After reading this article you will learn about:- 1. Meaning of a Cheque 2. Parties to a Cheque 3. Format 4. Importance in Payment System.

Meaning of a Cheque:

A cheque is a negotiable instrument instructing a financial Institution to pay a specific amount of specific currency from a specific demand account held in the name of the maker/depositor’s name with that institution. Both the maker and payee may be natural persons or legal entities.

As per negotiable instrument act a ‘Cheque’ is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on Demand. REMEMBER all cheques are bills of exchange but all bills are not cheques. Since term Bill is not the subject matter of this book here we will discuss about cheques only.

When a cheque is issued it becomes a bill of exchange and also a negotiable instrument.

ADVERTISEMENTS:

Before we proceed further I feel to make it clear as to what is a bill of exchange and negotiable instrument. Not going into the details of different laws and Acts I would like to explain these terms in very simple way to be understood in a very simple manner.

A bill of exchange is unconditional order in writing, addressed by one person to another. The person giving it, requesting the person to whom it is addressed to make payment on demand or at any fixed future date, the sum mentioned in the bill.

A negotiable instrument (with particular reference to cheques) in simple words is a method of payment of money. It is a specialized type of contract for payment of money, which is unconditional and capable of transfer by negotiation. Suppose you have given me a currency note of Rs.100/-. Here the currency note is an instrument and Rs.100/- is value and your act of giving it to me is the act of a contract meaning negotiation done by you.

Like wise when you give me a cheque for Rs.100/- it stands as negotiated. It said to be a specialized type of contract only because it is different than the contract defined under the contract Act of India where certain conditions like making an offer and accepting the offer where some conditions are involved. It stands negotiated merely by act of handing over.

ADVERTISEMENTS:

After having understood what a cheque is we must know how to use these cheques and what purpose a cheque can serve for us. As already stated you can withdraw cash through cheques from your account, you can make payments to someone, you can lend money by way of a cheques. On the other side you can also receive a cheque from someone for value, take a loan in the form of a cheque and can receive money through cheques.

Parties to a Cheque:

When a cheque is issued there becomes many parties to it;

1. Drawer of the Cheque:

A person who issues a cheque or writes a cheque is the maker of the cheque and is called the DRAWER of the cheque.

ADVERTISEMENTS:

2. Drawee:

The person/bank being directed to make the payment is called the drawee.

3. Payee:

One who receives a payment is called the payee.

ADVERTISEMENTS:

As per negotiable instrument act a Payee is the person named in the instrument, to whom or to whose order the money is by the instrument directed to be paid is called the payee.

4. Payer:

The person who issues the cheque or makes the payment is called payer.

There are so many other terms related to cheques like holder of a cheque, holder in due course etc. but for the purpose brevity these are not being discussed here.

ADVERTISEMENTS:

After having understood the meaning of a cheque and its utility we will now discuss as to how to use a cheque so that it properly serves the purpose in a legitimate manner within a specified time for which it has been issued by the drawer. Before that it is necessary that we understand the format of a cheque.

Format of Cheque:

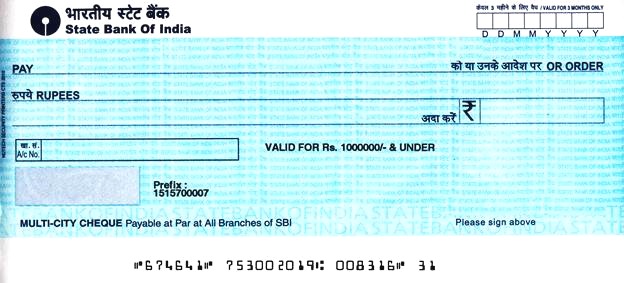

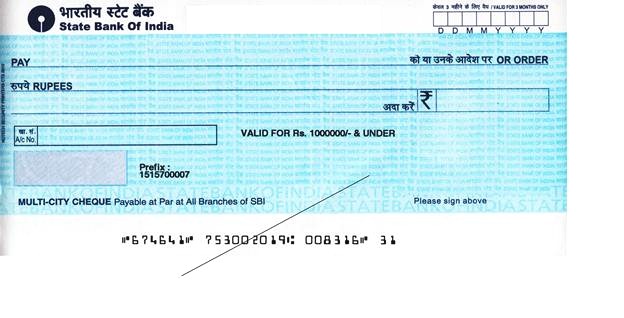

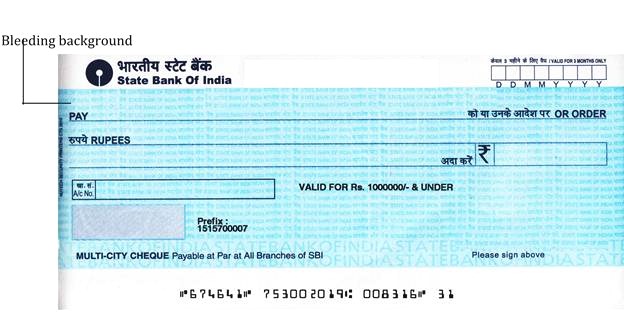

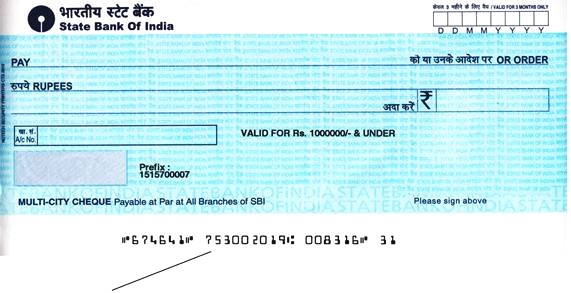

A cheque is usually a printed security from like

Printing of cheques is done by way of security printing. For security printing different types of security measures are adopted. Some banks follow one type of security measures and some other banks follow different types of security measures. Some of such security measures are being explained below. But it is not necessary that all such measures be taken care by all the banks.

ADVERTISEMENTS:

Background Printing In Fugitive Ink:

The Background of a cheque is printed using such type of ink that vanishes away very easily while in touch with water or through fingers socked with mouth water. Any attempt to change the figures written on the cheques adversely affects the background printing and becomes a cause of suspicion. If background printing appears to be vanishing your banker will become alert while negotiating such type of cheques.

If organic and inorganic tampering solvents are used the background reacts like bleeding. Bleeding ink prints in black but when exposed to any aqueous solution it will produce a red stain. Authenticity of a document can easily be tested without the use of any special agents. User can just wet a finger and run it across the ink to instantly see the affect of the bleeding ink.

Primary fluorescence:

It is special feature when cheques are put to test under an ultraviolet lamp the numbers printed on the cheque become fluorent under the light.

Anti copy features:

Some such security marks are provided on cheques, which are difficult to be copied which make the cheques equipped with anti copy features. Some documents can be copied on colour photocopier, Black and white photocopier, Fax-Machines, Digital copier and on Digital cameras but the type of paper used in printing of cheque should be a deterrent against making copies. It is therefore difficult to copy a cheque.

Micro line and secret pattern printing:

ADVERTISEMENTS:

Every cheque is provided with micro line printing which includes secrets of bank, branch, city etc. and also provision for encoding the cheque.

Void pantographs:

It is a description, which is not visible with naked eyes. In fact a pantograph is an instrument consisting of an adjustable parallelogram for copying drawings, designs etc. But in case of void pantograph printing such type of copying is not possible as such type of printing is not visible.

Invisible U.V. Pattern Printing:

The UV process relies on special inks that have photo initiators in them that when exposed to UV light, spurs a chain reaction that forms a solid, dry continuous ink, yielding bright, vivid colors and deep rich blacks. (UV light means ultra violet lamps).

ADVERTISEMENTS:

Temperature and pressure sensitive inks:

The ink used are sensitive to temperature and pressure. Here the inks used are sensitive to temperature or pressure. In different temperature and under different pressure this ink reacts differently. While printing security papers like cheques such parameters are pre decided and can be checked in case of need.

Use of Ultra Violet Fibers in the Cheque Paper:

All above features of a cheque are not the subject matter of customers of any bank. Banks to detect frauds being done through fraudulent cheques use these features. By the way if a cheque is put against an ultra violent light these fibers can be seen. But these differ from bank to bank.

Importance of Cheques in Payment System:

In spite of introduction of various mode of payments and settlements still a large number of people are addicted to use of cheques and all the Clearing Houses are handling a very large number of cheques every day. In view of the importance of cheques it is must that one should know what is a cheque and how it enables settlement of payments.

While withdrawing money from the bank, making payment to someone you have to make use of cheques issued to you. First you have to understand what is a cheque.