The following points highlight the top six investment strategies adopted by a firm. The strategies are: 1. Asset Allocation Strategies 2. Constant Proportion 3. Constant Mix 4. Rupee Cost Averaging 5. Value Cost Averaging.

1. Asset Allocation Strategies:

Asset allocation refers to the process of allocating the investments between different asset classes. Asset allocation is an investment strategy by systematically placing of money investment into various classes of investments such as stock, bonds and cash equivalents.

Cash equivalents are short-term investments that are virtually like cash because of their high liquidity and safety. The asset allocation plan minimizes the risks on securities by keeping different baskets and to maintain the average returns on investment.

a. Traditional Allocation:

ADVERTISEMENTS:

It refers to allocating assets primarily between stocks and bonds. Most investors prefer equity for their core portfolio, adding bonds to reduce volatility and downside risk.

b. Core-Satellite Allocation:

The asset allocation policy of mutual funds, pension funds, insurance companies includes allocating assets to stocks, bonds, commodities, derivatives and non-directional hedge funds. Their portfolio construction process is called ‘core-satellite approach’. The core portfolio provides market or beta exposure and satellite portfolio strives to generate alpha returns i.e. excess returns attributable to the manager’s skill.

c. Reverse Asset Allocation:

ADVERTISEMENTS:

Some investors prefer to enhance their exposure to alpha generators (investments that outperform their class). Such investors can apply a new concept called ‘reverse asset allocation’, where alpha generators constitute the core portfolio instead the satellite portfolio. Stocks and bonds are added to this core to balance overall portfolio risk.

2. Constant Proportion:

In a constant ratio plan an investor maintains a fixed ratio between stocks and bonds throughout the investment period with regular adjustments made to compensate for different levels of price increases and decreases. This allocation strategy requires the investors to define a floor and a multiplier.

Portfolio management services firms in India use similar process to manage their capital guaranteed products. The constant proportion strategy loads more equity into the portfolio when the market moves up and reduces exposure when the market moves down.

Problem 1:

ADVERTISEMENTS:

Mr. X wants to invest an amount of Rs.10 lakhs which he wants to allocate between stocks and bonds. Assume a floor of Rs.8 lakhs and a multiplier of 2. The difference between the total assets and the floor is called the ‘cushion’. The equity exposure is a multiple of the cushion.

The investor is having a cushion of Rs.2 lakhs. With a multiplier of 2, the initial equity exposure will be Rs.4 lakhs. The balance Rs.6 lakhs will be typically invested in bonds or term deposits.

If the equity portfolio declines by 10 per cent, the total portfolio would be worth Rs.9.6 lakhs and equity exposure permissible is Rs.3.2 lakhs 2(Rs.9.6 lakhs – Rs.8 lakhs). This means that the investor would have to rebalance the portfolio by selling Rs.40,000 worth of equity and invest in bonds.

If the equity portfolio moves up by 10 per cent, then the total portfolio would be worth Rs.10.4 lakhs. The cushion would be Rs.2.4 lakhs, which allows an equity exposure of Rs.4.8 lakhs. Then the investor would have to sell Rs.80,000 worth bonds and invest in equity.

3. Constant Mix:

ADVERTISEMENTS:

This strategy maintains constant equity exposure as a percentage of the total assets. In constant mix strategy the investors buys more equity when prices go down and sell as prices go up. This continual buy-and-sell strategy helps investors take advantage of reversals within a range-bound market. The strategy under performs when the market is trending up or down, for the same reason that it does well on reversals.

The constant mix strategy plays on the behavioural psychology of investors. The reason is that it engages in value-buying by increasing equity exposure when stock prices decline. The strategy also helps investors take profits quickly, as it cuts exposure when stock prices move up. In this strategy a person maintains a fixed rupee amount of a portfolio of stocks, buying and selling shares periodically to maintain the fixed rupee amount.

The maintenance of same level of investment in stock regardless of fluctuations in shares prices by selling and buying as and when the price of stocks rises or falls. The major advantage of this strategy is that taking profits while stock prices rises and when the price falls, buy more shares, thereby allowing to take advantage of the expanded purchasing power of money.

Problem 2:

ADVERTISEMENTS:

Mr. Y decides to invest Rs.10 lakhs, out of which the investor intends to maintain 60% equity exposure. The initial portfolio will have Rs.6 lakhs in equity and Rs.4 lakhs in bonds.

If the equity portfolio declines by 10%, it would be worth Rs.5.4 lakhs i.e. 57% of the total assets of Rs.9.4 lakhs. To have an equity exposure of 60%, the investor would have to buy shares worth Rs.24,000 and sell equivalent value of bonds.

If the equity portfolio moves up by 10% to Rs.6.60 lakhs, then the total portfolio would be worth Rs.10.60 lakhs. The portfolio would have to be rebalanced, as 60% of Rs.10.60 lakhs is Rs.6.36 lakhs. The investor would, therefore, have to sell Rs.24,000 worth shares and invest in bonds.

4. Rupee Cost Averaging:

The rupee cost averaging (RCA) is always not possible to keep track of the share price movement and investors may not catch right shares at low prices to sell at higher prices. The investor will go on investing at regular intervals at a fixed amount of installment. This strategy will catch the turns in the market. Regular investing will allow you to buy more shares when prices are low given a fixed investment schedule.

ADVERTISEMENTS:

This plan is suggested for those investors who are having small amounts to invest on regular intervals, and who are risk-averse but would still like to invest. The RCA strategy suggests a long-term plan of investment to catch the markets and be fully invested in the up- markets. The investor has to retain his investments when the market is down, to minimize loss.

It is a strategy whereby a person invests the same amount of money at regular intervals in a stock or mutual fund without regard for price fluctuations of the security, this strategy will give good results based on the principle that when the price of the security declines, the fixed investment amount buys more shares and vice versa, then over a period of time the cost of each share is lower than the average price per share during the investment period.

Problem 3:

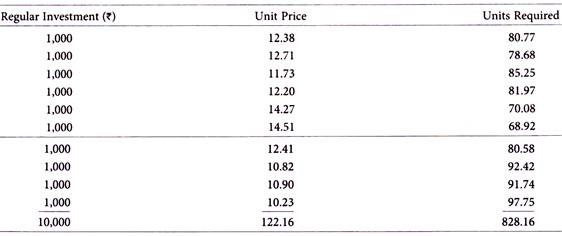

Mr. Y wants to make an investment of Rs.10,000 in a fixed monthly installment of Rs.1,000 under rupee cost averaging plan.

Average unit cost to the investor = Rs.10,000/828.16 = 12.07

Average unit price to the investor = Rs.122.16/10 = 12.22

The investor has acquired 828 units by investing an amount of Rs.10, 000. The average cost incurred by the investor to acquire these units is Rs.12.07 and the average market price of such investments is Rs.12.22.

5. Value Cost Averaging:

The value cost averaging (VCA) concept is also called as ‘value averaging’ in which the investor will invest his money gradually in the market by picking a target amount or value for his account to reach, for each time period e.g. per month. Instead of investing a fixed amount regularly, the investor will increase his investment by a specified amount till the cumulative amount reaches the target amount meant for investment, in the rising market.

When the market is in declining state, the investor will gradually decrease his investment by a specified amount till the cumulative amount reaches the target amount meant for investment. The investor will benefit from lower market prices by ending up buying more shares as security prices go down and less shares when prices go up.

The VCA plan is suggested for the investors who can sustain higher price volatility. This investment approach delivers reasonable returns. It entails more money at regular intervals to buy more shares when prices are low. The VCA plan works best when markets go sideways or down for an extended period (measured in years) then go back up and recover with strong upside.

ADVERTISEMENTS:

Problem 4:

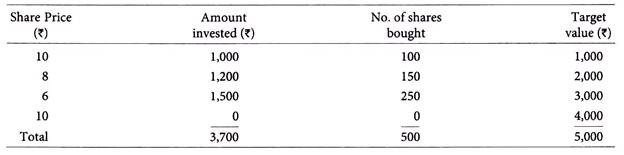

Mr. X wants to make his investment to a targeted value of Rs.5,000 under rupee cost averaging plan.

