Various methods of remunerating labour are: 1. Time or Day Rate System 2. Straight Piece Work Rate System 3. Time Rate v/s Piece Rate System 4. Incentives and Profit Sharing 5. Bonus System.

Method # 1. Time or Day Rate System:

This is the most common system found in practice. Under this the worker is paid an hourly, daily, weekly or monthly rate of wages. Thus, his remuneration depends upon the number of hours for which he is employed and not upon the amount of his production.

Advantages:

(i) There is no dispute about the amount of payment, because it has been fixed from the very beginning and the worker knows in advance what he is going to get.

ADVERTISEMENTS:

(ii) It possesses security from the stand point of the workers because they are sure to receive their wages irrespective of temporary reduction in personal efficiency, which may result from unavoidable accident or sickness or fatigue from outside activities.

(iii) The quality of the work can be achieved very easily, as there is no need of hurrying about the things to be done.

(iv) There is no rough handling of machinery due to “slow and steady” working of workers.

(v) The interruptions to work due to breakdown of machinery or some other part of the plant will not make workers to suffer from the loss of wages.

ADVERTISEMENTS:

(vi) There are no difficult calculations to be made. If there are many calculations to be made to arrive at the remuneration of a worker, it is possible that an illiterate worker may doubt the exactness of his remuneration from time to time.

Disadvantages:

(i) The employer bears the loss resulting from slow and sluggish workers as they are paid the same wages, irrespective of their output.

(ii) This system tends to reduce production, unless a strict supervision is managed. Therefore, a well-qualified and strict foreman is required for satisfactory production.

ADVERTISEMENTS:

(iii) The system tends to give higher production cost.

(iv) This system is not suitable in the case of lazy workers.

(v) In this system, efficient workers may also become inefficient by working with inefficient workers.

Method # 2. Straight Piece Work Rate System:

This is an improvement on the Time Rate System. Under this, a fixed rate of wage is paid for each piece or unit produced.

ADVERTISEMENTS:

Suitability:

Hence this system is only suitable where the worker repeats regularly a definite operation or produces the same type of products continuously. Many employers in India have introduced this system and it has been found efficient, easy and economical.

For the application of this system, a careful time study is conducted and different types of workmen are observed for the time they take in carrying out the job. The standard time for the completion of a job by the workmen of different calibers is found out and the rate of the wage per job is decided such that every worker can get at least a minimum wage. The skilled and active workers are free to earn more by putting more efforts.

Combination of Day Rate and Piece-work Rate System:

ADVERTISEMENTS:

Under this system minimum weekly wages are fixed for every worker, which shall be paid to him irrespective of his output during the week, provided he has worked for the full working hours required in a week.

If a worker is absent for some length of time during a week his wages will be deducted proportionately, i.e., a week consists of 48 working hours and if a worker works for only 40 hours, then he will be paid 5/6 of his regular weekly wages. Thus the payment is based on time rate system.

The piece-work system is combined with the above as follows:

A job card of each worker is maintained, which clearly shows number of pieces of job completed by the worker during a week. Piece-work rate of each job is fixed in advance.

ADVERTISEMENTS:

If the piece-work wages earned by a worker are in excess than the time wages, the balance is paid to the worker, on the other hand, if they are short of the time rate, the worker shall have to make good during the next week, i.e., suppose the worker is paid Rs. 240 a week according to time rate and the piece rate of a job which he is doing is Rs. 3 each.

Again he has completed 100 jobs, during a week, he will be paid Rs. 300 for that week. However, if he completes only seventy jobs he shall still be paid Rs. 240. During the next week, he shall only be paid in excess than the time wage, if he completes more than ninety jobs i.e., after compensating for last week’s short fall.

Advantages:

(i) It provides incentive to the workers to produce more.

ADVERTISEMENTS:

(ii) The overhead costs of production are lowered.

Disadvantages:

(i) It needs check on quality.

(ii) It needs careful piece rate fixing.

(iii) The entire benefit of extra payment goes to the worker.

Method # 3. Time Rate v/s Piece Rate:

In the piece rate system, worker is paid per piece of job and no consideration of time taken is made. Actually this system is an improvement on the “Time Rate” system of payment. This system gives every workman an opportunity to earn more by putting more efforts and at the same time output also increases.

