Everything you need to know about the types of dividends. Dividend is the portion of earnings available to equity shareholders that are equally (per share basis) distributed among the equity shareholders.

Generally corporations pay dividends in the form of cash. But cash form of dividends may take place only when the cash is available with the company. Sometimes, firms may declare dividends in the form of scrip, bond, stock and property dividends.

Everything you need to know about the Types of Dividends

Types of Dividends – Cash, Scrip, Bond, Property, Stock Dividends

Dividend is the portion of earnings available to equity shareholders that are equally (per share basis) distributed among the equity shareholders.

Generally corporates pay dividends in the form of cash. But cash form of dividends may take place only when the cash is available with the company. Sometimes, firms may declare dividends in the form of scrip, bond, stock and property dividends.

The following discussion deals with the different types of dividends:

1. Cash Dividend:

Generally, many companies pay dividends in the form of cash. But payment of dividend in the form of cash requires enough cash in its bank or in hand. In other words, there should not be any shortage of cash for payment of dividends. Sufficient cash is available only when a company prepares cash budget to estimate the required amount for the period for which the budget is prepared.

If the company finds any shortage of cash, it should make arrangements to borrow funds. But it may be difficult to prepare cash budget with the expected amount needed for payment of dividends.

2. Scrip Dividend:

In this form of dividends, the equity shareholders are issued transferable promissory notes for a shorter maturity period that may or may not be interest bearing. Stated simply it means payment of dividends in the form of promissory notes. Payment of dividend in this form takes place only when the firm is suffering from shortage of cash or weak liquidity position.

Payment of dividends in the form of cash is justifiable only when the company has earned profits and it will take some time to convert current assets into cash.

3. Bond Dividend:

Both scrip dividend and bond dividend are same, but they differ in terms of maturity. Bond dividends carry longer maturity whereas scrip dividend carries shorter maturity. Effect of both forms of dividends on the company is the same. Bond dividend bears interest.

4. Property Dividend:

The name itself suggests that payment of dividend takes place in the form of property. This form of dividends takes place only when a firm has assets that are no longer necessary in the operation of business and shareholders are ready to accept dividend in the form of assets. This form of dividend payment is not popular in India.

5. Stock Dividend (Bonus Shares):

Stock dividend is the payment of additional shares of common stocks to the ordinary shareholders. It is known as stock dividend in the USA to the existing shareholder. Bonus shares are shares issued to the existing shareholders as a result of capitalisation of resources.

The declaration of bonus shares will increase the paid- up share capital and reduce retention of earnings. But there would not be any change in the net worth. Issue of bonus shares increases the number of outstanding shares. Distribution of bonus shares is done proportionately.

Payment of dividend in the form of bonus shares does not affect the wealth of owners’, since earnings per share and market price per share will fall proportionately.

Types of Dividends – Top 6 Types of Dividends as Studied in Financial Management

Type # 1. Stock Dividends:

Stock dividends rank next to cash dividends in respect of the popularity. In this form of dividends, the firm issues its own stock to the stockholders in proportion to the number of shares held in lieu of cash dividends. The payment of stock dividends does not effect cash and earnings position of the firm nor his ownership of stockholders changed.

Indeed there will be transfer of the amount of dividend from surplus account to the capital stock account which tantamount to capitalization of retained earnings. The net effect of this would be an increase in number of shares of the current stockholders. But there will be no change in their total equity.

With payment of stock dividends the stockholders have simply more share of stock to represent the same interest as it was before issue of stock dividends. Thus, there will be merely an adjustment in the firm’s capital structure in terms of both book value and market price of the common stock.

Utility of Stock Dividends to the Company:

A firm can use stock dividends to kill two birds with one stone without impairing cash position of the firm. The management can pacify stockholders and make use of business earnings for other purposes.

The company deficient in cash resources despite huge earnings can satisfy shareholders’ desire for dividend by means of issuing additional shares as it need not worry to arrange cash for dividend payments.

A company with extremely large earnings per share may have to face labour trouble. Labourers may feel being fleeced by the management. Consumers too may think that they are being charged too much for the products. Stock dividend relieves the company from these dangers because earnings per share will be moderated without affecting, in any way, the interests of the stockholders.

For growth companies stock dividend is invaluable because, as a general rule, such companies are constantly short of cash. Not only does it allow the firm to conserve cash but it also permits the firm to secure funds for expansion purposes from internal rather than external sources.

Stock dividend may also widen marketability of the corporate securities. It keeps the market price of shares within easy reach of ordinary investors. With increased business earnings, earnings per share may tend to rise resulting in an increase in share values, and if this tendency continues unabated, market price of the firm’s shares may touch peak level which scare away a large number of marginal investors.

