After reading this article you will learn about the internal and external growth strategies adopted by a firm.

Internal Growth Strategy:

It is a form of growth strategy where firms grow from within. They use their own resources or acquire them from outside to increase their size, scale of operations, resources (financial and non-financial) and market penetration.

Intensive Growth Strategy (Expansion):

It is a form of internal growth. Firms grow by expanding their scale of operations. It may be product expansion or market expansion. Firms concentrate on products and markets which have not yet reached their maturity stage.

Intensive growth or product/market expansion can be achieved in the following ways:

ADVERTISEMENTS:

1. Increase sale of existing products in the same market through better promotional efforts or introduce new uses of existing products. The firm penetrates into the market to increase its market share. Sale of products like tea, coffee or bourn-vita is promoted in this manner. Selling tea in tea bags, cold tea, cold coffee represent sale of the same product to the same consumers by promoting their new uses.

This strategy is suitable for firms with small market shares. It is called the strategy of market penetration. It increases sale of existing products in the existing markets to present and new customers. Growth is achieved by expanding market base of the company.

2. Increase sale by introducing new products in the existing markets. Adding similar products to the existing products promotes growth in the existing markets. Firms that sell soaps can also sell detergents to achieve higher growth targets. This is called the strategy of product development.

3. Increase sale of existing products to new customers in new markets. Transport companies can grow by increasing transport services in national and international markets. Firms reduce the price of products to approach the middle and lower-income groups in new markets. It means selling existing products in unexplored markets.

ADVERTISEMENTS:

It is called the strategy of market development. It increases sale by entering into new markets with same products or products with minor modifications. Mobile companies have grown by selling mobile phones with affordable prices in rural areas. Cosmetics can be sold in different markets with different consumer preferences and price range.

4. Increase sale by adding new products to the existing products, new markets to the existing markets, modifications in the existing products to cater to new market segments. Change in colour, size, shape or similar features increase sales in existing and new markets. This is called the strategy of product and market development.

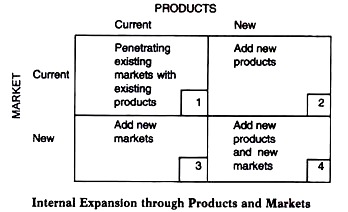

Internal growth through products and markets is depicted as follows:

Benefits of Intensive Growth Strategy:

ADVERTISEMENTS:

Intensive growth strategy has the following benefits:

1. Companies use own physical, financial and human resources and, therefore, have control over the strategy.

2. Major changes are not required in the organisation structure as companies deal in same or similar products.

ADVERTISEMENTS:

3. It leads to optimum utilization of resources.

4. Firms enjoy economies of scale as they expand their area of operation.

Limitations of Intensive Growth Strategy:

This strategy suffers from the following limitations:

ADVERTISEMENTS:

1. Firms which already enjoy big share of the market cannot grow through internal resources. They have to look for external growth avenues.

2. It is slower than external growth strategies. Firms cannot enjoy the benefits of synergy by combining their operations with other firms.

3. In the fast changing world of fashion and technology, consumers in the same or new markets may not want existing products even with minor modifications.

4. Firms cannot take advantage of environmental opportunities as they confine their operations to existing products and markets.

Diversification:

ADVERTISEMENTS:

Expansion, as a growth strategy has limited scope as firms deal in similar products. To promote growth further, firms need to diversify their operations. To diversify means to add something new — new product, new market or new technology.

Diversification involves framing a strategy to achieve growth (increase in the scale of operations) by adding new products or selling in new markets which are different from the existing ones. Jay Pee industries dealing in the business of hotels, education and cement is an example of diversification.

Birla industry has diversified into textiles, cement and tyres. The J.K. Group of companies has a portfolio of textiles, computers, plastics, chemicals, tyres, tubes, dry cells, paints, cement, sugar and a number of other products.

Benefits of Diversification:

ADVERTISEMENTS:

Diversification has the following benefits:

1. It enhances skills and abilities of workers. Doing the same work over and over again becomes dull and monotonous. Diversification motivates them to perform new and challenging tasks and increases individual and organisational productivity.

2. It reduces business risks. Loss in one line of business can be compensated by profit in the other.

3. It increases profitability of the firm. A firm that ventures into different product lines can earn more profits.

4. It allows firms to grow in size, turnover, capital, workforce, sales revenue and profits. It, thus, facilitates growth.

5. It increases competition and reduces the ill effects of monopoly as firms produce goods produced by other firms also.

ADVERTISEMENTS:

6. It optimizes use of resources and technology. Use of existing technology in new areas reduces the cost of products and increases productivity of firms. Use of same resources over diversified products provides synergy in diversification.

7. It stabilizes earnings of the firm when existing products reach declining stage of their life cycle. Decline in sale of one product can be compensated by growth in sale of another product.

Limitations of Diversification:

Diversification suffers from the following limitations:

1. It requires high level of managerial skill and technical expertise to diversify. Firms with managerial and technical inefficiency cannot diversify their operations.

2. Top managers may not be able to co-ordinate the diverse business operations if they lack managerial efficiency to manage diversified business operations.

ADVERTISEMENTS:

3. Huge amount of funds are required for diversification. Firms that are not financially sound will not be able to diversify their operations.

4. By selling new products in new markets, managers are exposed to high degree of risk. Failure to perform well in new areas can result in huge financial losses.

These limitations can be overcome through scientific forecasting techniques. Through proper demand forecasts, new products can do well in new markets. Training and development programmes increase managerial efficiency to diversify in new areas.

External Growth Strategy:

It is a form of growth strategy where two or more firms combine together. Firms combine to form large enterprises and grow their operations. It overcomes economic stagnation by providing avenues to open new and wider markets through cost reduction, new products or new processes. External growth strategy is also called integrative growth strategy.

a. Mergers:

An entrepreneur can grow his business either by internal expansion or external expansion. In the case of internal expansion, a firm grows gradually over time in the normal course of business, through acquisition of new assets, replacement of the technologically obsolete equipment’s and establishment of new lines of products.

In external expansion, firm acquires a running business and grows through corporate combinations. These combinations are in the form of mergers, acquisitions, amalgamations and takeovers and have now become important features of corporate restructuring. They have become popular because of increase in competition, breaking of trade barriers, free flow of capital across countries and globalisation of businesses.

ADVERTISEMENTS:

In the light of economic reforms, Indian industries have also been restructuring their operations around their core business activities through acquisition and takeovers both domestically and internationally. Mergers and acquisitions are strategic decisions that maximise company’s growth by enhancing its production and marketing operations.

Mergers and acquisitions are taking place in wide areas such as information technology, telecommunication and business process outsourcing as well as in traditional businesses in order to expand the customer base, reduce competition or enter into new markets or product segments.

Mergers or Amalgamations:

A merger is a combination of two or more businesses into one business. Laws in India use the term ‘amalgamation’ for merger. The Income-tax Act, 1961 [Section 2(1 A)] defines amalgamation as the merger of one or more companies with another or the merger of two or more companies to form a new company, in such a way that all assets and liabilities of the amalgamating companies become assets and liabilities of the amalgamated company and shareholders not less than nine-tenths in value of the shares in the amalgamating company or companies become shareholders of the amalgamated company.

Thus, mergers or amalgamations may take two forms:

Merger through Absorption or Acquisition:

ADVERTISEMENTS:

An absorption is a combination of two or more firms where one acquires the assets and liabilities of the other in exchange for shares, debentures or cash. Shareholders of the company that is absorbed are issued shares by the company that takes over its operations.

All companies except one lose their identity in such a merger. For example, absorption of Tata Fertilizers Ltd (TFL) by Tata Chemicals Ltd. (TCL). TCL, an acquiring company (a buyer), survived after merger while TFL, an acquired company (a seller), ceased to exist. TFL transferred its assets, liabilities and shares to TCL.

