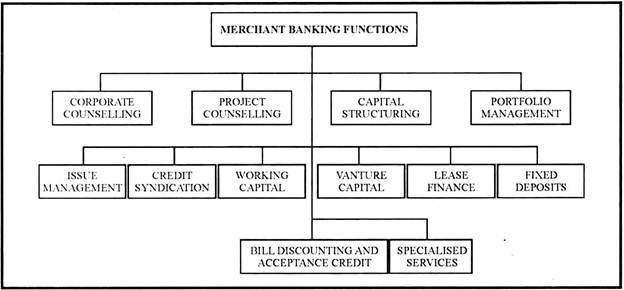

This article throws light upon the top twelve functions performed by merchant bankers. The functions are: 1. Corporate Counselling 2. Project Counselling 3. Capital Restructuring Services 4. Portfolio Management 5. Issue Management 6. Loan/Credit Syndication 7. Arranging Working Capital Finance 8. Bill Discounting and Acceptance Credit 9. Lease Finance 10. Venture Capital 11. Public Deposits 12. Specialised Services.

Function # 1. Corporate Counselling:

This service is, usually, provided free of charge to a corporate unit. Merchant bankers render advise to corporate enterprises from time to time in order to improve performance and build better image/reputation among investors and to increase the market value of its equity shares. Counselling is provided in the form of opinions, suggestions and detailed analysis of corporate laws as applicable to the business unit.

Areas of corporate counselling include:

(a) After considering the existing Government’s economic and licensing policies, it guides the corporate units as to areas of diversification.

ADVERTISEMENTS:

(b) Merchant banks make a detailed market analysis so as to evaluate profitability of each product line, its growth or demand at present and in future. On the basis of analysis it advises whether to continue/expand or discontinue any product line.

(c) It helps in reviving the old-line projects and sick units by assessing their requirements, studying their manufacturing process and technology in terms of its obsolescence. Based on their studies, merchant banker advises on the restructuring or reorganisation of capital base.

In India, Punjab National Bank (PNB) claims to have acquired special expertise in revival of sick units. It offers help to the sick units in the following ways:

(i) Conducts detailed studies.

ADVERTISEMENTS:

(ii) Makes an assessment of the revival prospects and then prepares rehabilitation plans including schemes of modernisation, identifying areas of diversification, reorganisation of financial and organisational structure.

(iii) Provides help in raising loans from the financial institutions and credit facilities from the banks.

(iv) Helps in getting approval of financial institutions or banks for schemes of rehabilitation.

(v) Monitors rehabilitation schemes.

ADVERTISEMENTS:

(vi) Finds out the possibilities of takeover of sick units and accordingly makes arrangement for negotiations with financial institutions/banks and other interested parties.

Function # 2. Project Counselling:

Project counselling broadly covers the study of the project and providing advisory services on the project viability and procedural steps to be followed for its implementation.

It covers the following aspects:

(i) Development of an idea of a project or review of the project idea/project profile.

ADVERTISEMENTS:

(ii) Preparation of project report after considering its financial, economic and market feasibility.

(iii) Estimation of the cost of the project.

(iv) Deciding the means of financing and the composition of various types of securities.

(v) Studying the procedural aspects of project implementation.

ADVERTISEMENTS:

(vi) Provide assistance in obtaining government consent for implementation of the project.

Sometimes, merchant banks also encourage and guide Indian entrepreneurs to make investment in Indian projects in India and joint ventures overseas by offering all possible help in project appraisal and implementation.

Other Services in the field of project counselling may also include:

(i) Identification of potential investment opportunities.

ADVERTISEMENTS:

(ii) Capital structuring.

(iii) Shaping the pattern of financing.

(iv) Negotiating with foreign collaborations and making all necessary arrangements.

(v) Amalgamations, mergers and takeovers.

ADVERTISEMENTS:

(vi) Profitability study of the project and preparation of feasibility reports.

(vii) Assisting clients in preparing the applications for financial assistance to All India Financial Institutions/Banks.

(viii) Assisting the clients in seeking approvals from the Government of India for foreign technical and financial collaboration agreements.

(ix) Guiding young entrepreneurs as to investment opportunities in India.

Function # 3. Capital Restructuring Services:

Merchant banks render different capital restructuring services to the corporate units depending upon the circumstances a particular unit is facing.

It may include the following services:

ADVERTISEMENTS:

(i) Examination of the capital structure of corporate unit to decide the extent of capitalisation.

(ii) In case of bonus issue, it helps the clients in preparing the Memorandum for Controller of Capital Issue (CCI) and in obtaining his consent.

(iii) For companies governed by Foreign Exchange Regulation Act (FERA), merchant bankers suggest an alternative capital structure which is in conformity with the legal requirements. It also advises company on disinvestment issues to their maximum advantage.

(iv) For sick units, it suggests appropriate capital structure which will help the unit in revival. It also advise as to the extent and means of bringing fresh capital into business.

(v) Merchant bankers also render advise on mergers, takeovers and amalgamations and help in their implementation.

(vi) Merchant bankers also identify the areas of diversification of the existing production systems and suggest various strategies to widen and restructure the capital base accordingly.

Function # 4. Portfolio Management:

ADVERTISEMENTS:

Merchant banks offer services not only to the companies issuing the securities but also to the investors. They advise their clients, mostly institutional investors, regarding investment decisions as to the quantum of amount of security and the type of security in which to invest.

Merchant banks render necessary services to the investors by advising on the optimum investment mix, taking into account factors like:

(i) Objectives of the investment.

(ii) Tax bracket applicable to the investor.

(iii) Need for maximising return.

(iv) Capital appreciation etc.

ADVERTISEMENTS:

Merchant bankers even undertake the function of purchase and sale of securities for their clients so as to provide them portfolio management services. Some merchant bankers are managing mutual funds and off share funds also.

Services to Indian Nationals:

Merchant banks provide portfolio management services to the Indian nationals in the form of:

(a) The sale and purchase of securities;

(b) Investing and purchase of securities;

(c) Investing and managing fixed deposits;

ADVERTISEMENTS:

(d) Trust funds, pension funds and provident fund investments and their review;

(e) Safe custody of securities in India and overseas;

(f) Reinvesting the returns collected from investments in some profitable avenues;

(g) other investment advisory services etc.

Services to Non-Resident Indians:

In order to attract foreign capital resources for being invested in India, Union Government has offered various incentives to Non-Resident Indians (NRIs) and Persons of Indian Origin Resident Abroad (PIORA). Merchant banks provide special services on this account to encourage the NRIs to invest their savings in Indian industry.

ADVERTISEMENTS:

The services include:

(i) Advice on selection of investment.

(ii) Critical evaluation of investment portfolio.

(iii) Securing approval from RBI for the purchase/sale of securities.

(iv) Hold securities in safe custody.

(v) Maintaining investment records and complying with ceiling requirements.

(vi) Collecting and remitting interest and dividend on investment.

(vii) Providing tax counselling and filing tax returns.

(viii) Evaluation of investment portfolio periodically at the request of investors.

(ix) Circulation of investment news for the benefit of the investors.

Function # 5. Issue Management:

In the past, the functions of a merchant banker had been mainly confined to the management of new public issues of corporate securities by the newly formed companies, existing companies (further issues) and foreign companies in dilution of equity as required under FERA.

In this capacity, the merchant bank usually acts as a sponsor of issues. They obtain consent of the Controller of Capital Issues (CCI) now, SEBI and provide a number of other services to ensure success in the marketing of securities.

The services provided by them include:

(i) Preparation of the prospectus.

(ii) Preparation of a plan and budget to estimate total expenditure of the issue.

(iii) Preparation of CCI (Controller of Capital Issues) application and providing assistance in obtaining consent of the CCI.

(iv) Selection of institutional and broker underwriters and underwriting agreements.

(v) Appointment of registrars, brokers and bankers to the issue.

(vi) Advertising and arranging publicity agency for post and pre-issue.

(vii) Selection of issue house.

(viii) Compliance of listing requirements of stock exchanges.

(ix) Act as co-ordinator with underwriter’s brokers and bankers to the issue and stock exchanges.

(x) Merchant banker advises the client whether to go for

(a) A fresh issue or

(b) Additional issue or

(c) Bonus issue or

(d) A right issue of equity or preference or both, if both then, in what proportion it is to be made.

If debentures are to be issued, it advises on the type of debentures, whether convertible or non-convertible, whether redeemable or non-redeemable or whether linked with equity or preference shares etc.

Merchant banks also performs the function of taking a decision as to the size and timing of the public issue in the light of prevailing market conditions, press coverage, underwriting support from brokers institutional underwriters etc.

Thus, merchant bankers not only act as experts of the type, timing and terms of issues of corporate securities and make them acceptable for the investors on the one hand and also provide flexibility and freedom to the issuing companies.

Function # 6. Loan/Credit Syndication:

Merchant bankers provide specialised services in preparation of project, loan applications for raising short-term as well as long-term credit from various banks and financial institutions for financing the project or meeting the working capital requirements. They also manage Euro-Issues and help in raising funds abroad.

To be more detailed, credit syndication does involve the following services:

(i) Estimation of the total costs/expenditure on the project.

(ii) Preparing a financial plan to meet the total cost of the project keeping into consideration the requirements of the promoters and their collaborators, financial institutions, banks, government agencies and underwriters.

(iii) Assisting the clients in the preparation of loan applications for financial assistance from term lenders/financial Institutions/banks and monitoring their progress.

(iv) Making selection of the institutions/banks for participation in financing.

(v) Follow-up of the term loan application with the financial institutions and banks and obtaining the satisfaction for their share of participation.

(vi) Merchants banks help in expediting legal documentation formalities listed by the participating financial institutions and banks and help in completion of formalities also.

(vii) Merchant banks also help in estimating the working capital requirements and assist the client in negotiating for the sanction of appropriate facilities.

(viii) Arrange bridge finance which could be either as a part of the main loan sanctioned to the client by the term lenders or it could be amount against the issue of capital or may be both.

Function # 7. Arranging Working Capital Finance:

Earlier, working capital finance was not considered to be a merchant bank activity but used to be a part of the commercial bank’s function. But some banks like Canara Bank, Grindlays Bank and Central Bank of India have started including working capital finance as one of the merchant banking service area.

Finance for working capital is provided usually for new ventures or for existing companies through issue of debentures. Grindlays bank claims to offer expertise for meeting the requirements for long-term working capital for private placement of secured debentures. Grindlays Bank helps the company in obtaining the enhanced cash credit facilities as well as bill discounting facilities for their customers or suppliers from banks.

Canara Bank renders advisory service to the clients in the matter of working capital finance. It includes the following services:

(i) Estimation of working capital requirements.

(ii) Assistance in preparing the application for credit facilities for submission to the bankers and Reserve Bank of India.

(iii) Assistance in negotiations for sanction of appropriate credit facilities.

(iv) Helps in expediting documentation and other formalities for disbursements.

(v) Advises the client for issue of debentures for meeting the increased long term working capital requirements of the client company.

Central Bank of India (CBI) helps the client companies in the calculation and provisions of working capital needed for a given project, management of non-convertible debenture issues, and management of fixed deposit.

Function # 8. Bill Discounting and Acceptance Credit:

In foreign countries, acceptance credit and bill discounting function is another important area which is recognised as a merchant banking activity. But in India this facility is not provided to the corporate units by the merchant bankers.

The need for such services was recognised when Banking Commission 1972, in its report had recommended the establishment of acceptance and discount house in India following the development of bill market.

A bill of exchange accepted by a house of established reputation automatically becomes acceptable to the seller of goods and to the lenders of money even though they do not have any knowledge of the creditworthiness of the drawer of the bill.

Proposed functions of merchant banker would include the following:

(i) Finding out the reputation and financial standing of the acceptor.

(ii) The existence of a system for collection of information on borrowers.

Commercial banks can undertake acceptance and discount business because they have the necessary expertise and broad network of branches.

But at present only bill discounting facility is available to commercial banks under the RBI’s formalised scheme for credit accommodations and under refinancing schemes. Indian merchant bankers have still to formulate the practices and procedure so that efficient services could be offered in acceptance and bill discounting.

Function # 9. Lease Finance:

Many merchant bankers also provide leasing and finance facilities to their customers. Leasing is an arrangement that provides a firm with the use and control over assets without buying and owning the same. It is a form of renting assets.

Lease is a contract between the owner of the asset (lessor) and the user of the asset called the lessee, whereby the lessor gives the right to use the asset to the lessee over an agreed period of time for a consideration called the lease rental.

The lease contract is regulated by the terms and conditions of the agreement. The lessee pays the lease rent periodically to the lessor as regular fixed payments over a period of time. The rentals may be payable at the beginning or end of a month, quarter, half-year or year.

The lease rentals can also be agreed both in terms of amount and timing as per the profits and cash flow position of the lessee. At the expiry of the lease period, the asset reverts back to the lessor who is the legal owner of the asset. However, in long-term lease contracts, the lessee is generally given an option to buy or renew the lease.

Merchant bankers assist their clients by providing finance for the acquisition of asset taken on lease.

Function # 10. Venture Capital:

Many merchant bankers maintain venture capital funds to assist the entrepreneurs who lack capital to be risked. Capital funds may be provided for unproven ideas, products technology-oriented or start-up funds. Venture capital has emerged as a new merchant banking activity. It is a form of equity financing especially designed for funding high risk and high reward projects.

Function # 11. Public Deposits:

Merchant bankers also help companies in raising finance by way of public deposits.

Function # 12. Specialised Services:

In addition to the basic activities involving marketing of securities, merchant banks also provide corporate advisory services on issues like mergers and amalgamation, takeovers, tax matters, recruitment of executives and cost and management audit etc. Many merchant bankers have also started making of bought out deals of shares and debentures.

The activities of the merchant bankers are increasing with the change in the money market. These specialised services which all the merchant banks in India have not been able to render excepting the ICICI, Canara Bank and Grindlays Bank and Punjab National Bank (PNB).

Grindlays Bank renders this specialised service in accordance with the individual requirements of the client.

These services include:

(i) Advice and assistance in negotiating terms and conditions of acquisitions and mergers;

(ii) Expert advice on valuation of the amount of purchase consideration and its nature;

(iii) Help in expediting legal documentation process and obtaining official approval;

(iv) Carry out management audits to identify areas of strength and weaknesses of a corporate unit;

(v) Assist in formulating guidelines and plans for future growth.

Canara Bank provides the following specialised services in relation to merger and amalgamation:

(i) Determining the strengths and weaknesses and their financial implications.

(ii) Deciding suitable form of organisation.

(iii) Assist the client company in preparation of the proposal draft, legal documentation.

(iv) Assistance in obtaining approval from various authorities.

(v) Co-ordinating the activities of solicitors, accountants, valuators & other professionals involved in merger and Amalgamation.

Punjab National Bank has a separate Merchant Banking Division that renders specialised services in the area of merger and amalgamation.

The services include:

(i) Assessing pros and cons of proposals for financial reconstruction, merger amalgamation.

(ii) Assistance in preparation and formulation of scheme of financial restructuring

(iii) Obtaining consent from shareholders, depositors, creditors, government and other authorities

(iv) Monitoring implementation of schemes of merger and amalgamation