Here is a term paper on the ‘Cash Management in a Business’ for class 11 and 12. Find paragraphs, long and short term papers on the ‘Cash Management in a Business’ especially written for school and management students.

Term Paper on Cash Management

Term Paper Contents:

- Term Paper on the Management of Cash

- Term Paper on the Objectives of Cash Management

- Term Paper on the Factors Determining Cash Needs

- Term Paper on Approaches to Derive Optimal Cash Balance

- Term Paper on Cash Budget

- Term Paper on the Motives for Holding Cash

- Term Paper on the Cash Management: Basic Strategies

- Term Paper on Minimum Operating Cash

- Term Paper on the Cash Management Techniques

- Term Paper on the Marketable Securities

- Term Paper on the Cash Management Trends

Term Paper # 1. Management of Cash:

ADVERTISEMENTS:

Management of cash is an important function of finance manager. The modern day business comprises of numerous units spread over vast geographical areas. It is the duty of finance manager to provide adequate cash to each of the units. For the survival of the business it is absolutely essential that there should be adequate cash. It is the duty of the finance manager to have liquidity at all parts of the organisation while managing cash.

On the other hand, he has also to ensure that there are no funds blocked in idle cash. Idle cash resources entail a great deal of cost in terms of interest charges and in terms of opportunity/ opportunities costs. Hence, the question of costs of idle cash must be kept in mind by the finance Manager. A cash management scheme, therefore, is a delicate balance between the twin objectives of liquidity and costs.

Term Paper # 2. Objectives of Cash Management:

The basic objectives of cash management are two folds:

ADVERTISEMENTS:

1. To meet the cash disbursement needs i.e., payment schedule.

2. To minimise funds committed to cash balances.

Note:

These are conflicting and mutually contradictory and the task of cash management is to reconcile them.

ADVERTISEMENTS:

1. Meeting Payments Schedule:

In the normal course of business, firms have to make payments of cash on a continuous and regular basis to suppliers of goods, employees and so on. At the same time, there is a constant inflow of cash through collections from debtors. Cash is, therefore, aptly described as the “oil to lubricate the ever-turning wheels of business, without it the process grind to a stop”.

A basic objective of cash management is to meet the payment schedule that is to have sufficient cash to meet the cash disbursement needs of a firm.

The importance of sufficient cash to meet the payment schedule can hardly be over emphasized.

ADVERTISEMENTS:

The advantages of adequate cash are:

i. It prevents insolvency or bankruptcy arising out of the inability of a firm to meet its obligations.

ii. The relationship with the bank is not strained.

iii. It helps in fostering good relations with trade creditors and suppliers of raw materials, as prompt payment—may help their own cash management.

ADVERTISEMENTS:

iv. A cash discount can be availed of if payment is made within due date.

v. It leads to a strong credit rating which enables the firm to purchase goods on favourable terms and to maintain its line of credit with banks and other services of credit.

vi. To take advantage of favourable business opportunities that may be available periodically.

vii. The firm can meet unanticipated cash expenditure with a minimum of strain during emergencies like strikes, fires or a new marketing campaign by competitors.

ADVERTISEMENTS:

Notes:

a. Keeping large cash balances, however, implies a high cost.

b. The advantage of prompt payment of cash can well be realised by sufficient and not excessive cash.

2. Minimising Funds Committed to Cash Balances:

ADVERTISEMENTS:

The second objective of cash management is to minimise cash balances. In minimising the cash balances, two conflicting aspects have to be reconciled.

A high level of cash balances will ensure prompt payment together with all the advantages. But, it also implies that large funds will remain idle, as cash is a non-earning asset and firm will have to forego profits.

A low level of cash balances, on the other hand, may mean failure to meet the payment schedule. The aim of cash management therefore should be to have an optimal amount of cash balances.

Term Paper # 3. Factors Determining Cash Needs:

The factors that determine the required cash balance are:

1. Synchronization of cash flow.

ADVERTISEMENTS:

2. Short costs.

3. Excess cash balance cost.

4. Procurement and management.

5. Uncertainty..

1. Synchronisation of Cash Flows:

The need for maintaining cash arises from the non-synchronisation of the inflows and outflows of cash. If the receipts and payments of cash perfectly coincide or balance each other, there would be no need for cash balance.

ADVERTISEMENTS:

The first consideration in determining the cash need is therefore, the extent of non-synchronisation of cash receipts and disbursements. In this respect, inflows and outflows have to be forecast over a period of time, depending upon the planning horizon, which is typically a one year period with each of the 12 months being a sub period. The technique adopted is a cash budget.

2. Short Costs:

Another general factor to be considered in determining cash needs is the cost associated with a shortfall in the cash needs. The cash forecast presented in the cash budget would reveal periods of cash shortages. In addition, there may be some unexpected shortfall. Every shortfall of each- whether expected or unexpected —involve a cost depending upon the severity, duration and frequency of the shortfall and how the shortage is covered. Expenses incurred as a result of shortfall are called short cost.

Short costs include the followings:

(i) Transaction Cost.

(ii) Borrowing Costs.

ADVERTISEMENTS:

(iii) Loss of Cash Discount.

(iv) Cost Associated with Deterioration of Credit Rating.

(v) Penalty Rates.

i. Transaction Cost:

It is associated with raising cash to tide over the shortage. This is usually the brokerage incurred in relation to the sale of some short-term near cash assets such as marketable securities.

ii. Borrowing Costs:

ADVERTISEMENTS:

It is associated with borrowing to cover the shortage and includes interest on loan, commitment charges and other expenses relating to the loan.

iii. Loss of Cash Discount:

It is a substantial loss because of a temporary shortage of cash.

iv. Cost Associated with Deterioration of Credit Rating:

It reflected in higher bank charges on loans, stoppage of supplies, demands for cash payment, refusal to sell, loss of image and the attendant decline in sales and profits.

v. Penalty Rates:

ADVERTISEMENTS:

It is charged by banks to meet a shortfall is compensating balances.

3. Excess Cash Balance Costs:

The cost of having excessively large cash balances is known as the excess cash balance cost. If large funds are idle, the implication is that the firm has missed opportunities to invest those funds and has thereby lost interest which it would otherwise have earned. This loss of interest is primarily the excess cost.

