Here is an essay on the ‘Reforms in Secondary Market’ for class 11 and 12. Find paragraphs, long and short essays on the ‘Reforms in Secondary Market’ especially written for school and college students.

Essay # 1. Introduction to Reforms in Secondary Market:

The purpose of a stock exchange or secondary securities market is to enable buyers and sellers to affect their transactions more quickly and cheaply than they could do otherwise. But in our country, this secondary market suffered from serious deficiencies. The general functioning of stock exchanges was not satisfactory.

Trading members were also not adequately capitalized. Insider trading was rampant and was one of the major causes of excessive speculative activity, leading to default by stock brokers, frequent payment crises and disruption of market activity. The stock exchanges followed inefficient and outdated trading systems.

This in turn led to lack of transparency in trading operations, besides resulting in long and uncertain settlement cycles. The risk management system in the market was also not satisfactory.

ADVERTISEMENTS:

Though the margin system was operative, the margins were inadequate and the system of collection of margins was not enforced strictly. Post trade settlement procedures also suffered from some serious draw backs, such as, high share of bad deliveries, delayed settlements, clubbing of settlements etc.

The capital market regulator Securities and Exchange Board of India (SEBI) initiated various reform measures in the secondary market with the aim of improving market efficiency, enhancing transparency, preventing unfair trade practices and building investor confidence in the securities market.

It is an accepted fact that SEBI’s procedures have helped building up well-regulated entities of intermediaries in the securities market with distinctive roles, duties and responsibilities. One of the major reforms—the introduction of T + 2 settlement, the investors’ problems with intermediaries (brokers), their participation in derivatives trading and their knowledge about Trade Guarantee Fund.

2. Settlements in Reforms of Secondary Market:

Settlement:

ADVERTISEMENTS:

The term settlement in stock market indicates the system whereby the positions of brokers accumulated till the end of a specific period are settled on the basis of netted out positions with respect to every security. It may be an accounting period settlement or a rolling settlement.

Accounting Period Settlement:

The Indian stock market has historically adopted accounting period settlement. The accounting period settlement indicates the system whereby the positions of brokers accumulated till the end of a specific accounting period are settled on the basis of netted out positions with respect to every security.

The accumulation of position during the settlement period gave scope for speculative activities thus, increased the possibility of default by participants. To overcome the deficiencies of the accounting period settlement system, rolling settlement system was introduced in a phased manner.

ADVERTISEMENTS:

Rolling Settlement:

Under the Rolling settlement system, any transaction made on a particular day necessarily results in delivery after a fixed number of days. For example, under T + 5 rolling settlement system, any transaction made on a particular day i.e., Transaction day—T, necessarily results in delivery after five working days.

T + 5 (Transaction + 5 Days) Settlement:

The rolling settlement on a T + 5 basis was introduced in select scrips numbering Ten in January 2000 and then increased the number of scrips in phased manner to 163 by May 2000. The announcement made by the Finance Minister in March 2001 to introduce rolling settlement in 200 scrips, gave rolling settlement a further boost.

ADVERTISEMENTS:

SEBI thereafter announced a list of 251 scrips for compulsory rolling settlement from July 2, 2001 on all exchanges. With effect from December 31, 2001 rolling settlement was extended to the remaining scrips on all exchanges. In December 2001, SEBI announced the shortening of settlement cycle to T + 3 basis for all securities.

With that the Indian securities market complied with the standard for clearing and settlement laid down by the Joint Committee of Clearing and Payment System of the Bank of International Settlements and the International Organisation for Securities Commission.

T + 2 Settlement:

From 2003 the settlement cycle has further been reduced to T + 2 for all securities. The trades accumulate over a trading cycle of one day and at the end of the day, these are clubbed together, and positions are netted and payment of cash and delivery of securities settle the balance after 2 working days. All trades executed on a day ‘T’ are settled on T + 2 day.

ADVERTISEMENTS:

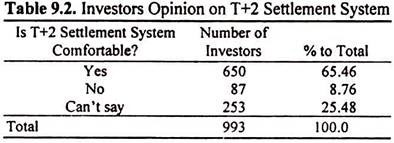

What is the feeling of the investors about this new system? Do they face any hardship due to this? need to be enquired. The investors were enquired about their comfortability with the T + 2 settlement system. Table 9.2 brings out their opinion.

The above Table reveals that 65 percent of investors feel that T + 2 system as comfortable and said ‘ Yes’ and 8.8% of the investors said ‘No’. Nearly 25% of the investors have preferred ‘can’t say’ option. This can be interpreted as they do not have any ill feeling about the system.

