modernisation:

This strategy involves increasing sales volume by bringing modified or new products in the same market segment. Due to technological advancements and developments, products become obsolete very quickly. Modernisation is one of the ways to grow with the market by launching updated products. For example, launching smartphones instead of normal phones, launching LED TV instead of LCD TV.

ADVERTISEMENTS:

iii. Horizontal Diversification:

A firm adopts diversification strategy by exploring new product lines to be launched in new or existing markets. Diversification as a growth strategy is called as an internal strategy of an organisation when it is done by the organisation itself without joining hands with other organisations. Diversification is called as horizontal when company plans to expand by entering into new product line parallel to their existing products.

Horizontal diversification can be of two types:

a. Concentric Diversification – It is that type of diversification strategy which involves introduction of new products or services similar to the existing product line of the company. For example, AMUL adding on cheese and milk shakes to the existing product line.

b. Conglomerate Diversification – In this type of diversification, company adds dissimilar product to the existing product lines. According to Norman Berg, ‘a firm is called a conglomerate if it has at least five to six divisions selling different products principally to external markets.’ For example, Tata Group has diversified into automobiles, consultancy, edibles, etc.

2. External/Integrative Strategy:

ADVERTISEMENTS:

External growth strategy may be defined as adoption of those strategic decisions which involve expansion by way of joining hands with other companies. Internal growth is not eternal. After certain period of time, it is not possible to grow internally without any external support.

Various ways through which external support may be sought are collaboration, mergers, acquisitions, takeover, joint venture, etc. With the help of above modes, companies may go for integrative growth strategies. Normally, external strategy is possible only through diversification strategy.

It can be of two types:

i. Horizontal Diversification:

Whenever diversification into similar product lines is done by joining hands with some external company, horizontal diversification becomes a part of external growth strategy.

ii. Vertical Diversification:

ADVERTISEMENTS:

Vertical diversification is a type of growth strategy where company enters into such product lines which complement the existing product lines of the company. Thus, it involves either moving back or moving ahead from the existing product or service level in order to create linkages.

So, vertical integration may be:

a. Backward Integration – Here, a company aims at expanding through producing products which serve as an input or raw material to the existing product line of the company. For example, a shirt manufacturing company collaborates with the company manufacturing cloth.

b. Forward Integration – Here, a company aims at expanding through entering into the business of finishing, distributing or selling of existing product lines. It is sometimes referred to as downstream expansion. For example, a textile manufacturer joins hands with its retailer and opens its own retail outlets.

Type # 2. Stability Strategy:

This strategy indicates that management would continue with the same level of operations, utilise its present resources and stick to the current objectives. The focus under this strategy is on maintenance of existing level of operations.

The features of this strategy are:

ADVERTISEMENTS:

(a) No major change in product or service composition of the company;

(b) Focus is on maintaining current competitive level;

(c) Ensure the rate of improvement observed in the past is sustained.

Type # 3. Retrenchment Strategy:

This strategy involves reduction from the existing level of operations. Retrenchment strategy is defensive in nature as it is taken as an outcome of operational problems stemming either from internal conditions or external environment factors.

Type # 4. Combination Strategy:

Whenever a company adopts mixture of strategies for different product lines at the same point of time or for same product line in different market segments, it is adopting a mixed strategy approach.

Types of Strategies – Corporate and Directional Strategies

According to Glueck and Jauch, “A strategy is a unified, comprehensive and integrated plan designed to ensure that the basic objectives of the enterprise are achieved”. A strategy is not just any plan. It is a plan that is unified – it ties all the parts of the enterprise together. A strategy is integrated in the sense that all parts of the plan are compatible with each other and fit together well. Moreover, a strategy is comprehensive as it covers all the major aspects of the enterprise.

ADVERTISEMENTS:

Strategy refers to the basic goals and objectives of the organisation, the major programmes of action chosen to reach these goals and objectives and major pattern of resource allocation used to relate the organisation to its environment. According to Chandler, “Strategy is the determination of the basic long-term goals and objectives of an enterprise and the adoption of courses of action and the allocation of resources necessary to carry out these goals and objectives”.

Strategy is a firm’s planned course of action to meet some objectives such as fighting competition and increasing its market share. It is thus the action element of the business firm. These strategies are of different types.

These are explained in details as under:

1. Corporate Strategies:

Corporate strategy is primarily concerned about the choice of direction for the firm as a whole. This is applicable to small or big, corporate or non-corporate firm; single product or multi-product company. In multi-product companies, however, corporate strategy is also about managing various product lines and business units, for maximum value. Even though each product line or business unit has its own competitive or cooperative strategy used to gain competitive advantage, the company must co-ordinate these different business strategies so that the firm succeeds as a whole.

All the firms will have to take decisions on many issues simultaneously. Similarly, each of such decisions can be taken in many ways. Corporate strategy deals with three key issues of the firm as a whole.

