The methods used in analysis of financial statements are as follows: 1. Comparative Financial Statements 2. Common-Size Statements 3. Trend Ratios 4. Ratio Analysis.

Method # 1. Comparative Financial Statements:

Comparative financial statements are statements of financial position of a business designed to provide time perspective to the consideration of various elements of financial position embodied in such statements.

Comparative financial statements reveal the following:

I. Absolute data (money values or rupee amounts)

ADVERTISEMENTS:

II. Increase or reduction in absolute data in terms of money values

III. Increase or reduction in absolute data in terms of percentages

IV. Comparison in terms of ratios

V. Percentage of totals

ADVERTISEMENTS:

Financial statements of two or more firms can also be compared for drawing inferences. This is called ‘interfirm comparison’.

I. Comparative Income Statement:

A comparative income statement shows the absolute figures for two or more periods and the absolute change from one period to another. Since the figures are shown side by side, the user can quickly understand the operational performance of the firm in different periods and draw conclusions.

II. Comparative Balance Sheet:

ADVERTISEMENTS:

Balance sheets as on two or more different dates are used for comparing the assets, liabilities and the net worth of the company. Comparative balance sheet is useful for studying the trends of an undertaking.

Advantages:

The comparative financial statements are useful for analysis of the following:

a. Comparative statements indicate trends in sales, cost of production, profits etc. and help the analyst to evaluate the performance of the company.

ADVERTISEMENTS:

b. Comparative statements can also be used to compare the performance of the firm with the average performance of the industry or interfirm comparison. This helps in identification of the weaknesses of the firm and remedial measures can be taken accordingly.

Disadvantages:

The comparative financial statements suffers from the following weaknesses:

i. Interfirm comparison can be misleading if the firms are not identical in size and age and when they follow different accounting procedures with regard to depreciation, inventory valuation etc.

ADVERTISEMENTS:

ii. Inter-period comparison may also be misleading, if the period has witnessed changes in accounting policies, inflation, recession etc.

Problem 1:

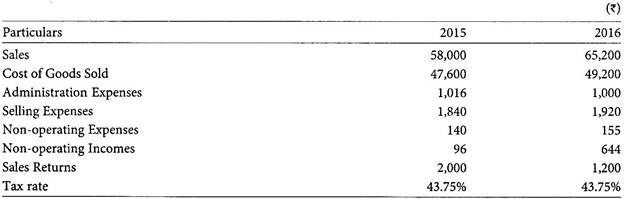

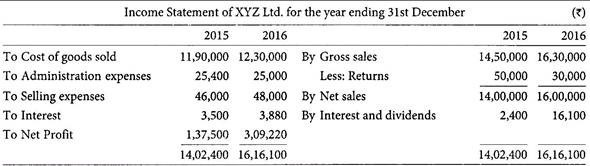

From the following particulars pertaining to ABC Ltd. you are required to prepare a comparative Income Statement and interpret the changes:

Solution:

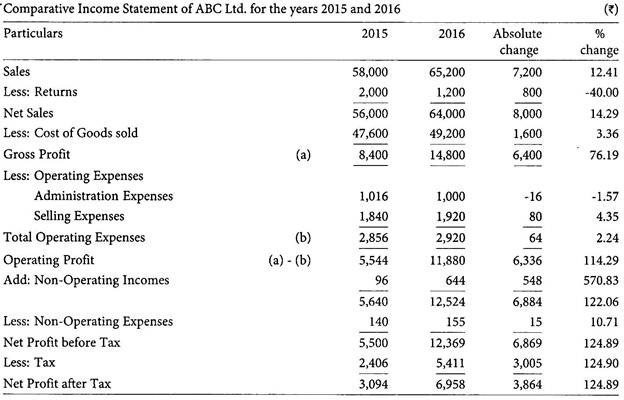

Interpretation:

(1) There is a modest increase in sales. While gross sales have increased, returns have come down by 40%, which is a healthy sign. It points towards increased acceptability of the company’s products and customer satisfaction.

(2) The rate of growth of sales is considerably higher than the rate of growth of cost of goods sold. This has resulted in a handsome rise in gross profit of the company.

ADVERTISEMENTS:

(3) There is a marginal fall is administration expenses and a marginal rise in selling expenses, which do not affect the overall financial position of the company significantly.

