The total risk of a company can be broken-down into business risk and financial risk.

A company’s business risk is determined by how it invest its funds i.e., the type of projects which it undertakes, while financial risk is determined by how it finances these investments.

A company’s competitive position, the industries in which it operates, the company’s market share, the rate of growth of the market and the stage of maturity all influence business risk.

Financial risk, on the other hand, is primarily influenced by the level of financial gearing, interest cover, operating leverage, and cash flow adequacy.

Meaning of Risk:

ADVERTISEMENTS:

In modern day scenario, almost every business operates in an environment which is not within its control. Business is exposed to many dangers both internal as well as external.

It suffers risks from the points such as: its products, competitors, properties, employees or even its customers.

Some of these risks are general whereas most others are connected with or affect finances of the enterprise.

‘Risk’ means possibility of a future loss which can be foreseen. Risks, as such, financial or otherwise, can be well predicted.

ADVERTISEMENTS:

Usually in business accounting also suitable provisions are made for all such risks or for most of them.

This is done by forecasting possibilities of such risks on the basis of their past occurrences and future estimated trends. An example of this is the ‘provision for doubtful debts’ made while determining current year’s profits.

Meaning of Uncertainty:

The word uncertainty to cover all future outcomes which cannot be predicted with accuracy. People have different attitudes towards the future.

Uncertainty arises from a lack of previous experience and knowledge.

ADVERTISEMENTS:

In a new venture, for example, it is possible for uncertainty to be attached to the following factors:

(i) Date of completion.

(ii) Level of capital outlay required.

(iii) Level of selling prices.

ADVERTISEMENTS:

(iv) Level of sales volume.

(v) Level of revenue.

(vi) Level of operating costs.

(vii) Taxation rules.

ADVERTISEMENTS:

Inevitably decision making under conditions of uncertainty is more complicated than is the case under risk condition.

In fact there is no single best criterion that should be used in selecting a strategy of the various available techniques.

Risk occurs where future outcomes of current actions are unknown, but the probabilities of these future outcomes can be reasonably estimated from a knowledge of past and current events.

Risk is therefore normally measured by volatility of returns, because a certain outcome has no variance and, hence, no volatility.

ADVERTISEMENTS:

Uncertainty, on the other hand, occurs where the probabilities of future outcomes cannot be predicted from past or current events, because no probability estimates are available.

Risk-Return Relationship in Project Selection:

The acceptability of projects depends upon cash flows and risk.

Cash flow is operational cash receipts less operational cash expenditure and investment outlay.

Risk is a more difficult operational concept to grasp.

ADVERTISEMENTS:

Risk must be taken into account when estimating the required rate of return on a project.

Risk relates to the volatility of the expected outcome, the dispersion or spread of likely returns around the expected return.

Investors do not like risk and the greater the riskiness of returns on a project, the greater the return they will require.

There is a trade-off between risk and return which must be reflected in the discount rates applied to investment opportunities.

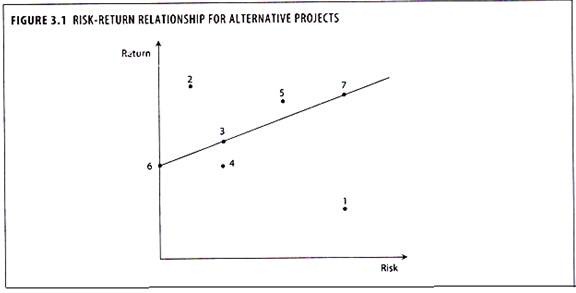

Figure 3.1 shows the risk-return relationship of seven projects:

The best available project is number 2, it is a high return and low risk project, and presents the most and desirable combination of these characteristics.

ADVERTISEMENTS:

The least desirable project is number 1, which has a low return and high risk project.

Investment number 3 will always be preferred to investment number 4, because it has a higher return for the same level of risk.

The highest risk project is number 7, but it also has high expectation return.

The project 6 is a zero risk investment with a certain outcome. Such an investment might be a short dated Government security, where the exact interest rate is known in advance. If it is assumed that the line joining projects 6, 3 and 7 represents the trade-off between risk and return in the real world. These three projects can be examined further, since these three projects are on the risk- return line, they have zero net present values. Their expected returns are just enough to compensate for their riskiness.

Investors can be logical in their choice patterns and yet select either 6 or 3 or 7. Equally, and investor could choose to invest anywhere along the risk-return line 6-3-7 by varying the proportions of his total portfolio.