They are:

ADVERTISEMENTS:

i. The firm’s overall orientation towards growth, stability or retrenchment (directional).

ii. The Industry or markets in which firm competes through its products and strategies (portfolio).

iii. The manner, in which top management coordinates activities, transfers resources and cultivates capabilities among its product lines and business units (parenting).

The directional strategy will have growth orientation, portfolio strategy will deal with coordination and parenting will concentrate on synergy among product lines by resource sharing and development.

2. Directional Strategy:

Such strategies can be of three types:

(a) Growth strategies – Strategies to expand the activities to achieve growth in terms of products, sales, manpower, technologies, etc.

(b) Stability strategies – Strategies to maintain status quo in respect of company’s activities like, sales, purchase, manpower, R&D, etc.

(c) Retrenchment strategies – Reduce the company’s level of activities so that it is able to tide over an adverse situation.

Portfolio strategies include decisions regarding assessment of business or product lines for their efficiencies by analytical models like (BCG) growth share matrix, GE business screen or international portfolio analysis. Such strategies help a company to allocate time and resources properly among business/product lines.

Parenting strategies are decisions on how to coordinate the activities, transfer the resources and cultivate capabilities among the product lines or business units. This may require organisational restructuring, capital flow management, technology movement, etc.

A detailed discussion on directional strategy is presented here:

a. Growth Strategies:

Most corporate directional strategies are about growth in sales, assets, profits or their combination. Companies that do business in expanding industries must grow to survive.

A firm can grow internally by expanding its operation globally and domestically or it can grow externally through mergers, acquisitions and strategic alliances.

Merger:

Merger is a process-involving establishment of a single corporate body by merging resources and technologies of two different bodies performing competitive or cooperative business in the same industry. The merger is designed for growth.

The strategy to merge and form a new corporate may be followed in situations like:

i. The companies of equal size in term of sizes, profits, orders, assets, etc.

ii. Two companies may be competitive and merger may act as a platform to overcome the competitive problems.

iii. Two companies may be cooperative in their business and merger will consolidate their cooperation.

iv. Two companies are of same industry.

v. Two companies enjoy same/partially same board of directors.

vi. Two companies require consolidation in term of assets, market, manpower, etc.

Merger involves MOU (Memorandum of Understanding) statement and official authentication to declare that earlier entities are no more in existence and the shares/assets/liabilities/technologies/ manpower and all other resources of two companies stand merged into a new legal entity. Usually, the name given to the new company comes into existence as a new legal entity. Usually, the name given to the new company consists of two parts indicating the names of two earlier companies Ex – HP – Compaq.

The functional and organisational modifications brought about by mergers include:

(i) Instead of two boards, the new company will have one board of directors generally drawn up from earlier two boards.

(ii) In divisional structure of organisation, the divisions of similar activities are merged to have common objective, common control, common process, common marketing, etc.

(iii) The listing in stock exchange will have to be changed suitably and both the earlier names lose their earlier status. New company is listed with its new name. Appropriate share certificates are issued by collecting and canceling share certificates of old companies.

(iv) The new company may choose to have different activities under separate division (divisional structure) or may decide to have more simple functional structure with department for each function.

(v) The staff reorganisation is done according to their competence and specialisation so that new company gets best output of their work.

(vi) After a brief transitional period, the new company will adopt functional policies like policy for marketing, pricing policy, production policy as well as various strategies required for implementing new policies. Strengths and weaknesses of earlier two companies are always considered as basses for formation of new policies and strategies.

(vii) If earlier two companies had the branches, the new company may retain them as it is or wind them up or shift them to new locations.

(viii) Physical shifting of fixed assets, machinery and even manpower are seldom done with mergers. The supervisory and working staff are usually retained in the same place with similar duties. Middle and top-level reorganisation may become necessary.

Acquisition:

It is an important method of corporate growth wherein a company acquires all the assets, shares, liabilities of other company. Acquisitions will normally lead to extinction of weak company and continuance of business in the name of strong company. Acquisitions are very popular in international transactions, as a foreign investor finds it safe to run the company under his control rather than any other method of growth.

Features of Acquisition:

1. Usually acquisition takes place between bigger corporate body with stronger asset base and a smaller corporate body with weaker structure.

2. Acquisitions are made for specific objectives like capital investment, corporate growth, market coverage, and new products or technology addition.

3. Acquisitions may or may not lead to change in the name of company. This is convenient from the angles of goodwill, stock rates, etc.

Takeover:

Takeovers are in no way different than acquisitions except the following:

1. Acquisitions are done through negotiation, but generally takeovers are done tacitly at stock exchange level may be against the wishes of company being taken over.

2. Takeover usually takes place between rival companies to consolidate competitive position. But acquisition can be undertaken by any company interested to increase its growth mandate.

3. Takeover usually results in discontinuation of corporate strategies, policies of company taken over, whereas acquisition may lead to continuation of good policies and strategies of company acquired by acquisition process.

