This article throws light upon the top four categories for classification of cost. The categories are: 1. Classification of Cost by Nature or Element 2. Functional Classification of Cost 3. Classification of Cost on the Basis of Behaviour 4. Classification of Costs for Managerial Decisions and Control.

Classification of Costs:

- Classification of Cost by Nature or Element

- Functional Classification of Cost

- Classification of Cost on the Basis of Behaviour

- Classification of Costs for Managerial Decisions and Control

Category # 1. Classification of Cost by Nature or Element:

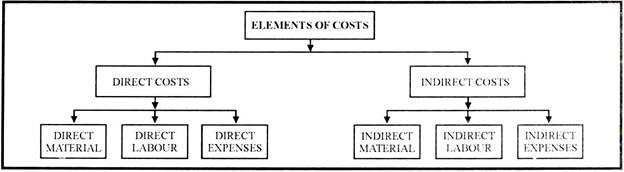

According to the nature or elements of cost, costs can be broadly classified as:

(a) Direct Costs

ADVERTISEMENTS:

(b) Indirect Costs.

(a) Direct Costs:

Direct Costs are the costs which can be conveniently identified with and allocated to a particular unit of final product. Such costs are treated as the cost of the unit produced. The examples of direct costs are raw materials, labour and other direct expenses which are exclusively incurred for a particular unit of cost, i.e., job, product or process.

Hence, direct costs can be further classified as:

ADVERTISEMENTS:

(i) Direct Material

(ii) Direct Labour

(iii) Direct Expenses.

All materials which become an integral part of the finished product and which can be conveniently assigned to specific physical units is called direct material. Direct materials include all materials specifically purchased or requisitioned for specific cost unit, all primary packing materials.

ADVERTISEMENTS:

Direct Labour cost consists of wages paid to workers directly engaged in manufacturing or handling a product, job or process. It includes the payment of wages to the workers engaged on the actual production of the product or an operation or a process; and to the workers engaged in helping such production operation or process by way of supervision, maintenance, etc.

All expenses other than the direct material or direct labour that are specifically incurred for a particular job, product or process are called direct expenses. Direct expenses are also known as chargeable expenses as they are charged directly to the particular unit of cost concerned.

Examples of direct expenses are: cost of special tools, patterns, etc., made for a specific job, product or process, hire charges of a special equipment, excise duty, cost of trial castings, royalties, freight and insurance on special materials, etc.

(b) Indirect Costs:

ADVERTISEMENTS:

Indirect Costs are those costs which cannot be assigned to any particular cost unit, i.e., job, product or process. Indirect costs are, usually, incurred for the business as a whole and are, therefore, apportioned among the various cost units (product, job or process) on some reasonable basis.

Like direct costs indirect costs include:

(i) Indirect Material such as fuel, lubricating oil, small tools, and material consumed for repairs and maintenance work, miscellaneous stores used in the factory, etc.

ADVERTISEMENTS:

(ii) Indirect labour which includes wages of general supervisors, inspectors, workshop cleaners, store-keepers, time-keepers, etc.

(iii) Indirect expenses such as rent, lighting, insurance, canteen, hospital, welfare expenses, etc.

Indirect costs are also called ‘Overheads’. Overheads may be further classified as:

(a) Factory Overheads which include all indirect expenses connected with the manufacture of a product such as lubricants, oil, consumable stores, works manager’s salary, time-keeper’s salary; factory rent, factory insurance, etc.

ADVERTISEMENTS:

(b) Office and Administration Overheads which include all indirect expenses relating to administration and management of an office such as office rent, office lighting, insurance, salaries of clerical and executive staff, etc.

(c) Selling and Distribution Overheads which include all indirect costs connected with marketing and sales such as advertising expenses, salaries of salesmen, indirect packing material, etc.

Category # 2. Functional Classification of Cost:

Functionally, costs can be classified under the following heads:

(a) Prime Cost:

ADVERTISEMENTS:

It consists of the costs of direct materials that go into the product, the costs of direct labour and direct expenses. It is also known as direct cost or first cost.

(b) Factory Cost:

It consists of prime cost plus factory overhead or works expenses or factory on cost. Factory cost is also known as works cost, production cost or manufacturing cost.

(c) Cost of Production:

Also called office cost, administration cost or gross cost of production, it consists of factory cost plus office and administrative expenses.

(d) Total Cost or Cost of Sales:

ADVERTISEMENTS:

It comprises cost of production plus selling and distribution overheads.