Meaning of Risk Management:

ADVERTISEMENTS:

Risk management is the process of measuring or assessing risk and developing strategies to manage it.

It is a systematic approach in identifying, analyzing and controlling areas or events with a potential for causing unwanted change.

It is through risk management that risks to any specific program are assessed and systematically managed to reduce risk to an acceptable level.

Risk management is the act or practice of controlling risk.

It includes risk planning, assessing risk areas, developing risk handling options, monitoring risks to determine how risks have changed and documenting overall risk management program.

Objectives of Risk Management:

1. Risk management basically has the following objectives.

ADVERTISEMENTS:

2. Anticipating the uncertainty and the degree of uncertainty of the events not happening the way they are planned.

3. Channelizing events to happen the way they are planned.

4. Setting right, at the earliest opportunity, deviations from plans, whenever they occur.

5. Ensuring that the objective of the planned event is achieved by alternative means, when the means chosen proves wrong, and

6. In case the expected event is frustrated, making the damage minimal.

Steps in Risk Management Process:

Risk management process refers to the process of measuring or assessing risk and then developing strategies to manage risk.

ADVERTISEMENTS:

The steps involved in the risk management process are as follows:

1. Identifying and classifying the areas and nature of risks.

2. Evaluating the degree of risks.

3. Eliminating the risks, wherever possible.

4. Overcoming the risks by timely action.

5. Transferring the risks appropriately.

Application of Risk Management in New Projects:

ADVERTISEMENTS:

The risk evaluation and its minimization is to be made for the projects which are going to be implemented.

The application of risk management in new projects consists of the following steps:

1. Plan should include risk management tasks, responsibilities, activities and budget.

2. Assigning a risk officer, a team member other than a Project manager, who is responsible for foreseeing potential project problems.

3. Maintaining live project risk data base. Each risk should have the following attributes: opening date, title, short description, probability and importance.

4. Creating anonymous risk reporting channels. Each team member should have possibility to report risk that he foresees in the project.

5. Preparing mitigation plans for risks that are chosen to be mitigated.

6. Summarize the planned and faced risks, effectiveness of mitigation activities and effort spend for the risk management.

Enterprise Risk Management (ERM):

ERM deals with risk and opportunities affecting value creation or preservation.

ERM is a comprehensive and integrated approach to addressing corporate risk.

ERM enables management to effectively deal with uncertainty and associated risk and opportunity, enhancing the capacity to build value.

In ERM, a risk is defined as a possible event or circumstance that can have negative influences on the enterprise in question. Its impact can be on the very existence, the resources (human and capital), the products and services, or the customers of the enterprise, as well as external impacts on society, markets or the environment.

ERM is at a nascent stage in India and that Indian firms often tend to focus on the downside of risk and not the opportunity side. Global competition and rapid growth has forced many Indian companies to look into their ERM.

ERM is an enterprise wide process allowing companies to identify, assess and respond to the social, political and economic risks.

Hillier’s Model for Risk Analysis:

In view of Hillier, uncertainty or risk associates with the capital investment decisions is determined by the variation (standard deviation) of the expected cash flows.

If the cash flows of the project are less uncertain, there would be a lesser deviation from the mean cash flows and vice versa.

If there is lesser deviation in cash flows from the mean cash flow, the project’s capital investment and its cash flows are less vulnerable to risk and uncertainty.

The determination of standard deviation of various levels of cash flow will be required to ascertain the uncertainty factor of cash flows of a project.

Based on above argument he has developed a model to evaluate the various alternative cash flows by taking into the mean of present value of the cash flows and the standard deviation of such cash flows.

Certainty Equivalent Approach:

The certainty equivalent approach takes into account the risk factor in making estimations and appraisal of capital investment decisions.

Under this technique, the estimated cash flows are adjusted by using risk-free rate to ascertain risk free cash flows. The expected cash flows of the project are converted to equivalent riskless amounts.

The smaller certainty equivalent will be used in case of an expected cash inflow and the larger certainty equivalent is used for payments.

The technique varies with risk adjusted discount rate, which adjusts risk by varying the discount rate.

The certainty equivalent approach is theoretically a superior technique over the risk adjusted discount approach, because it can measure risk more accurately.

The certainty equivalent factors will differ for different investment proposals. It is a conservative approach in making estimation of project cash flows, recognizing the risk factor in cash flows.

