Project appraisal is the process by which a financial institution makes an independent and objective assessment of the various aspects of the investment proposition for arriving at a financing decision. There are four broad aspects of appraisal: 1. Financial Feasibility 2. Technical Feasibility 3. Economic Feasibility 4. Management Competence.

Aspect # 1. Financial Feasibility:

The basic data required for a financial feasibility analysis can be grouped as under:

1. Cost of project and means of financing.

2. Cost of production and profitability.

ADVERTISEMENTS:

3. Cash flow estimates during the period of loans outstanding.

4. Proforma balance sheets as at the end of each financial year during the period of loan.

Cost of Project:

When a company or promoter intend to set up a new project or undertaking expansion, diversification, modernization or rehabilitation scheme, it is necessary to ascertain the scheme of the project i.e., cost of project and means of finance.

ADVERTISEMENTS:

Cost of project is the aggregate of costs estimated to be incurred on various heads for bringing the project into existence. Establishing the cost of project constitutes a critical step in project planning, on the basis of which means of finance is worked out.

The cost of project usually comprises the following items:

(a) Land and site development.

(b) Factory building.

ADVERTISEMENTS:

(c) Plant and machinery.

(d) Escalation and contingencies.

(e) Other fixed assets or miscellaneous fixed assets.

(f) Technical know-how fees.

ADVERTISEMENTS:

(g) Interest during construction.

(h) Preliminary and pre-operative expenses.

(i) Margin money for working capital.

Means of Financing:

ADVERTISEMENTS:

For implementation of the project, it is required to raise finance from various sources of finance. After consideration of various aspects attached to different sources of finance, the scheme of finance will be determined.

The scheme of means of finance will generally consist of raising of amounts from the following:

(a) Equity share capital.

(i) Promoters.

ADVERTISEMENTS:

(ii) Public.

(b) Term loans from all India or State level financial institutions.

(c) Debentures.

(d) Unsecured loans.

ADVERTISEMENTS:

(i) Promoters.

(ii) Others.

(e) Others.

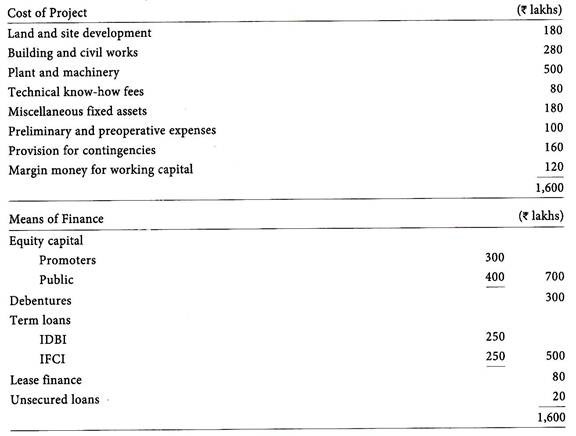

A hypothetical scheme of cost of project and means of finance is given below:

Illustration 1:

Weldon Ltd. is setting up a project with a total project cost of Rs. 16 crore.

ADVERTISEMENTS:

Its cost of project and means of finance are given below:

Cost of Production and Profitability:

The next step is the assessment of the earning capacity of the project. The unit should be in a position to manufacture the product at a reasonable cost and sell them at a reasonable price which would allow adequate profit margin even in a competitive market.

The profitability of an enterprise depends on the total cost of production and the aggregate sale price of the output. The cost of production and sale estimates are also useful in working out the break-even point, the point at which the income from sales would cover the working costs of the project. At this point the unit begins to make profit.

Cash Flow Estimates:

ADVERTISEMENTS:

The cash flow estimates are essential to ensure availability of cash to meet the requirements of the project from time to time. The cash flow estimates will show the sources of funds including those arising from depreciation and profits as well as uses of funds including repayment of term loan installments.

The debt service coverage ratio is arrived at by dividing cash accruals comprising net profits (after taxes, interest on term loans and depreciation added back) by total interest charges and installments. This will indicate whether the cash flow would be adequate to meet the debt obligations and also provide sufficient margin of safety, the repayment of term loans being drawn taking into consideration the above aspect.

Proforma Balance Sheets:

Proforma balance sheets are drawn for existing concerns going for expansion, as well as, for new projects. However in the case of existing concerns going for expansion, the balance sheets for the past three years are also analyzed and compared, with the projections. The projected balance sheets can be drawn for the cash flow estimates and profitability projections. Various ratios are derived from the balance sheets and inferences drawn therefrom.

Aspect # 2. Technical Competence:

The technology may be indigenous or imported through foreign collaboration. In the case of indigenous technology it should be ensured that suitable technical personnel are available.

For technology acquired through collaboration tie-ups, the key areas to be probed are:

ADVERTISEMENTS:

1. The standing of the collaborators and past experience concerning tie-up arrangements with them.

2. Adequacy of the scope and competitiveness of the terms of the collaboration in relation to the requirements of the project, project engineering, equipment specifications, drawings, process know- how, erection and commissioning of the plant, trial-run operations and performance test, training facilities etc.

3. Performance guarantee and it’s adequacy in relation to rated capacity of plant and machinery.

4. Reasonableness of financial and other costs by way of down payment, royalties etc.

The cost of the project should provide for the know-how fee, training expenses, foreign trips etc.

The project needs to be examined with particular reference to the following points regarding the technical feasibility:

ADVERTISEMENTS:

1. Location:

The success of a project generally depends on its proper location yielding the advantages of nearness to the sources of raw material, labour; availability of power and transport facilities and market. The subsidies and other concessions available at certain specified areas are to be compared with these basic infrastructure aspects.

2. Land and Building:

The land should necessarily be sufficient to take care of future expansion. If the land is on lease, the terms and conditions of the lease to be verified and so also whether the municipal laws regarding construction of building are complied. Actual plant lay out is to be studied before deciding on the size of the building.

3. Plant and Machinery:

The important aspect to be noted in examining the list of plant and equipments is to ascertain the appropriateness of the process of technology, capacity and the related sectional balances amongst various assembly lines. It has to be ensured that the cost of equipment is based on proper quotations from suppliers and that suitable provisions have been made for insurance, freight, duty and transportation to site, erection charges and allied expenses. Adequate provision for spare parts is also essential especially if the same have to be imported.

Aspect # 3. Economic Feasibility:

ADVERTISEMENTS:

1. The economic feasibility basically deals with the marketability of the product.

2. Basic data regarding demand and supply of a product in the domestic market so also marginal and also artificial.

3. Man-made shortages are not to be reckoned as genuine demand and the market analysis is an essential part of a full appraisal.

4. Projection or forecasting of demand is no doubt a complicated matter but is of vital importance.

5. Equally important is to examine the sales promotion proposed by the enterprise and its adequacy.

Aspect # 4. Managerial Competence:

1. The success of a business enterprise depends largely on the resourcefulness, competence and integrity of its management.

2. However, assessment of managerial competence has to be necessarily qualitative, calling for understanding and judgment.

3. The managerial requirements are the experience and capability of the principal promoters to implement and run the project.

4. The adequacy of the management set up for day to day operations like production, maintenance, marketing, finance etc. and also the homogeneity of the management set up.

5. For a new entrepreneur it will always be advisable to build up a competent team of specialists in the required discipline to join hands with an entrepreneur who has the requisite organizational and managerial expertise in the implementation and operation of the project.