Thus, as much as 90% of the investors surveyed have no grievances about T + 2 rolling settlement system. Those investors who are not comfortable with the present T + 2 rolling settlement system have aired their problems.

ADVERTISEMENTS:

Some of their problems are listed below:

a. Giving delivery slips/cheques the next day is a problem.

b. Prefer settling on the very same day as we cannot sell the scrip with in 3 or 5 days in case of better price too.

c. Credit is not given on the 3rd day.

ADVERTISEMENTS:

d. Time is not sufficient.

e. Some times in case of selling execution of Delivery Instructions is troublesome.

f. Though it is T + 2 we do not get back money from brokers in time but if we make any delay in payment we are penalized by the broker.

g. T + 1 will be ideal.

Essay # 3. Stock Brokers of Secondary Market Reforms:

A stockbroker is a person or company who buys and sells stocks on behalf of another person or company. Stockbrokers earn their living by charging a commission on the purchase and sale of stocks. A stockbroker matches stock buyers and sellers. A transaction in a stock exchange must be made between two members of the exchange.

An investor cannot walk into a stock exchange and trade in a stock. Such transaction must be done through a broker. In addition to actually trading stocks for their clients, stockbrokers may also offer advice to their clients on which stocks, mutual funds, etc. to buy.

ADVERTISEMENTS:

With the advent of automated stock broking systems on the internet the client often has no personal contact with his/her stock broking firm. The stock broker’s system performs all the stock broking functions. Stock brokers deal in crores of rupees with computerised operations and qualified industry specialists to advice on buying and selling of stocks.

How Brokers Operate?

The Share broker’s business is of two types:

I. Primary market and

II. Secondary market

I. Primary Market:

ADVERTISEMENTS:

In primary market companies issue their shares directly to the public. The stock brokers on behalf of investors collect applications and after sorting out the good issues, they put the investors’ applications. The share brokers get their brokerage on the transactions made.

II. Secondary Market:

The secondary market comprises of brokerage that a broker earns in the buying and selling of companies’ securities that are listed in the stock exchange. The brokers take the order from their clients and execute them through on-line trading. The automated screen based trading facilities and market operation transparency meets the demands and expectations of the investors.

As and when the orders are executed the clients are given confirmation orally about the volume and rate. Later a contract note is issued to the clients which give details of securities name, quantity sold or purchased, rate, time, brokerage, service tax, securities transaction tax, etc. and the total amount of the transaction.

The amount due from the investor or the amount payable to the investor is made accordingly. The erratic fluctuation of rates in the share market makes the activity in a trade market a dynamic process. The stock broker keeps the interest of the client in mind while buying and selling shares for them at required rates. Further, it is necessary for a broker to have adequate knowledge about the economic and political factors that affect the share market.

Brokers’ Office:

ADVERTISEMENTS:

The office of a broker is organized into:

(i) Front office and

(ii) Back office.

(i) Front Office:

This part of a brokerage firm is client facing. The trading terminals, sales staff, brokers and traders are part of the front office. Functions of the front office include acquisition and entry of orders, fulfillment of the orders, and all the regulatory reporting for the orders.

(ii) Back Office:

ADVERTISEMENTS:

The back office is where the clearance processing of the trades is done. Transfer of securities and money and the tracking of “failure to deliver” are handled. Securities lending for a brokerage firm, wherein shares of a security that is being sold short are located to ensure they can be delivered, is usually done at the back office.

Investors’ Problems with Brokers:

In the recent past, the regulator has taken comprehensive measures to make stock markets a safe place for investors in general. There is no doubt that transparency and efficiency in transactions has tremendously improved and that the cost of transactions has come down drastically in the face of fierce competition amongst broking houses. But these regulatory measures have further compounded the problems for investors with respect to brokers.

Some of the points of irritation in a broker-investor relationship are discussed below:

Nature of Investor Complaints:

First, investors are asked by the broker to sign a detailed and complex agreement when they enroll with a broker as his client. The investor neither reads the agreement nor understands all the clauses. He is not given a copy of that agreement. The situation created is similar to that of a person taking a loan from a lender where the borrower is made to sign at a number of places without being told the implications of it.