Merger through Consolidation or Amalgamation:

A consolidation is a combination of two or more firms who dissolve their operations and form a new firm that takes over the assets and liabilities of the dissolved firms, against issue of new shares and debentures.

The new company is known as amalgamated company and the companies whose operations are dissolved are known as amalgamating companies. Shareholders of amalgamating companies are given shares and debentures in the new company.

In this form of merger, all companies are legally dissolved and a new entity is created. Here, the acquired company transfers its assets, liabilities and shares to the acquiring company for cash or exchange of shares. For example, Hindustan Computers Ltd., Hindustan Instruments Ltd., Indian Software Company Ltd. and Indian Reprographics Ltd. merged into an entirely new company called HCL Ltd.

ADVERTISEMENTS:

Techniques of Mergers:

Mergers may take place in the following ways:

(i)Friendly merger:

When two or more firms decide to merge through mutual consent, it is called friendly merger. It takes place through negotiation and cooperation.

(ii) Hostile merger:

Hostile merger occurs when one company acquires another company against its wishes. One firm takes over the other usually by purchasing a major portion of its share capital in the open market. This is also known as takeover.

Merits of Mergers:

Mergers have the following merits:

1. It is an effective substitute for internal growth strategy.

2. It provides the benefits of synergy. Firms combine their operations to attain higher degree of efficiency and profitability.

3. It increases earning capacity of the firms and market value of shares.

4. It enables the firms to diversify their operations and increase their market share.

5. It provides opportunities to merged firm to take advantage of R&D and technological developments of other firms.

6. When two or more competing firms merge their operations, it reduces unhealthy competition.

7. It provides tax advantage to the merged company if it is a profit-making unit and merges with a loss-making unit. Losses of one business can be set off against profits of the other.

8. It provides economies of scale by enlarging the scale of operations.

9. It results in optimum utilisation of resources.

10. It prevents loss-making units from being declared as sick units, if they merge with the profit-making units.

11. It provides plant, machinery and other capital equipment’s to firms more easily and economically than acquiring them from the market.

12. Managerial inefficiencies can be overcome by acquiring a business with managerial competence.

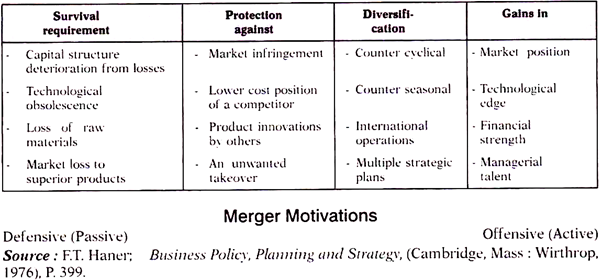

F.T. Haner cites the following reasons for company mergers:

Limitations of Mergers:

Mergers suffer from the following limitations:

1. Empirical studies have shown that merged companies generally grow slower than the merging companies.

2. If executives of the absorbed company are not placed at senior ranks in the new company, it will lower their morale and affect productivity.

3. Merger can result in social ills like monopoly, concentration of economic and social power, restricted supply, high prices etc.

Types of Mergers:

Mergers can be of the following types:

(i) Horizontal merger:

When business firms engaged in same business or production process combine together, it is known as horizontal merger. It eliminates competition and provides economies of scale to the companies. For example, two shoes manufacturing companies can merge their operations to gain dominant market share.

(ii) Concentric merger:

This is similar to horizontal merger. It is a merger of business firms related by product, market or technology. Though the companies do not have common customers and suppliers, it increases the ability of the firms to use the same distribution channels to reach the customers of both the businesses.

(iii) Vertical merger:

When business firms producing complementary products join together, it is known as vertical merger. When a garments manufacturing unit takes over a dyeing unit, it is backward vertical merger. It is combination of two or more firms at different stages of production or distribution of the same product.