(4) There is an abnormally high rise in non-operating income. However, it can be attributed to the low base of the previous year. The increase in operating profit without considering the non-operating income has been impressive.

(5) The net profit before and after tax have increased at the same rate, since the tax rate applicable to both the years is the same. Both the figures have doubled in 2016.

(6) The overall profitability of the company is more than satisfactory.

Problem 2:

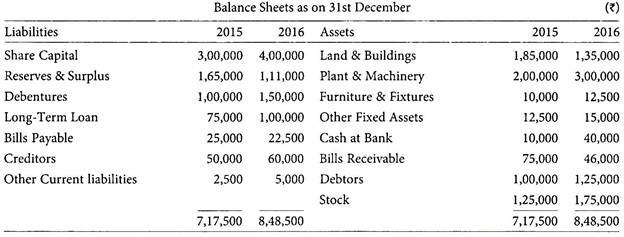

Following are the Balance Sheets of ABC Ltd. for the years 2015 and 2016. Prepare a Comparative Balance Sheet and explain the financial position of the concern.

Solution:

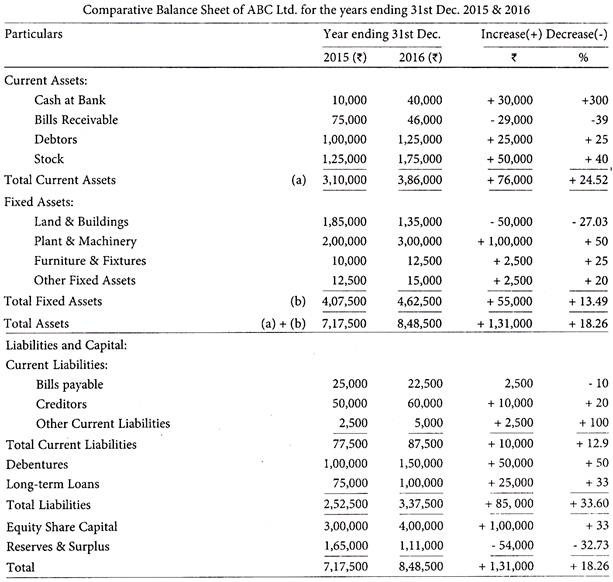

Interpretation:

(a) In the comparative balance sheet of the company in 2016 shows an increase in fixed assets of Rs.55,000 (13.49% where as long-term liabilities and share capital showed an increase of Rs.75,000 and Rs.1,00,000 respectively. So, the company purchased fixed assets out of long-term funds. So, there will be no change in the working capital.

(b) Current assets showed an increase of 24.52% and cash Rs.30,000 (300%) stock also increased by Rs.50,000, Current liabilities showed an increase of Rs.10,000 (12.9%). So, the company acquired current assets from long-term fund. The liquidity position improved considerably.

(c) Reserves and surplus were decreased by Rs.52,000 (32.7%). So, the company might have utilised the reserve for the issue of bonus shares or for the payment of dividends.

ADVERTISEMENTS:

The overall position of the company is satisfactory.

Method # 2. Common-Size Financial Statements:

The figures shown in financial statements viz. profit and loss account and balance sheet are converted to percentages so as to establish each element to the total figure of the statement and these statements are called ‘common-size statements’. These statements are useful in analysis of the performance of the company by analyzing each individual element to the total figure of the statement.

These statements will also assist in analyzing the performance over years and also with the figures of the competitive firm in the industry for making analysis of relative efficiency. The following statements show the method of presentation of the data.

I. Common-Size Income Statement:

In common size income statement, the sales figure is taken as 100 and all other figures of costs and expenses are expressed as percentage to sales. When other costs and expenses are reduced from sales figure of ‘100’, the balance figure is taken as net profit. This reveals the efficiency of the firm in generating revenue which leads to profitability and we can make analysis of different components of cost as proportion to sales. Interfirm comparison of common size income statements reveal the relative efficiency of costs incurred.

II. Common-Size Balance Sheet:

ADVERTISEMENTS:

In common size balance sheet, the total of assets side or liabilities side is taken as ‘100’ and all figures of assets and liabilities, capital and reserves are expressed as a proportion to the total i.e. 100. The common size balance sheet reveals the proportion of fixed assets to current assets, composition of fixed assets and current assets, proportion of long-term funds to current liabilities and provisions, composition of current liabilities etc. It also helps in making interfirm comparison and highlights the financial health and long-term solvency, ability to meet short-term obligations and liquidity position of the enterprise.

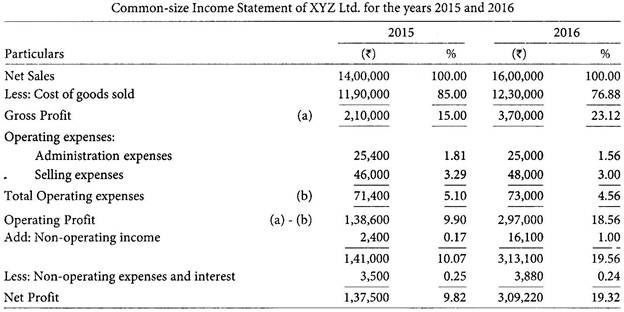

Problem 3:

The following is the income statement of a XYZ Ltd. for the years 2015 and 2016. Convert them into Common-size Income Statement and comment on the profitability.

Solution:

Interpretation:

ADVERTISEMENTS:

(1) The cost of goods in the year 2015 was 85%. It was reduced to 76.88% in 2016 and as a result the gross profit increased from 15% in 2015 to 23.12% in 2016.

(2) The operating expenses were decreased from 5.1% in 2015 to 4.56% in 2016. So, the operating profit shows an increase.

(3) The net profit in 2015 was 9.82% to 19.32% in 2016. The net profit actually doubled during period. The profitability of the concern is satisfactory.

Method # 3. Trend Ratios:

The trend ratios of different items are calculated for various periods for comparison purpose. The trend ratios are the index numbers of the movements of reported financial items in the financial statements which are calculated for more than one financial year. The calculation of trend ratios are based on statistical technique called ‘ index numbers’. The trend ratios help in making horizontal analysis of comparative statements. It reflects the behaviour of items over a period of time.

The methodology used in computation of trend ratios is as follows:

ADVERTISEMENTS:

I. The accounting principles and policies should be consistently followed throughout the period for which the trend ratios are calculated.

II. The trend ratios should be calculated only for the items which have logical relationship with one another.

III. The trend analysis should be made at least for four consecutive years.

IV. The financial statements of one financial year should be selected as a base statement and financial items of it should be assigned with value as 100.

V. Then trend ratios of subsequent years’ financial statements are calculated by applying the following formula:

VI. Tabulate the trend ratios for analysis of trend over a period.

The trend percentages are calculated for select major financial items in the financial statements to arrive at the conclusions for important changes. The trend may sometimes be affected by external factors like government policies, economic conditions, changes in income distribution, technology development, population growth, changes in tastes and habits etc. The trend analysis is a simple technique and does not involve tedious calculations.

Limitations:

The analysis through trend ratios is subject to the following limitations:

I. The trend ratios are incomparable, if there is inconsistency in accounting policies and practices.

II. The price level changes are represented in trend ratios.

III. The trend ratios must be studied along with absolute data for correct analysis.

IV. While analyzing the trend ratios, non-financial data should also be considered, otherwise conclusions would be misleading.

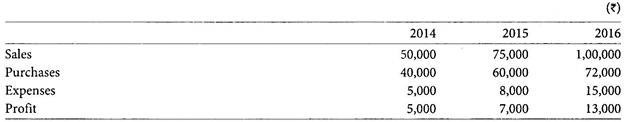

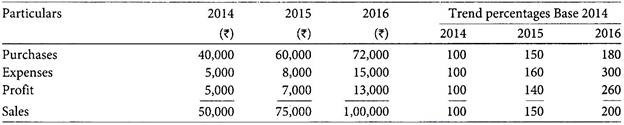

Problem 4:

From the following data, calculate trend a percentage taking 2014 as base:

Solution:

Method # 4. Ratios:

The term ‘accounting ratio’ is used to describe significant relationships which exist between figures shown in a balance sheet, in a profit and loss account, in a budgetary control system or in any other part of the accounting organization. The accounting ratios indicate a quantitative relationship which is used for analysis and decision making.

It provides basis for interfirm, as well as, intra-firm comparison. The ratios will be effective only when they are compared with ratios of base period or with standards or with the industry ratios. The financial statements viz. Income statement and Balance Sheet report what has actually happened to earnings during a specified period and presents a summary of financial position of the company at a given point of time.