ADVERTISEMENTS:

Second, most of the brokers do not adhere to common norms such as keeping the monies/securities in separate account-separate from the broker/any other client’s accounts, reconciling the client’s accounts at frequent intervals, issuing contract notes/bills/statement of accounts promptly, electronically or by any other mode, as mutually agreed and non-involvement of cash transactions except in extreme emergency/exceptional circumstances.

Non-adherence to the above norms put a large number of investors into serious problems such as unauthorized transactions in client’s accounts resulting into huge losses. This is more common in large broking houses operating through an extensive branch network manned with hired work force. The investors are taken by surprise when they see a large number of transactions being done in their accounts without their consent, especially in the Futures & Options (F&O) segment.

Whenever the market crashes by a few hundred points, these overzealous brokers press the sell button on various securities held by investors without even intimating them on the pretext of fulfilling the margin requirement. Alternatively, the client is informed through telephone or email about the shortfall of margin in his account usually when the banking hours are over.

The client is asked to deposit the amount immediately which is invariably impossible as the banks will open the next day. By the time, the client arranges for the money, the securities are sold resulting in heavy losses. Many of the brokers, especially the large broking houses sometimes sell the securities of clients to meet the requirements of their own exposure without assigning any reasons.

Next, the unsuspecting investors are lured into consenting to deals in the F&O segment, though orally, by promises of huge profit. At times, some profits are shown to them initially. But ultimately the client is taken for a ride by showing huge losses arising out of these deals.

The interesting part is that the client hardly knows about these transactions before they are actually entered. He actually comes to know them, when he is either asked to deposit the money due to debit arising out of these deals, or receives the statement wherein some of the shares from his depository account are already transferred to set off such a debit.

How to Avoid Problems with Brokers?:

In view of the above, the onus lies on investor to be extra careful while dealing with a broker. It is in the investor’s interest to deal only with a SEBI registered broker or sub-broker and carefully read the agreement specifically asking for the deletion of clauses for which he is not prepared (working in F&O segment).

The broker should never be authorized to do something the significance of which is not clear to the account holder. Investors must insist for prompt delivery of contract note, sale/purchase bill/transaction statement, etc. and frequently settle the account with the broker. Finally, as far as possible, no payments in cash should be made.

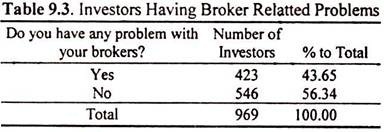

In this background, the investors were asked whether they face any problems in their dealings with their brokers.

As per Table 9.3 only 44 percent of them have some problems with their brokers. Rest 56 percent does not have any problems with their brokers.

City Wise Classification of Investors having Broker Related Problems:

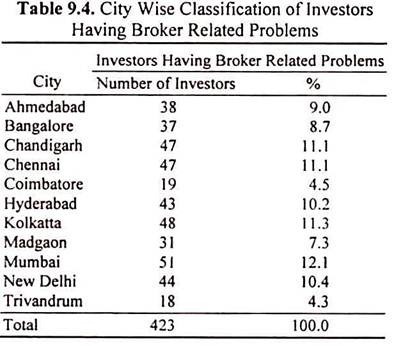

The investors who reported problems with their share brokers were further classified based on their city of living. The classification is given in Table 9.4.

The above Table reveals that investors from Mumbai have maximum number of problems with their share brokers. One in eight investors has some grievance about his/her share broker. Kolkata, Chennai and Chandigarh follow closely with investors having more number of problems with share brokers.

The investors from Trivandrum followed by investors from Coimbatore reported least number of problems with their share brokers. Other cities’ investors too have reported problems with their share brokers.

Investors’ Types of Problems with Brokers:

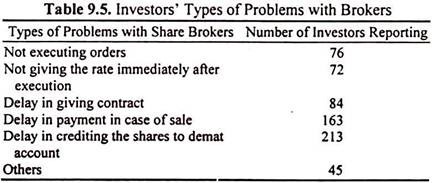

Further, the investors’ types of problems with their brokers are discussed below in Table 9.5.

More than 50 percent of the investors having problems with brokers identified that there is a delay in crediting the shares they buy to their demat account. This leads to further problems like inability to sell the same, as they cannot give delivery. Thus, they are unable to sell their shares as per their will. Nearly two fifths said that when they sell the shares the payment is delayed.

The investors when they buy the shares are forced to pay for it immediately in a day or two whereas in case of sale of shares the proceeds are not paid even after a week. One in every five of the investors feels that their brokers delay in giving the contracts.

Not executing the orders in time and not giving the rate of the deal immediately after execution are the other problems faced by the sample investors with their brokers. One tenth of these investors have also mentioned some other problems they face with their brokers.

