Information and Communication Technology (ICT) has emerged as an effective facilitator in the development of any society and is a prime driving force in the growth of economies worldwide.

The role of Information and Communication Technology (ICT) in advancing the growth of national economies through enhanced efficiency and productivity, and expanded market reach is both undisputed and irreversible.

Learn about:-

1. Introduction to ICT 2. Present Scenario of ICT 3. Need for Up-Scaling the Financial System 4. Need in Microfinance 5. Impact to Agriculture 6. Challenges in Rural Areas.

Information and Communication Technology (ICT): Introduction, Present Scenario, Need, Impact and Challenges

Information and Communication Technology – Introduction to ICT in Rural Finance

Recently, Information and Communication Technologies (ICT) have emerged as a powerful tool to reduce operating costs, making it viable for financial institutions to expand into rural and low- income areas. Relevant ICT innovations include personal computers connected to the internet, mobile phones, Automated Teller Machines (ATM) or Point-Of-Sale (POS) devices located at a retail or postal outlet.

ADVERTISEMENTS:

Using these innovations may be less expensive for financial institutions than establishing branches located in rural areas and more convenient for customers. Unlike pure cash based transactions, ICT-based transactions can take place with less time or with no time required from a teller.

Rather than hand over cash to a teller when making a deposit or loan repayment, a customer can give cash to a store clerk, swipe a debit card through a POS card reader, and input an identification number to authorize the transaction. The store’s account at the financial institution would be debited by an amount equivalent to the cash deposit, and the customer’s would be credited. Since the transaction is electronic, from the institution’s perspective, it is less costly to process.

It is this possibility of ICT solutions for expanding the rural finance frontier that has stimulated this paper. Field work was conducted in September 2005 and focused particularly on XacBank, one of the leading micro finance institutions in Mongolia, to identify feasible and appropriate applications of ICT in rural areas. ICT is gaining much research attention in present times especially for its ability towards poverty alleviation.

ADVERTISEMENTS:

The Millennium Development Goals call for reducing the proportion of people living on less than $1 (Rs.50.00) a day to half the 1990 level by 2015, i.e., from 28.3 percent of all people in low and middle income economies to 14.2 percent, World Bank (2003). Yet, there are still an estimated 1,000 million people living on less than $1 a day. One way of making progress in achieving the poverty reduction goal is by providing financial services to the poor.

Despite several efforts over the decades, there continues to be a large unmet need for rural finance in India. While some initiatives have been very successful, such as in the area of agriculture credit and micro-finance, there is still considerable scope to improve the situation with regard to terms of access and reach.

The impacts of providing rural finance can be expected to be far reaching as banking and insurance form the backbone of all economic activity. Providing rural finance on a large scale can, therefore, catapult the pace of economic development in the country.

Agriculture continues to be the bulwark of Indian economy and also a decisive driver of GDP growth. It is playing the central role in all strategies for planned socio-economic development of the country. Rapid growth in agriculture is essential not only to achieve self-reliance at national level but also for household food security and to bring about equity in distribution of income and wealth resulting in rapid reduction in poverty.

ADVERTISEMENTS:

Credit is one of the key factors in agricultural development. In the context of technological up gradation and commercialisation of agriculture, which is envisaged for the coming years, it is necessary that credit support to agricultural sector be stepped up considerably. There is a close relationship between the credit and agricultural productivity.

On the other hand, Information and Communication Technology (ICT) has emerged as an effective facilitator in the development of any society and is a prime driving force in the growth of economies worldwide. In a vibrant democracy like India, which is marked by plethora of languages and diverse cultures ICT assumes greater significance in delivery of credit to the farm sector cutting across various linguistic barriers.

Though the government has in a big way tried to orient various practices to help farmers through numerous activities and set up departments like agriculture research institutions, irrigation facilities, rural banking in terms of commercials bank, cooperative bank, regional rural bank, self- help groups, and provided subsidies on various agriculture inputs besides established Mandis, storage warehouses etc., there still exist gaps and extensive work needs to be done to achieve progressive agricultural development.

The one major area that needs to be emphasised is the application of information and communication technology and IT Enabled Services (ITES) as the improvised delivery channel to finance agriculture. These initiatives could bring a change in the systems of lending to this important sector of the economy by the banks with better efficiency and at a lesser cost.

Information and Communication Technology – Present Scenario of ICT in Rural India

1. Connectivity in Rural India:

ADVERTISEMENTS:

India has seen an unprecedented growth in the telecom sector over the past decade and yet for a country whose population is over a billion, the tele-density is just over 9 percent. The distribution of telephones is also highly inequitable, with rural tele-density being less than 1.5 percent against an urban tele-density of 20.7 percent as of 2004 which was marginally improved to 2.8 percent in rural against 22.5 percent in urban areas as on end of March, 2008. Less than 2% of the population has access to the internet and access in rural areas is virtually absent.

The poor rural scenario for telephone and internet access is especially alarming given that over 68% of India’s population lives in these areas. The silver lining in the whole story is that the connectivity is increasing in the rural hinterland with the intervention from the Public as well as private sector corporate by way of extending the telephone and mobile services.

ADVERTISEMENTS:

An innovative business model is required to deliver internet services to rural areas. Commercial delivery is essential in the long run since funded models drain financial resources and are neither scalable nor sustainable. However, since the urban market is now well understood and profits can be made within a reasonable period of time, there is little incentive for businesses to focus efforts in the rural market.

The latter has not been explored and therefore poses greater effort and risk. Therefore, an organization dedicated to providing rural connectivity alone is needed, which would be willing to invest in understanding the market thoroughly.

The utility of access to telephones and the internet in rural areas cannot be over-emphasized. By bridging distances, telephony and the internet, which fall under a broader category known as Information and Communication Technologies (ICT), allow people living in remote areas unprecedented access to resources and opportunities.

ADVERTISEMENTS:

Online services in the areas of health, education and e-Government significantly impact the quality of life in rural areas. In the health arena, remote diagnostics is a significant technological advancement that could prove extremely useful in areas where medical facilities are poor or absent. In the field of education, distance learning can be used to supplement the locally available school and college education or to provide certification from well- known academic institutions located in cities.