4. Acquisition may lead to technological transfer. But takeover is generally made for market advantages than technological advantages.

b. Stability Strategies:

Stability strategies are mainly concerned with continuation of current activities at current level without any directional change. It is based on philosophy that present level of business / present line of business is viewed with complacence. Sometimes, it is said that stability strategy is no strategy at all as it lacks growth. However, it is very popular strategy for small business owner’s entrepreneurs with limited capital base and limited manpower.

Stability strategies are usually useful in short run and can be dangerous in long run. Some of the popular stability strategies are – (i) Pause/proceed strategies, (ii) No change strategies, and (iii) Profit strategies and these are discussed here under.

(i) Pause/proceed strategies – They are strategies to test before a growth strategy is adopted. It is deliberate attempt to make only incremental improvement until a particular situation exists. After the situation improves, the growth strategy is again adopted. For example, in the present recession period, the production is cut down by Bajaj Auto Ltd.

(ii) No change strategies – They are strategies to do nothing new to the present level of sales/profit/ production. The relative stability created by the firm’s modest competitive position in an industry facing little or no growth encourages the company to continue on its current course, malting only small adjustments for inflation in its sales and profit objectives.

(iii) Profit strategies – They are decision to artificially support profits when company’s sales are declining by reducing investment and short-term discretionary expenditures. Instead of announcing company’s poor position, the management attempts to adopt profit strategies. They may range from deferring the investments to cutting avoidable expenses besides stringent discipline in reducing cost of production.

If profit strategies are adopted for long, they may seriously deteriorate the competitive position of the company.

c. Retrenchment Strategies:

Retrenchment strategies are often called reduction strategies – They are strategies adopted to cut down the sales, production and investments to reduce the losses. Such strategies are adopted when company loses its competitive position in industry in respect of some or all of its products. Retrenchment strategies are mainly adopted to eliminate weaknesses that are dragging the company down.

Retrenchment strategies may be necessary to be adopted by small or big companies, by single or multiple product companies. They are usually adopted as last resort after trying all other strategies at corporate level.

Some of the important retrenchment strategies are:

(1) Turnaround strategy,

(2) Captive company strategy, and

(3) Disinvestment strategy and these are discussed below.

(1) Turnaround Strategy:

It is an important retrenchment strategy in corporate world. Such strategy emphasises on the improvement of operational efficiency.

The main features of turnaround strategies include:

i. Cuts in profits/sales/production

ii. Cuts in costs including manpower

iii. Identify and stabilise at new level of profit/sales/production

iv. Improvement of operational efficiency

v. Adopt growth strategies from new stabilised level.

Turnaround strategy is basically a strategy of cuts combined with strategy of growth identified and adopted at proper time. Its feature of realisation of new level (of profit / sales / production) after ‘cuts’ is significant in turning around the objectives of company.

Turnaround strategies are adopted in two steps:

(i) Contraction – It is a phase of cuts. In this phase, the strategies to cut down the production, cut down the manpower to results into cuts of sales/profits are necessarily imposed.

(ii) Consolidation – It begins with realisation of new objective of restructured production / sales / profit subsequent to cuts. After attaining stability at such a level, the company adopts new strategies to emerge from retrenchment period.

Classical example of IBM adopting turnaround strategy to emerge as a leader again can be cited to justify the turnaround strategies.

Entrepreneurial Turnaround Strategies:

They are the turnaround strategies adopted at the level of entrepreneur who forms the sole person taking all decisions. Entrepreneurship is the first level of corporate development.

Efficiency Turnaround Strategies:

They are the turnaround strategies formulated with a stress on efficiency building at consolidation level, while the cuts are made on the basis of inefficiencies. Thus, inefficient manpower, unremunerative investment, and weak micro/macro environmental parameter are deliberately subjected to serious cuts. But, at the same time efficiency is built up at all the levels in consolidation phase to achieve newly set objectives of restructured sales / profit / production.

2. Captive Company Strategy:

It is a strategy of giving up the independence in exchange for security. A Company with weak competitive position may not be able to engage in full-blown turnaround strategy. The industry may not be sufficiently attractive to justify such an effort from either the current management or from investors. In such situation the company offers itself to be in captivity of one of the valuable customer in order to guaranteeing the company’s continued existence.

When captive strategy is adopted, firm will have to reduce the scope of some functional activities such as marketing to reduce the cost significantly. In return, it depends heavily on one of the valued customer for most of its sales.

3. Disinvestment Strategy:

Disinvestment or sell out strategy is a decision to sell its shares to other companies. The disinvestment strategy is adopted in such a situation – when turnaround and captive strategy are not possible to be adopted due to weak competitive position. That is, such disinvestment becomes imperative – when a sinking company fails to identify a suitable customer who can captivate it. For example, public sector companies like NTC sells out many of its companies.