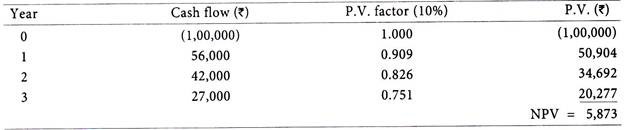

Illustration 1:

XYZ Ltd. is considering a project with the following expected cash flows. Initial investment Rs. 1,00,000 Expected cash inflows 1st year Rs. 70,000; 2nd year Rs. 60,000; 3rd year Rs. 45,000. The cost of capital is 10%. Due to uncertainty of future cash flows, the management decides to reduce the cash inflows to certainty equivalents by taking only 80%, 70% and 60% respectively. Is it worth-while to take up the project?

Solution:

Calculation of Certainty Equivalents of Cash Inflows.

1st year 70,000 × 80/100 = Rs. 56,000

2nd year 60,000 × 70/100 = Rs. 42,000

3rd year 45,000 × 60/100 = Rs. 27,000

Calculation of Risk Adjusted NPV of the Project.

Decision:

The NPV of the project is positive and, therefore, the project can be selected.

Risk Adjusted Discount Rate:

Investors are risk averse and so require a reward for undertaking a risky investment in the form of the rate of return that it is expected to produce.

The more risky the investment, the greater must be its expected return if investors are going to be persuaded to undertake it.

In NPV decision rule that a positive NPV means that the project produces a return greater than the discount rate – which itself represents the minimum acceptable rate of return.

The risk-adjusted discount rate idea takes the commonsense approach to handling risk in investment appraisal of adjusting the level of the minimum acceptable return to reflect the project’s level of risk.

The method taken is usually to add a risk premium to the risk-free rate of return.

The greater the projects perceived level of risk the greater is the risk premium.

The risk-free return is usually taken to be the going rate of return on long-term government securities.

Many companies introduce the concept of discounting risky cash flows at different rates when they introduce variable risk premiums for different types of investments.

They set different required rates of return, or hurdle rates, for their investment projects depending on the nature of the investment.

This is usually in the form of a premium on what is considered the basic company cost of capital.

Project Beta:

Risk can be defined as the volatility of returns. When other things remain same, all investments can expect same volatility.

Such volatility happen as a result of changes in overall economy or market.

But some investments are more volatile than others.

The measure of such risk of volatility is expressed as 3 (beta) in the portfolio theory.

Beta is an expression of the market sensitivity of an investment, or how volatile it is compared with the normal volatility of the market.

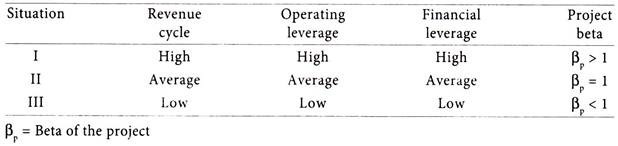

Beta signifies risk inherent in a business or firm. Risk is divided into two types; namely business risk and financial risk.

The former one is concerned with operating leverage and latter is connected with financial leverage.

The situation of project beta can be summarized as below:

A beta of 1 indicates that changes in an investment’s returns correspond exactly to overall market fluctuations.

A beta of 1 indicates that changes in an investment’s returns correspond exactly to overall market fluctuations.

A beta of less than 1 reflects a low-risk project whose returns are more stable than the overall market.

A beta of greater than 1 indicates an investment whose returns are more volatile can be expected from the overall market movements.

Capital Structure and Beta Values:

In a practical business situation, two companies are unlikely to have identical capital structure.

At the one extreme, a project is an all equity financed project called ‘unlevered company’.

Another situation is that, a project is partly financed by the equity finance and balance in the form of long-term loan funds, such company is termed as ‘levered company’. These companies (both unlevered and levered) maybe investing in either a single project or in multiple projects each of which may have a different pattern of risk and return.

Symbols used in Calculation of Project Beta:

The symbols used while calculations of a project beta are as follows:

βP = Beta of portfolio (total assets)

βA = Beta of Project ‘A’

βB = Beta of Project ‘B’

βu = Beta of unlevered firm (all-equity firm)

β1 = Beta of levered firm

RA = Expected rate of return on assets/project

E = Market value of Equity

D = Market value of Dept

V= Market value of Firm

Required Rate of Return on Project A

RA = Rf + βA (Rm – Rf)

Where,

RA = Expected rate of return on assets

Rf = Risk-free rate of return

Rm = Market rate of return

βA = Beta of total assets of Project A