Here is an essay on ‘Credit Risk and Its Management’ for class 11 and 12. Find paragraphs, long and short essays on ‘Credit Risk and Its Management’ especially written for school and banking students.

Credit Risk and Its Management

Essay Contents:

- Essay on the Concept of Credit Risk

- Essay on the Management Framework of Credit Risk

- Essay on the Organisation Structure of Credit Risk

- Essay on the Risk Identification of Credit Risk

- Essay on the Measurement of Credit Risk

- Essay on the Control and Monitoring of Credit Risk

- Essay on the Credit Risk Policies and Guidelines at Transaction Level

- Essay on the Credit Control and Monitoring at Portfolio Level

- Essay on Active Credit Portfolio Management

- Essay on the Controlling Credit Risk through Loan Review Mechanism

- Essay on Credit Risk Mitigation

- Essay on Securitisation

Essay # 1. Concept of Credit Risk:

ADVERTISEMENTS:

Conceptually credit risk is easily understandable. We all know that credit risk arises from lending activities of a bank. It arises when a borrower does not pay interest and/or installments as and when it falls due or in case where a loan is repayable on demand, the borrower fails to make the payment as and when demanded. Banks follow up for the payments and more often than not end up in receiving less than the amount that is due. The shortfall in payment is written off eventually to the debit of profit and loss account. This is the risk that arises from lending activities.

Credit Risk in banks not only arises in course of direct lending when funds are not repaid, it also arises in course of issuing guarantees or letters of credit when funds will not be forth coming upon crystallisation of the liability, or in the course of transactions involving treasury products when series of payments due from the counterparty cease or are not forthcoming, or in case of trading of securities if settlement is not effected or in case of cross-border exposure where free transfer of currency is restricted or ceases. The list is, however, not exhaustive.

Since, lending activities are usually spread across all the branches and controlling offices of banks, and lending activities typically command more than half of all risk taking activities of a bank, management of credit risk is very critical requirement of banks. In addition, communication of credit risk management policy of the bank across the entire organisation assumes importance as this risk taking activity is exercised across a large cross-section of branches and a planned approach is required to build a portfolio with desired characteristics.

Essay # 2. Management Framework of Credit Risk:

ADVERTISEMENTS:

As in case of market risk management, credit risk management also involves finding answer to four key questions:

(a) What are the risks?

(b) Which, when and how much risk to accept that results in improving bottom-line?

(c) How can we monitor and control credit risk?

ADVERTISEMENTS:

(d) Can we reduce the risk? And, if so then how?

Management processes are designed essentially to answer these questions.

Accordingly, credit risk management processes are sub-divided into following four parts:

1. Credit Risk Identification

ADVERTISEMENTS:

2. Credit Risk Measurement

3. Credit Risk Monitoring and Control

4. Credit Risk Mitigation

Management of credit risk needs an organisation structure in place that can carry out the functions required for the purpose.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 3. Organisation Structure of Credit Risk:

Organisation for credit risk management is created with the objective of achieving compatibility in risk and business policies and to ensure their simultaneous implementation in a consistent manner. It involves setting risk limits based on objective measures of risk and simultaneously ensuring optimum risk adjusted return keeping in view capital constraint. It is a question of bank’s policy in balancing risks, returns and capital. Organisation for credit risk management should be able to achieve it.

Usually, Credit Risk Management organisation would consist of:

i. The Board of Directors

ADVERTISEMENTS:

ii. The Risk Management Committee

iii. Credit Policy Committee (CPC)

iv. Credit Risk Management Department.

i. Board of Directors:

ADVERTISEMENTS:

The Board of Directors has the overall responsibility for management of risks. The Board articulates credit risk management policies, procedures, aggregate risk limits, review mechanisms and reporting and auditing systems. The Board decides the level of credit risk for the bank as a whole, keeping in view its profit objective and capital planning.

ii. Risk Management Committee:

The Risk Management Committee is a Board level Sub-Committee.

The responsibilities of Risk Management Committee with regard to credit risk management aspects include the following:

i. Setting guidelines for credit risk management and reporting

ii. Ensure that credit risk management processes conform to the policy

ADVERTISEMENTS:

iii. Setting up prudential limits and its periodical review

iv. Ensure robustness of measurement of risk models

v. Ensure proper manning for the processes

iii. Credit Policy Committee:

Credit Policy Committee, also called Credit Control Committee deals with issues relating to credit policy and procedures and to analyse, manage and control credit risk on a bank wide basis. The Committee formulates policies on standards for presentation of credit proposals, financial covenants, rating standards and benchmarks, delegation of credit approving powers, prudential limits on large credit exposures, asset concentrations, standards for loan collateral, portfolio management, loan review mechanism, risk concentrations, risk monitoring and evaluation, pricing of loans, provisioning, regulatory/legal compliance, etc.

iv. Credit Risk Management Department (CRMD):

ADVERTISEMENTS:

Credit Risk Management Department (CRMD), which is independent of the Credit Administration Department, enforces and monitors compliance of the risk parameters and prudential limits set by the CPC. The CRMD also lays down risk assessment systems, monitor quality of loan portfolio, identify problems and correct deficiencies, develop MIS and undertake loan review/audit. The Department undertakes portfolio evaluations and conduct comprehensives studies on the environment to test the resilience of the loan portfolio.

People with necessary credit dispensation skills, abilities and knowledge are a critical input in the CRM process. Therefore CRM needs to evaluate the existing competency levels and identify the training needs to enhance the competency levels to meet the requirements for successful functioning of CRM on an ongoing basis.

Essay # 4. Risk Identification of Credit Risk:

Credit risk arises from potential changes in the credit quality of a borrower.

It has two components:

i. Default risk and

ADVERTISEMENTS:

ii. Credit spread risk.

i. Default Risk:

Default risk is driven by the potential failure of a borrower to make promised payments, either partly or wholly. In the event of default, a fraction of the obligations will normally be paid. This is known as the recovery rate.

ii. Credit Spread Risk or Downgrade Risk:

If a borrower does not default, there is still risk due to worsening in credit quality. This results in the possible widening of the credit-spread. This is credit-spread risk. Usually this is reflected through rating downgrade. It is normally firm-specific.

Loans are not usually marked-to-market. Consequently, the only important factor is whether or not the loan is in default today (since this is the only credit event that can lead to an immediate loss). Capital market portfolios are marked-to-market. They have in addition credit spread volatility (continuous changes in the credit-spread). This is more likely to be driven by the market’s appetite for certain levels of risk. For example, the spreads on high-grade bonds may widen or tighten, although this need not necessarily be taken as an indication that they are more or less likely to default.

ADVERTISEMENTS:

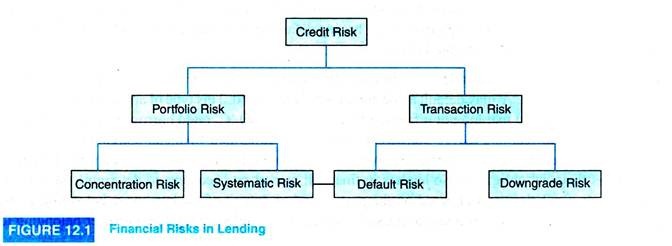

Default risk and downgrade risk are transaction level risks. Risks associated with credit portfolio as a whole is termed portfolio risk.

Portfolio risk has two components:

a. Systematic or Intrinsic Risk

b. Concentration Risk.

a. Systematic or Intrinsic Risk:

Portfolio risk is reduced due to diversification. If a portfolio is fully diversified, i.e. diversified across geographies, industries, borrowers, markets, etc., equitably, then the portfolio risk is reduced to a minimum level. This minimum level corresponds to the risks in the economy in which it is operating. This is systematic or intrinsic risk.

ADVERTISEMENTS:

b. Concentration Risk:

If the portfolio is not diversified that is to say that it has higher weight in respect of a borrower or geography or industry etc., the portfolio gets concentration risk.

A portfolio is open to the systematic risk i.e., the risks associated with the economy. If economy as a whole does not perform well, the portfolio performance will be affected. That is why when an economy stagnates or faces negative or reduced growth, credit portfolio of banking industry as a whole shows indifferent performance. Credit portfolio having concentration in any segment would be affected if the segment does not perform well.

Measuring and managing credit risk, whether for loans, bonds or derivative securities, has become a key issue for financial institutions. The risk analysis can be performed either for stand-alone trades or for portfolios as a whole. The latter approach takes into account risk diversification across trades and borrowers. Ignoring risk diversification can lead to erroneous risk management decisions, increasing rather than reducing the risk exposure of the financial institution.

Diversification occurs both at the borrower (obligor) level and at geographical level besides across trades and industries. Since different firms do not default at the same time, the risk level and corresponding capital that must be held against defaults for a well-diversified portfolio is only a fraction of the total exposure of the portfolio.

The following chart outlines financial risks in lending as shown in Figure 12.1:

A variant of credit risk is ‘Counterparty Risk’. The counterparty risk arises from non-performance of the trading partners. The non-performance may arise from counterparty’s refusal/inability to perform. The counterparty risk is generally viewed as a transient financial risk associated with trading rather than standard credit risk.

