Industries in India! Read this article to learn about the different industries in India, their policy, structure and problems.

Industries in India: Iron, Steel, Cement, Sugar, Cotton, Textile and IT

Iron and Steel Industry in India:

Steel even today is decidedly the vital component of a country’s economy and is considered as the crux of modernization. The level of per capita consumption of steel is treated as one of the important indicators of socio-economic development and living standards in any country. Steel continues to be the foremost engineering material and is environment-friendly and is recyclable. It is a product of large and technologically complex industry having strong forward and backward linkages in terms of material flow and income generation.

The Indian iron and steel industry is nearly a century old, with Tata Iron & Steel Co. (Tata Steel) as the first integrated steel plant to be set up in 1907. It was the first core sector to be completely freed from the licensing regime (in 1990-91) and the pricing and distribution controls.

ADVERTISEMENTS:

The steel industry is expanding worldwide. For a number of years it has been benefiting from the exceptionally buoyant Asian economies (mainly India and China). The economic modernization processes in these countries are driving the sharp rise in demand for steel.

The finished steel production in India has grown from a mere 1.1 million tonnes in 1951 to 56.08 million tonnes in 2007-08. The growth in the steel sector in the early decades after independence was mainly in the public sector units. However, the following adoption of new economic policy and subsequent deregulation and decontrol of Indian Iron & Steel Sector, the 1990’s witnessed accelerated growth in the private sector catapulting its share from 45% in 1992-93 to 76% in 2007-08.

Steel exports from India began in 1964. Exports in the first five years were mainly as a result of recession in the domestic Iron and Steel market. Exports subsequently declined due to revival of domestic demand. India once again started exporting steel in 1975 only to witness slump again due to declining domestic demand. Post liberalisation, rejuvenation in the steel sector, resulted in large-scale exports of iron and steel. In 1991-92, the main producers exported 3.87 lakh tonnes.

Exports rose to 1.68 million tonnes in 1998-99 and to 8.25 million tonnes in 2007-08. Though the country’s production of iron & steel is sufficient to meet the domestic demand, it imports mainly finished/semi-finished steel and iron & steel (scrap) to meet requirements of supply of essential grades.

Liberalisation Process in Indian Steel Sector:

ADVERTISEMENTS:

The Government’s new economic policies have opened up opportunities for expansion of the Steel Industry. With a view to accelerating growth in the steel sector, the Government since 1991 has been initiating and implementing a number of policy measures.

These measures have impacted the Indian steel sector as under:

(i) Large-scale capacities were removed from the list of industries reserved for the public sector. The licensing requirement for additional capacities was also withdrawn subject to locational restrictions.

(ii) Private sector came to play a prominent role in the overall set up.

ADVERTISEMENTS:

(iii) Pricing and distribution control mechanism were discontinued.

(iv) The iron and steel industry was included in the high priority list for foreign investment, implying automatic approval for foreign equity up to 50%, subject to foreign exchange and other stipulations governing such investments in general.

(v) Freight equalization scheme was replaced by a system of freight ceiling.

(vi) Quantitative import restrictions were largely removed. Export restrictions were withdrawn.

National Steel Policy-2005:

ADVERTISEMENTS:

The National Steel Policy (NSP) was announced in 2005.

The salient features of the NSP are as follows:

1. The NSP has set a target of 110 million tones of domestic steel production by 2.019-20. This would require about 190 million tones iron ore.

To meet the additional iron ore requirement, the Government plans to take the following steps:

ADVERTISEMENTS:

(i) Create additional mining capacity of 200 million tonnes iron ore.

(ii) Encourage investments totaling to about Rs.20,000 crore.

(iii) Ensure that clearances from authorities of Environment & Forest be obtained within a specified timeframe.

(iv) To make investment plans for large number of iron ore leases which are idle.

ADVERTISEMENTS:

(v) Renewal of existing leases only against credible mining investment plans.

(vi) Grant of fresh leases only against new norms and stringent assessment of technical and financial capabilities of the applicants.

(vii) Restrictions on long-term exports of iron ore to a maximum of 5-year contracts.

(viii) Encourage sintering and pelletisation so as to use fines which make up about 90% of the present exports.

ADVERTISEMENTS:

2. Projections for requirement of coking coal and non-coking coal were fixed at 70 million tones and 20 million tones, respectively, to achieve the target steel production. The NSP has recommended the first priority to the Steel and Sponge Iron Industry in allocation of higher grade (below 12% ash content) non-coking coal.

The policy makes it clear that 85% of the requirement of coking coal will have to be imported. Further, reduced rate of production of non-coking coal would necessitate import of non-coking coal as well for utilisation in the steel sector. The coal shortages have prompted the NSP to call for a constant review of allocation and pricing of natural gas as a suitable alternative.

3. The NSP assumes that 60% of the new steel capacity would come up through blast furnace route, 33% through sponge iron & EAF route and 7% through other routes. Sponge iron units are expected to increase capacity from 13 million tonnes at present to 38 million tonnes by 2020, especially in Jharkhand and Orissa. The NSP envisages a judicious blend of exports and domestic supply of steel.

4. The NSP also seeks the up-gradation and modernisation of the refractory industry.

5. The NSP has noted the anomaly wherein the steel sector is deprived of fiscal incentives which are usually available to other infrastructure projects. The policy seeks to examine the issue and formulate corrective measures, as also the rationalisation of customs and excise duty structure for reducing the fiscal and revenue deficits.

Structure and Role of Indian Steel Industry:

Steel sector represents around Rs.90,000 crore capitals and directly provides employment to over 5 lakh people in the country. The Indian Steel sector was the first core sector to be completely free from the licensing regime and the pricing and distribution controls. This was done primarily because of the inherent strengths and capabilities demonstrated by the Indian Iron and Steel Industry.

ADVERTISEMENTS:

India has risen to the fifth position as largest crude steel producing country in the world in 2006 as against 8th position held three years back and retained its 5th rank during 2008 too. The Indian Steel Industry comprises integrated steel plants in the primary sector using BF-BOF route of iron & steel production. In the primary sector, there are 11 integrated steel plants in the public and private sectors.

The secondary sector constitutes Electric Arc Furnace/Induction Furnace, pig iron/ sponge iron units, re-rolling units, HR units, CR units, galvanised/colour coated units, tin plate units, wire-drawing units, etc. for producing either semi-finished or finished steel.

Traditionally, Indian steel industry was classified into Main Producers (SAIL plants, Tata Steel and Vizag Steel/RINL) and Secondary Producers. However, with the coming up of larger capacity steel making units of different process routes, the classification has been characterized as Main Producers & Other Producers.

Other Producers comprise Major Producers, namely, Essar Steel, JSW Steel and Ispat Industries as well as large number of Mini Steel Plants based on Electric Furnaces & Energy Optimising Furnaces (EOF). Besides, the steel producing units, there are a large number of Sponge Iron Plants, Mini Blast Furnace units, Hot & Cold Rolling Mills & Galvanising/Colour Coating units which are spread across the country.

The New Industrial policy adopted by the Government of India has opened up the iron and steel sector for private investment by removing it from the list of industries reserved for public sector and exempting it from compulsory licensing. Imports of foreign technology as well as foreign direct investment are freely permitted up to certain limits under an automatic route.

This, along with the other initiatives taken by the Government has given a definite impetus for entry, participation and growth of the private sector in the steel industry. While the existing units are being modernized/expanded, a large number of new/greenfield steel plants have also come up in different parts of the country based on modern, cost effective, state of-the-art technologies.

Production and Consumption Scenario:

ADVERTISEMENTS:

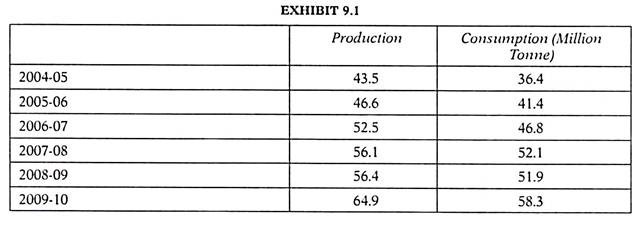

India’s steel production during 2009-10 was 64.88 million tonne (MT), up 11% from a year ago 2008-09. India has emerged as the fifth largest producer of steel in the world and is likely to become the second largest producer of crude steel by 2015-16.

