This article will guide you about how to use a cheque.

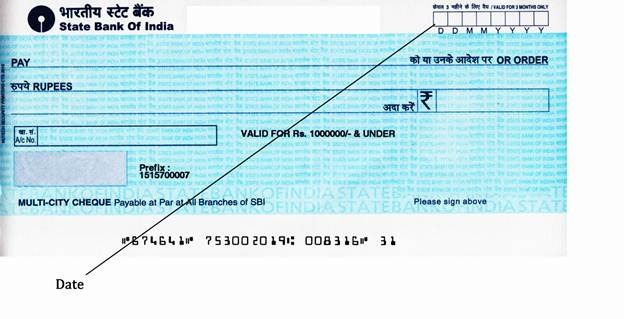

1. On the right hand side there is space to mention the date when the cheque is issued. (It is mandatory to mention the date on the cheque without which a cheque can be dishonored) Please write at least month in words like June 2011.

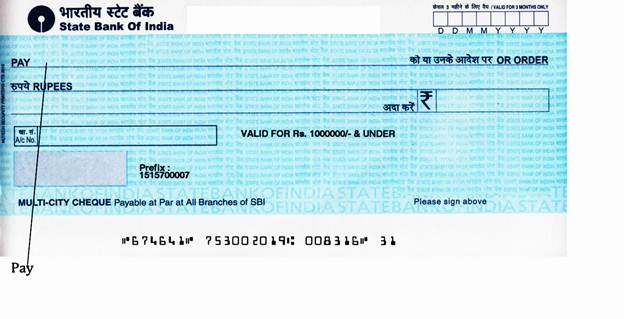

2. In next line it is written PAY________________ OR ORDER

ADVERTISEMENTS:

A cheque writer/ drawers of the cheque is required to mention the name of the person after the word PAY printed on the cheque to whom the drawer wants to make payment. (If the Cheque is issued to an unknown person please make it an (A/C payee cheque and strike of the word ‘bearer’.)

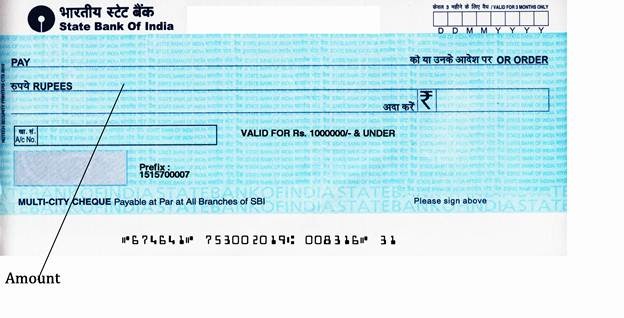

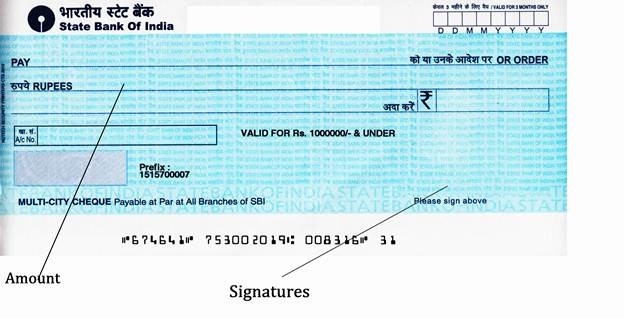

3. In next line it is written Rupees___________________ ( )

ADVERTISEMENTS:

The Drawer of the cheque has to write in words the amount he intends to pay to the persons named in the cheque. He has also to mention the amount of the cheque in figures also. In case the amount written in words and figures differ the cheque may not be paid. In case of dispute the amount written in words is considered to be the true amount of the cheque. (Please ensure that the amount written in figures is correctly written in words also).

Make it sure to sign a cheque before it is issued to anyone. In the absence of signatures of the account holder no bank will make payment of the cheque. If it remains unpaid, the payee may sue the drawer of the cheque in the court of law.

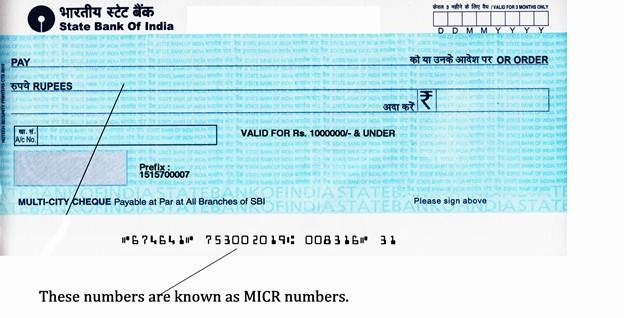

Cheque Number and MICR Number:

ADVERTISEMENTS:

On the bottom line some numbers are written. First number is your cheque number; the second number is MICR number of your cheque. The MICR number includes in codes the name of your bank the city in which your bank is located and the branch, which has given you the cheque book. The clearinghouse of each bank to clear the proceeds of your cheque utilizes this MICR number.

What is MICR?

Magnetic Ink Character Recognition is a character recognition system that uses special ink and characters. When a document that contains this ink needs to be read, it passes through a machine, which magnetizes the ink and then translates the magnetic information into characters.

ADVERTISEMENTS:

Banks use MICR technology. Numbers and characters found on the bottom of checks (visually containing the check number, sort number, and account number) are printed using Magnetic Ink.

MICR provides a secure, high-speed method of scanning and processing information.

Decoding the MICR Number:

ADVERTISEMENTS:

Next comes two digit numbers like “—and some space is left blank. This space is utilized by the clearinghouses while decoding the MICR number of your cheque and also the amount of your cheque.

The subject matter explained above relates to issuing of a cheque by you in order to pay some money to someone or to make a payment of some money by you.

One More feature you might have noticed on the above cheque. On the extreme left upper corner there are two parallel lines and in between these lines the words “A/C payees” can be written.

Such type of two parallel transverse line on the face of a cheque make it a crossed cheque which can not be paid across the counter in cash. When the words A/C Payee has also been written such cheques become account payee cheques and can be paid through the account of the payee only. This is known as crossing of cheque account payee cheques. In between two parallel line across the face of the cheque the words like “Account Payee only” “com.” etc. can be written.