4. Procurement and Management:

These are the cost associated with establishing and operating cash management staff and activities. They are generally fixed and are mainly accounted for by salary, storage, handling of securities etc.

5. Uncertainty and Cash Management:

Finally, the impact of uncertainty on cash management strategy is also relevant as cash flows cannot be predicted with complete accuracy. The first requirement is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements, defaults and unexpected cash needs.

The impact of uncertainty on cash management can however be mitigated through:

(i) Improved forecasting of tax payments, capital expenditure, and dividends etc.

(ii) Increased ability to borrow through overdraft facility.

Term Paper # 4. Approaches to Derive Optimal Cash Balance:

There are two approaches to derive an optimal cash balance:

These are:

1. Minimising cost cash models

2. Cash budget

1. Cash Management Models:

In the recent years several types of mathematical models have been developed which helps to determine the optimum cash balance to be carried by a business organisation.

The purpose of all these models is to ensure that cash does not remain idle unnecessarily and at the same time the firm is not confronted with a situation of cash shortage.

All these models can be put in two categories i.e.:

(i) Inventory models.

(ii) Stochastic models.

Inventory type models have been constructed to aid the finance manager to determine optimum cash balance of his firm. William J. Baumal’s Economic order quantity model applies equally to cash management problems.

However, in a situation where EOQ model is not acceptable, stochastic model of cash management helps in determining the optimum level of cash balance. It helps only when the demand for cash is stochastic and not known in advance.

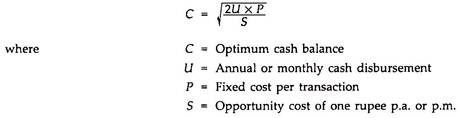

(i) William J. Baumal’s Economic Order Quantity Model:

According to this model, optimum cash level is that level of cash where the carrying costs and transaction costs are the minimum.

The carrying costs refer to the cost of holding cash, namely, the interest foregone on marketable securities.

The transaction costs refer to the cost involved in getting the marketable securities converted into cash. This happens when the firm falls short of cash and has to sell the securities resulting in clerical, brokerage, registration and other costs.

The optimum cash balance according to this model will be at that point where these two costs are equal.

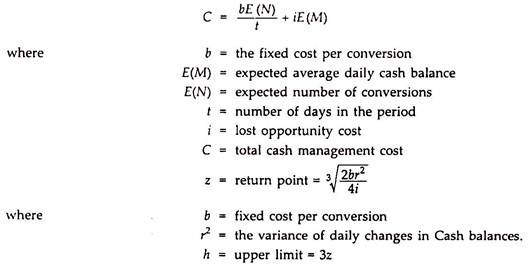

(ii) Miller-On Cash Management Model:

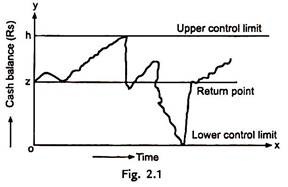

According to this model the net cash flow is completely stochastic. When changes in cash balance occur randomly the application of control theory serves a useful purpose. Miller-On model is one of such control limit model.

This model is designed to determine the time and size of transfers between an investment a/c and cash a/c.

In this model control limits are set for cash balances. These limits are h’ as upper limit, ‘z’ as the return point, ‘0’ zero as the lower limit.

When the cash balance reaches to upper limit, the transfer of cash equal to (h – z) is invested in marketable securities a/c when it touches the lower limit, a transfer from marketable securities a/c to cash a/c is made.

During the period when cash balance stays between (w, z) and (z, 0) i.e., high and low limits of cash balance are set up on the basis of fixed cost associated with the securities transactions, the opportunity cost of holding cash and degree of likely fluctuations in cash balances.

These limits satisfy the demand for cash at the lowest possible total lost.

This model determines the optimum cash balance level which minimises the cost of cash management.

Further, the financial manager could consider the use of less liquid, potentially more profitable securities as investments for the cash balances in excess of ‘h’.

There is another model of cash management known as Orgler’s Model.

According to this model, an optimal cash management strategy can be determined through the use of a multiple linear programming model.

The construction of the model comprises three sections:

i. Selection of the appropriate planning horizon,

ii. Selection of the appropriate decision variables,

iii. Formulation of the cash management strategy itself.

The advantage of linear programming model is that it enables coordination of the optimal cash management strategy with the other operations of the firm such as production and with less restriction on working capital balances.

Note:

a. Model basically uses one year planning horizon with 12 monthly periods because of its simplicity.

b. It has four basic sets of decisions variables which influence cash management of a firm and must be incorporated in linear programming model of firm.

These are:

(a) Payment schedule,

(b) Short-term financing,

(c) Purchase and sale of marketable securities,

(d) Cash balance.

The formulation of the model requires that the financial managers first specify an objective function and then specify a set of constraints.

Orgler’s objective function is to minimise the horizon value of the net revenues from the cash budget over the entire planning period.

Assumption:

i. All revenues generated are immediately reinvested.

ii. Any cost is immediately financed.

Objective function represents the value of the net income from the cash budget at the horizon by adding the net returns over the planning period.

Thus, the objective function recognises each operations of the firm that generates cash inflows or cash out flows as adding or subtracting profit opportunities for the firm from its cash management operations.

In the objective function, decision variable which cause inflows, such as payments on receivables, have (+ve) positive coefficient while decision variables which generate cash out flows such as interest on short-term borrowings have (-ve) negative coefficient. While the sale of those securities would incur conversion cost and have a (-ve) negative coefficient.

Objective Function:

Maximise profit = a1 x1 + a2 x2

The constraints of the model could be:

(i) Institutional.

(ii) Policy constraints.

Institutional constraints are those imposed by external factors i.e., bank required compensating balance.

Policy constraints are imposed on cash management by the firm itself e.g., financial manager may be prohibited from selling securities before maturity.

Either constraint can occur in the model during one monthly period or over several or all the months in the one year planning horizon.

Note:

A very important feature of this model is that it allows the financial managers to integrate cash management with production and other aspects of the firm.

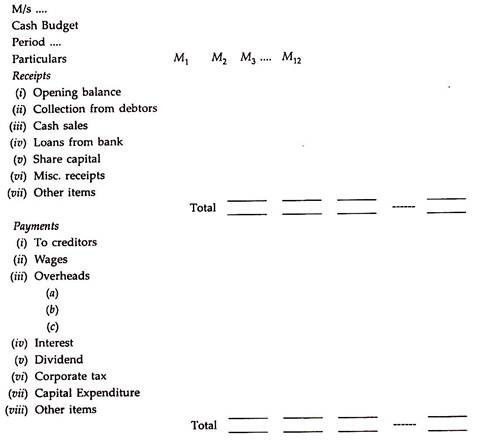

Term Paper # 5. Cash Budget:

Cash budget represents cash requirements of business during the budget period. It is the plan of receipts and payments and payments of cash during the budget period.

Cash budget can be prepared for:

1. Short period or

2. Long period.

1. Cash Budgets for Short Period:

Preparation of cash budget month by month would involve making the following estimates:

A. As Regards Receipts:

i. Receipts from debtors.

ii. Cash sales.

iii. Any other sources of receipts of cash e.g., dividend etc.

B. As Regards Payments:

i. Payments to be made for purchases.

ii. Payments to be made for expenses.

iii. Payments that once made periodically but not every month.

(a) Debenture interest.

(b) Income tax paid in advance.

(c) Sales tax.

iv. Special payments to be made in a particular months e.g., dividends to shareholders, redemption of debenture, repayments of loans, payment for assets acquired etc.

Format of Cash Budget:

Closing balance

(+ve → surplus, -ve → shortfall)

Term Paper # 6. Motives for Holding Cash:

The term cash with reference to cash management is used in two senses.

In a narrow sense, it is used broadly to cover currency and generally accepted equivalents of cash, such as cheques, demand drafts and deposits in banks.

The broad view of cash also includes near-cash assets such as marketable securities and time deposits in banks. The main characteristics of these is that they can be readily sold and converted into cash and serve as a reserve pool of liquidity that provides cash quickly when needed. They also provide a short-term investment outlet for excess cash and are also useful for meeting planned outflow of funds.

Note:

The term cash management is employed in the broader sense.

Irrespective of the firm in which it is held a distinguishing feature of cash as an asset, is that it has no earning power. Still cash is always held.

The motives behind holding the cash are as follows:

1. Transaction motive.

2. Precautionary motive.

3. Speculative motive.

4. Compensating motive.

1. Transaction Motive:

An important reason for maintaining cash balances is the transaction motive. This refers to the holding of cash to meet routine cash requirements to finance the transactions which a firm carries on in the ordinary course of business. A firm enters into a variety of transactions to accomplish its objectives which have to be paid for in the form of cash. Example, cash payment for purchases, wages, operating expenses, financial charges like interest, taxes, dividends and so on.

Similarly there is a regular inflow of cash to the firm from sales operations, returns on outside investments and so on. These receipts and payments constitute a continuous two way flow of cash. But the inflows and outflows do not perfectly coincide.

At time receipts exceeds outflows while at other times, payments exceeds inflows. To ensure that the firm can meet its obligations when payments become due in a situation in which payments exceeds inflows or receipts, it must have an adequate cash balance.

In other words “The requirement of cash balances to meet routine cash needs is known as the transaction motive and such motive refers to the holding of cash to meet anticipated obligations whose timing is not perfectly synchronized in the cash receipts.”

Note:

a. If receipts and payments of cash could exactly coincide in the normal course of operations, a firm would not need cash for transaction purposes.

b. Although a major part of transaction balances are held in cash, a part may also be in such marketable securities whose maturity conforms to the terming of the anticipated payments, such as payment of taxes, dividends etc.

2. Precautionary Motive:

In addition to the non-synchronization of anticipated cash inflows and outflows, in the ordinary course of business, a firm may have to pay cash for purposes which cannot be predicated or anticipated.

The unexpected cash needs at short notice may be the result of:

(i) Floods, strikes and failure of important customers.

(ii) Bills may be presented for settlement earlier than expected.

(iii) Unexpected slowdown in collection of accounts receivable.

(iv) Cancellation of some orders for goods as the customer is not satisfied.

(v) Sharp increase in cost of raw materials.

“The cash balances held in reserve for such random and unforeseen fluctuations in cash flows are called as precautionary balances.”

In other words, precautionary motive of holding cash implies the need to hold cash to meet unpredictable obligations.

Note:

a. Precautionary cash balance serves to provide a cushion to meet unexpected contingencies.

b. The more unpredictable are the cash flows the larger is the need for such balances.

c. If availability of short-term credit is more, the need to maintain a precautionary cash balance will be less and vice-versa.

d. These cash balances are usually held in the form of marketable securities so that these earn a return.

3. Speculative Motive:

It refers “to the desire of a firm to take advantage of opportunity/ies which presents themselves at unexpected movements and which are typically outside and normal course of business.”

Note:

a. Precautionary motive is defensive in nature in that firms must make provision to tide over unexpected contingencies.

b. Speculative motive represents a positive and aggressive approach. Firms aim to exploit profitable opportunities and keep cash in reserve to do so.

The speculative motive helps to take advantage of:

(a) An opportunity to purchase raw materials at a reduced price on payment of immediate cash.

(b) A chance to speculate on interest rate movements by buying securities when interest rates are expected to decline.

(c) Delay purchases of raw materials on the anticipation of decline in price.

(d) Make purchases at favourable prices.

4. Compensating Motive:

Another motive to hold cash balances is to compensate banks for providing certain services and loans.

Banks provide a variety of services to business firms as clearance of cheque, supply of credit information, transfer of funds etc., while for some of these services banks charge a commission or fee, for others they seek indirect compensations.

Usually clients are required to maintain a minimum balance of cash at the bank. Since this balance cannot be utilized by the firms for transaction purposes, the banks can use the amount to earn a return. Such balances are compensating balances.

Compensating balances are also required by some loan agreements between a bank and its customers. During periods when supply of credit is restricted and interest rates are rising, bank require a borrower to maintain a minimum balance in his account as a condition precedent to the grant of loan. This is presumably to compensate the bank for a rise in the interest rate during that period, when loan will be pending.

The compensating cash balances can take either of following two forms:

(i) An absolute minimum, amount below which the actual bank balance will never fall,

(ii) A minimum average balance over the month.

Notes:

a. The first form or alternative is more restrictive as the average amount of cash held during the month must be above that minimum balance by the amount of the transaction balance.

b. From the point of view of firm, this is obviously dead money.

c. The second form is quite suitable for the firm’s and can agree with the bank.

Out of four primary motives of holding cash only transaction motive and compensation motive are important. Firms usually do not speculate and need not have speculative balances. The requirement of precautionary balances can be meet out of short-term borrowings.

Term Paper # 7. Cash Management: Basic Strategies:

Cash budget gives the net cash position of a firm. After knowing the cash position the management should work out on the basic strategies to be employed to manage its cash.

The broad cash management strategies are essentially related to the cash turnover process, that is the cash cycle together with cash turnover.

Cash cycle is the process by which cash is used to purchase materials from which goods are produced and when these are sold to customers who latter pay the bills. The firm receives cash from customers and cycle repeats itself.

Cash turnover means the number of times cash is used during each year.

Cash cycles have usually following steps:

(i) Materials ordered.

(ii) Materials received.

(iii) Payments.

(iv) Cheque clearance.

(v) Goods produced.

(vi) Goods sold.

(vii) Customer makes payments.

(viii) Payment received.

(ix) Cheques deposited.

(x) Funds collected.

In cash management strategy, the time period involved at each step is concerned/ important.

Note:

a. Firm has no control over the time involved between step ‘a’ and ‘b’.

b. The time lag between ’d’, ‘e’ and ‘f’ is determined by the production process and inventory policy.

c. The time period between steps ‘f’ and ‘g’ is determined by credit norms and payment policy of customers.

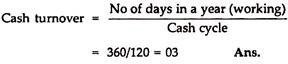

Example 1:

A firm which purchases raw materials on credit is required by the credit terms to make payments within 30 days. On its side, the firm allows its credit buyers to pay within 60 days. Its experiences has been that it takes on an average 35 days to pay its accounts payable and 70 days to collect its accounts receivable. Moreover 85 days elapse between the purchase of raw materials and sale of finished goods, that is to say, the average age of inventory is 85 days.

Calculate the firm’s cash cycle and estimate cash turnover?

Solution:

The cash cycle of the firm can be calculated by finding the average number of days that elapse between the cash outflows associated with paying accounts payable and the cash inflows associated with collecting accounts receivable.

Cash cycle = 85 days + 70 days – 35 days = 120 days

Term Paper # 8. Minimum Operating Cash:

The higher is the cash turnover the lesser is requirement of cash in a firm. Therefore firm should try to minimise the cash turnover. But must maintain a minimum amount of operating cash balance so that it does not run out of cash.

The minimum amount or minimum level of operating cash is determined.

Total operating annual outlays/rate of cash turnover.

For example:

If the total operating annual outlay of a firm is Rs.240 lakhs, and rate of cash turnover is 3.

Then 240/3 = 80 lakh, will be the minimum cash requirement.

The operational implication of the minimum operating cash requirement is that if the firm has opening cash balance of Rs.80 lakhs, it would be able to meet its obligations when they became due.

In other words, it would not have to borrow anything. But the minimum operating cash involves a cost in terms of the earnings foregone from investing it temporarily, that is to say, there is an opportunity cost.

If 10% return on a riskless investment, the cost of minimum cash balance of Rs.80 lakhs will be Rs.8 lakhs.

Cash management strategies to the minimum cash balance requirement. The basic strategies that can be employed to do the needful are as follows:

1. Stretching accounts payable

2. Efficient inventory-Production management

3. Speedy collection of accounts receivable

4. Combined cash management strategies

1. Stretching Accounts Payable:

One basic strategy of efficient cash management is to stretch the accounts payable. In other words, a firm should pay its accounts payable as late as possible without damaging its credit standing.

Note:

It should, however, take advantage of the cash discount available on prompt payment.

In the above example, if the accounts payable from the current level of 35 days to 45 days, the cash cycle will 85 + 70 – 45 = 110 days, the cash turnover will be 360/110 = 3.27. This will lead to a decrease in the minimum cash requirement from Rs.80 lakhs to Rs.73.40 lakhs.

2. Efficient Inventory-Production Management:

Another strategy is to increase the inventory turnover avoiding stock-outs that is shortage of stock.

This can be done in the following ways:

i. Increasing the raw materials turnover by using more efficient inventory control techniques.

ii. Decreasing the production cycle through better production planning scheduling and control techniques. It will lead to an increase in the W/P inventory turnover.

iii. Increasing the finished goods turnover through better forecasting of demand and a better planning of production.

In the above example, if able to reduce the average age of its inventory from 85 to 70 that is by 15 days then the cash cycle will be = 70 + 70 – 35 = 140 – 35 = 105 days. Cash turnover will be 360/105 = 3.43

The effect of an increase in the cash turnover will be to reduce the minimum cash requirement from Rs. 80 lakhs to Rs.70 lakhs.

Thus efficient inventory and production management causes a decline in the operating cash requirement hence, a saving in cash operating costs.

3. Speeding Collection of Accounts Receivables:

Another strategy for efficient cash management to collect accounts receivable as quickly as possible without losing sales because of high pressure collection techniques.

The average collection period of receivables can be reduced by changes in:

(i) Credit terms.

(ii) Credit standards.

(iii) Collection policies.

Credit standards represent the criteria for determining to whom credit should be extended. The collection policies determine the efforts put forth to collect accounts receivable promptly.

In the above example, if firm manages to reduce the average age of its accounts receivable from the current level of 70 days to 50 days then cash cycle will be = 85 + 50 – 35 = 100 days, and Cash turnover = 360/100 = 3.6.

The operating cash requirement will fall from 80 lakhs to approximately Rs.66.67 lakhs. Thus a reduction in the average collection period by 20 days, releases funds equivalent to Rs.13.33 lakhs and leads a saving in cash operating cost of Rs.1.33 lakhs.

4. Combined Cash Management Strategies:

The effect of individual strategies on the efficiency of cash management is favourable on operating cash requirement.

In the above example if:

(i) Increases the average accounts payable by 10 days = 35 + 10 = 45 days,

(ii) Reduces the average age of inventory by 15 days = (85 – 15) = 70 days,

(iii) Speeds up the collection of accounts receivable by 20 days = 70 – 20 = 50 days.

Then cash cycle = 70 + 50 – 45 = 120 – 45 = 75 days.

Cash turn over = 360/75 = 4.8

Minimum operating cash requirement = 240/4.8 = Rs.50 lakhs. assuming a 10% rate of interest, the saving in cash operating cost will be Rs.3 lakhs.

The three basic strategies of cash management related to:

(a) Accounts payable.

(b) Inventory.

(c) Accounts receivable.

Lead to a reduction in the cash balance. But they imply certain problems for the management.

These are:

i. If the accounts payable are postponed too long the credit standing of the firm may be adversely affected.

ii. A low level of inventory may lead to a stoppage of production as sufficient raw materials may not be available for uninterrupted production of the firm may be short of enough stock to meet the demand for its product that is stock out.

iii. Restrictive credit standards, credit terms and collection policies may jeopardise sales.

These implications should be constantly kept in view while working out cash management strategies.

Term Paper # 9. Cash Management Techniques:

The strategic aspects of efficient cash management are-efficient inventory management, speedy collection of accounts receivable and delaying payments on accounts payable. There are some specific techniques and processes for speedy collection of receivables from customers and slowing disbursements.

They are:

1. Speedy Cash Collections:

In managing cash efficiently, the cash inflow process can be accelerated through systematic planning and refined techniques.

There are two broad approaches to do this:

(i) The customers should be encouraged to pay as quickly as possible.

(ii) The payment from customer should be converted into cash without any delay.

2. Prompt Payment by Customers:

One way to ensure prompt payment by customers is prompt billing. What the customer has to pay and the period of payment should be notified accurately and in advance. The use of mechanical devices for billing along with the enclosure of a self-addressed return envelop will speed up payment by customers.

Another and more important, technique to encourage prompt payment by customers, is the practice of offering cash discounts. The variability of discount implies considerable saving to the customers. To avail the facility the customers would be eager to make payment early.

3. Early Conversion of Payments into Cash:

Once the customer makes the payment by writing a cheque in favour of the firm, the collection can be expedited by prompt encashment of the cheque.

There is a lag between the time a cheque is prepared and mailed by the customer and the time the funds are included in the cash reservoir of the firm.

Within this time interval three steps are involved:

(i) Transit or Mailing Time:

It is the time taken by the post offices to transfer the cheque from the customer to the firm. This delay or lag is referred to as postal float.

(ii) Time taken in Processing the Cheque within the Firm:

Before they are deposited in the banks, known as lethargy.

(iii) Collection Time within the Bank:

It is the time taken by the bank in collecting the payment from the customer’s bank called bank float.

The early conversion of payment into cash as a technique to speed up collection of accounts receivable, is done to reduce the time lag between posting of the cheque by the customer and the realisation of money by the firm.

Note:

Postal float, lethargy and bank float are collectively referred to as deposit float and can be defined as the sum of cheques written by customers that are not yet usable by the firm.

The collection of accounts receivable can be considerably accelerated by reducing transit, processing and collection time.

An important cash management technique is reduction in deposit float. This is possible if a firm adopts a policy of decentralized collections.

Following are some of the important processes that ensure decentralized collection as to reduce:

(i) The amount of time that elapses between the mailing of a payment by a customer.

(ii) The funds become available to the firm for use.

The principal methods of establishing a decentralised collection network are:

1. Concentration Banking.

2. Lock box system.

3. Slowing Disbursement.

1. Concentration Banking:

In this system of decentralized collection of accounts receivable, large firms which have a large number of branches at different places, select some of the strategically located branches as collection centres for receiving payment from customers.

Instead of all the payments being collected at the head office of the firm, the cheques for certain geographically areas as are collected at the specified local collection centre.

Under this programme/arrangement, the customers are required to send their payments i.e., cheques to the collection centre covering the area in which they live and these are deposited in the local account of the concerned collection centre, after meeting local expenses, if any.

Note:

a. Funds beyond a predetermined minimum one transferred daily to a central or disbursing or concentration bank or account.

b. A concentration bank is one which the firm has a major account usually a disbursement account.

c. This arrangement is called as concentrating banking.

Concentrating banking as a system of decentralised billing and multiple collection points is a useful technique to expedite the collection of accounts receivable. It reduces the time needed in the collection process by reducing the mailing time. Since the collection centres are near the customers the time involved in sending the bill to the customer is reduced. Moreover, the time lag between the despatch of the cheque by sending the bill to the customer is reduced. Mailing time is saved both in respect of sending the bill to the customers as well as in receipt of payment.

The second reason of reduced deposit float by concentration banking is that banks of the firm as well as customers may be in close proximity.

Thus, the arrangement of multiple collection entries with concentration banking results in a saving of time in both mailing and clearance of customer payments and lead to a reduction in the operating cash requirements.

Another advantage is that concentration permits the firm to store its cash more efficiently. This is so mainly because by pooling funds for disbursement in a single account, the aggregate requirement for cash balance is lower than it would be if balances are maintained at each branch office.

2. Lock-Box System:

The banking arrangement is instrumental in reducing the time involved in mailing and collection. But with this system of collection of accounts receivable, processing for purpose of internal accounting is involved, that is same time elapses before a cheque is deposited by the local collection centre in its account.

The lock-box system takes care of this kind of problem, apart from effecting economy in mailing and clearance times.

Under this arrangement firms hire a post office lock-box at important collection centres. The customers are required to remit payments to the post office lock-box. The local banks of the firm, at the respective places are authorised to open the box and pick up the remittances i.e., cheques received from the customers. Usually, the authorised banks pick up the cheques several times a day and deposit them in the firm’s accounts. After crediting the accounts of the firm, the bank send a deposit slip along with the list of payments and other enclosures, if any, to the firm by way of proof and record of the collection.

Thus, the lock box system is like concentration banking in that the collection is decentralised and is done at the branch level. But they differ in one very important aspect. While the customer sends the cheques, under the concentration banking arrangement, to the collection centre, he sends them to a post office box, under the lock box system. The cheques are directly received by the bank which empties the box and not from the firm or its local branch.