Types of Strategies – Corporate, Functional and Operating Strategies

1. Corporate Strategy:

Corporate strategy is the long-term strategy encompassing the entire organization. Corporate strategy addresses fundamental questions such as what is the purpose of the enterprise, what business/businesses it wants to be in (portfolio strategy) and how to expand/get into such business/ businesses (for example, by establishing green-field enterprises or by M&As). In other words, corporate strategy is formulated by the top level corporate management (board of directors, CEO, and chiefs of functional areas).

SBU-level strategy, sometimes called Business Strategy or Competitive Strategy, is concerned with decisions pertaining to the product mix, market segments and maneuvering competitive advantages for the SBU.

While corporate strategy decides the business portfolio (i.e., the types of business), the competitive strategy decides the strategy/strategies to succeed in the chosen business/businesses.

SBU strategy has to conform, obviously, to the corporate philosophy and strategy.

In short, “the SBU-level strategic management is the management of an SBU’s effort to compete effectively in a particular line of business and to contribute to overall organizational purposes.”

The responsibility for SBU strategy is with the top executives of the SBU who are normally second-tier executives in the corporate hierarchy. In single-SBU organizations senior executives have both corporate and SBU-level responsibilities.

2. Functional Strategies:

Functional-level strategies are strategies for different functional areas like production, finance, personnel, marketing etc. In other words, Functional-level strategy is the responsibility of functional area heads.

3. Operating Strategy:

Operating strategies, which represent still narrower initiatives and approaches than functional strategies, “concern how to manage key organizational units within a business (plants, sales districts, distribution centers) and how to perform strategically significant operating tasks (materials purchasing, inventory control, maintenance, shipping, Advertising campaigns).”

Although operating strategies come at the bottom of the strategic hierarchy, they are of critical importance in strategic management. For example, if a plant fails in meeting its targets in respect of production volume, unit cost, quality etc., the whole strategy can go haywire.

Operating strategies are usually drawn up by front-line managers, subject to review and approval by higher level managers.

Types of Strategies – 4 Main Types

The main strategic types are as follows:

Type # 1. Stability Strategy:

A strategy oriented towards stability is generally followed by an enterprise when it is satisfied with its present position. As long as the company is doing well, managers may be reluctant to change. Stability strategy is likely to be successful in a stable and simple external environment. Organizations may choose stability strategy because it is the easiest, most comfortable and least risky course of action.

If the firm has been profitable in the past by pursuing stability it is most likely to continue to do so. Stability strategy is appropriate in a mature industry with a static technology. Another source of stability strategy is the background, orientation and values of top management. Stability strategy may create complacency among managers. This may become a significant problem, when the environment undergoes rapid change. Managers conditioned to stability strategy may find it difficult to react to environmental changes in time.

Type # 2. Growth Strategy:

Many enterprises prefer the strategy of expansion and growth. They are not satisfied with their present position. When the environment is dynamic managers may find it necessary or desirable to expand and diversify the firm’s operations. Growth strategy is generally used .in dynamic industries with rapidly changing technologies.

A firm may grow internally through expansion and diversification. Alternatively, growth may be achieved by integrating with other firms. Market penetration, market development and product development are three forms of expansion. Integrative strategy has several alternatives e.g. backward integration, forward integration, horizontal integration, conglomerate integration and joint venture.

Type # 3. Retrenchment or Retreat Strategy:

An enterprise may retreat or retrench from its present position in order to survive or improve its performance. Such a strategy may be adopted during recession and other crisis such as heavy losses. For firms in a declining industry, retrenchment may be a healthy way to streamline and reinforce operations.

It is a defensive strategy adopted as a reaction to operating problems caused by internal mismanagement, changes in market conditions or unanticipated actions of competitors.

Retrenchment may take the following forms:

(a) Turnaround – Under this strategy, attempts are made to improve functional performance and to cut down operations which cause losses. The purpose is to ‘hold the present business and cut the costs’. Costs may be cut by retrenching staff and eliminating discretionary expenses. Revenues may be increased through inventory control, better collection of receivables, etc.

(b) Divestment – This strategy involves sale of loss making division, plant or subsidiary. The money obtained through such sale is utilised to improve performance and profits of the remaining divisions or units.

(c) Liquidation – When the company is so sick that it cannot be revived, liquidation is used as the last resort. It involves complete sell out of business.

Type # 4. Combination Strategy:

A large firm active in a number of industries may adopt a combination strategy. It represents a mix of any of three strategies given above. For instance, a diversified firm may adopt growth strategy for its paper division and a retrenchment strategy for its cotton textiles division.

Types of Strategies

1. Stability Strategies:

Stability strategy is adopted by an organization when it attempts at incremental improvements of functional performance in terms of its customer groups, customer functions, and alternative technologies – either singly or collectively.

