How to Fix the Price of a Product: Calculations, Methods, Formula, Step, Strategies and Policies!

Introduction to Price:

Setting the right price is an important part of effective marketing. It is the main factor which affects the profitability of an organization. Price is the only part of the marketing mix that generates revenue, pricing policy can influence sales and brand image of a product. Quantity of commodities purchased by any customer depends on price factor; it is also the marketing variable that can be changed most quickly. The price of a product may be seen as a financial expression of the value of that product.

For a customer, price is the value placed on what is exchanged. Purchasing power depends on a buyer’s income, credit, and wealth, price is the monetary expression of the value to be satisfaction and benefit with the purchasing of a product and services, and it is an indicator of product quality in a general perception high price of a product indicate high quality.

Price is the amount of money or goods for which a thing is bought or sold.

Price can be defined as that which people have to forego in order to acquire a product or service.

Price is the amount of money charged for a product or service, or the sum of the values that consumers exchange for the benefits of having or using the product or service.

The concept of value can therefore be expressed as:

(Perceived) VALUE = (Perceived) BENEFITS – (Perceived) COSTS

A customer’s motivation to purchase a product comes firstly from a need and a want, second motivation comes from a perception of the value of a product in satisfying that need/ want suppose need is hunger and want is pizza. Want depends on price of pizza and purchase power of customer the perception of the value of a product varies from customer to customer, because perceptions of benefits and costs vary.

Factors Influencing Pricing Decisions:

Price as an element of marketing is influenced by the market forces of demand and cost of the product. However, there are various other factors which influence price namely the competitive environment, prevailing economic conditions, objectives of the firm, the behaviour of buyer etc.

Various factors affecting pricing decisions are:

1. Demand of the Product:

Demand of the product is one of the basic factors influencing pricing decisions. The relationship between demand and price is expressed in law of demand. This law states that other thing, remaining some, if price increases, demand decreases, and if price decreases, demand increases. Thus, there is an inverse relationship between price and demand.

2. Cost:

Cost plays a vital role in price determination. Cost form the base for determining the price. Different types of costs are there like production cost, marketing cost, overhead cost, office cost, transportation cost etc.

Above this, there is a profit margin for the seller. Different cost taken together plus the profit gives the price for the product.

3. Objectives of the Firm:

The overall objectives of the firm in general and pricing objectives in particular affect the pricing decisions. Different pricing objectives may be there like survival of the firm, profit maximisation, meeting beating competition, target return on investment, maintaining the image, earning goodwill etc. For example, if the objective of the firm is to penetrate the market a low price may be charged. On the other hand, if the objective is to beat the competition, firm may bring down the price below competitors price.

4. Competitive Environment:

The number of competitor’s and the degree of competition also influence pricing decisions. The price here may be set above or below or equal to the competitor’s price. In present day market condition the competition is so intense, that firms are constantly engaged in price war.

5. Buyer Behaviour:

Buyers mean both final buyers and intermediate buyers. The behaviour of the buyer significantly influence the pricing decisions. If more number of buyers are there, but they are not organised, it will not have much impact on pricing decisions as they lack strength to influence the price. However less number of buyers, who have more strength, exercise considerable influence on price. It is important to note that same pricing policy cannot be followed for final buyers and industrial buyers.

6. Economic Conditions:

The prevailing economic conditions in the country and outside have decisive impact on a firm’s pricing decisions. If the economic climate is good, demand increase resulting in increasing sales and more profit. Periods of boom add further to the prosperity of the seller and competitors. Opposite will be the case where there is general downturn or depression in the economy.

7. Product Life Cycle:

The different stages in the life cycle of a product also influence pricing decisions. In introductory stage normally penetration pricing policy is followed. Here the firm has to penetrate the market, hence a low price. Gradually as goodwill is build-up in the growth stage the prices can be raised. In the stage of maturity, the prices can be raised by following the policy of market skimming. In declined stage, prices are reduced to maintain the demand.

8. Marketing Mix:

Various elements of marketing mix are interrelated and interdependent. Any shift or change in any of them has an impact on the other elements. Therefore, pricing decisions should not be taken in isolation but in light of the product, place and promotion decisions.

Methods of Price Determination and How to price a product Calculation

On the basis of its various pricing objectives and policies, a firm may select a pricing method based either on cost, competition or demand factor. The choice of the method depends upon the pricing requirements of the management.

Important pricing methods are:

1. Cost Based Pricing Method

Cost based pricing method, also known as full cost pricing or mark-up pricing is the most commonly used method of pricing. It involves adding a certain percentage of cost to arrive at the price. Cost-plus and mark-up pricing are slightly different. The cost plus pricing is calculated on cost whereas mark-up considers percentage on sale. Under cost plus pricing, profit percent is calculated on cost (say 10 percent on cost) whereas under mark-up it is on sale say 10 percent on sale.

Under this method, base cost figure us taken, to which is added a certain percent of profit, which can be expressed in the following formula. Price = cost of production + profit margin, where cost of production = Fixed cost + variable cost per unit + factory overhead.

To Illustrate:

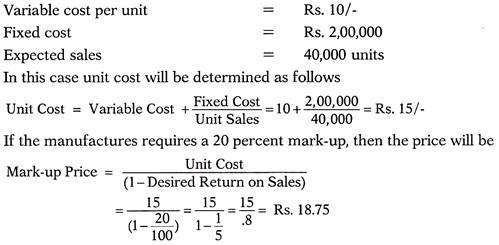

Furniture manufacturer has the following cost and sales forecast figure:

2. Target Return Pricing:

This is one of the most frequently used methods for pricing. It is based on the break even analysis. It sets the prices at a desired percentage return over and above the break-even point. Under this method, first the cost of producing and offering the goods is determined to which is added at target percentage return. The manufacturer has invested Rs.8,00,000 in the business and wants to earn 20 percent return on investment, the target return price will be as follows –

3. Competition Based Pricing Methods:

Most of the firms try to set the prices in relation to the competitor’s price. Through cost and demand factors are primary factors for price determination, it is also important that competitor’s pricing is also taken into consideration.

Competitions based pricing has two variations:

(a) Going Rate Pricing

(b) Sealed Bid Pricing

(a) Going Rate Pricing:

This is a method of setting price in relation to competitor’s price. Firm may charge a price either more or less or same as that of the competitor’s price. This is also known as customary pricing. This method is popular where it is difficult to measure the cost and a large number of firms are selling similar products.

(b) Sealed Bid Pricing:

Sealed bid pricing is used in those business units where the firms bid for jobs or contracts. It is a pricing method which is based on the competitor’s pricing rather than demand and cost of the product. To win a job or a contract the firm has to price its product below the competitor’s price.

However, here he has certain constraints. First he cannot price below the cost and second if he charges higher price, he may not win the contract. Thus, he is required to strike a balance between the two extremes. He can be guided by the expected profit of different bids, and go for that bid where he has maximum expected profit and reasonable chances of getting the bid.

4. Demand Based Pricing Method:

The major defect in cost and competition oriented pricing methods is that they do not consider consumers response to the proposed price. Greater consumer price consciousness among the consumers due to intense competition has caused firms to pay more attention to demand based pricing. Here the price is determined on the basis of demand and consumer’s perception about the product.

Accordingly there are two types of pricing here:

(a) Demand based pricing

(b) Perceived value pricing

(a) Demand Based Pricing:

Here the firm considers the pattern of demand of the product to set the price. Higher demand of product may lead to charging higher prices, and vice-versa. Demand based pricing is common in hotels, museums, status related goods industry etc. The main difficulty is that it is difficult to measure accurately the demand.

(b) Perceived Value Pricing:

This method of pricing, of late, is being used by many firms, where they set the price on the basis of the customer’s perception about the product. Here it is the buyer’s perception of value which is important for pricing and not the seller’s cost. On the basis of non-price factors like advertisement, product differentiation, superior quality etc. the price setters build up perceived value in the buyer’s mind and then price is set to capture the perceived value.

In brief, it is the product positioning through which marketer tries to create a good image of the product in buyer’s mind. For example; people perceive Tata Trucks, Leo Toys, and Bajaj Tempos as superior and are willing to pay a higher price for the product. The customer here has to be convinced as to why he should pay a particular price.

Steps Involved in Setting the Price:

The Pricing strategy plays a key role in the success of any business. Once a company develops a new product, it needs to fix the price. For example, Tata launched its midsized C segment car Indigo Manza on 14th Oct., 2009 and fixed the price between Rs. 4.8 Lacs to Rs. 6.75 Lacs, which is almost similar to its direct competitor Swift Dzire.

Recently Ford has also priced its compact SUV Ecosport quite competitively against Renault Duster. The pricing is so competitive that Ford is even aiming at buyers of compact sedans such as Maruti Suzuki Dzire and Toyota Etios.

A company may also need to price the product, when it enters new markets or a new geographical area. Most of the multinational companies face the challenge of pricing the product in different markets. Apple also had to juggle a lot while pricing its iPhone4 in India and ultimately, it decided the price of Rs. 31,000/- for an 8GB version and Rs. 36,100/- for a 16 GB version; while it costs $199 for an 8GB model and $299 for a 16 GB model in USA. But, somehow this pricing has not gone down well with the Indian customers and that’s why in the initial phase mere 20,000 units of iPhone have been sold in Indian market; while it is successful in most of the foreign markets.

Apple took a lesson from the iPhone4 and it launched iPhone5 with an EMI offer. It worked wonders for Apple and now it is selling more than 4,00,000 units every month with sales growth of 400%.

On the other hand, Motorola was also facing a tough time in the Indian market and nearly closed down its Indian operations. But today, with the success of Moto G, Moto X and Moto E, it has truly made a comeback. The exclusive deal with Flipkart helped in creating a big hype and the value

Price produces revenue for the company. The revenue in turn helps the company to fund the firm’s current value creation activities and generate a profit. It also helps a pharmaceuticals company like Ranbaxy or a technology company like Intel or Microsoft to support research that leads to future value creation. As the customer is interested in getting the value for his money, the price should be set in relation to the value delivered and perceived by the consumer. In case the price is lower than the value received, the company may lose the potential profit, while in the other case the company may lose customers.

Price is consumer’s incentive to buy and company’s incentive to sell. It is very crucial for any company, as too high a price will reduce the demand and too low a price will increase the demand, but will reduce the profit margin. That’s why you need to think a lot, while pricing your product.

A company may set the price on the basis of the following six steps:

1. Pricing Objective

2. Demand

3. Costs

4. Competition

5. Pricing Method

6. Final Price

1. Pricing Objective:

Here the company may be guided by the objective, it sets for the market. Few of the common objectives are:

i. Market Share:

For a large company like Reliance and Tata, the objective of market share is very important, as it produces several strategic benefits for the company. The ad campaign like ‘Kar Lo Dunia Mutthi Mein’ and subsequent pricing of the handset and mobile service at a down payment of just Rs.500/- led Reliance to have a leadership share in the mobile service category. This type of pricing is called Market Penetration Pricing, by pricing the product as low as possible.

ii. Profit Maximisation:

A company can also look for maximizing its profit in the short run or in the long run.

iii. Unit Sales Maximisation:

A company like Reliance or Tata DoCoMo may look forward to subscribing more and more people to the network or LG may try to sell the highest number of LED TV in India. Discourage competition – A company can also go for modest profits to discourage the entry of competitors in the market.

iv. Exclusivity:

Bentley, Rolls- Royce, Rolex may price their products higher to create a perception about exclusivity of the product. When a company launches a new technology, then they set a higher price to ‘skim’ the market. The consumer electronics Sony regularly follows the policy of Market Skimming pricing. When it launched High Definition television for the first time in 1990, the price was $43,000. Now the same product costs a mere $600.

v. Partial Cost Recovery:

In the case of nonprofit and social organisations, the pricing is based on the partial cost recovery like in the government colleges and hospitals.

vi. Slashing the Price of a Staple Item:

This strategy of ‘Loss Leader’ is regularly applied by retailers like Big Bazaar and Spencer’s in India, where they sell one staple item like Atta, Wheat, Rice or Sugar at a lower price to drive the traffic to their store. The losses are made up from stimulating the other profitable sales in the store.

vii. Trial Purchases:

A company may price the products lower to induce the trial purchases.

The objectives may differ from company to company and situation to situation, but the companies, which use price as a strategic tool, are the companies, which will be successful in the long run. The market forces or the cost should not drive the strategy of pricing.

2. Demand:

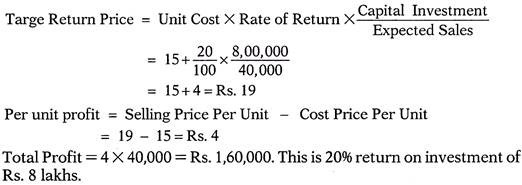

Once the pricing objective is clear, a company needs to determine the demand for the product or service. Generally, the price and the demand are inversely related – The higher the price, the lower the demand and the lower the price, the higher the demand. This is called Price elasticity of Demand. Once plotted on a graph, it is a downward sloping curve, as it is seen in the below figure.

I. Inelastic Demand Curve:

ii. Elastic Demand Curve:

But in the case of prestige and exclusive goods like Bentley or Rolls Royce cars, or perfumes like Christian Dior, Ralph Lauren, the higher price may lead to more demand, as some customers assume it to be of superior quality.

In the case of frequently bought FMCG products, the customers are very price sensitive. But in the case of infrequently bought items like LCD TV or Air Conditioner, they will be less price sensitive. Sometimes, a company can charge a higher price and still sell more, when the company can convince the customer that the Total Cost of Ownership (TCO) is lower than the competing brands. HP advertises on the principle of low cost of ownership for its PCs, by showing downtime cost to the company for its competitors PCs.

Generally companies try to estimate their demand curve by doing a statistical analysis or price experiments or by a survey. In the statistical analysis, the past data is analysed to understand the trends in the demand by doing longitudinal (over a period of time) or cross sectional (different locations in the same period).

A price experiment was conducted by Bennett and Wilkinson, where they systematically varied the prices of several products sold in a discount store and observed the results. Similarly customers can be enquired about the quantity they will buy at different price points.

It is important to understand price elasticity of demand for the pricing strategy. In the case of inelastic demand, where the impact of price change is not much; the company can change the prices. But in the case of elastic demand, it may hurt the company to increase the prices.

3. Costs:

Besides the demand, a company also needs to estimate the cost. Costs are internal to the company, while demand is an external factor. Demand shows the way as to how much maximum a company can charge its customers. While costs helps to find out how much minimum price can a company can afford.

In any business, there are different types of costs. Fixed Cost is the cost, which does not vary with production. For example, fixed cost like plant and machinery remains the same, whatever the number of units are produced. But variable costs vary with the production. For example, for producing one Tata Nano, five tyres are required and if you want to produce two Tata Nanos, then you require ten tyres.

Total Cost is the sum of the fixed and variable cost and average cost of the product is taken out from total costs divided by no. of units produced. A company should try to keep the production level at the optimum, where the average cost of production per unit is least.

Once a company goes on producing the same product for a longer duration like Maruti Suzuki manufacturing Alto or Hero manufacturing Splendor, then the company can reduce the average costs with accumulated production experience. It is also called Experience Curve or learning Curve. Maruti Suzuki still sells its Alto at a price lower than the price ten years back or Hero still sells its bike at a similar price of 1999 and makes a handsome profit, in spite of increase in raw material and component prices.

i. Activity Based Cost Accounting:

Retailing: In the age of organized retailing, the real profitability of dealing with different retailers, the manufacturer needs to use activity based cost (ABC) accounting instead of standard cost accounting. ABC accounting takes real costs into consideration on each of its customers. Besides the other costs, it also takes overhead cost into account.

ii. Target Costing:

Generally in the learning curve, you can reduce the cost of production with your scale and your experience. But if you are offering a new product in the market, then how do you do that? You do it by the cumulative effort of your engineers, designers and your suppliers.

This way you can reduce the cost and offer the product at a lower price than your competitor like the Japanese companies do. They call it Target Costing. They at first decide the price to sell it and then go backward to the target cost, on which they want the product.

Taking a cue from the target costing, Ratan Tata announced a car to be made for Rs. 1 Lac in 2003 and made it possible in the form of ‘Tata Nano’ in 2009. The success of Bajaj Auto can also be attributed to target costing, when Rajiv Bajaj decided to sell its bike Bajaj Boxer at four to six thousand rupees cheaper than Splendor, the largest selling bike in India.

4. Competition:

Competition plays an important role in setting the price. In few segments like Mobile Services, the competition is so tough that the companies react to the price change within hours and days. When Airtel launched the lifetime prepaid validity card for Rs. 999 on 23rd Dec., 2005, Hutch launched its lifetime scheme on 26th Dec., 2005 and Reliance on 27th Dec., 2005. It was then followed by Idea and MTNL.

In Oct., 2009, with Tata DoCoMo’s offer of one paisa one second, Aircel started offering the same and Reliance came out with 50 paisa per minute call rate for local or STD calls. Now, Airtel, Vodafone, Idea, MTNL and BSNL have been offering similar plans for their customers.

Although the price is decided on the basis of the cost and demand factors, the competitive prices and offers are very important to sustain the business. If the differentiation is big enough, then you can relax with your premium pricing. But if the difference is not understood, then the company may offer similar pricing or better pricing than the competitor.

5. Pricing Method:

On the basis of the customer demand, cost of the product and the price set by the competitor, the company can select a pricing method. There are several ways to select the price.

a. Full Cost or Markup Pricing:

Full Cost or Markup pricing is the most elementary and desirable way of pricing by the company. The company just needs to calculate its cost and then it has to decide the margin or the markup it wants, and price is decided. But the market is not that easy to let you decide your price. Most of the time, the customer and competition will drive you to go for a different pricing altogether.

b. Target Return Pricing:

In the similar way, a company may decide its return on investment (ROI). On the basis of the ROI, the company can decide its target return pricing.

c. Perceived Value Pricing:

In the case of perceived value pricing, price is decided on the basis of perceived value from the product by the customers. The value can be understood with the help of a survey, focus groups, conjoint analysis, statistical analysis of the past data and through own judgement.

Most of the time, leading companies prices their product higher than their competitor on the basis of higher perceived value; as the perceived value with the company is higher than the competitors, on account of better performance, warranty offered, customer care and brand value. Companies like DuPont and Caterpillar generally go for perceived value pricing.

d. Value Pricing:

Value pricing is an age old technique to price the products lower, while giving a high quality product to the customer. The success of retail giants like Wal-Mart, Big Bazaar, Vishal are a proof of that. Low cost airlines like Go Air, Indigo and Spice Jet also follow the value pricing method in the airline segment, introduced earlier by Captain Gopinath of Air Deccan. Bata also follows the value pricing for its footwear products in India.

Wal-Mart follows the philosophy of value pricing through Every Day Low Prices (EDLP), where it charges constant low prices. Another method is High-low pricing, where the prices are temporarily lowered for a specific period than the EDLP level. On the other days, the retailer charges a higher price.

e. Follow the Crowd or Going Rate Pricing:

It is largely based on competitors’ prices. Most of the commodities like cement, steel, paper, fertilizer, TMT bars are sold at a similar price. If there are some differences in the price, it is minuscule. Although the going rate pricing is based on the collective wisdom of the industry, it cannot be the best option for many companies.

f. Auction Type Pricing:

Sealed Bid Auction has been quite popular with the government agencies for getting the price from their suppliers. In the Business to business (B2B) segment also, it’s quite prevalent. Now it is also becoming popular for Business to consumer (B2C) or consumer to consumer (C2C) segment through Priceline(dot)com or Ebay(dot)in.

There are two types of auctions- English Auction and Dutch Auction. When there is just one seller and many buyers, the English auction takes place, where the highest bidder is decided on the basis of ascending bids. In Dutch auctions, it is decided on the basis of descending bids.

g. Group Pricing:

Group pricing is quite popular in the western countries, where through Internet, buyers join groups to purchase the products at a lower price. In India, snapdeal(dot)com was a popular website offering upto 90% discounts on group buying. But now it has become a full-fledged online shopping site. Mydala(dot)com with the tagline of ‘We bargain you gain’ is another website promoting group buying. Groupon is another very popular website, which is present in many countries across the globe, besides India

6. Final Price:

Pricing methods help a company to select a price from a range of prices.

While selecting the final prices, a company must consider the following:

a. Consumer Psychology and Pricing:

Many customers feel that if they are buying an expensive product, they are buying a better quality product. In status symbol and ego sensitive products also, price becomes an indicator of quality. Again, if the price happens to be an odd number and falls on say 99 or 95 or .95, then the consumers might feel it being cheaper. Bata pricing with Rs.99.95 or Rs 134.95 or a book priced at Rs. 295 or an LED television priced at Rs. 29990 makes pricing attractive to the customers.

Many companies also like to keep their maximum retail price (MRP) higher than the actual price in the market i.e. market operative price (MOP). It leads the customers to believe that the product is of high quality and now it is available for a lower price. In the case of Sony, actual prices may only be lower by 5%, while in the case of LG it can be 10-15% below the MRP In the case of new cars in demand, there is often lesser or no discount, while there will be more discount on the models, which are not so much in demand.

b. Gain and Risk Sharing Prices:

In the case of software, generally the prices are too high. In those cases, the software development company may guarantee the expected returns or expected profits or expected efficiency for the buyer company with the usage of the software. Here, the seller company might bear the risk in selling and the method is known as gain and risk sharing prices.

c. Impact of Other Marketing Activities:

Besides the price, depending upon the quality of the product and the advertising and promotions, a company can charge a premium price or, it can go for competitive pricing. Most of the times, consumers are more concerned about the quality, service, customer support, delivery and other aspects.

d. Company Pricing Policies:

Different companies in different sectors have different pricing policies, while selling the product. In the banking sector, with more usage of ATM and other facilities like online banking or mobile banking, most of the banks are charging penalty for not maintaining average quarterly balance (AQB). In the same way, most of the Low Cost Airlines charge a cancellation fee on their tickets. Dell uses a technique called ‘Cost Forecasting’ to price its products based on consumer demand and the company’s own cost.

e. Pricing Impact on Other Parties:

While a company decides its pricing it needs to take into consideration its distributors, dealers and retailers, besides the competition and the government regulations.

Pricing Policies and Strategies:

Pricing policies are the guidelines which provide a focus within which the company administers the policies to match the market needs. Without price policies, determination of price will be a difficult task. A policy framework relating to price should therefore be provide which will be consistent with the company’s objectives, costs, competition and demand for the product.

Various pricing policies are there which are as follows:

1. On the Basis of Variability:

Price variation policies are those in which the firm attempts to vary the price of its product, so as to match with the differences in the market need.

This includes:

(a) Variable Price Policy – In this policy the firm charges different prices from different buyers for the like goods. Same product is offered to different customers at different prices depending upon their bargaining ability, family relationship etc. More useful in small business, here the seller can adjust the price according to competitive position or equal to buyer’s perception about the product. However, this policy does not make buyer happy as they are paying different prices.

(b) One Price Policy or Fixed Price Policy – Under one price policy, firm offers its product to all customers at same price at a particular time. No discrimination is made between buyers in charging the price. There is no scope for bargaining. The main advantage of this policy is its administrative convenience and ability to maintain goodwill among customers. However, rigidities should be avoided.

(c) Non-Variable Price Policy – Also called as ‘one price’ policy, this policy charges similar price for sale of like goods to a class of buyers. The variations in prices are from class to class. For example, wholesalers, retailers, distributors etc. belonging to one class are charged similar price.

This policy is less discriminatory in nature than variable price policy as the price variations are from class to class and not from customer to customer. Within a particular class, all customers are charged same price. This method is popular with those firms who use indirect method of distribution as there will be no price bargaining with wholesalers, retailers etc.

2. On the Basis of Geographical Conditions:

There are long distance between the buyers and the sellers due to geographical conditions. While sellers have their production units concentrated in and around certain specific metropolitan cities, buyers are spread all over the country. The cost of transportation which links them is high. It is important to decide whether the transit charges will be borne by the seller or buyer. As a result, taking transport cost as major thrust, pricing policies are decided.

Major policies here are:

(a) Point of Origin Price Policy – In this type of policy, the firm quotes ex- factory price and does not consider the transportation cost for moving the goods to the point of destination. Here the firm may charge ex-factory price and Fare or Rail (F.O.R.) price. Under ex- factory price, buyer has to bear the entire transportation cost from the factory to the point of destination. Under F.O.R. pricing, the firm bears the cartage till the railway station. From there buyer has to bear the freight charges to bring the goods to the destination.

(b) Uniform Delivered Price Policy – This policy is also known as ‘postage stamp’ or ‘F.O.R’ or ‘destination price’. It is a policy in which the firm absorbs full transportation cost and delivers the goods to the buyers at a uniform price irrespective of the distance. Buyers in different parts of the country get the product at same price. In actual practice, the firm adds full or part of the total freight charges to the basic price and then arrives at a final price.

(c) Zonal Price Policy – Zonal price policy is a one in which the firm divides the markets into zones and uniform price is charged from the buyers located in the same zone. Price differs from zone to zone but within a particular zone, price is same for all customers. In this type of pricing, average transportation cost is added to the basic price to arrive at a zonal price. This policy helps in price-stabilization within a particular zone.

(d) Base Point Price Policy – In this price policy, the firm absorbs partially the transport cost. Certain specific locations are selected as the base point and the buyers pay ex-factory price plus the freight charges from the nearest base point instead of the actual freight incurred by the firm. The buyers who live near this base point have to pay less in comparison to the buyers scattered at far places.

3. On the Basis of the Competitors Price:

Markets are highly competitive these days and the role of the competitor cannot be ignored in deciding the price policy. Here the firm may adjust the price as per the prevailing price in the market. Price may be equal to, above or below the competitors price.

Accordingly following policies may be there:

(a) Meeting the competition policy – In this policy, the firm follows the competitor closely. It sets the price at the level of the competitors price. Any increase or decrease in price by the competitor is quickly followed by the firm also. Thus, the firm by maintaining the price at competitors level tries to meet the competition.

(b) Above the market policy – Under this policy, the firm charges a higher price than the price prevailing in the market. This type of policy is normally used by market leader firms who have a good reputation in the market. It is used in those industries which produce standardised product on mass scale.

(c) Under the market policy – In this policy, the firm decreases its price in comparison to the prevailing price of the competitor in the market. This type of pricing policy is mainly used when the firm wants to establish itself in the market or wants to expand the size of its market share.

4. New Product Pricing Policy:

New products are the products which are introduced for the first time in the market. This is a very crucial task and requires correct pricing policy otherwise the product will not be successful.

In case of new products there are two possible price policies:

(a) Skimming price policy – This policy sets the introductory price at high levels relative to the cost so as to ‘skim the cream’ off the market. Initially under this policy, high prices are set to take advantage of the inelastic demand, later the prices are reduced, so that more price sensitive customers can buy the product.

(b) Penetration price policy – This is opposite of skimming policy. This involves setting low initial price relative to the cost so as to penetrate the market and establish the firm. By setting low initial prices, the firm keeps away the competitors and can thus, enlarge its share by generating larger sales volume.

5. On the Basis of Price Differential:

Price differentials refer to the difference between the price quoted and price charged to the buyer. Price differentials have been accepted as a part of pricing strategies to encourage the buyers, to meet the competition and to achieve financial objectives.

Different forms of price differentials are:

(a) Discounts – Discounts reduce the price of the product from the quoted price. Discount is an allowance made to the buyers in consideration of marketing services rendered. Discounts are of four types; Trade discount, cash discount, quantity discount and seasonal discount. Trade discount is the deduction allowed due to the specific position of the buyers in the channel of distribution like wholesaler and retailers get trade discount from manufacturer.

Cash discount is the discount given to those who make the payment within the desired time limit. It is a reward for timely payment. Quantity discount is the discount allowed on the basis of quantities of goods brought. Seasonal discount are allowed to encourage purchasing in off season when less demand is there.

(b) Rebates – Rebate is also a deduction from the quoted price of the product. Rebate are allowed when buyer has suffered a loss of value satisfaction on account of reasons like defective goods, delay in delivery of goods, damaged goods, deterioration in quality etc. To compensate the buyer for these losses, rebates are given to the buyer.

6. On the Basis of Specialty:

(a) Leader pricing – Leader price policy is a one where the firm initiates a price change and other firms quickly follow it. In marketing terms, they are termed as ‘market leaders’ and ‘market follower’ respectively. The market here tries to follow the established and giant units.

(b) Loss leader pricing – Under this policy, the firm offers few popular products at low prices for short period of time. This is done to attract the market and lure the buyers to buy other products. Such popular products for short period of time are known as loss leaders.

(c) Psychological pricing – This type of pricing policy is mainly followed for consumer durables. The marketer here fixes the price in such a manner that it influences the psyche of the customer and he pays the price without evaluating much. Pricing of the shoe by the companies at Rs.249.50 instead of Rs.250.00 or Rs.399.95 instead of Rs.400.00, is a good example of this type of pricing. Consumer here never feels exploited, as the manufacturer is honest to the last paisa.

(d) Bait pricing policy – Under this policy, the marketer uses a bait to attract the customers. By showing low price goods he attracts the customers and then tries to sell high price goods. He first brings the customer inside the store through bait (normally low price items) and thereafter motivates him to buy high price goods.

Approaches to Product Pricing/Pricing Strategies:

A firm may adopt different pricing policy and consider the factors affecting the market.

There are eight different pricing strategies generally adopted by the retailers:

1. Skimming Pricing:

This Pricing strategy is often followed by the retailers for new products. A higher price in the introduction stage of the product and subsequently may settle down for a lower price. A high price in the beginning is OK, if the product has no competitor and demand is inelastic. A higher price can provide a large margin which generates cash flow easily and if the pricing is too high it affects sales then it can be easily lowered.

Skimming pricing will also help the firm get the feel of the market and demand for the product and then make suitable changes in the pricing strategy. This is generally adopted by retailers dealing in IT products. This strategy is employed only for a limited duration to recover most of the investment made to build the product.

2. Leader Pricing:

A pricing strategy where one particular industry sets the prices and the other entities in the industry has to imitate and follow similar price set strategies, In many consumer goods industries we do come across one or few price leaders and the market price is set by them via its pricing policy.

3. Penetration Pricing:

This strategy includes setting the price low with the goals of attracting customers and gaining market share. The price will be raised later once this market share is gained. It is the opposite of skimming price.

This method is quite useful in pricing new products when demand for products is highly elastic and makes large size sales at reasonable price before competitors enter the market with a similar product. Retailers dealing in Fast- moving consumer goods may use this strategy for certain product categories.

4. Price Bundling:

When the products which are closely related or unrelated are bundled together and sold as one unit at an attractive rate it is called as price bundling. Products are sold as a package. For ex- Travel and Tourism retailers often go for price bundling so as to differentiate their offerings in the form of package. Such price package includes Travel, Lodging and Boarding that can attract customers.

5. Multiunit Pricing:

When a customer buys in large quantities the retailers offer discounts on buying items in multiple units, it is referred to as multi-unit pricing. This strategy is applied successfully for the slow moving products. For ex- Three soaps for the price of two are best examples of multi-unit pricing.

6. Everyday Low Pricing:

When a retailer continuously offer their goods and services at the prices lower than its competitors, this pricing Strategy is known is Everyday Low Pricing or EDLP. Customers do not have to wait to seek products at cheaper rates in this type of strategy. This technique of price is best suited to the retailers in India where customers are price conscious, ex- Walmart.

7. Psychological Pricing:

This approach of pricing deals with emotion rather than rational response of the customer, this strategy is implied to attract the customers. This is sometimes referred to as odd pricing. Where retailers price product say as Rs. 199 or Rs. 295.97. However there is no conclusive evidence that such pricing policies make any significant difference to profits.

Ex- Bata company’s pricing strategy or the mobile talk time pricing strategy.

8. Decoy Pricing:

Methods of pricing where the seller offers at least three products and where the two of them have a similar or equal price. The two products with the similar prices should be the most expensive ones and one of the two should be less attractive than the others. This strategy will make people compare the options with similar prices and as a result sales of the most attractive choice will increase.