Here is a compilation of top nine problems on cash flow statements along with its relevant solutions.

Problem 1:

The bank balance of a business firm has increased during the last financial year by Rs.1,50,000. During the same period it issued shares of Rs.2,00,000 and redeemed debentures of Rs.1,50,000. It purchased fixed assets for Rs.40,000 and charged depreciation of Rs.20,000. The working capital of the firm, other than bank balance, increased by Rs.1,15,000 during the period. Calculate the profit of the firm for the year.

Solution:

ADVERTISEMENTS:

1,50,000 = Profit + 2,00,000 – 1,50,000 – 40,000 + 20,000 – 1,15,000

∴ Profit = Rs.2,35,000

Problem 2:

A chemical company has net sales of Rs.50 lakhs, cash expenses (including taxes) of Rs.35 lakhs and depreciation expenses of Rs.5 lakhs. If debtors decrease over the period by Rs.6 lakhs, what is its cash from operations?

ADVERTISEMENTS:

Solution:

Cash from operations = Rs.50 lakhs – Rs.35 lakhs + Rs.6 lakhs = Rs.21 lakhs

There are two methods of converting net profit into net cash flows from operating activities:

(a) Direct method, and

ADVERTISEMENTS:

(b) Indirect method.

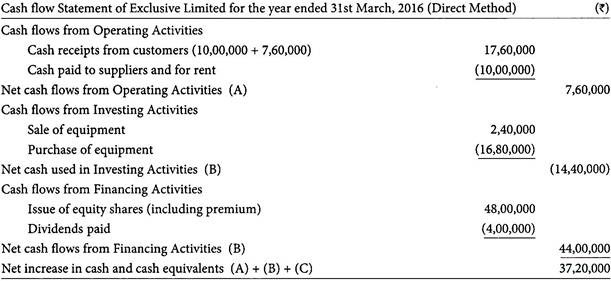

Problem 3:

The following information is available from the books of Exclusive Ltd. for the year ended 31st March, 2016:

ADVERTISEMENTS:

(a) Cash sales for the year were Rs.10,00,000 and sales on account Rs.12,00,000.

(b) Payments on accounts payable for inventory totalled Rs.7,80,000.

(c) Collection against accounts receivable were Rs.7,60,000.

(d) Rent paid in cash Rs.2,20,000, outstanding rent being Rs.20,000.

ADVERTISEMENTS:

(e) 4,00,000 Equity shares of Rs.10 par value were issued for Rs.48,00,000.

(f) Equipment was purchased for cash Rs.16,80,000.

(g) Dividend amounting to Rs.10,00,000 was declared, but yet to be paid.

(h) Rs.4,00,000 of dividends declared in the previous year were paid.

ADVERTISEMENTS:

(i) An equipment having a book value of Rs.1,60,000 was sold for Rs.2,40,000.

(j) The cash account was increased by Rs.37,20,000.

Prepare a cash flow statement using direct method.

Solution:

Problem 4:

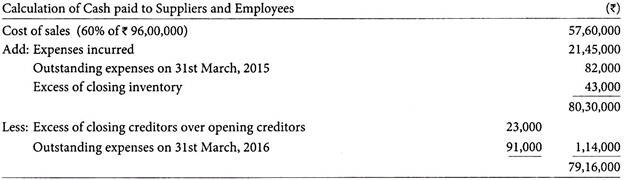

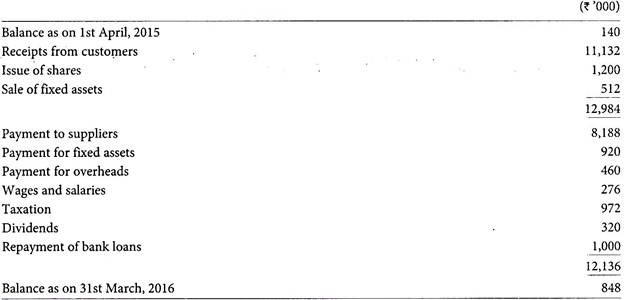

Madhuri Ltd. gives you the following information for the year ended 31st March, 2016:

(a) Sales for the year totalled Rs.96,00,000. The company sells goods for cash only.

(b) Cost of goods sold was 60% of sales.

(c) Closing inventory was higher than opening inventory by Rs.43,000.

(d) Trade creditors on 31st March, 2016 exceeded those on 31st March, 2015 by Rs.23,000.

ADVERTISEMENTS:

(e) Tax paid amounted to Rs.7,00,000.

(f) Depreciation on fixed assets for the year was Rs.3,15,000 whereas other expenses totalled Rs.21,45,000. Outstanding expenses on 31st March, 2015 and 31st March, 2016 totalled Rs.82,000 and Rs.91,000 respectively.

(g) New machinery and furniture costing Rs.10,27,500 in all were purchased.

(h) A rights issue was made of 50,000 equity shares of Rs.10 each at a premium of Rs.3 per share. The entire money was received with applications.

(i) Dividends totalling Rs. 4,00,000 were distributed among shareholders.

(j) Cash in hand and at bank as at 31st March, 2015 totalled Rs.2,13,800.

ADVERTISEMENTS:

You are required to prepare a cash flow statement using direct method.

Solution:

Proceeds from issue of share capital:

Issue price of one share =Rs. 10 + Rs.3 = Rs.13

Proceeds from issue of 50,000 shares = Rs. 13 x 50,000 = Rs. 6,50,000

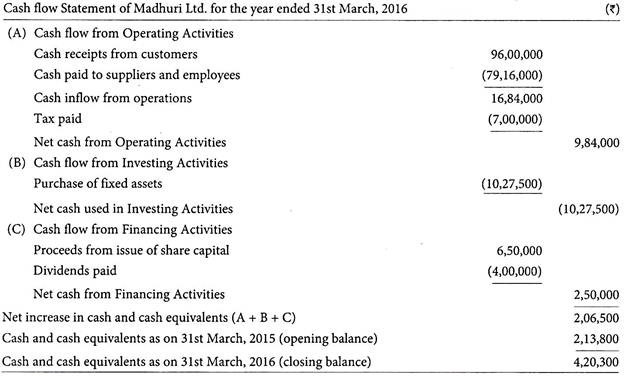

Problem 5:

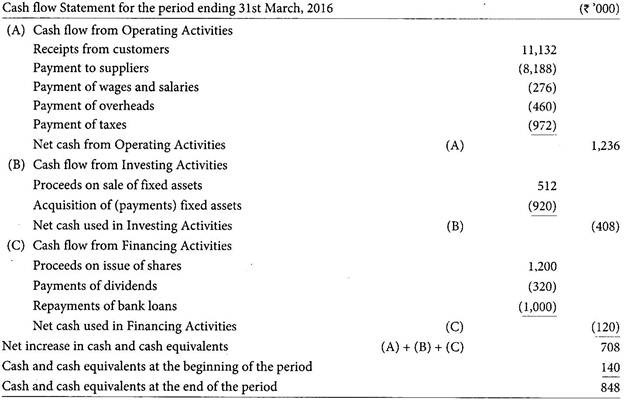

The summary of cash transactions extracted from the books of Happy Ltd. are:

You are required to prepare a cash flow statement of the company for the period ended 31st March, 2016 in accordance with the Indian Accounting Standard-3(Revised).

Solution:

ADVERTISEMENTS:

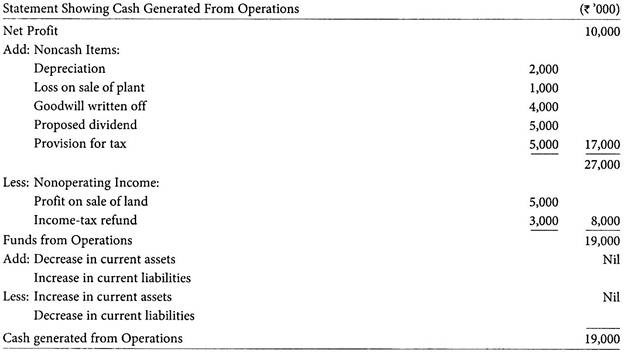

Problem 6:

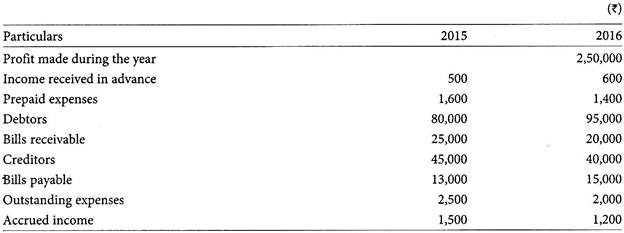

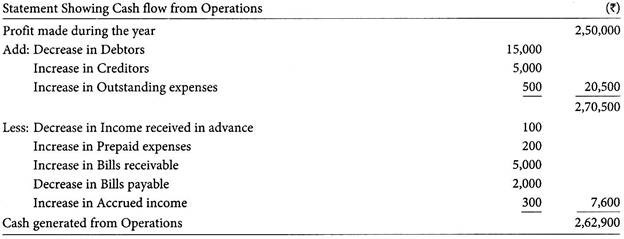

Following information is available from the books of Standard Company Ltd.:

Calculate cash flow from operations.

Solution:

Problem 7:

From the following calculate cash from operations:

Solution:

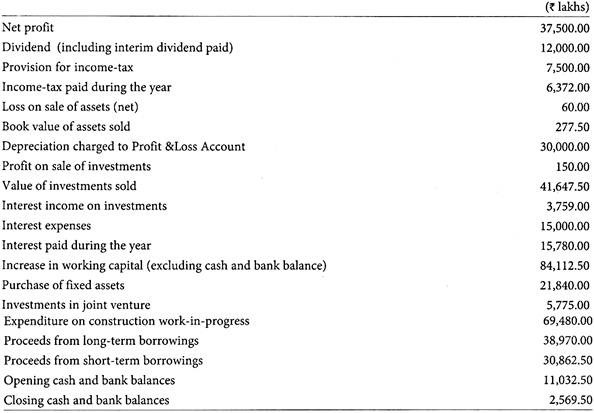

Problem 8:

Swastik Oils Ltd. has furnished the following information for the year ended 31 st March, 2016:

You are required to prepare the cash flow statement in accordance with IAS-3 for the year ended 31st March, 2016.(Make assumption wherever necessary).

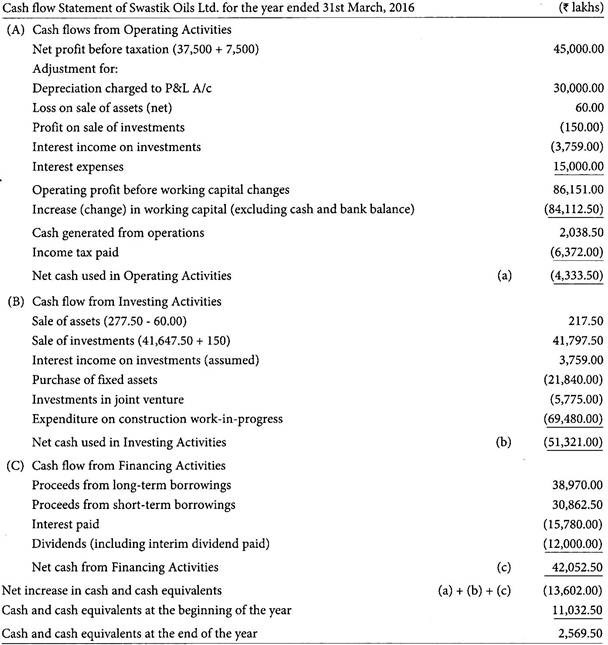

Solution:

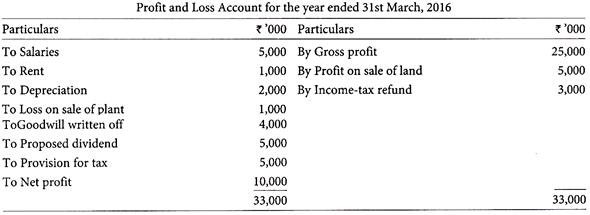

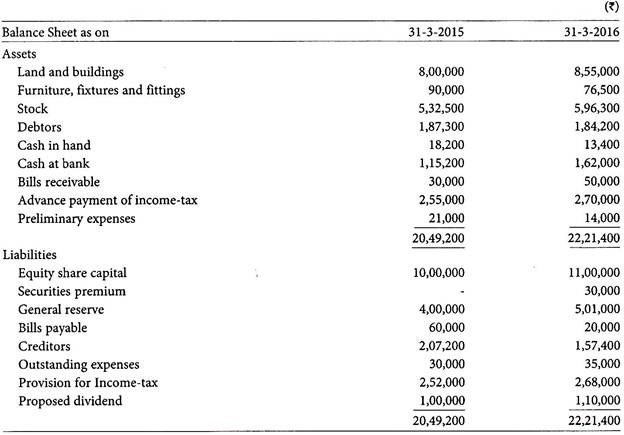

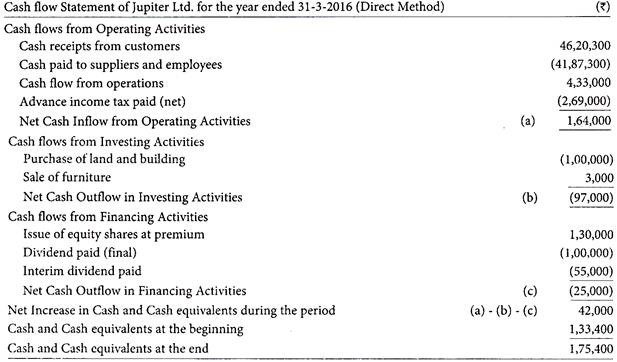

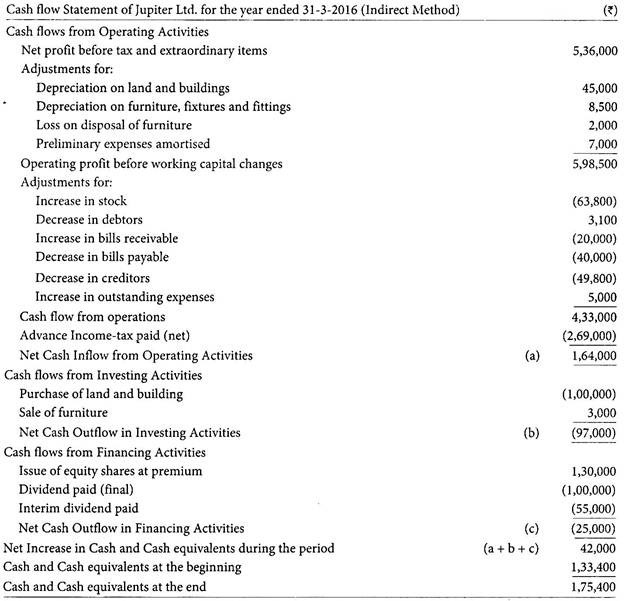

Problem 9:

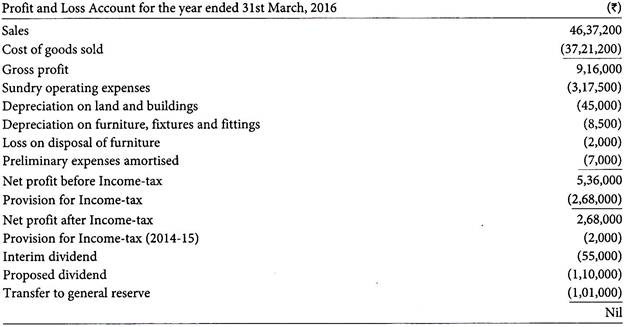

The following data is available from the books of Jupiter Ltd.:

(i) Liability for income-tax for the accounting year 2014-15 was fixed at Rs.2,54,000 and hence, a refund of Rs.1,000 was received out of the advance tax paid for that year.

(ii) Book value of furniture sold during the year was Rs.5,000.

You are required to prepare a Cash flow statement for the year ended 31st March, 2016.

Solution:

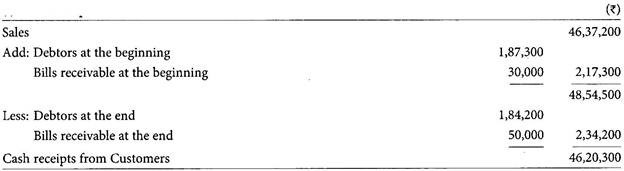

(i) Cash Receipts from Customers:

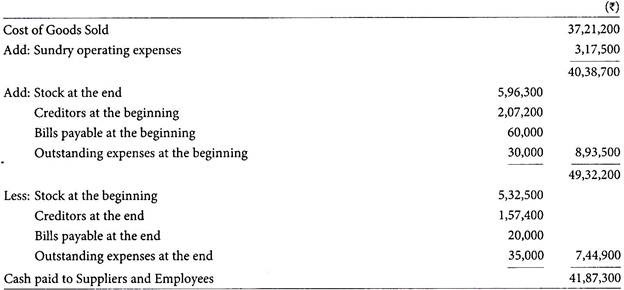

(ii) Cash Paid to Suppliers and Employees:

(iii) Tax Paid:

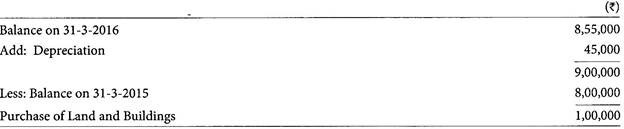

(iv) Purchase of Land and Building: