Here is an essay on ‘IPO’ for class 11 and 12. Find paragraphs, long and short essays on ‘IPO’ especially written for school and college students.

Essay on Initial Public Offer (IPO)

Essay Contents:

- Essay on the Introduction to IPO

- Essay on the Importance of IPO

- Essay on the Regulatory Framework of IPO Since, 1992

- Essay on the Methods of IPO

- Essay on the Refund Problem in IPO

- Essay on the Problems in IPO Subscribing

Essay # 1. Introduction to IPO:

ADVERTISEMENTS:

Companies raise capital in the primary market by way of an initial public offer, rights issue or private placement. An Initial Public Offering (IPO) is one through which an unlisted company makes either a fresh issue of securities or an offer for sale of its existing securities or both for the first time to the public.

This paves way for listing and trading of the issuer’s securities. IPOs deepen the market, diversify investors’ portfolios, reduce volatility in stock prices, bring domestic investors money into the market and attract Foreign Institutional Investor funds. Given the need for capital by large and small firms, IPOs also promote economic activity.

Essay # 2.

Importance of IPO:

A company may choose to go for a public issue of shares because of its several advantages.

ADVERTISEMENTS:

The following points highlight the importance of IPO:

a. A company may not be able to raise funds through venture capital or from institutional funds. Under such circumstance, IPO is an important avenue available for the company.

b. A company needs a significant amount of permanent capital, which it will not pay back to its lender in its life time. This permanent capital may be provided by IPO.

c. After an IPO, in future a public company has direct and easy access to the capital markets and can raise more capital by issuing additional stock in a secondary offering.

ADVERTISEMENTS:

d. Public companies can use their common stock to attract and retain good employees.

e. Being a public company is considered to be more prestigious than being a private company.

f. An IPO provides promoters of the company and any venture capitalists invested in it, an exit opportunity for selling their ownership holdings in the business.

Essay # 3.

Regulatory Framework of IPO Since, 1992:

ADVERTISEMENTS:

SEBI Act, 1992:

Enactment of SEBI Act in 1992 was an attempt towards integrated regulation of the securities market. SEBI was given full authority and jurisdiction over the securities market under the Act, and was given concurrent/delegated powers for various provisions under the Companies Act, 1956 and the SCR Act, 1956.

Major part of the economic liberalization was the revocation of the Capital Issues (Control) Act, 1947 by the government in the early 1990s. With this, Government’s control over issues of capital, pricing of the issues, fixing the premium and rates of interest on debentures etc. ceased, and the office, which administered the Act, was abolished. The market was allowed to allocate resources to competing uses.

To ensure effective regulation of the market, SEBI Act, 1992 was enacted. SEBI can specify the matters to be disclosed and the standards of disclosure required for the protection of investors in respect of issues; can issue directions to all intermediaries and other persons associated with the securities market in the interest of investors; and can conduct enquiries, audits and inspection of all concerned and adjudicate offences under the Act.

ADVERTISEMENTS:

In short, it has been given necessary autonomy and authority to regulate and develop an orderly securities market. All the intermediaries in the market, such as brokers and sub-brokers, underwriters, merchant bankers, bankers to the issue, share transfer agents and registrars to the issue, are now required to register with SEBI and are governed by its regulations.

A code of conduct for each intermediary has been prescribed in the regulations; capital adequacy and other norms have been specified; a system of monitoring and inspecting their operations has been instituted to enforce compliance; and disciplinary actions are being taken against the intermediaries violating any regulation.

The Depositories Act, 1996 is administered by SEBI. A high level committee on capital markets has been set up to ensure coordination among the regulatory agencies in financial markets.

In the interest of investors, SEBI issued Disclosure and Investor Protection (DIP) Guidelines. The primary issuances are governed by SEBI in terms of SEBI (Disclosures and Investor protection) guidelines SEBI framed its DIP guidelines in 1992. Many amendments have been carried out in it in line with the market dynamics and requirements.

ADVERTISEMENTS:

In 2000, SEBI issued “Securities and Exchange Board of India (Disclosure and Investor Protection) Guidelines, 2000” which is compilation of all circulars organized. These guidelines and amendments thereon are issued by SEBI India under Section 11 of the Securities and Exchange Board of India Act, 1992. SEBI (Disclosure and investor protection) guidelines 2000 are in short called DIP guidelines. It provides a comprehensive framework for issuances by the companies. The issuers are now required to comply with these guidelines before they can access the market.

