After reading this article you will learn about Financial Plan for a New Project and Established Business:- 1. Initial Financial Plan for a New Project 2. Financial Plan for Expansion of Established Business Enterprise.

Initial Financial Plan for a New Project:

Financing pattern of new companies in India is usually in the form of a four-legged stool:

(1) Indian promoters and their connections contribute 15 per cent of the initial capital outlay.

(2) Foreign collaborators may contribute 15 per cent of the initial capital needs.

ADVERTISEMENTS:

(3) General public may be called upon to provide 40 per cent of the initial capital needs.

(4) Banks and financial institutions have to fill up the balance i.e., 30 per cent of the total initial capital requirements. In the initial capital plan 70 per cent of the initial capital is in the form of share capital and 30 per cent is in the form of loan capital.

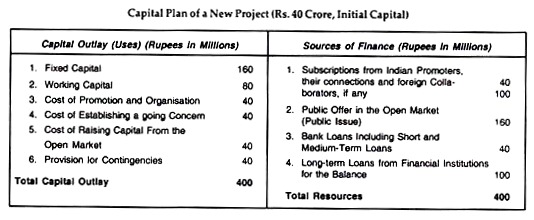

The promoters of the new enterprise have to prepare a financial plan of a new corporation. It is in the form of a capital investment budget. The capital outlay for the new project is based on the estimated cost of various items.

Let us assume that the total capital outlay required to finance the various items mentioned above is Rs.400 M. The promoters are now required to laydown a scheme of sources of finance. In our case the promoters required Rs. 400 M.

ADVERTISEMENTS:

The sources of finance may be as follows:

1. Private placing of capital stock to the Indian promoters, their connections and the foreign collaborator if any. Let us assume that private placing can contribute Rs.100 M.

2. Open market offer through prospects may be Rs.160 M and the entire public issue of Rs. 160 M may be duly underwritten and sold through authorised Share Brokers.

ADVERTISEMENTS:

3. Bank loans including medium term loans from the commercial bank may be arranged by the promoters to the extent of Rs.40 M.

4. Long-term loans from financial institutions may be arranged for the balance, i.e., for Rs. 100 M.

Thus, total resources of Rs.400 M. can be raised by the promoters to finance the capital outlay for the new project.

Financial Plan for Expansion of Established Business Enterprise (Further Capital for Growth):

An established business enterprise has two types of resources to provide the growth finance:

ADVERTISEMENTS:

(i) Internal Resources:

1. Depreciation accounting for 30 per cent growth finance.

2. Reserves and surplus accounting for 20 per cent growth finance. Thus, a corporation can finance expansion and growth from the resources generated from within in the form of depreciation and retained profits reinvested in the business to the extent of 50 per cent of the growth finance.

Internal resources provide the corporation independence from the money market and capital market institutions and the normal or steady growth of any business can be easily financed from the internal resources. This is considered as a sound principle of financial management.

ADVERTISEMENTS:

(ii) External Resources:

An established business concern is capable of taking full advantages of trading on the equity. It is wise to borrow, if the borrowed funds can earn more than those funds cost in interest. To borrow at 15% per annum to finance our business which has prospects of 30 per cent earning, is a profitable proposition.

The difference between the two, in our case 15 per cent, is enjoyed by the existing members and they will get rising dividends. Just how much trading on the equity is proper depends upon what constitutes a proper capital structure.

When, for, example, is the proportion of debt to equity too high? The answer depends mainly on the income on our investment. If, for 12 per cent of debentures, a company has substituted 12 per cent cumulative preference shares, the effect on the equity shareholder’s return would be the same, except there would be less risk.

ADVERTISEMENTS:

If management feels that it can easily earn more on the loan capital than it pays out in the form of fixed interest on debt, a company can probably borrow and continue to do so. However, the management has to ensure a reasonable debt-equity ratio to secure the financial stability and solvency of the corporation. The normal equity-debt ratio is 3: 2. Under equity we include equity share capital and free reserves.

Established business enterprise can easily secure debenture capital by public issue. Debentures constitute the best source of additional capital because the company can offer assets for mortgage, it has stable earning power and growth prospects, it has also a good market reputation. The management can also secure necessary long-term loans from the special institutions.

Thus, the management has two alternatives to raise loan capital:

1. Debenture issue.

ADVERTISEMENTS:

2. Long-term loans.

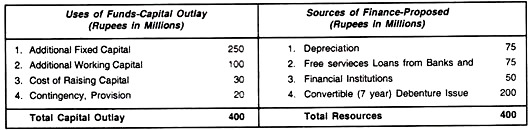

When the needs of growth capital be considerable, say, Rs.400M, i.e., company can have the following sources:

1. Depreciation and free reserves,

2. Loans from banks and finance corporations,

3. Further issue of shares, and

4. Issue of convertible debentures partly as rights issue to members and partly by prospectus.

ADVERTISEMENTS:

Let us assume that a company needs Rs.400M. It can raise Rs.150 M. through free reserves and depreciation. It may have loans from banks and finance corporations to the extent of Rs.50M. It may have Rs.200M, as convertible debenture issue as Rights Issue to members.

The Financial Plan for growth may be as follows:

1. The present equity share capital is Rs.120 crores.

2. The free reserves are Rs.120 crores.

3. There is no loan capital and proposed loan capital for further expansion is Rs.20 crores (convertible debentures) and Rs.50 M from Banks and Finance Corporations.

ADVERTISEMENTS:

4. Debt: Equity ratio of 2:1 is permitted.

In a bid to revive the debenture market, the Government on (Oct. 27, 1980) announced the increase in the ceiling of interest from 11% to 12% and from 12% to 13. 5% (March, 1981). Convertible debentures can now act as important instrument for mobilising industrial finance in an active capital market. Interest rate 13. 5% allowed. On non-convertible debentures it is 15%

Financial plan is expected to answer two questions:

1. What amount of securities shall be issued? The answer to this question is given by capitalisation of a corporation.

2. What kind of securities shall be issued? The answer to this question is given by the capital structure of a corporation.