These can enhance the skills and employability of the rural population. e-Government services can provide an opportunity for the rural populations to interface easily with government officials and access important government documents without having to physically travel to distant locations.

Services that generate employment such as the outsourcing of work from urban areas through ICT can increase the income levels in rural areas. ICT also provide people in these areas with the ability to access experts in various domains such as agriculture who might be located far away.

By raising the income levels and standard of living in rural areas in these ways, the persistent trend of rural-urban migration can also gradually be curbed. Governments across the world today and international organizations such as the United Nations are paying greater attention to the important role that ICT can play in bringing about socio-economic development.

Information and Communication Technology – Need of ICT for Up-Scaling the Financial System

Economy of every nation flows through its financial system and a common requirement of all participants in building nation’s economy is that each of them has minimal access to banking and financial services. Access to finance by the poor and vulnerable groups is a prerequisite for poverty reduction and social cohesion.

ADVERTISEMENTS:

This has to become an integral part of the efforts to promote inclusive growth. In fact, providing access to finance is a form of empowerment of the vulnerable groups. The Banking industry functions as an intermediary between surpluses and deficit, savings and investment and thus plays an important role in the economic development of the country.

Financial inclusion denotes delivery of financial services at an affordable cost to the vast sections of the disadvantaged and low-income groups. The objective of financial inclusion is to extend the scope of activities of the organized financial system to include within its ambit people with low incomes and the unreachable by the formal financial system to make them partner of economic growth of the country.

Though the Indian economy recorded an impressive growth over the last three years, its impact was not adequately spread out among all stake holders of the society. Despite being one of the ten fastest moving economies of the world, India is the home to over one-third of the World’s poor people. Providing seamless financial services to these teeming million has become a very important agenda to the financial services industry of our country.

1. Financial Services to Poor:

Providing financial services to poor people is costly, in part, because they have small amounts of money and rarely have documented credit histories. During the past few decades, the commercial banks in India have begun to solve the latter problem by developing techniques that permit safe lending in the absence of borrowers’ credit histories.

ADVERTISEMENTS:

Still, the banks feel that they are charging relatively less interest rates to cover the administrative costs of handling small transactions in the branch model of banking. It is estimated that the banks operating in the rural areas with operating costs of 10-12 percent of assets are considered efficient, while the similar ratio for banks in the developed countries rarely exceeds 5 percent.

Despite significant inroads in micro finance in recent years, such as through widespread Retail lending to SHGs and wholesale lending to MFIs by the commercial banks, most commercial banks still view micro finance as unprofitable. Many of the commercial banks cannot compensate for high costs by charging high interest rates due to certain restrictions and the social responsibilities. In India, most commercial banks cannot charge more than their prime lending rate (roughly averaging 13%) for loans below Rs.2,00,000.

Public-sector banks are particularly sensitive to the political implications of charging poor borrowers relatively high interest rates. Public Sector Banks in India do serve poor clients but their objectives are largely social rather than commercial. Most of the Private Sector Banks devote resources and attention to a smaller set of wealthier retail and corporate customers, while a majority of people remain without access to formal financial services.

Banks will not aggressively target the poor as a market until they find ways to serve these customers profitably. This will require delivery channels that are inexpensive to set up, a wider range of financial services to poor customers, and the ability to handle transactions at low cost.

2. Felt Need of Innovations in Financial Services to the Poor:

An efficient financial sector is an engine for economic growth. It converts the fuel of savings into kinetic energy for the economy. The Banking industry which is at the core of the financial sector must take the lead. The reform process started in the 90’s has given the industry a great opportunity. As such there is a felt need that this sector becomes more efficient and also must identify other sectors having growth opportunities and devise strategies to move savings into these sectors through different innovations.

ADVERTISEMENTS:

Industry experts agree that to fully benefit from the income opportunities available in today’s increasingly favourable marketplace, the lenders, i.e., the commercial banks with special reference to Public Sector Banks must demonstrate the operational efficiency necessary to keep pace with the requirement of the day, i.e., serving the mass with greater efficiency.

So that the balance of delivery by the supply side is maintained with the requirement of the demand side. Under the above situation, the outreach of the formal credit delivery system needs up scaling. It is felt that with the introduction of new and innovative delivery channels as envisaged by the different visionaries and being practiced in limited scale by some commercial banks could be considered as the tools to achieve the business objectives of financial inclusion.

3. Innovations in Information Technology:

Now it has been proved by many researchers that the banking technologies, applied innovatively in the countries like India could make financial inclusion through micro finance (both retail and wholesale) profitable for formal financial institutions like commercial banks.

It is also a matter of fact that the use of information technology has the potentiality to reduce costs to such an extent that banks could profitably serve even those whom MFIs have mostly excluded till date, such as very poor and remote rural customers. The innovations in this field have also ensured that these customers could use the technology comfortably.

Some of the innovations commercial banks need to service poor clientele may be found in leveraging information and communications technologies (ICTs) for effective delivery of financial services. In India, low-cost “direct banking” technology channels, such as Internet kiosks, Automated Teller Machines (ATMs), Bio-Metric Machines (poor man’s ATM) etc., can be set up at only one- fifth the cost of a branch teller.

ADVERTISEMENTS:

4. International Experience of Use of ICT in Financial Inclusion:

Banks in Brazil use point-of-sale (POS) terminals, such as bankcard readers, at retail and postal outlets to deliver bill payment, savings, credit, insurance, and money transfer products in nearly every municipality in the country. These terminals can be set up at a cost of less than 0.5 percent the cost of setting up a typical bank branch.

They reduce costs to such an extent that banks could profitably serve even those whom MFIs have mostly excluded to date, such as very poor and remote rural customers? Will these customers be comfortable using technology?