‘Country Risk’ is also a type of credit risk where non-performance by a borrower or counterparty arises because of restrictions imposed by a sovereign. The restrictions may be in the nature of a sanction or may arise due to economic conditions.

Essay # 5. Measurement of Credit Risk:

Measurement of credit risk consists of:

(a) Measurement of risk through credit rating/scoring;

(b) Quantifying the risk through estimating expected loan losses, i.e., the amount of loan losses that bank would experience over a chosen time horizon (through tracking portfolio behaviour over 5 or more years) and unexpected loan losses i.e. the amount by which actual losses exceed the expected loss (through standard deviation of losses or the difference between expected loan losses and some selected target credit loss quartile).

i. Credit Rating – Why is it Necessary?

Credit Rating of an account is done with primary objective to determine whether the account, after the expiry of a given period, would remain a performing asset, i.e., it will continue to meet its obligation to its creditors, including Bank and would not be in default. In other words, credit rating exercise seeks to predict whether the borrower would have the capability to honour its financial commitment in future to the rest of the world.

There is no mathematical/econometric/empirical model, which can predict the future capability of a borrower to meet its financial obligations accurately. Nevertheless, lenders in financial market, all over the world, rely on some model, which seek to predict the future capability of a borrower to meet its financial obligations. This is because behaviour of a group of borrowers having similar rating, in terms of their failure to meet financial obligations i.e., having defaulted financially, has been found to be, within bounds, consistent.

This is explained below:

A borrower, even though he is rated ‘C’, may not default after a given period of say one year, whereas, another borrower rated ‘A’ may default at the end of the given period. This type of apparently paradoxical situation does arise and that too not infrequently. However, if 100 ‘C’ rated borrowers are tracked over a period of say one year and say 10 borrowers default in meeting their financial obligations, as against that, 100 ‘A’ rated borrowers, if tracked over the same period, only one borrower may default in meeting his financial obligation.

So lenders in financial market rate accounts to determine the class to which a borrower belongs. And based on the past record of default of the borrowers belonging to the same class, they have a fair estimate of possible number of defaults among the borrower belonging to the said class.

In other words, if a bank say has 200 borrowers who have been rated ‘A’ in their portfolio and if past record show that 1% of such borrowers have defaulted every year, they would estimate that 2 borrowers among these ‘A’ rated accounts may default at the end of a year. This in turn, helps the bank to assess cost of default to it, and is built into the loan pricing so that cost of default is recovered.

Similarly, if the bank has 400 borrowers who have been rated ‘B’ in their portfolio and if past records show that 5% of such borrowers have defaulted every year, they would estimate that 20 borrowers among these ‘B’ rated accounts might default at the end of a year. This then is to be built into the loan pricing for ‘B’ rated accounts so that cost of default is recovered. Because of higher rate of default, ‘B’ rated accounts would be priced at higher level than that of ‘A’ rated accounts.

Besides, pricing of loans and advances, this also helps in estimating defaults that the credit portfolio of the Bank may generate if the entire portfolio is rated and default probability is available for all rating categories. This also helps in assessing minimum capital required.

This is the basic approach that financial institutions/banks have adopted the world over in managing credit portfolio as it helps them to design a credit portfolio with a desired level of defaults and expected profits against available capital. This also has a bearing on the capital market and share prices of banks/FIs. The desire to have the portfolio rated and actively manage the credit portfolio stems from this basic need.

Regulatory authority, i.e., Reserve Bank of India has also issued necessary instructions and guidance notes emphasising upon banks to apply credit rating to their borrower accounts and classify them rating category-wise. They have also advised banks to develop and maintain necessary data on defaults of borrowers rating category wise. This would also help to manage credit portfolio in a proactive manner and to have a prior estimate of expected defaults, expected contribution and capital requirements to maintain the portfolio.

ii. Credit Rating – Approach to it:

In order to develop our capability to actively manage our credit portfolio, one must have in place the following:

a. Credit Rating Model (or models for different categories of loans and advances)

b. Develop and maintain necessary data on defaults of borrowers rating category, wise, i.e., ‘Rating Migration’.

a. Credit Rating Model:

A credit rating model essentially differentiates borrowers, based on degree of stability in terms of top line (e.g., sales) and bottom-line (net profit) revenue generation. This is because where uncertainty in revenue generation in a business is more, chances of failing in keeping financial commitments to the rest of the world is also more. Where revenue generation is stable over a given period, uncertainty or risk associated is zero.

For example, cash generation from an investment in Government. Securities are absolutely stable and hence risk associated with such investment is also non-existent. This would also mean that an ‘A’ rated borrower would have more stable revenue generation than that of a ‘B’ rated borrower and an ‘A++’ rated borrower’s revenue generation would be more stable than that of ‘A’ rated borrower.

