Cost of capital is a composite cost of the individual sources of funds including equity shares, preference shares, debt and retained earnings.

The overall cost of capital depends on the cost of each source and the proportion of each source used by the firm. It is also referred to as weighted average cost of capital. It can be examined from the viewpoint of an enterprise as well as that of an investor.

Some of the components of cost of capital are:-

1. Cost of Debt Capital 2. Cost of Preference Capital 3. Cost of Equity Capital 4. Cost of Retained Earnings 5. Weighted Average Cost of Capital 6. Marginal Cost of Capital 7. The Cost of Preferred Stock 8. Return on Capital.

Cost of Capital: Components, Concept, Importance, Example, Formula and Significance

Cost of Capital – With Formula for Calculation

1. Cost of Debt Capital:

Generally, cost of debt capital refers to the total cost or the rate of interest paid by an organization in raising debt capital. However, in a real situation, total interest paid for raising debt capital is not considered as cost of debt because the total interest is treated as an expense and deducted from tax. This reduces the tax liability of an organization.

ADVERTISEMENTS:

Therefore, to calculate the cost of debt, the organization needs to make some adjustments. Let us understand the calculation of cost of debt with the help of an example.

Suppose an organization raised debt capital of Rs.10000 and paid 10% interest on it. The organization is paying corporation tax at the rate of 50%. In this case, the total 10% of interest rate would not be deducted from tax and the deduction would be 50% of 10%.

Therefore, the cost of debt would be only 5%. While calculating cost of debt capital, discount allowed, underwriting commission, and cost of advertisement are also considered.

ADVERTISEMENTS:

These expenses are added to the amount of interest paid, which is considered as total cost of debt capital. For example- when an organization increases its proportion of debt capital more than the optimum level, then it increases its risk factor. Therefore, the investors feel insecure and their expectations of EPS start increasing, which is the hidden cost related to debt capital.

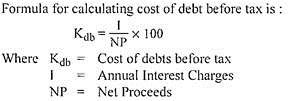

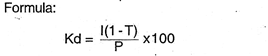

Formulae to calculate cost of debt are as follows:

1. When the debt is issued at par –

ADVERTISEMENTS:

Where,

KD = Cost of debt

T = Tax rate

R = Rate of interest on debt capital

ADVERTISEMENTS:

KD = Cost of debt capital

2. Debt issued at premium or discount when debt is irredeemable –

Where,

ADVERTISEMENTS:

NP = Net proceeds of debt

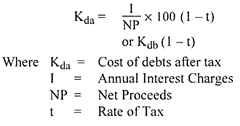

3. Cost of redeemable debt –

KD= [{I (1-T) + (P – NP / N) x (1- T)} / (P + NP / 2)] x 100

where,

ADVERTISEMENTS:

N = Numbers of years of maturity

P = Redeemable value of debt

2. Cost of Preference Capital:

Cost of preference capital is the sum of amount of dividend paid and expenses incurred for raising preference shares. The dividend paid on preference shares is not deducted from tax, as dividend is an appropriation of profit and not considered as an expense.

Cost of preference share can be calculated by using the following formulae:

ADVERTISEMENTS:

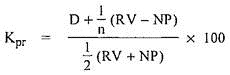

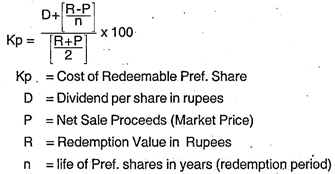

1. Cost of redeemable preference shares –

Kp = [{D + F / N (1 – T) + RP / N} / {P + NP / 2}] x 100

Where,

KP = Cost of preference share

D = Annual preference dividend

F = Expenses including underwriting commission, brokerage, and discount

ADVERTISEMENTS:

N = Number of years to maturity

RP = Redemption premium

P = Redeemable value of preference share

NP = Net proceeds of preference shares

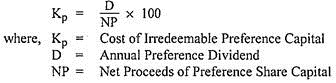

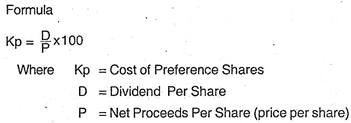

2. Cost of irredeemable preference shares –

KP = (D / NP) x 100

3. Cost of Equity Capital:

ADVERTISEMENTS:

It is very difficult to calculate the cost of equity capital as compared to debt capital and preference capital. The main reason is that the equity shareholders do not receive fixed interest or dividend. The dividend on equity shares varies depending upon the profit earned by an organization. Risk factor also plays an important role in deciding rate of dividend to be paid on equity capital. Therefore, there are various approaches to calculate cost of equity capital.

The explanation of these approaches are as follows:

The dividend price approach describes the investors’ view before investing in equity shares. According to this approach, investors have certain minimum expectations of receiving dividend even before purchasing equity shares. An investor calculates present market price of the equity shares and their rate of dividend.

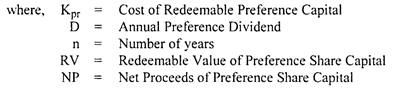

The dividend price approach can be mathematically calculated by using the following formula:

KE = (Dividend per share / Market price per share) x 100

ADVERTISEMENTS:

KE = Cost of equity capital

However, the dividend price approach his criticized on certain grounds, which are as follows:

a. Does not take into consideration the appreciation in the value of capital. The dividend price approach is based on the assumption that investors expect some dividend on their shares. It completely ignores the fact that some investors also consider the chances of capital appreciation, which increases the value of their shares.

b. Ignores the impact of retained earnings, which affect both the market price of shares and the amount of dividend paid. For example- suppose if an organization keeps major portion of its profit as retained earnings then it would pay low dividend, which may decrease the market price of its shares.

ii. Earnings Price Ratio Approach:

The earnings price ratio approach suggests that cost of equity capital depends upon amount of fixed earnings of an organization. According to the earnings price ratio approach, an investor expects that a certain amount of profit must be generated by an organization. Investors do not always expect that the organization distribute dividend on a regular basis.

ADVERTISEMENTS:

Sometimes, they prefer that the organization invests the amount of dividend in further projects to earn profit. In this way, the organization’s profit would increase, which in turn increases the value of its shares in the market.

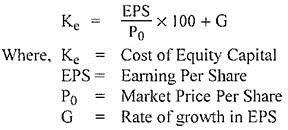

The formula to calculate cost of capital through the earnings price ratio approach is as follows:

KE = E / MP

where,

E = Earnings per share

MP = Market price

ADVERTISEMENTS:

However, this approach is criticized on the following grounds:

a. Assumes that EPS would remain constant

b. Assumes that market price per share would remain constant

c. Ignores the fact that all the earnings of an organization are not distributed in the form of dividend. However, some part of earnings may be kept in form of retained earnings.

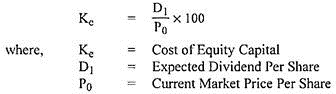

iii. Dividend Price Plus Growth Approach:

The dividend price plus growth approach refers to an approach in which the rate of dividend grows with the passage of time. In the dividend price plus growth approach, investors not only expect dividend but regular growth in the rate of dividend. The growth rate of dividend is assumed to be equal to the growth rate in EPS and market price per share.

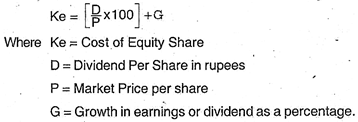

In the dividend price plus growth approach, cost of capital can be calculated mathematically by using the following formula:

KE = [(D / MP) + G] x 100

Where,

D = Expected dividend per share, at the end of period

G = Growth rate in expected dividends

This approach is considered as the best approach to evaluate the expectations of investors and calculate the cost of equity capital.

In the realized yield approach, an investor expects to earn the same amount of dividend, which the organization has paid in past few years. In this approach, the growth in dividend is not considered as major factors for deciding the cost of capital.

This approach is based on the following assumptions:

a. Risk factor remains constant in an organization. Returns in the given risk remain the same as per the expectations of shareholders.

b. Realized yield is equivalent to the reinvestment opportunity rate for shareholders.

According to the realized yield approach, cost of capital can be calculated mathematically by using the following formula:

KE = [{(D – P) / p} – 1] x 100

Where,

P = Price at the end of the period,

p = Price per share to day

v. Capital Asset Price Model (CAPM):

CAPM helps in calculating the expected rate of return from a share of equivalent risk in the capital market. The cost of shares that carry risk would be equal to cost of lost opportunity. For example- an investor has two investment options- to buy the shares of either X Ltd. or Y Ltd. If the investor decides to buy the shares of X Ltd. then the cost of shares of Y Ltd. would be the cost of lost opportunity.

CAPM is based on the following assumptions:

a. A rationale investor would always avoid risk

b. A rationale investor would always wish to maximize the expected yield

c. All investors would have similar expectations

d. All investors can lend freely on the riskless rates of return

e. Capital market is in good condition and there is no existence of tax

f. Capital market is competitive in nature

g. Securities are completely divisible and there is no transaction cost

The computation of cost of capital using CAPM is based on the condition that the required rate of return on any share should be equal to the sum of risk less rate of interest and premium for the risk.

According to CAPM, cost of capital can be calculated mathematically by using the following formulae:

Where,

E = Expected rate of return on asset

β = Beta coefficient of assets

R1 = Risk free rate of return

E (R2) = Expected return from market portfolio

This value can be calculated by analyzing data of usually five years.

Formula used to calculate beta value is as follow:

β = PIM (SD1) (SDM) / SD2M

Where,

β = Beta of stock

PIM = Correlation coefficient between the returns on stock, I and the returns on market portfolio, M.

SD1 = Standard deviation of returns on assets

SDM = Standard deviation of returns on the market portfolio

SD2M = Variance of market returns

vi. Bond Yield Plus Risk Premium Approach:

The bond yield plus risk premium approach states that the cost on equity capital should be equal to the sum of returns on long-term bonds of an organization and risk premium given one equity shares. The risk premium is paid on equity shares because they carry high risk.

Mathematically, the cost of capital is calculated as:

Cost of equity capital = Returns on long-term bonds + Risk premium

The bond yield plus risk premium approach is based on the fact that a risky organization would have high financial leverage. As a result of this, it would be earning higher profit. Therefore, the equity shareholders due to higher risks on their investments expect higher returns in the form of risk premium.

The Gordon model was proposed by Myron Gordon to calculate cost of equity capital. As per this model, an investor always prefers less risky investment as compared to more risky investment. Therefore, an organization should pay risk premium only on risky investment. The Gordon model also suggests that an investor would always prefer more of those investments, which would provide them current income.

The Gordon model is based on the following assumptions:

a. The rate of return on the investments of an organization is constant

b. The cost of equity capital is more than the growth rate

c. The corporation tax does not exist in the economy

d. The organization has perpetual existence

e. The growth rate of the organization is a part of retention ratio and its rate of return

According to the Gordon model, cost of capital can be calculated mathematically by using the following formula:

P = E (1 – b) / K- br

Where,

P = Price per share at the beginning of the year

E = Earnings per share at the end of the year

b = Fraction of retained earnings

K = Rate of return required by shareholders

r = Rate of return earned on investments made by the organization

4. Cost of Retained Earnings:

Retained earnings are organizations’ own profit reserves, which are not distributed as dividend. These are kept to finance long-term as well as short-term projects of the organization. It is argued that the retained earnings do not cost anything to the organization. It is debated that there is no obligation either formal or implied, to earn any profit by investing retained earnings.

However, it is not correct because the investors expect that if the organization is not distributing dividend and keeping a part of profit as reserves then it should invest the retained earnings in profitable projects. Further, the investors expect that the organization should distribute the profit earned by investing retained earnings in the form of dividend.

Cost of retained earnings can be calculated with the help of various approaches, which are as follows:

i. KE = KR Approach:

Assumes that if the profit earned by an organization is not retained but is distributed as dividend, then the shareholders would invest this dividend in other projects to earn further profit. If an organization retains the dividend then it prohibits the shareholders from earning more profit.

Therefore, for retaining the dividend, the organization should earn the profit, which the shareholders would have earned by investing the dividend in other projects. Therefore, the amount of profit expected from the organization on retained earnings is the cost of retained earnings.

ii. Soloman Erza Approach:

Includes the two options that an organization has that is either to retain the earnings to meet future uncertainties or invest in its or other organization’s projects.

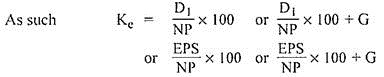

5. Weighted Average Cost of Capital:

Weighted average cost of capital is determined by multiplying the cost of each source of capital with its respective proportion in the total capital. Let us understand the concept of weighted average cost of capital with the help of an example. Suppose, an organization raises capital by issuing debentures and equity shares. It pays interest on debt capital and dividend on equity capital.

When the organization adds the total interest paid on debt capital to the total dividend paid on equity capital, it obtains weighted average cost of capital. An organization requires to generate the profit on its various investments equal to the weighted average cost of capital.

Weighted average cost of capital can be calculated mathematically by using the following formula:

Weighted Average Cost of Capital = (KE x E) + (KP x P) + (KD x D) + (Kr x R)

Where,

E = Proportion of equity capital in capital structure

P = Proportion of preference capital in capital structure

D = Proportion of debt capital in capital structure

KR = Cost of proportion of retained earnings in capital structure

R = Proportion of retained earnings in capital structure

6. Marginal Cost of Capital:

Marginal cost of capital can be defined as the cost of additional capital required by an organization to finance the investment proposals. It is calculated by first estimating the cost of each source of capital, which is based on the market value of the capital. After that, it is identified that which source of capital would be more appropriate for financing a project. The marginal cost of capital is ascertained by taking into consideration the effect of additional cost of capital on the overall profit.

In simpler terms, the marginal cost of capital is calculated in the same manner as the weighted average cost of capital is calculated by just adding additional capital to the total cost of capital.

Marginal cost of capital can be calculated mathematically by using the following formula:

Marginal Cost of Capital = KE {E / (E + D + P + R)} + KD {D / (E + D + P + R)} + KP {P / (E + D + P + R)} + KR {R / (E + D + P + R)}

Cost of Capital – Cost of Debt, Preferred Stock, Retained Earnings, Equity Stock, Weighted Average Cost of Capital and Return on Capital

The following are the components of cost of capital:

1. The Cost of Debt:

Debt financing is one of the more frequently sought forms because it is one of the least costly. In terms of the cost of capital definition, the firm must make sure that when it borrows funds, the rate earned through use of the debt-invested funds is equal to or greater than the cost of this debt.

Thus, the cost of debt must be equal to the rate of return earned on debt-invested funds, so that the earnings available to the common shareholder remain unchanged. This means that the explicit component cost of debt is equal to the rate of return earned by investors, or the interest rate on debt.

Thus the cost of capital is really a minimization concept in the sense that a minimum rate of return that must be earned on invested rupees is specified. Of course, a higher rate of return, above the cost factor to the firm, is much more desirable. Initially we may define the cost of debt as the interest rate the firm has to pay to the lending source, whether it be to a bank or for a new debt issue the firm has placed with the public market.

This will be referred to as the cost of debt because this is what the firm has to pay annually to its debt investors for borrowing the sum. The firm must earn such a rate of return on its debt-financed investments that the earnings available to the common shareholders remain unchanged.

If less than an estimated per cent return were received on the investment, the earnings available to the shareholders (earnings per share) would decline, and this could have an adverse effect on the price of the stock.

2. The Cost of Preferred Stock:

Preferred stock (or preference shares) is frequently referred to as a hybrid security which is somewhere between debt and common equity. It is similar to debt in that it pays a fixed commitment or annual dividend, and, in case of liquidation, the claim to the assets of the corporation by preferred holders has priority over the claims of the common shareholders.

It is similar to equity, or common stock, in that if the dividends are not paid, the result is not corporate bankruptcy. To the investor, an investment in preferred stock is less risky than one in the common stock of the corporation, but more risky than an investment in its debt securities.

3. The Cost of Using Retained Earnings:

Equity capital usually consists of two components. The first is the amount of funds available in the form of net income that may be used to pay dividends or may be retained in the business for asset purchases. The second source of equity capital is the amount of funds raised by a new common stock issue.

The definition of the cost of retained earnings is the rate of return that must be earned on equity-invested capital so that the total yield available to the common shareholders remains unchanged. The cost of retained earnings simplifies to the rate of return that stockholders expect to earn on the common stock of the firm. This expected or required rate of return can be determined from the valuation formula for common stock.

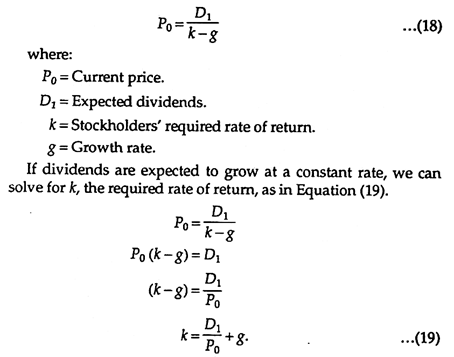

It was stated that the value or price of a share of common stock is equal to:

Thus the required rate of return is equal to the dividends yield plus the growth rate of dividends, which will reflect itself in future prices.

If, for example, a firm plans to pay Rs. 2.40 dividend, its current price is Rs40, and it has an expected growth rate of 6 per cent, we could calculate the rate of return earned on this stock as:

With a dividend yield of 6 per cent and a growth rate of 6 per cent, the rate return earned by investors on this stock is 12 per cent.

This rate of return paid by the corporation becomes a required rate of return to the investor who applies the opportunity cost doctrine. If 12 per cent has been the historical rate of return on the stock, the investor will expect this to continue. If it decreases, he or she will re-evaluate the position in the stock and possibly sell.

Investors classify firms by risk classes and then seek the firm that pays the highest return in the given risk class. If the firm continues to make investments that yield 12 per cent, the rate of return to the common shareholder will remain unchanged, and the investor will yield 12 per cent. If, however, the firm yields less than 12 per cent, this will lead to a revaluation of the required rate of return and possibly a decrease in the price of the stock.

The growth rate of earnings, dividends, and stock price was expected to be 6 per cent. The stock price at the beginning of Year 1 was Rs.40. At the end of Year 1, the earnings were Rs.4.80 per share, and since the firm pays 50 per cent in dividends, the dividends were Rs.2.40. The remaining Rs.2.40 was retained to be invested in Year 2.

From Equation (20), the rate of return for Year 1 was calculated to be 12 per cent (k = (Rs.2.40/40) + 0.06 = 0.12). The stock price, growing at the 6 per cent growth rate, would be Rs.42.40 (1.06 x 40) at the end of Year 1. This price increase results from the fact that the firm is expected to earn a 12 per cent return on Rs.2.40 per share reinvested capital.

To explain more fully, assume the firm will have net income of Rs.4.80 again at the end of Year 2 (unless investment is made). The firm retains from Year 1 Rs.2.40 per share for this investment. It will need to earn a 12 per cent return on this reinvested capital during Year 2 in order to justify the price at the beginning of Year 2 of Rs.42.40.

The earnings, therefore, at the end of Year 2 would be Rs.5.088 per share- Rs.4.80 + (0.12 x Rs.2.40). A 50 per cent dividend would be Rs.2.544. Earnings and dividends have grown by 6 per cent, which was the expected rate at the beginning of Year 1. The stock price at the end of Year 1 was Rs.42.40.

This can be verified:

Therefore, for the price to be Rs.42.40 at the end of Year 1, the firm must be able to invest the retained funds at 12 per cent.

Consider the result if the company expects it can only reinvest this Rs.2.40 per share retained earnings at 6 per cent. The earnings at the end of Year 2 would be Rs 4.944: Rs.4.80 + (.06 x Rs.2.40). A 50 per cent dividend would be Rs.2.472. Earnings and dividends have only grown at a 3 per cent rate.

The stock price at the end of Year 1 was supposed to be Rs.42.40, but this cannot be verified:

Since the retained funds are not expected to be invested at 12 per cent, the value of stock will decrease as long as investors fed that the firm will not earn that 12 per cent in the future.

4. The Cost of Issuing New Equity Stock:

It will be found that the cost of issuing new common stock or external equity is slightly higher than the cost of internal equity or retained earnings. This is because the price that the stock is sold for in the market is not the price the firm receives.

As with preferred stock, when new common stock is issued, firms utilize the services of investment bankers to help place it; for their services, the bankers are paid a commission, which is referred to as the flotation costs of underwriting a new equity issue.

The price the firm is interested in to determine its cost of equity for a new issue is the net price, which is the market price of the stock less the’ flotation costs.

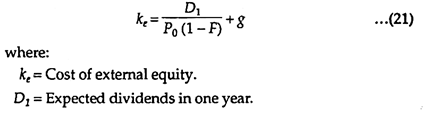

The cost of external equity is found with Equation (21):

The formalization for the cost of external equity is basically the same as the one for the cost of retained earnings or internal equity. It states that the cost of equity is equal to the expected dividend yield plus the expected growth of earnings, dividends, and price. Only in the case of a new issue or external equity will the denomination, P, become the net price per share the corporation will receive in cash when the new issue is sold.

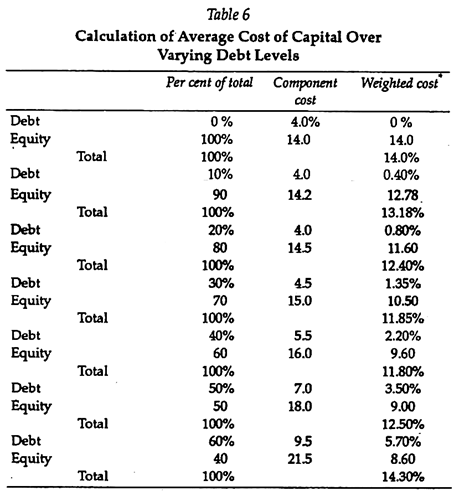

5. Weighted Average Cost of Capital:

When examining the cost of capital for a firm, we are not always interested in examining the cost of a single component such as debt or preferred stock or equity but may want to know the total cost of capital to the firm, considering all forms of financing.

The cost of long-term debt, preferred stock, and equity, considered together, is referred to as the average cost of capital. But is it appropriate to simply add the three costs together and then divide by 3 to arrive at an average? The answer is no.

Very seldom do the three forms of financing contribute equally to the capital structure of a firm. If they do not, it is unfair to state, for example, that the cost of preferred stock contributes equally to the overall average cost of capital for the firm, when in fact there is hardly any preferred stock in the capital structure.

A good way to measure the average cost of capital for the firm accurately is to derive what is termed a weighted average cost of capital. This technique applies weights to each source of financing in terms of its contribution to the capital structure of the firm; the average thus is a simple weighted average.

Calculation of the Weighted Average Cost of Capital:

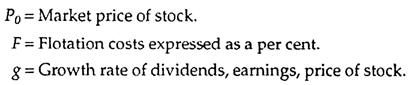

The calculation process to derive the weighted average cost of capital is quite simple. Assume that a firm had in its balance sheet Rs.35 million of debt, Rs.15 million of preferred stock, and Rs.50 million of common equity.

Further assume that the average before-tax rate for all debt is 6 per cent; that the preferred stock has a dividend yield of 8 per cent, and that the component cost of equity is equal to 12 per cent Table 5 shows how the weighted average cost of capital for this firm is calculated.

We first list all the rupee amounts of debt, preferred stock, and common equity. Next, these dollar amounts are converted into per cent form by expressing each as a percentage of the total financing for the firm. These percentage components become the weights for the weighted average.

Next, we list the component costs for each source of financing. To arrive at the weighted average cost of capital, we multiply the percentage weights by the component costs and then sum the answers. For this illustration, the weighted average cost of capital is equal to 8.28 per cent

The Cost of New and Historical Capital:

The historical data on which the illustrations of the calculation of the cost of capital have been based are derived by looking at the past balance sheets of a corporation and pulling out information on capital structure and associated costs. This is fine for certain situations, but there are times when historical data are not adequate.

We divide the product of per cent of total with component cost by 100 to obtain a percentage; figures rounded to nearest hundredth.

We divide the product of per cent of total with component cost by 100 to obtain a percentage; figures rounded to nearest hundredth.

One of the primary applications of the results of a cost of capital analysis is in the capital budgeting process of selecting among alternative investments. In utilizing cost of capital information in capital budgeting, the concern is with the cost of obtaining new funds, whether they be debt, preferred stock, or common equity.