In a recent survey made by the Consultative Group to Assist Poor (CGAP), 62 financial institutions in 32 countries report using technology channels (these technologies, including ATMs, POS devices, and mobile phones) to handle transactions for poor people. Nearly 75 percent of the respondents (46) were banks that operate in both large markets (e.g., India, Brazil, and South Africa) and small markets (e.g., Malawi, Namibia, and Guatemala).

Most poor people, particularly those working in the informal economy and in rural areas, earn and spend in cash. To handle a cash transaction outside of a bank branch, banks have at least two ICT options. They may use an ATM that can accept, store, and dispense cash, or they can use a Biometric device which are mobile in nature and can be carried by the Business correspondent and Business facilitator.

ADVERTISEMENTS:

These technologies are becoming increasingly available in India because of falling hardware costs and growing support infrastructure. At one time, the poor supply of telecommunications and electricity could not support ATMs or other devices, particularly in rural areas. Now, however, telecommunications and electricity infrastructure is more widespread and reliable.

From 1999 to 2007, the number of mobile subscribers in India grew from 8 million to 185 million, an average annual increase of 150 percent. There are more users than mobile phone owners.

Technology has also made advancement and in cooperation with hardware manufacturers, it is now available at a lower cost. To overcome the problem of high capital investment, some of the hardware providers have designed rural ATM priced between Rs.60,000 to Rs. 75,000 depending upon the configuration.

This type of ATM has an additional capability of using fingerprints as the means of authentication with a view that the rural people are more comfortable with the fingerprints than the plastic cards. Some of the banks both in public and private sectors started using these ATMs and are receiving good results. Such a system could facilitate banking services in villages for 365 days.

6. Benefiting from Using these Technologies:

Most respondents to CGAP’s survey use technology channels to automate basic transactions, reduce processing costs, and give customers added convenience. For example, of the seven respondents who answered questions about their use of ATM and Bio-Metric devices, only two report offering services beyond payments and withdrawals with this technology channel?

ADVERTISEMENTS:

Some of the banks in India like ICICI Bank, HDFC Bank, State Bank of India etc. are probably gaining more dramatic benefits, by creating new channels with ICTs that allow them to gain new customers in areas where setting up a bank branch is too costly. Mobile phone operators are also beginning to offer banking services, usually in partnership with banks or MFIs.

7. Improving Customer Convenience:

Banking institutions in India typically place ATMs in or near branches, where they can process routine deposit, withdrawal and balance inquiry transactions at a far lower cost than the cost of using a teller, freeing staff to sell products or give customers personalised attention.

ATMs also save customers from having to wait in line to get to a teller. Corporation Bank, Andhra Bank, ICICI Bank, AXIS Bank, HDFC Bank to name a few using ATMs to serve Rural, urban and semi-urban customers who live far from the bank branch or who cannot visit banks during normal business hours because they are at work.

Many poor people are unfamiliar with bank branch procedures or feel uncomfortable dealing with tellers and other branch staff. In contrast, retail and postal outlets often enjoy substantial brand value and are trusted by community members; many retail and postal outlets have a long history of operating in the community. Instead of branch banking, customers may use the ATM and also the Bio-metric devices.

The banks also offers payroll deposit services to the factory premises (e.g., Sugar factories in Uttar Pradesh) allowing workers and the farmers to withdraw cash from their accounts anytime using an ATM at the factory. Most workers and the farmers prefer this to carrying a lot of cash home on payday. Delivering banking services through retail and postal outlets equipped with ATM and Bio-metric devices offers similar client benefits.

Bank branches are expensive because they require considerable investment in staffing, infrastructure, equipment, and security for storing and transporting cash and valuables. In India, the estimated average costs associated with opening a new bank branch at rural and semi urban areas are about Rs.75 lakhs, and costs can be as high as several hundred lakhs in urban and metropolitan areas.

The ATM channel is generally less expensive than the use of branch tellers because ATMs fully automate cash disbursements and collections, but cash still needs to be transported to and from the machine. The use of Bio-metric devices is probably the least expensive of these channels, because the devices are mobile and can move around as per the requirement of the customers.

In general, banks worldwide are trying to move customers toward low-cost technology delivery channels. From June 2000 to January 2002, ICICI Bank reduced the number of transactions at branches from 78 percent of all transactions to 35 percent. The remaining 65 percent were processed online and transaction costs at ICICI Bank were estimated to be Rs.34 at a branch, Rs.28 through a call center (e.g., phone banking), and Rs.20 at an ATM.

9. Reaching Unserved Areas with Technology Channels:

Private and state-owned banks in our country pioneered the use of ATM and Bio-metric devices at retail outlets to deliver banking services to previously unbanked low income and rural people. Both the private-sector banks and public sector banks are in the process of appointing “business correspondents”.

These correspondents are post offices, supermarkets, grocery stores, petrol pumps, and other retail outlets that are present in every nook and corner of the country, including very rural areas where bank branches would probably be too costly to set up. In small shops, the shopkeeper handles banking services for customers, and in larger stores, a store employee is dedicated for this purpose.

The banks could think to equip each business correspondent with a Bio-metric device, which are less costly to install than ATMs, and running costs are limited to charges for telecommunications and transaction fees for the retail outlet. In addition, these devices can work without an always-on communication and electrical connection, making them ideal for rural locations.

With the business correspondents, customers can open current accounts and access a variety of services, including savings, credit, insurance, money transfers, pensions, other government benefits, and bill payments. Since banking correspondents first emerged in Brazil in 2000, private and public banks have opened an estimated 8 million new current accounts through this channel.

10. Strategic Implications of ICT for Micro Finance and Financial Inclusion:

The profitability of technology delivery channels, and the extent to which they can serve a wide range of poor people, is not yet known. Still, banks and micro finance practitioners have much to learn from the early experience of Brazil’s private and public sector banks in reaching remote areas and from mobile banking initiatives under way in South Africa, Philippines and the India.

Three aspects of the use of technology for micro-finance deserve more attention. If governments want to harness the potential of technology to increase access to financial services for poor people, they must think more broadly about policy. Further study is needed to understand the extent to which poor people are excluded by technology delivery channels and the effect this has on channel profitability.

With technological innovation, providing connectivity in rural areas is entirely possible today. The efforts of organizations to provide all sorts of Communications facilities in the rural and far flung areas have also ensured that ICT infrastructure exists in several villages across the country.

There is considerable scope to utilize this infrastructure in order to provide ICT based solutions to provide finance in rural areas, which were unthinkable in the earlier paradigm. By gathering systematic information on the rural population and assessing their credit worthiness banking can be taken to rural areas.

Online transactions can be carried out and the low-cost ATMs and hand held biometric devices which can be deployed in villages to dispense cash. The possibilities, therefore, are much better today, with such technology and infrastructure in place, to provide suitable, affordable and scalable options for finance in rural areas. With a focused approach, a systematic solution to this hitherto elusive area appears finally within reach.

Information and Communication Technology – Need of ICT in Microfinance

Both micro finance and Information and Communication Technologies (ICTs) are new age paradigms on the development and the corporate canvas. Earlier, micro finance was closely associated with a non-profit based organization working solely for social cause. But after the synergistic effect of Information and Communication Technologies, the notion has changed.

It is now understood that just downsizing a traditional business and its products is not a working approach to micro finance and that new skills are required in product design, distribution, data mining and technology. Today the profit-making institutions are interested to bank upon this opportunity with their high end customized solutions, by capturing these unrecognized markets, making profits and at the same time aiding the rural societies. Due to their nascent state and tremendous potential both micro finance and ICT continue to evolve at mind-boggling speeds.

The micro finance investments (MFIs) need technological innovation to increase security, regulatory transparency, and scalability. It must therefore reduce repetitive tasks, remove costly processes, and move the function to point of sale, which is the first lesson in lowering costs.

Following outreach success, it must provide data warehousing to achieve sustainability and subsequent profitability. So we are looking at capacity building, credit rating, and access to wholesale finance arising from this layer. The key to sustaining micro finance is making products affordable for customers and keeping operating costs acceptable to providers.

Technology can minimize costs if the following components are present in the micro finance infrastructure and architecture. This list is by no means exhaustive, but it does give a good idea of the many aspects of technology that can be used to keep process costs low.

i. Global Positioning Systems (GPS)

ii. Mobile banking

iii. Cell phones

iv. Email

v. Secure SMS (Short Message Service)

vi. Web-based sales

vii. Web-based financial services

viii. ATM debit and credit card

ix. Non-ATM debit and credit card

x. Personal Digital Assistants (PDAs)

xi. Credit scoring

xii. Online marketplaces

xiii. Specialty portals

xiv. Instant messaging

xv. Satellite telephony

xvi. Electronic identity verification

xvii. Virtual training modules

xviii. Web-based email

xix. Digital policy pens

xx. USB watches and other USB collections

xxi. Offline data capture support

xxii. Vehicle-based telematics

xxiii. Mobile card readers and document printers.

Personal Digital Assistants (PDAs), Java Card, and mobile banking may be the most relevant and promising technologies for low-cost micro finance. PDAs improve transactional efficiency, reduce data entry error, and prevent fraud. This can achieve a 50% reduction in loan processing and a 90% reduction in manual collection and door-to-door services.

JavaCard will reduce operating costs in rural areas (and now they come with fingerprint readers). Mobile banking allows clients to transfer money, withdraw and deposit cash, make loan payments, and pay insurance premiums – all from their mobile phones.

Management Information System:

MFIs must able to manage relevant information and reporting facilities in real time in order to provide the proper operational risk management across the enterprise. There are new performance indicators in micro finance that do not exist in traditional finance, which leads to new MIS (Management Information) issues. MFIs need to manage their internal distribution networks and have access to both billing and claims information.

They also need to respond to workflow requests in the automated areas of:

i. Policy issue and enrollment at point of sale

ii. Premium collections

iii. Automated billing for group clients

iv. Online claim submission and tracking

v. Fast claim processing and payment by ATM or local banks

vi. Remittances from one person in one location to relatives in another.

Indian MFIs are among the most dynamic and best-managed institutions worldwide. Altogether 50 million Indian people, of whom 90% are women, currently benefit from micro finance. This represents one-third of the total number of micro finance beneficiaries worldwide, estimated at 150 million. However, 65% of Indian people still do not have a bank account.

This means the potential demand for micro finance services is estimated to lie between 290 million (number of people living below the $1-a-day-poverty-line) and 650 million (number of unbanked people). It is not a question of whether or not the poor need information technology, but rather what the appropriate technology is that will enable them to escape poverty.

Whatever the technology, it needs to be seen as a device with real and relevant benefits, not as an extravagance. Solutions that work in developed countries cannot simply be transplanted into developing country environments; solutions must be based on an understanding of local needs and conditions.

Both the challenge of Digital Divide and the challenge of micro finance for the masses needs to be addressed from a variety of angles including infrastructures, hardware and software solutions, technology access, public/private partnerships, public policy issues, localised content creation, information access, connectivity and networking, transparency, sustainable banking practices, cost reduction, client-driven services, Management Information Services (MIS), impact assessment, and specialized training.

The role of ICTs in advancing the growth of national economies through enhanced efficiency and productivity, and expanded market reach is both undisputed and irreversible. It is within this vein that adequate and strategic attention has to be placed so that these new opportunities provided by ICTs are not purely limited and accessible only by the larger corporations within national economies but also to the SME and the rural buyers at the BOP as well.

The application of ICT solutions for the development of rural India opens up a vast range of possibilities. Giving an opportunity to the vast majority of the population living in rural areas, to cross the digital divide to obtain access to information resources and services provided by ICT is the next revolution waiting to happen.

Information and Communication Technology – Impact of ICT on Agriculture

The commercial banks are expected to increase its lending to agriculture sector by at least 25 percent this year (2008-09) alone to double the level of agriculture lending so as to achieve the commitments made by the Government during the budget announcement of February, 2008.

According to the Trends and Progress of Banking in India, for the year 2007-08 published by the Reserve Bank of India, the lending to agriculture sector during the year 2007-08 reached Rs.2,82,085 crores, of which the contribution made by the Public sector Banks and Private Sector Banks were Rs.2,32,900 crores and Rs.49,185 crores, respectively. This shows the robustness of our commercial banking system and its contribution to this most important sector of the Indian economy.

The Private Sector Banks which have traditionally focused on retail lending—are jumping on the agriculture lending bandwagon. According to Trends and Progress, the Private Sector Banks during 2007-08 increased their agricultural lending by 37% over 2006-07. The Public Sector Banks increased their lending to agriculture during same period by 28%. So there is plenty of room for the Public Sector Banks to expand into the agriculture lending business; and industry analysts have expected them to do so even more aggressively in 2009.

1. A New Business Climate:

After the debt waiver of the agriculture loans to the tune of Rs.72,000 crores by the Central Government during the year 2008-09, we are now seeing a marked change in the agricultural lending business climate. Expansion is the word of the day, and as usual, small to midlevel businesses in agriculture and its value added products are leading the way.

Big corporate like PepsiCo, Reliance, Tata, Birla to name a few has already entered into agri-business and the demand for capital in this sector is increasing, and both the public and private sector banks are welcoming a return to a business- lending climate not seen during the last year.

2. Increased Efficiency – Improved Profitability:

Industry experts agree that to fully benefit from the income opportunities available in today’s increasingly favourable marketplace, the lenders, i.e., the commercial banks must demonstrate the operational efficiency necessary to keep pace with customer expectation. So that the balance of delivery by the supply side is maintained with the requirement of the demand side.

Unfortunately, the agriculture lending business of different banks have generally lagged behind other banking business, e.g., retail lending, forex etc. in adopting new technology since it was not considered as a business opportunity. But to take full advantage of the opportunity, the banks need to find efficient ways to serve their farming community’s needs.

As we have observed that there is a growth of more than 40% in the agriculture credit portfolio of the commercial banks, be it cash credit lending or project lending, there is a need to make the lending process more simpler and user-friendly. In recent years, technology visionaries of our country have been requesting the commercial banks to make more profitable agriculture loans by use of more efficient loan processing and monitoring tools. The lending process at many banks is still largely a manual operation which needs to be revisited.

Now, it has become imperative to the commercial banks to transform the existing agricultural lending and monitoring process in such a manner that the entire work processes can flow seamlessly, with minimal need for manual intervention. It is believed that commercial banks’ lending to agriculture must now make a focused effort to trim redundancy and expense from their lending processes by adopting the application of Information and Communication Technology.

The competitive makeup of the agricultural lending business has taken on an entirely new look in recent years. According to the latest available facts and figures reveals that there has been a marked change in the competitive mix of Public and Private Sector Banks. It’s no longer one commercial bank versus another commercial bank—now we have to consider the growth in terms of product innovation and delivery channels.

It may also be noted that with the evolution in branch structures, installation of ATMs, V-SATs, Centralised Banking Solutions and other technological up gradation the competitors can now come from outside the geographic region of a bank’s customers. For example, an agricultural loan may be booked in one location or state, while the loan collateral is held in multiple locations or states.

We as commercial bank need to think about these kinds of probabilities and issues while evaluating the software solutions which are required for better delivery of credit to this important sector of economy as per the requirement of the farming community.

In addition, the agricultural lending market is highly diversified, with different types of lending being done all over the country. The market varies by geographical location, local economy, local industry, and lending policy of different banks. So when commercial banks are thinking about technology solutions, they are required to consider both flexibility and scalability to meet current and future market needs.

In recent years, the banking industry observed that, there is a major shift in negotiation of loans. Increasing competition has made the loan-negotiation process more difficult and complex for the commercial banks. Intense competition squeezes interest-rate margins, new requirements for operational risk management and more transparent reporting. It is not surprising that many commercial banks are looking for more robust and economical lending systems.

This is particularly true for banks pressured to make agricultural lending more viable to improve the Net Interest Margins (NIM). Of course, the competition is great for borrowers, but it puts tremendous pressure on lenders too. The commercial banks both public and private are still willing to take the calculated risks in lending to agriculture as they are getting better margins in today’s hyper-competitive business arena.

And today’s industry observers are negotiating with the technology providers to do a better job of helping the commercial banks to become more efficient, push more agricultural loans through their pipelines and generate bigger profits.

4. The Value of Integrated Efficiency:

Despite on-going evolution and technological up gradation in the Banking Industry, the technology for delivery of agricultural lending still suffers from a heavy dose of fragmentation in their systems and procedures. This can be proved from the following list of the wide variety of systems and procedures that many banks currently have in place for mobilizing, processing and monitoring of agricultural loans are given hereunder-

i. A stand-alone not so structured customer relationship management (CRM) system or database for visit of the customers/probable customers.

ii. A series of standalone products on agriculture lending.

iii. A series of application forms for different activities.

iv. A stand-alone system for cash flow analysis/appraisal.

v. A stand-alone system for loan documentation.

vi. An array of spread sheets for portfolio reporting to ZO/HO.

vii. A series of forms and transmittal sheets used to move files between agriculture loan officers and the back-office loan monitoring department.

Although, with the implementation of R.V. Gupta Committee report and Vyas Committee report, the banks have devised the system of rationalization of loan application and the documentation in case of agriculture lending, still there are lot more to do in this aspect to have a holistic approach towards integration of all the activities.

The banks are also in the process of implementation of Centralised Banking Solution (CBS) which may lead to streamlined systems and procedures. But before that, the banks are required to take a vital decision on implementation of CBS in their rural/ semi urban branches, which happen to be the major delivery channel of agriculture credit.

It is believed that the next phase of agricultural lending technology needs to be built around a business model that features integrated work flow—a technological shift that has greatly influenced retail lending in recent years.

The technology providers should also ponder over the lack of workable solutions that are available to commercial banks for delivery of agriculture credit at the same time it is also imperative from the part of the lenders that they must also demonstrate a greater willingness to resolve their technological issues and work out an integrated approach.