A few of them are highlighted here under:

a. Maintaining investors ‘shares in brokers’ account. Hence, delivery positions are confused.

b. In case of IPO allotment the shares are not credited to investors account immediately. There is a possibility of those IPO allotments sold on listing at high price and later bought at a lower price and credited to investors’ accounts.

c. Brokers not providing information on individual holdings.

d. Delay or non-payment of dividend.

e. Wrong execution of telephonic instructions.

f. The rules are not transparent and the brokers change the rules frequently.

g. Brokers fix sudden margins.

h. Brokers must be equipped with more communication channels.

i. Absence of professionalism.

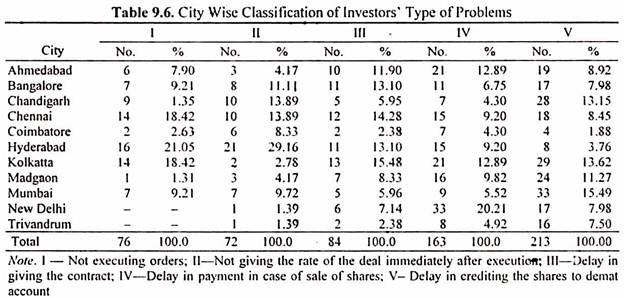

City Wise Classification of Investors’ Type of Problems:

To get an idea about the type of problems faced by investors living in different cities the investors’ problems were further classified based on their city of living. Table 9.6 brings out the classification.

An analysis of the Table reveals that maximum percent of problems of not executing the orders given by investors and not giving the rate of the deal immediately after execution are against Hyderabad brokers.

The maximum percent of complaints regarding delay in giving the contract is against Kolkata brokers and delay in payment in case of sale of shares is against New Delhi brokers. Even though the problem of delay in crediting the shares to the investors demat account is spread among all the cities Mumbai brokers tops the list with maximum percent of complaints against them followed by Kolkata and Chandigarh.

Insider Trading, Price Manipulation, Broker Defaults, etc.:

Insider trading means dealing in securities of a company by insiders which term includes Directors, Officers and Employees of the Company who are connected with the Company and/or reasonably expected to have access to Unpublished Price Sensitive Information (UPSI) in respect of securities of the Company or who had access to such UPSI.

Such dealings by Insiders erode the investors’ confidence in the fairness and integrity of the management. Rampant Insider Trading deters investment from capital market which in turn affects growth of economy.

The Securities and Exchange Board of India (SEBI), as part of its efforts to protect the interests of investors in general, had issued the SEBI (Insider Trading) Regulations, 1992 under the powers conferred on it by the SEBI Act, 1992. Applicable to all listed companies, these Regulations came into force with effect from 19th November 1992.

The Regulations prohibit insider trading. Regulation 3 of the Regulations, which prohibits insider trading is quoted hereunder:

No Insider shall—

(i) Either on his own behalf or on behalf of any other person, deal in securities of a company listed on any stock exchange when in possession of any unpublished price sensitive information; or

(ii) Communicate, counsel or procure, directly or indirectly, any unpublished price sensitive information to any person who while in possession of such unpublished price sensitive information shall not deal in securities, provided that nothing contained above shall be applicable to any communication required in the ordinary course of business or profession or employment or under any law.

Under the Regulations, it is mandatory for every listed company/entity to adopt a Code of Conduct for Prevention of Insider Trading, for its Directors, Officers and Employees in terms of Schedule I to the Regulations.

The Directors, officers and employees of the Company owe a fiduciary duty to all the stakeholders of the Company whereby the interests of such stakeholders have to be placed above the interests of the said Directors, officers and employees. In view of this, this Code lays down that these persons shall deal in the securities of the Company in a manner that does not create any conflict of interest.

The Insider trading is prohibited and is considered an offence. The SEBI regulations, 1992 prohibit an insider from dealing in securities on the basis of ‘unpublished price sensitive information’, communicating such information and also from counseling any other person to deal in securities of any company on the basis of such of information.

Unpublished price sensitive information, which if published or known, is likely to have an impact on the market price of the securities of that company. In order to strengthen insider trading regulations, SEBI has approved a code of conduct for listed companies, its employees, analysts, market intermediaries and professional firms.

Further all the stock exchanges in the country have adopted on-line screen-based electronic trading which reduces price manipulation by few interested parties. The main advantage of electronic trading over floor based trading as observed in our country is transparency. Transparency ensures that stock prices fully reflect available information and lowers the trading costs by enabling the investor to assess over all supply and demand.