The various components of total cost can be presented as follows:

1. Prime Cost = Direct Material + Direct Labour + Direct Expenses

2. Factory Cost or Works Cost = Prime Cost + Works Expenses or Factory Expenses or Works on Cost.

3. Office Cost or Gross Cost of Production = Factory Cost + Administrative and Office Overheads

4. Total cost or Cost of Sales = Office Cost + Selling and Distribution Overheads

Category # 3. Classification of Cost on the Basis of Behaviour:

ADVERTISEMENTS:

On the basis of behaviour or variability, costs may be classified as:

(a) Variable Costs:

Costs that vary almost in direct proportion to the volume of production are called variable costs. The examples of such costs are direct material, direct labour and direct chargeable expenses, such as electric power, fuel, etc.

(b) Fixed Costs:

Costs which do not vary with the level of production are known as fixed costs. These costs are called fixed costs because these remain constant irrespective of the level of output. It must, however, be noted that fixed costs do not remain constant for all times. In fact, in the long run ail costs have a tendency to vary. Fixed costs remain fixed upto a certain level of production.

(c) Semi-variable Costs:

ADVERTISEMENTS:

Those costs which are partly fixed and partly variable are called semi-variable costs. These costs vary with the level of production but not in direct proportion to the level of production. The examples of such costs are depreciation of machinery, maintenance of equipment, administrative costs, etc.

Category # 4. Classification of Costs for Managerial Decisions and Control:

(a) Controllable and Uncontrollable Costs:

Controllable costs are those costs which can be controlled or influenced by a specified person or a level of management of an undertaking. Costs which cannot be so controlled or influenced by the action of a specified individual of an undertaking are known as uncontrollable costs. The difference in controllable and uncontrollable costs is only in relation to a particular person or a level of management.

(b) Normal and Abnormal Costs:

Costs which are normally incurred at a given level of output are called normal costs while the costs which are not normally incurred at a given level of output in the conditions at which that level is normally achieved, are called abnormal costs.

(c) Avoidable and Unavoidable Costs:

ADVERTISEMENTS:

Avoidable costs are those costs which can be escaped or avoided if some activity of the business to which they relate is discontinued. Unavoidable costs are those which cannot be escaped or eliminated.

(d) Shut Down and Sunk Costs:

Those fixed costs which have to be incurred even if production or operations of an undertaking are discontinued temporarily due to certain reasons such as strike, shortage of raw material, etc., are called shut down costs. Costs which have been incurred and are irrelevant in a particular situation are called sunk costs.

(e) Product Costs and Period Costs:

Costs which are associated with production and which become part of the cost of the product are called ‘product costs’. The examples of product costs are raw material, direct wages, etc. Costs which are not associated with production or which are associated with period for which they are incurred are called ‘period cost’. The examples of period costs are administration costs, rent, insurance, salesmen salaries, etc.

(f) Differential, Incremental and Decremental Costs:

ADVERTISEMENTS:

The difference-in-costs due to change in the level of activity or the method of production is known as ‘differential cost’. In case, the change increases the cost, it is called incremental cost and in case, the change decreases the cost, it is called decremental cost.

(g) Out of Pocket Costs:

It is that cost which gives rise to costs expenditure as opposed to that cost which do not involve any costs expenditure, e.g., depreciation of an asset owned is not an out of pocket cost. Out of pocket costs are important for price fixation during recession and where make or duy decision is involved.

(h) Marginal Costs:

Marginal cost is the cost of producing one additional unit. The marginal cost concept is based on the distinction between fixed and variable costs. Marginal cost is the total of variable cost only and fixed costs are ignored for the purpose of marginal cost. The concept of marginal cost is very useful in making many managerial decisions such as price fixation, make or by decisions, etc.

(i) Opportunity Costs:

Opportunity costs refer to the advantages foregone as a result of adopting one course of action and not the other. For example, if an owned building is proposed to be used for a project, the expected rent of the building is the opportunity cost that must be taken into consideration while evaluating the profitability of the project.

(j) Conversion Cost:

It is the cost of converting or transforming raw materials into finished products. Conversion cost can be calculated as the total of direct labour, direct expenses and chargeable factory overheads.

(k) Budget Costs and Standard Cost:

Budget costs are estimated costs prior to a defined period of time. Standard cost is a ‘predetermined cost based on technical estimate for materials, labour and overheads for a selected period of time and for a prescribed set of working conditions’. Standard costs are based upon technical assessments whereas budgets are based on historical costs adjusted to future trends.

(i) Imputed or Hypothetical Costs:

These costs do not involve any expenditure in real sense. They are included in cost accounts only for taking managerial decisions. For example, the rent of owned building or interest on owned capital should be taken into consideration while evaluating the profitability of a project. These costs are also called ‘notional costs’.