In periods of rising interest rates, the cost of new capital or the incremental cost of capital will be higher than the historical weighted average cost of capital.

In using incremental costs, the same logic applies as in using the weighted average cost of capital. If a firm uses debt it is using up this source of cheap funds, since as the new level of debt increases, the firm’s leverage position moves toward or beyond the industry norm. This will jeopardize the firm’s access to future debt capital markets. A good example of this is the firm that uses too much debt.

At some future time it may need more capital, but the only market open to it will be equity, because the market will not absorb another debt issue from it. If the equity market is not available, due to a decline in the price of the company’s stock or a general decline in the stock market, the firm could be in considerable trouble in terms of its ability to raise the needed capital.

This is a perfect illustration of why it is important for a company to maintain a proper balance between debt and equity. If this is done (as in the example with the firm with a 45 per cent optimal leverage ratio), the firm will have access to both markets. If one market is in a period of decline, it can turn to the other as a source of funds.

If the firm is interested in utilizing cost of capital information for capital budgeting decisions, which involve new projects or investment alternatives, the analysis should also include new cost data. Then it is possible to compare rates of return on these projects with the cost of capital for raising new capital to undertake investment alternatives.

6. Return on Capital:

Rate of Return on Capital is widely used to appraise the effectiveness of management performance, to select the contents of an investment portfolio, and to make decisions regarding new product development and acquisition of plant and equipment. Unfortunately, the term means different things to different people. Some refer to it as ‘rate of return on investment’.

Definition:

Return on capital is the relationship, usually expressed as a ratio or percentage, between the income (or “profit” or “interest”) from an enterprise or undertaking and the related investment or capital commitment.

The Mercantile Rate of Return:

The mercantile rate of return is the ratio (expressed in percentage form) between some figure appearing on the contemporary income statement and some figure appearing on the contemporary balance sheet.

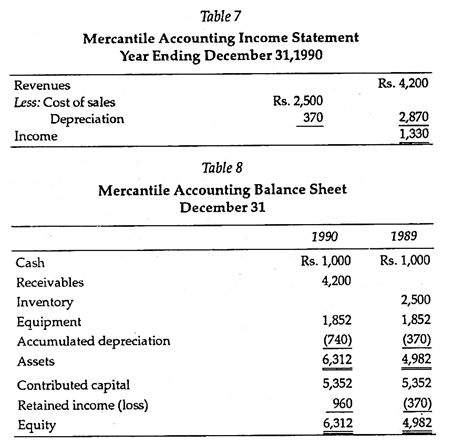

For illustrative purposes, a simplified income statement for a hypothetical company for the year ending December 31, 1990 and the related balance sheets at the beginning and end of the year are presented in Tables 7 and 8 respectively.

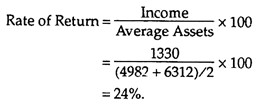

Referring to the figures given there, the mercantile rate might be computed as follows:

This mercantile method of computing rate of return on capital has also been referred to as the “accountant’s method” (a lamentable libel on a proud profession!) and the “financial- statement method.”

Assets are chosen as the base when it is desired to measure the performance of management in using the total amount of property entrusted to its control. Thus, for internal management purposes and from the point of view of the entity as a whole, the important thing may be the effectiveness with which management makes use of the total assets of the company.

In contrast, stockholders’ equity may be the base of the computation when appraising not only the overall use of the assets, but also the extent to which financing methods were advantageous from the point of view of the stockholders.

The two approaches may be distinguished by the terms “return on assets” and “return,” or “yield,” on “equity.”

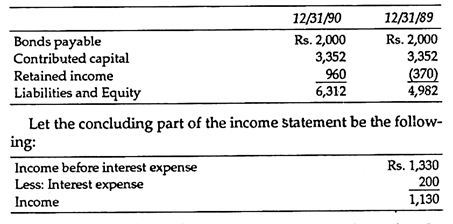

To illustrate the distinction, suppose the corporation had been partly financed by the issue of 10% bonds and that the liabilities and equity section of the balance sheet was as follows:

The computation of return on assets would be identical to the previous computation. It would be the ratio of total income (Rs.1,330) earned from the use of all assets (averaging Rs.5,647) without considering the amounts of that income available for the different types of investors and without considering the extent to which those assets had been financed by particular classes of investors.

In contrast, emphasizing the interests of stockholders, it would be necessary to relate the net income available to stockholders with the stockholders’ equity, specifically:

Trading on the Equity:

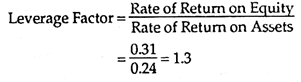

Return on assets and return on equity may be used to understand the effect of “trading on the equity.” Where bondholders are paid a lower rate of return on their investment than the rate of return earned on total assets, stockholders will benefit. Stockholders, in effect, will receive the benefit on the extra return earned on the assets financed by bondholders.

The following leverage factor may be computed to assess the extent to which return on equity is improved over return on assets a$ a result of trading on the equity:

Where this leverage factor is greater than 1 (as in the example), the stockholders may have benefited through use of the funds supplied by bondholders at a lower rate of return than that earned on the assets.

To determine whether stockholders have really benefited, however, it is further necessary to assess or attempt to weigh the greater risk that may be incurred by title company as a result of the greater fixed obligation imposed by the interest and principal on the bonds.

Some companies use gross assets (that is, assets before deducting the depreciation taken on these assets in prior years) instead of net assets in computing return on assets.

Such companies justify their use of gross assets by their desire to prevent the rate of return from rising as the net book value of depreciable assets is reduced by depreciation. Undepreciated cost provides an unchanging base and, so long as annual income is constant, the rate return is stable.

This viewpoint involves certain preconceptions not only about the stability of future earnings but also about what rate of return ought to be: Should the figure for rate of return be stable from year to year because it is stable or because the accountant expects it to be stable and therefore adopts conventions that make it stable?

Some accountants have argued that the relevant investment base should instead be assets net of accumulated depreciation allowances, since it seems inconsistent to compare a profit figure from which depreciation has been deducted with an investment figure from which the accumulated depreciation has not been deducted.

There are also many other variations regarding the rate base and dealing with matters such as whether the assets should include excess or idle assets, assets still in construction, assets financed by short-term sources of credit, etc.

There are also many variations in the income figure employed for the mercantile rate of return. Thus some companies do not deduct taxes because they are anxious to measure those things under the control of management, and they feel that taxes, while somewhat subject to managerial control (tax planning), are more under the control of Congress than of management.

There are also variations in practice regarding the inclusion of dividend income, interest income, and “other income” and “other expenses” in computing net income for the rate of return calculation.

Whatever variations exist with regard to the capital base and the return on that capital, certain common features seem to be evident in the mechanics of computation. Thus, most companies attempt to get a “representative” figure for the capital base in the sense that it is the average of the relevant balance sheet magnitude at the beginning and end of the year, or it is a thirteen-point average of the balance sheet magnitude at the beginning of the year and at the end of the following twelve months.

Furthermore, most companies “annualize” their income statement figure; thus, net income for two months would be multiplied by 12/2 to get its annual equivalent.

These sources of finance are called components of cost of capital.

Specific Sources of Finance:

It includes:

1. Cost of Debt

2. Cost of Preference Share Capital

3. Cost of Equity Share Capital

4. Cost of Retained Earnings.

1. Cost of Debt:

A company may raise the debt in a number of ways. It may borrow funds from the financial institutions or public either in the form of public deposits or debentures (bonds) for a specified period of time at a specified rate of interest. A debenture or bond may be issued at par, at a discount or at a premium. The contractual rate of interest forms the basis for calculating the cost of any form of debt.

Debt may either be irredeemable or redeemable after a certain period.

Cost of both these types may be calculated as follows:

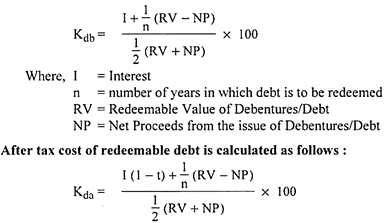

(A) Cost of Irredeemable Debt:

(i) Cost of Irredeemable (Perpetual) Debt, before Tax:

(ii) Cost of Irredeemable (Perpetual) Debt, after Tax:

When a company uses debt as a source of finance then it saves a considerable amount in payment of tax because the amount of interest paid on the debts is a deductible expense in computation of tax.

Thus, the effective cost of debt is reduced because of saving in taxation.

Cost of debt after tax is:

(B) Cost of Redeemable Debt:

Normally a company issues a debt which is redeemable after a certain period during its life-time. Such a debt is termed as Redeemable Debt. Cost of redeemable debt may also be calculated before tax and after tax.

Before tax cost of redeemable debt is calculated as follows:

If the debt or debentures are redeemable at premium after a certain period, premium payable on redemption will also be taken into consideration.

2. Cost of Preference Share Capital:

A fixed rate of dividend is payable on preference shares. But, unlike debt, the dividend is payable at the discretion of the Board of Directors and there is no legal binding to pay the dividend.

Nevertheless, companies usually pay the stipulated dividend, if there are sufficient profits, for a number of reasons:

(i) The preference shareholders carry a prior right to receive dividends over the equity shareholders. Unless, therefore, the firm pays out the dividend to its preference shareholders, it will not be able to pay anything to equity shareholders.

(ii) Preference shares are usually cumulative which means that preference dividend will get accumulated till it is paid. As long as it remains in arrears, no dividend can be paid to equity shareholders.

(iii) Non-payment of preference dividend may entitle their holders to participate in the management of the company as voting rights are conferred on them in such cases.

(iv) Non-payment of preference dividend adversely affects the fund raising capacity of the firm.

(v) Market value of the equity shares can be adversely affected because of non-payment of preference dividend.

For these reasons, dividends are usually paid regularly on preference shares except when there are insufficient profits. Therefore, the stipulated dividend on preference shares, like the interest on debt, constitutes the basis for the calculation of the cost of preference shares.

However, unlike interest payments on debts, dividend payable on preference shares is not tax-deductible. Preference dividend is paid out of after tax earnings of the company. Hence, no adjustment is required for taxes while computing the cost of preference capital. Since interest on debts is tax deductible and preference dividend is not, the after-tax cost of preference capital is substantially higher than the after-tax cost of debt.

There are two types of preference shares:

(i) Irredeemable, and (ii) Redeemable.

(i) Computation of Cost of Irredeemable (or Perpetual) Preference Capital:

The cost of preference shares which has no specific maturity date is calculated as follows:

The cost of preference shares is not adjusted for taxes because preference dividend is paid after the Corporate Taxes have been paid.

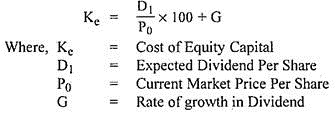

(ii) Computation of Cost of Redeemable Preference Capital:

Redeemable preference capital has to be returned to the preference shareholders after a stipulated period.

The cost of preference capital which has a specific maturity date is calculated as follows:

3. Cost of Equity Share Capital:

The cost of equity share capital is most difficult and controversial cost to measure. This is so because unlike cost of debt and cost of preference capital, there is not any stipulated rate of return which has to be paid on equity capital. The rate of equity dividend varies from year to year depending upon the profits earned by the company and the discretion of the directors.

It is not legally binding for companies to pay dividends to equity shareholders. It may, therefore, prima facie, appear that equity capital is free of cost. But this is not true. Equity capital like other sources of funds, does certainly involve an opportunity cost to the firm. When equity shareholders invest their funds in the firm’s equity shares they also expect returns in the form of dividends and capital gains commensurate with their risk of investment.

Hence, the market value of equity shares is determined by the return that the shareholders expect and get. If the company does not meet the expectation of its shareholders regarding payment of dividends, it will have an adverse effect on the market price of its shares. The equity shares thus implicitly involve a return in terms of dividend expected by the shareholders and, therefore, carry a cost.

In fact, the cost of equity capital is relatively the highest among all the sources of funds. This is so because the equity shares involve the highest degree of financial risk since they are entitled to receive dividend and return of principal after all other obligations of the firm are met. As compensation to the higher risk, they expect a higher return and, therefore, higher cost is associated with them.

According to J. C. Van Horne- “Cost of Capital is the minimum rate of return that a firm must earn on the equity-financed portion of an investment project in order to leave unchanged the market price of the shares.”

In practice, it is a formidable task to measure the cost of equity because of two reasons:

(i) It is very difficult to estimate the expected dividends, and

(ii) The future earnings and dividends are expected to grow over time.

