A warrant is a long-term security, issued by a company, which provides the holder with the right to buy a fixed number of company’s ordinary shares at a fixed price during a specified period of time. Warrants are usually issued in conjunction with a bond or a preferred stock. The primary purpose of a warrant is to increase the marketability of the new issue. A warrant can either be a detachable or a non-detachable warrant.

A detachable warrant can be sold separately from the bond or preferred stock to which it was originally attached. A non-detachable warrant cannot be sold separately from the bond or preferred stock to which it is attached. The warrant holders are not entitled to vote or to receive dividends. But once they exercise their right and buy ordinary shares, they become the company’s ordinary shareholders with all such rights.

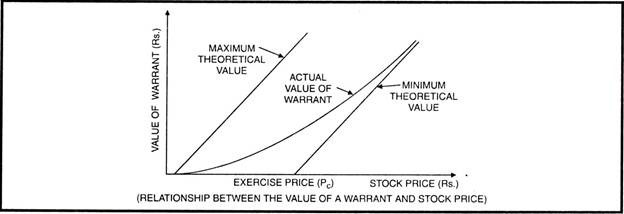

A warrant usually has no value when it is issued. But, it becomes valuable when the market price of company’s ordinary shares moves above the fixed price at which the investor has a right to buy the common stock. Thus, the market value of a warrant based upon the market price of the ordinary shares and the exercise price.

Theoretical Value:

The theoretical value of a warrant can be calculated as below:

(a) When the market price of equity share is greater than the exercise price (Ps > Pc):

(i) Theoretical Maximum Value of the Warrant = P × N

(ii) Theoretical Minimum Value of the Warrant = (Ps – Pc) × N

Where, Ps = Current market price of equity share

Pc = Exercise price of warrant

N = Exercise ratio, i.e. number of equity shares per warrant.

(b) When the market price of equity share is less than the exercise price (Ps < Pc):

Theoretical Minimum Value of Warrant = Zero

It means, in such a case, warrant has no market value.

Illustration 1:

The current market price of an equity share of a company is Rs. 120 and the exercise price of the warrant is Rs. 80. An investor is holding a warrant giving him the right to buy 2 ordinary shares from the company. Calculate the minimum theoretical value of the warrant.

Solution:

Minimum Theoretical Value of Warrant = (Ps – Pc) × N

= (120 – 80) x 2

= Rs. 80

Premium Value:

The market value of a warrant is generally higher than its minimum theoretical value. The difference between the market value of a warrant over the theoretical minimum value is called premium.

The premium value of a warrant depends mainly upon two things:

(i) The ratio of the stock price to the warrant price, called leverage, generally greater the leverage the greater is the premium; and

(ii) The length of option period, the longer the time to maturity, the larger is the premium. Further, as the exercise period of a warrant runs out, the premium comes closer and closer to the minimum value. The figure below shows the relationship between the value of a warrant and stock price.