India’s consumption of stainless steel is much higher at 14%, compared to the global consumption of 6%, in the last 15 years.

Soaring demand by sectors like infrastructure, real estate and automobiles, at home and abroad, has put India’s steel industry on the world map. Dominating the Indian horizon is steel giant Tata Steel, whose takeover of the UK-Dutch steel company Corns is the country’s biggest buyout. Meanwhile, the LN Mittal-owned Mittal Steel acquired French steel company Arcelor to create the world’s number one steel company, Arcelor Mittal; and Korean steel giant POSCO is pumping money into mines and steel plants in Orissa to emerge as one of the biggest steel plants in the state.

The domestic steel consumption grew by 9.8% to 29.82 MT during April-September 2010 over the year-ago period, on the back of steady demand from sectors like automobile and consumer durables. The consumption was at 27.15 MT in the same period a year ago. In September 2010, steel consumption rose 4.1 % to 4.72 MT, against 4.53 MT in the year-ago period.

Industry Structure:

ADVERTISEMENTS:

Indian Iron and steel Industry can be divided into two main sectors Public sector and Private sector.

Further on the basis of routes of production, the Indian steel industry can be divided into two types of producers:

(a) Integrated Producers:

Those that convert iron ore into steel. There are three major integrated steel players in India, namely Steel Authority of India Limited (SAIL), Tata Iron and Steel Company Limited (TISCO) and Rashtriya Ispat Nigam Limited (RINL).

(b) Secondary Producers:

These are the mini steel plants (MSPs), which make steel by melting scrap or sponge iron or a mixture of the two. Essar Steel, Ispat Industries and Lloyd’s steel are the largest producers of steel through the secondary route.

Problems of Iron and Steel Industry:

ADVERTISEMENTS:

Major problems of Iron and Steel Industry are as follows:

(i) Growing Cost of Basic Inputs:

High administered price of essential inputs like coal, fuel and electricity, puts Indian steel industry at a disadvantage. Poor quality and ever increasing prices of coking and non-coking coal has also created problems for the steel industry. Besides, ban on mining and delay in environmental approvals has led to the reduction in supply of iron ore to the steel industry. For the last three years especially from 2009-10 prices of iron ore also show an increasing trend.

(ii) Un-remunerative Prices:

Stagnating demand, domestic oversupply and falling prices are the most important problems of steel industry. It also discourages existing manufactures to avoid capacity additions which have further created constraints before the Indian Steel industry.

(iii) High Export Duty:

ADVERTISEMENTS:

Frequent upward revision in the export duty on iron ore to 30 per cent in 2011-12 would make India’s produce uncompetitive in the global market and total shipments of iron ore not to exceed 50 million tonnes at present. In fact, following the duty hike in budget 2011-12 and a slew of events like environmental problem and ban on mining thereafter iron ore exports from the country have witnessed a negative growth trend.

(iv) Poor Labour Productivity:

It is good that steel industry is enjoying the advantages of cheap labour but its gain gets offset by low labour productivity which ultimately increased the cost of labour for steel makers.

(v) Inefficient Management:

The top management especially in public sector plants comprises non-specialized and non-technical people who lack requisite managerial competence for running of capital intensive projects as the steel plants. They do not have technical qualifications and experience. Political interference, frequent labour disputes etc. also affects the decision making process of the management.

(vi) Growing Technological obsolescence:

Some of the steel plants especially under Steel Authority of India are facing technological obsolescence. Most of integrated steel plants are inefficient in terms of blast furnace productivity, consumption of coke and tap-to-tap time in convertors.

(vii) Dumping of Inferior Steel Products:

New Export-Import Policy fails to boost the demand of steel products. Even it has allowed liberal import of iron and steel goods under lower tariff regime. It has also encouraged the dumping of second and defective grades of steel into the economy.

Prospects of Iron and Steel Industry:

Steel demand traditionally grows at 1.5 times the pace of the economy but during 2010-11 demand growth slipped to 3.9% lower than the gross domestic product (GDP) growth rate. During 2011-12 steel makers ran their plant at just around 70-75% capacity. However, the infrastructure, core and allied industries may help in sustaining the steel sector growth in near future.

Most Indian steel producers would continue to pursue both organic and inorganic capacity expansion opportunities to cater to the anticipated demand. Indian steel market was experiencing change in the pattern of consumption of steel sectors such as auto, oil and gas power are growing fast and even in the coming years likely to register annual average growth in the range of 12-15 per cent. The demand for products such as auto grade CR & HR, ADI pikes, CRGO, CRNO, alloy steel, long products and stainless pipes is likely to grow. At present the country is dependent on imports for most of these products. Due to additions of new capacities in steelmaking it has become increasingly important that we grow our share of value added products.

Moreover, the steel industry in India is going through a difficult phase due to higher raw material cost, while reducing demand and declining steel prices globally threatens to put domestic steel prices under pressure. This could result in a reduction in retained earnings for 2011-12 forcing steel companies to increase their reliance on debt to meet the ever growing latex requirement. This could lead to an increase in debt/equity ratio for the steel industry going forward.

Cement Industry in India

Cement Company plays a major role in the growth of the nation. Cement is a key infrastructure industry. Cement industry in India was under full control and supervision of the government. However, it got relief at a large extent after the economic reform. It has been decontrolled from price and distribution on 1st March, 1989 and delicensed on 25th July, 1991. But government interference, especially in the pricing, is still evident in India.

In spite of being the second largest cement producer in the world, India falls in the list of lowest per capita consumption of cement with 125 kg. The reason behind this is the poor rural people who mostly live in mud huts and cannot afford to have the commodity. Despite the fact, the demand and supply of cement in India has grown up. In a fast developing economy like India, there is always large possibility of expansion of cement industry.

The cement industry is the building block of the nation’s construction industry. Few construction projects can take place without utilizing cement somewhere in the design. Annual cement industry shipments are currently estimated at $10.0 billion for 2008; down from $15.0 billion in 2006. U.S. cement production is widely dispersed with the operation of 113 cement plants in 36 states. The top five companies collectively operate 54.4% of U.S. clinker capacity with the largest company representing 15.9% of all domestic clinker capacity. An estimated 80.0% of U.S. clinker capacity is owned by companies headquartered outside of the U.S.

Historical Perspective:

The history of the cement industry in India dates back to the 1889 when a Kolkata-based company started manufacturing cement from Argillaceous. But the industry started getting the organized shape in the early 1900s. In 1914, India Cement Company Ltd. was established in Porbandar with a capacity of 10,000 tons and production of 1000 tons installed.

The World War I gave the first initial thrust to the cement industry in India and the industry started growing at a fast rate in terms of production, manufacturing units, and installed capacity. This stage was referred to as the Nascent Stage of Indian Cement Company. In 1927, Concrete Association of India was set up to create public awareness on the utility of cement as well as to propagate cement consumption.

The cement industry in India saw the price and distribution control system in the year 1956, established to ensure fair price model for consumers as well as manufacturers. Later in 1977, government authorized new manufacturing units (as well as existing units going for capacity enhancement) to put a higher price tag for their products. A couple of years later, government introduced a three-tier pricing system with different pricing on cement produced in high, medium and low cost plants.

Growth Profile of Cement Industry:

India is the second largest cement producing country after China with 137 large and 365 mini cement plants. The large plants employ 1,20,000 people. For the year ended March 31, 2011, the Indian cement industry is the second largest in the world. In 2010-11, total cement consumption in India stood at 300 million tonnes while exports of cement and clinker amounted to around 3 million tonnes.

The Indian cement industry is not only meeting the requirements arisen within the domestic territory but also fulfilling the burgeoning demands of the international arena. India is also exporting good amount of cement clinker and by products of cement. Due to the superlative quality, the Indian cement has occupied the high position on the global map.

The cement industry holds a significant place in the national economy because of its strong linkages to various sectors such as construction, transportation, coal and power. The cement industry in India is also one of the major contributors to the exchequer by way of indirect taxes.

Even during the global economic slowdown in 2008-09, growth in cement demand remained robust at 8.4 per cent. In 2009-10 cement consumption has short up, reporting, on an average, 12.5 per cent growth in consumption during the first eight months with the growth being fuelled by strong infrastructure spending, especially from the Government Sector.

