Learn about the various shifts observed in the yield curve explained with the help of suitable diagrams.

Direction of the Yield Curve:

A yield curve can have 3 broad directions:

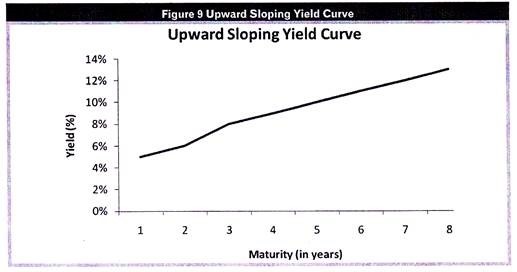

1. Upward Sloping:

This is the most common and ‘normal’ direction of the yield curve. Its interpretation is that bonds with longer maturities have higher yields than those with shorter maturities. This is only obvious since the longer the maturity, the longer the time before he gets back his principal, the greater the risk involved and hence higher would be the yield (yield is your required return, remember!) an investor would demand for the investment. Notice that the Government Securities yield curve that we have plotted above (Figure 9) is upward sloping in the shorter end of the yield curve (for maturities up to 5 years).

ADVERTISEMENTS:

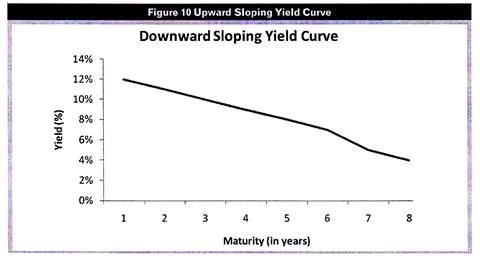

2. Downward Sloping:

The yield curve may sometimes take an inverted position resulting in a downward sloping yield curve. Its interpretation is that the yields on the short term bonds are higher than those on the long term bonds.

ADVERTISEMENTS:

The occurrence of an inverted yield curve is a rarity.

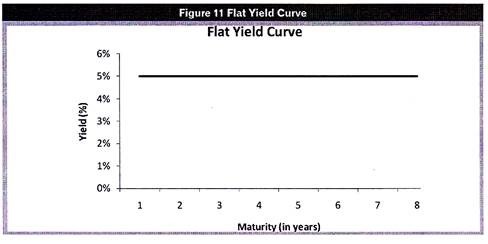

3. Flat:

The yield curve is flat if the yields across all maturities are more or less the same. Notice that the yield curve that we prepared from the yields on Government Securities was more or less flat at the longer end of the curve (maturities above 15 years).

Changes or Shifts in the Yield Curve:

ADVERTISEMENTS:

The yield curve does not remain constant but will undergo changes over time.

The changes in the yield curve can broadly be of two types:

I. Parallel shifts

II. Non parallel shifts

ADVERTISEMENTS:

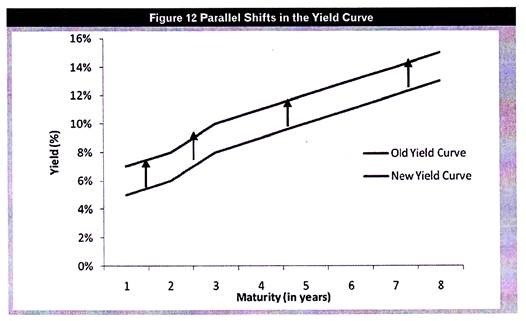

I. Parallel Shifts in the Yield Curve:

The yield curve will undergo a parallel shift if the yields across maturity horizon change (increase or decrease) by the same magnitude.

A parallel shift in the yield curve will look something like this:

A parallel shift in the yield curve will represent a change in the general level of interest rates in the economy. In the real world, over a short period of time, parallel shifts in the yield curve are a rare occurrence.

ADVERTISEMENTS:

II. Non Parallel Shifts in the Yield Curve:

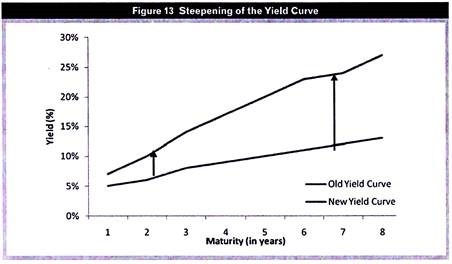

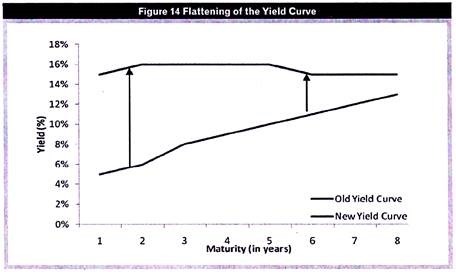

More often than not, yields on different maturity periods need not change by the same magnitude or even in the same direction. Such changes result in a non-parallel shift in the yield curve.

A non-parallel shift in the yield curve is further classified into two types:

ADVERTISEMENTS:

Twists occur when the yield curve slope changes. The yield curve may become steeper or flatter than before.

i. Steepening of the Yield Curve:

ii. Flattening of the Yield Curve:

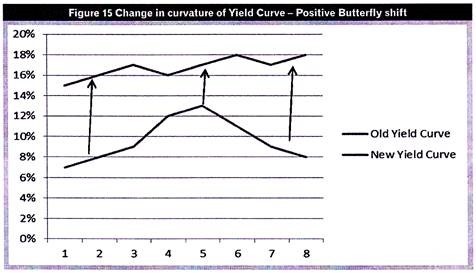

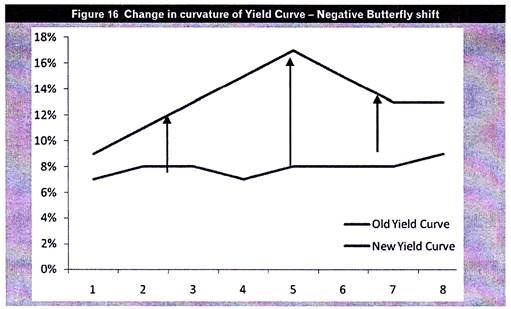

2. Change in Curvature of the Yield Curve:

Sometimes the yield curve may become humped or develop a trough. A change in curvature depends mainly on how the yields on medium term maturities have changed in relation to the yields on short and longer term maturities.

A change in the curvature is sometimes called as a butterfly shift in the yield curve. A positive butterfly shift implies a previous bulge in the yield curve is now flattened. This may happen, for example, when the yields of short and long term maturities increase more than those of medium term maturities.

Such a shift will look something like this:

A negative butterfly shift implies that a yield curve that was previously flat has now developed a bulge or a trough.

In sum, a yield curve should be upward sloping for a sound economy. If the yield curves turn flat or downward sloping, it indicates a sign of looming problems for the economy.

Steepeners and Flatteners:

Another concept in the context of non-parallel shifts in the yield curve is that of steepeners and flatteners.

Steepeners:

A steepener is a non-parallel shift in the yield curve, where the difference between the long terms yields and short term yield increases.

ADVERTISEMENTS:

Such a shift can be bullish or bearish:

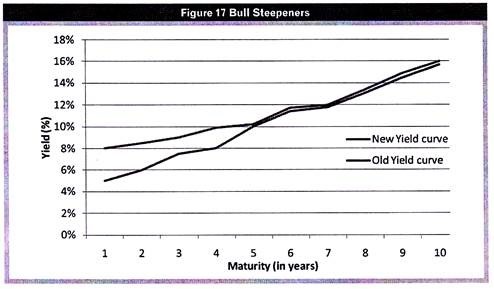

i. Bull Steepener:

This happens when interest rates are falling (a good, bullish event) and the short term interest rates are falling faster than the long term interest rates.

As is seen above, the short term interest rates have fallen much faster than the long term interest rates resulting in a steepening of the yield curve.

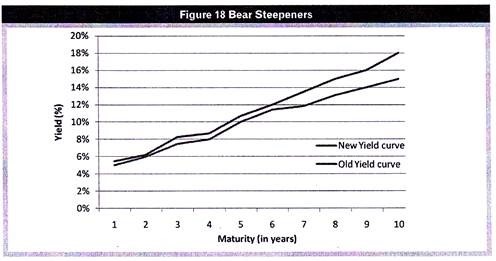

ii. Bear Steepeners:

ADVERTISEMENTS:

This happens when interest rates are rising (a bad, bearish sign) and the longer term rates are rising much faster than the shorter term rates.

As is seen above, the long term interest rates have risen much faster than the short term interest rates resulting in a steepening of the yield curve.

Flatteners:

A flattener is a non-parallel shift in the yield curve, where the difference between the long term yields and short term yield decreases.

Such a shift too can be bullish or bearish:

ADVERTISEMENTS:

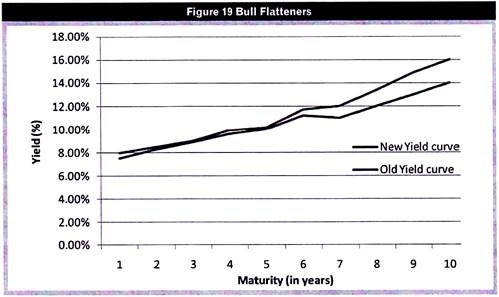

i. Bull Flatteners:

This happens when interest rates are falling (bullish sign) and the long term interest rates are falling faster than the short term interest rates.

As is seen above, the long term interest rates have fallen much faster than the short term interest rates resulting in a flattening of the yield curve.

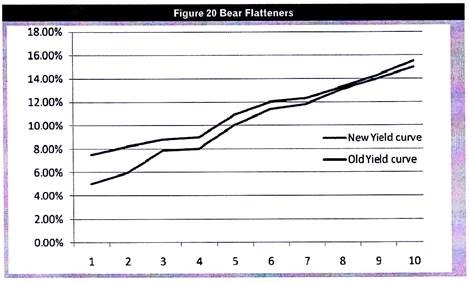

ii. Bear Flatteners:

This happens when interest rates are rising (bearish sign) and the short term interest rates are rising faster than the long term interest rates.

As is seen above, the short term interest rates have risen much faster than the long term interest rates resulting in a flattening of the yield curve.