Everything you need to know about the time value of money as studied in financial management. This article will further help you to learn about:-

- Time Value of Money in Financial Management

- Time Value of Money Example

- Time Value of Money Formula

- Importance of Time Value of Money

- Reasons for Time Value of Money

- Time Value of Money Calculation

Time Value of Money: Concept, Techniques, Importance, Formula and Calculations

Time Value of Money as Studied in Financial Management

The concept of time value is that the value of money received today is more than the value of the same amount received after a certain period of time. In simple terms, money received in the future is not as valuable as money received today.

Time Preference of Money:

If you are given the choice of receiving Rs. 1,000 today or after one year, you will definitely opt to receive it today than after one year. This is because the value of current receipt of money is higher than the future receipt of the same money. This concept is referred to as time preference of money.

Reasons for Time Preference of Money:

Normally people would want to receive money today rather than after some time.

The reasons are as follows:

1. Present Needs are Considered as More Important:

People consider present needs as more important than their future needs. Purchase of clothes, television, car and luxurious articles for their present use feels more urgent than saving for tomorrow. Therefore, people consider the value of money today as more than its value as of tomorrow.

2. Investment Opportunities Available:

If you pay Rs10,000 to a person today, and if he invests it at 12% per annum, he would receive Rs11,200 (Rs10,000 plus Rs10,000 X 12/100) at the end of the year. Where as if he is to receive the same amount after one year, he would receive only Rs10,000. Sometimes, by investing in shares, one can even double the money in a short period. So, a person prefers to receive a certain sum of money today rather than receiving it after a certain period of time.

3. Uncertainty and Loss:

Future is uncertain. If you expect to receive a certain amount in future, there is always an uncertainty with regard to its receipt in future. The future is subject to risks. A person may incur loss due to not getting the expected amount in future. So, a person prefers to receive the money today.

Techniques of Time Value of Money:

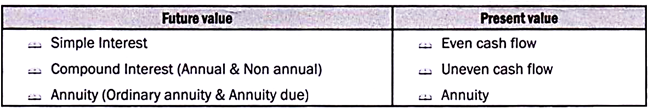

There are two techniques for adjusting the time value of money:

A. Compounding technique or Future value technique, and

B. Discounting technique or Present value technique.

A. Compounding Technique or Future Value Technique:

The time preference of money encourages a person to receive the money at present instead of waiting for the future. But he may like to wait if he is duly compensated for the waiting time by way of ensuring more money in future. For example, a person being offered Rs1,000 today may wait for a year if he is ensured of Rs1,100 at the end of one year taking his time preference for money is 10% per annum.

Compounding technique or future value technique may be classified as follows:

1. Future value of a single flow

2. Future value of multiple flows

3. Future value of an annuity

1. Future Value of a Single Flow [Lump Sum]:

The future value of a lump sum can be calculated by using the following formula:

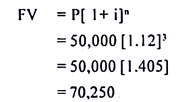

Illustration-1:

Calculate the future value of Rs50,000 at the end of 3 years at 12% per annum rate of interest.

Solution:

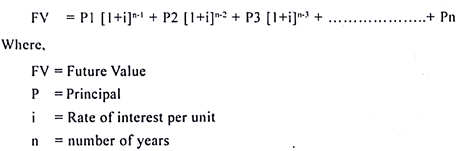

2. Future Value of Multiple Flows or a Series of Flows:

So far we have considered only the future value of a single flow. But, in many cases we may invest different amounts at different time periods.

In such a case Future Value can be calculated as follows:

a) When the investments occur at the end of each period:

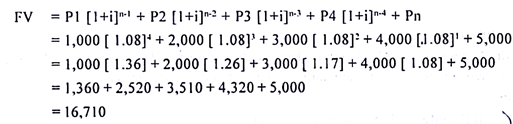

Illustration-2:

Determine the future value at the end of 5 years of the following series of payment at 8% rate of interest.

At the end of 1st year Rs1,000

At the end of 2nd year Rs2,000

At the end of 3rd year Rs3,000

At the end of 4th year Rs4,000

At the end of 5th year Rs5,000

Solution:

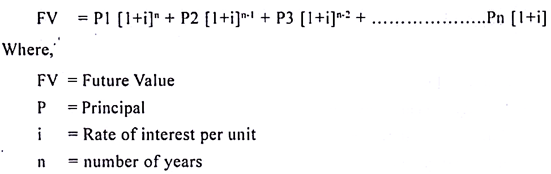

b) When the investments occur at the beginning of each period:

3. Future Value of an Annuity:

a) When the annuity occurs at the end of each period:

When cash flows occur at the end of each period, the annuity is called immediate annuity.

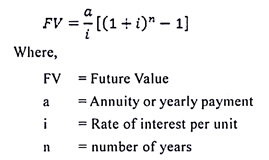

The future value of an immediate annuity can be calculated as follows:

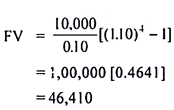

Illustration- 3:

Mr. X deposits Rs10,000 at the end of every year for 4 years and the deposit earns a compound interest at 10% per annum. Determine how much money he will have at the end of 4 years?

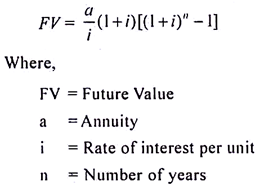

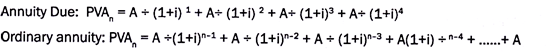

b) When the annuity occurs at the beginning of each period:

When cash flows occur at the beginning of each period, the annuity is called annuity due.