India produces variety of cement based on different compositions such as Ordinary Portland cement, Portland Pozzolana, Portland Blast Furnace Slag cement, white cement and specialized cement. Cement in India produced as per the Bureau of Indian standards comparable with the best in the world.

Expanding Market Size:

The Indian cement industry can be divided into five geographical zones-North, South, East, West and Central-based on localized differentiation in the consumer profile and supply-demand scenario. Demand in the cement industry has been wonderful growth on the back of infrastructure, residential and commercial projects. Cement production in India is anticipated to increase to 315-320 million tonne (MT) by end of 2011-12 from the current 300 MT. According to Cement Manufactures Association, the country is expected to reach a capacity of 550 million tonnes by 2020.

This industry has seen constant modernization and implementation of latest technologies during past few years. About 93 per cent of the total capacity is based on eco-friendly dry process technology. Progressive liberalization and easing of foreign direct investments (FDI) norms in various sectors paved the way for growth in FDI, which led to growing demand for office space from multinational companies (MNCs) and other foreign investors.

Total FDI in the cement sector between April 2000 and August 2010 stood at US $1.9 billion. The cement industry in India is known for its linkages with other sectors. The Government of India has taken various steps to provide the required impetus to the industry. At present 100 per cent FDI is allowed in this industry. Both the state and export policies promote cement production.

Exporters can claim duty drawbacks on imports of coal and furnace oil up to 20 per cent of the total value of imports. Most state governments offer fiscal incentives in the form of sales tax exemptions/deferrals in order to attract investment. A contract worth Rs.1,200 crore (US $228.59 million) has been awarded to the Perth based India Resources by Prism Cement towards development of a captive coal mine, emphasizing the growing trend of Indian companies outsourcing their mining operations to foreign entities.

India Cement has acquired a coal mine in Indonesia for US$ 20 million. It is expected to be operational by January 2012. Germen cement giant Heidelberg and domestic cements have shown interest to be the joint venture partner in state-run Rashtriya Ispat Nigam’s proposed Rs.1,000 crore (US$ 190.45 million), 3 mt pa cement plant at Vizag.

Cement Production and Growth:

India, being the second largest cement producer in the world after China with a total capacity of 151.2 Million Tones (MT), has got a big No. Cement Companies. With the government of India giving boost to various infrastructure projects, housing facilities and road networks, the cement industry in India is currently growing at an enviable pace. More growth in the Indian cement industry is expected in the coming years.

It is also predicted that the cement production in India would rise to 236.16 MT in FY 11. It’s also expected to rise to 262.61 MT in FY 12. The cement industry in India is dominated by around 20 companies, which account for almost 70% of the total cement production in India. In the present year, the Indian cement companies have produced a total cement production in FY 09-10 to 231 MT.

Domestic demand plays a major role in the fast growth of cement industry in India. In fact the domestic demand of cement has surpassed the economic growth rate of India. The cement consumption is expected to rise more than 22% by 2009-10 from 2007-08. In cement consumption, the state of Maharashtra leads the table with 12.18% consumption, followed by Uttar Pradesh. In terms of cement production, Andhra Pradesh leads the list with 14.72% of production, while Rajasthan remains at second position.

Cement Dispatches:

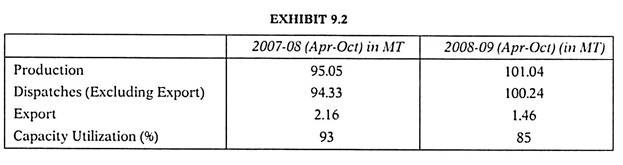

Cement industry in India has successfully maintained almost total capacity utilization levels, which resulted in maintaining a 10% growth rate. In 2006-07, the total despatch was 155 MT, which rose up to 170 MT in 2007-08. The month of October 2009 saw a cement dispatch of 12.22 MT, which was almost 9% higher than the total cement dispatch of 11.21 MT in the same month in the 2008.

Exhibit 9.2 shows that there was an improvement in capacity utilization from 85% to 93% in 2007-08 and 2008-09 respectively. Similar trend is also reported in production and export of cement during the same period.

Technology Up-gradation Programme:

Cement industry in India is currently going through a technological change as a lot of up-gradation and assimilation is taking place. Currently, almost 93% of the total capacity is based entirely on the modern dry process, which is considered as more environment- friendly. Only the rest 7% uses old wet and semi-dry process technology.

There is also a huge scope of waste heat recovery in the cement plants, which lead to reduction in the emission level and hence improves the environment. Cement industry has made tremendous strides in technological up-gradation and assimilation of latest technology.

At present ninety three per cent of the total capacity in the industry is based on modern and environment-friendly dry process technology and only seven per cent of the capacity is based on old wet and semi-dry process technology. There is tremendous scope for waste heat recovery in cement plants and thereby reduction in emission level.

One project for co-generation of power utilizing waste heat in an Indian cement plant is being implemented with Japanese assistance under Green Aid Plan. The induction of advanced technology has helped the industry immensely to conserve energy and fuel and to save materials substantially.

India is also producing different varieties of cement like Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC), Portland Blast Furnace Slag Cement (PBFS), Oil Well Cement, Rapid Hardening Portland Cement, Sulphate Resisting Portland Cement, White Cement etc. Production of these varieties of cement conform to the BIS Specifications. It is worth mentioning that some cement plants have set up dedicated jetties for promoting bulk transportation and export.

Problems of Cement Industry:

Major problems of cement industry are as follows:

1. Poor Government Infrastructure Spending:

Before 2010-11, there was a stimulated growth in the spending of government on infrastructure projects. But due to resource crunch government has reduced its spending on infrastructure has resulted in lower demand of cement. Private sector especially real estate sector due to financial market condition has also lowered down its demand for cement.

2. High Lending Rates:

Banks’ lending rates are now hovering near the peak level so cement industry is unable to meet out its working capital requirements as well as capital expenditure programme. Actually it has affected the modernization and expansion programme of the cement industry.

3. High Tariffs:

Frequent upward revision of various tariffs – high excise duty, sales tax, royalty on lime stone and coal etc. has adversely affected the demand as it has increased the cost of products to the customers. The excise duty on cement has been steadily rising.

4. Poor Availability of Coal:

Coal is an important input in the cement industry. The availability of coal has remained the contentious issue for the industry as Coal India one of the largest domestic suppliers, priorities supply to the power sector as per the government direction. Coal availability in the auction conducted by the Coal India has shrunk during 2011-12 leading to sharp spike in prices. Import has also turned costlier after the rupee depreciation.

5. The Power Shortage:

Power cuts, unsteady and inadequate power supply have created serious problems for cement units. Continuous process requires uninterrupted power supply to operate efficiently. Various cement plants have installed their captive power plants but their cost increases the cost of production and adversely affects the margins of the industry.

6. Transportation Problem:

Indian Railways is the base for the transportation of cement in the country. But due to shortage of wagons, cement dispatches by rail have declined over the years. Besides, Railways hiked fright charges by six percent. It increases the cost of supplies. However, Road transport is offering all help in logistic management of cement industry.

Prospects:

Cement industry has affected a gradual shift from wet to modern, fuel efficient dry process plants. Most of these new plants have adopted state-of-the-art technology. Existing plants are also implementing modernization programmes to improve their performance. This has resulted in better capacity utilization, higher productivity; reduce energy consumption and better quality of cement.

Available study suggests that the cement industry in India witnessed massive growth on the back of various industrial development and pro-economic policies of the Union Government. This has helped attracting the attention of various global cement giants, thereby sparking off a wave of mergers and acquisitions in several states. The report has estimated India’s cement consumption to grow at a compound annual growth rate (CAGR) of 11 percent, between 2011-12 and 2013-14.

The study, which focused on the demand-supply outlook and the cement pricing in various regions of the country revealed that the Andhra Pradesh topped the chart in terms of large plants and its installed capacity in India. Fast growing economy and the regulatory support is expected to further encourage the industry players to embark on expansion plans. Furthermore, it is infrastructure projects, road networks and housing facilities will boost the growth in cement consumption in the near future.