It may also be clarified that rating has nothing to do with profitability. A highly profitable company may have higher level of uncertainties in revenue generation and therefore may be rated lower than a borrower with a relatively lower profitability but having more stable revenue generation. To cite the example of Government Securities again, we all know that returns on them is one of the lowest but are rated highest as stability in cash flow is absolute.

In developing a rating model therefore, factors that have an impact on the stability of revenue generation are relied upon. In fact, there is several rating models with various levels of complexities and require data sets that could be fairly extensive and cover few years.

The issue of simplicity and its user- friendliness are also very crucial in designing a model. A balance is struck keeping in view the need of both these aspects. As such, a purely simple model very easy to use may not be feasible as such a model may not be able to capture stability of revenue generation of the borrower and may not be acceptable.

This can be explained further. As in case of students, they are assessed against a set of standards using appropriate testing methods. If a College or Board, in order to show a better result, lowers its standards of testing and thereby show higher level of 1st division students, we know that the market assesses the standard of the college at a lower level. Even really better students suffer as they are rated in relation to the standard of the college. In the world of rating too this market behaviour is clearly visible. The standard of rating is assessed in the market through rating migration.

b. Rating Migration:

Rating migration is change in the rating of a borrower over a period of time when rated on the same standard or model. For example, say a borrower M/s. XYZ Ltd. is rated as B+ based on its position as on 31-3-02. The same company is again rated as on 31-3-03 based on its position as on that date, its rating, based on the same model, say comes to B. Then we say that the rating of the account has migrated from B+ to B over one year period.

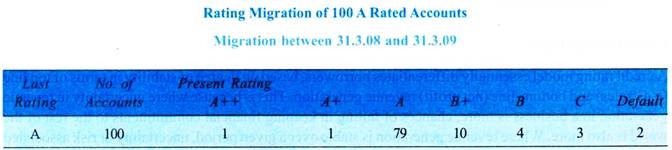

As in case of rating of borrower, rating migration of a single account also does not convey much. It becomes useful when migration of a large number of accounts of similar rating is observed. Say, we have 100 ‘A’ rated borrowers as on 31st March 2008.

When these accounts are rated again as on 31st March 2009, i.e., after one year, typically we may find new ratings as given below:

This migration table implies that ‘A’ rated borrower would have 2% default probability. This is based on one-year data only. When this observation is collated over a number of years, we would have a fairly reasonable estimation of default probability.

This migration pattern of ‘A’ rated borrowers should also compare well with standard migration patterns published by rating agencies. This means that if usually ‘A’ rated borrowers show 0.2% default probability in terms of standard migration pattern observed, and rating migration as per the model records 2% default for ‘A’ category borrowers, then regulatory authorities, rating agencies and market will assume a lower rating for all borrowers rated ‘A’ under that model. The rating equivalent would be considered say B+, if default probability of B+ rated borrowers happens to be 2% in terms of standard rating models. This is known as mapping with market standards.

Acceptability of a rating model is an issue with the regulatory authorities, rating agencies and other market watchdogs and is tested based on two counts:

1. Whether relevant factors (i.e., risk drivers) have been taken into account in the model covering standard rating factors in the areas of management, financials, past conduct, business-related issues, industry, etc.

2. Whether rating migration developed based on the model maps fairly well with market standards, i.e., rating migration pattern published by rating agencies.

Many of the international banks have adopted credit risk models for evaluation of credit portfolio. The credit risk models offer banks framework for examining credit risk exposures, across geographical locations and product lines in a timely manner, centralising data and analysing marginal and absolute contributions to risk. The models also provide estimates of credit risk (unexpected loss), which reflect individual portfolio composition.

A few of them are mentioned here:

i. The Altman’s Z score forecasts the probability of a company entering bankruptcy within a 12- month period. The model combines five financial ratios using reported accounting information and equity values to produce an objective measure of borrower’s financial health.

ii. J.P. Morgan has developed a portfolio model ‘Credit Metrics’ for evaluating credit risks. The model basically focusses on estimating the volatility in the value of assets caused by variations in the quality of assets. The volatility is computed by tracking the probability that the borrower might migrate from one rating category to another (downgrade or upgrade).

Thus, the value of loans can change over time, reflecting migration of the borrowers to a different risk grade. The model can be used for promoting transparency in credit risk, establishing benchmark for credit risk measurement and estimating economic capital for credit risk under RAROC framework.

iii. Credit Suesse developed a statistical method for measuring and accounting for credit risk, which is known as Credit Risk+. The model is based on actuarial calculation of expected default rates and unexpected losses from default.

