Everything you need to know about the international business. International business refers to those business activities that take place beyond the geographical limits of a country.

It involves not only the international movements of goods and services, but also of capital, personnel, technology and intellectual property like patents, trademarks, knowhow and copyrights.

“International business consists of transactions that are devised and carried out across national borders to satisfy the objectives of the individuals, companies and organisations. These transactions take on various forms which are often interrelated.” – Michael R. Czinkota

Learn about:

ADVERTISEMENTS:

1. Introduction to International Business 2. Meaning and Definitions of International Business 3. Nature 4. Scope 5. Features 6. Factors Influencing International Business

7. Reasons 8. Modes of Entry into International Business 9. Difference between Domestic Business and International Business 10. Benefits 11. Problems.

International Business: Introduction, Definitions, Meaning, Nature, Scope, Features and Other Details

Contents:

- Introduction to International Business

- Meaning and Definitions of International Business

- Nature of International Business

- Scope of International Business

- Features of International Business

- Factors Influencing International Business

- Reasons for International Business

- Modes of Entry into International Business

- Difference between Domestic Business and International Business

- Benefits of International Business

- Problems of International Business

International Business – Introduction

The world has become a ‘global village’. Business has expanded and is no longer restricted to the physical boundaries of a country.

ADVERTISEMENTS:

Even countries which were self-reliant are now depending upon others for procurement of goods and services. They are also ready to supply the goods and services to developing countries. There is a change from self-reliance to dependence. This is because of the development of new modes of telecommunication and infrastructure facilities like faster and efficient means of transportation. They have brought countries closer to each other.

Besides development in technology, infrastructure and communication efforts of World Trade Organisation (WTO) and the reforms carried out by governments of different countries have also been a major reason for increasing commercial interactions among the countries.

India has been trading with other countries for a long time but now it has caught up in the process of globalisation in a big way and is integrating its economy with the world economy.

International business refers to those business activities that take place beyond the geographical limits of a country. It involves not only the international movements of goods and services, but also of capital, personnel, technology and intellectual property like patents, trademarks, knowhow and copyrights.

International Business – Meaning and Definitions: By Michael R. Czinkota and Roger Bennett

International business refers to those business activities that take place beyond the geographical limits of a country.

ADVERTISEMENTS:

“International business consists of transactions that are devised and carried out across national borders to satisfy the objectives of the individuals, companies and organisations. These transactions take on various forms which are often interrelated.” – Michael R. Czinkota

“International business involves commercial activities that cross national frontiers” – Roger Bennett

Thus, it involves not only the international movement of goods and services, but also of capital, personnel, technology and intellectual property like patents, trademarks, knowhow and copyrights etc.

ADVERTISEMENTS:

It is a business which takes place outside the boundaries of a country, i.e., between two countries. It includes the international movements of goods and services, capital, personnel, technology and intellectual property rights like patents, trademarks and knowhow. It refers to the purchase and sale of goods and services beyond the geographical limits of a country.

It is of three types:

(i) Export Trade – It is selling of goods and services to foreign countries.

(ii) Import Trade – It is buying goods and services from other countries.

ADVERTISEMENTS:

(iii) Entreport Trade – It is import of goods and services for re-export to other countries.

International Business – Nature and Scope

Nature:

1. International Business is much broader term than that of International Trade.

International business includes:

ADVERTISEMENTS:

(a) Export and import of goods.

(b) Export and import of services or intellectual property rights.

(c) Licencing and franchising.

(d) Foreign Investments including both direct investment and portfolio investments.

ADVERTISEMENTS:

2. International Trade refers to only export and import of merchandise, i.e., goods only. It is also called visible trade. The goods are tangible, like machinery, gold, silver, electronic goods etc.

Scope:

International business involves export and import of goods.

(ii) Export and Import of Services:

It is also called invisible trade. Items of invisible trade include tourism, transportation, communication, banking, warehousing, distribution and advertising.

ADVERTISEMENTS:

(iii) Licensing and Franchising:

Licensing is a contractual agreement in which one firm (the licensor) grants access to its patents, copyrights, trademarks or technology to another firm in a foreign country (the licensee) for a fee called royalty. It is under the licensing system that Pepsi and Coca Cola are produced and sold all over the world.

Franchising is also similar to licensing, but it is a term used in connection with the provision of services. For example, McDonald’s operates fast food restaurants all over the world through its franchising system.

It involves investments of funds abroad in exchange for financial return.

Foreign investments can be of two types:

ADVERTISEMENTS:

(a) Foreign Direct Investment (FDI) – Investment in properties such as plant and machinery in foreign countries with a view to undertaking production and marketing of goods and services in those countries.

(b) Portfolio Investment – Investments in shares or debentures of foreign companies with a view to earn income by way of dividends or interest.

International Business – Features: Involves Two Countries, Use of Foreign Exchange, High Degree of Risk, Heavy Documentation, Time Consuming and Lack of Personal Contact

The main features of international business are as follows:

1. Involves Two Countries – International business is possible only when there are transactions across different countries.

2. Use of Foreign Exchange – Every country has its own different currency. This gives rise to the problem of exchange of currencies as foreign currency is used in making transactions.

3. Legal Obligations – Each country has its own laws regarding foreign trade, which have to be complied with. Further, there is more government intervention in case of international transactions.

ADVERTISEMENTS:

4. High Degree of Risk – International business faces huge risk due to long distances, risk of fluctuations in two currencies, fear of obsolescence, etc.

5. Heavy Documentation – It is subject to number of formalities. Many documents have to be filled in and despatched to the other party.