Continuous technological upgrading and assimilation of latest technology has been going on in the cement industry. Presently 93 per cent of the total capacity in the industry is based on modern and environment-friendly dry process technology and only 7 per cent of the capacity is based on old wet and semidry process technology. There is tremendous scope for waste heat recovery kiln cement plants and thereby reduction in emission level.

One project for co-generation of power utilizing waste heat in an Indian cement plant is being implemented with Japanese assistance under Green Aid Plan. The induction of advanced technology has helped the industry immensely to conserve energy and fuel and to save materials substantially.

Sugar Industry in India

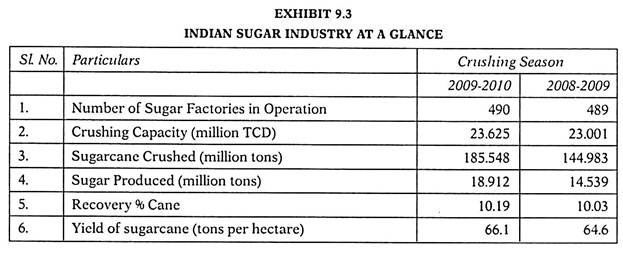

Sugar is the second largest agro-based industry in India. The industry provides employment to about two million skilled and semi-skilled workers besides those who are employed in ancillary activities, mostly from rural areas. Though the industry contributes a lot to the socio-economic development of the nation, it is plagued with a number of problems such as cyclical fluctuations, high support prices payable to farmers, lack of adequate working capital, partial decontrol and the uncertain export outlook.

Despite the problems, the industry has good growth potential due to steady increase in sugar consumption, retail boom and diversification into areas such as power generation and production of ethanol. In addition to this, strong possibilities exist for counter trade, if the Government designs and develops sugar industry-oriented policies. With this background, an attempt has been made to examine the problems and prospects of sugar industry in India.

Sugar Industry in India is well developed with a consumer base of more than billions of people. It is also the second largest producer of sugar in the world. There are around 45 million of sugarcane growers in India and a larger portion of rural labourers in the country largely rely upon this industry. Sugar Industry is one of the agricultural based industries. In India it is the second largest agricultural industry after.

Trade Policy:

Forced by the severe domestic shortages and abnormally high sugar prices since beginning of 2009, the Government of India (GOI) took several measures to relax import restrictions to augment domestic supplies. On February 17, 2009 the government relaxed the norms for duty free imports of raw sugar under the advance licensing scheme (ALS) exempting future export commitments from actual user conditions for raw sugar imports during February 17, 2009, the government allowed mills to import raw sugar at zero duty under the open general license (no future export commitments).

The government also allowed select State Trading Enterprises (STEs) to import white sugar at zero duty. Subsequently, on July 31, 2009, the government allowed duty free imports of white sugar by traders and processors until November 31, 2009. Through a series of notifications the GOI has extended the duty free imports of raw sugar and white sugar up to December 31, 2010.

The GOI has also exempted imported sugar, both raw sugar and white sugar, from the levy sugar obligation and the market quota release system, applicable to domestic sugar. With the sugar prices easing, there is an increasing pressure from the local industry to re-impose the import duties on white and raw sugar, and reverting back to the old import policy regime. Currently, the GOI does not allow exports of sugar and or provide any export incentive (transport subsidy) for sugar.

Sugarcane Production and Pricing Policy:

The Government of India (GOI) supports research, development, training of farmers and transfer of new varieties and improved production technologies (seed, implements, pest management) to growers in its endeavour to raise cane yields and sugar recovery rates. The Indian Council of Agricultural Research (ICAR) conducts sugarcane research and development at the national level.

State agricultural universities, regional research institutions, and state agricultural extension agencies support these efforts at the regional and state levels. The central and state governments also support sugarcane growers by ensuring finance and input supplies at affordable prices.

The GOI establishes a Minimum Support Price (MSP) for sugarcane on the basis of recommendation by the Commission for Agricultural Costs and Prices (CACP) and after consulting State Governments and associations of the sugar industry and cane growers.

Last year the GOI announced a new system of Fair and Remunerative Price (FRP) that would links the cane price with sugar price realization by the sugar mills. Several state governments further augment the MSP/FRP, typically by 20-25 per cent, due to political compulsions rather than market pricing.

Sugar Production and Marketing Policy:

The GOI levies a fee of Rs.240 ($5.33) per ton of sugar produced by mills to raise a Sugarcane Development Fund (SDF), which is used to support research, extension, and technological improvement in the sugar sector. The SDF is also often used to support sugar buffer-stocks operations, provide a transport subsidy for sugar exports, and provide an interest subsidy on loans for the installation of power generation and ethanol production plants. In March 2008, the GOI enacted the Sugar Development Fund (Amendment) Bill, 2008 that enables the government to include the use of the funds for debt restructuring and soft loans to the sugar mills.

The Government of India follows a policy of partial market control and dual pricing for sugar. The local sugar mills are required to supply 20 per cent of their production to the government as ‘levy sugar’ at below-market prices, which the government distributes through the Public Distribution System (PDS) to its below-poverty line population at subsidized rates.

Mills are allowed to sell the balance of their production as ‘free sugar’ at market prices. However, the sale of free-sale sugar and levy sugar is administered by the government through periodic quotas, designed to maintain price stability in the market.

On March 12, 2009 the central government advised the state government to impose stock and turnover limits on traders to prevent hoarding of sugar. Khandsari sugar has also been brought under the ambit of stockholding and turnover limit from July 17, 2009. Most state governments imposed stock and turnover control orders in their respective states.

On August 22, 2009, the government imposed stock holding limits on large consumers (food and beverage companies) who consume more than 1.0 ton of sugar per month. Initially these consumers were asked to maintain stock necessary to meet not more than 20 days requirements; which were further lowered to 10 days requirements in February 2010.

These limits are effective up to Sept 30, 2010. With the improvement in domestic sugar supplies, there is growing pressure from the domestic sugar mills and traders to remove these stock limits.

In May 2011, the government allowed futures trading in sugar, and three national exchanges have been given permission to engage in sugar futures trading. However, in May 2009, the government suspended futures trading in sugar until December 2009, which has been subsequently extended till September end 2010.

Sugar Decontrol in India:

The Government of India has launched economic reforms in 1991 and process of liberalisation, privatization and globalization was started to give a new thrust towards different segments of Indian economy. Naturally, Sugar industry is also crying for sugar decontrol since long in the changed scenario.

Sugar Industry is seeking freedom at least from the mandatory supply of the Sugar by the industry at below cost for state-run welfare programmes – also known as the levy obligation – and the monthly sale quota. These apart, the government also decides the minimum price the mills have to pay for sugarcane purchases periodical limits on stocks large buyers can hold to thwart hoarding. The sector has been under the government control since 1940s.

The Sugar Industry is facing problem between high cane prices-often used by state governments as a tool to get the political support of the farming community-and low sugar sales realisation. The cash-strapped sugar industry has also renewed its calls this year again (2011-12) for lifting the government control over the sector. Surplus sugar stocks for a second straight year have kept domestic prices subdued for more than six months now despite a 17% hike in cane prices in the largest producing state of Uttar Pradesh and to a large extent in other states.

Present Regulatory Framework for Sugar:

The Sugar mills are mandated to sell 10% of their output to the government for its public distribution system around 60% of their cost of sugar at current prices. The government’s control over how much sugar mills will sell in the open market each month compounds their worries as a failure to complete sales with in the month could result in a conversion of the unsold quantity into the levy quota. The levy obligation alone cost $2,500 crore to $3,000 crore a year to the sugar mills.

Composition of the Committee:

The Government of India has constituted in January, 2012 six-member committee under the chairman-ship of Dr. C. Rangarajan, chairman. Economic Advisory Committee to the Prime Minister to look into all issues relating to de-regulation of the sugar sector. It has been assigned to give its recommendations to the Prime Minister at the earliest.

Other members on the panel include the Chief Economic Advisor, Dr. Kaushik Basu; the Chairman of Commission for Agricultural Costs and Prices, Dr. Ashok Gulati; Secretaries of Agriculture, and Food and Public Distribution, Secretary EAC, Dr. K.P. Krishan; and the former secretary of Food and Public Distribution, Mr. Nanda Kumar, currently a member of National Disaster Management Authority.

The Committee has been empowered to involve such experts, academics as required as special invitees. The food ministry would provide the necessary support to the committee in discharging its functions.

Actually in late 2010, the Prime Minister had set up a four- member committee under Dr. C. Rangarajan to look into the issue of linking cane prices to the sugar rates. “In a sense, the present committee is an extension of the earlier committee, and may look into all issues relating to the sugar sector.”

“The industry welcomes the constitution of such a committee consisting of several experienced senior economists and government officials. It expects for some positive outcome quickly, which will be in the interests of both the farmers as well as the industry.” Various controls and dwindling returns on sugar sales bled their viability and that is why Sugar industry is demanding for decontrol.

Rationale of Sugar Control:

Rationales of sugar decontrol are given below:

(i) Present L. P. G. environment has created conducive environment for sugar decontrol.

(ii) It is in accordance with the policy of the government to reduce subsidy in public distribution mechanism.

(iii) Levy quota pricing is irrelevant because cost of sugar production is increasing on continuous basis.

(iv) Most of the sugar units are non-viable due to levy quota burden and restrictions on open market sale quota etc.

(v) Sugar mills are facing resource crunch and they also need funds for their expansion and modernization programmes. Survival of sugar units will be at stake in case decontrol is not there.

Prospects of Sugar Decontrol under Present Scenario:

The timing of demand for decontrol of sugar sector is quite appropriate. Sugar output during this season is expected at 25-26 million tonnes (mt). This, along with opening stocks of 6.1 mt, can more than take care of domestic demand of 22-23 mt. With no major festivals, November to March is usually a lean period for local consumption. But for farmers sugar realizations during this period matter, as they determine the cane price mills can realistically afford to pay.

This is also a time when supplies from Brazil dry up, with the new crop there due for crushing only from early April. All this provides a window of opportunity to free the industry – from levy obligations, controls on how much sugar any mill can sell in the open market in a month, and stocking limits – and also open up exports. Sugar prices are firming up now in the sugar market.

Problems of Sugar Industry:

Major problems of sugar industry are as follows:

(i) It is characterized by instability in recurring imbalance between the demand for and supply of sugar in the country.

(ii) It is a totally agro-based industry. The manufacturing plant is merely an extraction unit. Sugarcane forms about 2/3rd of the total manufacturing cost of sugar.

(iii) Sugar mills are facing tough competition from gur and khandsari producers who try to corner major chunk of sugarcane from the farmers.

(iv) Poor yields of cane per hectare, low recovery of sugarcane; uneconomic size of sugar units increase the cost of production and force them to become uncompetitive in the international market.

(v) Organized cane suppliers and manufacturing units generally exploit the small cane growers as they do not have sufficient bargaining power.

(vi) Growing obsolescence and old machineries have forced the large number of sugar mills to become sick.

(vii) The Sugar industry has been delicensed since August 1998 but government still regulate the free sale quota and export volume of the sugar to regulate the domestic price scenario.

Suggestions:

Major suggestions to improve the working of sugar mills are as follows:

(i) Government should formulate the policy of area demarcation for cane supplies. It will prevent unhealthy competition among sugar factories in enticing growers to supply their cane at bargaining prices.

(ii) Sugar factories should be allowed to develop their own cane areas for improving their internal cane supplies.

(iii) Sugar factories should formulate their own cane drawl programme based on registration of cane on an area basis.

(iv) Sugar Factories should be required to pay more incentives for early maturing cane varieties to encourage more production in early months of crushing.

(v) Optimum utilization of the by-products should be ensured to improve viability of the mills.

(vi) Import of raw sugar should be allowed on systematic basis to avoid shortage of sugar.

Cotton and Textiles Industry in India

The Indian Textiles Industry has an overwhelming presence in the economic life of the country. It occupies an important place in the economy of the country because of its contribution to the industrial output, employment generation and foreign exchange earnings.

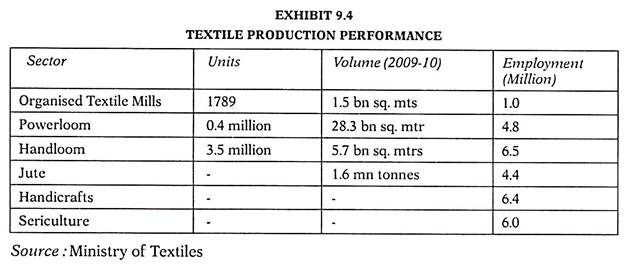

Apart from providing one of the basic necessities of life, the textiles industry also plays a pivotal role through its contribution to industrial output, employment generation, and the export earnings of the country. Currently, it contributes about 14 per cent to industrial production, 4 per cent to the GDP, and 17 per cent to the country’s export earnings. It provides direct employment to over 35 million people, which includes a substantial number of SC/ST, and women. The Textiles sector is the second largest provider of employment after agriculture. Thus, the growth and all round development of this industry has a direct bearing on the improvement of the economy of the nation.

The Indian textiles industry is extremely varied, with the hand-spun and hand-woven sector at one end of the spectrum, and the capital intensive, sophisticated mill sector at the other. The decentralized power looms/hosiery and knitting sector from the largest section of the Textiles Sector. The close linkage of the Industry to agriculture and the ancient culture, and traditions of the country make the Indian textiles sector unique in comparison with the textiles industry of other countries.

This also provides the industry with the capacity to produce a variety of products suitable to the different market segments, both within and outside the country. The major sub-sectors that comprise the textiles sector include the organized Cotton/Man-Made Fibre Textiles Mill industry, the Man-Made Fibre/Filament Yarn Industry, the Wool and Woollen Textiles Industry, the Sericulture and Silk Textiles Industry, Handlooms, Handicrafts, the Jute and Jute Textiles Industry, and Textiles Exports.

The Cotton/Man-made fibre textile industry is the largest organized industry in the country in terms of employment (nearly 1 million workers) and number of units. Besides, there are a large number of subsidiary industries dependent on this sector, such as those manufacturing machinery, accessories, stores, mills (non-SSI) in the country with an installed capacity of 38.53 million spindles 5,18,000 rotors and 57,000 looms.

Textile production covering man-made fibre, filament yarn and spun yarn is showing increasing trend. Man-made fibre production recorded a marginal fall and filament yarn production recorded a slight increase of about 1.89% during 2010-11 (April – October 2010).

The production of spun yarn during April-Oct (2010-11) is showing an increasing trend by 9.17%. The production of cotton yarn during 2010-11 April-Oct (2010-11) recorded an increase of 11% (Provisional). Blended and 100% Non-cotton yarn production recorded an increase of about 4% during 2010-11.

Cloth production by mill sector showed marginal increase of 3% during April-Oct. (2010-11) (provisional). During the same period cloth production by power loom and hosiery sector showed an increase of 1.7% and 5.30% respectively. However the cloth production in handloom sector showed a decrease of 4.7%.

Production Performance:

At present, the contribution of the textile industry to GDP is about 4 per cent. The textile industry provides direct employment to about more than 35 million people and is the second largest employment provider in India after agriculture. Of this, textile industry alone accounts for 29 million and the apparel industry accounts for employment of 6 million people.

With exports as well as domestic sector growing rapidly the Textile and Apparel Industry is expected to provide direct employment to 40 million people by year 2010. Size of the Indian Textile and Apparel Industry is estimated to be US $ 85 bn comprising US $ 45 bn in domestic and balance in exports by 2010.

The contribution of this industry to gross export earnings is about 17% and it adds less than 2% to the gross import bill of the country in 2009-10. The textile industry is a self-reliant industry from the production of raw materials to the delivery of final products with considerable value addition at each stage of processing.

Technology Up-gradation Fund Scheme (TUFS):

The Technology Up-gradation Fund Scheme (TUFS) was commissioned on 01.04.1999 initially for a period of 5 years with a view to facilitate the modernization and up-gradation of the textiles industry by providing credit at reduced rates to the entrepreneurs both in the organized and the unorganized sector. The scheme, which has now been extended up to 31.03.2012, has been fine-tuned to catapult-the rapid investment in the targeted segments of the textile industry.

TUFS has helped in the transition from a quantitatively restricted textiles trade to market driven go a merchandise. It has infused an investment climate in the textiles sector and in its operational life span has propelled investment of more than Rs.2, 07,747 crores up to 30.6.2010. The garmenting, technical textiles and processing segments of the textiles industry have great potential to add value and generate employment.

The Working Group on Textiles and Jute Industry for the XI Five Year Plan, constituted by the Planning Commission, has set a growth rate of 16% for the sector, projecting an investment of Rs.150,600 crore in the Plan period. In this context, it was decided to extend the Technology Up-gradation Fund Scheme during the Eleventh Plan period, and to reframe some of the financial and operational parameters of the Scheme in respect of new loans.

In the Tenth Plan Period (2002-07), Rs.1,270 crore had been earmarked for the scheme. However, the net utilization of funds under this Scheme was Rs.2044.17 crore. The modified techno-financial parameters of the Scheme will infuse capital investment into the textiles sector, and help it capitalize on the vibrant and expanding global and domestic markets, through technology up-gradation, cost effectiveness, quality production, efficiency and global competitiveness.

It is estimated that this will ensure a growth rate of 1696 in the sector. The modified structure of TUFS focuses on additional capacity building, better adoption of technology, and provides for a higher level of assistance to segments that have a larger potential for growth, like garmenting, technical textiles, and processing.

The Scheme covers spinning, cotton ginning & pressing, silk, reeling & twisting wool, scouring & combing, synthetic filament yarn texturising, crimping and twisting, manufacturing of viscose filament yarn (VFY)/viscose staple fibre (VSF), weaving/knitting including non-woven and technical textiles, garments, made-up manufacturing, processing of fibres, yarns, fabrics, garments and made-ups, and the jute sector.

Export Performance:

(i) Exports of textiles and clothing products from India have increased steadily over the last few years, particularly after 2004 when textiles exports quota were discontinued.

(ii) India’s Textiles & Clothing (T&C) export registered robust growth of 2596 in 2005-06, recording a growth of US$ 3.5 billion over 2004-05 in value terms thereby reaching a level of US $ 17.52 billion and the growth continued in 2006-07 with T&C exports of US $19.15 billion recording an increase of 9.2896 over 2005-06 and reached US $22.15 billion in 2007-08 denoting an increase of 15.796 but declined by over 596 in 2008-09 with exports of US $20.94 billion.

During 2009-10, the exports of T&C increased by over 5.6096 and reached the level of US$ 22.42 billion. Thus exports of T&C have denoted an increase of 60.1496 in the last five years (2004-05 to 2009-10). Indian T&C exports is facing various constraints of infrastructure, high power and transaction cost, incidence of state level cess and duties, lack of state of the art technology etc.

(iii) Readymade Garments account for almost 4596 of the total textiles exports. Apparel and cotton textiles products together contribute nearly 7096 of the total textiles exports.

(iv) The exports basket consists of a wide range of items comprising readymade garments, cotton textiles, handloom textiles, man-made fibre textiles, wool and woolen goods, silk, jute and handicrafts including carpets.

(v) India’s textiles products, including handlooms and handicrafts, are exported to more than a hundred countries. However, the USA and the EU, account for about two-third of India’s textiles exports. The other major export destinations are Canada, U.A.E., Japan, Saudi Arabia, Republic of Korea, Bangladesh, Turkey, etc.

(vi) The export of textiles and clothing aggregated to US$ 22.42 billion in 2009-10. The Government fixed the target for 2010-11 at US $25.48 billion. So far during the period April-September 10, exports of T&C have been achieved at USD 11.26 billion.

Scheme for Integrated Textile Parks (SITP):

The ‘Scheme for Integrated Textile Parks (SITP)’ is being implemented to facilitate setting up of textile units with appropriate supporting infrastructure. Industry Associations/ Group of Entrepreneurs are the main promoters of the Integrated Textiles Park (ITP).

The scheme targets industrial clusters/locations with high growth potential, which require strategic interventions by way of providing world-class infrastructure support. The project cost covers common infrastructure and buildings for production/support activities, depending on the needs of the ITP.

The components of an ITP are:

(a) Group A – Land.

(b) Group B – Common Infrastructure like compound wall, roads, drainage, water supply, electricity supply including captive power plant, effluent treatment, telecommunication lines etc.

(c) Group C – Buildings for common facilities like testing laboratory, design centre, training centre, trade centre/display centre, warehousing facility/raw material depot, creche, canteen, workers’ hostel, offices of service providers, labour rest and recreation facilities etc.

(d) Group D – Factory buildings for production purposes.

(e) Group E – Plant & machinery.

The total Project Cost for the purpose of this Scheme includes the cost on account components of ITP, as listed under Groups A, B, C and D above, provided the ownership of the factory buildings vests with the SPY. The SPY has, however, have the option of seeking financial support from Government of India for components under Groups B and C only, if factory buildings are individually owned.

These Parks would have facilities for spinning, sizing, texturising, weaving, processing, apparels etc. The estimate project cost (for common infrastructure and common facilities) is Rs.4193.6 crore, of which Government of India assistance under the scheme would be Rs.1419.69 crore. 2292 entrepreneur will put up their units in these parks covering an area of 4307.97 acre. The projected investment in these parks is Rs.19,456.90 Crore and estimated annual production is Rs.33568.50 crore. After these parks are fully operational there would be employment available for 7.50 lakh persons (3 lakh direct & 4.50 indirect).

So far assistance of Rs.882.60 crore has been provided for execution of these projects. The promoters of these textiles park projects have brought in Rs.100 crore (approx.) as their contribution. Four projects have been completed – Brandi & Pochampally Handloom Park Ltd. – Andhra Pradesh, Gujarat Eco Textile Park Gujarat and Palladam Hi-Tech Weaving Park – Tamil Nadu and production has been started in 24 out of 40 projects.

Changing Scenario of the Indian Textile Industry:

India produces a wide range of home furnishings, household linen, curtain tapestry and yardage made with different textures and varying thickness. The Handloom industry mainly exports fabrics, bed linen, table linen, toilet and kitchen linen, towels, curtains, cushions and pads, tapestries and upholstery’s, carpets and floor coverings, etc.

The Handloom industry has adopted various measures and techniques to provide high quality and eco-friendly products to the world market. The manufacturers in India are well aware that AZO free colours and dyes should be used. India has discarded the usage of banned materials in the dyeing process with safe substitutes, to ensure eco-friendliness of the products manufactured by the industry.

The Handloom industry mainly exports fabrics, bed linen, table linen, toilet and kitchen linen, towels, curtains, cushions and pads, tapestries and upholstery’s, carpets and floor coverings, etc. The Handloom industry has adopted various measures and techniques to provide high quality and eco-friendly products to the world market.

In the world of handlooms, there are Madras checks from Tamil Nadu, ikats from Andhra and Orissa, tie and dye from Gujarat and Rajasthan; brocades from Banaras, jacquards form Uttar Pradesh, daccai from West Bengal, and phulkari from Punjab.

The Surat tanchoi based on a technique of satin weaving with the extra weft floats that are absorbed in the fabric itself has been reproduced in Varanasi. Besides its own traditional weaves, there is hardly any style of weaving that Varanasi cannot reproduce. The Baluchar technique of plain woven fabric brocaded with untwisted silk thread, which began in Murshidabad district of West Bengal, has taken root in Varanasi.

Their craftsmen have also borrowed the jamdani technique. In the deportment of Woolen textiles, Woolen weaves are no less subtle. The Kashmiri weaver is known the world over for his Pashmina and Shahtoosh shawls. The shawls are unbelievably light and warm.

The states of Kashmir and Karnataka are known for their mulberry silk. India is the only country in the world producing all four commercially known silks – mulberry, tasser (tussore), eri and muga. Now gaining immense popularity in the U.S.A. and Europe Assam is the home of eri and muga silk. Muga is durable and its natural tones of golden yellow and rare sheen become more lustrous with every wash. The ikat technique in India is commonly known as patola in Gujarat, bandha in Orissa, pagdu bandhu, buddavasi and chitki in Andhra Pradesh.