The statement of retained earnings reconciles income earned during the year and any dividends distributed with the change in retained earnings between the start and end of the financial year under study. The statement of changes in financial position provides a summary of funds flow during the period of financial statements.

A ratio is a quotient of two numbers and the relation expressed between two accounting figures is known as ‘accounting ratio’. Ratio analysis is a very powerful analytical tool useful for measuring performance of an organization. The ratio analysis concentrates on the interrelationship among the figures appearing in the financial statements.

The ratio analysis helps the management to analyze the past performance of the firm and to make further projections. Ratio analysis allow interested parties like shareholders, investors, creditors, Government and analysts to make an evaluation of certain aspects of a firm’s performance. Ratio analysis is a process of comparison of one figure against another, which make a ratio.

The appraisal of the ratios will make proper analysis about the strengths and weaknesses of the firm’s operations. The calculation of ratios is a relatively easy and simple task but the proper analysis and interpretation of the ratios can be made only by the skilled analyst. While interpreting the financial information, the analyst has to be careful in limitations imposed by the accounting concepts and methods. Information of nonfinancial nature will also be taken into consideration before a meaningful analysis is made. Ratio analysis is extremely helpful in providing valuable insight into a company’s financial picture.

Ratios normally pinpoint a business firm’s strengths and weakness in two ways:

I. Ratios provide an easy way to compare present performance with past.

II. Ratios depict the areas in which a particular business is competitively advantaged or disadvantaged through comparing ratios to those of other businesses of the same size within the same industry.

Du Pont Analysis:

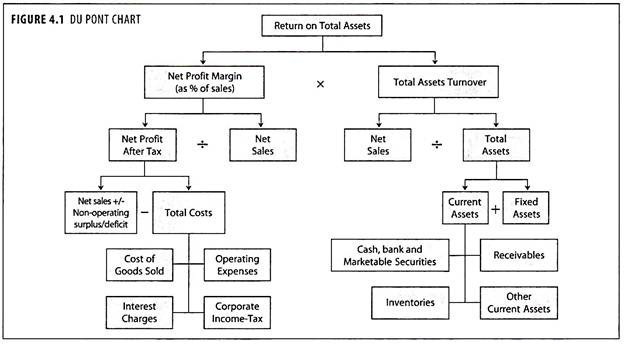

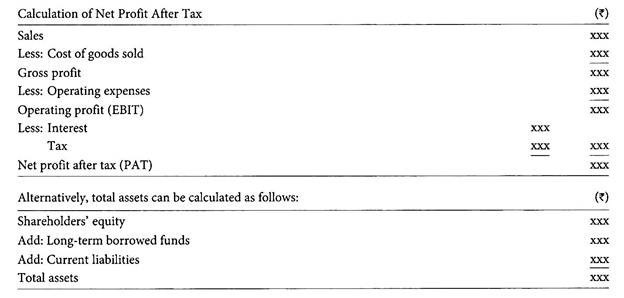

The Du Pont company of USA has introduced a system of financial analysis which has received a wider acceptance. The Du Pont Chart is a chart of financial ratios, which analyses the net profit margin in terms of asset turnover. Du Pont, a US company, developed and pioneered the systematic use of return on assets to evaluate the performance of different organisational units and target areas for improvement.

This led to development of Du Pont chart which exhibited the return on assets of financial control system. The central measure of Du Pont analysis is the return on assets (ROA), a variant of return on investments (ROI). ROA is computed by dividing operating profit EBIT by the average invested capital (i.e. capital deployed in acquiring operating assets – fixed assets and working capital.

ROA measures return on core assets (operating assets) and excludes from its denominator the amount of non-core assets. It also excludes from its denominator capital work-in-progress i.e. assets under construction. The numerator will comprise of only operating income (EBIT) and non-operating income/loss being excluded.

The Du Pont analysis is used as a tool in measuring the managerial performance by linking the net profit margin to total assets turnover. Du Pont analysis is an extension of return on investment ratio, which measures the overall profitability and operational efficiency of the firm. The Du Pont analysis considers the interrelationship of accounting information given in financial statements.

Comparative analysis can be done with reference to the data of previous period or industry data or competitor’s data. The Du Pont chart indicates that the return on investment is ascertained as a product of net profit margin ratio and investment turnover ratio. The Du Pont chart is useful in segregation and identification of factors that effect the overall performance of the company.

