Systematic risk can be measured using beta. Stock Beta is the measure of the risk of an individual stock in comparison to the market as a whole. Beta is the sensitivity of a stock’s returns to some market index returns (e.g., S&P 500). Basically, it measures the volatility of a stock against a broader or more general market.

It is a commonly used indicator by financial and investment analysts. The Capital Asset Pricing Model (CAPM) also uses the Beta by defining the relationship of the expected rate of return as a function of the risk free interest rate, the investment’s Beta, and the expected market risk premium.

Beta is calculated using correlation or regression analysis.

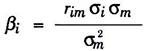

Using the correlation method, beta can be calculated from the historical data of returns by the following formula:

Where,

rim = Correlation coefficient between the returns of stock i and the returns of the market index

σi= Standard deviation of returns of stock i

σm = Standard deviation of returns of the market index

ADVERTISEMENTS:

σ2m = variance of the market returns

Using the regression analysis, beta can be calculated from the historical data of returns by the following formula:

Y = α + βX

Where,

ADVERTISEMENTS:

Y = Dependent variable

X = Independent variable

α and β are constants.

The above regression equation can also be written as follows:

ADVERTISEMENTS:

Ri = α +βi Rm

Where,

Ri = Return of the individual security

Rm = Return of the market index

ADVERTISEMENTS:

Βi = Beta (Systematic Risk) of individual security

α= Estimated return of security when market is stationary

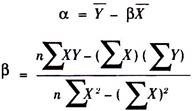

The formula for calculation of CC and β are as follows:

Where,

ADVERTISEMENTS:

n = number of items

X = Independent variable scores (returns of the market index)

Y = Dependent Variable scores (returns of individual security)

ADVERTISEMENTS:

Interpretation of Beta:

i. A beta of 1 indicates that the security’s price will move with the market.

ii. A beta of less than 1 means that the security will be less volatile than the market.

iii. A beta of greater than 1 indicates that the security’s price will be more volatile than the market.

For example, if a stock’s beta is 1.2, it’s theoretically 20% more volatile than the market. The Beta of the general and broader market portfolio is always assumed to be 1.

Example:

ADVERTISEMENTS:

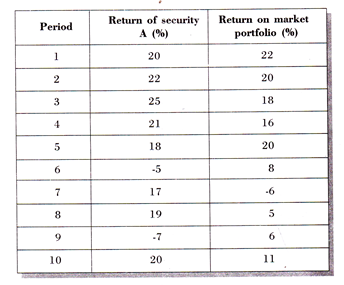

The rates of return on the security of A Ltd. And market portfolio for 10 periods are given below:

What is the best security of A?

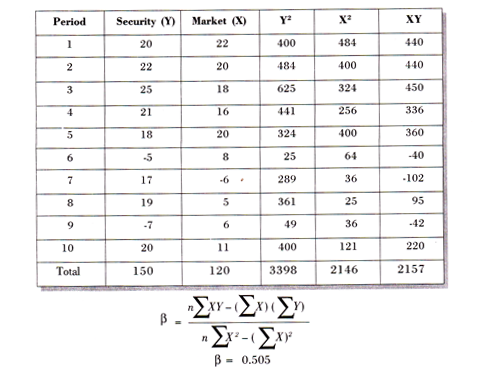

Solution: