The following points highlight the seven main types of risk on investment. The types are: 1. Interest Rate Risk / Market Risk 2. Credit Risk / Counter-Party Risk 3. Call Risk / Prepayment Risk 4. Put Risk 5. Yield Curve Risk 6. Inflation Risk 7. Sovereign Risk.

1. Interest Rate Risk / Market Risk:

If we talk of fixed income securities, the most prominent of all risks can be considered as the interest rate risk. It is called as market risk because as you are aware by now, the fixed income market is based around interest rates and ‘price’ is just the by-product of interest rates. If you draw a parallel to the stock markets, change in stock price can be considered as market risk while change in returns is only a by-product of change in stock prices.

Interest rate risk is the risk of changes in interest rates and its resulting impact on your returns. More specifically, it’s the risk that interest rates may move in a direction unfavorable to us. As such, interest rate risk stems out of risk of interest rates rising as well as falling. The unique nature of fixed income securities creates two components in the interest rate risk – price risk and reinvestment risk.

Price risk is the risk that interest rates may rise; and as you now know the result is that the market value of our fixed income investments will fall. But there is something to cheer about even in this scenario. Since market interest rates have gone up, cash flows from existing investments (coupons) can now be reinvested at higher interest rates i.e. the reinvestment income will increase.

Reinvestment risk is the risk that interest rates may fall; and the cash flows from existing investments will now have to be reinvested at these lower market rates. The outcome-your reinvestment income will fall. The good thing in this case is that the fall in market interest rates will cause the value of existing investments to rise in value.

Interest Rate Risk is affected by several factors related to the specific issue as well as the overall market conditions.

Some of the factors that affect interest rate risk are as follows:

Time to Maturity of the Security:

The longer the time to maturity of the security, the greater is its interest rate risk. Logically, the longer the time to maturity, the longer the uncertainty period and so greater is the risk. Mathematically, a long time to maturity means that as of today, a rise in interest rates will result in an immediate decline in the market value of the security.

On the other hand, when interest rates fall, your investment value will increase immediately but cash flows (coupons) will now have to be reinvested at lower interest rates for a longer time.

This is a statistical phenomenon. The security with the lower coupon rate is more sensitive to interest rates than one with a higher coupon rate.

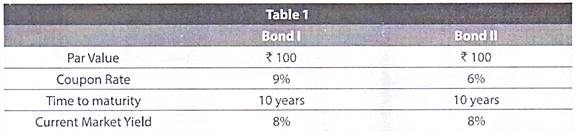

To explain this, consider two bonds:

As you can see above, the two bonds are exactly same in all respects except that Bond I has a coupon rate of 9% while Bond II has a coupon rate of 6%. If we calculate the modified duration of the two bonds, we find that Modified Duration for Bond I is 6.57 while that of Bond II is 7.05. This means that if interest rates in the market were to rise today by 1 %, Bond I will fall in value by 6.57% while Bond II will fall in value by 7.05%. – About 0.47% more.

A corollary to this phenomenon is that among comparable bonds, a zero coupon bond will be the most sensitive to interest rate changes.

Conceptually, this is similar to the fact that Bonds with higher coupon rates have low interest rate risk. When the interest rates prevailing in the market are high, the interest rate risk actually reduces. Logically, the reason is that interest rates cannot increase perpetually unless the circumstances are very exceptional. Prevailing high interest rates makes it more likely than not that the interest rates will fall rather than rise in value.

2. Credit Risk / Counter-Party Risk:

The other important risk concept for fixed income investments is credit risk.

Credit risk itself can be broken down into three parts:

I. Default Risk

II. Credit spread risk

III. Downgrade risk

Of course, the most important aspect of credit risk is default risk. The other two component risk actually stem from default risk.

Default risk is the exactly what it reads – risk that the issuer of the fixed income security may default on his obligations (to pay coupon, repay principal, honor a put option request, et cetera). A default by the issuer may suddenly render an investment worth nothing and so investors closely track the issuer’s financial health to get early warning signals of any forthcoming danger.

Every investor may not be able to read and interpret such signals on the financial health of an issuer. Credit rating agencies therefore play a major role in assessing credit risk. They do all the ‘number crunching’ and in depth analysis and conclude their study in not more than three characters – a credit rating.

Of course a credit rating agency will make available a detailed report of their analysis but the credit rating, as such is enough to get a basic understanding of credit risk.

Credit spread risk is the risk that the spread of a security against some benchmark may widen causing the investment to fall in value. You can call it a special component of the interest rate risk that relates to the credit quality of the particular issuer and the security.

A rise in the yield (or required return) of a particular security may not be because of a rise in the general interest rates in the economy but because of a decline in credit quality of the issuer.

We now know that spread is the excess return required over some other benchmark security (most commonly, government security of a similar maturity) for investing in a particular security. If the credit quality of the particular issuer or security declines, yield for investing in that security increases and so does the credit spread.

In these days, credit ratings have assumed such an importance that a downgrade by a credit rating agency can significantly affect the yields and consequently price of the security. Since such a downgrade depends on the credit quality of the issuer or the security, it is a type of credit risk.

3. Call Risk / Prepayment Risk:

By now, we know what a Bond with a call or put option really means. Now let’s understand why a call option creates a risk. Call option gives the issuer an option to call back the issue before its maturity at a predetermined price. Why exactly would an issuer feel like paying off his obligations before they fall due? Is it because he has excess cash and no longer wants the burden of debt? Not necessarily.

When interest rates in the market are falling, the issuer would actually be paying higher interest rates than that prevailing in the market. Had he issued the debt security today, he could have done so at a lower interest rate.

So when interest rates are falling, the issuer may find it advantageous to call back the old Issue and make a fresh Issue at lower interest rates. If he does so, you are required to exit your investment and reinvest at lower interest rates. This suddenly reduces your returns.

What’s worse is that the call price would most certainly be lower than the prevailing market price. This is because the call price is predetermined at the time of the issue and the issuer will not exercise his option unless his net interest cost is lower after call back and fresh issue.

This means that if the issuer does exercise his call option, you will lose out on both future reinvestment income as well as current capital appreciation. To ensure that investors are not put at a disadvantage, some issuers also offer a call option premium in case the call option is exercised.

Prepayment risk is special to mortgage backed securities (MBS) but it is similar to the concept of call risk. For an MBS, the underlying pool (or source of funds for servicing the MBS) is residential mortgage loans.

When interest rates in the market are falling, the home buyer is motivated by the same logic to refinance his mortgage obligation at lower interest rates. This means money invested in MBS is paid back early and you end up with a lot of money at a time when interest rates on reinvestment are low.

4. Put Risk:

For a change, this is a risk that should bother the issuer and not you – the investor. The put option is for your benefit. When interest rates in the market are rising and you see the value of your investment fall, you may exercise your put option. The put price will most likely be greater than the prevailing market price of the security.

This means you earn capital appreciation on the existing investment. Moreover, you exit your old investment in times of rising interest rates. This means you can now reinvest your money at higher interest rates and earn better reinvestment income.

Of course this privilege comes at a cost. A bond with a put option will have a yield that is lower than a comparable option free bond. For example a 10-year bond having a put option after 5-years will be priced by the market as if it were a 5-year bond.

5. Yield Curve Risk:

Yield Curve risk is the risk of changes in the yield curve. Changes in the yield curve can be of two types- a parallel change in the yield curve (called as yield curve shift) or a non-parallel change in the yield curve (called as yield curve twist).

A risk of parallel shift in the yield curve would be similar to interest rate risk. A risk of non-parallel shift in the yield curve is one where interest rates for the maturities that you hold move in a direction that is unfavorable to you.