Problems of the Cotton & Textiles Industry:

Major problems of cotton and textile industries are as follows:

1. Poor Modernization and Rationalization Programmes:

Modernization requires funds. Textile mills are unable to generate enough internal surpluses to meet their modernization needs. In the absence of internal resources, these mills have looked upon financial institutions to supply them with funds; but their attitude is not so encouraging. Non-availability of modern sophisticated machinery affects modernization programme of the industry.

2. Costly Raw Materials and Inputs:

Cotton is the most important segment among raw materials. The productivity of crop is very low in India. Cost of production is also high so price is relatively higher. The problem of low yield also affects profitability. Non availability of other inputs in time also affects capacity utilization.

3. Low Demand for Cotton Cloth:

Textiles units have to complete with Synthetic cloth are costly but it is more durable. It has been attracting more demand both from the urban and the rural consumer. Low demand for cotton cloth has also been a consequence of low availability of the purchasing power with weaker sections of society. Textiles units are also unable to integrate in necessary fashion changes in their products.

4. High Incidence of Mortality and Sickness:

Textiles Industry is a labour-intensive industry. Mortality rate of textiles units is also high. It creates widespread unemployment. Factors like low productivity, high operating costs and lack of modernization are responsible for huge losses of textiles units. Consequent their death rate is high. Major activities like weaving, processing, made-ups, and garments are all highly fragmented. The high level of fragmentation has discouraged economies of scale and creation of large capacities.

Suggestions:

Major suggestions to improve the viability of the textiles industry are as follows:

(i) Multi-fibre approach of cotton textile industry may be a proper adjustment with the development policy for cotton and textiles industry in the country.

(ii) Subsidy system should be discontinued. Incentives schemes are to be implemented to improve efficiency.

(iii) Rationalization of industry is need of the hour to get rid of excess capacity and excess labour. These are largely responsible for the present sickness of the industry.

Information Technology (IT) Industry in India

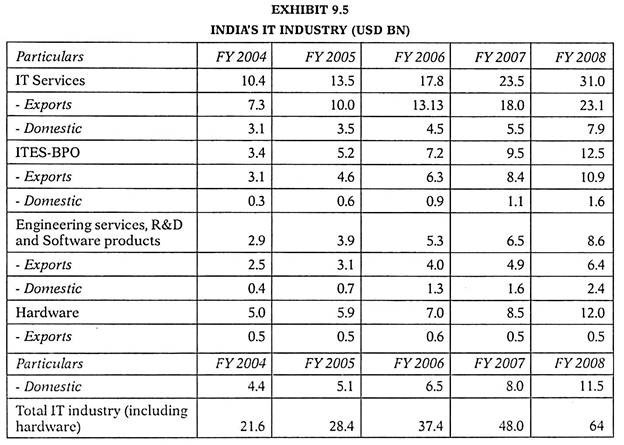

The Indian Information Technology industry accounts for a 5.19% of the country’s GDP and export earnings as of 2009, while providing employment to a significant number of its tertiary sector workforce. However, only 2.5 million people are employed in the sector either directly or indirectly. In 2010-11, annual revenues from IT-BPO sector is estimated to have grown over $54.33 billion compared to China with $35.76 billion and Philippines with $8.85 billion. It is expected to touch at US $225 billion by 2020.

Technically proficient immigrants from India sought jobs in the western world from the 1950s onwards as India’s education system produced more engineers than its industry could absorb. India’s growing stature in the Information Age enabled it to form close ties with both the United States of America and the European Union. However, the recent global financial crises have deeply impacted the Indian IT companies as well as global companies.

As a result hiring has dropped sharply, and employees are looking at different sectors like the financial service, telecommunications, and manufacturing industries, which have been growing phenomenally over the last few years. India’s IT Services industry was born in Mumbai in 1967 with the establishment of Tata Group in partnership with Burroughs. The first software export zone SEEPZ was set up here way back in 1973, the old avatar of the modern day IT Park. More than 80 per cent of the country’s software exports happened out of SEEPZ, Mumbai in 80s.

Historical Perspective:

The Indian Government acquired the EVS EM computers from the Soviet Union, which were used in large companies and research laboratories. In 1968 Tata Consultancy Services—established in SEEPZ, Mumbai by the Tata Group—were the country’s largest software producers during the 1960s. As an outcome of the various policies of Jawaharlal Nehru (office- 15 August 1947 – 27 May 1964) the economically beleaguered country was able to build a large scientific workforce, third in numbers only to that of the United States of America and the Soviet Union.

On 18 August 1951 the minister of education Maulana Abul Kalam Azad, inaugurated the Indian Institute of Technology at Kharagpur in West Bengal. Possibly modeled after the Massachusetts Institute of Technology, these institutions were conceived by a 22 member committee of scholars and entrepreneurs under the chairmanship of N. R. Sarkar.

Relaxed immigration laws in the United States of America (1965) attracted a number of skilled Indian professionals aiming for research. By 1960 as many as 10,000 Indians were estimated to have settled in the US. By the 1980s a number of engineers from India were seeking employment in other countries. In response, the Indian companies realigned wages to retain their experienced staff.

The United States’ technological lead was driven in no small part by the brain power of brilliant immigrants, many of whom came from India. The inestimable contributions of thousands of highly trained Indian migrants in every area of American scientific and technological achievement culminated with the information technology revolution most associated with California’s Silicon Valley in the 1980s and 1990s.

The National Informatics Centre was established in March 1975. The inception of The Computer Maintenance Company (CMC) followed in October 1976. Between 1977-1980 the country’s Information Technology companies Tata InfoTech, Patni Computer Systems and Wipro had become visible. The ‘microchip revolution’ of the 1980s had convinced both Indira Gandhi and her successor Rajiv Gandhi that electronics and telecommunications were vital to India’s growth and development.

MTNL underwent technological improvements. Between 1986-1987, the Indian government embarked upon the creation of three wide-area computer networking schemes- INDONET (intended to serve the IBM mainframes in India), NICNET (the network for India’s National Informatics Centre), and the academic research oriented Education and Research Network (ERNET).

Post Liberalization Effect:

In 1991 the Department of Electronics has established a corporation called Software Technology Parks of India (STPI) under the ownership of the government. It could provide VSAT communications without breaching its monopoly. The STPI set up software technology parks in different cities, each of which provided satellite links to be used by firms; the local link was a wireless radio link.

In 1993 the government began to allow individual companies their own dedicated links, which allowed work done in India to be transmitted abroad directly. Indian firms soon convinced their American customers that a satellite link was as reliable as a team of programmers working in the clients’ office. Videsh Sanchar Nigam Limited (VSNL) introduced Gateway Electronic Mail Service in 1991, the 64 kbit/s leased line service in 1992, and commercial Internet access on a visible scale in 1992. Election results were displayed via National Informatics Centre’s NICNET.

The Indian economy underwent economic reforms in 1991, leading to a new era of globalization and international economic integration. Economic growth of over 6% annually was seen between 1993-2002. The economic reforms were driven in part by significant improvement in the internet usage in the country.

The New Telecommunication Policy, 1999 (NTP 1999):

The policy helped in liberalization process of India’s telecommunications sector. The Information Technology Act, 2000 created legal procedures for electronic transactions and e-commerce. Throughout the 1990s, another wave of Indian professionals entered the United States. The number of Indian Americans reached 4.7 million by 2010. This immigration consisted largely of highly educated technologically proficient workers. Within the United States, Indians fared well in science, engineering and management.

Graduates from the Indian Institutes of Technology (IIT) became known for their technical skills. Thus, GOI planned to establish new Institutes especially for Information Technology to enhance this field. In 1998 India got the first IT institute name Indian Institute of Information Technology at Gwalior. The success of Information Technology in India not only had economic repercussions but also had far-reaching political consequences.

India’s reputation both as a source and a destination for skilled workforce helped it to improve its relations with a number of world economies. The relationship between economy and technology—valued in the western world—facilitated the growth of an entrepreneurial class of immigrant Indians, which further helped aid in promoting technology-driven growth.

Development Perspective:

India is now one of the biggest IT capitals in the modern world. The economic effect of the technologically inclined services sector in India—accounting for 40% of the country’s GDP and 30% of export earnings as of 2006, while employing only 25% of its workforce. The share of IT (mainly software) in total exports increased from 1 per cent in 1990 to 18 per cent in 2001.