6. Time Consuming – The time gap between sending and receiving of goods and payment is wider as compared to inland trade.

7. Lack of Personal Contact – It lacks direct and personal contact between importer and exporter.

International Business – 5 Main Factors Influencing International Business: Culture, Economic System, Economic Conditions, Exchange Rates and Political Risk and Regulations

When a firm engages in international business, it must consider the following characteristics of foreign countries:

1. Culture

ADVERTISEMENTS:

2. Economic system

3. Economic conditions

4. Exchange rates

5. Political risk and regulations

Factor # 1. Culture:

Because cultures vary, a firm must learn a foreign country’s culture before engaging in business there. Poor decisions can result from an improper assessment of a country’s tastes, habits, and customs. Many U.S. firms know that cultures vary and adjust their products to fit the culture. For example, McDonald’s sells vegetable burgers instead of beef hamburgers in India.

PepsiCo (owner of Frito Lay snack foods) sells Cheetos without cheese in China because Chinese consumers dislike cheese, and it has developed a shrimp-chip to satisfy consumers in Korea. Beer producers sell nonalcoholic beer in Saudi Arabia, where alcohol is not allowed.

ADVERTISEMENTS:

Wal-Mart is still learning from its experience in many countries. When it established stores in Argentina, it initially used the same store layout as in the United States, but it quickly learned that the local people preferred a different layout. In addition, it conducted meetings with suppliers in English, even though the primary language of the suppliers was Spanish.

Wal-Mart’s expansion into Mexico was more effective because it acquired a large Mexican retail firm and was able to rely on it for information about the local culture.

Factor # 2. Economic System:

A firm must recognize the type of economic system used in any country where it considers doing business. A country’s economic system reflects the degree of government ownership of businesses and intervention in business. A U.S. firm will normally prefer countries that do not have excessive government intervention.

Although each country’s government has its own unique policy on the ownership of businesses, most policies can be classified as capitalism, communism, or socialism.

i. Capitalism:

Capitalism allows for private ownership of businesses. Entrepreneurs have the freedom to create businesses that they believe will serve the people’s needs. The United States is perceived as a capitalist society because entrepreneurs are allowed to create businesses and compete against each other.

In a capitalist society, entrepreneurs’ desire to earn profits motivates them to produce products and services that satisfy customers. Competition allows efficient firms to increase their share of the market and forces inefficient firms out of the market.

U.S. firms can normally enter capitalist countries without any excessive restrictions by the governments. Typically, though, the level of competition in those countries is high.

ii. Communism:

Communism is an economic system that involves public ownership of businesses. In a purely communist system, entrepreneurs are restricted from capitalizing on the perceived needs of the people. The government decides what products will be produced and in what quantity.

It may even assign jobs to people, regardless of their interests, and sets the wages to be paid to each worker. Wages may be somewhat similar, regardless of individual abilities or effort. Thus, workers do not have much incentive to excel because they will not be rewarded for abnormally high performance.

In a communist society, the government serves as a central planner. It may decide to produce more of some type of agricultural product if it observes a shortage. Since the government is not concerned about earning profits, it does not focus on satisfying consumers (determining what they want to purchase).

Consequently, people are unable to obtain many types of products even if they can afford to buy them. In addition, most people do not have much money to spend because the government pays low wages.

Countries in Eastern Europe, such as Bulgaria, Poland, and Romania, had communist systems before 1990. During the 1990s, however, government intervention in these countries declined. Prior to the 1990s, communist countries restricted most U.S. firms from entering, but as they began to allow more private ownership of firms, they also allowed foreign firms to enter.

iii. Socialism:

Socialism is an economic system that contains some features of both capitalism and communism. For example, governments in some so-called socialist countries allow people to own businesses and property and to select their own jobs.

However, these governments are highly involved in the provision of various services. Health-care services are run by many governments and are provided at a low cost. Also, the governments of socialist countries tend to offer high levels of benefits to unemployed people.

Such services are indirectly paid for by the businesses and the workers who earn income. Socialist governments impose high tax rates on income so that they have sufficient funds to provide all their services.

Socialist countries face a tradeoff when setting their tax policies, though. To provide a high level of services to the poor and unemployed, the government must impose high tax rates. Many businesses and workers in socialist countries, however, would argue that the tax rates are excessive.

They claim that entrepreneurs may be discouraged from establishing businesses when the government taxes most of the income to be earned by the business. Entrepreneurs thus have incentive to establish businesses in other countries where taxes are lower. But if the government lowers the tax rate, it may not generate enough tax revenue to provide the services.

A socialist society may discourage not only the establishment of new businesses but also the desire to work. If the compensation provided by the government to unemployed workers is almost as high as the wages earned by employed workers, unemployed people have little incentive to look for work. The high tax rates typically imposed on employed people in socialist countries also discourage people from looking for work.

Comparison of Socialism and Capitalism:

In socialist countries, the government has more influence because it imposes higher taxes and can spend that tax revenue as it chooses. In capitalist countries, the government has less influence because it imposes lower taxes and therefore has less funds to spend on the people. Businesses and highly skilled workers generally prefer capitalist countries because there is less government interference.

Even if a capitalist country is preferred, people may disagree on how much influence the government should have. For example, some people in the United States believe that the government should provide fewer services to the unemployed and the poor, which would allow for lower taxes. Other people believe that taxes should be increased so that the government can allocate more services to the poor.