For example, merger of a construction company with a steel or iron company is a vertical merger. Vertical merger can be forward or backward merger. Combination with supplier of material is backward merger and when a firm combines with the customer, it is called forward merger. It makes a company independent and self-sufficient.

(iv) Conglomerate merger:

When business firms not related with respect to product, market or technology combine together, it is known as conglomerate merger, for example, combining a footwear company with a textile company. This results in better utilisation of financial resources, enhanced capacity to raise debt, more profits, low cost and diversed market by entering into new lines of business without making huge initial investment. L & T (Larsen & Toubro) is an example of such merger.

Effective Mergers:

Mergers require restructuring of the firms in terms of financial arrangements, organisation structures and organisational plans. It is, therefore, necessary that detailed pre-merger and post-merger plans are made, executive responsibilities are defined and effective management information systems are developed.

William Rockwell suggests the following guidelines for carrying out effective mergers:

1. Specify the merger objectives, especially earnings objectives.

2. Specify the gains of shareholders of both the combining units.

3. Be sure that management of the acquired company is or can be made competent.

4. Certify the existence of important dovetailing resources but do not expect perfection.

5. Initiate the process of merger with active involvement of the chief executive.

6. Clearly define the business that the company is in.

7. Identify and check on the strengths, weaknesses and key performance factors for both the combining units.

8. Anticipate problems and discuss them with the other company to create a climate of trust.

9. Be sure that merger does not threaten the present management team.

10. People should be of prime consideration in planning for merger and restructuring the organisation.

Examples:

Some of the important mergers that took place in 2010 are:

Reliance Power and Reliance Natural Resources merger:

This deal was valued at US$11 billion and was one of the biggest deals of the year. It smoothened the path for Reliance Power to get natural gas for its power projects.

Airtel’s acquisition of Zain in Africa:

Airtel acquired Zain at about US $ 10.7 billion to become the third biggest telecom major in the world. Zain is one of the biggest players in Africa covering over 15 countries and Airtel’s acquisition of Zain gave it the opportunities to establish its base in one of the important markets in the world.

ICICI Bank buys Bank of Rajasthan:

ICICI Bank acquired Bank of Rajasthan for Rs. 3,000 crore which would help ICICI improve its market share in Northern as well as Western India.

b. Acquisitions and Takeovers:

Acquisition is an act of acquiring effective control by one company over assets or management of another company without any combination of companies. Thus, in an acquisition, two or more companies may remain independent with separate legal entities, but there may be a change in control of the companies.

When an acquisition is ‘forced’ or ‘unwilling’, it is called a takeover. In an unwilling acquisition, the management of ‘target’ company would oppose a move of being taken over. But, when managements of acquiring and target companies mutually and willingly agree for the takeover, it is called acquisition or friendly takeover.

In the Companies Act (Section 372), a company’s investment in the shares of another company in excess of 10 percent of the subscribed capital can result in takeovers. An acquisition or takeover does not necessarily require full legal control. A company can also have effective control over another company by holding a minority ownership.

Reasons for Takeover:

An acquiring company may purchase another company for many reasons. These can be opportunistic reasons or strategic reasons.

Opportunistic reasons:

A company may acquire the target company because the target company is very reasonably priced and the acquiring company feels that in the long-run, it will make money by purchasing the target company.

Strategic reasons:

A takeover may take place not simply because it increases profitability of the acquiring company but also because of other secondary effects.

Some of the reasons are as follows:

1. An acquiring company may purchase a company that has good distribution capabilities in new areas which the acquiring company can use for its own products as well.

2. A target company may be attractive because it allows the acquiring company to enter a new market without having to take on the risk, time and expense of starting a new division.

3. An acquiring company could decide to take over a competitor so that it reduces competition in the same area of business and makes it easier, in the long run, to make profits by raising prices.