The guidelines contain a substantial body of requirements for issuers/intermediaries, the broad intention-being to ensure that all concerned observe high standards of integrity and fair dealing, comply with all the requirements with due skill, diligence and care, and disclose the relevant information.

The guidelines aim to secure fuller disclosure of relevant information about the issuer and the nature of the securities to be issued so that investor can take an informed decision. Officials of SEBI at various levels examine the compliance with DIP guidelines and ensure that all necessary material information is disclosed in the draft offer documents.

SEBI has placed a responsibility on the lead managers to give a Due Diligence Certificate, stating that they have examined the prospectus, they find it in order and that it brings out all the facts and does not contain anything wrong or misleading. Though the requirement of vetting has now been dispensed with, SEBI has raised standards of disclosures in public issues to enhance the level of investor protection.

ADVERTISEMENTS:

SEBI’s Role in an IPO Issue:

Any company making a public issue or a listed company making a rights issue of value of more than Rs. 50 lakhs is required to file a draft offer document with SEBI for its observations. The company can proceed further on the issue only after getting observations from SEBI.

The validity period of SEBI’s observation letter is three months only i.e., the company has to open its issue within three months period. SEBI does not recommend any issue nor does take any responsibility either for the financial soundness of any scheme or the project for which the issue is proposed to be made or for the correctness of the statements made or opinions expressed in the offer document. It is to be distinctly understood that submission of offer document to SEBI should not in any way be deemed or construed that the same has been cleared or approved by SEBI.

The Lead manager certifies that the disclosures made in the offer document are generally adequate and are in conformity with SEBI guidelines for disclosures and investor protection in force for the time being. This requirement is to facilitate investors to take an informed decision for making investment in the proposed issue.

The investors should make an informed decision purely by themselves based on the contents disclosed in the offer documents. SEBI does not associate itself with any issue/issuer and should in no way be construed as a guarantee for the funds that the investor proposes to invest through the issue.

However, the investors are generally advised to study all the material facts pertaining to the issue including the risk factors before considering any investment. They are strongly warned against any ‘tips’ or news through unofficial means.

ADVERTISEMENTS:

IPOs’ Capital Contribution:

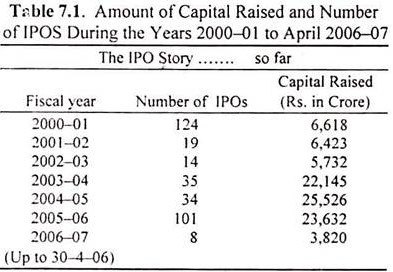

The India’s growth story is a best seller and the equity market is hot. There are no second thoughts about it. And India Incorporated’s promoters have capitalized on this fact. Table 7.1 presents the number of IPOs made and the amount of capital raised during the years from 2000-01 to up to April 2006-07.

In three Years (2003-04 to 2005-06), Rs. 70,000 crore plus has been raised and many more to come. The number of public offers in the recent past has increased phenomenally, thanks to the continued bull-run, and India Incorporated’s promoters seem to have en-cashed on their goodwill and retail investors have also made money.

Free Pricing of IPOs:

The primary capital market received a boost with the introduction of free pricing during early 1990s which paved the way for market-determined allocation of resources. Companies complied with the guidelines and accessed the market. Usually, every company would like to offer its investors adequate returns.

ADVERTISEMENTS:

As such, many IPOs were priced below the industry average and this helped in creating positive demand for the company. Research indicates that public offers are generally under-priced. Such under-pricing adds value to an investor’s portfolio and IPOs provided clear arbitrage opportunities.

Even offers made in 2005, in a high stock price valuation environment, have produced decent returns. Twenty-two of the 35 book-built offers made until October 2005 were in positive territory. About half the total offers have delivered returns of more than 20 percent up to this period.

However, of late the money left across the table during the IPO is on the decline, as IPOs these days seem to be fairly valued. The pricing of offers has become more aggressive, in line with the secondary market valuation levels, and this appears to have reduced the scope for gains on listing and post-listing.

Out of 38 issues, which came in 2006 and are listed on the NSE, only 10 are trading above their issue price as on August 7th 2006. Past experience teaches that opportunist issuers tend utilize IPO mania to their own and not to the investor’s advantage. However attractive the returns on listing may seem, investors need to watch out for the risks inherent in low quality IPOs.