The lock box arrangement is an improvement over the concentration banking system. Its superiority arises from the fact that one step in the collection process is eliminated with the use of lock box, the receipt and deposits of cheques by the firm.

In other words, the processing time within the firm before depositing a cheque in a bank is eliminated. Also, some extra saving in mailing timing is provided by the lock box system, as the cheques received in post office box are not delivered either by the post office or the firm itself to the bank rather bank itself picks them up at the post office.

Thus, the lock box system, as a method of collection of receivables has a time fold advantages:

i. The bank performs the clerical task of handing the remittances prior to deposits, services which the bank may be able to perform at lower cost.

ii. The process of collection through the banking system begins immediately upon the receipt of cheque/remittance and does not have to wait until the firms complete its processing for internal accounting purposes. The steps involved in cash cycle are merged therefore, the time lag between payment by a customer and the availability of funds to the firm for use would be reduced and the collection of receivables would be accelerated.

Although the use of concentration banking and lock box systems accelerate the collection of receivables, they involve a cost. While in the case of the former, the cost is in terms of the maintenance of multiple collection centres, compensation to the bank for services represents in the cost associated with the latter.

The justification for the use or otherwise of these special cash management techniques would be based on a comparison of the cost with the return generated on released funds.

If the income exceeds the cost, the system is profitable and should be used otherwise not.

Note:

These techniques can be more useful only for large firms which receive a large number of cheques from a wide geographical area.

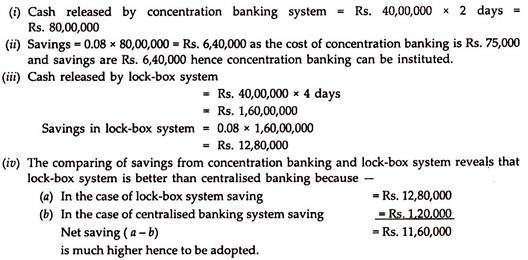

Example 2:

A firm uses a continuous billing system that results in an average receipt of Rs.40,00,000. It is contemplating the institution of concentration banking instead of current system of centralised billing and collection. It is estimated that such a system would reduce the collection period of accounts receivable by 2 days.

Concentration banking would cost Rs.75,000 annually and 8% can be earned by the firm on its investments. It is also found that a lock-box system could reduce its overall collection time by 4 days and could cost annually Rs.1,20,000.

(i) How much cash would be released with concentration banking system?

(ii) How much money can be saved due to reduction in the collection period by 2 days? Should the firm institute the concentration banking system?

(iii) How much cash would be freed by lock-box system?

(iv) Which system is better between concentration banking and lock-box system?

Solution:

3. Slowing Disbursements:

Apart from speedy collection of accounts receivables the operating cash requirement can be reduced by slow disbursements of accounts payable.

In fact, slow disbursements represent a service of funds requiring no interest payments.

There are several techniques to delay payment of accounts payable, namely:

(a) Avoidance of early payments.

(b) Centralised disbursements.

(c) Floats.

(d) Accruals.

(a) Avoidance of Early Payments:

One way to delay payments is to avoid early payments. According to the terms of credit, a firm is required a make a payment within a stipulated period. It entitles a firm to cash discount. If however, payments are delayed beyond the due date, the credit standing may be adversely affected so that the firms would find it difficult to secure trade credit latter.

But if the firm pays its accounts payable before the due date it has no special advantage. Thus a firm would be well advised not to make payments early that is before the due date.

(b) Centralised Disbursements:

Another method to slow down disbursements is to have centralised disbursements. All the payments should be made by the head office from a centralised disbursement account. Such an arrangement would enable a firm to delay payments and conserve cash for several reasons.

(i) It involves increase in the transit-time. The remittance from the head office to the customers in distant places would involve more mailing time than a decentralised payment by the local branch.

(ii) The reason for reduction in operating cash requirement is that since the firm has a centralised bank account, a relatively smaller total cash balance will be needed.

In the case of a decentralised arrangement, a minimum cash balance will have to be maintained at each branch which will add to large operating cash balance.

Schedules can be lightly controlled and disbursements made exactly on the right day.

(c) Float:

A very important technique of slow disbursements is float. The term float refers to the amount of money tied up in cheques that have been written but have yet to be collected and encashed.

Alternatively, float represents the difference between the bank balance and book balance of cash of a firm. The difference between the balance as shown by the firm’s second and the actual bank balance is due to transit and processing delays.

There is a time lag between the issue of a cheque by the firm and its presentation to its bank by the customers’ bank for payment. The implication is that although the cheque has been issued, cash would be required later when the cheque is presented for encashment.

Therefore, a firm can send remittances although it does not have cash in its bank at the time of issuance of cheque. Meanwhile, funds can be arranged to make payment when the cheque is presented for collection after a few days.

Note:

Float used in this sense is called cheque kiting.

There are two ways to do float, i.e.:

(a) Paying from a distant bank.

(b) Scientific cheque encashing analysis.

(a) Paying From a Distant Bank:

The firm may issue a cheque on bank away from the creditors bank. This would involve relatively longer transit time for the creditors banks to get payment and thus, enable the firm to use its funds longer.

(b) Scientific Cheque Encashing Analysis:

Another way to make use of float is to analyse on the basis of past experience, the time lag in the issue of cheques and their encashment.

Example 3:

Cheques issued to pay wages and salary may not be encashed immediately, it may be spread over a few days.

25% on 1st day, 50% on 2nd day and balance on 3rd day. It would mean that the firm should keep in the bank not the entire amount of a payroll but only a fraction represented by the actual withdrawal each day. This strategy would enable the firm to save operating cash.

(d) Accruals:

A potential tool for stretching accounts payable is accruals which are defined as current liabilities that represent a service or goods received by a firm but not yet paid for.

For example, payroll, that is remuneration to employees who render service in advance and received payment later. In a way, they extended credit to the firm for a period at the end of which they are paid, say a week or a month.

The longer the period, after which payment is made, the greater is the amount of free financing consequently and the smaller is the amount of cash balances required. Thus, less frequent payrolls that is weekly as compared to monthly are an important service of accrual.