Banks should have a comprehensive risk scoring/rating system that serves as a single-point indicator of diverse risk factors of a borrower/counterparty and for taking credit decisions in a consistent manner. A substantial degree of standardisation is required in ratings across borrowers.

The risk rating system should be designed to reveal the overall risk of lending, critical input for setting pricing and non-price terms of loans as also present meaningful information for review and management of loan portfolio. The risk rating, in short, should reflect the underlying credit risk of the loan book. The rating exercise should also facilitate the credit granting authorities some comfort in its knowledge of loan quality at any moment of time.

The risk rating system should be drawn up in a structured manner, incorporating, inter alia, financial analysis, projections and sensitivity, industrial and management risks. The banks may use financial ratios and operational parameters, as also qualitative aspects of management and industry characteristics. Such system should also be periodically reviewed.

Essay # 6. Control and Monitoring of Credit Risk:

Risk taking through lending activities needs to be supported by a very effective control and monitoring mechanism, firstly because this activity is widespread, and secondly, because of very high share of credit risk in the total risk taking activity of a bank.

An elaborate and well-communicated policy at transaction level that articulates guidelines for risk taking, procedural guidelines and an effective monitoring system is necessary. This is also necessary to achieve the desired portfolio. Active portfolio management is required to keep up with the dynamics of the economy. It is also necessary to monitor it.

Consequently, credit risk control and monitoring is directed both at transaction level and portfolio level.

It must be mentioned here that an appropriate credit information system is basic prerequisite for effective control and monitoring. A comprehensive and detailed MIS and CIS is the backbone for an effective CRM System. There is need to review the existing MIS available from HO and branches and the applicability of data for analysis purposes. A detailed MIS and CIS structure should be set up and enforced for future data requirements.

Essay # Essay # 7. Credit Risk Policies and Guidelines at Transaction Level:

The instruments of Credit Risk Management at transaction level are:

i. Credit Appraisal Process,

ii. Risk Analysis Process,

iii. Credit Audit and Loan Review, and

iv. Monitoring Process.

There is a need to constantly improve the efficiency for each of these processes in objectively identifying the credit quality of borrowers, enhancing default analysis, capturing the risk elements adequately for future reference and providing an early warning signal for deterioration in credit risk of borrowers.

Credit risk taking policy and guidelines at transaction level should be clearly articulated in the Bank’s Loan Policy Document approved by the Board.

Standards and guidelines should be outlined for:

i. Delegation of Powers

ii. Credit Appraisals

iii. Rating Standards and Benchmarks (derived from the Risk Rating System)

iv. Pricing Strategy

v. Loan Review Mechanism.

Credit Approving Authority:

Each Bank should have a carefully formulated scheme of delegation of powers. The banks should also evolve multi-tier credit approving system where the loan proposals are approved by an ‘Approval Grid’ or a ‘Committee’. The ‘Grid’ or ‘Committee’, comprising at least 3 or 4 officers, may approve the credit facilities above a specified limit and invariably one officer should represent the CRMD, who has no volume and profit targets.

The spirit of the credit approving system may be that no credit proposals should be approved or recommended to higher authorities, if majority members of the ‘Approval Grid’ or ‘Committee’ do not agree on the creditworthiness of the borrower. In case of disagreement, the specific views of the dissenting member/s should be recorded.

Credit Appraisal:

Credit appraisal guidelines include borrower standards, procedures for analyzing credit requirements and risk factors, policies on standards for presentation of credit proposals, financial covenants, rating standards and benchmarks etc. This brings a uniformity of approach in credit risk taking activity across the organisation. Credit appraisal guidelines may include risk monitoring and evaluation of assets at transaction level, pricing of loans, regulatory/legal compliance, etc.

Prudential Limits:

Prudential limits serve the purpose of limiting credit risk. There are several aspects for which prudential limits may be specified.

They may include:

(a) Prudential limits for financial and profitability ratios such as current ratio, debt equity and return on capital or return on assets, etc., debt service coverage ratio, etc.

(b) Prudential limits for credit exposure

(c) Prudential limits for asset concentration

(d) Prudential limits for large exposures

(e) Prudential limit for maturity profile of the loan book.

Prudential limits may have flexibility for deviations. The conditions subject to which deviations are permitted and the authority thereof should also be clearly spelt out in the Loan Policy.

Rating Standards and Benchmarks:

The credit risk assessment exercise should be repeated bi-annually (or even at shorter intervals for low quality customers) and should be delinked invariably from the regular renewal exercise. The updating of the credit ratings should be undertaken normally at quarterly intervals or at least a half-yearly intervals, in order to gauge the asset quality at periodic intervals.