Essay # 4.

Methods of IPO:

The Initial Public Offering can be made through:

ADVERTISEMENTS:

(a) The fixed price method,

(b) Book building method, or

(c) Combination of both

Fixed Price Method:

Fixed price method is one in which the issuer fixes the price for the shares being issued. The basis for the price is explained in an offer document through qualitative and quantitative statements. This offer document is filed with the stock exchanges and the registrar of companies.

Price at which the securities are offered/allotted is known in advance to the investor. Demand for the securities offered is known only after the closure of the issue. Payment is made at the time of subscription and refund is made after allocation. In the present day scenario, fixed price offers may be offered at a more attractive price by the issuer.

ADVERTISEMENTS:

They do tend to outperform book-built offers. For offers during the preceding three years, average returns of fixed price offers was 63 percent, against 35 percent for book built offers.

Book Building Process:

Book Building is basically a capital issuance process used in Initial Public Offer (IPO) which aids price and demand discovery. It is a process used for marketing a public offer of equity shares of a company. The book-building process is a process of securing the optimum price, for a company’s share.

The issuing company decides the price of the security by asking investors the quantity of shares and at what price they would be interested in, which is adopted when an initial public offering or divestment is made. Book building is a widely-accepted procedure which is particularly designed to establish a fair balance of interest between the issuer and the investor in relation to the level of the issue price.

The process aims at tapping both wholesale and retail investors. Book Building is a good concept and represents a capital market, which is in the process of maturing.

The book building process may serve as a medium for better price determination; such offers may also attract higher levels of subscription, but it is neither efficient in the fundamental economic sense nor fair to the investing public. It places the investors at a distinct disadvantage vis-a-vis the issuing company.

ADVERTISEMENTS:

The book building method clearly favors the issuing company and there is no doubt that the change to book building method from the fixed price method has made IPOs less friendly and more risky for the ordinary individual investor.

Book Building Procedure:

In case the issuer chooses to issue securities through the book building route then as per SEBI guidelines, an issuer company can issue securities in the following manner:

(a) 100% of the net offer to the public through the book building route.

(b) 75% of the net offer to the public through the book building process and 25% through the fixed price portion.

(c) Under the 90% scheme, this percentage would be 90 and 10 respectively.

Most of the IPOs now-a-days are being made through 100 percent Book Building process where in up to 50 percent of issue is available for allocation on a discretionary basis to Qualified Institutional Bidders. Further, 35 percent is available for allocation on a proportionate basis to Retail Individual bidders and 15 percent available for allocation on a proportionate basis to Non-institutional bidders.

Retail Investor:

Retail individual investor means an investor who applies or bids for securities for a value of not more than Rs. 1,00,000. Any bid made in excess of this will be considered in the High Net worth Individuals category.

Intermediaries in an Issue:

Merchant Bankers to the issue or Book Running Lead Managers (BRLM), syndicate members, Registrars to the issue, Bankers to the issue, Auditors of the company, Underwriters to the issue, Solicitors, etc. are the intermediaries to an issue. The issuer discloses the addresses, telephone/fax numbers and email addresses of these intermediaries. In addition to this, the issuer also discloses the details of the compliance officer appointed by the company for the purpose of the issue.

A Merchant banker possessing a valid SEBI registration in accordance with the SEBI (Merchant Bankers) Regulations, 1992 is eligible to act as a Book Running Lead Manager to an issue. The Book Runner(s) may appoint those intermediaries who are registered with SEBI and who are permitted to carry on activity as an ‘Underwriter’ as syndicate members. The syndicate members are mainly appointed to collect and enter the bid forms in a book built issue.

Reservation for Retail Investors in IPOs:

The reservation for retail investors was set at 25 percent earlier. It was found to be inadequate. The investors were not able to cash in on good investment opportunities as the portion reserved for them in IPO is low. In this context the Primary Market Advisory Committee’s (PMAC’s) of SEBI recommended hiking of the allocation for retail investors to 35% and the bid amount defining a retail investor to Rs. 1 lakh.

These have been accepted by SEBI and at present 35 percent of the public issue portion in a book built issue is reserved for retail investors. The Securities Exchange Board of India has thus allocated up to 50 percent of issue size to Qualified Institutional Bidders, minimum 15 percent of issue size to Non-Institutional Bidders and 35 percent of issue size to Retail individual Bidders in a public issue.