Growth in dividends should be estimated and incorporated in the computation of the cost of equity which is not an easy task.

The cost of equity capital can be computed by the following methods:

(i) Dividend Yield Method

(ii) Dividend Yield plus Growth in Dividend Method

(iii) Earning Yield Method

(iv) Earning Yield plus Growth in Earning Method

(v) Realised Yield Method

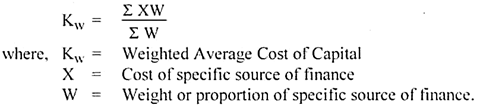

It is also known as Dividend/Price method. This method is based on the assumption that when an investor invests in the equity shares of a company he expects to get a payment at least equal to the rate of return prevailing in the market. Hence, in order to ascertain cost of equity capital according to this method dividend received is divided by the market value of the share.

The equation is:

Dividend yield method of Computation of cost of equity capital assumes that- (i) shareholders give prime importance to dividends, and (ii) risk in the firm remains unchanged.

This method suffers from the following limitations:

a. It ignores the growth in the rate of dividend

b. It ignores retained earnings, and

c. It ignores the expectations of shareholders about increase in share prices.

As such, this method is suitable only when the company has stable earnings and stable dividend policy.

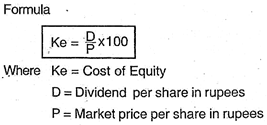

(ii) Dividend Yield plus Growth in Dividend Method:

Dividend yield method discussed above does not take care of future growth in the rate of dividend whereas in actual practice shareholders expect growing rate of dividend. Hence, when the dividends of a firm are expected to grow at a constant rate this method is used to compute the cost of equity capital-

Dividend yield plus growth in dividend method is based upon the following assumptions:

a. Price earnings ratio does not change

b. The payout ratio (the percentage of earnings distributed as dividend) does not change, and

c. The market price of the company’s share increase in proportion to the increase in the rate of dividend.

The limitation of this method is that it ignores retained earnings. However, the method is quite suitable when there is a constant growth in dividends.

(iv) Earning Yield plus Growth in Earning Method:

Earning yield method does not take care of future growth in the rate of earnings of the company whereas the earnings of a company are usually expected to grow in future.

If the EPS of a company is expected to grow at a constant rate of growth, the cost of equity capital can be computed as follows:

One of the major problems in the measurement of cost of equity capital is that the expectations of the shareholders regarding the rate of return on their investment in the company’s shares cannot be estimated accurately. It is not possible to estimate future dividends and earnings correctly because both of these depend upon so many uncertain factors.

The realised yield method overcomes this problem by assuming that the shareholders would expect the same rate of return in the future as they have realised in the past. Hence, as per this method actual average rate of return realised by the shareholders in the past is applied to compute the cost of equity capital. To compute the realised yield in the past both dividends received by the shareholders in the past as well as appreciation in the value of equity shares are considered.

This method of computing cost of equity capital is based upon the following assumptions:

(i) No significant changes are expected in the risk complexion of the firm.

(ii) Shareholders would feel satisfied if they earn same rate of return in future, which they have earned in the past.

(iii) Shareholders expect to earn the same rate of return as the realised yield even if they invest elsewhere

(iv) No significant changes are expected in the market price of company’s share.

Computation of Cost of Newly Issued Equity Shares:

When a company issues new equity shares, it is not possible to realise the full market value on the newly issued shares. This is because on new issues the company has to incur flotation costs such as underwriting commission, brokerage, printing etc. As such, in order to ascertain the cost of capital of new issues flotation costs are deducted from the expected market price.

In such a case P0 (Market Price) will be changed with NP (Net Proceeds).

It is sometimes argued that retained earnings carry no cost since a firm is not required to pay dividend on retained earnings. However, this is not true. Though retained earnings do not have any explicit cost to the firm but they involve an opportunity cost. Retained earnings accrue to a firm only because a part of the earnings has not been paid out to the equity shareholders as dividends.

If the earnings were not retained and were distributed to them as dividends, they could have invested such dividend in other firms and could have earned a return thereon. Because of withholding of dividends, shareholders lose the opportunity to invest such dividends elsewhere and forgo the return on the investment of such dividends.

Thus retained earnings involve opportunity cost. A firm is required to earn on the retained earnings at least equal to the rate that would have been earned by the shareholders if they were distributed to them. This is the cost of retained earnings.

An alternative way to compute the cost of earning is to use ‘external-yield criterion’. This criterion is based on assumption of external investment of funds by the firm itself. In other words, the opportunity cost of retention of earnings is the rate of return that could be earned by investing the funds in another enterprise by the firm instead of what would be obtained by the shareholders on their investments.

Hence, the firm should estimate the yield it can earn from external investment opportunities by investing the retained earnings elsewhere. The rate of return that could be thus earned constitutes the cost of retained earnings. The cost of retained earnings (Kr) under the assumption of external-yield criterion would be approximately equal to the cost of equity capital (Ke). However, Kr would be slightly lower than the Ke due to differences in flotation cost. Thus –

Kr = Ke (1 – Percentage Brokerage or Flotation Cost)

Where,

Kr = Cost of Retained Earnings

Ke = Cost of Equity Capital

Weighted Average Cost of Capital:

Capital structure of a company consists of different sources of capital. Cost of these different sources of capital is also calculated by different methods. Hence, after the calculation of cost of capital of these different sources of capital a practical difficulty arises as to what is the cost of overall capital structure of the firm.

In order to solve this problem finance managers developed the concept of Weighted Average Cost of Capital. It is also known as composite cost or overall cost. The use of weighted average and not the simple average is warranted by the fact that the proportions of various sources of funds in the capital structure of a firm are different.

The computation of weighted cost of capital involves the following steps:

(i) Compute the cost of each source of funds (i.e. cost of debt, cost of preference capital, cost of equity capital and cost of retained earnings).

(ii) Assign weights to specific costs

(iii) Multiply the cost of each of the sources by the assigned weights

(iv) Divide the total weighted cost by the total weights.

Weighted average cost of capital can be computed as follows:

Assignment of Weights:

For Computing Weighted average cost of capital, it is necessary to determine the proportion of each source of finance in the total capitalisation. For this purpose weights will have to be assigned to various sources of finance.

