In this article we will discuss about currency futures and currency options.

Currency Futures:

A currency futures contract is “a commitment to deliver a specific amount of a specified currency at a specified future date for an agreed price incorporated in the contract”.

A currency futures contract is an agreement to buy or sell a standardized quantity of specific foreign currency at a future date at a price agreed between two parties.

Financial futures is a binding contract of a standardized nature, inter locking both buyer and seller into a particular rate.

Features:

The features of a currency futures contract are summarized below:

1. These are standardized marketable instruments traded in organized futures markets.

2. These contracts can be liquidated even before the contracted date.

3. These contracts are relatively inflexible and are traded only in major currencies.

4. For entering into these contracts, the parties should keep margins with the exchange.

5. These contracts are cheaper than forward contracts, requiring a small commission payable.

6. Only upfront payment is for the initial margin, with variation margin adjustments being met if the market moves against a counter-party.

7. The clearing house takes the credit risk on each counter-party.

8. Delivery dates are usually quarterly, but most contracts are closed out by buying/selling equal and opposite contracts before the delivery date.

Currency Options:

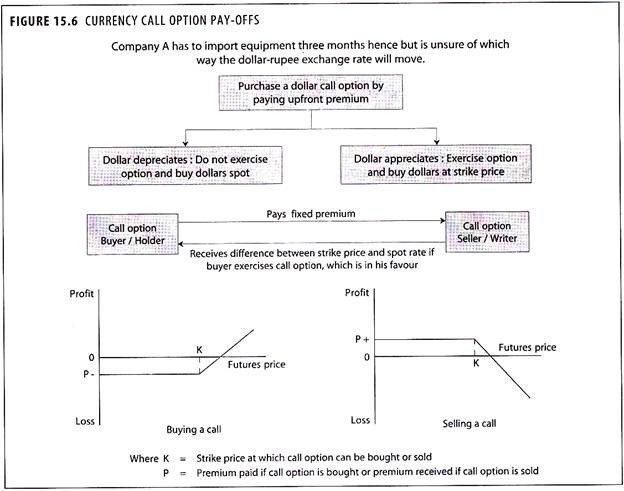

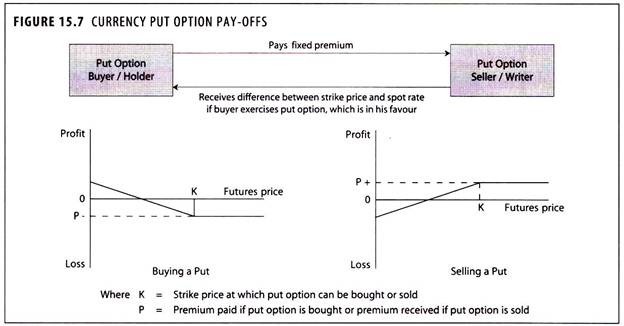

Currency options is “a contract giving the buyer the right but not the obligation to exchange a specified amount of one currency into another specified currency on or before a specified date at a specified rate of exchange. The buyer (holder) of the option pays a ‘premium’ to its writer (seller)”.

An option is a contract that gives the holder the right, but not the obligation, to buy (call) or sell (put) a specified underlying instrument at a fixed price called the ‘strike or exercise price’ before, or at, a future date.

The option-holder has to compensate the writer (the issuer of the instrument) for this right, and the cost borne is called the ‘premium’ or ‘option price’.

The premium should be adequate for the risk borne by the writer and yet, from the holder’s point of view, must be worth paying.

If the option contains a provision to the effect that it can be exercised any time before the expiry of the contract, it is termed as ‘American contract’.

If it can be exercised only on the expiry date, it is termed a ‘European contract’.

Currency options can be used for hedging currency exposures when a corporate is not sure which way the currency is going to move.

By entering into a currency option contract, the company gets the best of both worlds: its downside is restricted to the premium that it pays, and it enjoys an unlimited upside.

For the buyer of a currency option, the gains are unlimited and the losses are limited.

For the writer of the currency option, the losses are unlimited and the gains are limited to the extent of the premium he gains.

Benefits to Buyer of Currency Option:

By purchasing the currency option, the buyer can obtain the benefits as follows:

1. The buyer knows his worst position since his downside risk is limited.

2. The buyer knows the maximum cost at the outset, since he has to pay premium plus funding cost on making upfront payment.

3. The buyer can choose the amount, the strike price and the expiry date of his choice.

4. The buyer need not commit to exchange currency at strike price and can also allow the option to lapse, if it is in his favour.

5. The options can be taken out at any time.

6. If agreed at the outset there may be more than one delivery date, for specified amounts, to hedge a series of currency exposures with one option contract.

7. Options are available even for small amounts and in all major currencies.

8. The buyer can adopt strategy suitable to his business needs.

9. The option can be sold back to writer for fair value at any time.

10. The options can be better used in case of uncertainty of cash flows, since the risk is limited to the extent of premium paid only.

Drawbacks of Currency Option:

1. Options must be paid for immediately as and when they were bought.

2. There is a lack of negotiability for tailor-made options.

3. Traded options are not available in all currencies, although they can be obtained for the major currencies.

4. The buyer can adopt strategy to suit his requirements.

5. It is very costly to hedge through currency options, since nearly the cost would be equivalent to 5% of the total amount of foreign exchange covered.

6. There is no limit to potential cost to the writer, who in return only receives the premium.

7. There is a chance that buyer may forget to exercise the option.