Further, the accumulation of position during the settlement period gave scope for speculative activities and, thus increasing the possibility of default by participants. The rolling settlement system introduced along with T + 2 Settlement has overcome this problem of default by brokers.

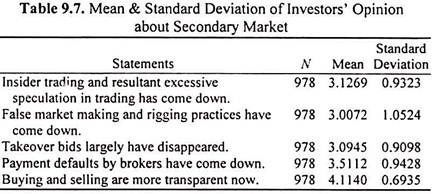

The impact of few of the secondary market reforms is discussed. Table 9.7 presents the sample investors’ responses towards those secondary market reforms.

Table 9.7 reveals that the investors’ opinions regarding the secondary market are not the same across all issues. The investors could neither agree nor disagree with the statements regarding insider trading, false market rigging and takeover bids. It seems they do not have enough information to decide on these issues.

On the other hand they are convinced on the aspect of transparency in buying and selling and in payment defaults by brokers coming down. The standard deviation of values from the mean values for the statement on ‘buying and selling are more transparent now’ is very low indicating the high level of uniformity among the investors in agreeing to this. Further, the standard deviation values of other statements too indicate the homogeneity of the investors’ views on the secondary market reforms.

Derivatives Trading:

Derivatives such as options or futures, are financial contracts which derive their value off a spot price time-series, which is called the ‘underlying’. The world over, derivatives are a key part of risk management in financial system. The most important contract types are futures and options, and the most important underlying markets are equity, treasury bills, commodities, foreign exchange and real estate.

The key motivation for such instrument is that they are useful in reallocating risk either across time or among individuals with different risk bearing preferences. In this way, derivatives supply a method for people to do hedging and reduce their risks. The ultimate importance of a derivatives market thus hinges upon the extent to which it helps investors to reduce the risks they face.

The liquidity and low transaction costs of exchange-traded derivatives make it cheaper to rapidly adjust a portfolio using derivatives rather than the underlying asset. In India, one of the prime objectives of introducing futures trading on exchanges is to reduce volatility in the spot market.

Derivatives trading in India took off in June 2000 on two exchanges. The exchange traded derivatives witnessed a volume of Rs. 48,24,250 crore with about 15.76 crore contracts during 2005-06 as against Rs. 4,42,343 crore during 2002-03. While NSE accounted for about 99.99 percent of total turnover, BSE accounted for the balance in 2005-06. NSE tops the list of world’s derivative exchanges.

It is observed that futures are more popular than options; contracts on securities are more popular than those on indices- call options, are more popular than put options; and near month contracts are more popular than no-so-near month contracts. The index futures, stock futures, index options and stock options accounted for 26 percent, 62 percent, 2 percent and 10 percent respectively.

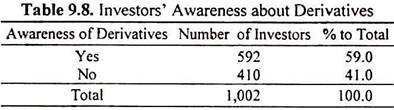

The investors’ awareness of derivatives and their participation in derivatives trading given below.

Table 9.8 reveals that out of thousand two investors only five hundred and ninety two investors were aware of the existence of derivatives. That is, more than two out of every five investors were unaware of derivatives. This shows that, they are either not interested in knowing about the developments in the securities market or they are not provided information regarding the developments by other market participants.

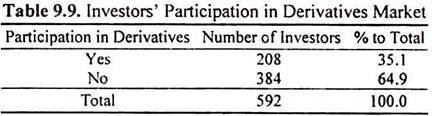

With the information that only two thirds of investors are aware about derivatives naturally, the next question arises. How many of them have actually participated in the derivatives market?

Table 9.9 shows that a little more than one third of the investors who are aware of derivatives only have participated in the derivatives market. That is they have bought and sold derivatives. A recent article in Portfolio Organizer cited that 90-95 percent of the volumes in the futures and options segment of NSE were from retail investors including high net worth individuals.

This information put together with the results of this survey indicates that the derivatives market is dominated by few individual investors. Overall, only twenty percent of the investors have participated in the derivatives trading. This shows that a large number of investors have not learnt the risk management offered by derivatives.

Trade Guarantee Fund/Settlement Guarantee Fund:

In order to introduce a system of guaranteeing settlement of trades and ensure that market equilibrium is maintained in case of payment default by the Members, the Trade Guarantee Fund was constituted by BSE and it came into force with effect from May 12, 1997.