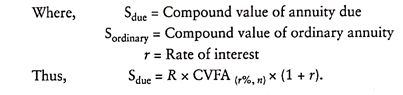

The future value of annuity due can be calculated as follows:

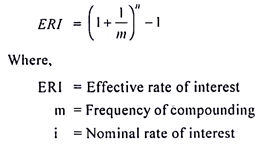

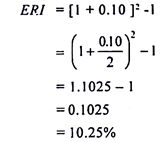

Effective Rate of Interest in Case of Multi-Period Compounding:

When the interest is compounded annually, the nominal rate of interest is the effective rate of interest. But, in case of multi period compounding, where the interest compounding is done at a frequency of a period which is less than one year, the rate of interest received by the investor for one year becomes more than the given nominal rate. This is called effective rate of interest. In such cases, the frequency of compounding may be half yearly, quarterly or monthly or any other fraction of a year.

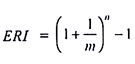

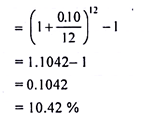

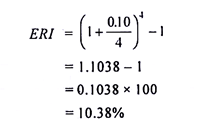

Illustration-4:

A company offers 10% rate of interest on deposits. What is the effective rate of interest if the compounding is done- a) Monthly b) Quarterly c) Half yearly?

Solution:

a) When the compounding is done monthly:

b) When the compounding is done Quarterly:

c) When the compounding is done half yearly:

It is the time taken for doubling an investment. Financial advisors and investors are interested in knowing the period in which their investment will be doubled. It is determined based on the rate of interest. Higher rate of interest reduces the doubling period and vice versa. There are two ways of determining the doubling period by adopting the rate of thumb method.

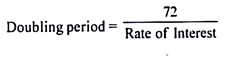

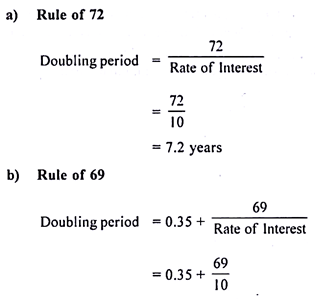

a. Rule of 72

b. Rule of 69

a. Rule of 72:

According to this rule,

Mr. X deposits Rs 10,000 on 1st January 2012 at 10% rate of interest. How many years will it take to double this amount? Work out this problem by using-

a) Rule of 72 and

b) Rule of 69

Solution:

B. Discounting Technique or Present Value Technique:

Present value of the money is today’s value of money to be received in future. It is the future of money discounted at a given rate of interest. In other words, present value shows what the value is today of some future sum of money.

Discounting technique or present value technique may be classified as follows:

1. Present value of a single flow

2. Present value of multiple flows

3. Present value of an annuity

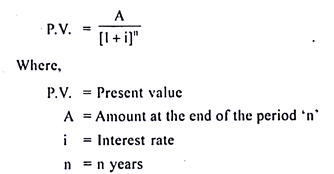

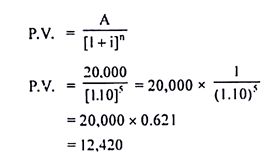

1. Present Value of A Single Flow:

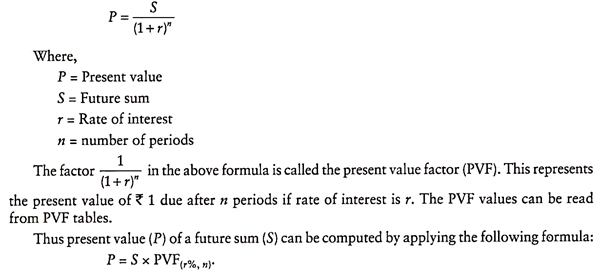

The present value of a sum of money received after ‘n’ years can be represented by the following formula-

Illustration-6:

Mr. X is to receive from Indira Vikas Patra Rs 20,000 after 5 years from now. His time preference for money is 10% p.a. Calculate its present value.

Solution:

2. Present Value of Multiple Flows or a Series of Flows:

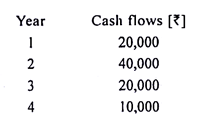

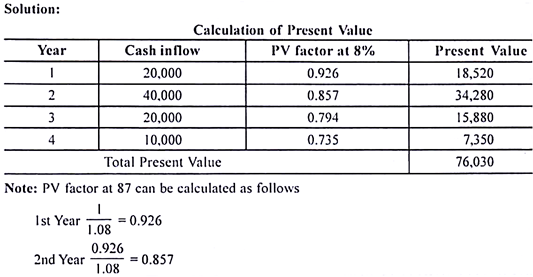

Illustration-7:

Calculate the present value of the following cash flows assuming a discount rate of 8% p.a.

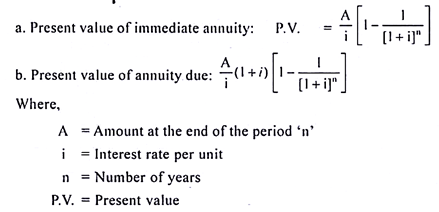

3. Present Value of an Annuity:

A series of equal amount of cash flows over a certain given years is called an annuity.

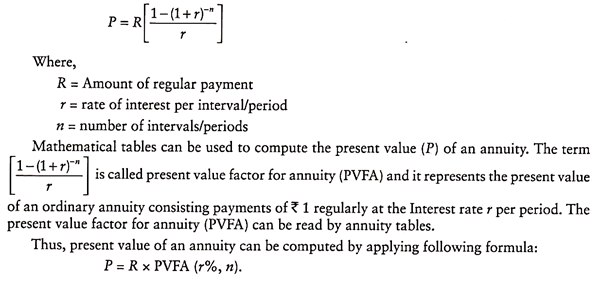

The present value of an annuity of amount A for n years at an effective rate of interest of i can be represented by the following formula-

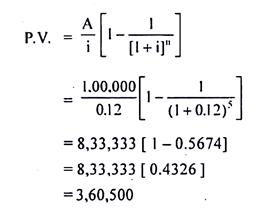

Illustration-8:

Determine the present value of an annuity of Rs1,00,000 receivable for 5 years at an effective rate of interest of 12% p.a.