Note:

Rating changes have implication at portfolio level. Variations in the ratings of borrowers over time indicate changes in credit quality and expected loan losses from the credit portfolio. Thus, if the rating system is to be meaningful, the credit quality reports should signal changes in expected loan losses.

In order to ensure the consistency and accuracy of internal ratings, the responsibility for setting or confirming such ratings should vest with the Loan Review function and examined by an independent Loan Review Group. The banks should undertake comprehensive study on migration (upward – lower to higher and downward – higher to lower) of borrowers in the ratings to add accuracy in expected loan loss calculations.

Risk Pricing:

The pricing strategy for credit products should move towards risk-based pricing to generate adequate risk adjusted returns on capital. The Credit Spread should have a bearing on expected loss rates and charges on capital.

Risk-return pricing is a fundamental tenet of risk management. In a risk-return setting, borrowers with weak financial position have high credit risk stake and should be priced high. Pricing of credit risk should have a bearing on the probability of default. Since probability of default is linked to risk rating, pricing of loans normally should be linked to rating. However, value of collateral, value of accounts, future business potential, portfolio/industry exposure and strategic reasons may also play important role in pricing.

There is, however, a need for comparing the prices quoted by competitors for borrowers having same rating/quality. Any attempt at price-cutting for market share would result in wrong pricing of risk.

Essay # 8. Credit Control and Monitoring at Portfolio Level:

Credit control and monitoring at portfolio level deals with the risk of a given portfolio, expected losses, requirement of risk capital, and impact of changing the portfolio mix on risk, expected losses and capital. It also deals with the marginal and absolute risk contribution of a new position and diversification benefits that come out of changing the mix. It also analyses factors that affect the portfolio’s risk profile.

The activities include:

i. Identification of portfolio credit weakness in advance – through credit quality migrations

ii. Move from measuring obligor specific risk associated with individual credit exposures to measuring concentration effects on the portfolio as a whole

iii. Evaluate exposure distribution over rating categories and stipulate quantitative ceilings on aggregate exposure in specified rating categories

iv. Evaluate rating wise distribution in various industries and set corresponding exposure limits to contain concentration risk

v. Move towards Credit Portfolio Value at Risk Models.

A framework of tracking the non-performing loans around the balance sheet date does not signal the quality of the entire loan book. A system for identification of credit weaknesses well in advance could be realised by tracking the migration (upward or downward) of borrowers from one rating scale to another.

This process would be meaningful only if the borrower wise ratings are updated at quarterly/half-yearly intervals. Data on movements within grading categories provide a useful insight into the nature and composition of portfolio.

Some measures to maintain the portfolio quality are:

1. Quantitative ceiling on aggregate exposure in specified rating categories.

2. Evaluation of rating wise distribution of borrowers in various industries, business segments, etc.

3. Industry wise and sector wise monitoring of exposure performance. Where portfolio exposure to a single industry is badly performing, the banks may increase the quality standards for that specific industry.

4. Target for probable defaults and provisioning requirements as a prudent planning exercise. For any deviation/s from the expected parameters, an exercise for restructuring of the portfolio should immediately be undertaken and if necessary, the entry-level criteria could be enhanced to insulate the portfolio from further deterioration.

5. Undertake rapid portfolio reviews, stress tests and scenario analysis when external environment undergoes rapid changes (e.g., volatility in the forex market, economic sanctions, changes in the fiscal/monetary policies, general slowdown of the economy, market risk events, extreme liquidity conditions, etc.). Based on the findings of stress test, prudential limits, quality standards, etc., may be revised.

6. Introduce discriminatory time schedules for review of borrowers.

The credit risk of a bank’s portfolio depends on both external and internal factors. The external factors are the state of the economy, wide swings in commodity/equity prices, foreign exchange rates and interest rates, trade restrictions, economic sanctions, government policies, etc.

The internal factors are deficiencies in loan policies/administration, absence of prudential credit concentration limits, inadequately defined lending limits, deficiencies in appraisal of borrowers’ financial position, excessive dependence on collaterals and inadequate risk-pricing, absence of loan review mechanism and post sanction surveillance, etc. Portfolio performance may be analysed to identify the causes and necessary remedial action.

Essay # 9. Active Credit Portfolio Management:

Motivation for active credit portfolio management comes from changing demand of traditional products and new business opportunities.

Change in demand of traditional products have arisen due to:

i. Less demand due to disintermediation

ii. More supply due to capital mobility

iii. Lower returns and increased importance of risk.

The motivation for active credit portfolio management also comes from new opportunities in the economy, such as:

i. Pass through certificates

ii. Syndicated lending

iii. Project/structured finance.