Payment of Margin Money:

There is inequality in treatment of retail investors regarding margin money. The retail investor has to pay 100% of the bid amount at the time of applying for shares. The Qualified Institutional Bidders (QIBs), in contrast, do not have to put any money up front. This makes the QIBs overbid as they do.

QIBs overbid secure in the knowledge that they do not have to pay anything upfront and that their merchant banker friends will overlook the additional bid. Merchant bankers benefit as overbidding conveys a healthy response to the issue, thereby attracting more investors. It is about time that this cost arrangement was broken.

It is also known that QIBs significantly revise their bid downwards or sometimes cancel them altogether as the IPO approaches closure. The Securities Markets Infrastructure Leveraging Expert Task Force (SMILE) report noted that this is done to inflate.

Essay # 5.

Refund Problem in IPOs:

Another important problem associated with IPO is the refunding of application money. Many of the complaints filed with SEBI are related to non-receipt of refunds from companies. SEBI with a view to solve this problem has amended the SEBI (DIP) Guidelines, 2000 providing for the use of various modes for making refunds in public issues vide a circular dated January 20,2006.

It was mentioned in the aforesaid circular that applicants in 15 centres where clearing houses are managed by Reserve Bank of India will get refunds through Electronic Clearing System only and the bank details of such applicants will be taken directly from the data base of the depositories in respect of issues made completely in dematerialized form. This is to ensure that the refunds are made in a smooth manner and that there are no problems in this aspect.

In the context of above said information on Initial Public Offers and Book Building Process it would be interesting to know the experience and opinion of the investors regarding these aspects.

Investors’ Subscription to Book Building Process:

The investors were enquired whether they or their household members have subscribed to a share issue through book building process? Only 55% of investors had subscribed to shares under the book building process. This shows that a large number of investors stay away from the IPO market which book building process dominates at present.

To the question, Is book building method of share issue a better method than traditional fixed price method? 55 percent of the investors said ‘No’. The responses to the earlier question and to this question put together reveals even though some investors are not in favour of book building method they subscribe to shares through book building process.

Essay # 6.

Problems in IPO Subscribing:

The investors were asked to specify the problems faced by them in IPO subscribing. 72 percent of the investors surveyed have said they face no problems in subscribing to IPO’s. Only 16 percent of the investors said they have problems.

Of those who said they face problems in IPO subscribing, a large number have specified the problems. Of them, nearly 50 percent were related to refund of application money. Some investors complained that refunds take a long time to come and the money gets blocked. They have even suggested that refund money should be credited to the bank account.

The next major problem identified by the investors was high levels of premium charged and the payment of the entire bid amount at the time of applying for IPOs. Some investors’ complaint was related to the collection of IPO application forms. They complained that applications are accepted only at brokers/DPs point and they are not accepted by banks as was done earlier during the fixed price method.

The collecting points are not in small cities and towns. The complaints of the rest of the investors include too little shares as allotment in IPOs for small investors, stoppage of stock invests and insufficient space in application forms to fill up address, non-availability of application forms etc. To sum up, a large number of problems cited by the investors were related to the refund of application money and the payment of full bid amount at the time of application.

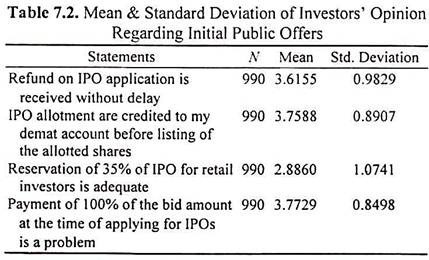

The investors’ opinion relating to Initial Public Offer was analysed using mean values. Table 7.2 presents the mean value and standard of deviation of values from the mean values. The table reveals that the investors agree with all the statements except that of 35 percent reservation for retail investors in an IPO is adequate.

The investors’ level of agreement on all these statements is above the level of indecisiveness moving towards the level of agreeing. This can be interpreted that the investors receive the refunds of application money without delay and the allotted shares are also credited to their demat accounts before they are listed in a stock exchange.

The mean value of their opinions reflects that this may not be case all the times and they might have faced some odd situations too. Earlier the investors used to pay a small amount at the time of applying for shares towards application money. Later if allotted they paid the balance in one or more installments.

