After reading this article you will learn about:- 1. Lending on the Basis of Risk Rating 2. Measuring Risk of Loans and Advances 3. Capturing Early Warnings 4. Asset Classification and Provisioning.

Lending on the Basis of Risk Rating:

If an over view is taken about credit management in banking industry in India, it tells a sordid affairs of actions which were required to be taken at the early stage of banking only because a resourceful was able to avail credit facilities from any bank. It was only after nationalization of banks that socio-economic efforts ere taken and banks were involved in social banking also.

A brief description is given above in the form of government sponsored bank lending schemes. In all the government sponsored schemes a due care was always taken that the banks are commercial entities and should not put to loss for implementing government sponsored schemes. In every such scheme the government had taken in view to compensate the commercial banks for the loss on account of interest or otherwise.

But at the same time the government has also placed before the banks a situation by adopting liberalised economic measures to bear more and more risk in the field of credit management. The government sponsored schemes are regulated as per guidelines but in the field of discretionary powers of lending by banks a large amount of risks have evolved. Before processing a loan proposals banks are subject to analyze the position of risks involved therein.

ADVERTISEMENTS:

There may be many kinds of risks including borrowers integrity, honesty, reliability. Creditworthiness, management competency, expertise, guarantor, collateral security etc. It is therefore very important that each bank must observe the KYC norms in credit management also prior to sanctioning any loan.

Measuring Risk of Loans and Advances:

The methods recommended by so many committees of the RBI including the Tendon Committee, Choire Committee, and so many other committees had done well for the time prevailing than now the banking industry has taken a New turn and have adopted many methods to examine the risk rate before going ahead.

All these committees constituted by RBI were meant to protect bank lending against defaults but with the help of Information technology banks have adopted new methods to gauge the risk involved before considering any proposal.

Based on the Basel accord 2004 the RBI indicated that banks in India, at a minimum, shall adopt a standardized approach for credit risk and Basic Indicator approach for operational risks.

ADVERTISEMENTS:

With the results banks in India have taken major initiatives in putting in place the Risk Management Systems like:

1) To establish separate risk management divisions,

2) Credit rating frame work with a rating scale of 7 to be established,

3) All accounts (except exempted categories) having total limits (fund based + non-fund based) above Rs. 20 lacs are subject to risk rating.

Capturing Early Warnings (Preventing Monitoring System) PMS:

ADVERTISEMENTS:

A separate tool to capture early warning signals named Preventive monitoring System popularly known as (PMS) to be implemented to monitor large value exposures of credit.

As per RBI guidelines the risk rating system should be designed to reveal the overall risk of lending, for setting pricing and non-pricing terms of loans and also to present meaningful information for review and management of loan portfolio.

For every loan a score sheet is prepared wherein essential information is obtained from the borrower in order to ascertain his capacity of borrowing. Based on this information the evaluation of the borrowers is ascertained on the basis of score obtained by him on the scale.

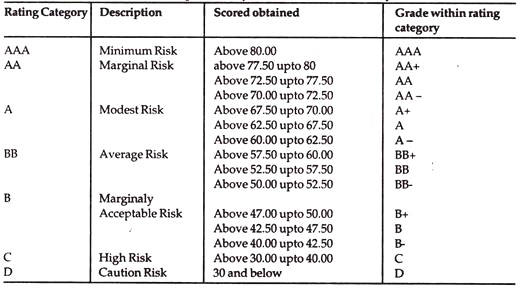

The rating of different borrowers based on their score sheets (score sheets are prepared on the basis of financial documents provided by the borrowers) can broadly be described as follows:

As per RBI each bank is required to put in place its own credit risk rating system and to ensure that such risk rating be done by an officer not directly involved in processing the loan proposals. As a more secure gesture the rating done by an officer is required to be vetted by another senior officer.

Such ratings are also subject to periodical review in order to ascertain operational risks. Most banks have developed different tools (software) for conducting risk rating for different categories of loans like loans below Rs. 2 lacs, from Rs. 2 lacs to 50 lacs, Rs 50 lacs to 5 crores, from Rs. 5 crores to 15 crores and for loans of above Rs. 15 crores etc.

In case of big loans. The banks are directed to get risk rating done by outside agencies also like CRISIL( the oldest risk rating company in India originally promoted by ICICI), ICRA promoted by IFCI, CARE promoted by IDBI.

The RBI also established a system by use of which banks are able to receive before hand information about the borrowers in respect of their loans raised from other banks and financial institutions and the conduct of their borrowable accounts with them.

ADVERTISEMENTS:

In case the borrower defaulter in any account the information about this default can be obtained by banks before taking any decision to grant loan to such borrowers. The system is operated by Credit Information Bureau India Ltd.