Distribution of shares may, therefore, become limited. Use of stock dividends will solve this problem by spreading over a large number of shares resulting in reduction of earnings per share.

However, the company may suffer from stock dividends in the following two respects:

(i) Payment of stock dividends will be justified only when the firm’s earnings improve proportionately. If the earnings of the firm do not register increase in the same proportion, earnings per share will drop sharply which in turn may suggest low profitability of the company and its poor management.

Credit standing of the company may deteriorate, posing a greater problem to the firm to garner funds from the market. In .view of this, it will not be wise for companies with fluctuating earnings to distribute stock dividends.

(ii) Another disadvantage of stock dividends to the company is that it is more expensive to administer stock dividends than cash dividends.

Utility of Stock Dividends to Investors:

In principle, the stockholders get nothing additional except additional share certificate in the event of stock dividends. Their equity in the firm stays the same. Although earnings per share declines but owing to the corresponding rise in shareholding of each stockholder’s total earnings stockholder has the advantage of earning capital gains by selling additional shares without affecting his original shareholding.

In stock dividend, stockholders get tax benefits. Bonus shares are at present exempted from tax payment while cash dividend is subject to tax. This is why stockholders in high tax bracket have a strong preference for stock dividends as opposed to cash dividends. The owner is required to pay capital gains tax when new shares are disposed of at a price than the par value of these shares.

In another direction too, stock dividends are advantageous to stockholders. They enable the stockholders to receive higher dividends. If a company maintains its dividends per share, issue of stock dividends will increase cash earnings of the stockholders. Suppose a stockholder has 100 shares of a company. Dividend per share is one rupee.

The management decides to issue stock dividends @ 10% and to maintain dividend per share of Rs.1. In such a situation shareholding of the stockholder will increase by 10 shares to 110 shares and consequently dividend earnings of the stockholder will increase to Rs.110.

In growing companies where earnings are reinvested for expansion purposes, stockholders have the advantage of liquidating additional shares received as stock dividends and making use of the proceeds for whatever purposes he likes and at the same time sharing the growth and prosperity of the firm.

Utility of Stock Dividends to Creditors:

Creditors react favourably to the announcement of stock dividends because it strengthens the liquidity position of the company and increase the margin of safety for them. But they are very likely to suffer if the management maintains the old dividend rate even after issue of bonus shares because in that case there will be shift of more cash away from the firm to the stockholders.

Legal Provisions Regarding Stock Dividends:

While announcing stock dividends, the management must keep in mind legal provisions regulating the distribution of such dividends. Section 205 (i) of the Companies Act, 1956 lays down conditions which must be complied with while distributing stock dividends.

These are:

(i) Articles of Association must permit issue of bonus shares.

(ii) Sufficient undistributed profits must be present.

(iii) A resolution capitalizing profits must have been passed by the Board of Directors.

(iv) The resolution of the Board of Directors must be approved by the stockholders in a general meeting.

(v) The permission of the FEMA must have been obtained. When a company makes any allotment of bonus shares, it must file within 30 days after the allotment with the Register of joint Stock Companies a return stating the number and par value of such shares comprised in the allotment and the names, addresses and occupations of the allottees and a copy of the resolution authorizing the issues of bonus shares.

(vi) The bonus issue is permitted to be made out of free reserves built out of genuine profits or share premium collected in cash only.

(vii) Reserves created by revaluation of fixed assets are not permitted to be capitalized.

(viii) Development rebate reserve is considered as free reserve for the purpose of calculation of residual reserves test and is also allowed to be capitalized.

(ix) The residual reserves after the proposed capitalization should be at least 40% of the increased paid-up capital.

(x) Thirty per cent of the average profits before tax of the company for the previous three years should yield a rate of dividend on the expanded capital base of the company at 10 per cent instead of 9 per cent as at present.

(xi) Declaration of bonus issues in lieu of dividend is not allowed.

(xii) The company should make a further application for an issue of bonus shares only after 36 months have elapsed from the date of sanction by the Government of an earlier bonus issue by the company, if any.

(xiii) Bonus issues are not permitted unless the partly paid shares, if any existing, are made fully paid-up.

(xiv) Companies defaulting in payment to any public financial institution will now have to produce a ‘no objection’ letter from it before issuing bonus shares.

(xv) The amount of reserves to be capitalized by issuing bonus shares should not exceed the total amount of paid-up capital of the company.

(i) Issue of bonus shares after any public rights issue is subject to the conditions that no bonus issue shall be made that will dilute the value or rights of the holders of debentures, convertible fully or partly.

(ii) Bonus share is made out of free reserves built out of the genuine projects or share premium collected in cash only.

(iii) Reserves created by revaluation cannot be capitalized.

(iv) The declaration of bonus issue in lieu of dividend cannot be made.

(v) The bonus issue cannot be made unless the partly paid-up shares, if any, are made fully paid-up.

(vi) The company has not defaulted in payment of interest or principal in respect of fixed deposits and interest on existing debentures or principal on redemption thereof, and it has sufficient reason to believe that it has not defaulted in respect of the payment of statutory dues of the employees such as contribution to provident fund, gratuity bonus, etc.

(vii) A company, which announced its bonus issue after the approval of the Board of Directors, must implement the proposals within a period of six months from the date of such approval and shall not have the option of changing the decision.

(viii) There should be a provision in the Articles of Association of the company for capitalization of reserves, etc., and if not, the company shall pass a resolution at its General Body Meeting making provisions in the Articles for Capitalization.

(ix) Consequent to the issue of bonus shares if the subscribed and paid-up capital exceeds the authorized share capital, a resolution shall be passed by the company at its General Body Meeting for increasing the authorized capital.

Type # 2. Stock Splits:

Closely related to a stock dividend is a stock split. From a purely economic point of view, a stock split is nothing but a giant stock dividend. A stock split is a change in the number of outstanding shares of stock achieved through a proportional reduction or increase in the par value of the stock.

The management employs this device to make a major adjustment in the market price of firm’s stock and consequently in its earnings and dividends per share.

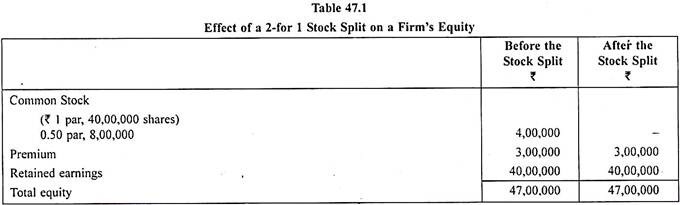

In stock split only the par value and number of outstanding share are affected. The amounts, in the common stock, premium and retained earnings remain unchanged. This is exhibited in Table 47.1. It may be noted from the table that although number of shares was doubled, capital account of the firm did not change because of proportional reduction in par value of the stock.

Except in accounting treatment, the stock dividend and stock split are very similar. Stock Split is recorded as a doubling of the number of shares outstanding and halving of the par share.

For a stock dividend, however, the accountant increases the common stock account by the par value of shares issued, increases the capital-surplus account by the difference between the market value of the shares issued and the par value, and reduces the retained earnings account by an amount needed to leave net worth unchanged.

For both stock split and stock dividends, therefore, net worth remains unaffected. The difference in accounting procedure may be illustrated.

A number of reasons may be offered for the splitting of the firm’s common stock.

These are:

(i) Broaden Marketability of the Stock:

The basic reason of stock split is to provide a broader and more stable market for the stock. It is argued that when stock prices of company tend to rise sharply due to economic prosperity of the company and its improved profitability and it is believed that the price of the stock has moved out of the price range of many investors narrowing the market of stock.

The management may in a bid to promote a wider distribution of shares resort to stock split. Stock split will result in lowering price of stock and the stocks will be within easy reach of common investors.

(ii) Need for Garnering External Resources:

A company contemplating to garner funds from the market may use stock split to prepare ground for new issues. In times of rising stock prices, market price of shares of profitable and prosperous companies rises beyond the reach of a large number of investors.

In view of limited sale ability of shares, companies may experience a great problem in acquiring desired amount of capital. Thus, to increase the marketability of new issues, stock split is very often used.

(iii) Merger or Acquisition of Companies:

A firm contemplating merger or acquisition through exchange of stock will often split its stock to make the transactions more attractive to stockholders of the firm it is taking over. Suppose, for example, Globe Company offers to acquire assets of Alfred Company through an exchange of stock.

The management of Globe Company decides that an exchange ratio of 1 to 10 (1 share of Globe Company for 10 shares of Alfred Company) would be fair to stockholders of both companies.

However, 1:10 exchange ratio may not appeal to stockholders of Alfred Company and the offer may be rejected. In such a situation stock split may be employed to make the offer attractive. Thus, the management of Globe Company, by splitting 1 share in 5 shares, may put the exchange ratio at 1:2 which may be readily accepted by stockholders of Alfred Company.

(b) Utility of Stock Splits to Investors:

With the stock splits, stockholders receive more shares than before. In a two for one split, a stockholder will have two times as many shares as before the split. But his percentage claim on future earnings and dividends of the company is unchanged. Assume that a 2-for-1 split halves the ownership represented by each share from 01 per cent to .005 per cent.

Before the split, the holder of 10 shares owns 1 per cent (10 x 001%) of the firm. After the split, the stockholder has twice as many shares, but he still owns only 1 per cent (20 x 005%) of the firm. Since it is the relative ownership which is relevant and not the absolute number of shares, it may be concluded that stock splits do not affect the investors’ wealth. Furthermore, the stock split does not change the tax liability of the investors.

However, three main benefits are likely to accrue to the stockholders. First, with stock split, market price per share will decrease by the proportion of stock split. As a result, more and more investors would show interest in buying shares of the firm, which were earlier out of the reach of these investors because of high price rise.

If this happens, market price of shares may show rising tendency. This will benefit the existing stockholders. Even though shares may have advanced in price due to a stock split, it is hard to prove that the increase in market value is an outcome of this step because price variation in shares is the consequence of a host of factors and it is difficult to isolate these factors.

Second benefits to the stockholders are that the company will not prune down the dividends in proportion to the stock split. Thus, if the company is paying Rs.10 per share in dividends prior to the split, one would expect the dividends to be cut to Rs.2.50 after a four for one split. However, the company might pay Rs.2.60 per share after the split. If this happens, the stockholders’ aggregate amount of dividends will increase.

Stock split will add to the marketability of shares of the stockholders. With improved marketability, the stockholders may find it convenient to dispose of the shares without depressing their price unduly because a large number of individuals will be supposedly engaged in trading in the issue.

The combined effect of all these benefits is very likely to be reflected in share price and as a result the market may react to the announcement of stock split.

The practice of splitting stocks in India was started by promoters of Information Technology Companies in 1999- 2000, making high-price stocks assessable to retail investors. In 2006-2007, real estate companies had announced stock splits followed by pharmaceutical companies in 2010.

Now, promoters of banks are queening up for stock splits. During 2014 so companies had announced a sub-division in their equity shares against 60 firms in 2013.

Type # 3. Reverse Split:

Sometimes, a company may think of reducing number of shares so as to enhance its share price. This can be accomplished by means of reduction in number of outstanding shares. To illustrate, assume a company has 4,00,000 outstanding shares of Rs.1 per share.

If the management declares 1-for-2 reverse split, the company will have 2,00,000 shares of Rs.2 per share. Under this arrangement stockholders receive fewer shares with higher par value.

The basic purpose of reverse split is to increase the market value of each share. Companies experiencing financial trouble usually find their share prices declining in the market. Such companies follow the policy of reverse split so as to check further decline and raise it. The announcement of a reverse split is an indication that the company is in financial jeopardy. Reverse stock splits are not as common as stock split-ups.

Stock splits must be approved by a majority in number, representing three-fourths in value of members of the firm and approved by court of law. The firm is required to give notice of this alteration to the Registrar of Joint Stock Companies within 30 days of doing so.

Type # 4. Scrip Dividend:

Scrip dividend means payment of dividend in scrips or promissory notes. Sometimes, a company needs cash generated by business earnings to meet business requirements because of temporary shortage of cash.

In such cases, the company may issue scrip or notes promising to pay dividend at a future date. The scrip usually bears a definite date of maturity or sometimes maturity date is not stipulated and its payment is left to the discretion of the Board of Directors.

Scrip may be interest bearing or non-interest bearing. Such dividends are relatively scarce.

The issue of scrip dividends is justified in the following circumstances:

(1) When a company has plentitude of earnings to distribute dividends but cash position is temporarily meager because bulk of the sale proceeds which are tied in receivable for time being will be released very shortly, the management in such a situation may issue certificates to the stockholders promising them to pay dividend in the near future.

(2) When a company wants to maintain an established dividend record without paying out cash immediately, it may take recourse to scrip dividend.

(3) When the management believes that stock dividends will not be useful because future earnings of the company will not increase sufficiently to maintain dividend rate on increased shareholding issue of promissory notes to pay dividends in future would be a wise step.

(4) When the company does not wish to borrow to cover its dividend requirement, the danger lies in their use as a stop to stockholders when business earnings are inadequate to make dividend payments. Such form of dividend payment is non-existent in India.

Type # 5. Bond Dividend:

As in scrip dividends, dividends are not paid immediately in bond dividends. Instead the company promises to pay dividends at a future date and to that effect bonds are issued to stockholders in place of cash. The purpose of bond and scrip dividends is alike, i.e., postponement of dividends payments.

Difference between the two is in respect of the date of payment and their effect is the same. Both result in lessening of surplus and addition to the liability of the firm. The only difference between bond and scrip dividends is that the former carries longer maturity than the latter.

Thus, while issue of bond dividend increases long-term obligation of the company, current liability of the company would raise as a consequence of the income of the scrip dividends. In bond dividends, stockholders have stronger claim against the company as compared to scrip dividends.

Bonds used to pay dividends, carry interest. This means that the company assumes fixed obligation of interest payment annually and principle amount of bond at maturity date. It should be remembered that the company is assuming this obligation in return of nothing except credit for declaring dividends.

How far the company will be able to satisfy this obligation in future is also difficult to predict at the time of issue of bonds. The management should, therefore, balance cost of issuing bond dividends against benefits resulting from them before deciding about distribution of dividends in the form of bonds. Bond dividends are not popular in India.

Type # 6. Property Dividend:

In property dividend the company pays dividends in the form of assets other than cash. Generally assets which are superfluous for company are distributed as dividends to the stockholders. Sometimes, the company may use its products to pay dividends. Securities of the subsidiary companies owned by the company may also take the form of property dividends. This kind of dividend payments is not in vogue in India.

Types of Dividends – Main Forms of Dividend (With Advantages)

Dividend can be paid in many forms.

Main forms of dividend are as follows:

(1) Cash Dividend:

Cash dividend is the most prevalent form of dividend. Most companies pay dividend in cash. Payment of dividend in cash depends on availability of cash balance with the company. Hence, before declaring cash dividends, amount required should be estimated in advance otherwise the company will have to take loans for paying cash dividends. Cash dividend reduces the reserves and assets of the company.

(2) Stock Dividend or Bonus Shares:

Sometimes, company issues shares to its existing shareholders free of cost rather than paying cash dividend. These free shares are called bonus shares. They are termed as stock dividend in U.S.A. Bonus shares are issued to existing shareholders in a fixed proportion over their existing shareholdings. For example, if a company declares 10% (i.e., 1:10) stock dividend, a shareholder having 100 shares will get 10 bonus shares as dividend and total number of shares with him will become 110. Stock dividend decreases the reserves of the company but increases the share capital of the company.

Thus, net worth of the company remains intact while in case of cash dividend net worth decreases. Stock dividend is beneficial from companies as well as shareholder’s point of view.

Advantages of Stock Dividend to the Company are as follows:

(i) No Cash Outflow:

Stock dividend is paid without outflow of cash from the company. Cash saved can be invested in profitable opportunities and the company needs not to procure additional funds from external sources.

(ii) Stock Dividend is Possible in Case of Financial Difficulty:

Sometimes inspite of adequate earnings, the company does not have sufficient cash balance to pay cash dividend. In such situation, company can pay dividend in the form of its shares.

(iii) More Attractive Share Price:

Sometimes the purpose of issuing bonus shares is to bring down the market price of company’s shares to make it more attractive to investors. Lower market price and the availability of larger number of shares due to bonus issue increases the trading activity in the shares of the company on the stock exchange.

(iv) Increase in Reputation:

The announcement of bonus issue results in the advancement of reputation and goodwill of the company because it is perceived as favourable news by the investors. It is taken as a proof of growing earnings and the bright prospects of the company.

Advantages of Stock Dividend to the Shareholders are as follows:

(i) Increase in Future Dividends:

Stock dividend by the company indicates that company has some good profitable opportunity to invest the preserved cash and it will pay higher dividend in future. In addition, the shareholder will be entitled to higher dividends in future due to increase in his holding. For example, supposing a company pays each year a dividend of Re 1 per share and if a shareholder who holds 100 shares is allotted 50 bonus shares, his total cash dividend in future will be Rs.150 instead of Rs.100 received in the past.

(ii) Increase in Market Value of Shares:

The company paying stock dividend is psychologically believed to be a growing company. It increases the market price of the shares of company. Shareholders can earn capital gains by selling the shares received as stock dividend and their original shares remain intact.

(iii) Does not Reduce the Proportional Ownership of Shareholders:

Company issues shares as stock dividend to its shareholders in proportion to their respective existing shareholdings in the company. Therefore, a shareholder remains owner of the company for a certain proportion and his proportion is not reduced by stock dividend. On the other hand, if company goes for a public issue of shares, proportional ownership of existing shareholders will reduce because new investors also become the shareholders of the company.

(3) Scrip Dividend:

Sometimes a company has temporary shortage of cash. In such a case the company may issue scripts or promissory notes to shareholders promising them to pay dividend at a certain date in near future. Such a form of dividend is not prevalent in India.

(4) Bond Dividend:

The only difference between scrip and bond dividend is that the latter carries longer maturity date than the former. Thus, while issue of scrip dividend increases the current liabilities of the company, the issue of bond dividend increases long-term liabilities. Such form of dividend is also not prevalent in India.

(5) Property Dividend:

Under this form, company pays dividends in the form of assets other than cash. The company may give its own products in lieu of cash dividends. For example, a watch manufacturing company may give watches to its shareholders as property dividend. This form of dividend is not prevalent in India.

(6) Composite Dividend:

Dividend in more than one form as explained above is known as composite dividend.

Types of Dividend: Scrip, Bond, Property, Cash and Stock (Distributed by a Company)

Dividend being distributed by a company may take several forms namely:

1. Scrip dividend

2. Bond dividend

3. Property dividend

4. Cash dividend and

5. Stock dividend

1. Scrip Dividend:

When earnings of the company justify dividend but the liquidity position does not permit cash dividend, it may declare dividend in the form of promissory notes. Under this method, the shareholders are issued transparent promissory notes instead of cash dividend. This method is justified only when the company has earned profit but it has to wait for conversion of other current assets in to cash in hand.

2. Bond Dividend:

Sometimes the dividends are paid in bonds or bills of exchange instead of cash. Effect of both Scrip dividend and Bond dividend is the same except that the payment is postponed in case of the Bond dividend. Under this method, the shareholders may have to wait few months to convert their bonds into cash. This method is also justified only when the company has earned profit but it has to wait for conversion of current assets in to cash in hand.

3. Property Dividend:

Under this method, dividends are paid in the form of assets instead of cash. This form of dividend may be followed in those cases where there are assets which are no longer necessary in the operations of the business. This method is usually followed in Western Countries and this is not in practice in India.

4. Cash Dividend:

Cash dividend is the dividend, which is distributed to shareholders in the form of cash out of the earnings of the company. This is a usual practice in Indian Corporate Sector.

5. Stock Dividend:

In case of stock dividend the company issues its own shares to the existing shareholders in lieu of cash dividend. Payment of stock dividend is popularly termed as issue of bonus shares in India.

Types of Dividend: In Case of Joint Stock Companies

All the profits of the company cannot be said to be divisible. Only those profits that can be legally distributed to the shareholders of the company in the form of dividend are called as “divisible profits”.

In the case of joint stock companies, the following are the conditions for dividend distribution:

1. Capital must never form part of divisible profits.

2. Dividends must be paid in accordance with sections 205 to 207 of the Companies Act.

3. Dividends must be paid in accordance with the Memorandum of Association and Articles of Association of the company.

4. If the company has not prepared its Articles of Association then provision 85 to 94 of Table A are applicable for dividend distribution.

5. Dividends must not be paid as to deprive the creditors or debenture holders of their claims on fixed assets.

6. Only bonafide surplus or profits are distributable amongst the shareholders.

i. Interim Dividend:

The interim dividend is the dividend declared between two annual general meetings. The Articles of Association of the company often contains provisions authorising the management to declare interim dividends.

The following are the conditions regarding interim dividends:

1. There is no need for holding the meeting of the shareholders’ to obtain their sanction for declaring interim dividend.

2. The directors often ask the auditors to give their expert opinion with regard to the declaration of interim dividend.

3. The auditors always advise the management for the preparation of interim accounts, in order to ascertain that there are profits to justify the interim dividends.

4. Unlike final dividend an interim dividend does not constitute a statutory obligation, and not a debt against the company.

5. Therefore, the board of directors can subsequently revoke the resolution if needed to cancel the announcements.

ii. Bonus Shares:

Bonus shares are shares issued to existing equity shareholders as a result of capitalisation of reserves. This is known as stock dividend in U.S.A.

Reasons for Issuing Bonus Shares:

1. The bonus issue tends to bring the market price per share within a more popular range.

2. It increases the number of outstanding shares. This promotes more active trading.

3. The nominal rate of dividend tends to decline thereby restricting profiteering.

4. The share capital base increases, this may in turn increase the investor base also.

5. Bonus issue gives the feeling to the shareholders that the company’s profitability position is good, so they can look for more dividends.

Regulatory Provisions for Issuing Bonus Shares:

The regulatory provisions governing the issue of bonus shares are the following:

1. The bonus issue should be made out of free reserves created out of genuine profits or share premium collected in cash, only.

2. The residual reserves, after the proposed capitalisation, should be at least 40 percent of the increased paid up capital.

3. 30 percent of the average profits before tax of the company for the three previous years, should yield a rate of return on the expanded capital base of the company at 10%.

Circumstances under Which Bonus Shares are Issued:

Bonus shares are issued under the following circumstances:

1. When the cash resources of the company are not sufficient to pay cash dividends.

2. When the company desires to plough back profits.

3. When the company desires to show to its shareholders, as well as the outsiders its correct earning capacity.

Conditions for the Issue of Bonus Shares:

1. Bonus shares can be issued by a company, only if it is empowered by its Articles of Association to do so.

2. The issue of bonus shares should be recommended by the board of directors by a resolution.

3. Similarly, the approval of the shareholders must be obtained for the issue of bonus shares, through a resolution passed at the general meeting.

4. The permission of the Controller of Capital Issues must be obtained, irrespective of the amount of bonus issue.

5. Bonus shares must be issued only to the existing equity shareholders.

6. Bonus shares are issued in proportion to the existing holdings of equity shares.

7. To issue bonus shares instead of cash dividend, the equity shares should be fully paid up.

iii. Scrip Dividend:

Scrip dividend is a dividend which is given in the form of scrips or promissory notes, which promises to pay the dividend declared by the company to the shareholders, at a future specified date.

Usually these scrips bear a definite date of maturity. If the date of maturity is not stipulated in the scrips, its payment is left to the discretion of the company. These scrips may be interest bearing, or non – interest bearing. But usually these scrips bear interest at a specified rate.

This type of dividend payment is not allowed in India, but it is popular in U.S.A.

iv. Property Dividend:

This type of dividend payment is also not allowed in India, but it is popular in U.S.A. In this case either the assets of the company which are not required by the company, or the products of the company, are distributed as dividend. For example- if a company produces computers, instead of paying dividend it distributes computers to the shareholders.

There three forms to pay dividends to shareholders as given below:

1. Cash dividends,

2. Bonus shares or stock dividends and

3. Buyback of shares.

Companies generally pay dividend in cash.

1. Cash Dividends:

The common form of dividend payments to shareholders in a company is cash dividends. The decision on cash dividends depends on cash position of the company. The company should prepare cash budget for the coming period before the declaration of cash dividend. If the company follows a stable dividend cash policy, the preparation of cash budget becomes a necessity. Investors general prefer cash dividends as most of them are interested in current and regular income.

The cash dividend payments reduces the balances in the cash account and reserve account of the company. It affects net worth and the value of the company. The market price of shares of the dividend paying company generally decline in consonance with the amount of dividend paid.

2. Bonus Shares:

Bonus shares are shares issued to the existing shareholders without seeking any payment from them. These shares are issued by converting the profits of the company into share capital. Hence, it is called capitalisation of profits of company. Since bonus shares are issued proportionately to existing shareholders, there is no dilution in the ownership of the company. The issue of bonus is merely an accounting transfer from reserves and surplus to paid up capital.

Advantages of Issuing Bonus Shares:

The issue of bonus shares is advantageous to both the shareholders and the company.

The shareholders have following advantages on issue of bonus shares:

(i) Tax Benefits:

The cash dividend received by shareholders from the company is taxable in the hand of investor itself. But, the receipt of bonus shares by the stockholders is not taxable as income. Further, shareholders can sell issued bonus shares as per their need and pay capital gain taxes, which are normally less than income tax on cash dividends.

(ii) Indication of Higher Profits:

The board of directors normally declares bonus shares when they expect higher earnings in future. The higher earnings offset the increase in additional capital. The shareholders usually interpret the issuance of bonus shares as indication of higher profitability of the company.

(iii) Appreciation in the Market Value:

The issue of bonus shares changes the market perception about the company and leads to more sale purchase transactions in the shares. As a result, this may lead to an appreciation in the market value of shares of the company.

(iv) Possibility of Increase in Future Dividend:

In cases, where companies are paying dividends on fixed amount basis, the issuance of bonus shares will result in increase in future dividends.

The company issuing bonus shares has following advantages:

(i) Conservation of Cash Resources:

The issuance of bonus shares retains the cash balance of the company. This cash can be invested in profitable opportunities. Such an exercise will result in increasing the profitability of the company.

(ii) Increased Marketability of Shares:

The number of shares of the company will increase in the capital market on issue of bonus shares. The shareholders, who need the cash, will start selling the shares. On the other hand, investors viewing the prospects of the company bright will start purchasing the shares of the company. Consequently, the issue of bonus share will increase the marketability of shares of the company.

(iii) Maintenance of Investors’ Confidence in Financial Distress:

The bonus share can be issued in financial distress. This act on part of management will maintain confidence of shareholders in the company intact.

3. Buyback of Shares:

Buyback of shares means repurchasing of its own shares by a company. The buyback of shares results in payments of dividends by company because shares are repurchased at a higher price in comparison of current market price. The Companies Act, 1999 permits companies in India to buy back their own shares.

A number of companies, like—India Nippon Electricals Limited, Reliance Industries Limited, Ashok Leyland Limited, Tata Consultancy Services etc. offered to buy back their equity shares. There are two methods which a company in India can apply to buy back its equity shares.