Many countries exhibit some combination of capitalism and socialism. For example, the governments of many developed countries in Europe (such as Sweden and Switzerland) allow firms to be privately owned but provide various services (such as health care) for the people. Germany’s government provides child-care allowances, health care, and retirement pensions. The French government commonly intervenes when firms experience financial problems.

European countries have recently attempted to reduce their budget deficits as part of a treaty supporting closer European relations. This may result in less government control because the governments will not be able to spend as much money.

iv. Privatization:

Historically, the governments of many countries in Eastern Europe, Latin America, and the Soviet Bloc owned most businesses, but in recent years they have allowed for private business ownership.

Many government-owned businesses have been sold to private investors. As a result of this so- called privatization, many governments are reducing their influence and allowing firms to compete in each industry.

Privatization allows firms to focus on providing the products and services that people desire and forces the firms to be more efficient to ensure their survival. Thousands of businesses in the former Soviet Bloc have been privatized. Some U.S. firms have acquired businesses sold by the governments of the former Soviet republics and other countries. Privatization has provided an easy way for U.S. firms to acquire businesses in many foreign countries.

Privatization in many countries, such as Brazil, Hungary, and the countries of the former Soviet Bloc, is an abrupt shift from tradition. Most people in these countries have not had experience in owning and managing a business. Even those people who managed government-owned businesses are not used to competition because the government typically controlled each industry.

Therefore, many people who want to own their own businesses have been given some training by business professors and professionals from capitalist countries such as the United States. In particular, the MBA Enterprise Corps, headquartered at the University of North Carolina, has sent thousands of business students to less-developed countries.

Even the industrialized countries have initiated privatization programs for some businesses that were previously owned by the government. The telephone company in Germany has been privatized, as have numerous large government-owned businesses in France.

Factor # 3. Economic Conditions:

To predict demand for its product in a foreign country, a firm must attempt to forecast the economic conditions in that country. The firm’s overall performance is dependent on the foreign country’s economic growth and on the firm’s sensitivity to conditions in that country.

Economic Growth:

Many U.S. firms have recently expanded into smaller foreign markets because they expect that economic growth in these countries will be strong, resulting in a strong demand for their products. For example, Heinz has expanded its business throughout Asia. General Motors, Procter & Gamble, AT&T, Ford Motor Company, and Anheuser-Busch plan new direct foreign investment in Brazil. The Coca-Cola Company has expanded in China, India, and Eastern Europe.

The primary factor influencing the decision by many firms to expand in a particular foreign country is the country’s expected economic growth, which affects the potential demand for their products. If firms overestimate the country’s economic growth, they will normally overestimate the demand for their products in that country. Consequently, their revenue may not be sufficient to cover the expenses associated with the expansion.

In addition, foreign countries may experience weak economies in some periods, which can adversely affect firms that serve those countries. For example, during the Asian crisis of 1997-1998, Asian economies were weak, and U.S. firms with business in Asia, such as Nike and Hewlett-Packard, experienced a decline in the demand for their products.

In 2001-2002, worldwide economic conditions were generally weak, and many U.S. companies that served foreign countries were adversely affected. Economic conditions in the United States were also weak.

Consequently, firms with business diversified across different countries were not insulated from the weak economic conditions because these conditions existed in most countries during this period.

For example, DuPont, Nike, 3M, and Hewlett-Packard experienced lower-than-expected revenue because of weak European economies in the 2001-2002 period. To illustrate the impact of global economic conditions, consider the comments made by Dell, Inc., in a recent annual report-

“During 2002, worldwide economic conditions negatively affected demand for the Company’s products and resulted in declining revenue and earnings The Company believes that worldwide economic conditions will improve. However, if economic conditions continue to worsen, or if economic conditions do not improve as rapidly as expected, the Company’s revenue and earnings could be negatively affected.”

Sensitivity to Foreign Economic Conditions:

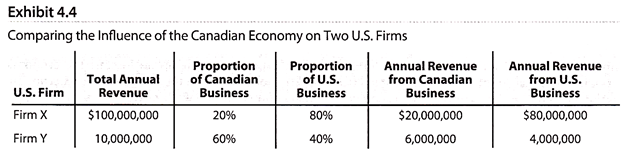

A U.S. firm’s exposure to a foreign country’s economy is dependent on the proportion of the firm’s business conducted in that country. To illustrate, compare the influence of Canada’s economy on two U.S. firms (Firm X and Firm Y), as shown in Exhibit 4.4.

Assume that Firm X typically generates 20 percent of its total revenue from selling its products in Canada and 80 percent of its total revenue from the United States.

Firm Y typically generates 60 percent of its total revenue from Canada and 40 percent of its total revenue from the United States. A weak economy in Canada will likely have a more negative effect on Firm Y because it relies more on its Canadian business.

Some U.S. firms, such as The Coca-Cola Company Dow Chemical, and ExxonMobil, generate more than half of their total revenue from foreign countries. Nevertheless, they are not heavily influenced by any single foreign country’s economy because their international business is scattered across many countries.

The Coca-Cola Company, for example, conducts business in more than 200 foreign countries. The demand for Coca-Cola’s soft drink products may decline in some countries where the weather is cooler than normal, but this unfavorable effect can be offset by a higher demand for the company’s products in other countries where the weather is warmer than normal.

Factor # 4. Exchange Rates:

Countries generally have their own currency. The United States uses dollars ($), the United Kingdom uses British pounds (£), Canada uses Canadian dollars (C$), and Japan uses Japanese yen (¥). 12 European countries recently adopted the euro (€) as their currency.