5. Catalysts for Change:

The face of agricultural lending has changed dramatically over the last several decades from both a demand and supply perspective. There has also been considerable attitudinal change in the lenders providing loans to farmers. There are a number of forces that will drive further change in agricultural lending in the next few years. These drivers in turn will influence credit analyses and portfolio management decisions at the commercial banks.

While outlining information and communication technology’s potential benefits for agricultural lending, it should be kept in mind that simply throwing technology at the problem is not a viable answer. An alert banker cannot simply “install” new technology and wait for the rewards. Rather it requires a strategic commitment from executive management, organizational and process changes, [and] a new model of relationship banking which will be the key drivers for the required changes.

From the above discussion and different reports it is quite clear that in many commercial banks, the process of agriculture credit, i.e., decision making, generating documents, and performing the due diligence of the loan is still highly fragmented. What’s really needed is a consistent, single access point for all information—so it needs to be entered only once and can be used for different purposes/ users at various levels.

Instead, information about a particular agriculture loan customer is too often simply jotted down on scraps of paper and then routed to several personnel for executing the various risk- management tasks, such as credit checking, financial analysis and finally the credit monitoring.

This usually means the same information is entered into computer systems multiple times from multiple locations in the bank. Ideally, we are interested in a technology solution that enables the bankers to enter the information from a single location and retrieve the same from different locations.

The outreach of the formal system needs up scaling. Further, the delivery of financial services in the agriculture sector is characterised by high cost, inadequate banking infrastructure and poor communication facilities. Medium to high level illiteracy and the lack of financial awareness tend to compound the operational challenges inherent in validating the customer at the field level.

Technology, while having transformed banking for the urban educated, has not yet impacted the rural customer in the same way. The branch banking structure which has served India’s urban centres well, has in its extension to the rural sector been characterised by inadequate outreach and high cost.

Notwithstanding this, there is an all-round recognition of an untapped market in the rural sector and the need for providing financial services in a sustainable way by leveraging the ICT for use of lending to agriculture sector. So, we need to pull all the available resources to improve the delivery of agriculture lending as a potential business opportunity by way of adopting the technology which can serve these clientele.

7. The Benefits of Integrated ICT:

The use of internet-based transactions can be made available at the kiosks and the ATMs, however, would be a mere beginning. If the financial needs of the rural population are to be met, a much more holistic approach is needed. The Kiosk Operator (KO)/Business Correspondent, with access to the internet and an ATM, could become a virtual agent for the bank.

The KO could also facilitate banking services by collecting comprehensive data pertaining to every person in the village, not a very difficult exercise as a village size typically comprises about 2,000 people. Such data would include personal details, financial profiles and information regarding property/assets owned. A database of this kind is imperative in order to build a credit history for those living in rural areas.

This would enable a system of credit rating, which forms the basis of loan disbursal. Only then can banks consider the rural population as potential clients and provide loans of a reasonable size. Therefore, through a system of data collection and credit rating as well as by building appropriate delivery channels such as the internet kiosks and the ATM, the situation with regard to financial access in villages can be vastly improved.

Important banking services can also be provided through the KO who can act as the local agent. Only then can rural entrepreneurs hope to get loans at an interest rate of approximately 10%. Another related concern in rural areas is that the population has by and large become incapable of taking risks.

The latter is an essential pre-requisite to any form of entrepreneurial activity. Exceptions do exist such as with the case of rearing dairy cattle, which is one the best businesses in rural areas even in the current scenario of relatively high interest rates.

However, even with this example, the risks to the farmer if he loses the cattle are grave. Insurance can play a very important role in mitigating risks and encouraging entrepreneurship in rural areas. Such insurance is required across almost all economic sectors of the rural economy. The kiosk can be used as a point of sale of insurance in rural areas.

There are host of benefits of using IT and ITES to improve the efficiency of the existing delivery channels, but we will be restricting ourselves in very few of it.

(a) The followings are the brief list of benefits of IT as envisaged by the policy makers of our country:

i. The use of IT is inevitable to improve the usage of existing branch infrastructure. Increasing outreach and up scaling number of accounts at each branch will require bankers to move out of their branches and source clients and then look at low cost delivery alternatives once the account relationship is established.

ii. IT can reduce cost and time in processing of applications, maintaining and reconciliation of accounts and enable banks to use their staff at branches for making that critical minimum effort in sustaining relationship especially with new accountholders.

iii. In rural areas customers cannot be expected to come to branches in view of opportunity cost and time and hence banks will have to reach out through a variety of devices such as weekly banking, mobile banking, satellite offices, rural ATMs and use of Post Offices.

iv. In urban and even in rural areas where mobile phones have penetrated, banks could use mobile technology for facilitating banking transactions.

(b) The approach of the Central and State Governments towards using information technology has been focused on certain key areas where information technology can make a perceptible difference to the lives of the farming communities.

The following potential areas in this context have been identified as their advantages:

i. Emerging opportunities in IT and IT enabled services could open up significant possibilities of generating incomes and employment in the country, which in turn could have trickle-down effects, thereby expanding opportunities for the farmers in the rural and semi-urban areas. IT enabled services could potentially become the lead sector providing momentum to the economy through high rates of growth.

ii. The delivery of credit to this sector could be enhanced in a cost-effective manner by meeting the timely and adequate credit requirement of the farmers.

iii. Information technology could contribute significantly to capacity building among the farmers through delivery of latest technological advancement in agriculture.

iv. Since the majority of the farmers are located in the rural areas, use of information technology for enhancing agricultural production and productivity could have an immediate impact on the poverty situation.

v. Improved access to information facilitated by IT could translate into higher earnings for the farmers and contribute to the process of their empowerment.

Livelihood opportunities in rural areas become seriously limited in the absence of access to finance. No serious entrepreneurial activity can thrive as long as finance is limited and the interest rates and transaction cost are very high. Despite a growing emphasis on finance to agriculture sector, banks find it practically difficult to provide any significant contribution towards lending to agriculture activities as expected from them.

