Here is a compilation of top five problems on funds flow analysis along with its relevant solutions.

Problem 1:

The bank balance of a business firm has increased during the last financial year by Rs.1,50,000. During the same period it issued shares of Rs.2,00,000 and redeemed debentures of Rs.1,50,000. It purchased fixed assets for Rs. 40,000 and charged depreciation of Rs.20,000. The working capital of the firm, other than bank balance, increased by Rs.1,15,000 during the period. Calculate the profit of the firm for the year.

Solution:

ADVERTISEMENTS:

1,50,000 = Profit + 2,00,000 – 1,50,000 – 40,000 + 20,000 – 1,15,000

∴ Profit = Rs.2,35,000

Problem 2:

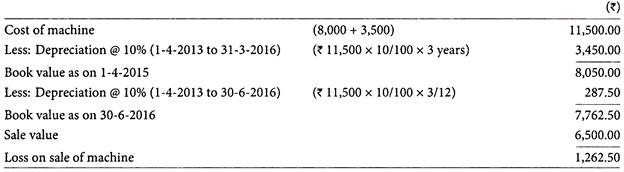

X and Y purchased a secondhand machine for Rs.8,000 on April 1, 2013 and spent Rs.3,500 on overhauling and installation. Depreciation is written-off 10% p.a. on original cost. On June 30, 2016, the machine was found to be unsuitable and sold for Rs.6,500. What is the loss to be written-off?

ADVERTISEMENTS:

Solution:

Problem 3:

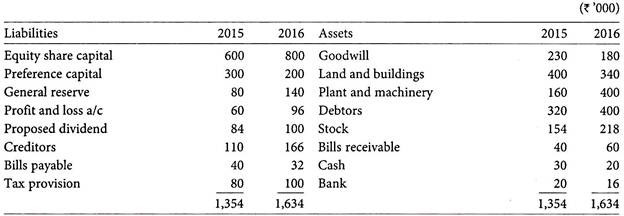

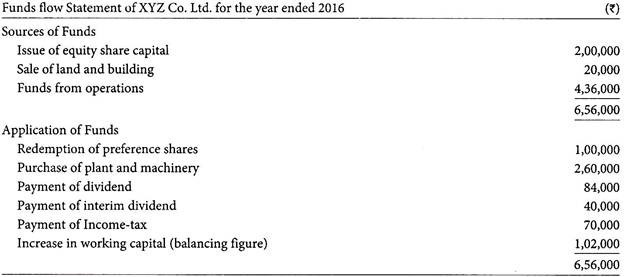

From the following balance sheets of XYZ Co. Ltd., prepare funds flow statement:

Additional Information:

(i) Proposed dividend made during 2015 has been paid during 2016.

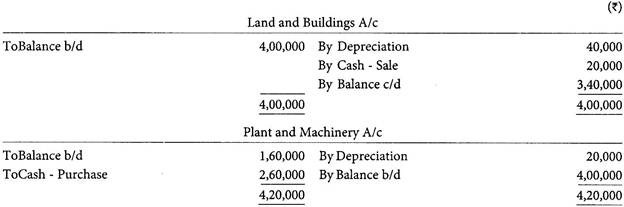

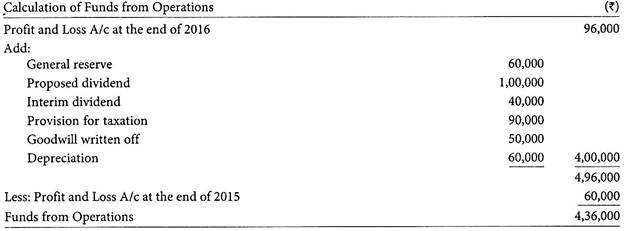

(ii) Depreciation – (a) Rs.20,000 on plant and machinery, and (b) Rs.40,000 on land and buildings.

(iii) Interim dividend has been paid Rs.40,000 in 2016.

ADVERTISEMENTS:

(iv) Income-tax Rs.70,000 has been paid during 2016.

Solution:

Problem 4:

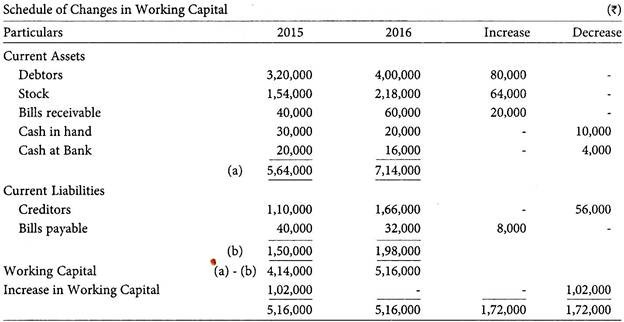

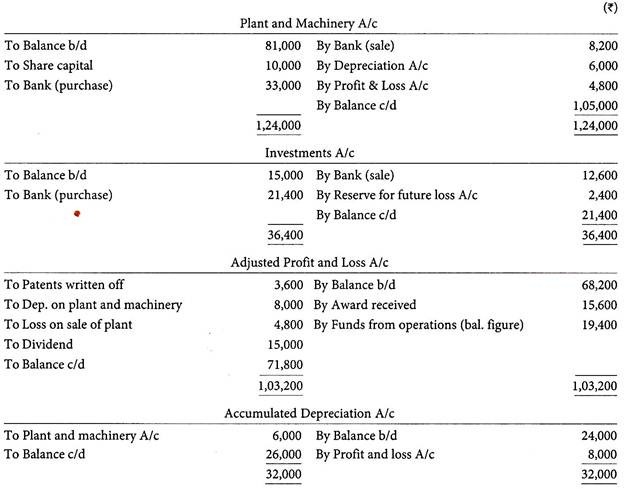

From the following information of XYZ Ltd., prepare a statement showing changes in working capital position along with funds flow statement:

Additional information:

ADVERTISEMENTS:

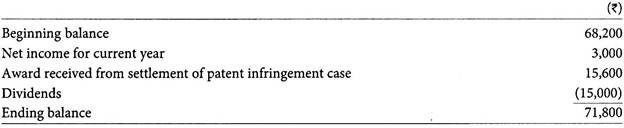

(i) A reconciliation of the balances in retained earnings is as follows:

(ii) Net income of the current year includes a loss of Rs.4,800 on the sale of a part of plant. The plant was for Rs.19,000 at the beginning of the year, accumulated depreciation being Rs.6,000.

ADVERTISEMENTS:

(iii) Investments of Rs.15,000 were sold during the year at a loss. The loss was charged to the reserve for future losses on investments and did not appear on the income statement.

(iv) During the current year the 12% debentures were called for redemption. Most of them were refunded through the issuance of new 14% debentures, and the rest were retired for cash.

(v) The equity shares were issued in exchange of machinery. The rest of the plant and machinery were purchased for cash.

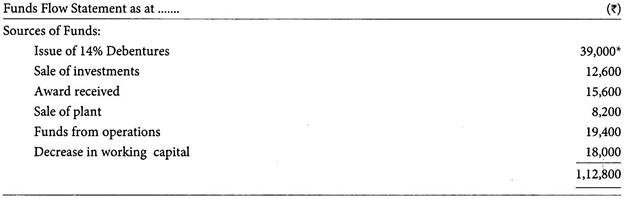

Solution:

Working Notes:

* Alternatively the net amount of Rs. 4,400 (Rs. 43,400 – Rs. 39,000) can be shown as application.

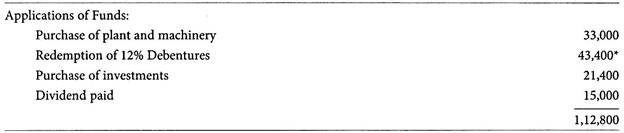

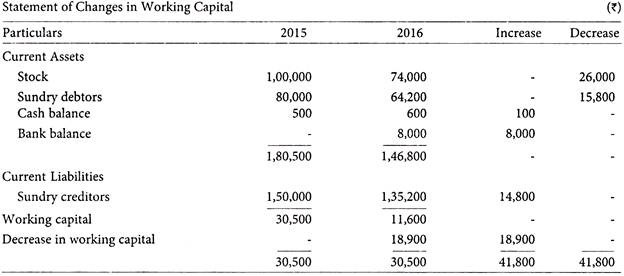

Statement of Changes in Working Capital:

Problem 5:

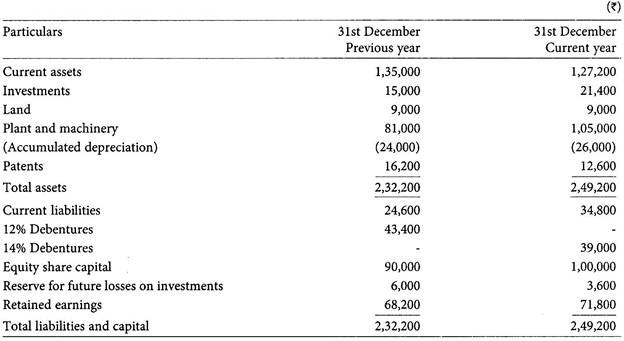

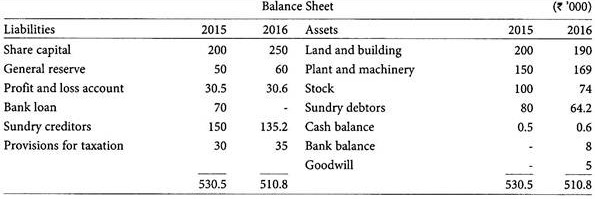

Following are the summarized Balance sheets of the Ganges Ltd. as on 31st December, 2015 and 2016:

The following additional information is available:

(a) During the year ended 31st December, 2016

(i) Dividend of Rs.23,000 was paid.

(ii) Assets of other company were purchased for Rs.50,000 payable in shares. Assets purchased were: stock Rs.20,000; and machinery Rs.25,000.

(iii) Machinery of Rs.8,000 was purchased in addition to that of (ii) above.

(b) Depreciation written off during the year, 2016:

ADVERTISEMENTS:

Building Rs.10,000; and machinery Rs.14,000.

(c) The net profit for the year 2016 was Rs.66,100.

(d) Income-tax paid during the year 2016 was Rs.28,000 and provision of Rs.33,000 was made to Profit and loss account.

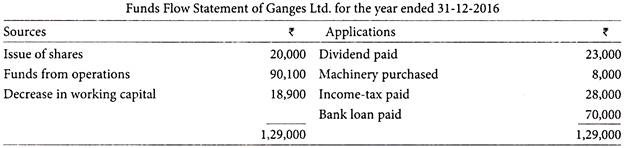

Prepare statement of sources and application of funds for the year ended 31st December, 2016 and a schedule setting out the changes in working capital.

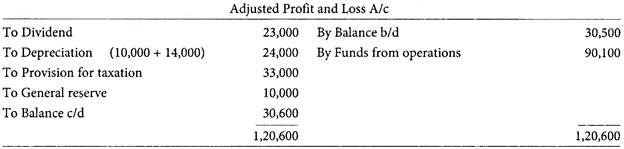

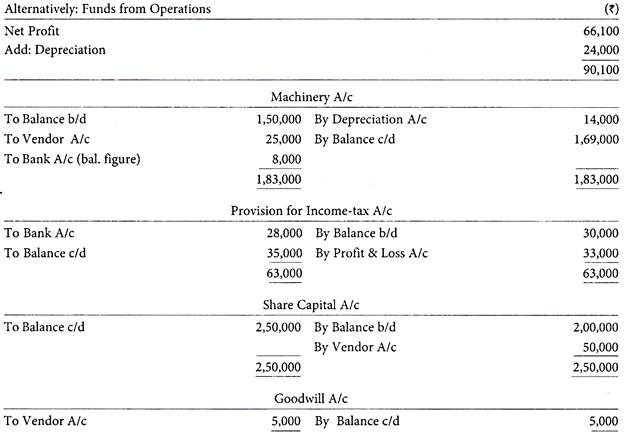

Solution:

Note:

Provision for taxation may alternatively be treated as a current liability and shown in the schedule of changes in working capital.