After reading this article you will learn about the Organisation and Growth of Stock Exchanges.

Stock Exchanges in India are organised in any of the following forms:

(a) Voluntary, non-profit making associations, e.g., Bombay, Ahmedabad and Indore;

(b) Public Limited Companies such as Calcutta, Delhi and Bangalore stock exchanges; and

ADVERTISEMENTS:

(c) Company Limited by guarantee, e.g.; Hyderabad and Madras stock exchanges.

Only the Securities which are ‘listed’ are traded on the stock exchanges in India, A company can list, delist and relist its securities in the stock exchange by paying the stipulated fees. Transactions on stock exchanges have been carried either on cash basis or on carry over basis. Some exchanges, like Ahmedabad and Madras have their own clearing houses.

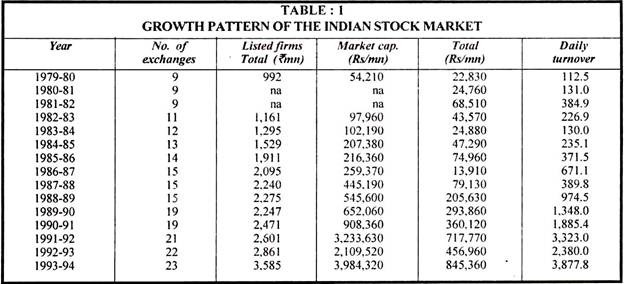

The growth of stock exchanges in India has been linked with the growth of corporate sector. We can study the growth of stock exchanges in terms of the number of recognised exchanges, the number of listed firms, market capitalisation and total capitalisation as given in Table 1, below.

The above table shows that stock exchanges recognised by the government increased from bust 9 in 1981-82 to 23 at the end of 1993-94. Market capitalisation which was just Rs. 54 billion n 1979-80 had gone upto Rs. 3,984 billion at the end of the financial year 1993-94, and upto Rs. 4,469 billion by the end of August, 1994.

ADVERTISEMENTS:

The total number of companies registered with all exchanges put together has also increased from just 992 in 1979-80 to 3,585 by the end of 1993-94 and upto 7,000 by the end of August 1994.

Further, in terms of paid up capital, listed companies constitute major portion of the total paid up capital of the non-government corporate sector. Another analysis of the date available for stock exchanges in our country indicates that four of the stock exchanges in Bombay, Calcutta, Delhi and Ahmedabad account for almost 90 percent of the overall business of the stock exchanges.

Another indicator to gauge the growth of stock exchange activities could be the volume of turnover of stock exchanges. It had increased from Rs. 22,830 mn. in 1979-80 to Rs. 845,360 mn. in 1993-94. We can find from the table that there is a sudden increase in the stock market activity from the year 1991-92 when the new Government in India adopted the new industrial policy coupled with liberalisation of economy.

ADVERTISEMENTS:

These developments in the stock exchange activity have been on account of increases in the primary market. The total amount raised through the securities market had gone upto Rs. 216 billion in 1993-94 from just Rs. 2 billion in 1980.

To regulate these ever increasing stock markets in India and to protect in investor’ interest, the Govt. of India has set up Securities and Exchange Board of India (SEBI) Under the SEBI Act, 1992. The National Stock exchange of India Ltd. was also incorporated in November 1992 with an equity capital of Rs. 25 crore. The NSE has started functioning in stock market from the year ending 1994.