Now under the book building method of IPOs, they have to pay 100 percent of the bid amount at the time of applying which is not agreeable. The only statement relating to IPO on which investors expressed disagreement is regarding the adequacy of 35 percent reservation for retail investors. The Standard Deviation of values for the agreed statements from their mean values is small indicating the high level of uniformity in investors’ views on the subject.

Age Wise Opinion on Initial Public Offers:

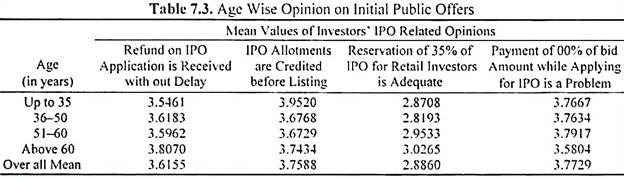

The investors’ opinion on IPOs was further analysed based on their age. The mean values of investors’ opinions on this basis are given in Table 7.3.

The Table 7.3 reveals that age wise mean value of investors IPO related opinions almost go with the opinion of the overall investors with one exception. The above sixty age group neither agrees nor disagrees with the statement ‘reservation of 35 percent of IPO for retail investors is adequate’. In that, the group differs from the overall investors’ slight disagreement with that statement.

Income Wise Opinion on Initial Public Offers:

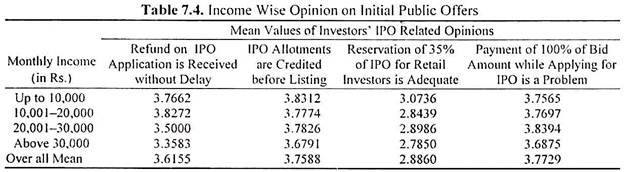

The mean values of investors’ level of agreement with opinion statements on IPOs were further classified based on their income. This classification is given in Table 7.4.

The Table 7.4 reveals that investors classified on the basis of their income does not differ significantly among themselves in their opinions regarding IPOs. However, the investors with monthly income up to Rs.10,000 even though neither agree nor disagree with the statement that 35 percent reservation for retail investors in IPOs is adequate, they seem to slightly lean towards agreeing to the statement as per the mean value.

City Wise Opinion on Initial Public Offers:

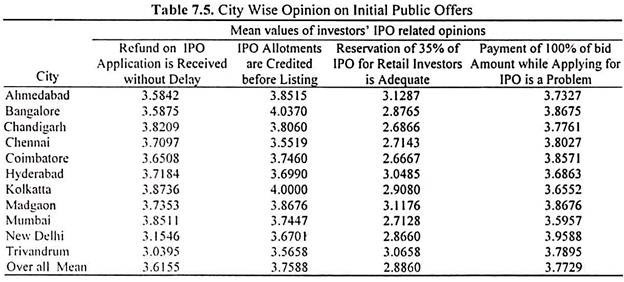

Is the opinion of investors from various cities remaining the same with regarding to IPOs? The curiosity led to the classification of the mean values of opinions based on the city of dwelling of investors. Table 7.5 presents the classification.

The city wise classification of the mean value of investors’ opinion reveals that over all investors are towards agreeing to the opinion that payment of 100 per cent of the bid amount while applying for IPO is a problem. The opinion of investors from Trivandrum is undecided on the statement ‘Refund on IPO application is received without delay’ even though the overall opinion of investors agrees with the statement.

It can be interpreted that investors from Trivandrum do not receive refunds in time. The investors from Bangalore followed by Kolkata agreed to the statement ‘IPO allotments are credited to demat accounts even before listing of those shares in the stock exchanges’ while rest of the investors were towards agreeing to the statement indicating that mostly investors get IPO allotments credited to their demat accounts before listing of those shares.

The investors of Ahmedabad, Madgaon, Hyderabad and Trivandrum neither agreed nor disagreed to the statement that 35 per cent reservation for retail investors in an IPO is adequate. However, investors from the rest of the cities disagreed with the statement indicating that it is not enough.

Investors’ Opinion to Prevent Companies with Dubious Intentions from Approaching Capital Market:

As per the data compiled by Economic Times investment Bureau, as many as 4,454 companies went public between 1993 and 1999 and 4,422 companies were listed on the Bombay Stock Exchange during the same period. However, currently only 1,484 companies are traded out of those that went public during that time. The remaining, comprising 2,938 companies disappeared from the market. Some may have delisted due to mergers or amalgamations, but a large majority is simply not traceable.