Solution:

Time Value of Money – Importance, Reasons, Examples and Formula

The idea that money available at the present time is worth more than the same amount available at a future date. This is called the time value of money as money; available today can earn interest at a future date. This is an important concept in financial management. It can be used to compare investment alternatives and can calculate the financial implications of loans, mortgages, leases, savings and annuities. This concept is called TVM, i.e., Time Value of Money.

A key concept of TVM is that a single sum of money or a series of equal, evenly spaced payments or receipts promised in future can be converted to an equivalent value today. Similarly we can determine the value to which a single sum or a series of future payments will grow to a specified future date.

Importance of Time Value of Money:

Money has time value. A rupee today is more valuable than a year hence. It is on this concept “the time value of money” is based. The recognition of the time value of money and risk is extremely vital in financial decision making.

Most financial decisions such as the purchase of assets or procurement of funds, affect the firm’s cash flows in different time periods. For example- if a fixed assets it purchased, it will require an immediate cash outlay and will generate cash flows during many future periods. Similarly if the firm borrows funds from a bank or from any other source, it receives cash and commits an obligation to pay interest and repay principal in future periods. The firm may also raise funds by issuing equity shares.

The firm’s cash balance will increase at the time shares are issued, but as the firm pays dividends in future, the outflow of cash will occur. Sound decision-making requires that the cash flows which a firm is expected to give up over period should be logically comparable. In fact, the absolute cash flows which differ in timing and risk are not directly comparable. Cash flows become logically comparable when they are appropriately adjusted for their differences in timing and risk.

The recognition of the time value of money and risk is extremely vital in financial desicion-making. If the timing and risk of cash flows is not considered, the firm may make decisions which may allow it to miss its objective of maximising the owner’s welfare. The welfare of owners would be maximised, when Net Present Value is created from making a financial decision. Thus, time value concept is important for financial decisions.

Thus, we conclude that time value of money is central to the concept of finance. It recognizes that the value of money is different at different points of time. Since money can be put to productive use, its value is different depending upon when it is received or paid.

In simpler terms, the value of a certain amount of money today is more valuable than its value tomorrow. It is not because of the uncertainty involved with time, but purely on account of timing. The difference in the value of money today and tomorrow is referred as time value of money.

Reasons for Time Value of Money:

Money has time value because of the following reasons:

1. Risk and Uncertainty – Future is always uncertain and risky. Outflow of cash is in our control as payments to parties are made by us. There is no certainty for future cash inflows. Cash inflows is dependent out on our creditors, bank etc. As an individual or firm is not certain about future cash receipts, it prefers receiving cash now.

2. Inflation – In an inflationary economy, the money received today, has more purchasing power than the money to be received in future. In other words, a rupee today represents a greater real purchasing power than a rupee a year hence.

3. Consumption – Individuals generally prefer current consumption to future consumption.

4. Investment opportunities – An investor can profitably employ a rupee received today, to give him a higher value to be received tomorrow or after a certain period of time.

Thus, the fundamental principle behind the concept of time value of money is that, a sum of money received today, is worth more than if the same is received after a certain period of time. For example- if an individual is given an alternative either to receive Rs.10,000 now or after one year, he will prefer Rs.10,000 now. This is because, today, he may be in a position to purchase more goods with this money than what he is going to get for the same amount after one year.

Thus, time value of money is a vital consideration in making financial decision.

Let us take some examples:

Example 1:

A project needs an initial investment of Rs.1,00,000. It is expected to give a return of Rs.20,000 per annum at the end of each year, for six years. The project thus involves a cash outflow of Rs.1,00,000 in the zero year and cash inflows of Rs.20,000 per year, for six years. In order to decide, whether to accept or reject the project, it is necessary that the present value of cash inflows received annually for six years is ascertained and compared with the initial investment of Rs.1,00,000.

The firm will accept the project only when the present value of cash inflows at the desired rate of interest exceeds the initial investment or at least equals the initial investment of Rs.1,00,000.

Example 2:

A firm has to choose between two projects. One involves an outlay of Rs.10 lakhs with a return of 12% from the first year onwards, for ten years. The other requires an investment of Rs.10 lakhs with, a return of 14% per annum for 15 years commencing with the beginning of the sixth year of the project. In order to make a choice between these two projects, it is necessary to compare the cash outflows and the cash inflows resulting from the project.

In order to make a meaningful comparison, it is necessary that the two variables are strictly comparable. It is possible only when the time element is incorporated in the relevant calculations. This reflects the need for comparing the cash flows arising at different points of time in decision-making.

Timelines and Notation:

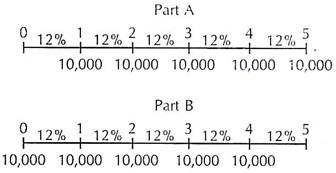

When cash flows occur at different points in time, it is easier to deal with them using a timeline. A timeline shows the timing and the amount of each cash flow and cash flow stream.

Thus, a cash flow stream of Rs.10,000 at the end of each of the next five years can be depicted on a timeline like the one shown below:

As shown above, 0 refers to the present time. A cash flow that occurs at time 0 is already in present value terms and hence does not require any adjustment for time value of money. You must distinguish between a period of time and a point of time. Period 1 which is the first year is the portion of timeline between point 0 and point 1. The cash flow occurring at point 1 is the cash flow that occurs at the end of period 1.

Finally, the discount rate, which is 12 per cent in our example, is specified for each period on the timeline and it may differ from period to period. If the cash flow occurs at the beginning, rather than the end of each year, as shown in Part B. Note that a cash flow occurring at the end of the year one is equivalent to a cash flow occurring at the beginning of year two. Cash flows can be positive or negative; a positive cash flow is called a cash inflow and a negative cash flow, a cash outflow.

Valuation Concepts:

The time value of money establishes that there is a preference of having money at present than a future point of time.