Essentially, new products have different risks from the traditional products.

In addition, banks have new tools to manage credit portfolio such as:

i. Secondary loan trading

ii. Securitisation

iii. Credit derivatives.

This calls for a business transformation plan – a gradual process with a well-articulated strategy and with a thorough understanding of markets and supported by:

i. Necessary infrastructure

ii. Appropriate policy development

iii. Human resource training

iv. Careful system selection

v. Continuous testing and refinement.

Essay # 10. Controlling Credit Risk through Loan Review Mechanism:

LRM is an effective tool for constantly evaluating the quality of loan book and to bring about qualitative improvements in credit administration. Loan Review Mechanism is used for large value accounts with responsibilities assigned in various areas such as, evaluating effectiveness of loan administration, maintaining the integrity of credit grading process, assessing portfolio quality, etc.

The main objectives of LRM are:

i. To identify promptly loans, which develop credit weaknesses and initiate timely corrective action

ii. To evaluate portfolio quality and isolate potential problem areas

iii. To provide information for determining adequacy of loan loss provision

iv. To assess the adequacy of and adherence to, loan policies and procedures, and to monitor compliance with relevant laws and regulations

v. To provide top management with information on credit administration, including credit sanction process, risk evaluation and post-sanction follow up.

Accurate and timely credit grading is one of the basic components of an effective LRM. Credit grading involves assessment of credit quality, identification of problem loans, and assignment of risk ratings. A proper Credit Grading System should support evaluating the portfolio quality and establishing a loan loss provisions. Given the importance and subject nature of credit rating, the credit ratings awarded by Credit Administration Department should be subjected to review by Loan Review Officers who are independent of loan administration.

Loan Review Policy should address the following issues:

Qualification and Independence:

The Loan Review Officers should have sound knowledge in credit appraisal, lending practices and loan policies of the bank. They should also be well-versed in the relevant laws/regulations that affect lending activities. The independence of Loan Review Officers should be ensured and the findings of the reviews should also be reported directly to the Board or Committee of the Board.

Frequency and Scope of Reviews:

The Loan Reviews are designed to provide feedback on effectiveness of credit sanction and to identify incipient deterioration in portfolio quality. Reviews of high value loans should be undertaken usually within three months of sanction/renewal or more frequently when factors indicate a potential for deterioration in the credit quality. The scope of the review should cover all loans above a cut-off limit.

In addition, banks should also target other accounts that present elevated risk characteristics. Although it is desirable to subject all loans above a cut off to LRM, at least 30-40% of the portfolio should be subjected to LRM in a year to provide reasonable assurance that all the major credit risks embedded in the balance sheet have been tracked.

Depth of Reviews:

The loan reviews should focus on:

i. Approval process

ii. Accuracy and timeliness of credit ratings assigned by loan officers

iii. Adherence to internal policies and procedures, and applicable laws/regulations

iv. Compliance with loan covenants

v. Post-sanction follows up

vi. Sufficiency of loan documentation

vii. Portfolio quality

viii. Recommendations for improving portfolio quality.

The findings of reviews should be discussed with line managers and the corrective actions should be elicited for all deficiencies. Deficiencies that remain unresolved should be reported to top management.

The banks should also evolve suitable framework for reporting and evaluating the quality of credit decisions taken by various functional groups. The quality of credit decisions should be evaluated within a reasonable time say 3-6 months, through a well-defined Loan Review Mechanism.

Review of Small Value Retail Loan Accounts:

Usually such assets are subjected to review on exception basis. Segments which show below average default performance are taken up for review and for putting in place remedial actions. Other segments are subjected to review on sample basis based on a predefined plan.

Essay # 11. Credit Risk Mitigation:

Credit risk mitigation is an essential part of credit risk management. This refers to the process through which credit risk is reduced or it is transferred to counterparty. Strategies for risk reduction at transaction level differ from that at portfolio level.

At transaction level banks use a number of techniques to mitigate the credit risks to which they are exposed. They are mostly traditional techniques and need no elaboration. They are, for example, exposures collateralised by first priority claims, either in whole or in part, with cash or securities, or an exposure guaranteed by a third party. Recent techniques include buying a credit derivative to offset credit risk at transaction level.

At portfolio level, asset securitisation, credit derivatives, etc., are used to mitigate risks in the portfolio. They are also used to achieve desired diversification in the portfolio as also to develop a portfolio with desired characteristics. It must be noted that while the use of CRM techniques reduces or transfers credit risk, it simultaneously may increase other risks such as legal, operational, liquidity and market risks.