The track record of SEBI and RBI in punishing the manipulators is poor. The structural shortcomings in the SEBI Act and other laws which govern securities market that embolden the scamsters are – Cheated investors are not entitled to compensation, have no right to get the existing laws enforced, no disgorgement or confiscation of ill-gotten profits and absence of any minimum imprisonment for manipulators. The manipulation has been made easier by making demat mode mandatory for IPOs.

The track record of SEBI regarding penalizing the lead managers-intermediaries of IPOs—is also not ensuring protection to individual investors. In the first nine years of its working, from 1992-93 to 2000-01, SEBI initiated prosecutions, under the SEBI Act, merely in 37 cases. These were for violation of take-over regulations (2); fraudulent and unfair trade practices (3); insider trading regulations (1); portfolio manager rules (2); unregistered entities (2) and for non-cooperation during investigation proceedings (13).

Inaction against merchant bankers and numerous other intermediaries, especially those connected with IPOs, is conspicuous by its absence though the mammoth vanishing companies scam took place during this period.

In 2002-03, number of prosecutions registered was 229. One can safely assume that most of them were against the brokers and vanishing companies. Further 24 prosecutions for violations under Depositories Act (9), Securities Contracts (Regulation) Act (14) and Indian penal Code (1) were registered. Not a single prosecution was initiated against lead managers under the Merchant bankers’ regulations.

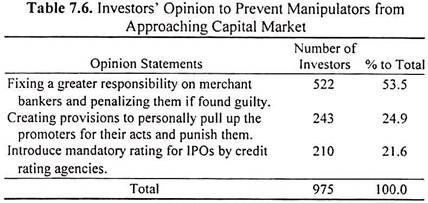

In this context the investors were asked to opine about the better way to prevent companies or promoter with dubious intentions from entering capital market. Their responses are given below in Table 7 6.

53.5 percent of investors want SEBI to fix a greater responsibility on merchant bankers and penalize them in case of wrong doing. More than one fourth of investors want the authorities to create necessary provisions to personally pull up the promoters for their wrong doings and punish them. More than one fifth (22%) of investors want introduction of compulsory rating of IPO’s by credit rating agencies. Nearly 3 percent of respondents have suggested other ways too.

Two of their suggestions are given below:

a. Company/merchant banker should guarantee the investor that they would buyback at least 50% of the issue at IPO issue price in case of a downfall in the market price up to a certain period.

b. Create legal provisions to facilitate the confiscation of the ill-gotten wealth of the promoters.

To sum up majority of the investors want SEBI to fix a greater responsibility on the merchant bankers and hold them responsible for the promoters’ dubious acts. Also they want SEBI to create legal provisions to pull up the promoters for their misdeeds and proceed against them under criminal laws and confiscate all their ill-gotten wealth.

Conclusion:

To conclude, IPOs promote economic activity. The IPO pricing has become more aggressive. The book building method clearly favors the issuing company. This has made IPOs less hospitable and more risky for the ordinary investor. Only 55 percent of investors surveyed had subscribed to shares under the book building process.

A similar percent of the investors said book building is not a better method of share issue. A large number of investors face no problems in subscribing to IPO’s and in receiving refunds of application money without delay and getting credit of the allotted shares in their demat accounts before they are listed in a stock exchange.

They find paying 100 percent of the bid amount at the time of applying a problem. The investors expressed disagreement over the adequacy of 35 percent reservation in IPOs for retail investors.

Age wise classification of IPO related opinions almost go with the opinion of the overall sample with one exception. The above sixty age group neither agrees nor disagrees with the statement – reservation of 35 percent of IPO for retail investors is adequate. The sample investors with monthly income Up to Rs. 10,000 seem to slightly lean towards agreeing to 35 percent reservation for retail investors in IPOs.

The city wise classification reveals that over all investors feel payment of 100 percent of the bid amount while applying for IPO as a problem. The sample investors from Trivandrum have highlighted delayed refunds as a problem.

Investors from Bangalore and Kolkata agreed that they receive their IPO allotments credited to their demat accounts even before listing of those shares in the stock exchanges. The investors from seven cities disagreed over the adequacy of 35 percent reservation in an IPO for retail investors.

Majority of the investors want SEBI to fix a greater responsibility on the merchant bankers and hold them responsible for the promoters’ dubious acts. Also they want SEBI to create legal provisions to pull up the promoters for their misdeeds and proceed against them under criminal laws and confiscate all their ill-gotten wealth.