The method of investment resorted is explained below:

Other Investment Strategies:

The other common investment strategies are given below:

ADVERTISEMENTS:

i. Buy and Hold:

In this strategy the investor will purchase and hold high quality stocks for a longer period. It is a passive management strategy which produces substantial returns with least management of investments.

The dividend receipts will also be reinvested in the same category of stocks which is having compounding effect. The buy and hold strategy will result in a position to profit from long-term upward trend of the stock market.

ii. Growth Stock Approach:

In this strategy the investment will be made in those companies who have above average earnings growth over a period of time which will tend to produce stock values that will lead to above average returns for the investor.

iii. Undervalued Stock Approach:

ADVERTISEMENTS:

The investors following this approach invest in companies that have either high dividend yields, low market to book value ratios or low price earnings ratios to achieve higher current income.

iv. Out-of-Favour Stocks:

In this strategy the investors will invest in shares with low P/E ratios and those stocks are out of favour due to the economic cycle in which a particular industry is passing through.

v. Small Capitalization Approach:

The small capitalization companies are growing attraction for the investors due to their potential for rapid growth.

vi. Market-Timer Approach:

ADVERTISEMENTS:

In this approach, the investor will vary stocks proportion in his portfolio depending on where he views the stock market to be at a particular time.

vii. Selling Short:

Selling short is a strategy investors use to profit during a price decline. Under this strategy, in anticipation of a price decline, first the investor will sell stock at high price and later buy it back at a lower price. Short sellers will make profit when price of stock declines and if the price of the stock rises, short sellers lose.

viii. Systematic Investment Plan:

The systematic investment plan (SIP) enforces discipline among the investors in saving the money for the future requirements and enables them to contribute to the stocks in monthly installments instead of making onetime payment of lump sum amount. This type of investment option gives greater flexibility to the investors especially salaried employees.

ix. Systematic Withdrawal Plan:

ADVERTISEMENTS:

The systematic withdrawal plan (SWP) enables an investor to systematically withdraw his money from the investment in securities.

x. Growth Option Plan:

Investors who prefer capital appreciation opt for growth plan. The scheme wouldn’t declare dividends under growth plan. The income earned on the stocks will remain invested within the stocks.

xi. Income Option Plan:

Investors who wish to receive regular income can opt for dividend plan. In this plan dividend and/or interest is received regularly from the investment.

xii. Income Reinvestment Plan:

In this plan, the investors decide to reinvest dividends and/or interest in additional stocks available in the market.

xiii. Switch Facility:

The unit holders are given freedom to switch over from one scheme to another. The switchover will take place at the applicable NAV based prices. The unit holders are allowed to exchange their units under existing investment plans to some other plans.

xiv. Fixed Sum Investment Plan:

In this plan, the investor will prefer to invest a lumpsum at a time and wait for growth of his investment. This plan is suggested when markets surge. It delivers handsome returns over the long-term. The investor can choose this plan when chunk of money is available for investment. While making the investment, the investor has to choose a blend of stocks in his portfolio to minimize risk.

Matrix Model:

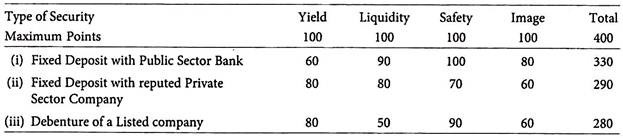

The management of investments and portfolio decision is complex task which requires careful analysis and planning which involves number of variables like, return, liquidity, safety, image etc. of the investment. By using the matrix approach, the investment is selected which fetches the highest score, based on the weights given for various features of the security.

The following problem will explain the method of using matrix approach in selection of investments:

Problem 5:

The investor can assign points to each character of the investment, and he can select the portfolio which has been awarded with high score of points. This method is criticized for the reason that some element of subjectivity is involved in awarding of marks. If this method is used with care, will give good results.