Therefore, it is imperative that banks employ robust procedures and processes to control these risks as well. In fact, advantages of risk mitigation must be weighed against the risks acquired and its interaction with the bank’s overall risk profile.

Essay # 12. Securitisation:

Securitisation refers to a transaction where financial securities are issued against the cash flow generated from a pool of assets. Cash flow arising out of payment of interest and repayment of principal are used to service interest and repayment of financial securities. Usually a SPV – special purpose vehicle is created for the purpose. Originating bank – that is the bank who has originated the assets – transfers the ownership of such assets to the SPV. SPV issues financial securities and has the responsibility to service interest and repayments on such financial instruments.

In the process the originating bank transfers credit risk to the investors. A bank may also become an investor in a securitisation transaction and may acquire credit risk.

A traditional securitisation is a structure where the cash flow from an underlying pool of exposures is used to service at least two different stratified risk positions or tranches reflecting different degrees of credit risk. Payments to the investors depend upon the performance of the specified underlying exposures, as opposed to being derived from an obligation of the entity originating those exposures.

The stratified/tranched structures that characterise securitisations differ from ordinary senior/subordinated debt instruments in that junior securitization tranches can absorb losses without interrupting contractual payments to more senior tranches, whereas subordination in a senior/subordinated debt structure is a matter of priority of rights to the proceeds of liquidation.

A synthetic securitisation is a structure with at least two different stratified risk positions or tranches that reflect different degrees of credit risk where credit risk of an underlying pool of exposures is transferred, in whole or in part, through the use of funded (e.g., credit-linked notes) or unfunded (e.g. credit default swaps) credit derivatives or guarantees that serve to hedge the credit risk of the portfolio. Accordingly, the investors’ potential risk is dependent upon the performance of the underlying pool.

Securitisation exposures include asset-backed securities, mortgage-backed securities, credit enhancements, liquidity facilities, interest rate or currency swaps, credit derivatives and tranched cover. Underlying instruments in the pool being securitized may include loans, commitments, asset-backed and mortgage-backed securities, corporate bonds, equity securities, and private equity investments. The underlying pool may include one or more exposures.

An asset-backed commercial paper (ABCP) programme predominately issues commercial paper with an original maturity of one year or less that is backed by assets or other exposures held in a bankruptcy- remote, special purpose entity.

A clean-up call is an option that permits the securitisation exposures (e.g., asset-backed securities) to be called before all of the underlying exposures or securitisation exposures have been repaid. In the case of traditional securitisations, this is generally accomplished by repurchasing the remaining securitisation exposures once the pool balance or outstanding securities have fallen below some specified level. In the case of a synthetic transaction, the clean-up call may take the form of a clause that extinguishes the credit protection.

A credit enhancement is a contractual arrangement in which the bank retains or assumes a securitisation exposure and, in substance, provides some degree of added protection to other parties to the transaction.

In view of the various options that can be built up in a securitisation structure, it affords ways to add assets with specific characteristics in the portfolio. As an originator, one may also reduce a given exposure or a group of exposure to achieve desired portfolio.

Collateralised loan obligation is a form of securitisation, which is fairly popular in the banking industry.

This has been discussed in brief as follows:

Collateralised Loan Obligations:

Collateralised loan obligations (CLOs) are securitised pools of commercial loans. Attractive feature of CLO structures for banks is that, while preserving the origination of new lending opportunities, CLOs offer banks the opportunity to remove assets from the balance sheet by securitizing the credit risk into a tradable security – and thus potentially freeing up regulatory capital.

The collateral for the CLO (the underlying loans) usually resides in an SPV (special purpose vehicle) which in turn issues several levels of debt such as senior, mezzanine, and subordinated tranches. The cash flows generated from the collateral are dedicated to paying each debt tranche in order of seniority. Most senior CLO tranche can withstand high levels of default because of this cash flow prioritisation and as a result, senior CLO papers are high-quality assets (and rated as such) with mezzanine and subordinated tranches rated accordingly.

CLOs differ from credit linked notes in several ways:

i. A CLO will provide credit exposure to a diverse pool of credits whereas most credit-linked notes are linked to a single credit.

ii. CLOs may provide a true transfer of ownership of underlying assets, whereas credit-linked notes typically do not provide such a transfer.

iii. CLOs may enjoy a higher credit rating than that of the originating institution; whereas the rating of credit linked notes are effectively capped to the issuer level.

Credit derivative structures have been used within CLO transactions as a means to transfer credit risk or market risk between the originator and the SPV issuer.

Collateralised bond obligations (CBOs) are securitised pools of bonds. Collateralised debt obligations (CDOs) include both collateralised loan obligations and collateralised bond obligations. The same principles, as for CLOs, also apply to CBOs.