In order to understand how stability strategies work, here are three examples to illustrate how organizations could aim at stability in each of the three dimensions of customer groups, customer functions, and alternative technologies respectively.

i. A packaged tea company provides special service to its institutional buyers in order to encourage bulk buying and thus, improve its marketing efficiency.

ii. A copier machine company provides better after-sales service to its existing customers to improve its company and product image and increase sales of accessories and consumables.

iii. A steel company modernizes its plant to improve efficiency and productivity.

Note that all the three companies here do not go beyond what they are doing presently; they serve the same markets with the present products using the existing technology. The strategies aim at stability by causing the companies to marginally improve their performance or at least, letting them remain where they are in case they face a volatile environment and a highly competitive market.

The essence of stability strategies is, therefore, not doing nothing but sustaining moderate growth in line with the existing trends. Where substantial growth is aimed at, the strategy to be adopted is that of expansion.

2. Expansion Strategies:

Expansion strategy is followed when an organization substantially broadens the scope of its customer groups, customer functions, and alternative technologies – singly or jointly – in order to improve its performance.

Because of the many reasons for which they are adopted, expansion strategies are quite popular. Given below are three examples to show how companies can aim at expansion either in terms of customer groups, customer functions or alternative technologies.

i. A chocolate manufacturer expands its customer groups to include middle-aged and old persons to its existing customers comprising children and adolescents.

ii. A stockbroker’s firm offers personalized financial services to small investors apart from its normal functions of dealing in shares and debentures in order to increase the scope of its business and spread its risks.

iii. A printing firm changes from the traditional letter press printing to desk top publishing in order to increase its production and efficiency.

In each of the above cases, the company moves in one or the other direction so as to substantially alter its present business definition. Expansion strategies have a profound impact on the companies’ internal configuration causing extensive changes in almost all aspects of internal functioning. As compared to stability, expansion strategies are more risky.

Sometimes strategies – like army commanders – do think it better to retreat than to advance. It is in such situations that retrenchment is a feasible strategic alternative.

3. Retrenchment Strategies:

Retrenchment strategy is followed when an organisation substantially reduces the scope of its customer groups, customer functions, or alternative technologies – singly or jointly – in order to improve its performance.

Retrenchment involves total or partial withdrawal from either a customer group, customer function or use of an alternative technology.

4. Combination Strategies:

Of stability, expansion and retrenchment, either at the same time in its different business or at different times in the same business with the aim of improving its performance.

Any combination strategy is the result of a serious attempt on the part of strategies to take into account the variety of environmental and organizational factors that affect the process of strategy formulation. Complex situations generally require complex solutions. Combination strategies are the complex solutions that strategists have to offer when faced with the complications of real-life businesses.

Observe how the two companies below deal with the complex situations they face:

i. A paints company arguments its offerings of decorative paints to provide a wider variety to its customers (stability) and expands its product range to include industrial and automotive paints (expansion). Simultaneously, it decides to close down the division which undertakes large-scale painting contract jobs (retrenchment).

ii. Over the years, strategic changes at a large business group indicate that it has been strengthening its manufacturing base and divesting its trading activities. Stability has been aimed at some of its divisions by retrenching the unprofitable products and services while major expansion has taken place in the case of its industrial products and construction business.

Types of Strategies – 5 Types: Stability, Growth, Retrenchment, Defensive and Combination Strategies

There are five types of strategies, viz., stability, growth, retrenchment, defensive and combination.

1. Stability Strategy:

If answer to the question whether the company should continue in the existing business is an affirmative and if the company is doing reasonably well in that business but no scope for significant growth, the strategy to be adopted is stability, (the stability strategy is sometimes referred to as I neutral strategy).

As Jack and Glueck observe, a stability strategy is strategy that a firm pursues when:

i. It continues to serve the customers in the same product or service, market and functional sectors as defined in its business definition, or in very similar sectors.

ii. Its main strategic decisions focus on incremental improvement of functional performance.

The stability is not a “do nothing” strategy, as indicated above, it may involve incremental improvements. It also requires adoption of appropriate competitive strategies to remain successful in the business. It may also have to make offensive and defensive moves vis-a-vis the competitors.

Long-term stability strategy also requires reinvestment, R&D and innovation. However, the business definition remains the same.

In short this so-the-same thing strategy endeavours to do-the-same thing better.

This strategy common with large and dominant companies in mature industries where the important challenge is to maintain the current position. Another category of industries this strategy is common with is the regulated industries such as alcoholic beverages, tobacco products, etc., many family dominated small and medium companies also prefer this strategy.

Reasons for Stability Strategy:

The important reasons for pursuing stability strategy are the following:

i. The company is doing fairly well and it is hopeful of the same in future.

ii. A family dominated or private company may not like to expend its business if it amounts to surrendering the control or if effective supervision is not possible by the family members.

iii. The feeling that sticking to the known business is always better and safe.

iv. The company may not have the resources and capabilities for expansion.

v. The company may not want to take the risks of growth and expansion.

vi. The company which has core competence in the existing business does not want to take the risk of losing sufficient attention to the current business by going for diversification.

vii. The management does not have the mind-set of a strategist to analyse the environmental and seize the opportunities.