They can be manipulated to slow down disbursements. Other examples of accrual are rent to lessons and taxes to government. But these can be utilized only to a limited extent as there are legal constraints beyond which such payments cannot be extended.

Term Paper # 10. Marketable Securities:

Once the optimum level of cash balance of a firm has been determined, the residual of its liquid assets is invested in marketable securities.

Such securities are short-term investment instruments to obtain a return on temporarily idle funds. In other words, they are securities which can be converted into cash in a short period of time, typically in few days. The basic characteristics of marketable securities affect the degree of their marketability/liquidity.

To be a liquid, a security must have two basic characteristics:

(i) A ready market.

(ii) Safety of principal.

Ready marketability minimises the amount of time required to convert a security into cash. A ready market should have both breath in the sense of a large number of participants scattered over a wide geographical area as well as depth as determined by its ability to absorb the purchase/sale of large amount of securities.

The second determinant of liquidity is that there should be little or no loss in the value of a marketable security over time. Only those security/ies that can be easily converted into cash without any reduction in the principal amount qualify for short term investments. A firm would be better off leaving the balances in cash if the alternative were to risk a significant reduction in principal.

Selection Criterion for Marketable Securities:

A major decision confronting the financial managers involves the determination of the mix of cash and marketable securities.

Some of the quantitative models for determining the optimum amounts of marketable securities to hold in certain circumstances have been outlined. In general the choice of the mix is based on a trade-off between the opportunity to earn a return on idle funds i.e., cash during the holding period, and the brokerage costs associated with the purchases and sale of marketable securities.

Example 4:

Suppose a firm is paying Rs.350 as brokerage costs to purchase and sell Rs.45,000 worth of marketable securities, yielding an annual return of 8% and held for one month. The interest earned on securities =1/12 × 0.08 × 45,000 = Rs.300.

Since this amount is less than the cost of the brokerages or transaction, hence not advisable for the firm to make investments.

This tradeoff between interest rate and brokerage is a key factor in determining the proportion of liquid assets should be held in the form of marketable securities.

There are three motives for maintaining liquidity (cash as well as marketable securities) and therefore, for holding marketable securities, transaction motive, safety/precautionary motive and speculative motive. Each motive is based on the premise that a firm should attempt to earn a return on temporarily idle funds. This type of marketable securities purchased will depend on the motive for the purchase.

An assessment of certain criteria can provide the financial manager with a useful framework for selecting a proper marketable securities mix.

These considerations include evaluation of:

1. Financial risk or default risk,

2. Interest rate risk,

3. Taxability,

4. Liquidity,

5. Yield among different financial assets.

1. Financial/Default Risk:

It refers to the uncertainty of expected returns from a security attributable to possible changes in the financial capacity of the security-issuer to make future payments to the security-owner. If the chance of default on the terms of the investment is high, then the financial risk is said to be high.

If the chance of default on the term of investment is low, then the financial risk is said to below:

As the marketable securities portfolio is designed to provide a return on funds that would be otherwise tied up in idle cash held for transaction or precautionary purposes, the financial manager will not usually be willing to assume such financial/default risk in the hope of greater return within the makeup of portfolio.

2. Interest Rate Risk:

The uncertainty that is associated with the expected return from a financial instrument attributable to changes in interest rate is known as interest rate risk of particular concern to the corporate financial manager is the price volatility associated with instruments that have long, as opposed to short-term of maturity.

If prevailing interest rates rise compared with the data of purchase, the market price of the securities will fall to bring their yield to maturity in line with what financial manager could obtain by buying a new issue of a given instrument, for instance treasury bills.

The longer the maturity of the instrument the larger will be fall in prices. To hedge against the price volatility caused by interest rate risk, the market securities portfolio will tend to be composed of instruments that mature over short periods.

3. Taxability:

Another factor affecting observed difference in market yields is the differential impact of taxes. Securities, income on which tax-exempt, sell in the market at lower yields to maturity than other securities of the same maturity.

A differential impact on yields arises also because interest income is taxed at the ordinary tax rate while capital gains are taxed at a lower rate. As a result, fixed interest securities that sell at a discount because of low coupon rate in relation to the prevailing yields are attractive to taxable investors. The reason is that part of the yield to maturity is a capital gain.

Owing to the desirability of discount on low interest fixed income securities, there yield to maturity tends to be lower than the yield on comparable securities with higher coupon rates. The greater is the discount, the greater is the capital gains attraction and the lower is its yield relatively to what it would be if the coupon rate were such that the security was sold at par.

4. Liquidity:

With reference to marketable securities portfolio liquidity refers to the ability to transform a security into cash. Should an unforeseen event require that a significant amount of cash be immediately available a sizeable position of the portfolio might have to be sold. The financial manager will want the cash quickly and will not want to accept a large price reduction in order to convert the securities.

Thus, in the formulation of preferences for the inclusion of particular instruments in the portfolio, consideration will be given to:

(i) Time period needed to sell the security.

(ii) The likelihood that the security can be sold at or near its prevailing market price.

The latter element here, means that thin markets where relatively few transactions take place or where trader are accomplished only with large price changes between transactions, should be avoided.

5. Yield:

The final selection criterion is the yields that are available on the different financial assets suitable for inclusion in the marketable/near-cash portfolio.

All the four factors listed above i.e., financial/default risk, interest rate risk, taxability and liquidity influence the available yields on financial instruments. Therefore, the yield criterion involves a weighing of the risks and benefits inherent in these factors. If a given risk is assumed, such as lack of liquidity then a higher yield may be expected on the instrument lacking the liquidity characteristics.

The finance manager must focus on the risk-return tradeoffs associated with the four factors on yield through his analysis. Coming to grips with this trade-off will enable the finance manager to determine the proper marketable securities mix for his firm.

Alternatives Marketable Securities:

Following are the prominent marketable/near-cash securities:

1. Treasury bills.

2. Negotiable certificates of deposits (CDs).

3. Commercial papers.

4. Banker’s acceptances.

5. Repurchase agreements.

6. Units.

7. Inter-corporate Deposits.

8. Bills discounting, and

9. Call market.

1. Treasury Bills:

These are obligations of the government and are sold on discount basis. The investor does not receive an actual interest payment. The return is the difference between the purchase price and the fare price i.e., par value of the bill.

The treasury bill are issued only in bearer form means these are purchased without the investors name upon them. This attribute makes these easily transferable from one investor to another. A very active secondary market exists for these bills. The secondary market for bills not only makes them highly liquid but also allows purchase of bills with very short maturity/ies.

As the bills have the full financial backing of the government, these are, for all practical purposes, risk free. The negligible financial risk and the high degree of liquidity makes their yield lower than those on any marketable securities. Due to their virtually risk free nature and active secondary market, treasury bills are one of the most popular marketable securities even though yield is less.

2. Negotiable Certificates of Deposits (CDs):

These are marketable receipts for funds that have been deposited in a bank for a fixed period of time. The deposited funds earn a fixed rate of interest. The denominations and maturities are tailored to the investor’s needs.

The CDs are offered by banks on a basis different from treasury bills, that is, these are not sold at a discount. Rather, when the certificate matures, the owner receives the full amount deposited plus the earned interest.

A secondary market exists for the CDs while CDs may be issued in either registered or bearer form, the latter facilitates transactions in the secondary market and thus, is the most common. The default risk in bank failure, the possibility of which is very low.

3. Commercial Papers:

It refers to short term unsecured promissory note sold by large business firms to raise cash. As these are unsecured, the issuing side of the market is dominated by large companies which typically maintain sound credit ratings. Commercial papers (CPs) can be sold either directly or through dealers.

i. Companies with high credit rating can sell directly to investors. The denominations in which these can be bought vary over a wide range.

ii. These can be purchased similarly with varying maturity/maturities.

iii. These papers are generally sold on discount basis in bearer form although at times commercial papers can be issued carrying interest and made payable to the order of the investor.

iv. There is no active trading in secondary market for commercial paper although direct sellers of CPs often repurchase it on request.

v. Financial manager when evaluates these for possible inclusion in marketable securities portfolio, he should plan to hold it to maturity.

vi. Owing to its lack of marketability, CPs provide a yield advantage over other near-cash assets of comparable maturity.

4. Banker’s Acceptances:

These are drafts (order to pay) drawn on a specific bank by an exporter in order to obtain payment for goods he has shipped to a customer who maintains an account with that specific bank.

This can also be used in financing domestic trade. The draft guarantees payment by the accepting bank at a specific point of time. The seller who holds such acceptance may sell it at a discount to get immediate funds. Thus, the acceptance becomes a marketable security.

Since the acceptance are used to finance the acquisition of goods by one party the document is not issued in specialised denominations its size/denomination is determined by the cost of goods being purchased. These serve a wide range of maturities and sold on a discount basis, payable to the bearer. A secondary market for the acceptances of large banks does exist.

Owing to their greater financial risk and lesser liquidity, acceptances provide investors a yield advantage over treasury bills of like maturity. In fact, the acceptances of major banks are a very safe investment, making the yield advantage over treasury bills worth looking for marketable securities portfolio.

5. Repurchase Agreements:

These are legal contracts that involve the actual sale of securities by a borrower to the lender with a commitment on the part of the former to repurchase the securities at the current price plus a stated interest change. The securities involved are government securities and other money market instruments. The borrower is either a financial institution or a security dealer.

There are two major reasons when a firm with excess cash prefer to buy repurchase agreements rather than a marketable security.

These are as below:

i. The original maturities of the instrument being sold can, in effect, be adjusted to suit the particular needs of the investing firm, therefore, funds available for a very short period, that is one/two days can be employed to earn a return.

ii. Since the contract price of the securities that make up the arrangement is fixed for the duration of the transaction, the firm buying the repurchase agreement is protected against market fluctuation throughout the contract period. This makes it a sound alternative investment for funds that are surplus for only short periods.

6. Units:

The units of Unit Trust of India (UTI) offer a reasonably convenient alternative avenue for investing surplus liquidity as:

(i) There is very active secondary market for these;

(ii) The income from units is tax exempt upto a specified amount;

(iii) The units appreciate in a fairly predictable manner.

7. Inter-Corporate Deposits:

It is a short-term deposits with other companies is a fairly attractive form of investment of short-term funds in terms of rate of return which currently ranges between 12 to 15%. However, apart from the fact that one month’s time is required to convert these into cash, inter-corporate deposits suffer from higher degree of risk.

8. Bill Discounting:

Surplus funds may be deployed to purchase/discount bills. Bills of exchange are drawn by seller (drawer) on the buyer (drawee) for the value of goods delivered to him. During the pendency of the bill, if the seller is in need of funds, he may get it discounted.

On maturity, the bill should be presented to the drawee for payment. A bill of exchange is a self-liquidating instrument.

Bill discounting is superior to inter-corporate deposits for investing surplus funds. While pending surplus funds in bills discounting, it should be ensured that the bills are trade bills arising out of genuine commercial transaction and as far as possible, these should be backed by letter of credit/acceptance by banks to ensure absolute safety of funds.

9. Call Market:

It deals with funds borrowed/lent overnight/one day (call) money and notice money for period up to 14 days. It enables corporates to utilise their float money gainfully. However the returns (call rates) are highly volatile.

The stipulations pertaining to the maintenance of cash reserve ratio (CRR) by banks is the major determinant of the demand of funds and is responsible for volatility in the call rates.

Large borrowings by them to fulfill their CRR requirements pushes up the rates and a sharp decline takes place once these funds are met.

Term Paper # 11. Cash Management Trends:

The overall cash management scenario is changing with technological advance and evolving customer needs. STP facilitates by the integration of bank’s cash management solutions with corporate’s ERD system, is gaining importance.

Electronic banking access on the internet with account viewing and transaction-initiation capabilities is increasingly critical for technology – Savvy customers. The emerging technologies and the payment system will significantly impact the corporate treasurer’s agenda. New strategies for effective cash management will soon emerge in the Indian Market.

In view of the geographic diversity of India, key cash management providers are strengthening their correspondent banking relationships to reduce transaction costs, enhance location coverage and improve service quality.

The new payment system also pose significant challenges for cash management service providers and will require banks to make a shift in terms of earnings (from float to fees) as well as service offerings.