Some of the commonly used methods for calculating the valuation of a firm are as follows: 1. Capitalised Earnings 2. Assets Approach 3. Market Value Approach 4. Earnings per Share.

Valuation of Firms: Method # 1. Capitalised Earnings:

The capitalised earnings method is based on the philosophy that the price which a buyer would like to pay for the property of a concern will depend upon the present and expected earning capacity of the business. The present price is paid in the expectations of future returns from such investments. The capitalised earnings will depend upon the (1) Estimate of earnings, and (2) Rate of capitalisation.

The estimation of earnings will involve the study of past earnings. The past earnings over a long period will give an exact idea about the earning position of the business. The past earnings of one or two years may be influenced by abnormal causes such as price fluctuations, etc.; so, a true and fair opinion will not be made available and nothing should be concealed.

If the earnings are showing a stability then the earnings will be easily calculated; if, on the other hand, the earnings are showing a trend then some allowance should be made for the conditions prevailing at that time.

ADVERTISEMENTS:

After estimating the average earnings, the earnings should be capitalised to arrive at an investment value. A decision about the rate of earnings at which the profits are to be capitalised is very difficult. It is a sort of arbitrary figure. One should be guided by economic factors only while calculating capitalisation rate. If the earnings per share are Rs. 5 and the capitalisation rate is 10%, then the value of the share will be Rs. 50.

Valuation of Firms: Method # 2. Assets Approach:

Assets approach is the commonly used method of valuation. The assets may be taken at book value, reproduction value and liquidation value. In book value method, the values of assets are taken from a current balance sheet. The excess of assets over debts will determine the assets values, divided by the number of equity shares will give the value of one share.

If preference stock is also outstanding then preference stock should be deducted before dividing the assets values by the number of equity shares. This approach is also known, as net worth value. There is a difference of opinion about the assets to be included and assets such as goodwill, patent rights, and deferred expenses should be excluded.

Another view is that goodwill and patents should be included while fictitious assets such as deferred expenses should only be excluded. The fixed assets are taken at book value less depreciation upto present balance sheet period. A company following a rigorous depreciation policy may be at a disadvantage than the company providing lower depreciations.

ADVERTISEMENTS:

Public utilities may use the reproduction value of assets while valuing the properly. Liquidation values of assets are used on the assumption that if the concern is liquidated at present then what values will be fetched by the assets. The concern is taken as a going concern and as such current book values of assets are used in most of the cases.

Valuation of Firms: Method # 3. Market Value Approach:

This approach is based on the actual market price of securities settled between the buyer and the seller. The market value will be the realistic value because buyers will be ready to pay in lieu of a purchase. The price of a security in the free market will be its most appropriate value.

Market price is affected by the factors like demand and supply and position of money market. The price of a security in the free market will be its most appropriate value. Market value is a device which can be readily applied at any time.

A number of practical problems are faced while applying market value approach. The market value will be available for securities of big companies only. The number of shares offered in the market is generally small and it will not be advisable to apply the same value to the whole lot of shares of the company.

ADVERTISEMENTS:

Another objection against this method is that there are many upward and downward trends in values of securities in the stock exchanges and it becomes a problem to decide about the price to be taken for valuation. Despite practical limitations, market value approach may be used under many conditions.

Valuation of Firms: Method # 4. Earnings per Share:

Another method of determining the values of the firms under merger or consolidation is the earnings per share. According to this approach, the value of a prospective merger or acquisition is a function of the impact of merger/acquisition on the earnings per share.

Such impact could either be positive resulting into the increases in EPS or may be negative resulting into dilution of EPS. As the market price per share is a function (product) of EPS and Price-Earning Ratio, the future EPS will have an impact on the market value of the firm. The following illustrative examples explain the effect of merger/acquisition on EPS.

Illustration 1:

ADVERTISEMENTS:

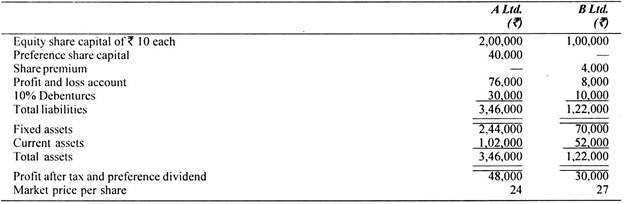

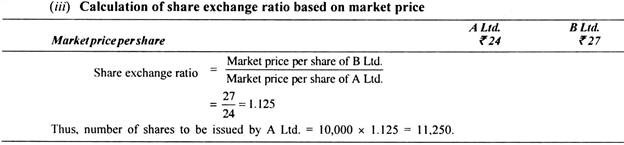

A Ltd. wants to take over B Ltd. and the financial details of both the companies are as below:

You are required to determine the share exchange ratio to be offered to the shareholders of B Ltd., based on:

(i) Net assets value,

ADVERTISEMENTS:

(ii) EPS, and

(iii) Market price.