2. Growth Strategies:

If the answer to the question should the company increase the level of activities in the current business and/or enter new business is affirmative, then a growth (expansion) strategy is called for.

The growth strategy amounts to redefining the business by adding new products/services or new markets or by substantially increasing the current business.

In other words, a company pursues a growth strategy when:

i. It enters new business (including functions) or market.

ii. Effect major increase in its current business.

A company may pursue either or both internal or external growth strategies.

Reasons for Growth Strategy:

Important factors, which encourage companies to adopt growth strategy, are the following:

i. The current business is perceived as having no future.

ii. The current business is unstable or volatile in nature.

iii. The current business does not fully utilize the available resources and capacities.

iv. There is a feeling of the need for spreading business risks.

v. In some cases, expansion is a retaliatory move. When a company in another business enters the firm’s business the firm retaliates by entering the other company’s business.

vi. Some firms have a tendency to imitate the growth strategies of competitors.

vii. In several cases, growth strategy is the result of the urge to grow.

viii. In several cases, the motive for growth is the objective to increase market share or gain dominance.

ix. In many cases, growth strategy results from the decision to exploit the environmental opportunities.

3. Retrenchment Strategies:

Retrenchment strategy, also known as defensive strategy, involves contractions of the scope or level of business or function. In some cases it amounts a redefinition of the business.

A firm pursues a retrenchment strategy when:

i. It drops product line (S), market (s), market segments/functions are not profitable.

ii. The profit from a business is less than the target rate.

iii. The company’s new strategy is to focus on its core business.

iv. The company is too diversified/scattered that effective management is not possible.

v. The company has serious financial problem so that the funds obtained by divestiture can be used for strengthening other business.

vi. Certain current business does not confirm to the company philosophy/ethics.

vii. The company is confronted with deteriorating performance indicators.

4. Defensive Strategies:

Defensive strategies include:

i. Divestiture,

ii. Liquidation,

iii. Becoming a captive, and

iv. Turnaround.

i. Divestiture – A divestiture strategy is pursued when a company sells or diverts itself of business or part of a business, it may be because of loss, less than target rate of return, urgency to mobilize funds, managerial problems, or redefinition of the business of the company.

ii. Liquidation – Liquidation occurs when an entire company is sold or dissolved. The reason for divestiture mentioned above could also be reasons for liquidation. When there are no buyers for a company that wants to be sold, its assets may be sold and company may be wound up.

iii. Becoming a Captive – A firm becomes a captive of another firm when it subjects itself to the decision of the other firm in return for a guarantee that a certain amount of the captive’s product will be purchased by the other firm.

iv. Turnaround Strategy – A turnaround strategy involve management measures designed to reverse certain negative trends and to bring the firm back to normal health and profitability.

5. Combination Strategy:

A company pursues a combination strategy when it adopts more than one grand strategy (i.e., stability, growth, and retrenchment) simultaneously or sequentially.

The reason for pursuing a combination strategy is the existence of a combination of reasons for any two or more of the other three generic strategies.

Under the combination strategy a company adopts any one of the following:

i. Stability and growth strategies.

ii. Stability and retrenchment strategies.

iii. Growth and retrenchment strategies.

iv. Growth, retrenchment and stability strategies.

A combination strategy results from environmental changes and redefinition of the business.

Types of Strategies

Strategy is a plan — a consciously intended course of action. Some of them may be unrealised or some other actions may emerge meanwhile.

Various kinds of strategies, from deliberate to mostly emergent are explained as under:

i. Planned Strategy:

Precise intentions are formulated and articulated by a central leadership, and backed up by formal controls to ensure their surprise-free implementation in an environment that is benign, controllable, or predictable (to ensure no distortion of intentions); these strategies are highly deliberate.

ii. Entrepreneurial Strategy:

Intentions exist as the personal, unarticulated visions of a single leader, and so are adaptable to new opportunities; the organisation is under the personal control of the leader and located in a protected niche in its environment; these strategies are relatively deliberate but can emerge too.

iii. Ideological Strategy:

Intentions exist as the collective vision of all the members of the organisation, controlled through strong, shared norms; the organisation is often pro-active vis-a-vis its environment; these strategies are rather deliberate.

iv. Umbrella Strategy:

A leadership in partial control of organizational action defines strategic targets or boundaries within which others must act (for example, that all new products be high priced and at the technological cutting edge, although what these actual products are to be is left to emerge); as a result, strategies are partly deliberate (the boundaries) and partly emergent (the patterns within them); this strategy can also be called deliberately emergent, in that the leadership purposefully allows others the flexibility to manoeuvre and form patterns within the boundaries.

v. Process Strategy:

The leadership controls the process aspects of strategy (who gets hired and so gets a chance to influence strategy, what structures they work within, etc.), leaving the actual content of strategy to others; strategies are again partly deliberate (concerning process) and partly emergent (concerning content), and deliberately emergent.

vi. Disconnected Strategy:

Members or sub-units loosely coupled with the rest of the organisation produce patterns in the streams of their own actions in the absence of, or in direct contradiction to the central or common intentions of the organisation at large; the strategies can be deliberate for those who make them.

vii. Consensus Strategy:

Through mutual adjustment, various members converge on patterns that pervade the organisation in the absence of central or common intentions; these strategies are rather emergent in nature.

viii. Imposed Strategy:

The external environment dictates pattern in actions, either through direct imposition (say by an outside owner or by a strong customer) or through implicitly pre-empting or bounding organisational choice (as in a large airline that must fly jumbo jets to remain viable); these strategies are organisationally emergent, although they may be internalized and made deliberate.

Types of Strategies – With Environmental Impact

The first step in strategic management is strategy formulation. A strategy is a comprehensive master plan of a firm stating how it achieves its objectives. A company has strategies at three levels- corporate, business and functional levels.

I. Corporate Level Strategy:

This strategy is formulated by top management to oversee the interests and operations of an organisation made up of more than one line of business. The major questions at this level are- What kinds of business should the company be engaged in? What are the goals and expectations for each business? How should resources be allocated to reach these goals?

In formulating corporate-level strategy, Peter Drucker suggests, corporations need to decide where they want to be in eight areas- market standing, innovation, productivity, physical and financial resources, profitability, managerial performance and development, worker performance and attitudes, and public responsibility.

Environmental Impact on Corporate Level Strategy:

At the corporate level strategy, environmental impacts on three key issues are significant:

(i) Patterns of diversification,

(ii) Portfolio planning, and

(iii) Risk return trade-offs.

(i) Patterns of Diversification:

In diversifying, there are two models a company can follow: internal and external. Firms choosing the internal model stress the development of new products and services through research and development efforts within the organisations. Conversely, companies diversifying externally focus on making acquisitions.

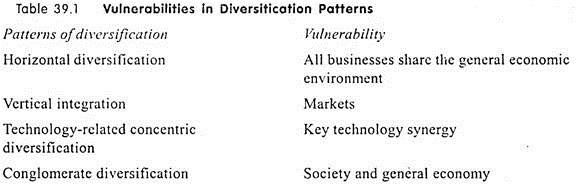

Environment influences patterns of diversification in atleast three ways. First, firms differ in the synergies they try to exploit across their businesses. These synergies could be upset or enhanced by macro-environmental changes. Second, different patterns of diversification manifest different vulnerabilities (see Table 39.1). Macro-environmental changes may amplify these vulnerabilities. Third, macro-environmental trends may open up or close out existing patterns of diversification. This is particularly so when the pattern of diversification is not conglomerate.

(ii) Portfolio Planning:

With regard to portfolio planning (the type of businesses a corporate entity must have), two strategic issues are relevant. First, the composition of the firm’s collection of businesses (or “portfolio”) must be determined. This involves the question of whether the firm should follow a conglomerate, concentric, vertical, or mixed pattern of diversification. It also raises the question of what businesses to add to the portfolio.

The second key issue concerns how resources are to be allocated among the several businesses in the portfolio. An analytical framework called portfolio analysis has been developed to help corporate management address and structure the issue.

Prominent portfolio planning models available are the G.E. Model, BCG Model, McKinsey Model and the one developed by Arthur D. Little, Inc. Although all these differ in detail, they all basically follow a similar methodology. They all require the identification of strategic business units (SBUs), the positioning of SBUs on a matrix, and the application of a particular resource strategy for each SBU, depending on its placement on the matrix.

Macro-environmental trends have important implications for portfolio planning. Typical portfolio planning focuses on competitive advantages within an existing industry, constrained by the internal financial resources of the firm.

Environmental analyses are also particularly important for planning potential future portfolios. The specific businesses to be targeted need to be considered in the light of macro-environmental forecasts and predictions.

(iii) Rick-Return Trade-Offs:

Political, economic, technological, and demographic shifts influence the returns and risks of existing and planned portfolios.

a. In a conglomerate firm, the accepted macro-environmental trends suggested a persistent level of inflation in the economy. One of the consequent considerations was that additional investments in any business unit should be justified not only by competitive position but also by returns in excess of the forecasted rate of inflation.

b. In a technology-related firm, a technology study suggested obsolescence of some key technologies within the next decade. As a result, the firm is searching for methods of converting technology so as to retain competitive advantage in their existing markets.

It is important to consider environmental impacts on each of these characteristics of corporate- level strategy.

