In this article we will discuss about the diversification of firms.

When considering ‘synergy’, it is important to note that businesses can be similar with respect to some resources while being different in terms of others. The key to successful diversification is to group together those businesses which, despite their differences, have at least one common resources need. Such businesses can then generate ‘synergy’ by sharing the common resource.

All businesses or any set of businesses in particular, regardless of their operating needs in such areas as manufacturing, marketing, and engineering, can synergistically share financing activity. Many successful diversified firms do not limit to financial synergy alone, rather they seek synergy with respect to operating functions as well.

Diversified firms intending to obtain synergy in operating function (called operating synergy), therefore, must carefully confine diversification to businesses that actually have common operating needs.

ADVERTISEMENTS:

1. Market-Related Diversification:

One common strategy for achieving operating synergy involves carefully limiting diversification to businesses having common marketing needs.

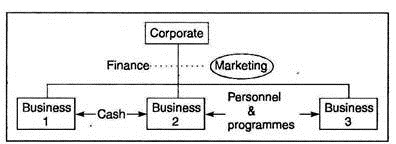

The managerial features of market-related diversification can possibly be summarised in a model below:

This approach to achieve Synergy (in marketing) produces a portfolio of businesses that can share such activities as sales, market research, advertising, promotion and product introduction.

ADVERTISEMENTS:

Market-related diversification offers other benefits also.

These are:

(i) Marketing synergy involves the use of high-level committees to review key marketing decisions affecting individual businesses; and

ADVERTISEMENTS:

(ii) Planned transfers of marketing personnel from time to time between different business units can ensure best marketing talent across all of its various units.

2. Input-Related Diversification:

This diversification strategy involves limiting activity to business units whose products require similar inputs. A firm pursuing such a strategy can often become a large enough user of the common input to economically produce the input itself. The company’s various business units, thus, enjoy a competitive advantage due to such factors as scale, experience and vertical integration.

To benefit substantially from this form of diversification, a company usually must assign production of the common input to a single sub-unit which then transfers the input to other business units’ needs. This way, a diversified firm can avail of ‘MODVAT credit’ under the excise law and thereby offsetting its tax burden.

ADVERTISEMENTS:

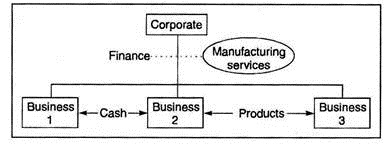

However, this arrangement is shown in a model below:

ADVERTISEMENTS:

3. Technology-Related Diversification:

This diversification strategy involves limiting activity to businesses utilising the same basic or core technology. It enables the business units to support and draw upon much more extensive research and development than would be possible were they operating as independent entities.

This way, the technical staff of a diversified firm is oriented towards engineering and manufacturing. Since the difficult problem of making the products efficiently can be solved through this technology expertise, it helps achieving manufacturing synergy.

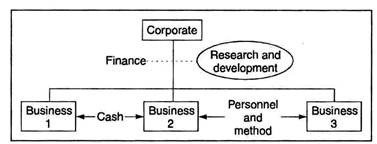

This scheme can be charted in a model below:

4. Conglomerate Diversification:

This diversification strategy does not largely contribute to operating synergy but focuses on finance as the key synergistic resource. Its wide use perhaps stems from the universal commonality of the finance function. All businesses use cash. As a result, the business units that are very different in an operating sense can generally generate at least some ‘financial synergy’.

Successful conglomerates usually take a quite deliberate approach to portfolio selection, and seek those business units which can specifically benefit from financial synergy. One common approach is to create and sustain a portfolio of business units with balanced cash flows; that is balancing of ‘Cash Cows’ and ‘Question Marks’ in the BCG Matrix.

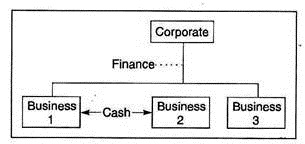

The organisation structure appropriate for conglomerate diversification is charted in a model below:

As indicated, the corporate staff is limited mainly to finance function while inter-business transfers are confined to cash.