It means:

(a) That a person will have to pay in future more, for a rupee received today. For example – suppose your father gave you Rs.100 on your tenth birthday. You deposited this amount in a bank at 10% rate of interest for one year. How much future sum would you receive after one year? You would receive Rs.110.

Future sum = Principal + Interest

= 100 + 0.10 x 100

= Rs.110

What would be the future sum, if you deposited Rs.100 for two years? You would now receive interest on interest earned after one year.

Future sum = 100 x 1.102

= Rs.121

We express this procedure of calculating as compound value or future value of a sum.

(b) A person may accept less today, for a rupee to be received in the future. Thus, the inverse of compounding process is termed as discounting. Here we can find the value of future cash flow as on today.

Basic Concepts in Time Value of Money:

a. Simple versus Compound Interest:

When money is borrowed, the amount borrowed is called the principal. The consideration paid for the use of money is called interest.

i. The rate of interest can be thought of as a price per period for the use of money.

ii. From the perspective of the lender, interest is earned; from the perspective of the borrower, interest is paid.

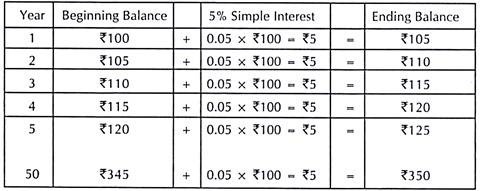

Simple interest refers to the situation in which interest is calculated only on the original principal amount.

With simple interest, the base on which interest is calculated does not change, and the amount of interest earned each period also does not change.

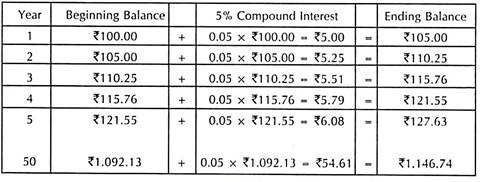

Compound interest refers to the situation in which interest is calculated on the original principal and the accumulated interest.

With compound interest, interest is calculated on a base that increases each period, and the amount of interest earned also increases with each period,

d. Application of Simple Interest:

Suppose someone invests Rs.100 for 50 years and receives 5% per year as simple interest. To calculate simple interest, multiply the beginning balance by the rate 0.05 x Rs.100 = Rs.5.

The growth in the investment is depicted in the table below:

With simple interest, each year’s interest is based only on the original principal amount.

e. Application of Compound Interest:

Assume the same investment of $100 for 50 years, but at compound interest:

With compound interest, interest is earned on both the original principal and accumulated interest. In other words, interest is earned on interest.

In the preceding example, with simple interest, the accumulated amount after 50 years is only Rs.350. With compound interest, the accumulated amount is Rs.1,147. As the term increases, the difference between the final amount with compound interest versus simple interest becomes more and more dramatic.

f. Present Value of Money:

In finance, present value of money is the present worth of a future sum or a stream of cash flows assuming a specified rate of return. It is often used to determine the viability of an investment that is to establish whether it is favorable or not. Finance experts also use it for establishing the best use of money. Calculating the present value of money also helps in identifying opportunities for profitable investments.

It is commonly used when the purchase price is below the intrinsic value of the asset. For example- in real estate the intrinsic value of an income yielding property is arrived at by finding the present value of the cash flows that will accrue in future.

An investor can use this intrinsic value and compare it with alternative investment opportunities with similar risks to decide on which offers better return on investment. However, while using the present value approach for determining the intrinsic value of an investment, investors must necessarily view it in relation with the replacement value.

The required rate of return (RRR) is a component in many of the metrics and calculations used in corporate finance and equity valuation. It goes beyond just identifying the return of the investment and factors in risk as one of the key considerations to determining potential return.

The required rate of return also sets the minimum return an investor should accept, given all other options available and the capital structure of the firm. To calculate the required rate, you must look at factors such as the return of the market as a whole, the rate you could get on no risk (the risk-free rate of return), and the volatility of the stock or the overall cost of funding the project.

h. Present Value of Shares and Bonds:

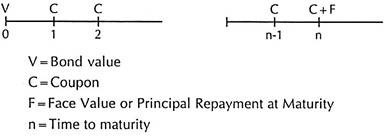

Bond valuation is the determination of the fair price of a bond. As with any security or capital investment, the theoretical fair value of a bond is the present value of the stream of cash flows it is expected to generate. Hence, the value of a bond is obtained by discounting the bond’s expected cash flows to the present using an appropriate discount rate.

In practice, this discount rate is often determined by reference to similar instruments, provided that such instruments exist. Various related yield-measures are calculated for the given price.

Financial Assets:

Financial assets are intangible, meaning that they cannot be seen or felt and may not have a physical presence except for the existence of a document that represents the ownership interest held in the asset. It is important to note that the papers and certificates that represent these financial assets do not have any intrinsic value (the paper held is only a document certifying ownership and is of no value). The paper derives its value from the value of the asset that is represented.

Examples of such financial assets include stocks, bonds, funds held in a bank, investments, accounts receivable, company goodwill, copyrights, patents, etc. Regardless of the fact that financial assets do not exist in physical form, they are still recorded in a firm’s balance sheet, to represent the value that is held by them.

Physical Assets:

Physical assets are tangible assets and can be seen and touched, with a very identifiable physical presence. Examples of such physical assets include land, buildings, machinery, plant, tools, equipment, vehicles, gold, silver, or any other form of tangible economic resource. From an accounting point of view, physical assets refer to the things that may be liquidated when the entity wound up its interest.

They usually experience a reduction in value due to wear and tear of the asset through continuous use known as depreciation, or may lose their value in becoming obsolete, or too old for use. Certain tangible assets are also perishable, such as a container of apples, or flowers that need to be sold soon in order to ensure that they do not perish and lose their value.

Distinction between Financial Assets and Physical Assets:

The main similarity between tangible and physical assets is that they both represent an economic resource that can be converted into value and both assets are recorded in a firm’s balance sheet. The main difference between the two is that physical assets are tangible and financial assets are not. Physical assets usually depreciate or lose value due to wear and tear, whereas financial assets do not experience such reduction in value due to depreciation.

However, financial assets may lose value to changes in market interest rates, fall in investment returns or fall in the stock market prices. Physical assets also require maintenance, upgrades and repairs, whereas financial assets do not incur such expenses.

Financial vs. Physical Assets:

1. Financial assets are intangible, physical assets, on the other hand, are tangible. Both assets represent value that can be converted into cash.

2. Financial assets lose value due to changes in market yields and other market price fluctuations, whereas physical assets lose value due to depreciation, wear and tear.

3. Physical assets can be depreciated over their useful life, while financial assets can be revalued.

4. Physical assets are disposed of when they served for their useful economic life, but financial assets are redeemed when they mature.

5. Financial assets are recognized at fair value (present value of future cash flow), while physical assets are recognized at cost.

6. Financial assets may yield cash flows of return during the time that they are held and a final receipt on the asset’s face value. Physical assets, on the other hand, may receive such cash flows in terms of rent or may contribute to increased earnings through the use in the production or increase in market value at the point of sale.

7. Financial assets do not require additional costs to keep them functional, but physical assets may need to be repaired, maintained and upgraded from time to time.

The Basic Principle of Value:

In determining the value of any financial asset (not limited to just bonds or equities) the statement is simple:

Value (Financial Asset) = Present Value (PV) of All Expected Future Cash Flows – Cash Out Flows

The current value of an asset is all the future cash-flows generated by it, discounted from its time of inflow to today’s date. In practical terms, the value of a share would be the sum of all the expected dividend pay-outs discounted to today. Or the value determinant of a bond is the sum of all the coupon payments and the face-value of the bond, discounted to the current time period.

Bonds:

A bond is a certificate showing that the issuer (a company or a government) owes the holder of the bond a specified sum of money. It is, in effect, an IOU [I OWE you] that the issuer promises to pay back the lender at some time in the future (at the date of maturity.) The issuer is also liable to pay any coupon-payments that are also specified in the bond certificate. Once they are issued by a company or a government, bonds can be traded between bond holders in a secondary market called a – bond market.

Bonds generate two types of cash-flow to the holder:

i. Coupon Payments – Timely payments of a certain predetermined percentage of the face-value of the bond (also referred to as the coupon rate). Usually paid either annually or semi-annually. It is possible to have a coupon rate of 0%. These are referred to as Zero Coupon Bonds. Hence, the only cash-inflow is generated from the face-value.

ii. Face Value at Maturity – Once the bond has reached its maturity date, which is also predetermined by the bond certificate; the issuer must pay the holder the face-value of the bond.

Yield-To-Maturity is an average rate of return gained by the investor if both the following statements are true:

i. The bond holder (the investor) purchases the bond now and holds it to maturity.

ii. The bond issuer (the company or government issuing the bond) does not default in any of the coupon payments.

The YTM is also the expected rate of return for a bond in the market. This is denoted by (i) and will be used in various calculations to follow.

The following diagram shows the cash-flows received by a bond holder for a typical bond:

Typical Cash Flows Received by the Bond Holder:

Shares:

Shares, which are a type of equity security, much like bond certificates that show the debt owed by a company, are certificates that show ownership of the company. These are most commonly traded in the form of outstanding company shares in secondary share markets.

Time Value of Money – Reasons, Examples, Formula and Calculation

What would be your preference—Rs. 1,000 today or Rs. 1,000 five years from today? The obvious answer is Rs. 1,000 today because it involves time value to money. If we receive Rs. 1,000 today, it provides us opportunity to our money to work and earn interest. Thus, in time value of money, the interest rate is important factor that allows us to adjust the value of cash flows, whenever they occur, to a particular point in time.

Once the mechanism to adjust the value of cash flows to a single point in time by using the rate of interest is developed, we will be in position to answer most difficult questions, like: Should a debenture providing income of Rs. 100 per annum for infinite number of years be purchased, if its offer price is Rs. 1000?

The interest rate allows us to adjust the value of cash flows, whenever they occur, to a particular point in time. The particular point in time is called focal point. The fair comparison can be made of various time adjusted cash flows at the focal point. The process helps in making financial decisions.

Most financial decisions, personal or business, involve time value of money considerations. Maximisation of shareholder’s wealth is the prime objective of financial management. In this regard, financial manager takes decisions relating to financing, investment and dividend.

In taking these decisions, a financial manager has to take into account the ‘time factor’. Here, financial manager needs to know the various valuation concepts, i.e., present value concept, compound value concept and annuity concept etc.

Much of the development of financial management depends on the concepts of time value of money. You will never really understand finance until you understand the time value of money.

The technique of finding future values is called ‘compounding’. Then, we discuss the ways to find the present values of cash flows. The technique of finding the present values is called ‘discounting’. In fact, this is not discounting.

It is reverse compounding. The present value is calculated in such a way that if present value is compounded it becomes equal to the future value.

Time Preference for Money:

The money has a time value because of the following reasons:

1. Investment Opportunities:

This is the basic fundamental reason for time value of money. Money can be employed productively to earn positive returns. If an individual receives money today, he can invest it in project. He will able to earn some profit by selling the products. Thus, if he is given opportunity, he would prefer money today to receive the same after some time.

Further, if an individual receives Rs. 1,000 today and deposit it in a bank offering interest rate of 10% p.a., his money grows to Rs. 1,100 in a year. Hence, the individual will obviously prefer Rs. 1,000 today as compared to receiving the same after one year.

The time value of money is adjusted by the rate of interest prevailing in the market.

2. Preference for Current Consumption:

People have a general tendency to prefer current consumption to future consumption. They have perception that they can buy more goods and services with the money received today in comparison of purchases made with the same amount received later on.

3. Risk:

The present is more certain than future, hence, there is a general preference to receive money at present than at a future date. There are number of factors causing the uncertainty. There is risk of dishonour on part of other party. There are chances that a person may fall ill.

Like these factors, there a number of unforeseen events that involve the elements of risk in deferring the receiving the money today. Due to these reasons, individuals prefer receiving the money today to receiving the money in future.

Therefore, the essential principle behind the concept of ‘time value of money’ is that a sum of money received today is worth more than if the same is received after some time. The rate of interest adjust the time value of money. Projects and investment proposals are selected on the basis of time value of money.

There are two techniques to find the time value of money, (i) Compounding is used to find the future value of money, (ii) Reverse Compounding (Discounting in finance terminology) is used in finding the present value of money to be received in future.

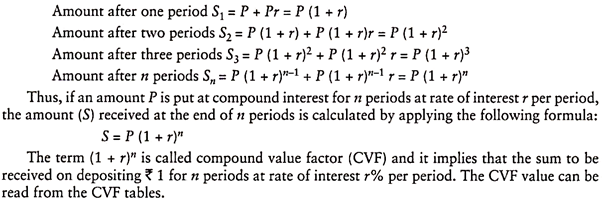

Compound Value of an Amount:

In compound interest computation, interest calculated for a given period is added to principal amount before calculating the interest for next period. The interest for next period is calculated on both the initial principal and interest amount of the preceding period. The same process is applied for calculating the interest in subsequent periods. The period may be a year, quarter, month, etc.

1. Interest Compounded Once in a Period:

Let P be the principal amount and r rate of interest per period. The interest amount is compounded once in the period.

The sum of amount to be received after the period(s) is computed as given below:

2. Interest Compounded Regularly:

When interest is compounded more than once in a period, the following formula is applied to find the sum received at the end of n periods:

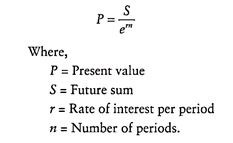

3. Interest Compounded Continuously:

When interest is compounded continuously in a period, the following formula is applied to find the sum received at the end of n periods:

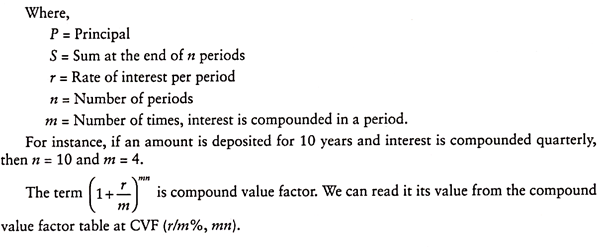

S = Pern

The announced rate of interest for period is called nominal interest rate. The rate by which financial obligation grows actually is called the effective interest rate. If interest is compounded more than once in a period, the effective interest rate for the period will be higher than the nominal rate of interest for the period.

For example- if the nominal rate of interest is r per year and interest is compounded quarterly, the effective rate of interest per year re will be higher than r. During the period, interest rate may be compounded regularly at intervals or continuously.

The following formula is used to find effective rate of interest:

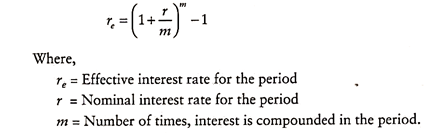

Compound Value of an Annuity:

An annuity is sequence of equal deposits/payments made for equal intervals at the end of each interval. In ordinary annuity, deposits/payments are made at end of each period.

Compound Value of an Annuity Due:

If the cash flow occurs at the beginning of each period, the annuity is an annuity due. Since each cash flow occurs one period earlier, the compound value of annuity due is equal to compound value of ordinary annuity multiplied by (1 + r).

The following formula is used to find the compound value of annuity due:

Present Value of an Amount:

Present value is found by the process of reverse compounding. The compound interest rate (discount rate in finance terminology) is applied to make present value equal to future sum. Technically, discount rate is different from compound interest rate. In fact cash flows are not discounted, present value of cash flows is compounded to make it equal to cash flows.

Present Value When Interest Compounded Once:

The present value of a future sum (S) compounded periodically for n periods is given by the following formula:

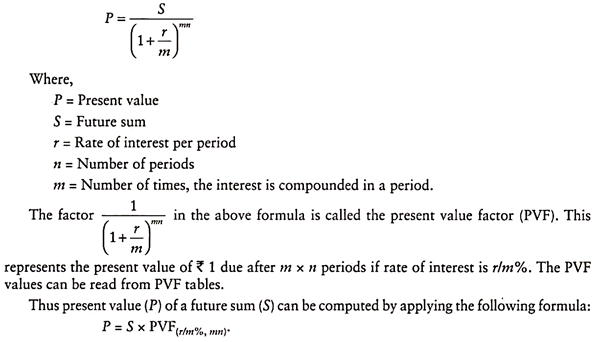

Present Value When Interest Compounded Regularly:

The present value of a future sum compounded more than one time in a period is computed as given below:

Present Value When Interest Compounded Continuously:

The present value of a future sum compounded continuously in a period is computed as given below:

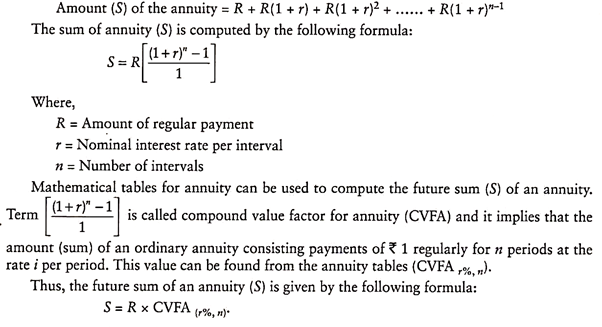

Present Value of an Annuity:

An annuity is sequence of equal deposits/payments made at equal intervals. The deposit/ payments are made at the end of each interval/period.

The present value of annuity (P) is computed by the following formula:

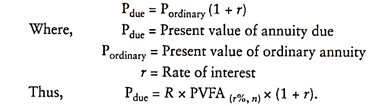

Present Value of an Annuity Due:

Since cash flow occurs in the beginning of each period with an annuity due, first cash flow will have full present value. The present value of annuity due is equal to present value of ordinary annuity multiplied by (1 + r).

The following formula is used to find the present value of annuity due:

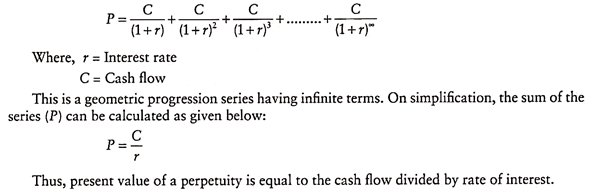

Present Value of a Perpetuity:

Perpetuity is an infinite series of equal cash flows occurring at regular intervals for infinite time period.

The present value (P) of series of cash flows can be represented by the following formula:

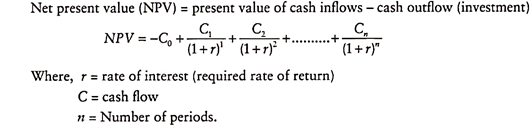

Net Present Value:

The concept of net present value is very important for decision-making in finance. The cash flows must be adjusted for time to find their present value. The net present value is calculated by subtracting the initial investment cash flow from the present value of subsequent cash inflows generated by the investment. An investment proposal or project is profitable if its net present value is positive. If there are a number of projects or investment proposals, the project or proposal having highest positive net value is opted for. Thus,

Time Value of Money – Importance, Concept and Formula

Time Value of Money is an important concept in financial management and has wide applications in many areas of corporate finance including capital Budgeting, valuation of bonds and shares. The concept of time value of money is based on the principle that ‘a rupee today is more valuable than a rupee receivable in future’. This means money available at the present time is worth more than the same amount in the future due to its potential earning capacity.

This happens because money received in future involves risk and uncertainty and money available at present provides investment opportunities as it can earn interest; therefore any amount of money is worth more the sooner it is received.

Need and Importance of Time Value of Money:

Time value of money is an important tool to assess the effects of proposed actions pertaining to valuing stocks and bonds, planning for retirement, making corporate capital budgeting decisions regarding investing in capital expenditure proposals like in new plant and equipment etc., and also helps in setting up loan payment schedules, savings, and annuities.

In the context of corporate financial management time value of money is an extremely important concept because firms operations are continuous in nature and some decisions such as investing is capital assets can affect their long-term cash flows. Thus the time value of money is a concept integral to all parts of business.

1. Measures Worth of an Investment:

The objective of investing in business is to maximise profits and in order to accomplish this task the organization prior to investing should assess the worth of investing. However investing involves risk which arises on account of various internal and external environmental factors with in which a firm operates.

In the context of investment decisions risk means uncertainty in generating profits from funds invested in long-term assets or the risk of inability to recover back the amount invested in assets and the investment turning out to be uneconomical or worthless. Therefore knowing what an investment is worth and what determines that value is a pre-requisite for intelligent decision making in business, in this context the concept of time value of money (TVM) calculation provides the most powerful tool available for making financial and business decisions.

The TVM process allows numerous calculations related to capital budgeting, valuation of bonds and shares, loans, insurance and it also examines the basic approaches that can be used to value an asset purchase or investment decision.

2. Evaluation of Financing Decisions:

The financing decisions are concerned with deciding capital structure and procuring funds. Several types of capital financing are available to companies-business bonds; stock issuance or bank loans are the most popular types of capital financing. Companies will determine the cost of capital and risk factor for each financing type before making a decision.

Cost indicates the interest rate, dividend companies must pay to borrow money. The cost of capital is usually different based on the type financing used by the company. In making financing decisions, a company must consider the time value of money by calculating the effective rate of interest of each source of financing.

3. Assessment of Credit Policies:

The Credit policy denotes the terms and conditions set by and organization for supplying and availing goods on credit, more credit period allowed to debtors will result in high book debts, which leads to high working capital and more bad debts.

Concept of Time Value of Money:

The study in the time value of money begins with gaining an understanding of the core concepts of the time value of money. The prime concept of TVM revolves around conversion of a single sum of money or a series of equal, evenly-spaced payments or receipts promised in the future to an equivalent value today.

On the other side TVM concept also determines the value to which a single sum or a series of future payments will grow to at some future date. There are two key components in TVM calculations.

These are:

A) Future Value of Cash Flow:

Cash flow is the movement of money into or out of an investment, the future value of cash flow measures worth of an investment or cash at a specified date in the future based on the rate of return (interest rate), interval, and number of periods.

Time value of money results from the concept of interest. So let us now discuss the concept of interest.

Interest is a charge for borrowing money, usually stated as a percentage of the amount borrowed over a specific period of time.

1. Simple Interest:

Simple interest is money earned on the investment in an equal amount periodically (every year, month etc.), simple interest is calculated on original amount invested also known as principal. The amount to interest depends on the interest rate, the amount of money invested (principal) and the length of time that the money is invested.

The formula for finding simple interest is:

FVn = Amount at the end of n years, P = Principal, R = Interest rate per annum (Expressed as a proportion e.g. 5% 0.05) and N = Number of years.

Future Value of a Single Cash Flow:

2. Compound Interest:

In compound interest money earned is on the principal as well interest attached to principal amount, in other words interest calculated on both the principal and the accrued interest.

This addition of interest to the principal is called compounding. Even though the interest rate is expressed yearly, the compounding periods can be yearly, semi-annually, quarterly, or even continuously.