II. Business Level Strategy:

Each division prepares its own strategy mainly translating the general statements of direction and intent, generated at the corporate level into concrete, functional objectives and strategies for individual business divisions or SBUs. In essence, business-level strategic managers (comprising principally of business and corporate managers) must determine the basis on which a company can compete in the selected product-market area. While doing so, they strive to identify and secure the most profitable and promising market segment. The strengths of market segment determine continuous viability of the corporation.

One well known model of business-level strategy was developed by Michael E. Porter of Harward Business School. In Porter’s view, an organisation’s ability to compete in a given market is determined by its technical and economic resources, as well as five environmental forces, each of which threatens the organisation’s venture into a new market. The five forces are- threats top entry, bargaining power of consumers, the bargaining power of suppliers the threat of substitute products and jockeying for position in a crowded market.

Environmental Impact on Business-Unit Strategy:

The impact of environmental analysis on business-unit strategy must be assessed with regard to- (1) business definition, (2) assumptions, and (3) general strategic thrust.

In broad terms, strategy formulation at the business or corporate level includes a definition of the business and positioning of the business in an industry. Definition and positioning are inevitably affected by industry structure; macro-environmental trends, as they affect industry structure, open up opportunities and threats for business strategy. Each of the three elements of business definitions can be affected by environmental change- What customers does business serve? What customer needs is satisfied? What technologies are employed to satisfy these consumer needs?

Some pivotal assumptions always underline a firm’s strategy-for example, industry assumptions such as actions of suppliers, competitive responses, the likelihood of new entrants, or the market penetration of substitute products. The success or failure of a strategy is often determined by the veracity of these assumptions. Assumptions about the macro-environment, however, may also critically influence strategy success.

Finally, the general strategic thrust of the firm or its business units, such as share building or share maintaining, is built around assumptions about the industry. As these assumptions are influenced by changes in the environment. Environmental analysis often signals the need for changes in strategic thrust by opening up pathways to gain market share or by rendering share maintaining strategies obsolete.

III. Functional Level Strategy:

Functional level strategy creates the framework for management of functions such as finance, research and development, and marketing-so that they support the business-level strategy. For example, if the business-unit strategy calls for the development of a new product, the R&D department will create plans on how to develop that product.

Functional strategies are more detailed than organisational strategies and have shorter time horizons. Their purpose is three-fold- (1) top communicate short-term objectives, (2) to describe the actions needed to achieve short-term objectives, and (3) to create an environment that encourages their achievement. It is critical that lower level managers participate in the development of functional strategies so that they will better understand what needs to be done and feel more committed to the strategy.

Environmental Impact on Functional Level Strategy:

Micro-environmental change has implications for the functional-level strategies of an organisation, over and beyond the business strategy. Any change in macro-environment shall necessitate changes in how various functional strategies are performed.

Traditionally, these functional changes are regarded as operating issues within the context of strategic management. Environmental changes offer opportunities for enhancing the operating capabilities of firms, as well as rendering some capabilities obsolete. Such enhancement of capabilities often accumulates over time, and these capabilities may become distinctive competencies that firms can wield to their advantage.

Types of Strategies – In Recent Times: Joint Ventures, Strategic Alliances and Consortia

In recent times, three more strategies have gained popularity namely:

i. Joint ventures,

ii. Strategic alliances, and

iii. Consortia.

i. Joint Ventures:

When two or more firms poll resources to accomplish a task that a firm could not accomplish, or that can be done more effectively by jointing, the result is a joint venture. Like a merger of acquisition, a joint venture is not strategy but a way of implementing a strategy. It helps a firm to undertake giant projects by spreading risks more efficiently (Thompson and Strickland).

Examples include, the joint ventures between Thermax and Babcock and Wilcox; Maruti Udyog and Suzuki; TELCO and Hitachi Construction Company etc.; in addition the Tata’s the Birla’s the Oberoi’s the Kiloskar’s and many software giants also have joint ventures with global partners from outside the country. To be successful, however, joint venture partners should be willing to share technology in the real sense resolve cultural differences clearly and integrate operations at various locations UN al more compact manner.

In any case “joint venture often limit the discretion control and profit potential of partners while demanding managerial attention and other resources that might be directed toward the firm’s mainstream activities”.

ii. Strategic Alliances:

In a joint venture, the companies involved take an equity stake in on another. In strategic alliances, the partners contribute their skills and expertise to a cooperatively conceive and executed project for a specific period. Partners, during the said period, try to peep into each other’s know-how and learn from one another.

Alliances could take the shape of a licensing agreement too, where licensor would transfer his property right offer patents, trademarks, technical know-how etc., to a licensee for a specified time in return for a royalty, outsourcing an anther useful approach to strategic fields such as software, telecommunications, electronics, bio-technology etc.

iii. Consortia:

Consortia are interlocking relationships between businesses of an industry. It works more or less like Japans Keirestu involving up to 50 different firms that are joined around large trading company or bank and are coordinated through interlocking directories and stock exchanges (like Sumitomo, Mitsui, Mitsubishi, Snawa).