This article throws light upon the nineteen main obligations of merchant bankers. The obligations are: 1. Merchant Banker not to Associate with any Business other than that of the Securities Market 2. Maintenance of Book of Accounts, Records, etc 3. Submission of Half-yearly Results 4. Maintenance of Books of Accounts, Records and other Documents 5. Report on Steps taken on Auditor’s Report and Others.

Obligations of Merchant Bankers:

- Merchant Banker not to Associate with any Business other than that of the Securities Market

- Maintenance of Book of Accounts, Records, etc

- Submission of Half-yearly Results

- Maintenance of Books of Accounts, Records and other Documents

- Report on Steps taken on Auditor’s Report

- Appointment of Lead Merchant Bankers

- Restriction on Appointment of Lead Managers

- Responsibilities of Lead Managers

- Lead Merchant Banker not to Associate with a Merchant Banker without Registration

- Underwriting Obligations

- Submission of Due Diligence Certificate

- Documents to be Furnished to the Board

- Continuance of Association of Lead Manager with an Issue

- Acquisition of Shares Prohibited

- Information to the Board

- Disclosures to the Board

- Appointment of Compliance Officer

- Board’s right to Inspect

- Obligations of Merchant Banker on Inspection by the Board

Obligation # 1. Merchant Banker not to Associate with any Business other than that of the Securities Market:

No merchant banker, other than a bank or a public financial institution, who has been granted a certificate of registration under these regulations, shall [after June 30th, 1998] carry on any business other than that in the securities market.

Not-withstanding anything contained above, a merchant banker who prior to the date of notification of the Securities and Exchange Board of India (Merchant Bankers) Amendment Regulations, 1997, has entered into a contract in respect of a business other than that of the securities market, may, if he so desires, discharge his obligations under such contract.

ADVERTISEMENTS:

Provided that a merchant banker who has been granted certificate of registration to act as primary or satellite dealer by Reserve Bank of India, may carry on such business as may be permitted by the Reserve Bank of India (SEBI/Merchant Bankers) (Second Amendment) Regulations, 1999.

Obligation # 2. Maintenance of Book of Accounts, Records, etc.:

Every merchant banker shall keep and maintain the following books of accounts, records and documents, namely:

(a) A copy of balance sheet as at the end of each accounting period;

(b) A copy of profit and loss account for that period:

ADVERTISEMENTS:

(c) A copy of the auditor’s report on the accounts for that period; and

(d) a statement of financial position.

Every merchant banker shall intimate to the Board the place where the books of accounts, records and documents are maintained.

Without prejudice to sub-regulation (I), every merchant banker shall, after the end of each accounting period furnish to the Board copies of the balance sheet, profit and loss account and such other documents for any other preceding five accounting years when required by the Board.

Obligation # 3. Submission of Half-yearly Results:

ADVERTISEMENTS:

Every merchant banker shall furnish to the Board half-yearly unaudited financial results when required by the Board with a view to monitor the capital adequacy of the merchant banker.

Obligation # 4. Maintenance of Books of Accounts, Records and other Documents:

The merchant banker shall preserve the books of accounts and other records and documents for a minimum period of five years.

Obligation # 5. Report on Steps taken on Auditor’s Report:

Every merchant banker shall within two months from the date of the auditors’ report take steps to rectify the deficiencies, made out in the auditor’s report.

Obligation # 6. Appointment of Lead Merchant Bankers:

All issues should be managed by atleast one merchant banker functioning as the lead merchant banker:

ADVERTISEMENTS:

Provided that, in an issue of offer of rights to the existing members with or without the right of renunciation the amount of the issue of the body corporate does not exceed rupees fifty lakhs, the appointment of a lead merchant banker shall not be essential.

Every lead merchant banker shall before taking up the assignment relating to an issue, enter into an agreement with such body corporate setting out their mutual rights, liabilities and obligations relating to such issue and in particular to disclosures, allotment and refund.

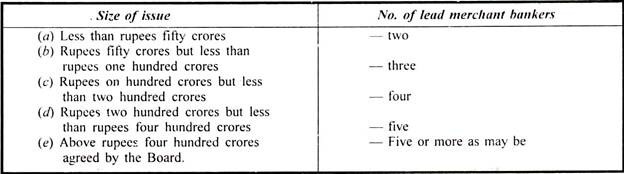

Obligation # 7. Restriction on Appointment of Lead Managers:

The number of lead merchant bankers may not, exceed in case of any issue of;

Obligation # 8. Responsibilities of Lead Managers:

(1) No lead manager shall agree to manage or be associated with any issue unless his responsibilities relating to the issue mainly, those of disclosures, allotment and refund are clearly, defined, allocated and determined and a statement specifying such responsibilities is furnished to the Board atleast one month before the opening of the issue for subscription:

ADVERTISEMENTS:

Provided that, where there are more than one lead merchant banker to the issue the responsibilities of each of such lead merchant banker shall clearly be demarcated and a statement specifying such responsibilities shall be furnished to the Board atleast one month before the Opening of the issue for Subscription.

No lead merchant banker shall, agree to manage the issue made by anybody corporate, if such body corporate is an associate of the lead merchant banker.

Obligation # 9. Lead Merchant Banker not to Associate with a Merchant Banker without Registration:

A lead merchant banker shall not be associated with any issue if a merchant banker who is not holding a certificate is associated with the issue.