Exchange rates between the U.S. dollar and any currency fluctuate over time. Consequently, the number of dollars a U.S. firm needs to purchase foreign supplies may change even if the actual price charged for the supplies by the foreign producer does not.

When the dollar weakens, foreign currencies strengthen; thus, U.S. firms need more dollars to purchase a given amount of foreign supplies. Exchange rate fluctuations can also affect the foreign demand for a U.S. firm’s product because they affect the actual price paid by the foreign customers (even if the price in dollars remains unchanged).

Factor # 5. Political Risk and Regulations:

A firm must also consider the political risk and regulatory climate of a country before deciding to do business there. Political risk is the risk that a country’s political actions may adversely affect a business.

Political crises have occurred in many countries throughout Eastern Europe, Latin America, and the Middle East. U.S. firms are subject to policies imposed by the governments of the foreign countries where they do business.

Firms are also vulnerable to the possibility that political problems between two governments may cause consumers to react negatively against the firms because of their country of origin. During the war in Iraq in 2003, anti-American protests against the war in the Middle East and other countries forced some U.S.-based multinational corporations to temporarily shut down their operations in some countries. In addition, the protests led to a decline in the demand for the products of some U.S.-based firms.

As an extreme form of political risk, a foreign government may take over a U.S. firm’s foreign subsidiary without compensating the U.S. firm in any way. A more common form of political risk is that the foreign government imposes higher corporate tax rates on foreign subsidiaries.

Some governments impose a tax on funds sent by a subsidiary to the parent firm (headquarters) in the home country. They may even prevent the funds from being sent for a certain period of time.

The exposure of multinational companies to political risks is clearly emphasized in a recent annual report of Dell, Inc.-

“The Company’s future growth rates and success are dependent on continued growth and success in international markets…… The success and profitability of the Company’s international operations are subject to numerous risks and uncertainties, including local economic and labor conditions, political instability, and unexpected changes in the regulatory environment, trade protection measures, tax laws, and foreign currency exchange rates.”

Corruption:

Corruption is a form of political risk that can have a major impact on firms attempting to do business in a country. For example, a firm that wants to establish a business in a specific country may obtain a quick approval only if it provides payoffs to some government officials.

Thus, corruption increases the cost of doing business. It may also be viewed as illegal. Firms may therefore be discouraged from doing business in those countries that have more corruption. Transparency International calculates a corruption index for most countries. Countries with relatively high ratings have less corruption.

Regulatory Climate:

Government regulations such as environmental laws vary among countries. By increasing costs, these laws can affect the feasibility of establishing a subsidiary in a foreign country. Stringent building codes, restrictions on the disposal of production waste materials, and pollution controls are examples of regulations that may force subsidiaries to incur additional costs. Many European countries have recently imposed tougher anti-pollution laws as a result of severe pollution problems.

Another type of regulatory problem occurs when countries do not enforce their laws. Some countries do not enforce regulations that protect copyrights laws. Thus, a firm that produces products such as books or music CDs may not benefit from establishing a business in these countries because the product may be easily copied by local firms without any penalty for violating copyright laws.

Some countries also do not enforce bribery laws. As a result of the Foreign Corrupt Practices Act, U.S. firms are not allowed to offer bribes to government officials or political candidates. Some U.S. firms argue that they are at a disadvantage because they are unable to offer bribes to government officials in a foreign country, when some other firms can.

Countries also differ in the penalties they may impose on businesses for producing defective products or discriminating against employees. The U.S. court system has a worldwide reputation for imposing excessive penalties on businesses. In numerous cases, a person who was injured because of poor judgment blamed the injury on the product and won a lawsuit against a business in a U.S. court.

Even if a business can prove that it was not at fault, defending against a lawsuit can be very expensive. Non-U.S. firms may be discouraged from establishing businesses in the United States for this reason.

Given the major differences in regulations among countries, a firm must understand the rules of any country where it is considering conducting business. Firms should pursue only those international business opportunities where the potential benefits are not offset by costs associated with regulations.

International Business – Reasons for International Business: Uneven Distribution of Natural Resources, Availability of Factors of Production, Specialisation and Cost Benefits

The international business is needed due to the following reasons:

1. Uneven Distribution of Natural Resources – All the countries cannot produce equally well or cheaply due to unequal distribution of natural resources among them or differences in their productivity levels. As a result, they exchange their surplus production with goods that they are in short supply in their country.

2. Availability of Factors of Production – The various factors of production such as labour, capital and raw materials, needed for producing different goods and services differ among nations.

3. Specialisation – Some countries specialise in the production of goods and services for which they have some advantages like advanced technical know-how, high labour productivity, suitable climatic conditions, etc. For example, West Bengal specialises in jute products.

4. Cost Benefits – Production costs differ in different countries due to difference in socio-economic, geographical and political conditions. Some countries are in a better position to produce some goods more economically than other countries. As a result, firms engage in international business to import what is available at lower prices in other countries and export goods on which they can fetch better prices.

International Business – 5 Important Modes of Entry into International Business (Along with their Advantages and Limitations)

There are various ways in which a company can enter into international business. Let us discuss the important ways or modes along with their advantages and limitations.

1. Exporting and Importing:

Exporting refers to selling of goods and services by a firm of home country to a firm of foreign country. For example, sale of sweets by Haldiram to WalMart Store in USA. Importing refers to buying of goods and services by a firm of home country from a firm of foreign country. For example, purchase of toys by an Indian toy dealer from a Chinese firm.

Two Important Ways to Export and Import:

(i) Direct Exporting/Importing – The firm deals directly with the overseas buyers or suppliers and carries out all formalities related to shipment and financing of goods and services.