ADVERTISEMENTS:

In the time rate system strict supervision is required, as now- a-days it has become difficult to extract more and more work from workers. Foremen are always found saying to workers, “you are wasting time” or “you have not so far completed the job” or “do this or that by that time” and so on.

While in the piece rate system workers believe that every second has its value and “work is worship”. This system is applicable to productive workers, where they repeat regularly a definite operation or produce the same type of product constantly. Many employers in India have introduced this method and they found it more simple, easy, economical and efficient.

This system is not suitable for workers such as Foreman, Supervisor, Time-keeper, Cleaner, Engine men etc. and Time rate system is used as the nature of their work is such that “Time” alone can be taken as the basis to remunerate them.

The other drawback of piece rate system is that no incentive scheme can be introduced and worker’s life may reduce because of hard labour involved to earn more and more. It also affects the quality of product.

Advantages of Piece Rate:

To Workers:

ADVERTISEMENTS:

(i) It is simple in its working and they can easily calculate their wages.

(ii) An inducement is given to the workers to increase their production, i.e., greater earnings.

(iii) Workers are paid on their merits.

(iv) As supervision will be less, they feel more independent.

To Employers:

(i) The employer can know easily labour cost per unit produced.

ADVERTISEMENTS:

(ii) Wasted time is not paid, as is done in time rate system.

(iii) No strict supervision is required.

(iv) Output increase’s and higher profit can be earned.

(v) Labour turnover is reduced, as no dispute takes place for earnings.

(vi) The allotment of work and loading of machines etc. once decided, work satisfactorily.

Disadvantages of Piece Rate System:

ADVERTISEMENTS:

To Workers:

(i) As the workers put maximum efforts to earn more and more, their health may reduce.

(ii) Active and slow workers feel jealousy between each other.

(iii) When the wages earned by workmen are high, the employer may be induced to reduce the rate, which will cause friction between the employer and employee.

To Employers:

(i) It is difficult to fix an accurate piece work rate.

ADVERTISEMENTS:

(ii) This causes displacement of labour with increase in production, the number of workers engaged will be reduced.

(iii) It will cause an increase in the waste of material, because the worker will always try to obtain the maximum output.

(iv) The quality of work may be reduced.

(v) It may cause over-production and may result in losses, if there is a limited demand for the product in the market.

(vi) The entire benefit of extra wages earned goes to the workmen.

(vii) When a sluggish worker takes unnecessary longer time for completing a given job, the employer will suffer extra shop and machine charges, thus increasing the overhead cost of production.

(viii) Accidents due to hasty work will be more.

(ix) Misutilisation of machinery.

Method # 4. Incentives and Profit Sharing:

(Supplementary Compensation):

Incentives refer to performance linked compensation paid to improve motivation and productivity of the employees. It is related directly or indirectly to productivity and profitability of the enterprise, and includes all the plans that provide extra pay for extra performance in addition to regular wages for the job.

Wage incentive scheme is a managerial device of increasing a worker’s productivity. It can also be defined as a method of sharing gains in productivity with workers by rewarding them financially for their increased rate of output. Wage incentive plans are designed to improve productivity and to secure better utilisation of human and material resources of the enterprise.

Incentives:

It is something that encourages a worker to put in more productive efforts voluntarily. Mostly, workers are not willing to exert themselves to produce anywhere near their full capacity unless their interest in work is created by some kind of reward. This is called ‘incentive’.

The incentive is a kind of monetary reward which is closely related to the performance of a worker, resulting increase in wages corresponding to an increase in output.

Types of Incentives:

(a) Financial Incentives.

(b) Non-financial Incentives.

(a) Financial Incentives:

If an employer finds that he will be earning an extra profit of Rs. 25, if a particular work is finished in 5 hours less than the prescribed time. Now, if the workman is promised an extra payment of Rs. 10. This extra payment is known as incentive and is in the first instance calculated in terms of time in hours of employment.

Methods of financial incentive payment:

(i) Piece rate system.

(ii) Cent per cent premium.

(iii) Halsey premium plan.

(iv) Weir premium plan.

(v) Bedaux premium plan.

(vi) Rowan premium plan.

(vii) Emersion efficiency plan.

(viii) Gantt’s task and bonus system.

(ix) Taylor’s differential piece-rate system.

(x) Merric’s multiple piece-rate system.

(i) Piece Rate system:

Under this system, a piece rate for the completion of job is fixed. Now, if a worker completes the job earlier, he can save his time and in that saved time, he can make jobs and whatever the extra money he gets for the extra work, it wholly goes to him but the employer will also be benefitted by the savings in overheads for the extra output.

It will be more clear by the following numerical example:

Example 1:

A worker is employed for the manufacture of M.S. pins at a piece rate of 150 paise. He has to prepare 40 pins in 8 hours of work, but he prepared 55 pins in 8 hours. Calculate his total daily earning by piece rate system.

Also calculate extra earnings.

Solution:

Rate per piece = 150 paise. He has to manufacture minimum 40 pins per day.

Then, his normal earning per day = 40 × 150 = Rs. 60.00.

But he prepared 55 pins/day.

... Total earning/day = 55 × 150 = Rs. 82.50 Ans.

Therefore, his extra earning will be Rs. 82.50 – Rs. 60.00 = Rs. 22.50 Ans.

From this, it is clear that all the extra money earned by the worker goes to him only.

(ii) Cent Per Cent Premium:

In this system, the standard time for the completion of a job is fixed and its rate of completion during this period is also fixed. Now the worker who completes the job in this standard time is not given any incentive but those who complete the job earlier, get full payment for the time saved.

Example 2:

The standard time for the completion of a job is 8 hours, and the worker is paid Rs. 100.00 for it. If he completes it in 6 hours, calculate his earnings by cent percent premium system for the whole day (i.e., for 8 hours of work).

Solution:

Standard time for the job = 8 hours

Wages of 8 hours = Rs. 100.00

Time taken by worker to complete the job = 6 hours

In 6 hours, worker can earn Rs. 100.00

In 8 hours of a day he will earn Rs. 100/6 × 8 = 400/3 = Rs. 133.33.

Therefore, worker gets cent percent of his savings.

Actually, this is also a piece rate system but adopted in the case of bigger jobs, in which a single job takes several days for its completion, and if a number of small jobs can be completed in a day, then piece-rate system is used.

(iii) Halsey Premium Plan:

In this system an hourly rate or daily rate is guaranteed to the workers. A standard time is fixed for the performance of each job and the worker is paid the agreed rate per hour for the time spent thereon plus a fixed percentage (usually 33 ⅓%) of the time he can save on the standard. This plan is easy to introduce.

It will be clear by the following example:

Example 3:

Standard time for a given job is 15 hours and hourly rate of wages is Rs 5.00. A worker completes the job in 10 hours and he is allowed 33⅓% of the time saved as incentive. Calculate the earnings of the worker and also direct saving of employer.

Solution:

Worker will receive wages for 10 hours plus 33⅓% of the time saved as bonus, that is, its further 5/3 hours wages.

Hence total remuneration for 11⅔ (i.e. 10 + 5/3) hours at the rate of Rs. 5.00 per hour is Rs. 58.33. Thus the employer has made a saving of Rs. 16.67 (i.e., Rs. 75.00-58.33) in direct wages, whereas the worker has gained Rs. 8.33 extra in 10 hours.

Therefore, from this it is clear that a part of the saving goes to the worker and remaining part of the saving to the employer.

(iv) Weir Premium Plan:

This is similar to Halsey premium plan but in this worker gets upto 50% of his extra output along with standard day rate.

(v) Bedaux Premium Plan:

This is also like Halsey and Weir premium plans. But in this workers are given at the rate of 75% of their extra output along with standard day rate.

(vi) Rowan Premium Plan:

In this, the worker is again guaranteed his daily or hourly rate. A standard time is fixed for each job and a premium is given in the ratio of the time saved to the standard time multiplied by the time taken on the job.

Taking the numerical problem of Halsey premium plan, the workers’ wages and premium under this plan would be as follows:

Actual wage for the time taken (10 hours @ Rs 5.00 is Rs. 50.00).

Time saved = 5 hours.

Proportion of time saved to standard time = 5/15 = 1/3

Premium 1/3 of time taken = 10/3 hours @ Rs 5.00 = Rs. 16.66.

Therefore, total wage = Rs.50.00 + 16.66 = Rs 66.66.