Even when the nearest bank branch is only 5 km away, the cost of inviting and evaluating loan applications for a very small amount, carrying out necessary checks, appraisals, sanctioning, monitoring the end use of funds and finally recovering the principal amount with interest becomes very cost affair.

Under the above situation, the outreach of the formal system needs upscaling. Hope that with the introduction of under noted new and innovative delivery channels as envisaged by the different visionaries and being practiced in limited scale by some private sector banks, could be considered as the tools to achieve the business objectives of lending to agriculture sector.

I. Internet Kiosk:

Internet kiosks have already been promoted in some parts of the country by Internet Service Providers, agri-business corporate etc. e-Choupal of ITC is the fore runner in this area. These kiosks use up to date technologies. The banks could partner these organisations and set up large networks of such kiosk in the rural sector. The kiosk would be structured to deliver a variety of services including insurance, loans and other financial services at the doorstep of the farmers.

II. ATMs:

It is well known that the farming sector continues to depend on the use of cash for transactions. Hence, the primary need for a commercial bank, while servicing farmers they should give more importance to cash disbursement and cash acceptance. In order to meet this requirement, the banks might have to work out low cost ATMs with innovative features, keeping the demand profile of the farmers in mind.

III. Simputer for Micro Banking:

The Simputer can also be an ideal platform for secured and convenient micro banking. At present, several small cooperative banks in the state of Maharashtra are providing services to their rural clients at their doorsteps. They carry around a small portable device with a transaction printer, which enables the client to transact with the bank and obtain a receipt directly. Current models of the “portable” device have several shortcomings.

The Simputer provides a much more secure environment, with the help of the Smartcard and simple-to-use encryption software (and its ability to synchronize remotely with the back end). It is expected that the Simputer can increase the level of penetration of micro banking for the farming community of India by truly facilitating anytime, anywhere banking.

IV. Kiosk-Cum-ATM:

Internet kiosks in rural areas have the potential to play an important role. The kiosks provided with ATM facilities can deliver the petty cash requirements of the farmers as well as the information required by the farmers for their daily requirement.

The cost of a conventional ATM is very high (Rs.6 to Rs.8 lakhs) and installing these in villages with populations below 3000 makes little economic sense. Experiments are under way for low costs ATMs with biometric identification for withdrawal of cash that could enable a low cost and therefore a more sustainable way of financial penetration and outreach while ensuring safeguards against foul play.

V. Smart Card:

On the product side it is widely accepted that the present loan appraisal and delivery processes of banks are cumbersome and time consuming. This could be addressed through an innovative product design, using the Smart Card technology for delivery of financial services in a cost effective manner. A one time limit could be set for the farmer by the bank and loaded on to the Smart Card through a secured mechanism. This methodology would lower the cost of operation and ensure timely delivery of the loans.

VI. Credit Information Bureau:

Banks often cite the absence of credit information as a major hurdle in scaling up their client base in rural areas. Credit information tracking and sharing through a Credit Information Bureau could enable lenders to provide incentives to those with good credit history and a strong deterrent to willful defaulters.

The Banks may take initiative to create a common pool for identification of the farmers (Unique ID code for each farmer) and make it available to the bank branches as well as the Zonal Offices/Head Offices on-line for verification. This process will also help the bankers to facilitate the farmers to mainstream institutional finance as well as aversion from the risk of multiple financing.

VII. Model of Data Warehousing:

A key issue in agriculture credit delivery is the availability of the authentic, authoritative, and complete data about the people, the environment and the activities of the area in a readily usable form on demand. Several procedures and documentation requirements emanate from the absence of such data for verification or otherwise to the banks in ready form. For instance if the detail of the land and cropping pattern, the record of rights were to be available in electronic form online to the bankers, there is no need for bankers to ask for records of landholdings from the applicants of crop loans.

The efficient rural credit delivery system using IT Data Centre warehousing all the required data and a Multi-Service delivery machine with connectivity to the Data Centre and through it to the banks etc. In this model, there is outsourcing of the front-end banking operations and the manual interventions in the process of credit appraisal and credit delivery would be minimized and the bank personnel devote their time for making credit judgments and for credit monitoring.

VIII. Use of Rural Knowledge Centre and CSOs:

The Government of India in a significant move proposed to set up village knowledge centres at every village of the identified 6,00,000 villages of our country to bring about synergy between technology and public policy. The Banks may take this as an opportunity by tying up with the Civil Society Organisations (CSOs), i.e., NGOs and other organisations and the village knowledge centre for improved delivery of the agriculture credit and empower the farmers by flow of all sorts of information.

9. Effective Technology – Good Business:

Many commercial banks are realising how important effective technology can be to the achievement of their strategic business objectives. Going forward, this realisation will generate a sea change in the methods lenders have traditionally used to control costs, gather information, process loans and manage risk. In this efficient, streamlined, fully automated environment, the process for agricultural loans is now becoming less of a mystical art and more of a profitable science.

Information and Communication Technology – Challenges of ICT in Rural Areas

There are certain unique challenges in providing connectivity in rural areas in a manner that is financially sustainable.

1. Technology for Rural Connectivity:

The challenges from a technology point of view are many. The systems that provide connectivity need to be relatively inexpensive if they are to be commercially deployed, given the lower incomes in rural areas compared to urban areas. Most households have incomes below Rs.3,000 per month (which amounts to Rs.600 per capita per month).

Providing telephony and internet to such populations on a commercial basis has always been a challenge. As a result the spread of telephones in rural areas is barely 3 telephones per sq. km, despite a higher population density compared to other parts of the world.

Another challenge is that the systems must be sufficiently robust in order to withstand the harsher physical environments that often characterize rural areas. They must also be capable of functioning without certain basic infrastructure such as regular power supply, for example. Fortunately, India has certain technology advantages with regard to providing rural connectivity.

Over the past 15 years, the Department of Telecommunications, the Government of India and Bharat Sanchar Nigam Limited (BSNL), the state-owned incumbent, have made significant contributions toward connecting rural India, by laying fibres to almost all taluka (county) headquarters and towns.

