A forward exchange contract is “a commitment to exchange (buy or sell) one foreign currency for another at a specified exchange rate, with the exchange taking place on either a specified future date or during a specified future period”.

In a forward contract, one party agrees to deliver a specified amount of one currency for another at a specified exchange rate at a designated date in future. The specified exchange rate is called the forward rate. The designated date at which the parties must transact is called the ‘settlement date’ or ‘delivery date’.

An investor takes a position in the market by buying a forward contract is said to be in a ‘long position’. If the investor’s opening position is the sale of forward contract, the investor is said to be in a ‘short position’.

Where the expiry is fixed for other than a round number of months, the contracts are said to be with ‘broken dates’. The difference between the forward and the spot exchange rates is called the ‘differential’. If rate of forward contract is quoted at ‘premium’. If the forward rate is quoted at a rate lesser than spot rate, it is quoted at ‘discount’.

ADVERTISEMENTS:

A forward contract is simply an agreement to buy or sell foreign exchange at a stipulated rate at a specified time in the future. It is a contract calling for settlement beyond the spot date.

The time-frame can vary from a few days to many years. The simplest of the derivative securities, the forward contract is an agreement to buy, or sell, an asset at a certain time for a certain price. Since forwards – unlike futures – are not traded on exchanges, the only exit option is through the cancellation of the forward cover. To cover its short-term foreign currency obligations, a company expecting the rupee to depreciate can lock in a rate at a specified premium over the current spot rate.

Clearly, the decision to hedge, and the extent of hedging, will depend on the comparison between the current forward premiums and the extent of the depreciation or appreciation, expected. A forward contract locks you to a particular exchange rate, thereby insulating from exchange rate fluctuations.

In India, the forward contract has been the most popular instrument employed by corporate to cover their exposures, and, thereby offset a known future cash outflow. Forward contracts are usually available only for periods up to 12 months. Forward premiums are governed purely by demand and supply, which provide corporate with arbitrage opportunities.

ADVERTISEMENTS:

The premiums in this market are quoted till the last working day of the month. Internationally, the forward premiums or discounts reflect the prevailing interest rate differentials. Arbitrage opportunities are, therefore, limited. As a rule, a currency with a higher interest rate trades as a discount to a currency with a lower interest rate.

Since there is a forward market available for longer periods, the forward cover for foreign exchange exposures can stretch up to five years. The premiums, or discounts, are quoted on a month-to-month basis. That is, from the spot date to exactly one month, or two months, or even a year.

Problem 1:

An Indian Importer has purchased capital goods worth $ 6,50,000 from U.S. which is payable in 3 months’ time. The Importer expects that Rupee will weaken over a period against Dollar. He has asked his banker for forward exchange cover.

ADVERTISEMENTS:

The rates existing at that time are:

Spot 1 US $ – Rs.61.87

Forward premium for 3 months – Rs.0.37

The Rupee exposure to U.S. $ purchased in forward market for delivery in 3 months as follows:

ADVERTISEMENTS:

= $ 6,50,000 x (Rs.61.87 + Rs.0.37) = Rs.4,04,56,000

Fixed Forward and Option Forward:

Fixed Forward Contract:

When a fixed contract is entered the performance of the contract will take place at future specified date. Suppose a three months fixed contract is taken place on January 15th, the date for performance of the contract is April 15th.

ADVERTISEMENTS:

Option Forward Contract:

In this type of contract the performance of the contract will take place at the option of the customer either:

1. At any date from the contract being made up to and including a specified final date for performance, or

2. At any date between two specified dates.

ADVERTISEMENTS:

Problem 2:

Broadway Ltd. is exporting its products to Germany on regular basis. The credit terms with German importer is 3 months after receipt of goods. The company exported goods worth Euros 4,00,000 during the month of January, 2016.

The receipts will spread in the month of May, 2016. The company took an option forward contract for Euros 4,00,000 with its Banker for Euro 1 = Rs.77.50.

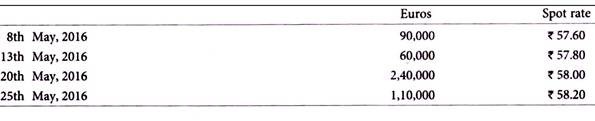

The Euro receipts made during the month of May, 2016 are as follows:

Solution:

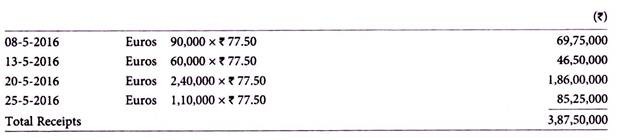

Cash inflow of the company from German importer, in the month of May, 2016:

Closing out Forward Contracts:

A forward contract can be closed out by the bank’s client before its maturity date by entering into a matching but reverse forward contracts, and bearing any resulting costs.

ADVERTISEMENTS:

When a customer cannot perform the forward exchange contract, the bank will close out the forward exchange contract in the following manner:

1. If the customer arranged with the bank to buy foreign exchange:

The bank will sell currency to the customer at spot rate and buy back the same under the terms of forward exchange contract.

2. If the customer arranged with the bank to sell foreign exchange:

The bank will sell to the customer the specified amount of foreign currency at the forward exchange contract and it will buy back the same at spot rate.

This is an internal adjustment to close out the unfulfilled forward exchange contracts.

ADVERTISEMENTS:

Problem 3:

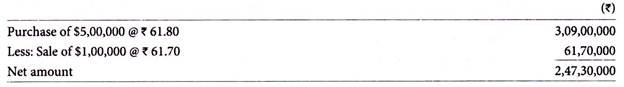

Burner Ltd. agrees to supply goods worth $5,00,000 on 1st April, 2016 to U.S. Importer who agrees to pay after 3 months’ time i.e. on 1st July, 2016. Burner Ltd. took a forward cover for 3 months immediately on 1st April, 2016. Later, due to unforeseen circumstances the value of consignment is reduced to $4,00,000. The bank closed out partial forward contract of $3,00,000 on 1st July, 2016.

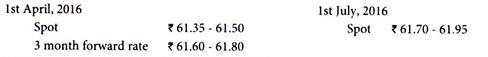

The exchange rates of Indian rupees against U.S. dollars are as follows:

Calculate the cost of transaction incurred by Burner Ltd.

Solution:

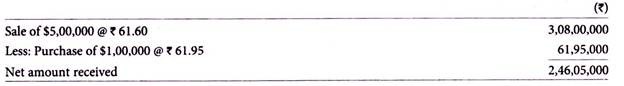

The above situation requires the partial closing out of forward contract.

Problem 4:

In continuation to problem 3, if Burner Ltd. is an importer, what would be the position.

Solution:

The above situation requires partial closing out of forward contract.

ADVERTISEMENTS:

Extension of Forward Contracts:

A customer may have entered into a forward exchange contract with a banker to buy or sell currency on certain due date. Sometimes the payment or receipt of foreign currency may be delayed due to some trade reasons.

If the customer still wants to buy or sell the agreed amount of foreign currency, but he may ask his banker to defer the contract for a future specified date. The bank may allow him to defer the contract with favourable terms to the customer than for an ordinary forward exchange contract. Sometime the bank may close out the old contract and will enter into a new contract afresh.

Cost or Gain of Forward Cover:

Forward rates are determined by interest rate differentials between the two currencies concerned. Depending upon the relationship, forward rates will be either at a premium or a discount to the spot rate and give rise to costs or gains.

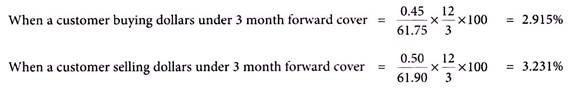

The cost of forward cover can be calculated using the following formula:

Where, n = Number of months in forward contract

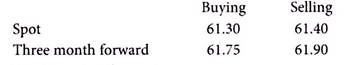

Problem 5:

The foreign exchange market quoted prices for U.S. dollars against Indian rupees are as follows:

Calculate the cost of forward cover.

Solution:

The average of these two rates i.e. 3.073% is the rate published in the financial newspapers.

Benefits and Drawbacks of Forward Contract:

Benefits By entering into forward exchange contract, a concern can derive the following benefits:

1. Forward contracts eliminate exchange rate risk, since the fixed values of currency are known in advance, which are to be exchanged at a later date.

2. The contract can be entered into for the specified amount and period as per the requirements of the client.

3. Forward contracts are available in most currencies and also for small amounts, depending on exchange control regulations of the Government.

4. Bank can make profit in booking forward contracts with their clients.

Drawbacks:

The forward exchange contracts are subject to the following drawbacks:

1. Parties to forward contracts cannot take advantage of favourable movements in rates of exchange.

2. If the expected funds are not received by the client by the date on which delivery of foreign currency is to be made under forward contract with the bank, he has to fulfill the commitment by purchasing the foreign currency at spot rate which may not be favourable to him.

3. There is a settlement risk if funds are paid away before the currency is received from the bank.

4. Proper care must be taken to monitor the dates on which forward contracts are due for settlement, otherwise heavy penalties and costs may be slapped by the bank on its clients.