Weights may be assigned by any of the following methods:

(a) Book Value Weights

(b) Market Value Weights

Book value weights (or proportions) are computed from the values taken from the balance sheet. The weight to be assigned to each source of finance is the book value of that source of finance divided by the book value of total sources of finance.

Advantages of Book Value Weights:

(i) Book values are readily available from the published records of the firm.

(ii) Book value weights are more realistic because the firms set their capital structure targets in terms of book values rather than market values.

(iii) The analysis of capital structure in terms of debt-equity ratio is based on book values.

(iv) Book value weights are not affected by the fluctuations in the capital market.

(v) In the case of those companies whose securities are not listed, only book value weights can be used.

Limitations of Book Value Weights:

(i) The costs of various sources of finance are calculated using prevailing market prices. Hence weights should also be assigned according to market values.

(ii) The present economic values of various sources of capital may be totally different from their book values.

As per market value scheme of weighting, the weights to different sources of finance are assigned on the basis of their market values. The weight assigned to a source of finance is equal to the market value of that source of finance divided by the market value of all sources of finance.

Advantages of Market Value Weights:

(i) The costs of various sources of finance are calculated using prevailing market prices. Hence, it is proper to use market value weights.

(ii) Weights assigned according to market values of the sources of finance represent the true economic values of various sources of finance.

Limitations of Market Value Weights:

(i) Market value weights may not be available as securities of all the companies are not actively traded.

(ii) It is very difficult to use market value weights because the market prices of securities fluctuate widely and frequently.

(iii) Equity capital gets greater importance while using market value weights. In brief, while the book value is operationally convenient, the market value basis is theoretically consistent and logical, and therefore a better indicator of a firm’s true capital structure.

The total cost of capital of a firm consists of the cost of various segments of total funds, which may be classified as follows:

1. Cost of Equity Share

2. Cost of Preference Share

3. Cost of Debt (Debentures & Bonds)

Component # 1. Cost of Equity Shares:

The cost of equity share may be defined as minimum rate of return that the company must earn on that portion of the total capital employed which is financed by equity capital, so that the market price of the share of the company remains unchanged.

Factors affecting the cost of equity share:

The considerable factors while calculating the cost of equity include:

(a) Price of an equity share in the beginning of the year.

(b) Expected equity dividend at the end of a year.

(c) Growth factor

Different Models as to the calculation of cost of equity share:

(a) Dividend Yield Method

(b) Dividend Growth Method

(a) Dividend Yield Method:

Under this method the cost of equity share capital is calculated on the basis of the present value of the expected future streams of dividends. Here, the cost of equity capital will be the rate of expected dividend which will maintain the market price of equity shares.

Note:

P indicates market price per share which is quoted in the stock exchange. But for new companies which go for IPO (Initial Public Offers) the net proceeds is considered as market price per share.

The Flotation expenses (issue expenses) include underwriting commission, Brokerage, bank commission, printing expenses etc.

(b) Dividend Growth Method:

This method is based Gordon’s Dividend growth model. Under this method, the cost of equity share capital is calculated on the basis of the present value of the expected future streams of dividends and the rate of growth in dividend. This growth rate of dividend (G) is equal to the compound growth rate in earnings per share.

The formula under this model-

Component # 2. Cost of Preference Shares:

The cost of preference share capital is the dividend expected by its holders. The payment of preference dividend is not adjusted for taxes as they are paid after taxes and is not deductible.

The cost of preference share capital is calculated by dividing the fixed dividend per share by the price per preference share.

Factors affecting the cost of preference shares are:

The considerable factors while calculating the cost of pref. shares are:

(a) Fixed dividend rate

(b) Issue expenses like underwriting commission, brokerage etc.

(c) Discount/Premium on issue/Redemption.

Preference shares may be redeemable or irredeemable. In India, irredeemable preference shares are not allowed. Redeemable pref. shares are redeemable after the expiry of certain number of years, but the redemption date of which is not announced at the time of issue of shares. They are compulsorily repayable within a maximum period of 10 years.

a. Computation of the Cost of Irredeemable Preference Shares:

b. Calculation of Cost of Redeemable Preference Shares:

If the preference shares are redeemable after the expiry of a fixed period, then the cost of preference shares would be-

Note:

If in any problem mentions the date of redemption, they are assumed as redeemable pref. shares. If not they are assumed as irredeemable pref. shares.

Component # 3. Cost of Debt:

A debt may be in the form of Bond or Debenture.

A bond is a long term debt instrument or security. Bonds are issued by the Government and the public sector companies. Bonds issued by the government do not have any risk of default, because it honours obligation of its bonds. Bonds of the public sector companies in India are generally secured, but they are not free from the risk of default.

The private sector companies also issue bonds, which are called debentures in India. A Company in India can issue secured and unsecured debentures.

Factors Affecting the Cost of Debt:

The considerable factors while calculating Cost of Debt are:

(a) Fixed Rate of Interest – Interest rate is fixed and known to debenture or bond holders. Interest paid on a debenture or bond is tax deductible. The interest rate is also called coupon rate. Coupons are detachable certificates of interest.

(b) Face value – Face value is called par value and interest is paid on face value.

(c) Issue expenses are like underwriting commission and brokerage.

(d) Income tax rate – interest paid tax deductible.

(e) Maturity – A bond or debenture is generally issued for a specified period of time. It is repaid on maturity.

(f) Redemption value – A bond or debenture may be redeemed at par or at premium or at discount.

(g) Market value – The price at which a bond or debenture currently sold or bought is called the market value. Market value may be different from par value or redemption value.

Cost of Irredeemable Debentures:

The Companies are not allowed to issue irredeemable debentures. All the debentures are redeemable within a maximum period of 5 years. But some companies especially, banking companies can raise funds through hybrid securities in the form of perpetual bonds and debentures. They continue forever in the balance sheet of Banking Companies. They are redeemable at the option of the bank. Hence, such debentures are called irredeemable debentures.

Computation of the Cost of Irredeemable Debentures:

Where,

Kd = Cost of debentures

I = Interest payable on debenture

T = Marginal Tax rate (decimal point)

P = Net Proceeds, received on issue of debenture