4. The combined company can be more profitable than the individual companies as it may reduce redundant functions or non-profitable or wasteful expenditures.

Types of takeover:

Takeover can be:

i. Friendly Takeover

ii. Hostile Takeover

1. Friendly Takeover:

In the friendly takeover, the bidder first makes an offer for another company, it informs the company’s board of directors and if the board feels that accepting the offer serves shareholders better than rejecting it, it recommends that the offer is accepted by the shareholders.

In private company, because the shareholders and the Board are usually the same people or closely connected with one another, private acquisitions are usually friendly. If the shareholders agree to sell the company, then the Board is usually of the same opinion and, thus, the takeover takes place.

2. Hostile Takeover:

In a hostile takeover, the acquiring company intends to takeover a target company whose management is unwilling to agree to a merger or takeover. The target company’s board rejects the offer, but the bidder still continues to pursue it, or he makes the offer directly to the target company after having announced its firm intention to make an offer.

Pros and Cons of Takeover:

Takeovers increase sales/revenues, promote the venture into new businesses and markets, increase profitability of the target company, increase its market share, reduce competition (from the perspective of the acquiring company), increase economies of scale and increase efficiency as a result of corporate synergies/redundancies (jobs with overlapping responsibilities can be eliminated, decreasing operating costs). However, there can be culture clashes within the two companies which can cause employees to be less-efficient.

c. Joint Ventures:

Joint venture is a combination of two or more independent firms that decide to participate in a business venture by contributing to the equity capital of the newly established organisation.

Joint venture can take place:

(i) Within the national boundaries, and

(ii) Across the national boundaries.

(a) Joint ventures within the national boundaries:

Joint venture takes place between two or more independent companies within the country; operating in the private sector or a private undertaking and the Government. Cochin Refineries and Madras Refineries are joint ventures of the Government and the private undertakings.

Such joint ventures are taken to:

(i) Accelerate growth of the economy;

(ii) Introduce new technology in the market;

(iii) Minimise the risk of new venture.

(b) Joint ventures across national boundaries:

When two or more companies of different countries participate in a business venture, joint venture takes place across the national boundaries.

It reduces the fear of ‘foreign takeovers’.

Business combination of Maruti of India with Suzuki of Japan is joint venture across the national boundaries.

Merits of Joint Ventures:

Joint ventures have the following merits:

1. Joint ventures save financial outlays for both the companies and lower the costs.

2. It increases sales and provides production-cost savings.

3. It provides speedy channel acceptance and, thus, reduces marketing costs.

4. It maintains independence of both the companies.

5. It reduces competition between two companies.

6. It reduces risk of business failure because of managerial inefficiency.

7. It provides synergical benefits to organisations who combine their resources together.

8. Collaboration with foreign companies provides advanced technical know-how to the company.

9. Foreign collaboration facilitates purchase of foreign equipment’s (imports).

10. It enlarges the scope of operations and reduces the costs of production and marketing.

11. Multinational corporations can enter developing countries through joint ventures than establishing subsidiaries there.

Limitations of Joint Ventures:

Joint ventures suffer from the following limitations:

1. Cultural and economic differences between two countries result in different managerial perceptions of the same problem. This may develop problems for effective joint ventures.

2. Joint ventures across national boundaries may create problems of equity participation, voting rights, dividend remittances and management control.

3. Foreign equity capital can be introduced according to provisions of FEMA (Foreign Exchange Management Act). There are, thus, legal restrictions on foreign investment.

4. Lack of co-operation and co-ordination amongst the combining firms can result in ineffective joint ventures.

5. In the urge to maximise individual share, joint venture business may not get the necessary boost.

6. Combination of unequal business partners may result in quasi-mergers than joint ventures.

In a quasi-merger, two or more companies exchange shares without the formal loss of independence. Both quasi-merger and joint venture are forms of company takeover, usually for small and medium enterprises. In amalgamation, each of the merging companies loses its former independence and becomes part of the new company.