In this essay we will discuss about the various markets and their sources of finance.

1. Essay on Domestic Market:

Companies raise funds through equity and debt in the domestic market, through financial instruments. These include commercial paper (CP), certificates of deposit (CD), equity shares (with or without voting rights or differential voting rights), medium-term or long-term bonds (straight, convertible, non-convertible, with fixed, floating, or no interest rates, with or without embedded call and put options), inter-corporate deposits and public deposits. Rules of issue vary between countries.

The selection of the financial instrument(s) is based upon cost comparison between alternative instruments in the same maturity spectrum, flexibility of issue and a comparison of the advantages of some forms of financing. When, 3-month CP costs are lower than the cost of a three-month bank loan, the capital market witnesses a spike in CP issues.

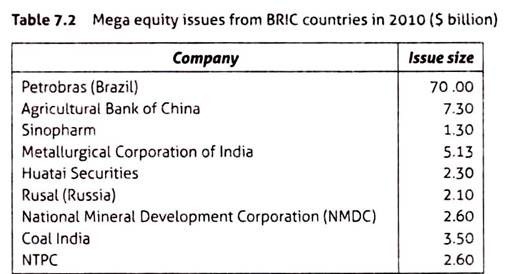

Whenever greening of loans (the rollover of short-term and medium-term loans for a further pre-set period) is permitted, companies may prefer loans. Selection of a particular form of financing is also influenced by investor interest, the mode of issue in capital markets (at a pre-determined price or through book building, through conventional public issue or through online issue. Table 7.2 lists some large equity issues in 2010.

The line between domestic and overseas financial markets has begun to blur, as size of domestic issues becomes larger, and there is enormous global interest in capital market issues. Mutual Funds in the US and sovereign wealth funds from the Middle East subscribed to the IPOs of Coal India and Agricultural Bank of China (valued at $22.1 billion). Shanghai became the top ranking IPO market in 2010. The $70 billion equity issue by Brazil’s state- owned oil firm, Petrobras, had global book runners—Bank of America, Citigroup, Merrill Lynch, Morgan Stanley, and Banco Santander. The issue attracted $30 billion in bids from institutional investors. When a domestic issue is capable of attracting overseas investor interest, the location of issue (domestic or foreign) becomes less relevant.

2. Essay on Eurocurrency Market:

Companies from all over the world raise funds in the Eurocurrency market through loans, debt instruments, equity issues, and money market instruments. A Euro-loan (also known as Euro-credit) is a Eurocurrency loan of very large size. Most Euro-loans are given by a syndicate of banks, and hence they are called syndicated loans. They often carry floating interest rates linked to LIBOR or the EURIBOR.

For example, a Euro-loan may be given at 2% above the current three-month EURIBOR. If the current EURIBOR is 4%, the interest rate for the first three months is 6%. Syndicated Euro-loans are collectively given by a group of banks called a syndicate. Each bank gives only as part of the entire loan. The terms of the loan are settled through negotiation.

EURIBOR-Based Loans:

ADVERTISEMENTS:

Selection of the benchmark is an important aspect of taking a floating rate loan. LIBOR is the most well-known benchmark and is the benchmark reference rate for US dollar-denominated loans and yen-denominated loans. The LIBOR, calculated by the British Bankers Association (BBA), is the weighted average of offer rates in the money market by 16 London-based banks. Another benchmark reference rate, the Euro LIBOR, also calculated by the BBA, was introduced in 1999 to coincide with the introduction of the euro in the EU.

It was intended for use in euro-denominated loans. A third benchmark reference rate, the EURIBOR, was also introduced in 1999. It is the weighted average of offer rates in the money market by 42 banks in the Eurozone, which was also meant for use in euro-denominated loans. The EURIBOR has become the preferred rate in transactions of EU banks. In 2010, it replaced the LIBOR as the reference rate for euro- denominated loans given by the World Bank.

A Euro-security (or Euro-instrument) is a security denominated and issued in a currency that is not the legal tender of the market in which it is being issued. It is issued in the Euro-market where a company issues instruments denominated in a currency other than the currency of that market. Euro-securities may be EuroCPs, Eurobonds and Euro-equities. A EuroCP is a CP issued in Eurocurrency. A Eurobond is a bond issued in Eurocurrency. A Euro-equity share is an equity share issued in Eurocurrency.

A EuroCP is usually issued in US dollars in multiples of $ 10 million and has a maturity of upto 1 year. The documentation required for issue is minimal. They are sold through placement agents and are not underwritten. They may be issued at discount to face value or as floating rate interest-bearing instruments.

ADVERTISEMENTS:

A EuroCD is a money market instruments issued by Euro-banks. It is a negotiable, bearer instrument usually denominated in US dollars or pound sterling. Maturity ranges between one month and one year. A ‘discount’ CD is issued at discount to face value and redeemed at face value on maturity. It carries no interest rate. A ‘straight’ CD (or ‘tap’ CD) has a fixed interest rate. A floating rate CD is linked to a benchmark (such as LIBOR).

Eurobonds are bearer instruments with maturity ranging between 5 and 15 years, usually issued in US dollars with a minimum denomination of $10,000. A Japanese company issuing US dollar-denominated bonds listed on the German, French and Swiss stock exchanges, to European investors is said to have made a Eurobond issue. Eurobonds vary with respect to tenor, interest rate (fixed versus floating) and repayment currency.

(i) A Eurobond issued in one currency (say USD) with interest payments and principal payments made in another currency (say pound sterling) is known as a dual currency bond.

(ii) A Eurobond may carry a floating rate of interest (a floating rate Eurobond) or no interest rate (zero coupon Eurobond).

ADVERTISEMENTS:

(iii) A reverse floater is a Floating Rate Bond (FRB) whose interest rate is fixed to a reference rate (LIBOR or EURIBOR) so that as the benchmark rate rises, the interest on the FRB declines.

(iv) A Eurobond convertible into equity of the issuing company after a pre-determined period is called a Euro-convertible bond.

Short-term Eurobonds with maturities between 3 months and 6 months are known as Euro-notes. They are underwritten by commercial banks and are also known as Note Issuance Facility (NIF), Revolving Underwriting Facility (RUF) or standby facility. They can get rolled over (extended for a further 3 months or 6 months) at maturity. This facility meets the needs of both the issuer and the investor. The issuer wants medium-term finance but the investor (that is the lender) wants to provide short-term finance. Both get what they want.

A medium-term Eurobond is also known as a euro medium-term note (EuroMTN). They are often placed by a tender panel—a group of financial institutions that is used in placing EuroNIFs and EuroCPs.

ADVERTISEMENTS:

Eurobonds may carry a Multiple Component Facility—the borrower can choose between several different options in the drawing of funds. The borrower can choose between Note Issuance Facilities (NIFs), a swingline, or euro Medium term Notes (EuroMTNs).

Since Eurobonds are sold in countries outside the issuer’s country, the issuer has to select a governing law, which will be applied to the issuer’s payment obligations. The governing law is chosen by negotiation between the issuer and the underwriter at the time of issue. Usually the governing law of UK or USA is selected, though sometimes that of Japan, Germany and Luxembourg is also chosen. The Eurobond market opened in 1963 when Italian company Autostrade made a bond issue of US$ 15 million.

Eurobonds are OTC instruments that are sold through two of Europe’s clearing houses, Cedel which commenced operations in 1971) and Euro-clear (which commenced operations in 1968). After the sale, buyers deposit the Eurobond with either of the two clearing houses. Interest paid by the issuer may be collected by the clearing house on behalf of the Euro-bondholders. Each clearing house maintains absolute secrecy by assigning a number to a particular bondholder.

It is not bound by any regulation to disclose the names of the owners, or the interest payments received by them. Sale of Eurobonds is routed through the clearing house concerned that debits (or credits) the numbered accounts with a sale (or purchase). Another very attractive feature of Eurobonds is that no withholding tax is imposed on interest payments.

ADVERTISEMENTS:

Eurobonds have some features that make them extremely attractive to issuers and investors alike. From the issuer’s perspective, Eurobonds are not underwritten, and the interest (both quantum and currency) can be fixed to suit the issuer’s needs. From the investor’s perspective, Eurobonds are issued as bearer securities, so the holder is the owner. Bearer bonds preserve anonymity, and are transferable by delivery, with the purchaser acquiring title. Some Eurobonds may carry exotic names—a Eurobond issue that replaces existing Eurobonds is called an Alladdin bond issue.

3. Essay on Foreign Market:

A foreign bond is a bond issued by a foreign borrower in a specific country and denominated in that country’s currency. Foreign bond issues carry prefixes that indicate the country in which the offering is made. A Japanese company (foreign borrower) making a US dollar-denominated bond issue in the US capital market is making an issue of Yankee bonds. Similarly, a samurai bond is a yen-denominated bond issue made by a foreign borrower in the Japanese capital market to Japanese investors.

A bulldog bond is denominated in pound sterling issued by a foreign borrower in the British capital market. Foreign bonds are designed to cater to the investment needs of the target market and carry attractive features specifically suited to investors in that market. The bonds must meet the security regulations of the capital market in the foreign country—the Securities Exchange Commission (SEC) in the USA and the Securities Exchange Board of India (SEBI) in India.

An issuer (borrower) will always make a tradeoff between the cost (in terms of time and money) of making a foreign bond issue and a Eurobond issue. Sometimes the stringency of the regulations in a specific market (such as the US market) tips the balance in favour of the latter. For instance only registered bonds can be issued in the US market, while bearer bonds can be issued in the Euro-market.

ADVERTISEMENTS:

A registered bond is one that is listed in a register maintained by the borrower, specifying the name of the bondholder. Bearer bonds are immensely attractive to those investors who, for tax considerations, would prefer not to have their name listed as the owner. Thus, markets compete with each other in their ability to attract issues. When the borrower perceives the Eurobond market as being less cumbersome, there will be a greater volume of such issues.

Foreign bonds may be subject to withholding tax. This is a tax levied by the country to which the borrower belongs, on interest payments made to foreign bon an Indian company makes a Yankee bond issue (a dollar-denominated bond issue in the US market) and the Indian tax law stipulates that a 20% withholding tax must be levied on interest payments made by the Indian company to non-Indian bondholders. An Indian company making a foreign bond issue (often of convertible bonds) is said to make a foreign currency convertible bond (FCCB) issue. Such issues are governed by guidelines on External Commercial Borrowing (ECB).

A depository receipt represents ownership of shares in companies of other countries. A Global Depository Receipt (GDR) is a depository receipt listed and traded on exchanges such as Dubai, Singapore, London and Luxembourg. GDRs are usually denominated in US dollars; hence a GDR is a Euro-security. Unlike in a Eurobond issue, GDR issues do not have a trustee and a trust deed. GDRs may be issued with warrants. The GDR holder has the option to convert the warrant at a pre-specified date into equity shares of the issuer.

An American Depository Receipt (ADR) is a depository receipt listed and traded on exchanges in the USA. The first ADR issue was made by JP Morgan in 1927. Since the US market has extremely stringent reporting norms, only those companies that make an ADR issue.

There are different kinds of ADR issues that are permitted in the US capital market. ADRs may also be privately placed in accordance with Rule 144A of the 1933 Registration Act applicable in the USA. Each state in the USA has its own State Securities Law, called Blue Sky Law.

If the ADRs are to be listed on the NASDAQ, the Blue Sky Law does not apply and can be ignored. But if the ADRs are to be listed on NYSE for example, a Blue Sky Survey must be part of the registration documents. Non-compliance with any of the rules of US stock exchanges leads to delisting of ADRs. According to a Securities and Exchange Commission (SEC) rule, companies whose ADRs are listed on US stock exchanges, must submit financial statements according to US generally accepted accounting principles (GAAP). US GAAP requires financial statements to be restated for all the years in which they were wrongly stated and incorrect.

ADVERTISEMENTS:

The ADR issue involves several steps:

1. The issuing company appoints a financial advisor, a depository bank (in the USA), and a custodian bank from its home country. The issuer applies for listing of the ADRS on NYSE or NASDAQ.

2. The issuer and the financial advisor decide on the depository receipt ratio. This is the number of equity shares that represent each ADR.

3. A US broker buys underlying equity shares in the issuer’s home market.

4. The custodian bank registers the equity shares in the name of the depository bank, which in turn issues the ADRs.

5. The ADRs are listed and traded.

ADVERTISEMENTS:

Types of ADRs:

An issuer can chose between a sponsored ADR, an unsponsored ADR, a Level I ADR, or Level II ADR. In a sponsored ADR issue, the issuer signs an agreement with a specific depository bank, requesting it to issue ADRs. The issuer bears the costs of the ADR issue. In an unsponsored ADR issue, the depository bank issues ADRs in response to market demand. The issuer does not sign an agreement with the depository bank, nor does it bears the issue costs of the ADRs.

In a Level I ADR issue, the ADRs are traded in the US OTC market and need not be registered with the Securities And Exchange Commission (SEC).The company issuing the underlying equity is not required by SEC rules to recast its financial statements according to US GAAP In a Level II ADR issue, ADRS are listed and traded on exchanges (AMEX, NYSE, NASDAQ). The issuer of the underlying equity shares must recast its financial statements according meet the periodic reporting norms specified by the SEC.

Impact of a DR Issue on Domestic Float:

Float refers to the number of equity shares that a company has issued and outstanding in the domestic capital market. When a company issues DRs through an additional issue of equity shares, it can result in either no change or increase in the domestic float. If a company has one million equity shares outstanding in the Indian capital market and makes an issue of an additional one million shares, the float rises to two million shares. If the company deposits 500,000 shares with a custodian bank for issue of DRs, float in the Indian capital market becomes 1.5 million shares.

If the entire additional one million shares are converted into DRs, then domestic float remains unchanged at one million shares. When the company raises DRs from the existing equity shares, it causes domestic float to decrease. In November 2004, Infosys Technologies made a sponsored ADR issue through shares surrendered by domestic investors, against which ADRs were issued in the US market. The domestic float of Infosys shares in the Indian capital market decreased, but the float of Infosys ADRs in the US capital market increased.

4. Essay on International Market:

ADVERTISEMENTS:

An international loan is given by multilateral agencies to finance specific projects. Such loans are often given by the World Bank and IMF to state governments, public sector undertakings and to municipalities. International bonds are a popular financial instrument with more than three-fourth of the total bonds outstanding (straights plus floating rate bonds) being issued by financial institutions.

A global bond is an extremely large issue (US$ 10 billion) that is made to investors in several continents. The issue is made by a corporate borrower or the government of a country (called sovereign bonds). Four currencies (the euro, US dollar, pound sterling and Swiss franc) account for nearly three-fourth of all issues outstanding.

External Commercial Borrowing (ECB) in India:

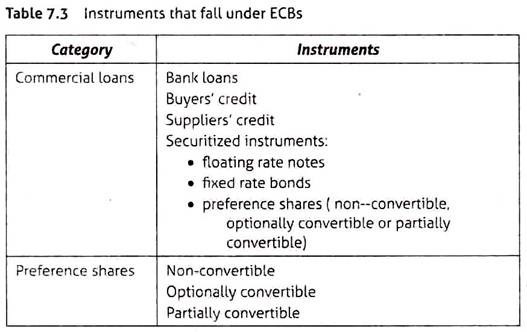

According to the RBI, ECB consists of commercial loans from nonresident lenders, preference shares, Foreign Currency Convertible Bonds (FCCBs), and Foreign Currency Exchangeable Bonds (FCEBs) issued to non-residents of India (Table 7.3). As per the Ministry of Finance, ECBs consist of non-sovereign debt.

The components of non-sovereign debt are:

ADVERTISEMENTS:

(i) Foreign Currency Convertible Bond (FCCB) is a foreign currency denominated bond issued by an Indian company, with principal repayment and interest payments in foreign currency. The minimum maturity is five years. FCCBs must be subscribed to by a nonresident in foreign currency Each FCCB has an equity-related warrant attached.

(ii) Foreign Currency Exchangeable Bond (FCEB) is a bond denominated in any freely convertible foreign currency, and issued to persons who are resident outside India. The principal repayment and interest payments are in foreign currency.

(iii) Overseas loans from commercial banks, and other commercial financial institutions

(iv) Suppliers’ credit and Buyer’s credit (together known as trade credit) for three years and above

(v) Money raised from overseas through the issue of securitized instruments, floating rate bonds, resurgent India bonds, and India development bonds

(vi) Private sector borrowings from the Asian Development Bank, and International Finance Corporation, and Nordic Investment Bank

ADVERTISEMENTS:

(vii) Deposits by non-resident Indians, such as Non-Resident (External) Rupee account, Foreign Currency Non-Resident (Banks) deposits, and non-resident ordinary rupee (NRO) account

(viii) Commercial loans, with a minimum average maturity of three years

(ix) Preference shares (non-convertible, optionally convertible, or partially convertible) denominated in rupees and issued to investors overseas. If money was received after May 2007, the RBI treats preference shares on par with debt. All ECB norms are applicable to them. The rupee interest rate is based on the swap equivalent of LIBOR plus the spread as permissible for ECBs of corresponding maturity.

ECB ceilings are announced annually and are exhausted on a first-come, first-served basis. Norms have been liberalized since 2000. The Ministry of Finance and the RBI amend guidelines from time to time relating to prepayment amounts, ECB ceilings, where funds raised through ECBs can be kept (within the country or overseas) and end use of money raised. The RBI fixes an annual overall ECB limit, within which Indian companies are eligible to avail of ECBs under the automatic route (USD 500 million) and the approval route. It announces a ceiling on the prepayment (USD 500 million in 2010). Such pre-payments do not need the prior approval of the RBI.

The borrower has to obtain approval from the ECB Division, Department of Economic Affairs, and Ministry of Finance. The terms of ECBs are decided by negotiation between the Indian company and the overseas lender. The borrower is free to select the currency of the loan, take a fixed rate or a floating rate loan. He can choose the collateral to be provided to the lenders, but if the borrowing has a guarantee from an Indian Financial Institution or from an Indian Scheduled Commercial Bank, the borrower cannot obtain counter-guarantee or confirmation of the guarantee by a foreign bank/foreign institution.

The RBI categorizes ECB proposals into two groups:

i. Automatic Route:

They include borrowings by Indian companies registered under the Companies Act (1956), units in Special Economic Zones, and Non-Government Organizations that undertake microfinance activities. The maximum amount that can be raised under this route is USD 500 million.

ii. Approval Route:

They include external borrowings by Infrastructure Finance Companies, FCCB proposals from housing finance companies, proposals from NBFC with a minimum average maturity of five years, proposals from SEZ developers, and special purpose vehicles set up for financing infrastructure projects. Companies that have already reached the USD 500 million ceiling under the automatic route, can apply up to a further USD 250 million under this route. The RBI ensures that the terms and conditions of each ECB proposal are reasonable and the ECB is taken at market-related rates.

ECB norms also carry stipulations with respect to eligibility of borrowers and recognized lenders besides the amount and maturity of debt, and end use of funds. Recognized lenders must submit a certificate of due diligence from an overseas bank, to the Authorized Dealer bank of the borrower. Lenders should be recognized and registered in the host countries for the purpose of extending international finance. The loan should be organized through a reputed merchant banker registered with the regulatory authorities of the host countries.

Recognized lenders include:

i. International banks

ii. International capital markets

iii. Multilateral financial institutions (such as International Finance Corporation, Asian Development Bank)

iv. Regional financial institutions

v. Government-owned development financial institutions

vi. Export credit agencies

vii. Equipment suppliers

viii. Foreign collaborators

ix. Foreign equity holders (except Overseas Corporate Bodies (OCBs)

Some key aspects of ECB financing are listed below:

a. In September 2000, sanctioning power was delegated to the RBI for an ECB up to USD 100 million. In January 2004, ECBs with an average maturity of five years and above were put under automatic approval route provided the funds were used for investment in ‘critical sectors’, infrastructure and small and medium enterprises. In 2010, the ceiling under the automatic route was US$ 500 million. ECB prepayment amounts were raised from time to time—from US$ 200 million to USD 500 million in 2010 (subject to compliance with the stipulated minimum average maturity period of the loan).

b. Borrowers are permitted to keep ECB proceeds abroad or to remit these funds to India. When kept overseas, such funds can be invested only in specified liquid assets.

They are:

i. Deposits with overseas branches / subsidiaries of Indian banks abroad,

ii. CDs, T Bills, other monetary instruments of one year maturity with a minimum credit rating by Standard and Poor/Fitch IBCA of AA (-), or a minimum credit rating by Moody’s of Aa3.

c. ECB proceeds can be used for acquiring shares in the disinvestment process, for lending to self-help groups or for microcredit or for bona fide microfinance activity including capacity building by NGOs engaged in microfinance activities, and to make payment for Spectrum Allocation.

d. ECB proceeds cannot be used for lending or investment in the capital market, to meet working capital requirements, Special Purpose Vehicles (SPVs), Money Market Mutual Funds, and the real estate sector.

e. An ECB’s ‘all-in-cost’ under the automatic route includes rate of interest, other fees and expenses in foreign currency (except commitment fee), pre-payment fee and fees payable in Indian rupees.

The payment of withholding tax in Indian rupees is excluded for calculating the all-in-cost.

The ceiling for the all-in-cost is reviewed by the RBI from time to time.

Ceilings in 2010 were:

i. The maximum all-in-cost under the automatic route, for ECBs with an average maturity of 3-5 years, was 200 basis points (or 2%) over the six-month LIBOR.

ii. The maximum all-in-cost under the approval route, for ECBs with an average maturity of 3-5 years, was 300 basis points (or 3%) over the six-month LIBOR.

iii. The maximum all-in-cost under the automatic route, as well as the approval route, for ECBs with a maturity of over five years, was 500 basis points (or 5%) over the six-month LIBOR.

vi. ECBs can be converted into equity only when the Foreign Investment Promotion Board has approved the FDI, the FDI is covered under the automatic route and the pricing of the shares complies with FEMA (1999) guidelines.

vii. The warrants attached to an FCCB are convertible (either wholly or partly) into ordinary shares of the issuing company. FCCBs must be issued in accordance with the Issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depositary Receipt Mechanism) Scheme (1993).

viii. FCEBs must be issued under the Issue of Foreign Currency Exchangeable Bonds (FCEB) Scheme, 2008. The FCEB is exchangeable into equity shares of another company (the Offered Company) either wholly, or partly or on the basis of any equity related warrants attached to the FCEB.

At the time of issue, the exchange price of the offered listed equity-shares should be the higher of:

a. The average of the weekly high and low of the closing prices of the shares of the offered company quoted on the stock exchange during the six months preceding the relevant date;

b. The average of the weekly high and low of the closing prices of the shares of the offered company quoted on a stock exchange during the two weeks preceding the relevant date.

The level of ECBs and their servicing costs are monitored by the Ministry of Finance. Servicing of ECBs consists of principal and interest payments. Servicing of ECBs accounted for 67.4% of total debt service in 2008-09, and 73.4% in 2009-10. In 2013-14, debt service for ECBs is projected at $ 16,459 million. ECB payments form part of India’s external debt service payments.