The formula for finding simple interest is:

FVn = Amount at the end of n years, P = Principal or Original sum invested, r = Interest rate per annum (Expressed as a proportion e.g. 5% 0.05) and n = Number of periods.

The future value of single cash flow is the assessment of certain sum of money at a particular period of time in future. The future value of a single cash flow determines how much value of a onetime investment (Example fixed deposit) will grow to, assuming it is left untouched and earns compound interest at a specified interest rate.

The future value of single cash flow is the assessment of certain sum of money at a particular period of time in future. The future value of a single cash flow determines how much value of a onetime investment(example fixed deposit) will grow to, assuming it is left untouched and earns compound interest at a specified interest rate.

Alternatively the calculation of the future value of a single amount can also be used to predict what a present cost of an item will grow to at a future date, when the item’s cost increases at a constant rate.

(i) Annual Compounding:

The equation below calculates how large a single sum will become at the end of a specified period of time. This value is referred to as the future value (FV) of a single sum. Since money has time value, we naturally expect the future value to be greater than the present value.

(ii) Non-Annual Compounding:

When the rate of interest is compounded semi-annually, the interest is calculated twice a year. In other words semi-annual compounding arises on account of payment of interest once in every six months. The computation of future value of a single cash flow when the rate of interest is compounded semi-annually is calculated with help of following equation-

In order to compute the future value of a single sum exponent in the equation for the future value (n) i.e., number of year is multiplied by (m) i.e., number of periods per year and the annual interest rate (i) is divided by the number of periods per year (m).

Where →

FVn → the future value of a single sum of amount at the end of n years

P → the initial amount of investment made

i → the rate of interest earned during each year

n → the number of periods the investment is allowed to compound

m → the number of times compounding occurs during the year.

3. Future Value of Annuity:

In previous discussion on compound interest (annual and non-annual) we learnt computing future value of single sum or “lump sums” cash flow. In case of future value of single sum investors compute present single sum of money invested on a given date at the given rate of interest.

The future value is the sum of present value and the compound interest. The concept of future value of single sum can be applied while investing in savings schemes, bonds, mutual funds and derivative markets. However there are many investment schemes such as insurance, provident fund, pension etc., in which investors make many payments towards investment scheme to receive benefits in future.

Therefore in this case where investor makes a series of payments finding future value of each payment separately and the totaling it is a time consuming process, therefore an easier way to assess future value for series of payments is by using annuities.

Thus, an annuity is a fixed sum of money paid towards a scheme at equal intervals; typically annuities are in the form of series of payments for a long duration. It is not necessary that payments are to made annually; they can be made daily, weekly, monthly or fortnightly.

If the payments occur at the end of each period, the annuity is an ordinary (or deferred), for example pension schemes. If the payments are made at the beginning of each period, the annuity is an annuity due.

For example – lease arrangements, the first payment is due immediately and each successive payment must be made at the beginning of the month.

B) Present Value of Money:

The difference between future and present value of money: The concept of future value of money explains the value of money’s worth at some time in the future. The future value equation explains how much an investment will be worth after compounding for so many years and therefore the concept of future value is also called compounding.

On the other hand present value, also known as discounting shows worth of a future sum of money given a specified rate of return. Thus present value is always less than or equal to the future value because money available at the present time is worth more than the same amount in the future due to its potential earning capacity.

Cash flow is the movement of money into or out of an investment, the present value of cash flow measures worth of a future investment or money or stream of cash flows given a specified rate of return.

1. Present Value of a Single Cash Flow:

The present value of single cash flow is the assessment of certain sum of money at a particular period of time in future. The concept of present value of single sum can be used to find the present worth of an investment to be received in future, to find the required amount of current investment we need an interest rate to generate a required future cash flow. Here interest rate refers to an opportunity to earn a certain return on the money also referred as discount rate, required return, cost of capital, and opportunity cost.

The formula for finding simple interest is:

PV = Present value of single cash flow

FV = Amount or investment at the end of n years

i = Interest rate per annum (Expressed as a proportion e.g. 5% 0.05)

n = Number of periods

2. Present Value of a Mixed Stream:

Cash flows can be in the form of mixed stream or in an equal annual flows pattern or even a perpetual stream. Mixed stream here means cash flows that are not consistent in amount. If the cash flows are different from each other we have to determine the present value of each future amount and then add all the individual present values together to find the total present value.

Increasing the Compounding Periods:

In case compounding periods the interest rate factors gets compounded more than once in a year. Therefore calculating present value of compounding period yearly is similar to computing future value with multiple periods yearly. In other words multiple compounding arises on account of payment of interest more than once in every a year.

The computation of present value of cash flows when the rate of interest is compounded increasingly is calculated with help of following equation:

Where →

i → the rate of interest earned during each year

n → the number of periods the investment is allowed to compound

m → the number of times compounding occurs during the year

3. Present Value of an Annuity:

Previously we have worked out future value of ordinary annuity and annuity due, like we need to find the present value of stream of cash flows. For an ordinary annuity, the cash flow occurs at the end of each period. For an annuity due, the cash flow occurs at the beginning of each period.

Where →

PVAn → the present value of an annuity of cash flow

i → the rate of interest earned during each year

n → the number of periods

A → Principle Amount invested at the end/beginning of every year for n years

Doubling Period:

The concept of doubling period primarily deals with the period of time required for an investment to double in size or value. It is also applied to population growth, inflation, resource extraction, compound interest, and many other things which tend to grow overtime. In finance, the rule of 72, the rule of 70 and the rule of 69 are methods for estimating an investment’s doubling time.

The Rule of 72 is a simple equation applied to determine the anticipated duration required to double an investment. The rule of 72 is primarily used in off the cuff situations where an individual needs to make a quick calculation instead of working out the exact time it takes to double an investment.

Rule 72= 72- n, where n = number of investment years or rate expressed as a whole number.