After reading this article you will learn about the break-even point of an enterprise.

Every enterprise has a break-even point which is the critical criterion of its probable profit range at a given or estimated volume of business. Profit must not be viewed as an earning by chance or luck. It has to be scientifically planned for.

An entrepreneur does not plunge into business blindly with the uncertain hope of earning profit or getting lost. The costs and the sales factors have to be analysed in detail. The break-even charts are drawn in order to find out the range of profit- zones for the proposed enterprise.

Break-even analysis is a scientific method of evaluating the profit potential of a business concern. It is the appraisal of the revenues and costs of an enterprise in the context of its volumes of sales. The main aim is to determine that volume of sales at which the firm’s costs and revenues will be equal.

Break-even point, in other words, is that stage of the particular business enterprise at which its volume of business is such that it earns enough to cover all its expenses, but earns no profit, nor incurs any loss. The break-even point is computed on the basis of fixed and variable costs. The point at which the firm is available to sell sufficient units of output to cover the fixed costs is known as the B. E. P. (Break -Even Point).

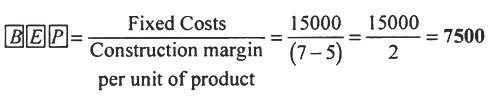

Suppose fixed costs in a proposed enterprise are estimated to be Rs. 15,000.00 per year while variable costs are estimated at Rs. 5.00 per unit. The selling price is to be fixed at Rs. 7.00 per unit.

The Break-Even point (B. E. P.) for this enterprise would be:

It means that the above-said proposed enterprise shall have to sell the minimum of 7,500 units of its product per year to be able to just cover all its costs and avoid any loss. Thus B. E. P. is that point in functioning of a business enterprise at which only the costs are covered, there is no profit. It follows from the above analysis that only if the market survey made by the promoters indicates a sales forecast higher than 7,500 units per year, the proposed firm can be considered to have the profit potentials.

Following examples will make the point clear:

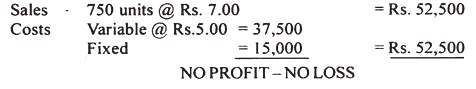

A. At the break-even point:

The firm sells 7,500 units of product at the rate of Rs. 7.00 per unit. The variable costs are Rs. 5.00 per unit and the fixed costs are Rs. 15000.00.

It would work out as under:

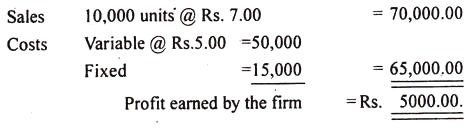

B. At higher than the B. E. P.:

The firm can sell 10,000 units at the rate of Rs. 7.00 per unit, the variable costs and fixed costs are as above.

Now the position would be as under:

Break even chart is graphically represented on the assumption that fixed costs remain constant and variable costs change with the change in the volume of sales.

Units of production are shown in Fig. 19.2 along the X-axis, and costs and revenue are shown along the Y-axis. The fixed costs are signified by the straight line FC and variable costs are recorded above the fixed cost line FC; thus the TC line represents Total Costs, i.e. fixed costs plus variable costs. The line TR indicates total revenue from sales at a given selling price.

The point at which TC and TR lines intersect is where the firm reaches the break-even point (no profit, no loss at P volume). If sales remain left to the BEP there would be loss to firm, if the sales go to the right to the BEP, there is possibility of profits.

The promoters can construct bread-even charts on the basis of estimated sales and costs and find out the profit or loss zones. If their forecasts of sales are above the BEP, they would proceed with the efforts to establish or expand the enterprise with the mobilisation of necessary investments and assets. If their sales forecasts lie below the BEP they have to think twice before starting the operations.

Even after the firm has been established break-even analysis is helpful in measuring the effects of change in price, costs, expansion of capacity, evaluating sales promotion activities, etc.