It will be seen from the above chart that, return on investment can be improved by increasing one or both of its components viz-the net profit margin and the investment turnover in any of the following ways:

(a) Increasing the net profit margin, or

(b) Increasing the investment turnover, or

(c) Increasing both net profit margin and investment turnover.

The obvious generalizations that can be made about ROI that any action is beneficial provided that it:

(1) Boosts sales,

(2) Reduces invested capital, and

(3) Reduces cost (while holding the other two factors constant).

Problem 5:

NDA Ltd. has a debt-equity mix of 3/2 and total assets turnover ratio of 2. If the net profit margin of NDA Ltd. is 5 per cent, what will be its return on equity (ROE)?

Solution:

Under Du Pont Analysis:

Debt – Equity = 3/2 implies total assets of 5

Debt/Assets = 3/5 = 0.60

ROE = 0.05 x 2 x 2.5 = 0.25 or 25%

Importance of Ratio Analysis:

The major benefits arising from ratio analysis are as follows:

(a) Ratio analysis is a very powerful analytical tool useful for measuring performance of an organization.

(b) Ratio analysis concentrates on the interrelationship among the figures appearing in the financial statements.

(c) Ratio analysis helps the management to analyze the past performance of the firm and to make further projections.

(d) Ratio analysis allow interested parties to make evaluation of certain aspects of the firm as below:

i. Shareholders and prospective investors will analyze ratios for taking investment and disinvestment decisions.

ii. Bankers who provide working capital will analyze ratios for appraising the creditworthiness of the firm.

iii. The financial institutions who provide long-term debt will analyze ratios for project appraisal and debt servicing capacity of the firm.

iv. The financial analysts will analyze ratios for making comparisons and recommending to the investing public.

v. The credit rating agencies will analyze ratios of a firm to give the credit rating to the firm.

vi. The Government agencies will analyze ratios of a firm for review of its performance.

vii. The company’s management will analyze ratios for determining the financial health and its profitability.

viii. The ratios will also be used for inter firm and intra-firm comparison and will also be used in financial planning and decision-making.

Factors Affecting Efficacy of Ratios:

Ratios by themselves mean nothing. Caution has to be exercised in using ratios.

They must always be compared with:

(a) A norm or a target,

(b) Previous ratios in order to assess trends, and

(c) The ratios achieved in other comparable companies (intercompany comparisons).

The following limitations must be taken into account:

I. Ratios are calculated from financial statements which are affected by the financial bases and policies adopted on such matters as depreciation and the valuation of stocks.

II. Financial statements do not represent a complete picture of the business, but merely a collection of facts which can be expressed in monetary terms. These may not refer to other factors which affect performance.

III. Over use of ratios as controls on managers could be dangerous, in that management might concentrate more on simply improving the ratios than on dealing with the significant issues. For example, the return on capital employed can be improved by reducing assets rather than increasing profits.

IV. A ratio is a comparison of two figures, a numerator and a denominator. In comparing ratios it may be difficult to determine whether differences are due to changes in the numerator, or in the denominator or in both.

V. Ratios are interconnected. They should not be treated in isolation. The effective use of ratios, therefore, depends on being aware of all these limitations and ensuring that, following comparative analysis, they are used as a trigger point for investigation and corrective action rather than being treated as meaningful in themselves.

VI. The analysis of ratios clarifies trends and weaknesses in performance as a guide to action as long as proper comparisons are made and the reasons for adverse trends or deviations from the norm are investigated thoroughly.

VII. While making inter firm comparison, the analyst must keep in mind that different firms follow different accounting policies e.g., depreciation allowance, valuation of inventory etc.

VIII. The standards will differ from industry to industry. Comparison of ratios of firms belonging to different industries is not suggested.

IX. Since ratios are calculated from past records, there are no indicators of future.

X. Proper care should be exercised to study only such figures as have a cause and effect relationship, otherwise ratios will only be meaningless or misleading.

XI. The reliability and significance attached to ratios depends on the accuracy of data based on which ratios are calculated.

XII. Ratios of a company can have meaning only when they are compared against standards. Past performance of the same company cannot be benchmarked when there is change in circumstances.

XIII. The change in price levels due to inflation will distort the reliability of ratio analysis.

XIV. The analyst should have thorough knowledge of methods of window dressing.