Consequent to buyback of shares, there will be change in the shareholding pattern. This could alter the controlling interest in the company without ensuring compliance with prevalent government regulations for increase in shareholding.

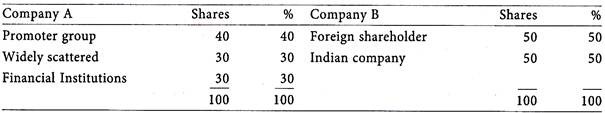

Consider the following illustration:

Illustration 1:

Company A is a publicly listed company and Company B is a Joint venture which is closely held.

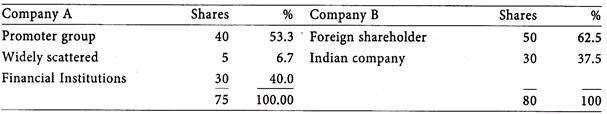

If there is buyback offer from the two companies to their respective shareholders and say 25 shares are offered by the public shareholders of Company A and 20 shares are offered by the Indian shareholder of Company B for buyback, the other shareholders not accepting the buyback offers, the resulting shareholding pattern would be as under:

We can observe from the above shareholding pattern, after buyback of shares as follows:

Company A:

ADVERTISEMENTS:

The shareholding of the promoter group has increased from 40% to 53.3% without acquiring additional shares. The promoter group has obtained an absolute majority control of the company.

Company B:

The Indian shareholder’s shareholding has reduced from 50% to 37.5%, reducing his controlling interest.

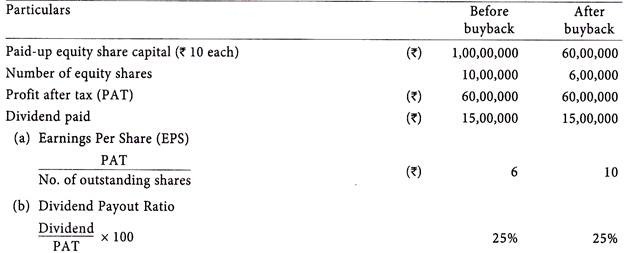

There is an enhancement of shareholders value as a result of buyback of shares and maximization of shareholders value is a common goal in corporate sector.

ADVERTISEMENTS:

The above proposition is illustrated as follows:

Illustration 2:

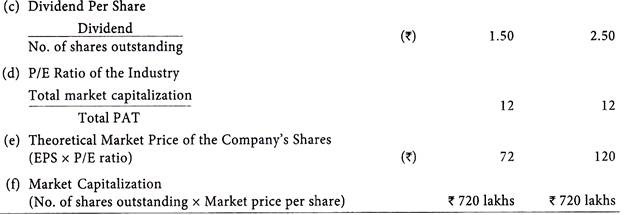

While the share price of the company before the buyback operation would have hovered around Rs.72 which is the theoretical market price based on the P/E ratio for the industry sector in which the company operates. After buyback, the EPS increases to Rs. 12 which leads to increase in the theoretical market price of company’s shares from Rs.72 to Rs.120.

ADVERTISEMENTS:

However, this increase in share price will not take place in the short-run. But in the long-run, basing on a continuation of the historical earnings flow or even an increase thereof, the share price will further climb upwards to settle around the theoretical share price after buyback.