Today, many of the private telecom operators (Reliance, Tata, Bharati) and organisations such as Railtel have also laid fibres to connect these towns. Nearly 85 percent of Indian villages are situated within a 15-20 km radius of taluka towns and therefore, a wireless system with a radius of coverage of about 20 kms deployed at these towns would be able to connect a majority of the villages in the country.

3. Appropriate and Affordable ICT-Based Services:

The value of ICT infrastructure is derived from its ability to deliver services that are valuable to the local population. If priced appropriately, ICT-based services can find a large rural market. Significant potential exists in several domains like agriculture, health, e-Government, education, outsourcing of work, etc. Financial services, especially in the form of banking and insurance is a critical service area that needs to be developed in this regard.

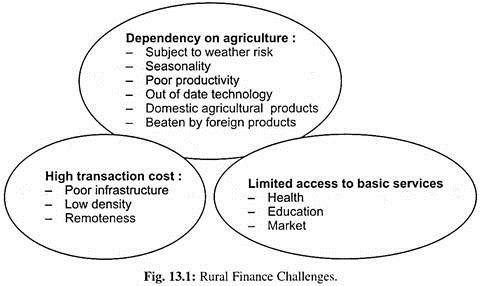

Despite the success of financing to agriculture sector and improved micro finance services in India, access to financial services in remote rural areas remains a challenge. The three main challenges that contribute to rural poverty are shown in Fig. 13.1.

It has been repeatedly recognized that the majority of the people in rural areas depend on agriculture as a source of living. Agriculture is widely considered more risky economically than industry and trade. Weather, pests, disease and other natural calamities affect the yield of crops.

Markets and prices are additional risks associated with agriculture. Many agricultural markets are imperfect, lacking information and communications infrastructure. Prices are also affected by the access to markets. Market and price risks can also be exacerbated by international market conditions and public policy decisions. For example, the creation or removal of tariff barriers in countries where goods are ultimately sold can dramatically change local prices, hence affecting rural farmers.

The precision of crop schedules generates a specific risk for agricultural finance. Loan disbursements need to be tailored to irregular cash flows, yet the timing of final crop income may vary, based on when farmers choose to sell. These characteristics require financial institutions to be efficient and physically close to their rural clients.

Yet, transaction costs are high and the volume of business in remote rural areas, where many poor people live, cannot support the cost of a bank branch. The problem is worsened by a low density of population and poor infrastructure in rural areas.

From an institutional point of view, the main problems include:

i. Small size average farm size, low population density, higher loan servicing costs due to limited lending volume and high information costs

ii. Lack of collateral or adequate security among rural people

iii. Lack of technical knowledge at the bank level to evaluate and analyse the creditworthiness of rural customers

iv. Risk correlation when lending to farmers: all borrowers are affected by the same risk, such as low market prices and reduced yields due to the weather

v. Underdeveloped communication and transportation infrastructure.

Livelihood opportunities in rural areas become seriously limited in the absence of access to finance. The traditional moneylenders have largely disappeared and those who remain tend to charge exorbitant interest rates. No serious entrepreneurial activity can thrive as long as finance is limited and the interest rates are very high.

Despite a growing emphasis on rural finance, banks find it practically difficult to provide any significant loans to those who live in villages. Even when the nearest bank branch is only 25 kilometres away, the cost of inviting and evaluating loan applications, carrying out the necessary checks, sanctioning the amounts, monitoring to ensure that the loans are being used for the intended purposes and finally recovering the interest and the principal, often exceeds the principal amount itself.

This is especially true of smaller size loans between Rs.10,000 and Rs.50,000. The Commercial banks in India has done a marvellous job by extending the loans to the farming community in a massive scale through Kisan Credit Cards. Still there is scope to improve further by adopting technology to extend the products related to both farm and non-farm sector at an affordable price, still the majority of the banks have not been able to replace the traditional lending sources in the villages and the villages are starved of finances.

Access to financial services forms a fundamental basis on which many of the other essential interventions depend. Moreover, improvements in health care, nutritional advice and education can be sustained only when households have increased earnings and greater control over financial resources.

In recent years Micro-finance has come up in a big way in order to fill this gap. The success of micro finance has been extensively discussed and written about and is indeed remarkable. Borrowing in bulk from the banks at 8-10% interest rates, the Micro Finance Institutions (MFIs) provide small loans to people in the villages who normally form groups, where the individuals serve as guarantors for one another.

With MFI employees/agents closely monitoring the small loans, the default rates are negligible. But the interest rate still works out to between 24 to 30%. While this is less than the rates charged by local moneylenders and therefore highly welcome, the rates are still too high for setting up any kind of enterprise.

The loans are good only for emergency consumption, trading and select activities such as cattle rearing. The bulk of other entrepreneurship activities would require loans at interest rates of 10 to 12%. Micro finance does not fulfill this need.

In this context, internet kiosks/hand held devices and other technological intervention in rural areas have the potential to play a key role. Can these intervention proved to be useful to provide the whole range of financial products and services in the villages? Perhaps, but the questions still remains how can the cash be actually delivered in the villages? This could be easily done if a ATMs were placed at the kiosks and the business correspondent (agents) moves through in the remote villages with a hand-held device (Biometric device).

Rural ATM, called Gramateller priced at between Rs.60,000 to 75,000 depending upon the exact configuration- this ATM has the additional capability of using fingerprints as the means of authentication (villagers prefer fingerprinting to the use of any kind of card). The ATM can also dispense soiled notes (since people in villages tend not to trust new currency notes), and has the feature of remote electronic locking. Such a system could facilitate banking services in villages.

Despite the low capital expenditure, however, the operational expenditure would not be negligible (especially as the bank would need to service the ATM and ensure that it is stocked with cash). Therefore, villages of appropriate size, which are capable of generating sufficient business, must first be identified, before the ATMs are installed. The Handheld Biometric machine is even less costly and also can be utilized by the villages as a source of transaction of their business at an affordable cost.

The use of ICT in rural finance has been classified in to two parts, one is the impact in agriculture and credit flow to this sector and the other one is the micro finance sector.