First, a company can buy its shares in open market through an authorised agent. Second, a company can make a tender offer specifying the purchase price of share, the total amount of purchase and the time period within which share will be bought back. There may be several reasons for buying back of its own shares by a company.

First, the company may like to return surplus cash, which it cannot put into any profitable investment, to the shareholders. Second, the company may like to use surplus cash to buy back shares rather than pay large dividends, which it cannot maintain in coming periods. Third, the company may buy back shares to reduce the availability of shares in the market and hence, to protect itself against hostile takeovers. Fourth, the company may buy back shares to achieve the target capital structure. There may be several other reasons for buyback of shares by the company.

The advantages of buy back of shares are given below:

(i) If a company has more equity capital in its capital structure, then it can achieve the targeted capital structure by buying back the shares.

(ii) The shareholders of the company will get benefited as the share are bought back by the company at higher price than the current market price.

(iii) Since the operating efficiency of the company remains unchanged, the Earnings Per Share (EPS) of the company will increase.

(iv) The control of the company will get consolidated. The buyback of shares by the company will reduce the number of its shareholders.

(v) The buyback of shares will provide tax benefit to shareholders selling the shares. The dividend is taxable in the hand of shareholders.

(vi) The company may protect itself from hostile takeovers by reducing the number of shares in the market through buyback of its shares.

In brief, buyback of shares is a financial tool to restructure the capital of the company when warranted. It is beneficial to both, the shareholders and the company.

Types of Dividend: Cash, Property, Scrip and Stock Dividend (Top 4 Types)

Payment of dividend to stockholders indicates the corporation is operating successfully. Dividends are declared and approved at the discretion of the Board of Directors, the part of profits generated by the company that the Annual Meeting, pursuant to the recommendation of the Board of Directors, decides to distribute to the shareholders. The undistributed part of profits is posted to the reserves in order to reinforce the equity capital.

Dividends are commonly paid in form of cash dividends but it can also be paid in various other forms discussed below:

Type # 1. Cash Dividend:

A cash dividend is a dividend paid in cash and it is the most common method of paying the dividend followed by most of the corporations. In order to pay dividend in the form of cash companies must have not only sufficient profits but also sufficient liquid cash.

Type # 2. Property Dividend:

A company may sometimes rather than paying a cash dividend may issue a non-monetary dividend to investors. Thus, a property dividend is a non-reciprocal transfer of non-monetary assets from a company and its shareholders. It is payable in form of assets other than cash. A property dividend can in the form of real estate, investments or inventories that the company holds or it can either be in the form of shares of its subsidiary company.

Type # 3. Scrip Dividend:

Scrip is a provisional certificate issued by a company to its shareholders, the certificate states a promise made by the company to the shareholders to pay them dividend at future specific date. Companies usually opt to distribute scrip dividend due non availability of liquid cash. Since the company postpones dividend therefore promissory note may or may not include interest to pay shareholders at a later date.

Type # 4. Stock Dividend:

Stock dividend is in the form of additional shares, rather than cash. Usually when company pay dividend in the form of additional or bonus shares when it doesn’t have sufficient money. In some countries dividend paid in the form of cash is taxable, however in India dividend received from an Indian company by the shareholders is exempted from tax under section 10(34) of Income Tax Act. On the other hand when a company issues a stock dividend, rather than cash, there usually are not taxed until the shares are sold.

Types of Dividend – Interim Dividend, Final Dividend and Preference Dividend

Dividend may be:

(i) Interim dividend,

(ii) Final dividend, and

(iii) Preference dividend.

(i) Interim Dividend:

An interim dividend is one which is declared before the declaration of the final dividend. Interim dividend is a dividend which is declared between two annual general meetings. The Board of Directors may from time to time pay to the members such interim dividend as appears to it to be justified by the profits of the company.

The directors must take into consideration the future prospects of the profits e.g., orders in hand, any seasonal element in business before declaration of interim dividend otherwise it may be considered payment out of capital. Cash resources, likelihood profitability of the company must also be taken into consideration while deciding to declare an interim dividend.

(ii) Final Dividend:

At the end of the accounting period, the accounts of the company are prepared to ascertain the amount of profit earned by the company. The directors, taking into consideration the financial position of the company’s future prospects, provision for resources, etc., decide to recommend to the shareholders at the annual general meeting the dividend to be paid to the shareholders.

(iii) Dividend on Preference Shares:

The articles of association of a company empower the directors to declare and pay both interim and final dividend on preference shares. Holders of preference shares are entitled to receive dividend before any dividend is paid to the equity shareholders as per the terms of the issue.