Here is an essay on ‘Foreign Exchange Market’ for class 11 and 12. Find paragraphs, long and short essays on ‘Foreign Exchange Market’ especially written for school and college students.

Essay Contents:

- Essay on the Regulation of Foreign Exchange Market

- Essay on the Nominal Effective Exchange Rate (NEER) of Foreign Exchange Market

- Essay on the Currency Devolution and Depreciation in Foreign Exchange Market

- Essay on the Effects of Volatility of Exchange Rates on Foreign Exchange Market

- Essay on the Integration of Capital Market and Foreign Exchange Market

- Essay on Indian Foreign Exchange Market

- Essay on the Reforms in the Foreign Exchange Market

Essay # 1. Regulation of Foreign Exchange Market:

A country’s central bank regulates the foreign exchange market. It buys and sells foreign exchange with a view to stabilizing exchange rates and maintaining them within an ‘orderly range’—a range that it considers appropriate. This is called intervention. When each central bank intervenes on its own, it is known as unilateral intervention. When central banks in several countries coordinate their interventions in foreign exchange markets, it is known as coordinated intervention.

ADVERTISEMENTS:

The Indian foreign exchange market is regulated by the RBI. It stabilizes the exchange rate of the rupee in the foreign exchange market by buying or selling rupees against foreign currency, depending on the direction in which it wants the exchange rates to move. When the dollar is sold to commercial banks (in order to stop the slide of the rupee against the dollar), the RBI collects rupees in the foreign exchange market.

When the dollar is purchased from commercial banks (to stop the rupee from appreciating against the dollar), the RBI releases rupees into the foreign exchange market. In both cases the supply of rupees gets affected. If the RBI allows the rupees to stay with the commercial banks, there is an increase in liquidity in the banking system. When there is excess money supply in the banking system due to central bank intervention, it is called unsterilized intervention.

The central bank may choose one or a combination of the following mechanisms for intervention:

i. Open market operations,

ADVERTISEMENTS:

ii. Altering the cash reserve ratio, and

iii. Selling bonds especially issued to absorb the excess liquidity.

The process of removing excess money supply is termed sterilization or sterilized intervention. The bonds being issued with the express intention of mopping up excess liquidity caused by RBI activities in the foreign exchange market are called market stabilization bonds.

Central bank intervention in the foreign exchange market is commonplace. Between 2004 and 2007, Brazil and Russia increased their foreign exchange reserves through massive interventions in the foreign exchange markets. In September 2010, Japan’s central bank conducted unsterilized intervention to bring down the yen’s value.

ADVERTISEMENTS:

Commercial banks, companies, and individuals buy and sell foreign exchange on a daily basis for meeting their specific foreign exchange requirements (business transactions, education, tourism, and travel) or for profiting from exchange rate movements. In addition, commercial banks buy and sell foreign exchange because they treat it as an asset. It is not uncommon for a commercial bank to hold several foreign currencies as part of its proprietary trading.

An Authorized Dealer (AD) is an entity (usually a bank) that is authorized by the RBI under Section 10 of the Foreign Exchange Management Act (1999), to buy and sell foreign exchange. Only designated branches of banks are permitted to transact in foreign exchange. ADs are usually commercial banks, but non-banking entities may also be given this privilege.

ADs in India are classified into- category-I banks (known as AD Cat-I) and category-II banks (known as AD Cat-II). The Foreign Exchange Dealers Association of India (FEDAI) is an association formed by ADs in 1958. According to its website, FEDAI seeks to ensure ‘the smooth functioning of the Indian foreign exchange market’. It also imparts training in foreign exchange market activities to bank personnel and provides assistance to ADs.

An Authorized Money Changer (AMC) is a body corporate licensed by the RBI to deal in foreign exchange. A Full-fledged Money Changer (FFMC) is authorized to purchase foreign exchange from residents and non-residents visiting India, and to sell foreign exchange for certain approved purposes. An FFMC can conduct its business only at places approved by the RBI. The minimum net owned funds should be Rs. 25 lakhs for an FFMC with a single branch and Rs. 50 lakhs for an FFMC with multiple branches.

ADVERTISEMENTS:

Prior to 2007, the RBI permitted Restricted Money Changers (RMCs) but they have since been replaced by franchisees. An RMC was authorized to buy foreign exchange from non-bank clients but could not sell foreign exchange to these clients. RMCs are no longer permitted to operate in the Indian foreign exchange market. However, the RBI permitted RMCs that were functioning within ten kilometres of the international border with Pakistan and Bangladesh to continue their operations as of 2010.

A franchisee (also known as an agency) is appointed by an AD (either Cat-I or Cat-II) or an FFMC to purchase foreign currency. Franchisees perform the function of the erstwhile RMCs, and buy foreign exchange (currency and travellers’ cheques) in exchange for Indian rupees.

RBI guidelines for AMCs and franchises are:

i. Franchisees must display exchange rates for conversion of foreign currency into rupees. The rates must be ‘the same or close to the daily exchange rate’ charged by the AD Cat-I/AD Cat-II /FFMC at its branches.

ADVERTISEMENTS:

ii. AMCs/franchisees can freely purchase foreign currency notes, coins and travellers cheques from residents, non-residents, AMCs and ADs.

iii. The maximum amount of foreign exchange that an AMC can sell to each client is specified in Schedule III to FEMA (Current Account Transactions) Rules, 2000. As of November 2010, the maximum was US$10,000 per visit for clients making private visits abroad, and US$25,000 per visit for clients making business visits abroad. The term ‘abroad’ includes any country except Bhutan and Nepal.

iv. AMCs can open a Foreign Currency Account in India, but can have only one account at a particular centre. The AMC cannot maintain an idle balance in the account.

v. A franchisee must have minimum net owned funds of Rs. 10 lakhs.

ADVERTISEMENTS:

vi. Foreign exchange purchases by the franchisee must be surrendered to the AD/FFMC within seven working days of the purchase.

vii. The franchisee must maintain a record of all transactions. The franchiser must conduct inspections of the franchisee at least once a year.

A market maker is an entity (usually a commercial bank) that offers two-way quotes in the foreign exchange market. It quotes the rate at which it will buy a specific foreign currency (bid rate) and the rate at which it will sell a specific foreign currency (offer rate) and stands ready to buy or sell that specific foreign currency at these rates.

A speculator buys and sells foreign currencies with a view to making a profit from the change in exchange rates between two points in time. He has no underlying requirement for foreign exchange because of a prior contractual commitment. A company may want to buy US$ 1 million to pay for its imports, but a speculator has no such requirement. He buys and sells foreign exchange purely because he thinks he can make a right call on the direction of movement of the exchange rates. Speculators are extremely active in foreign exchange markets, and impart liquidity and depth to the market.

ADVERTISEMENTS:

The Finance Act (2005) distinguishes between hedging and speculation—any contract entered into for hedging purposes is not treated as a speculative transaction. This distinction is important since the taxation of gains from a speculative and a non-speculative derivatives transaction differs under Indian tax rules. A hedger is an entity (either an individual or a business firm) that covers its existing foreign exchange position to protect against loss from future price fluctuations. RBI guidelines issued in 2010 stipulate that NBFCs can participate as clients on designated currency futures exchanges recognized by SEBI, ‘only for the purpose of hedging their underlying forex exposures’, and subject to RBI (Foreign Exchange Department) guidelines.

A foreign exchange broker brings two parties in the foreign exchange market together. The FEDAI provides accreditation to foreign exchange brokers.

Essay # 2.

Nominal Effective Exchange Rate (NEER) of Foreign Exchange Market:

Discussions on international trade and foreign currency dealings make frequent reference to the nominal effective exchange rate (NEER) and real effective exchange rate (REER). Both are exchange rate indices that indicate the external competitiveness of the domestic currency. According to the RBI, the NEER is ‘the weighted geometric average of the bilateral nominal exchange rates of the home currency in terms of foreign currencies’. The NEER a country’s currency is the relative price of the currency in terms of selected foreign currencies.

The NEER is constructed by a country’s central bank as the weighted average of major nominal bilateral exchange rates. The nominal bilateral exchange rate is the exchange rate of a currency with another currency. The NEER of the rupee is the relative price of the rupee in terms of a basket of currencies.

The RBI constructs two types of NEERs for the Indian rupee, both of which use 3-year moving average weights (both exports and trade weights) with 100 as the base value, and 1993-94 as the base year:

ADVERTISEMENTS:

i. A Six-Currency NEER:

It contains the currencies of China, Japan, Hong Kong, the Eurozone, UK and the USA. These countries and regions accounted for around 40% of India’s total foreign trade in 2004-05 (the latest year for which the RBI specified the country’s major trading partners).

ii. A 36-Currency NEER:

It represents currencies of 47 major trading partner countries (including 12 European Union countries) that account for more than three-fourth of India’s total foreign trade.

The countries were selected based upon three criteria:

(i) The share in India’s exports and trade,

ADVERTISEMENTS:

(ii) Regional representation and

(iii) The regular availability of data on exchange rates and prices on a monthly basis.

The Real Effective Exchange Rate (REER) of a currency is its NEER multiplied by the relative local price index. The REER of the rupee is the nominal effective exchange rate multiplied by relative local price index (that is Wholesale Price Index in India divided by Consumer Price Indices of the other countries).

Essay # 3.

Currency Devolution and Depreciation in Foreign Exchange Market:

Currency Devolution and Revaluation:

When the central bank fixes the value of the domestic currency against a selected intervention currency, the former is said to have a fixed exchange rate. The official decline in the value of a currency from its earlier fixed exchange rate is called devaluation. The extent of devaluation is announced by the central bank. Devaluation makes the intervention currency more expensive.

ADVERTISEMENTS:

It will be noted that an exchange rate is a currency pair. So, what is devaluation of one currency is exactly opposite for the other currency. The opposite of devaluation is revaluation that is fewer units of domestic currency are needed in order to buy the intervention currency (and conversely fewer units of domestic currency are received when the intervention currency is sold).

Currency Depreciation and Appreciation:

When the value of the domestic currency against an intervention currency is determined by the forces of demand and supply (as in the case of the rupee-dollar rate), the domestic currency is said to be on a floating exchange rate. Its market value against all other currencies is also determined by the forces of demand and supply. Depreciation is the decline in the market value of the domestic currency with respect to a foreign currency.

The rate of depreciation ‘d’ between day zero and day ‘t’, is expressed as a percentage and calculated as:

d = (St/S0) – 1

where S0 = spot exchange rate (domestic currency per unit of foreign currency) on day zero

ADVERTISEMENTS:

St = spot exchange rate (domestic currency per unit of foreign currency) on day ‘t’

Note that the rate of depreciation is zero when St = S0. Conversely, there is no theoretical upper limit for the rate of depreciation since St can take any value. Currencies of countries such as Zimbabwe (which experienced hyperinflation in 2009) have extremely high depreciation rates.

Appreciation is the rise in the market value of the domestic currency with respect to a foreign currency.

The rate of appreciation ‘a’ between day zero and day ’t’, is expressed as a percentage, and calculated as:

a = 1 – (St/S0)

where S0 = spot exchange rate (domestic currency per unit of foreign currency) on day zero

ADVERTISEMENTS:

St = spot exchange rate (domestic currency per unit of foreign currency) on day ‘t’

Note that the rate of appreciation is zero when St = S0. As St decreases the term (St/S0) approaches zero, and the rate of appreciation approaches 100%.

Essay # 4.

Effects of Volatility of Exchange Rates on Foreign Exchange Market:

Events such as the fall of a government, a coup or declaration of war affect the value of the currency, as do macroeconomic phenomena like rise or fall in interest rates, spike in inflation, unemployment or change in money supply and external events like decline in imports by a country’s major trading partner or imbalances in global demand and supply. While some cause short-term changes in the exchange rate, others have a lasting impact. A currency shows a trend of appreciation or depreciation over time.

For example, the rupee depreciated against the US dollar over two decades from INR 17.50/USD in 1990, to INR 46.21 on July 15, 2010. The Chinese renminbi rose by more than 20% against the US dollar between July 2005 and July 2008. A country on a floating exchange rate experiences greater exchange rate volatility for a variety of reasons— when there is an increase in capital inflows or outflows, in the run-up to a financial crisis, poor fiscal management, rising current account deficits and fiscal deficits. Since exchange rate volatility affects all participants in the foreign exchange market, it must be factored into investment and hedging strategies.

Exchange rate volatility has the following consequences:

i. It Alters the Selection of Settlement Currency:

Exporters and importers change their invoicing currency and settlement currency based on trends in hard currencies. By shifting invoicing to an appreciating currency, exporters shift exchange losses to the buyers. When, the rupee appreciates against the US dollar, some Indian exporters move from dollar invoicing to euro invoicing, while others shift the invoicing currency from the dollar to rupee.

ii. It Increases Uncertainty of Domestic Currency Denominated Cash Flows:

When the domestic currency appreciates, exporters would find that their domestic currency inflows decrease, while for importers the rupee payments for imports would fall.

iii. It Affects the Decision to Hedge Currency Exposure:

When there is a trend of appreciation of the domestic currency, importers do not hedge their foreign currency denominated payments. Similarly, when there is a trend of depreciation of the domestic currency, exporters do not hedge their foreign currency denominated receipts. These decisions tend to change in the face of a trend reversal.

Given the rupee’s consistent decline against the US dollar since 1993, Indian exporters became used to rupee depreciation and did not hedge their receipts. Many of them, caught unawares by the rupee appreciation in 2002, 2003 and 2010, suffered losses because they did nothing to minimize this risk by entering into currency derivative contracts.

iv. It Alters the Selection of Source of Finance:

Currency fluctuations alter financing decisions. Overseas lenders may recall their loans, negotiate for re-pricing of the loan, or convert their loans into equity. Even when the exchange rate remains stable, expectations regarding future exchange rate movements also affect financing plans. When overseas interest rates decline, Indian companies opt for cheaper overseas financing. If they expect the rupee to appreciate during the tenor of the loan, foreign borrowing becomes even more attractive.

v. It Affects Timing of Borrowing:

Currency fluctuation can lead to a postponement of borrowing. In April 2010, the euro became volatile as the EU plunged into a fiscal crisis. As exchange rate volatility increased, Indian companies decided to defer further overseas borrowing until the euro stabilized and global financial markets became less volatile.

vi. It Affects Corporate Profitability:

Currency fluctuations can hurt corporate bottom lines, when a large proportion of revenues are generated overseas. In mid-2010, a weak euro had an adverse impact on the revenues and margins of Indian IT major, Infosys Technologies, and caused a decline in TCS’ revenues generated from Europe.

vii. It Triggers Intervention by Central Banks:

Currency fluctuations lead to a flurry of action by central banks. In May 2010, Greece’s sovereign debt crisis and fiscal crises in Spain, Portugal and Ireland, caused a sharp decline in the value of the euro. The European Central Bank (ECB) purchased €16.5 billion of bonds from financial institutions in the EU. Similarly, within a 12-month period the yen appreciated against the US dollar in 2010. On September 16, 2010, the Japanese Central bank intervened by selling dollars and buying the yen.

viii. It Influences FII Inflows and Outflows:

Portfolio investment in emerging markets is sensitive to exchange rate movements. Large scale outflows occur when a currency becomes volatile. In January 1995, when the Mexican peso fell against the US dollar by 50%, international mutual funds that had invested US$ 45 billion in Mexican stock markets began selling their holdings to exit from Mexico.

Essay # 5.

Integration of Capital Market and Foreign Exchange Market:

All cross-border financial inflows pass through the foreign exchange market. Overseas portfolio inflows first enter the foreign exchange market and then move either into the equity market, money market or debt market depending on where the investment is made. When the capital market and foreign exchange market are well integrated, any change or new information arriving in one market is rapidly reflected in other markets.

A market is said to be efficient based on the speed with which new information is incorporated into prices. The degree to which signals get transmitted between markets within a country and between countries is an indicator of the degree of integration of markets. Conversely, the degree of ‘openness’ of domestic financial markets influences the extent of their integration with global markets.

Activity in capital markets affects foreign exchange markets. When portfolio inflows increase, there is a general upward pressure on stock prices. At the same time there is an increase in demand for the rupee. The rupee appreciates against the dollar. The extent to which foreign inflows and outflows affect the exchange rate depends on the depth and width of the domestic market.

The Rupee as Settlement Currency:

The rupee’s share in the global foreign exchange market is pitiably low and remains miniscule compared to currencies such as the pound sterling, yen and the US dollar. In 1995, the Indian rupee had a near-zero share. In October 2001, its share was 0.2%, and in 2010 0.9%. Even amongst Southeast Asian countries, the Indian rupee runs a poor second to the Singapore dollar.

The dominance of the US dollar in foreign exchange markets, and the continued small share of the Indian rupee, is corroborated by another source. The Bank for International Settlements (BIS) began conducting a Triennial Survey of the global foreign exchange market activity in 1989. Each survey documented the dominance of the dollar in foreign exchange turnover.

The most actively traded currencies are from developed countries with deep capital markets, low inflation rates and low levels of political risk— the US dollar, Canadian dollar, euro, yen, pound sterling, Australian dollar, Swiss Franc, the Hong Kong dollar, and the Swedish kroner. The most popular currencies are the US dollar, yen and euro. The euro, launched in January 1999, is the Eurozone’s common currency, and the world’s youngest currency. Within a short span of a decade, it has come to be seen as an alternative to the US dollar as an invoicing currency and anchor currency.

Renminbi as the New Invoicing Currency:

After the end of World War II, the US dollar was globally accepted as the international reserve currency. This was a natural consequence of the evolution of the international financial system. In the 21st century, China has emerged as a leading economic power, overtaking Japan in terms of economic size. By the end of 2009, China and Japan together held 43% of the world’s foreign exchange reserves. The yuan (also known as the renminbi) may join the US dollar as a reserve currency.

China’s impressive growth rate between 2000 and 2010, its emergence as the largest trading partner of Brazil, Japan and USA, its strong export-led growth, large domestic market, and sustained accumulation of foreign exchange reserves, made it possible for the yuan to replace the US dollar as the preferred invoicing currency. But the yuan is largely unknown outside China. Cross-border trade settled through yuan was a paltry 3.5% in 2010.

This was because China imposed restrictions on the use of the renminbi—foreign investors could not invest their renminbi holdings in China, and foreign companies were not permitted to hedge their exposure in the Chinese financial markets. Since this posed a huge deterrent to the renminbi becoming an international currency, China embarked on a set of measures to popularize its usage in line with the target deadline of making Shanghai an international financial centre by 2020.

It began removing curbs on the free flow of its currency in 2009. It launched a program in 2009 to encourage its trading partners to use the renminbi for settling cross-border transactions. The scope of this one-year pilot program was expanded in June 2010 and received assistance from global banks which encouraged their clients to use the renminbi instead of the US dollar to settle transactions.

In June 2010, China entered into an agreement through which Pakistan’s cross-border trade with China would be settled using the renminbi instead of the US dollar. A similar arrangement was being mooted with India. It also entered into currency swap deals with Argentina, Indonesia, Malaysia and South Korea, to encourage them to use the renminbi in cross-border trades.

The Governor of the People’s Bank of China (China’s central bank) announced that the bank was ready to assist companies overseas to use the renminbi as the settlement currency. A number of financial and hedging instruments denominated in the currency were permitted in the Chinese financial markets. In August 2010, China opened up its inter-bank bond market to foreign central banks and foreign commercial banks with renminbi reserves. Renminbi-denominated bonds are permitted to be issued in Hong Kong by foreign companies.

Essay # 6.

Indian Foreign Exchange Market:

The foreign exchange market consists of the RBI (regulator), authorized dealers (ADs), market makers, full-fledged money changers, franchisees, foreign exchange brokers and clients. The market operates during business hours of the authorized dealers. ADs and banks trade in foreign exchange on their own behalf (called proprietary trades) or on behalf of their clients (client-driven trades). The inter-bank market (or the wholesale market) consists of the purchase and sale of foreign exchange between commercial banks. All over the world, the inter-bank market is the most active, with more than 80% of foreign exchange trades struck between commercial banks.

Clearing:

Inter-bank foreign exchange trades in India are cleared through the Clearing Corporation of India Limited (CCIL) which began its clearing operations on November 8, 2002. The CCIL received approval from the United States Federal Reserve to clear foreign exchange deals in the same year. The CCIL provides counter-party guarantee for each leg of every inter-bank foreign exchange transaction.

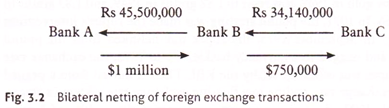

The CCIL processes inter-bank foreign exchange deals through an electronic payment system called INFINET, and offers multilateral netting, so that each bank settles several transactions with different banks in only a single amount per currency. Figure 3.2 shows the process of bilateral netting for two foreign exchange deals.

Bank A has agreed to sell $1 million to Bank B in exchange for rupees, at an exchange rate of INR 45.50/$. Bank B entered into another deal with Bank C to sell $750,000 in exchange for rupees, at an exchange rate of INR 45.52/$. In the multilateral netting mechanism, Bank B has to make the net payment of Rs. 11.36 million to CCIL, since the rupee leg of both transactions are netted out.

The rupee leg of each transaction for Bank B is:

Payment @ (INR 45.50) ($1 million) = INR 45.50 million

Receipt @ (INR 45.52) ($750000) = INR 34.14 million

Net payment by Bank B = INR 45.50 million – 34.14 million = INR 11.36 million

The retail market consists of trades between commercial banks and their corporate and non-corporate clients. Such trades are called merchant trades. Companies need to buy or sell foreign exchange due to exports and imports, overseas loans, foreign exchange remittances (inwards and outwards), and inter-subsidiary transfers. Individuals need foreign exchange to meet the needs of education, medical treatment, tourism and travel. They may also wish to convert gifts of foreign exchange into domestic currency. Exchange rates in the retail market (merchant rates) are higher than those in the wholesale market (inter-bank rates).

Offshore Rupee-Dollar Market:

Indian companies can hedge their foreign exchange positions, but they are not permitted can speculate on the movements of the rupee-dollar exchange rate. Companies circumvent these rules by entering into speculative trades outside India. Such deals take place in the offshore rupee-dollar market through a currency derivatives product called the non-deliverable forward contract. By 2010, the offshore rupee-dollar market tripled in size compared to the value of trades in 2007. By 2010, BIS estimated that more than one-half of the total rupee forward and forex swap market was offshore.

Evolution of the Exchange Rate Regime in India:

Between 1947 and 1971, the Indian rupee’s par value was fixed in terms of fine gold. The par value set at 4.15 grains of fine gold in 1947, was reset to 1.88 grains in 1949, and 1.83 grains in June 1966. In 1971, the pound sterling was made the rupee’s intervention currency. In September 1975, the rupee was delinked from the pound sterling and pegged to a currency basket. Up to 1992, the exchange rate of the rupee was officially set by the RBI. Then it moved from a pegged (fixed) exchange rate regime to a floating exchange rate system in stages.

In March 1992, the rupee was put on a partial float—40% of foreign exchange inflows were converted at the official exchange rate fixed by the RBI by surrendering the foreign exchange to an AD. The remaining could be sold in the open market at market-determined exchange rates. In March 1993, the rupee was put on a full float. Since then, the exchange rate of the rupee is determined by demand and supply forces in the Indian foreign exchange market, and all foreign exchange is converted into the rupee (and vice versa) at the market-determined exchange rate.

Even though the rate of the rupee versus the US dollar is determined by market forces, the central bank steps in to buy or sell the domestic currency in order to keep the exchange rate within a desired range.

Essay # 7. Reforms in the Foreign Exchange Market:

The RBI followed a carefully calibrated sequence of reforms in the foreign exchange market. These reforms are largely based on the recommendations of several committees instituted by the RBI.

i. Prior to March 1992:

A single exchange rate system existed. All foreign exchange had to be converted at the official exchange rate specified by the RBI.

ii. March 1992:

A dual exchange rate system was adopted, following the acceptance of the recommendations of the High Level Committee on Balance of Payments (Rangarajan Committee). Under this system, the Liberalized Exchange Rate Management System (LERMS) was introduced. Two exchange rates coexisted—the official rate and the market determined rate.

The RBI continued to announce an official exchange rate, 40% of the inflows were to be converted at this rate, and the rest at market-determined rates. All foreign exchange receipts had to be routed through the RBI (via the Authorized Dealers) at the official exchange rate. The LERMS was intended to familiarize market participants with the market-determined exchange rates and exchange rate fluctuations.

Illustration 2:

Calculate the rupee receipts under the dual exchange rate system. Assume that the official exchange rate was INR 35/USD and the market rate was INR 36/USD. An exporter received $1 million. What was his net gain under the dual exchange rate system, as compared to the single exchange rate system?

Solution:

Under the dual exchange rate system- Converted $400,000 at INR 35/$, and the balance of $600,000 at INR 36/$. His rupee cash receipts = ($400000) × (INR 35) + ($600000) × (INR 36) = INR 35,600,000. Under the single exchange rate system – Receipts = ($1 million) × (INR 35) = INR 35 million. His net gain under dual exchange rate system = INR 35.6 million – INR 35 million = INR 0.6 million

i. March 1993:

The modified LERMS or the Single (Market Determined) Exchange Rate System came into effect on March 1. This led to a convergence of the dual rates adopted just a year earlier, and the foreign exchange market moved back to a single exchange rate system. But it was a market-determined rate and there was no more an official exchange rate. All foreign exchange receipts had to be routed through the RBI (via the Authorized Dealers) and converted into rupees.

ii. August 1994:

The rupee became fully convertible on the current account.

The onus of enforcing discipline in the financial system falls on the regulators and the central bank. Once a currency crisis strikes, the central bank is faced with the task of getting the financial system back on its feet and restoring credibility in the financial institutions. The RBI has the twin responsibilities of maintaining stability of the rupee versus foreign currencies (exchange rate stability), as well as ensuring that the price levels in the country are stable (domestic price stability), while keeping in mind the need for economic growth and a healthy, vibrant financial infrastructure.