Asset Classification and Provisioning:

Based on the recommendations of Narasimha Committee the Reserve Bank of India issued guide lines in April 1992 regarding asset classification, income recognition, provisioning standards and valuation of investments applicable to banks. These guidelines were to be implemented in phased manner w.e.f 1.4.1992 and were revised from time to time in order to bring improvement in NAP management of banks.

Before the recommendations of Narasimha Committee the banks used to monitor the performance of credits by various methods like providing health codes to different loan account on the basis of recovery received, financial documents another factors. But after issuing the guidelines by the RBI in 1992 the system was standardised and specific method was adopted.

In practice the loan accounts can be classified into two categories 1 Performing Assets and 2. Non- performing assets. In case of performing assets banks do not see any problem and in simple words performing asset includes an account where interest amount and installment/other dues are being paid by the borrower in time but in case of non-performing accounts is where bank feels difficulty in recovery of interest or installments or observes non-operation of account by the borrower etc.

ADVERTISEMENTS:

Non-Performing Assets (NPA):

In first phase of implementations of RBI guidelines a loan account was considered as non- performing account on the basis of the concept of “Past due”. The term was used where the due date of repayment by the borrower has passed and the borrowers has not made repayment on the due date. Such “Past due” was taken as 30 days.

In other words the due amount remained unpaid for 30 days from due date. For example the amount was due on 1st day of a month but was not paid even after 30 days of 1st day of that month. With the improvement m the payment and settlement system, information technology in the banking sector the concept of “Past due” was dispensed with from March31, 2001.

RBI issued new guidelines w.e.f 1.4.2001 for classification of Non- Performing Assets. According to these guidelines a non-performing assets was a loan/advance where interest and/or instalment of principal remained overdue for a period of more than (two quarters) i.e., 180 days. From April 1, 2004 an advance is a non-performing asset where

ADVERTISEMENTS:

Term Loan:

1. Interest and/or instalment of principal remain overdue for a period of more than 90 days.

Cash Credit and Overdraft Accounts:

The account remained “out-of-order” for a period of more than 90 days in respect of an Over Draft or Cash Credit accounts.

Bills Purchased and Discounted:

The bill remained overdue for period of more than 90 days in case of bills purchased and discounted.

ADVERTISEMENTS:

Agriculture Advances:

Interest and/or installment of principal remained overdue for two harvest seasons but for a period not exceeding two half-years in the case of an advance granted for agricultural purposes.

Other Accounts:

Any amount to be received remained overdue for a period of more than 90 days in respect of other accounts.

In the guidelines of RBI with respect to Non-performing three specific terms have been used Past- due, Overdue and out-of-order these terms indicate to;

Past Due:

ADVERTISEMENTS:

When a due amount remains unpaid even after the specified period of due date of payment.

Over-Due:

An amount is considered as Over-due under any credit facility if it is not paid on the due date fixed by the bank.

Out-of-Order:

This term relates to Cash Credit and Over Draft accounts.

These accounts are treated out of order:

ADVERTISEMENTS:

a) When the outstanding balance is more than the drawing power of sanctioned limit, or

b) When there are no credits continuously for six months or credits are not enough to cover the interest debited during the same period, or

c) When the submission of stock statement is delayed for 3 months or renewal of limit does not take place or is delayed for 3 months.

Asset Classification:

As per RBI guidelines loans and advances should be classified as:

1. Standard Assets:

ADVERTISEMENTS:

Standard Asset is one which does not discloses any problem and which does not carry more than normal risk attached to the business. These type of assets are not treated as NPA

2. Sub-Standard Asset:

Sub-Standard Asset is one which has been classified as NPA for a period not exceeding 12 months. In such cases, the current net-worth of the borrower/guarantor or the current market value of the security charged is not enough to ensure recovery of the dues to the bank in full. Such an assets has well defined credit weaknesses that jeopardize the liquidation of the debt and is characterized by the distinct possibility that bank will sustain some loss, if deficiencies are not corrected.

An asset where the terms of the loan agreement regarding interest and principal have been renegotiated or rescheduled after commencement of production, should be classified as sub-standard and should remain in such category for at least one year of satisfactory performance under the renegotiated or rescheduled terms.

3. Doubtful Assets:

A doubtful asset is one which has remained NPA for a period exceeding 12 months.

ADVERTISEMENTS:

A loan classified as doubtful has all the weaknesses inherent in assets that were classified as sub-standard asset, with the added characteristic that weaknesses make collection or liquidation in full, on the basis of currently known facts, conditions and values – highly questionable and improbable.

4. Loss Assets:

A loss asset is one where loss has been identified by the bank or internal or external auditors or the RBI inspectors but the amount has not been written off, wholly or partly. In other words, such an asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted although there may be some salvage or recovery value.

The classification of NPA is done on the basis of record of recovery and not on the basis of available security.

Provisioning Norms for Loan Assets:

Taking into account the time lag between an account becoming doubtful of recovery, its recognition as such, the realization of the security and erosion over time in the value of security charged to the Banks, RBI decided that banks should make provisions against sub-standard, doubtful and loss assets.

Recently the RBI has desired to make some provisions against Standard assets also (except some exempted categories). RBI has laid down certain guidelines for making provisions for loan assets. These guide lines provide for minimum provisioning requirements that should be complied with by each bank as mandatory. However where any bank feels that there is substantial uncertainty to recovery, higher provision should be made by banks.

The requirement of making provisions for different categories of loans is as follows:

Standard Assets:

A general provision of 0.25 % of total outstanding is required to be made w.e.f. 31-3-2000.

Sub-Standard Assets:

A general provision of 10 % of total outstanding. While calculating provisions, DICGC/ECGC cover is not to be deducted from the outstanding balance.

Doubtful Assets:

100 % of the extent to which the advance is not covered by the realisable value of the security to which the bank has a valid recourse and the realizable value should be estimated on a realistic basis.

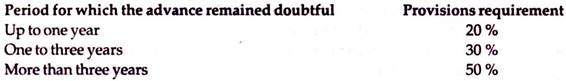

In addition to above provisions the banks are required to make provisions for the secured portion also depending upon the period for which the asset remained doubtful.

Consequent upon changed definition of doubtful assets effective from March31, 2001 additional provisioning was to be made in phases:

As on 31.03.2001 – 50% of additional provisioning for assets became doubtful on account of new norm of 18 months for transition from Su-standard to doubtful category.

As on 31-3-2002 Balance of the provisions not made during the previous year. In addition to provisions needed, as on 31-3-2002.

Banks are permitted to phase the additional provisioning consequent upon the reduction in the transition period from sub-standard to doubtful asset from 18 months to 12 months over a four year period commencing from the year ending 31st March, 2005, with a minimum of 20% each year.

Loss Assets:

In first instance all the loss assets must be written off If not done 100 % provision is required to be made regardless of security.

Income Recognition:

As per practice hereto before the banks had been charging interest in all accounts and the interest so charged was shown as income earned by way of interest on loans and advances. While doing so no cognizance was taken to ensure whether the interest amount debited to loan accounts has been paid by the borrowers or not but was shown as income by way of interest. This was done because India usually recognises interest income on advances, on accrual basis.

In another words normally the income is accounted for as and when it is earned irrespective of the fact whether same has been actually received or not. Although the Institute of Chartered Accountants of India has issued guide lines but so far as banks are concerned the guidelines prescribed and issued by the Reserve Bank of India are to follow relating to income recognition.

RBI guidelines provide that the policy of income recognition in banks has to be objective and based on the record of recovery. As per International standards the income from NPA is not recognized on accrual basis but is booked as income only when it is actually received.

Following the international standard and the decision of Basel committee same standards are being adopted in India also according which Indian banks should not charge and take into income account interest on NPA.

Exceptional Cases:

There are some exceptional cases which do not fall under the above general rule like:

(A) Interest on advances against banks own term deposits, National Saving Certificates issued by postal department of India, Indra Vikas Patra, Kisan Vikas Patra and Life policies may be taken to income account on the due date, provided adequate margin is available in these accounts.

All these accounts are self-liquidating accounts i.e. on maturity of the security full amount with interest is received by the bank to recover its full dues. However it must be insured that before granting loans the requisite margin is sufficient.

(B) Fees and commissions earned by the banks as a result of renegotiations or rescheduling of outstanding debts should be recognized on an accrual basis over the period of time covered by the re-negotiated or rescheduled extension credit.

In case of Government guaranteed advances become NPA, the interest on such advances should not be taken to income account unless the interest has been recovered or actually received.

Reversal of Income already booked:

As per RBI guidelines each bank must ensure that if any advance, bill purchased/discounted becomes NPA as at the close of any year, interest accrued and credited to income account in the corresponding previous year, should be reversed or provided for if the same is not recovered actually. This rule is applicable even to government guaranteed accounts too.

In respect of NPAs, fees, commission and similar income that have been accrued should be stopped to accrue in the current period and should be reversed or provided for with respect to past periods, if uncollected.

Appropriation of Recovery in NPA Accounts:

1. Recovery received in NPAs (other than suit filed and decreed accounts) be appropriated first towards interest and thereafter towards arrears of installments for current previous year for term loan and principal irregularities in other accounts.

2. It should be ensured that credits/recovery in the borrowable account towards interest taken to income are not out of fresh/additional credit facilities sanctioned to the borrower.

3. In case of suit filed and decreed accounts, the appropriation of recoveries will continue to be made as per Court’s ruling.

After any account becomes regular i.e., outstanding including interest booked as NPA account and kept separately, comes within DPO/limit, the account should be treated as a normal account and not as NPA.

In NPA account the interest portion remains a point of discretion of individual bank whether the interest accrued is parked in any suspense account, sundry account or maintaining only a record of interest amount entries popularly known as Recorded Interest.