The main objectives of the fund are as follows:

1. To guarantee settlement of bonafide transactions of members of the Exchange inter se which form part of the Stock Exchange settlement system, so as to ensure timely completion of settlements of contracts and thereby protect the interest of Investors and the Members of the Exchange.

2. To inculcate confidence in the minds of secondary market participants generally and global Investors’, particularly to attract larger number of domestic and international players in the capital market.

3. To protect the interest of Investors’ and to promote the development of and regulation of the secondary market.

The Fund is managed by the Defaulters’ Committee, which is a standing Committee constituted by the Exchange, the constitution of which is approved by SEBI. Trade Guarantee Fund (TGF) is maintained by the stock exchanges for meeting the shortages arising out of non-fulfillment or partial fulfillment of the funds obligations by members in a settlement before declaring the concerned member defaulter.

A large TGF provides the cushion for any residual risk. It operates like a self-insurance mechanism where members contribute to the Fund. The corpus of TGF is mainly funded through the base capital contributed by the members of the stock exchanges additional base capital and margin money paid for trading purpose.

In the event of failure of a trading member to meet settlement obligations or committing a default, the Fund is utilised to the extent required for successful completion of the settlement This has eliminated counter party risk of trading on the exchange. As a consequence, despite the fact that the daily turnover at time exceeds Rs. 10,000 crore, credit risk no longer poses any threat in the market place. The market has full confidence that settlement shall take place in time and shall be completed irrespective of default by isolated trading members.

In 2005, during the stock scam involving broker Ketan Parekh there were problems at the Calcutta Stock Exchange (CSE) which had to dip into its TGF to meet the shortfall. This led to sharp erosion in the corpus of CSE’s TGF. At that time even BSE and NSE had to depend on the TGF. But the amount utilised by these exchanges was minuscule compared to the size of TGF.

The corpus of TGF has fallen sharply between March 2001 and March 2002 on both NSE and BSE. On the NSE, the TGF has fallen by 38 percent from Rs. 2, 919 crore (March 2001) to Rs. 1,781 crore (March 2002). On the BSE the corpus of TGF has fallen by 46 percent to Rs. 977 12 crore (Rs. 1,813.58 crore).

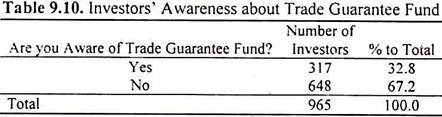

In this back drop, investors were enquired about whether they are aware of the Trade Guarantee Fund. Their responses are given in Table 9.10.

Table 9.10 reveals that more than two thirds of the investors are not aware of the Trade Guarantee Fund, which will help their brokers in times of their default. It indicates that less than one third of investors only are aware of this Trade Guarantee Fund.

Conclusion:

As much as 90 percent of the investors surveyed had no grievances about T + 2 rolling settlement system. Only 44 percent of the investors have some problems with their brokers. The city wise analysis of investors’ having problems reveals that investors from Mumbai to have maximum number of problems with their share brokers.

Kolkata, Chennai and Chandigarh follow closely with investors having more number of problems with share brokers. The investors from Trivandrum followed by investors from Coimbatore reported least number of problems with their share brokers.

More than 50 percent of the investors having problems with brokers identified delay in crediting the shares they buy to their demat account as their major problem. Nearly two fifths complained delayed payment in case of sale of shares as their problem with brokers.

Delay in giving contracts, not executing orders in time and not giving the rate of the deal immediately after execution are the other problems faced by the sample investors with their brokers. The investors from different cities differ in their problems with brokers.

The investors’ opinions regarding some issues of the secondary market are not the same. The investors could neither agree nor disagree with the statements regarding insider trading, false market rigging and takeover bids. It seems they do not have enough information to decide on these issues. On the other hand, they are convinced on the aspect of transparency in buying and selling and in payment defaults by brokers coming down.

Two out of five investors were unaware of derivatives and a little more than one third of the investors who are aware of derivatives only have participated in the derivatives market. Overall, only twenty percent of the investors have participated in the derivatives trading. This shows that a large number of investors have not learnt the risk management offered by derivatives.

Settlement Guarantee Fund is maintained by the stock exchanges for meeting the shortages arising out of non-fulfillment or partial fulfillment of the funds obligations by members in a settlement before declaring the concerned member defaulter. More than two thirds of the investors are not aware of the Trade Guarantee Fund. This shows that investors have not learnt about the developments taking place in the market place.