(ii) Indirect Exporting/Importing – The firm employs a middleman (such as export houses or buying offices of overseas customers), who deals with the overseas buyers or suppliers and carries out all the formalities. The firm’s participation is minimum.

Tangible vs. Intangible Exports and Imports:

The exports and imports can be of two types:

1. Merchandise exports and imports – Merchandise means goods that are tangible, i.e., which can be seen and touched. The trade in merchandise is also known as ‘Visible Trade’. Merchandise exports involves sending tangible goods abroad, while merchandise imports means bringing tangible goods from a foreign country to the home country.

2. Service exports and imports – It involves trade in intangibles, i.e., which cannot be seen and touched. The trade in services is also known as ‘Invisible Trade’. It includes trading in wide variety of services, such as tourism, entertainment, transportation, communication, banking, etc.

Advantages of Exporting and Importing:

1. Easy Mode – As compared to other modes of international business, it is the easiest way to get entry into international market.

2. Less Investment – It does not require heavy investment as needed in case of other modes of entry. Moreover, firm is not required to invest much of its time in business operations.

3. Less Risk – It is less risky due to negligible or low foreign investment as compared to other modes of entry.

Limitations of Exporting and Importing:

1. High Cost – As goods physically move from one country to another, it involves heavy additional packaging, transportation and insurance costs (especially in case of heavy items). Moreover, such goods are also subject to custom duty and other levies and charges.

2. Import Restrictions – Where import restrictions exist in a foreign country, then other modes of entry (like joint venture or licensing) are suitable.

3. Lack of Direct Contact – Exporters normally do not have much contact with the foreign markets as they have with their local market. It puts the export firms in a disadvantageous position.

Conclusion:

Even though exporting/importing suffers from certain limitations, still it is the most preferred mode of international business. Firms generally start their overseas operations with exports and imports and then switch over to other forms of international business operations.

2. Contract Manufacturing:

Contract manufacturing is a type of international business, in which a firm enters into a contract with another firm in foreign country to manufacture certain components or goods as per its specifications. For example, international companies such as Nike, Reebok, Levis, etc. get their products or components produced in the developing countries under contract manufacturing. Contract manufacturing is also known as outsourcing.

Contract manufacturing can be done in three ways:

(i) Production of certain components to be used in producing final products – For example, giving contract to manufacture car accessories (like door handles, rear mirror) so that they can be used in manufacturing the final product (i.e. car).

(ii) Assembly of components into final products – For example, assembly of processor, mother board, hard disk, RAM, etc. into a computer.

(iii) Manufacture of the complete product – The contract may also be given to manufacture the complete product. For example, companies like Sony, Samsung get most of the products manufactured as per their specifications.

Advantages of Contract Manufacturing:

Contract manufacturing offers several advantages to both the international company and local producers in the foreign countries.

1. No need to set Production Facilities – It allows the international firms to get the goods produced on a large-scale without requiring investment in setting up production facilities.

2. Low Investment Risk – The investment risk is almost negligible due to no/ little investment in the foreign countries.

3. Lower Cost of Production – It benefits the international company to get the products manufactured or assembled at lower costs. For example, many foreign firms get their goods manufactured in India due to cheap labour.

4. Better utilisation of idle capacity – Local producers in foreign countries also gain as contract manufacturing ensures better utilisation of their production capacity. For example, Godrej group has been benefitted by using its excess soap manufacturing capacity in manufacturing Dettol soap for foreign company, Reckitt and Colman.

5. Benefits of Export Incentives – The local manufacturers can get benefits of export incentives if the produced goods are to be delivered to a foreign country (as per requirements of the international firm).

Limitations of Contract Manufacturing:

The major disadvantages of contract manufacturing are as follows:

1. Risk of Poor Quality – Local firms may not be so rigid or concerned with regard to production design and quality standards, which may lead to product quality problems to the international firm.

2. Loss of control over production process – The local manufacturer in the foreign country loses his control over the manufacturing process as goods are strictly produced according to terms and specifications of the contract.

3. No Control over Output – The local manufacturer is not allowed to sell the contracted output in the open market. It has to sell the goods to the international company at predetermined prices. It reduces the profits of the manufacturer if prices in the open market are higher than the prices agreed upon under the contract.

3. Licensing and Franchising:

Licensing:

Licensing is a contractual arrangement in which one firm grants access to its patents, trade secrets or technology to another firm in a foreign country for a fee called royalty. For example, Pepsi and Coca Cola are produced and sold all over the world by local bottlers in foreign countries under the licensing system.

The firm that grants such permission is known as ‘Licensor’ and the other firm in the foreign country that acquires such rights are known as ‘Licensee’. When there is mutual exchange of knowledge, technology and/or patents between the firms, it is known as ‘Cross-licensing’.

It may be mentioned here that it is not only technology that is licensed. For example, in the fashion industry, designers license the use of their names.

Franchising:

Franchising is a contractual agreement which involves grant of rights by one party to another for use of technology, trademark and patents in return of the agreed payment for a certain period of time. The company that grants the rights (i.e. parent company) is known as ‘Franchiser’ and the other company (which acquires the rights) is known as ‘Franchisee’.

Why is Franchising so Popular?

The franchiser has developed a unique technique for creating and marketing of services under its own name and trade mark. This uniqueness enables the franchiser to have a competitive edge in the market and induces the firms to become their franchisee. For example, McDonald, Pizza Hut and Wal-Mart are some of the leading franchisers operating worldwide.

