After reading this article you will learn about the relationship between Risk and Expected Return.

There is a positive relationship between the amount of risk assumed and the amount of expected return. Greater the risk, the larger the expected return and the larger the chances of substantial loss.

Investments which carry low risks such as high grade bonds will offer a lower expected rate of return than those which carry high risk such as equity stock of a new company. A rational investor would have some degree of risk aversion, he would accept the risk only if he is adequately compensated for it.

One of the most difficult problems for an investor is to estimate the highest level of risk he is able to assume. Any such estimate is essentially subjective, although attempts to quantify the willingness of an investor to assume various levels of risk can be made.

ADVERTISEMENTS:

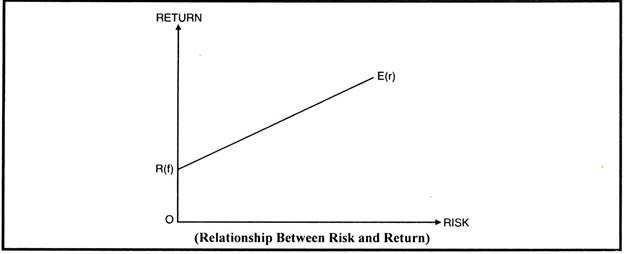

The following figure shows the relationship between the amount of risk assumed and the amount of expected return:

Risk is measured along the x-axis and return is measured along vertical axis. Risk increases from left to right and return rises from bottom to top. The line from O to R(f) indicates the rate of return on risk less investments.

The diagonal line from R(f) to E(r) illustrates the concept of expected rate of return increasing shows a linear relationship between risk and return, but it need not be linear. In developing countries like ours, with administered interest rates and many other restrictive regulations, this linear relationship generally does not hold.