6. Inflation Risk:

Inflation risk, also called as purchasing power risk, refers to the risk that the cash flows generated from a fixed income security may not be sufficient enough to cover the rising cost of inflation.

This happens because the interest rate offered on a fixed income security is usually fixed for the life of the security (except in the case of floating rate securities). However, inflation rates keep on fluctuating and in case if the inflation rate goes beyond the interest rate offered on the security, you may actually lose money in real terms. For example- if the interest rate currently offered on a bank fixed deposit is say 8% but if the inflation rate is say 10%, you are actually not earning any real income.

Even in the case of a floating rate security, although the interest rates keep changing, the reference rate on the basis of which interest rate is determined may not really be linked to inflation. Thus, an investment in a floating rate security would also expose you to a bit of inflation risk.

The only exception to this rule is in the case where the reference rate on the basis of which a floating rate coupon is determined itself is the prevailing inflation rate i.e. in the case of inflation indexed bonds.

7. Sovereign Risk:

Such risk gains significance especially if you invest in a debt security issued by a government, especially a foreign government. This risk also has components of default risk and credit spread risk. For example- as of today, the greatest worry for financial markets is that some of the Euro-Zone nations may default on the debt issued by them.

This would be a classic example of sovereign risk. However, that is not all! Adverse political happenings in India are frowned upon by international investors. This results in increase in spreads demanded by them for investing in bonds issued by the Indian Government. Such increase in spreads due to decisions of a government would also form a part of sovereign risk.

Sovereign risk will have two components- Economic risk (which reflects a sovereign’s ability to repay its debts) and Political risk (which reflects a sovereign’s willingness to repay its debt).

However, with growing significance of supra-national bodies like the IMF, it is now difficult for a nation to simply disown its debt obligations i.e. today, political risk is not as major a component of sovereign risk as economic risk is.

Risks Typical to Structured Obligations:

Structured obligations have their typical risk factors that are often considered in evaluating these products.

Some of these risks pertinent to structured obligations are as below:

1. In the Nature of Credit Risks:

i. Asset Risks:

It refers to the nature of the assets underlying structured products. For example- the collection pattern and default rates on housing loans would be quite different from those on credit card loans.

ii. Portfolio and Pool Risks:

In the case of structured finance, portfolio refers to the entire universe of the relevant financial assets of the originator while pool refers to the specific portion of these assets that has been securitized. For example; in the case of a Bank, the entire housing loan assets that it holds refers to that bank’s housing loan portfolio. If the bank decides to securitize a portion of this portfolio and sell them off to an SPV to convert it into Mortgage Backed Securities (MBS), this portion will be called as the asset pool.

The average default rates in the entire portfolio would be one of the risk components of the structured finance products. However, the characteristics of the asset pool may not necessarily be similar to the characteristics of the portfolio. For example: the default rates on the pool may be higher than that on the portfolio if the average asset quality of the pool is lower than the average asset quality of the portfolio.

iii. Originator Risks:

The originator is the entity that created the financial assets in the first place. The quality of the originator will have an impact on the quality of the asset portfolio as well as the asset pool and will result in increase in credit risks.

2. In the Nature of Counterparty Risk:

i. Servicer Risks:

Servicer is the person who undertakes to collect the underlying receivables of the financial asset for an agreed fee. Naturally, the quality of the servicer will have an impact on the quality of the recoverability of the underlying pool of assets.

ii. Commingling Risks:

This risk arises from the fact that there is usually a time lag between collection of the underlying receivables by the servicer and payouts to the investors in the securitized asset. During this period, the cash flows remain with the servicer. In case of default or bankruptcy of the servicer, the cash collections with him will also be irrecoverable. Such risk is called as the commingling risks.

3. In the Nature of Legal Risks:

The structured finance products usually involve creation of a Special Purpose Entity (SPE or SPV).The legal structure of the SPE may create several limitations on the recoverability from the loan originator in case of defaults on the securitized asset.