It is observed that, in this system, the incentive increases upto certain output but decreases in the same ratio afterwards but in Halsey plan, incentive goes on increasing as the output increases.

Example 4:

Prove that in Rowan bonus plan, the bonus hours cannot, in any circumstances exceed 25% of the allowed standard time.

Solution:

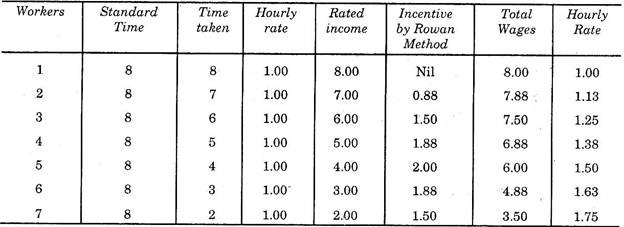

This can be proved by the following table. Let the standard time for the completion of a given task be 8 hours and an hourly rate of wages be Rs. 1.00.

The table for 7 different workers who finished the task of 8 hours in different hours is shown as under:

From this table it is clear that under Rowan method a worker cannot get more than a fixed amount even if he finishes his task too early. It is also seen that he can get maximum bonus, if he completes the task in half standard time and at this time bonus hours are 25% of the allowed standard time as shown in table for worker No. 5 and if he saves more than half the time his bonus decreases as shown in table for worker Nos. 6 and 7.

Therefore, this method safeguards the management against the chances of paying big sums to the workers as bonus, if a mistake has been made in setting the standard time. The weak point in Halsey system is that in extreme cases the worker receives a very high rate of bonus, which is not possible under this system.

(vii) Emerson Efficiency plan:

In this system premium is given to those workers who attain more than 2/3 of the standard output. In this, standard output for the day is so decided that the average worker can complete at least 2/3 of the standard output.

In this method, standards are set and workers get additional incentive along with their basic day rate. A basic day rate is fixed irrespective of the workers capabilities, and every worker gets atleast his minimum day wage.

Following are the rates at different efficiencies:

(а) If a worker performs upto 60% of the standard output, he gets no incentive.

(b) If a worker performs upto 80% of the standard output, he gets 10% of the day wages as incentive.

(c) If a worker performs upto 100% of the standard output, he gets 20% of the day wages as incentive.

(d) If a worker performs upto 120% of the standard output, he gets 40% of the wages as incentive, and so on.

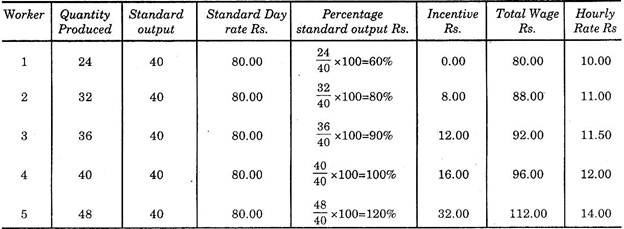

Example 5:

Five workers are manufacturing electric switches. The standard day rate is Rs. 80.00 per worker and standard output is 40 switches. Calculate their daily earning by Emerson Efficiency Plan, if they are manufacturing 24, 32, 36, 40 and 48 switches respectively.

Solution:

It can be solved in the following table:

It can be seen from the table above, that the wages of the workers go on increasing as the output increases.

(viii) Gantt’s Task and Bonus System:

In this system, first careful study of the job is made and from that study best conditions for the performance of the job are determined. On the basis of these performances standard output for a given time is set. Now, if a worker completes the job in a given standard time he receives bonus equals to 25% of the time taken. When a worker fails to produce the required output he only gets his time rate without any bonus.

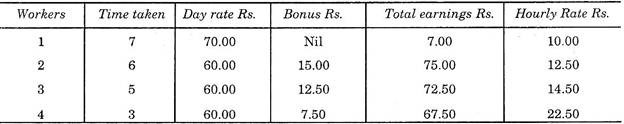

Example 6:

Four workers have taken 7, 6, 5 and 3 hours respectively for the completion of a job. The time rate is Rs 10.00 per hour. A bonus of 25% on the time taken is fixed for those, who complete the job within 6 hours. Calculate the earnings of individuals and their hourly rate by Gatt’s Task and Bonus system.