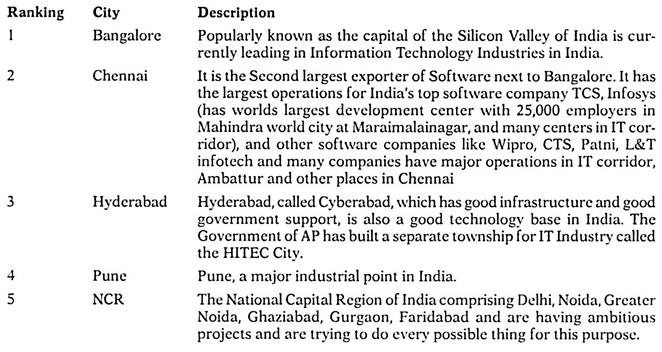

IT-enabled services such as back-office operations, remote maintenance, accounting, public call centers, medical transcription, insurance claims, and other bulk processing are rapidly expanding. Indian companies such as HCL, TCS, Wipro, and Infosys may yet become household names around the world. Today, Bangalore is known as the Silicon Valley of India and contributes 33% of Indian IT Exports.

India’s second and third largest software companies are head-quartered in Bangalore, as are many of the global SEI-CMM Level 5 Companies. Mumbai too has its share of IT companies that are India’s first and largest, like TCS and well established like Reliance, Patni, LnT Infotech, i-Flex, WNS, Shine, Naukri, Jobs pert etc. are head-quartered in Mumbai and these IT and dot.com. Companies are ruling the roost of Mumbai’s relatively high octane industry of Information Technology.

On 25 June 2002, India and the European Union agreed to bilateral cooperation in the field of science and technology. A joint EU-India group of scholars was formed on 23 November 2001 to further promote joint research and development. India holds observer status at CERN while a joint India-EU Software Education and Development Center is due at Bangalore.

Top Five IT Hubs:

Top 5 IT hubs in India are as follows:

In India, IT industry is a sun-rising industry. Growing needs of investment in the sector has given an important role in Indian economy. It is generating more and more employment opportunities for IT professionals in the country.

Problems of IT Industry:

Major problems of IT industry are as follows:

(i) It lacks tangible current assets.

(ii) It faces increasing level of obsolescence and gets affected by major risk factor. The fixed assets of software companies depreciate rapidly.

(iii) It has low entry barrier. Initial investment required for IT industry is quite low. This has led to multiplicity of small and medium players and consequently rate of failures is high.

(iv) It faces excessive attrition rate of man power. It increases the cost of training and development.

(v) There are risks in product development since the product could turn out to be non-marketable. Sometimes, similar product of a competitor is also affect the marketability of original product.

Prospect of IT Industry:

IT industry is a sunrise industry in India. It is playing a crucial role in employment generation at comparatively low level of investment. It has also created technical revolution in the country by developing and providing IT solutions to each and every segment of Indian economy. IT sector is a big business now and it continues to do well. Growth projection in 2012-13 are likely to be more or less similar to that in current year 2011-12 perhaps marginally lower-may be a percentage point lower than 2011-12.

Due to increase in cost, there is pressure on IT industry to go far a hike in prices. But at the moment, a hike in prices is not so viable keeping in mind the recessionary trends abroad. However, there has not been a drop in prices. On the other hand, depreciation of the rupee over the last six month the ending March 2012 (by nearly 18 per cent) absorbed a larger part of the costs.

It is also notable that order book position of the IT industry is quite satisfactory. There has indeed been some momentum from the past. Given the fact that both Europe and the US are now in trouble facing recession any trend, things seem to be pretty for the Indian IT industry. However, there is continuing concern about the volatility of the rupee.

While hedging, two way currency movements are to be kept in view. If IT Company had not taken any hedge (against rupee appreciation) during the rupee depreciation of 2011, it would have made huge gain. Thus, Indian IT industry has a bright future but it has to equip itself with all safeguards of recessionary trends in foreign countries.

Changes in Industrial Pattern since Independence:

The industrial development pattern on the eve of independence was characterized by the following elements:

(a) Lop-sided pattern of development dominated by too large and too small sized industrial units, with very few medium size units.

(b) Capital employed per worker in industry was very low because of low priority given to industry, low level of domestic demand and low per capita income.

(c) There was a preponderance of consumer goods industries to the utter neglect of capital goods industries like steel, machinery, heavy electrical and chemicals. The country had to largely depend on imports for capital goods.

The progress of industrialization during the last 60 years has been striking. There has been a phenomenal development of capital goods industries, substantial diversification and broad-basing of manufactured products. The country has achieved near self-sufferance in many industries. An impressive base has been created in sophisticated and high technology industrial sectors like electronics, machine tools, telecommunication equipment and the like.

The following points clearly show what important changes have taken place in industrial pattern since Independence:

(1) The structure of Indian industry has shifted in favour of basic and capital goods and intermediate goods sectors during the period of planning era in terms productive capital employed, value-added and employment. Several capital goods industries which were hitherto unknown in India were started. The relative importance of consumer goods industries declined correspondingly.

(2) Within the consumer goods sector, the goods which could be afforded by relatively higher income groups enjoyed handsome advances. There has been a remarkable growth of industries manufacturing elite-oriented consumer goods such as man-made fibres, finer varieties of textiles, beverages, cigarettes, motor cars, motor cycles and scooter, refrigerators, TVs, air-conditioners, electrical goods like fans, watches and clocks, cosmetics and so on.

The majority of low income groups whose needs are basic do not get a square deal. Their requirement of say-cotton textiles, sugar, kerosene, vanaspati, tea etc. are not given much importance in allocation of productive resources, with the result that scarcities are felt in these goods and prices continuously increase.

(3) There has been a massive increase in the size and diversification of public sector. Before independence, the existence of public sector was only nominal. The post- independence period saw a sea-change so far as the emergence of public sector was concerned. It has achieved commanding heights in Indian economy.

(4) So far as the private sector is concerned, the dominance of large and monopoly business houses has increased several times. There were hardly two large business houses- Tata and Birla in 1991. But at present in 2011-2012 the number of big business houses has increased enormously to about 40.

(5) A remarkable expansion and sophistication has taken place in infrastructural facilities since 1951, in respects of power generation, development of energy sources, railway transport, telecommunication, roads and road transport and the like, which are basic prerequisites for industrial development.

Large scale railway electrification and dieselization, extensive discovery of petroleum reserves and their extraction, nationalization of coal mining and its development, petroleum refineries, pipelines, storage and distribution arrangements, hydro-thermal and atomic power generation, together with manufacture of heavy electrical equipment, electricity grids, electronic telephone exchanges and micro-wave long distance telephone facilities and so on were taken up; significant strides made in these and other infrastructural facilities have catalyzed industrial development in several ways. Industrial finance was supported heavily by public financial institutions and commercial banks. Port facilities for imports and exports have been substantially expanded.

(6) The country could boast of achieving conspicuous progress in the science and technology front. Several research laboratories have been set up; R&D facilities have been installed in public and private sector units. Technological know-how has been extensively imported through foreign technical collaboration arrangements.

Science, Engineering, Management and other professional educational institutions have been established on a large scale. An elite cadre of scientific, technical and professional manpower has been built; India ranks high in the world in respect of technological talent and manpower and in development of information and communication technology, space research, nuclear technology, electronics etc.

(7) One of the notable features of the planning are since 1951 has been the mammoth growth of small scale industrial units. The number of registered and unregistered units was about 16000 in 1950; it has gone up to nearly 35 lakhs in 2011-12.

(8) The policy of liberalisation has led to delicensing of many industries and Competition Commission has been created under Competition Act to regulate the functioning of big business houses.

(9) The import intensity of industrial production has increased considerably over the past few years. This has mainly resulted from intensive import liberalization measures taken during the last ten years.

(10) The emerging industrial pattern manifests growing regional imbalance. The share of three Eastern States, West Bengal, Bihar and Orissa in total value addition in the industrial sector has come down from 23 per cent in 1970-71 to only 15 per cent in recent years. In contrast, the share of Maharashtra and Gujarat has gone up to more than 33 per cent during these years.