The following valuation methods are generally used basing on the industry averages or averages of a similar company in the same industry: 1. Dividend Yield Method 2. Earnings Yield Method 3. Return on Capital Employed Method 4. Price/Earning Method.

1. Dividend Yield Method:

Ownership of shares in a company entails the holders of shares to receive dividends as and when declared. Since investors in a company get their return in the form of a dividend, the amount of dividend paid gives some indication of how valuable the shares will be to the potential buyer. When valuing a small shareholding (which cannot influence the proportion of earnings to be distributed), the calculation should be based on the dividends, rather than earnings per share.

If dividend is seen as one of the key factors determining how valuable shares are, it is possible to look at the relationship between level of dividend and price in other companies and base a price on what dividend is normally paid. This concept can be presented as a formula for any individual company to an accepted average for similar business.

Value of Business = Value per equity share × Total number of equity shares

Disadvantages:

The dividend yield method is subject to the following disadvantages:

1. It ignores the element of capital gain which is the important financial justification for investing in shares.

ADVERTISEMENTS:

2. The growth of a company could be seen as being a mean to securing the flow of dividends to shareholders in future, rather than a goal in itself.

3. The method is based on the assumption that dividend policy will remain constant. In practice, companies can and do change their dividend policies.

4. In case of unquoted companies, they are not concerned to keep shareholders happy, so levels of dividend may well be lower than for quoted companies. This valuation might, under value unquoted companies.

5. One drawback of the dividend yield valuation of an unlisted share is that it is usually based on past dividends, and these may not be representative of future expectations which should help, determine the current price.

ADVERTISEMENTS:

The disparity between the dividend policies of unlisted and listed companies is caused by a number of factors. The listed company tries to prevent falls in its share price which leave it vulnerable to a takeover bid and unable to attract additional investment. A generous dividend policy helps maintain a high share price.

Unlisted companies, and especially private companies, find it more difficult to attract external funds. The need to plough back into the business a large proportion of earnings leaves limited amounts available for distribution.

Problem 1:

Ashoka Builders Ltd. has an issued and paid up capital of 5,00,000 shares of Rs.10 each. The company declared a dividend of Rs.12.50 lakhs during the last five years and expects to maintain the same level of dividends in future. The control and ownership of the company is lying in the few hands of directors and their family members. The average dividend yield for listed companies in the same line of business is 18%.

ADVERTISEMENTS:

Calculate the value 3,000 shares in the company.

Solution:

Dividend per share = Rs.12,50,000/5,00,000 shares = RS.2.5

Industry’s normal rate of dividend = 18%

Value of 3,000 shares = 3,000 shares × Rs.13.89 = Rs.41,670

Problem 2:

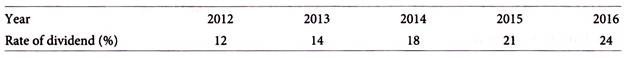

ABC Ltd. has declared dividend during the past five years as follows:

The average rate of return prevailing in the same industry is 15%. Calculate the value per share of Rs.10 of ABC Ltd. based on the dividend yield method.

Weighted average rate of dividend = 298/15 = 19.87%

Problem 3:

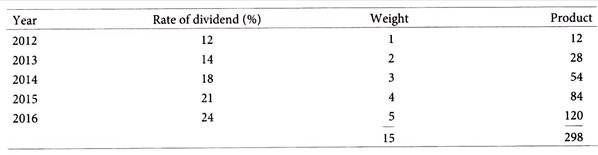

The profit of X Ltd. for the year ended 31st March, 2016 were Rs.60,00,000. After setting apart amounts for interest on borrowings, taxation and other provisions, the net surplus available to shareholders is estimated at Rs.15,00,000.

The company’s capital base consisted of:

(i) 1,00,000 Equity shares of Rs.100 each, Rs.50 per share paid up, and

(ii) 25,000 12% Cumulative Redeemable Preference shares of Rs.100 each, fully paid up.

Enquiries in the stock market reveal that shares of companies engaged in similar business and declaring a dividend of 15% on equity shares are quoted at a premium of 10%.

ADVERTISEMENTS:

What do you expect the market value of the company’s shares to be, basing your working on the yield method?

Solution:

2. Earnings Yield Method:

To overcome the problems associated with dividends, the yield based upon earnings can be used. The total amount of profit belongs to the shareholders, whether distributed as dividend or not.

The undistributed profit used to finance the growth of the business helps to increase the value of the shares, and is just as much a part of the shareholders return on the investment as the dividend. The value of a company on the earnings yield basis is the value of the stream of profit or earnings which the company is expected to generate.

Calculation of an earnings yield value involves three steps:

ADVERTISEMENTS:

Step 1:

Predict the future maintainable profits (annual earnings) of the company being valued.

Step 2:

Identify the required earnings yield by reference to the results of similar companies.

Step 3:

Apply the earnings yield to future profits using the following formula:

The profit figure is available from the profit and loss account of the company. But when estimating the future earnings, factors which cause distortions and changes anticipated in the future should be taken care of. The ability of the valuer to prepare an accurate forecast will depend on access to relevant information.

Problem 4:

Kavery Industries Ltd. is expected to generate future profits of Rs.54,00,000.

What is its value of business if investments of this type are expected to give an annual return of 18%.

Solution:

Company’s expected future profits = Rs,54,00,000

ADVERTISEMENTS:

Industry’s normal rate of return = 18% or 0.18

Value of Business = Rs.54,00,000/0.18 = Rs.3,00,00,000

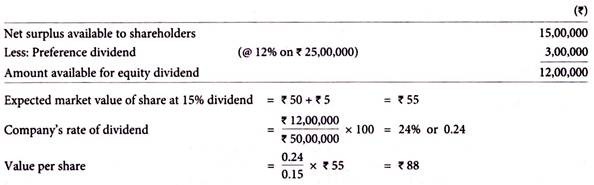

Problem 5:

Jain Castings Ltd. agrees to acquire Nayagara Steels Ltd. based on the capitalisation of last three years profits of Nayagara Steels Ltd. at an earnings yield of 21%.

Calculate the value of business on earnings yield basis.

ADVERTISEMENTS:

Solution:

Company’s 3 years average profit = (75 + 89 + 82)/3 = Rs.82 lakhs

Earnings yield = 21% or 0.21

Problem 6:

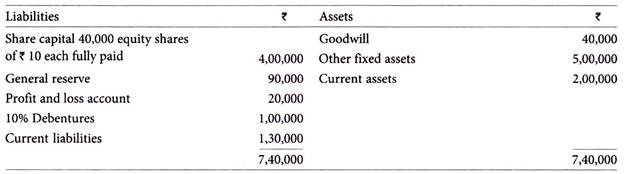

On 31st March, 2016 the Balance sheet of XYZ Ltd. disclosed the following position:

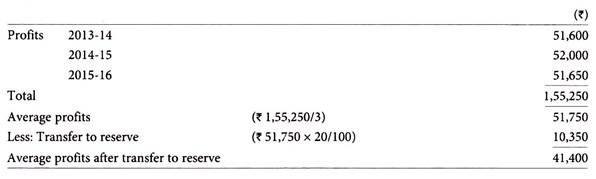

On 31st March, 2016 the goodwill of the company was valued at Rs.50,000 while other fixed assets were valued at Rs.3,50,000. The net profit earned by the company amounted to Rs.51,600 for 2013 -14; Rs.52,000 for 2014-15 and Rs.51,650 for 2015-16.

Every year an amount equal to 20% of the profit earned was transferred to general reserve – this being considered reasonable in the industry in which the company is engaged. A return of 10% on the investment is considered fair in the industry.

Compute the value of the company’s share by the yield method.

Solution:

(i) Calculation of Expected Average Future Profits:

Problem 7:

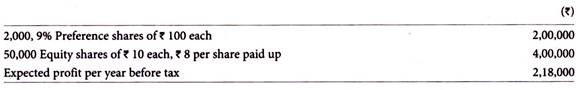

From the following particulars, calculate the value of an equity share:

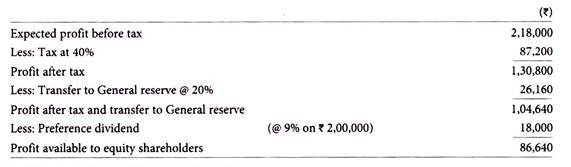

Rate of tax 40%. Transfer to general reserve every year is 20% of profit. Normal rate of earning 15%.

Solution:

(i) Calculation of Profit Available to Equity Shareholders:

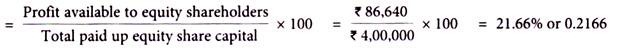

(ii) Calculation of Company’s Expected Rate of Earnings:

(iii) Calculation of Value of an Equity share:

3. Return on Capital Employed Method:

It is a simple method which considers the rate of return on capital employed which will be required from the company whose shares are to be valued. This is based on the predetermined notion of the rate of return investor would expect on this particular type of investment, and then having decided on the earnings of the company, to calculate the capital sum that would result in such a rate of return.

The steps used in this method are as follows:

Step 1:

Select the past period of investigation.

Step 2:

Estimate the future maintainable profits, after making any necessary adjustments.

Step 3:

Establish the acceptable normal rate of return on capital invested in a similar type of company, allowing for the industry effect, the size of the company, and the level of capital gearing.

Step 4:

Capitalize future maintainable profits at a rate established as the acceptable rate of return.

The problem with this type of approach is that the estimate of earnings is usually based on historical earnings. Whether this is a straight average of the past five years’ earnings, or some weighted average attaching greater importance to the more recent year’s earnings, it is still based on past performance.

Problem 8:

Sarojini Steels Ltd.’s after tax profit for the year 2016 is Rs.24 lakhs. The company is expecting to earn an after tax profit of Rs.30 lakhs in the next five years.

All the companies in the similar business is yielding a post-tax accounting rate of return on capital employed is 24%.

Calculate the valuation of the company based on rate of return on capital employed.

Solution:

Company’s expected future maintainable profit p.a. = Rs.30,00,000

Industry’s normal rate of return on capital employed = 24% or 0.24

Value of Business =Rs.30,00,000/0.24 = Rs.1,25,00,000

Problem 9:

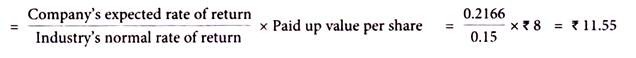

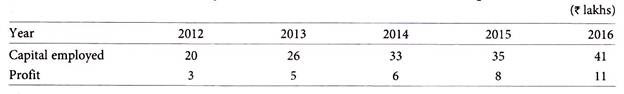

From the following data available from the books of Timken Bearings Ltd., calculate the value of equity shares based on return on capital employed:

The market expectation being 16%

Solution:

The rate of return on capital employed is calculated by adopting weighted average method is as follows:

Company’s weighted average rate of return on capital employed = 333.6/15 = 22.24% or 0.2224

Market expected rate of return on capital employed = 16% or 0.16

4. Price/Earning Method:

Quoted companies are regularly described in terms of their P/E ratio. Like the earnings yield this links price and earnings, but P/E ratio is the inverse of earnings yield, dividing price by earnings rather than earnings by price.

As with the earnings yield, the figures can be calculated per share or for the company as a whole using simple formula:

Value of Business = Company’s expected future maintainable profits x Industry’s average P/E ratio

Value of Shares = Company’s expected earnings per share x Industry’s average P/E ratio

The P/E ratio can be used as a valuation tool of shares and business. This ratio sets EPS against the current market price of the share, and is expressed as a number. It can be seen as the number of years which the investor must wait to recoup the invested sum out of earnings, whether they are distributed as a dividend or not.

The ratio is normally thought of as the number of times earnings an investor would pay for a small number of shares of a company. If the total shares of company are being purchased, the market P/E ratio may have to be adjusted.

For valuation under this method, there must be an industry P/E ratio that is appropriate for the investment. The P/E ratio method would be used when it is not realistic to estimate the yearly cash flows into the future or indeed the rate at which they will grow. Financial analysts often use P/E ratios as a guide to the market value.

Listed companies offer significant advantages to their members as their shares are marketable and their large size gives them an element of stability – these advantages make their shares more desirable, and therefore more highly priced, than those of an unlisted company. The P/E ratio of an unlisted company is expected to be less than that for a corresponding listed company, and so the use of unadjusted quoted ratios can result in over-valuation.

Problem 10:

Permanent Magnets Ltd. is having an issued and subscribed capital of 5,00,000 equity shares of Rs.10 each fully paid up. The company’s after tax profits for the year 2016 amounting to Rs.28 lakhs. The average present stock exchange price of the company’s share is Rs.19.

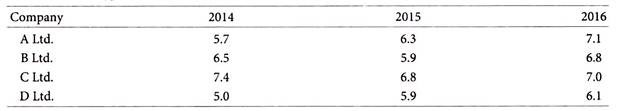

The P/E ratio of the four listed companies to be used for calculation, their type of business seems to be similar to Permanent Magnets Ltd. are:

Calculate the valuation of business and per share based on average P/E ratio of the industry.

Solution:

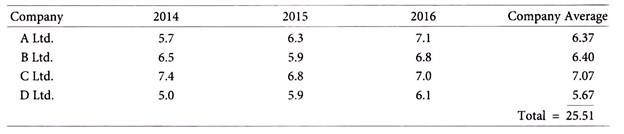

Calculation of P/E Ratio of Four Listed Companies:

Industry’s average P/E ratio = 25.51/4 = 6.38

Value of Business = Company’s expected future maintainable profit x Industry’s average P/E ratio

= Rs.28,00,000 x 6.38 = Rs.178.64 lakhs

= Value of share = Company’s earnings per share x Industry’s average P/E ratio

= Rs.5.60 x 6.38 = Rs.35.73