Obligation # 10. Underwriting Obligations:

ADVERTISEMENTS:

In respect of every issue to be managed, the lead merchant banker holding a certificate under Category I shall accept a minimum underwriting obligation of five per cent of the total underwriting commitment or rupees twenty-five lacs, whichever is less:

Provided that, if the lead merchant banker is unable to accept the minimum underwriting obligation, that lead merchant banker shall make arrangement for having the issue underwritten to that extent by a merchant banker associated with the issue and shall keep the Board informed of such arrangement.

Obligation # 11. Submission of Due Diligence Certificate:

The lead merchant banker, who is responsible for verification of the contents of a prospectus or the letter of offer in respect of an issue and the reasonableness of the views expressed therein, shall submit to the Board atleast two weeks prior to the opening of the issue for subscription, a due diligence certificate in Form C.

Obligation # 12. Documents to be Furnished to the Board:

(1) The lead manager responsible for the issue shall furnish to the Board, the following documents, namely:

ADVERTISEMENTS:

(i) Particulars of the issue;

(ii) Draft prospectus or where there is an offer to the existing shareholders, the draft letter of offer;

(iii) Any other literature intended to be circulated to the investors, including the shareholders; and

(iv) Such other documents relating to prospectus or letter of offer, as the case may be.

The documents referred to in sub-regulation (1) shall be furnished atleast two weeks prior to date of filing of the draft prospectus or the letter of offer, as the case may be, with the Registrar of Companies or with the Regional Stock Exchanges, or with both.

The lead manager shall ensure that the modifications and suggestions, if any, made by the Board on the draft prospectus or the letter of offer, as the case may be, with respect to information to be given to the investors are incorporated therein.

Obligation # 13. Continuance of Association of Lead Manager with an Issue:

ADVERTISEMENTS:

The lead manager undertaking the responsibility for refunds or allotment of securities in respect of any issue shall continue to be associated with the issue till the subscribers have received the share or debenture certificates of refund or excess application money.

Provided that where a person other than the lead manager is entrusted with the refund or allotment of securities in respect of any issue, the lead manager shall continue to be responsible for ensuring that such other person discharges the requisite responsibilities in accordance with the provisions of the Companies Act and the listing agreement entered into by the body corporate with the stock exchange.

Obligation # 14. Acquisition of Shares Prohibited:

No merchant banker or any of its directors, partner or manager or principal officer shall either on their respective accounts or through their associates or relatives enter into any transaction in securities of bodies corporate on the basis of unpublished price sensitive information obtained by them during the course of any professional assignment either from the clients or otherwise.

Obligation # 15. Information to the Board:

Every merchant banker shall submit to the Board complete particulars of any transaction for acquisition of securities of anybody corporate whose issue is being managed by that merchant banker within fifteen days from the date of entering into such transaction.

Obligation # 16. Disclosures to the Board:

A merchant banker shall disclose to the Board as and when required, the following information, namely:

(i) His responsibilities with regard to the management of the issue;

ADVERTISEMENTS:

(ii) Any change in the information or particulars previously furnished, which have a bearing on the certificate granted to it;

(iii) The names of the body corporate whose issues he has managed or has been associated with;

(iv) The particulars relating to breach of the capital adequacy requirement;

(v) Relating to his activities as a manager, underwriter, consultant or adviser to an issue as the case may be.

Obligation # 17. Appointment of Compliance Officer:

Every merchant banker shall appoint a compliance officer who shall be responsible for monitoring the compliance of the Act, rules and regulations, notifications, guidelines, instructions, etc. issued by the Board or the Central Government and for redressal of investors’ grievances.

The compliance officer shall immediately and independently report to the Board any non-compliance observed by him and ensure that the observations made or deficiencies pointed out by the Board on/in the draft prospectus or the Letter of Offer as the case may be, do not recur.

Obligation # 18. Board’s right to Inspect:

ADVERTISEMENTS:

The Board may appoint one or more persons as inspecting authority to undertake inspection of the books of accounts, records and documents of the merchant banker for any of the following purposes:

(a) To ensure that the books of account are being maintained in the manner required.

(b) That the provisions of the Act, rules, regulations are being complied with;

(c) To investigate into the complaints received from investors, other merchant bankers or any other person on any matter having a bearing on the activities of the merchant banker, and

(d) To investigate suo moto in the interest of securities business or investors interest into the affairs of the merchant banker.

Obligation # 19. Obligations of Merchant Banker on Inspection by the Board:

It shall be the duty of every director, proprietor, partner, officer and employee of the merchant banker, who is being inspected, to produce to the inspecting authority such books, accounts and other documents in his custody or control and furnish him with the statements and information relating to his activities as a merchant banker within such time as the inspecting authority may require.

ADVERTISEMENTS:

The merchant banker shall allow the inspecting authority to have reasonable access to the premises occupied by such merchant banker or by any other person on his behalf and also extend reasonable facility for examining any books, records, documents and computer data in the possession of the merchant banker or any such other person and also provide copies of documents or other materials which, in the opinion of the inspecting authority are relevant for the purposes of the inspection.

The inspecting authority, in the course of inspection, shall be entitled to examine or record statements of any principal officer, director, partner, proprietor and employee of the merchant banker.

It shall be the duty of every director, proprietor, partner, officer or employee of the merchant banker to give to the inspecting authority all assistance in connection with the inspection which the merchant banker may reasonably be expected to give.