Franchising vs. Licensing:

1. Franchising is used in connection with service business, while licensing is used in connection with production and marketing of goods.

2. Franchising is relatively more rigid than licensing, i.e., franchisers usually set strict rules and regulations as compared to licensing.

Except for these two differences, franchising is pretty much the same as licensing.

Advantages of Licensing and Franchising:

1. Less Expensive Mode – It is a less expensive mode for licensor/franchiser to enter into international business as investment in business is made by the licensee/franchisee.

2. No Risk of Loss – Licensor/franchiser do not face risk of losses in the foreign business because of no or negligible foreign investment. Moreover, they are entitled to license fees and royalty.

3. Low Risk of Takeover – There are lower risks of business takeovers or government interventions as business is carried on by the licensee/ franchisee who is a local person.

4. Benefits of Market knowledge – Licensor/franchiser can successfully conduct their marketing operations as they can take advantage of market knowledge and contacts of licensee/franchisee.

5. Prevents misuse of Trademarks and Patents – Only licensee/franchisee is legally entitled to make use of the licensor’s/franchiser’s copyrights, patents and brand names. It prevents misuse of such trademarks and patents by other firms.

Limitations of Licensing and Franchising:

1. Risk of competition from licensee/franchisee – There is a danger of severe competition to the licenser/ franchiser as licensee/franchisee can start marketing an identical product under a different brand name. It may happen because licensee/franchisee gains full knowledge in the manufacturing and marketing of licensed/franchised products.

2. Risk of leakage of trade secrets – There is always a risk of disclosure of trade secrets to outsiders in case of any lapse on the part of the licensee/ franchisee.

3. Conflicts – The conflicts may arise between the licensor/franchiser and licensee/franchisee over issues like maintenance of accounts, payment of royalty, non-adherence to quality standards, etc. These differences are harmful to both the parties.

4. Joint Ventures:

When two or more firms join together for a common purpose and mutual benefit, it is known as joint venture. For example, joint venture of Hero of India with Honda of Japan. It involves establishing a firm that is jointly owned by two or more otherwise independent firms.

In India, joint venture is very popular as it not only attracts foreign capital but also foreign technology.

Formation of Joint Venture:

A joint venture company can be formed in any of the following ways:

1. A foreign company acquires interest (i.e. portion of equity shares) in an existing Indian company.

2. An Indian company acquires interest in an existing foreign firm.

3. Both foreign company and Indian company join together to form a new enterprise.

Advantages of Joint Venture:

1. Less Financial Burden in Global Expansion – It is financially less burdensome to expand globally for the international firm as local partner also contributes to the equity capital of such venture.

2. Facilitates Large-scale Operation – Joint ventures make it possible to operate on large-scale and execute heavy projects, which require huge capital and manpower.

3. Benefits of Local Partner’s knowledge – The joint venture helps to take advantage of knowledge of local partner regarding the competitive conditions, culture, business and political systems.

4. Sharing of Cost and Risks – Generally, business in foreign market is very costly and risky. Joint venture facilitates sharing of such costs and risks with a local partner.

Limitations of Joint Venture:

1. Risk of Loss of Trade Secrets – There is a risk of disclosure of technology and trade secrets to outsiders as foreign firms share them with local firms in the foreign country.

2. Conflict of Interest – The dual ownership may lead to conflicts between the partners over control of business.

5. Wholly Owned Subsidiaries:

A ‘wholly owned subsidiary’ is a company in which 100 per cent investment in its equity capital is made by a parent company. The company making the investment is known as ‘Parent Company’ or ‘Holding Company’. This mode of entering into international business is preferred by those companies, which want full control over their overseas operations.

There are two ways of establishing a wholly owned subsidiary in a foreign market:

i. Setting up a new company by making 100% investment in a foreign country. It is also referred to as a Green Field Venture.

ii. Acquiring an established company by investing 100% in its equity in a foreign country and using that firm to manufacture and/or promote its product in the host country.

A company becomes the holding company when it acquires more than 50% equity shares in another company (known as subsidiary company). However, if the holding company holds 100% equity shares in a company, then the latter is termed as ‘wholly-owned subsidiary company’.

Advantages of Wholly Owned Subsidiaries:

The major advantages of a wholly owned subsidiary in a foreign country are as follows:

1. Full Control – The parent company is able to exercise full control over the management of wholly owned subsidiary company in the foreign country.

2. No Disclosure of Trade Secrets – As the parent company has full control over operations of foreign subsidiary, it prevents leakage of technology or trade secrets to others.

Limitations of Wholly Owned Subsidiaries:

1. Huge Investment – This mode is not suitable for small and medium size firms who do not have sufficient funds to make 100% equity investment.

2. Huge Risk – The parent company has to bear the risk of entire losses in the event of business failure because of its 100% investment.

3. High Political Risk – This mode of international business is subject to high political risk as some countries do not permit 100% wholly owned subsidiaries by foreigners in their countries.

International Business – 4 Common Motives: Attract Foreign Demand, Capitalize on Technology and a Few Others

International business can enhance a firm’s performance by increasing its revenue or reducing its expenses. Either result leads to higher profits for the firm. There are various motives for international business, and each of them allows the firm to benefit in a manner that can enhance its performance.

Some of the more common motives to conduct international business are:

(i) Attract foreign demand

(ii) Capitalize on technology

(iii) Use inexpensive resources

(iv) Diversify internationally

Firms that engage in international business are commonly referred to as multinational corporations. Some multinational corporations such as Amazon.com, The Gap, IBM, and Starbucks are large well-known firms, but many small U.S. firms also conduct international business so that they can enhance their performance.

(i) Attract Foreign Demand:

Some firms are unable to increase their market share in the United States because of intense competition within their industry. Alternatively, the U.S. demand for the firm’s product may decrease because of changes in consumer tastes. Under either of these conditions, a firm might consider foreign markets where potential demand may exist.

Many firms, including DuPont, IBM, and PepsiCo, have successfully entered new foreign markets to attract new sources of demand. Wal-Mart Stores has recently opened stores in numerous countries, including Mexico and Hong Kong. Boeing (a U.S. producer of aircraft) recently received orders for jets from China Xinjiang Airlines and Kenya Airways.

Avon Products has opened branches in many countries, including Brazil, China, and Poland. McDonald’s is now in more than 80 different countries and generates more than half of its total revenue from foreign countries. Hertz has expanded its agencies in Europe and in other foreign markets. Amazon.com has expanded its business by offering its services in many foreign countries.

Blockbuster has more than 3,000 stores located in 27 markets outside the United States. It is focusing its efforts for future growth in those markets because it already has business there and therefore has some name recognition.

General Electric’s philosophy is that economic growth will be uneven across countries, so it must position its businesses in those markets where demand will increase. It believes that as globalization continues, only the most competitive companies will be able to effectively serve their employees and stockholders.

In 1999, AutoZone established its first retail store for auto parts in Mexico because many older vehicles are still in use in that country, so demand for auto parts is high. Today, AutoZone has 49 stores in Mexico. eBay has provided some foreign markets with a service that was not previously available in those areas. It has served hundreds of millions of requests to buy or sell products from consumers in more than 150 countries.

The Coca-Cola Company’s business has also expanded globally over time. Now the company has a significant presence in almost every country. It expanded throughout Latin America, Western Europe, Australia, and most of Africa before 1984. Since then, it has expanded into Eastern Europe and most of Asia.

The motivation of firms to attract foreign demand is summarized in a recent annual report of Procter & Gamble (P&G):

“More than 80 percent of P&G’s sales come from the top 10 markets. We need to keep driving P&G growth in these countries, which are some of the biggest and strongest economies in the world. P&G’s business in the top 10 countries taken together is growing at a rate of 11 % per year. P&G is a leader in these markets…. Yet, despite this strength in P&G’s 10 largest countries, we still have significant opportunities to grow.” — Procter & Gamble

(ii) Capitalize on Technology:

Many U.S. firms have established new businesses in the so-called developing countries (such as those in Latin America), which have relatively low levels of technology. AT&T and other firms have established new telecommunications systems in developing countries.

Other U.S. firms that create power generation, road systems, and other forms of infrastructure have extensive business in these countries. Ford Motor Company and General Motors have attempted to capitalize on their technological advantages by establishing plants in developing countries throughout Asia, Latin America, and Eastern Europe.

IBM is doing business with the Chinese government to capitalize on its technology. Amazon.com can capitalize on its technology advantage by expanding in foreign countries where technology is not as advanced.

(iii) Use Inexpensive Resources:

Labor and land costs can vary significantly among countries. Firms often attempt to set up production at a location where land and labor are inexpensive. The costs are much higher in the developed countries (such as the United States and Germany) than in other countries (such as Mexico and Taiwan). Numerous U.S. firms have established subsidiaries in countries where labor costs are low.

For example, Converse has shoes manufactured in Mexico. Dell, Inc., has disk drives and monitors produced in Asia. General Electric, Motorola, Texas Instruments, Dow Chemical, and Corning have established production plants in Singapore and Taiwan to take advantage of lower labor costs.

Many firms from the United States and Western Europe have also established plants in Hungary, Poland, and other Eastern Europe countries, where labor costs are lower. General Motors pays its assembly-line workers in Mexico about $10 per day (including benefits) versus about $220 per day for its assembly-line workers in the United States.

(iv) Diversify Internationally:

When all the assets of a firm are designed to generate sales of a specific product in one country, the profits of the firm are normally unstable. This instability is due to the firm’s exposure to changes within its industry or within the economy. The firm’s performance is dependent on the demand for this one product and on the conditions of the one economy in which it conducts business.

The firm can reduce such risk by selling its product in various countries. Because economic conditions can vary among countries, U.S. firms that conduct international business are affected less by U.S. economic conditions. A U.S. firm’s overall performance may be more stable if it sells its product in various countries so that its business is not influenced solely by the economic conditions in a single country.

For example, the demand for PepsiCo’s products in Mexico might decline if the Mexican economy is weak, but at the same time economic growth in Brazil, the Netherlands, and Spain might result in a higher overall demand for PepsiCo’s products.

DuPont has diversified its business across countries. Because DuPont has achieved geographic diversification, it is not as exposed to the economic conditions in the United States. Of course, it is somewhat exposed to economic conditions in the foreign countries where it conducts its business.

Combination of Motives:

Many U.S. firms engage in international business because of a combination of the motives just described. For example, when 3M Company engages in international business, it attracts new demand from customers in foreign countries. Second, it is able to capitalize on its technology, which is often more advanced than the technology available to local firms in these countries.

Third, it is able to use low-cost land and labor in some countries. Finally, it is able to diversify its business among countries. It has also reduced its exposure to U.S. economic conditions by increasing its international business over time.

General Electric is another example of a major firm that has expanded internationally in recent years. It has substantial business in Europe. Its sales have also increased in Latin America and the Pacific Basin WalMart is another firm that has been motivated by the reasons just described to expand into foreign countries.

International Business – Difference between Domestic (Internal) Business and International Business

Difference # Domestic (Internal) Business:

1. Meaning – Business transaction within the geographical boundaries of a country is domestic or national business.

2. Mobility of Factors of Production – The movement of factors of production like labour and capital is free within a country.

3. Homogeneity of Markets – Domestic markets and business systems are homogeneous in nature.

4. Political System and Risks – Domestic business is subject to the political system and political risks of single country.

5. Nationality of Business Firms – Business organisations only from one country participate in business transactions.

6. Nationality of Other Stakeholders – All stakeholders like suppliers, employees, middlemen, and partners are usually citizens of the same country.

7. Currency used in Business Transactions – Single currency of domestic country is used.

8. Business Regulations and Policies – Domestic business is subject to rules, regulations, laws and policies, taxation system, of a single country.

9. Mode of Payment – Payments are made by cash or by cheque.

10. Mode of Transport – Rail, road and air transport is used.

Difference # International Business:

1. Meaning – Business transaction beyond the boundaries of a country is international or external business.

2. Mobility of Factors of Production – The mobility of factors of production like labour and capital across different countries is very little.

3. Homogeneity of Markets – International markets and business practices lack homogeneity due to differences in language and cultural preferences of the customers.

4. Political System and Risks – Countries over the world have different forms of political systems and different political risks which are a barrier to international business.

5. Nationality of Business Firms – Business organisations of different countries are involved in international business transactions.

6. Nationality of Other Stakeholders – The stakeholders like suppliers, buyers, middlemen, partners are from different countries.

7. Currency used in Business Transactions – In international business use of currencies of more than one country is involved.

8. Business Regulations and Policies – International business transactions are subject to rules, regulations, laws and policies, tariffs and quotas of different countries.

9. Mode of Payment – Payments are made by financial documents through banks.

10. Mode of Transport – Air and sea route is generally used.

International Business – Benefits: To Nations and To Business Firms

International business is important to both ‘Nations’ and ‘Business Firms’ and offers them several benefits.

Benefits to Nations:

1. Earning of Foreign Exchange:

It helps a country to earn foreign exchange, which can be further used to import capital goods, technology, petroleum products, etc. which are not available domestically.

2. More Efficient Use of Resources:

External trade enables the countries to specialise in production of those goods for which they possess natural resources and can produce more economically and efficiently. The countries export surplus production of such goods to import those goods in which other countries have specialisation. It facilitates more efficient and optimum use of resources.

International Business operates on a simple principle- Produce what your country can produce more efficiently and trade the surplus production with other countries, to procure what they can produce more efficiently.

3. Improving Growth Prospects and Employment Potentials:

International business improves the growth prospects of many countries, especially the developing ones as firms can raise their production capacity and export surplus output to foreign countries. Countries can also import technical know-how and capital equipments to boost up the economic growth.

External trade also creates employment both directly and indirectly. It provides direct employment to those people who are hired by different firms to meet increased demand for exports. Indirectly, a number of intermediary firms (like forwarding and clearing agents) are established to facilitate business of export-oriented industries.

4. Increased Standard of Living:

External trade enables each country to obtain all types of goods and services from different foreign countries, which the country was unable to produce. It improves standard of living of people, especially of developing and underdeveloped countries.

Benefits to Business Firms:

1. Prospects for Higher Profits – International business can be more profitable than the domestic business, especially when the firms are able to sell their products at higher prices in foreign countries as compared to home country.

2. Increased Capacity Utilisation – Firms can utilise their surplus production capacity and improve profitability by getting engaged in international business. With increase in production capacity, firm is able to take advantage of economies of scale, which reduces the production cost and improves profit margin.

3. Prospects for Growth – When demand for the products starts getting saturated in the domestic market, then international business enables the firm to enhance its growth prospects by entering into overseas market. For your reference: Many MNCs like General Motors, Ford entered Indian market when they recognised the potential of demand for cars in India.

4. Way out to Intense Competition in Domestic Market – When there is intense competition in the domestic market, then the international business facilitates the firms to grow and expand by operating in the foreign market.

5. Improved Business Vision – International business enables the firms to improve their business vision. The vision to become international comes from the urge to grow, the need to become more competitive, the need to diversify and to gain strategic advantages of internationalization.

International Business – 7 Major Problems: Different Currencies, Legal Formalities, Distance Barriers, Language Barrier, Difference in Laws and a Few Others

There are various complexities or problems involved in the international business.

The major problems faced are as follows:

1. Different currencies – Every country has its own currency. So, importer has to make payment in the currency of exporter’s country. It involves risk of loss due to exchange-rate fluctuation.

2. Legal Formalities – International business is subject to a large number of legal formalities and restrictions. The government of every country exercises strict control over business with other nations. Heavy documentation and various legal formalities involve much time and effort.

3. Distance Barriers – Due to large distances between countries, it is difficult to establish quick and personal contacts between traders from different countries. It also creates problem of time-gap between placement of order and its execution, transport of goods and greater transit risk.

4. Language Barrier – Due to different languages in different countries, it becomes difficult for traders to understand the terms and conditions of the contract.

5. Difference in laws – International business transactions are subject to laws, rule and regulations of multiple countries.

6. Information Gap – It is difficult to obtain accurate information about foreign markets and about the financial position of foreign merchants.

7. Transport Problem – Water (shipping) and air transport (airways) are the important modes of transport used in international business. Shipping is less costly but time-consuming. On the other hand, airways are faster but the cost involved is very high.