Solution:

It can be solved in the following table:

In this method, foreman also receives bonus along with the workers and, therefore, the foreman for each department is thus directly interested to see that the men under his charge doing their work to the bonus standard.

(ix) Taylor’s Differential Piece Rate System:

In this system, standard time is fixed for the performance of a piece work and those who complete the job in standard time or produce job earlier are paid at higher rates and those who do not complete the job in standard time are paid at lower rates.

This system, therefore, gives an encouragement to active workers but punishes lazy workers. In this system, it is difficult to determine the standard of higher and lower production and thus the system may prove to be unjust to the workers.

(x) Merric’s Multiple Piece Rate System:

In this system, Merric divided the workers into three categories, namely, beginners, average and first class workers and three different rates for them. The higher rates are paid to those who reach the standard, the second rates are for those who reach at least 80% of standard, and third rate is below the 80% output.

The system is very well suited for increasing efficiency and is the modification of Taylor’s system.

Advantages of Incentive System:

(i) Apart from the direct reduction in labour cost, there is indirect saving due to reduction of shop and machine charges as the time is saved.

(ii) Workers are encouraged to increase production to earn more.

(iii) Workers’ day wages are guaranteed, even if they are unable to complete the job in standard time. In case the job is completed in less than the specified time, incentive is earned.

(iv) This promotes relations between employers and employees.

(v) Cost of supervision is reduced as workers themselves are motivated to work hard and improve performance.

(vi) A spirit of mutual cooperation and teamwork is created among workers.

(vii) These help to improve discipline and industrial relations.

(viii) Employees are encouraged to become innovative.

The success of the incentive system depends on efficient and sufficient machines and tools, avoidance of delay and interruptions. A scientific work study is necessary to be conducted before introducing the incentive plan as it helps to make improvement in work flow, work methods and man-machine relationship.

Essentials of a Sound Incentive Plan:

1. Proper Climate. Sound policies regarding requirement, selection, placement, training, transfer, promotions etc. are required before introducing the plan.

2. Installation of plan in consultation with workers and their union.

3. Standards of performance should be established through scientific work study.

4. Guaranteed minimum wage.

5. Incentive plan should be easy to understand and simple to operate so that a worker can also calculate his own earnings.

6. Plan should provide equal opportunities to all workers.

7. The plan should be flexible for making changes to rectify errors and to take care of changes in technology, market demand etc.

8. Prompt payment.

9. Adequate earnings with ceiling in earnings.

Profit Sharing System:

This system has been introduced by the employers in order to encourage their employees and by means of which the workers receive a share of the profit over and above their normal wages.

Advantages:

(i) Better co-operation may be easily expected.

(ii) There is reduction of supervision, which results in reduction of supervision cost.

(iii) Non-productive labour cost will be reduced.

(iv) As there is a community of interest of all the workers, they all work more harmoniously, honestly, resulting in better production.

Disadvantages:

(i) It is difficult to ascertain the share of profit to be given to each worker and unless the profits are large, the share of each worker may appear to him very insignificant.

(ii) Since the efficiency of individual worker is of no concern to the group, individual efficiency escapes from the notice of the management.

(iii) As the distribution will normally take place only once a year, worker may lose interest in it.

(iv) If the efficient workers are not selected as group leaders, the efficiency of the whole group suffers.

Method # 5. Bonus System:

This system is used in continuous process and assembly lines where efforts of a number of workers are required to complete the job and, therefore, it is not practicable to assess the output of individual worker, there it is necessary to pay a collective or group bonus to retain the incentive payment idea.

Following are the methods of payments in this system:

(a) Collective Bonus System:

In some big industrial concerns, a collective bonus in the form of an extra salary for one or more months is given to its employees, if the profits, during the business year are handsome. If there are good profits the bonus will be declared after about six months or at the end of the year and will be payable to the workers in service at the time of declaration.

(b) Group Bonus System:

In this system, each department or section is offered a separate fixed bonus per unit time or per unit job, if the standard time is saved or the production reaches or exceeds a predetermined quantity.

Such bonus is divided between the foremen and workmen of the department or section in proportions agreed before-hand. In this system bonus is given to foreman also as they are mainly responsible for increasing output and preventing wastage of material.