Which should be preferred from the point of view of A Ltd.?

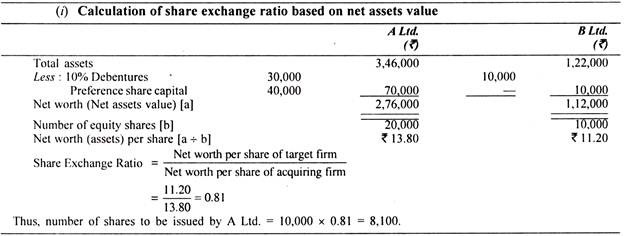

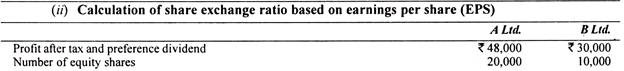

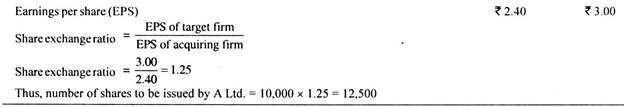

Solution:

Comments:

ADVERTISEMENTS:

A Ltd. should prefer the share exchange ratio based on net assets value as it has to issue minimum number of shares i.e., 8,100 in that case.

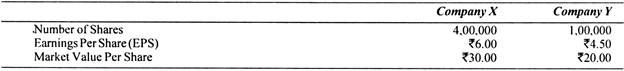

Illustration 2:

Company X is considering the purchase of company Y.

The following are the financial data of the two companies:

Assuming that the management of the two companies has agreed to exchange shares in proportion to:

ADVERTISEMENTS:

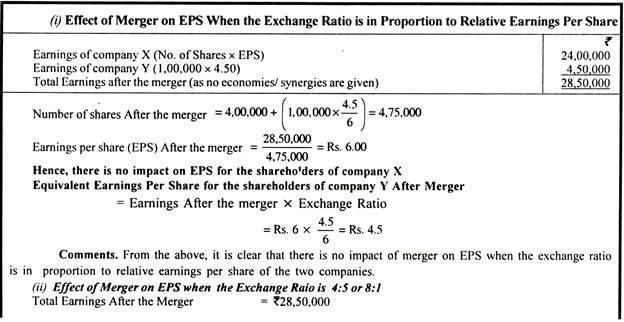

(i) The relative earnings per share of the two firms;

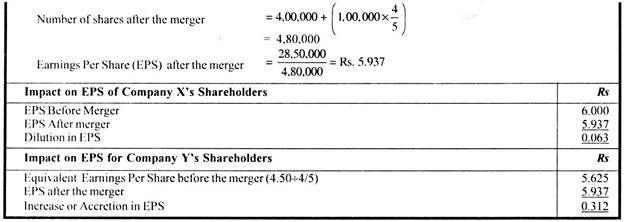

(ii) 4 shares of company X for every 5 shares held in company Y.

You are required to illustrate and comment on the impact of merger on the EPS.

Solution:

Comments:

ADVERTISEMENTS:

When the exchange ratio is 4:5, the impact of merger on EPS is dilution of Rs. 0.063 per share on the earnings per share for the shareholders of the acquiring company and accretion in the EPS of the acquired firm amounting to Rs. 0.312 per share. However, for a more reliable analysis of the impact of merger on EPS, the growth rate of the two companies should also have been considered.

Illustration 3:

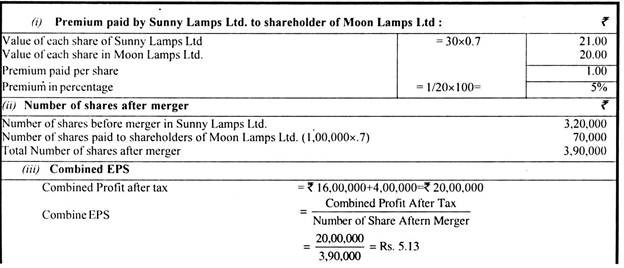

Sunny Lamps Ltd. is taking over Moon Lamps Ltd. As per the understanding between the managements of the two companies, shareholders of Moon Lamps Ltd. would receive 0.7 shares of Sunny Lamps Ltd. for each share held by them.

The relevent data for the two companies are as follows:

Ignoring the economies of scale and the operating synergy, you are required to calculate:

ADVERTISEMENTS:

(i) Premium paid by Sunny Lamps Ltd., to the shareholders of Moon Lamps Ltd,

(ii) Number of shares after the merger;

(iii) Combined EPS;

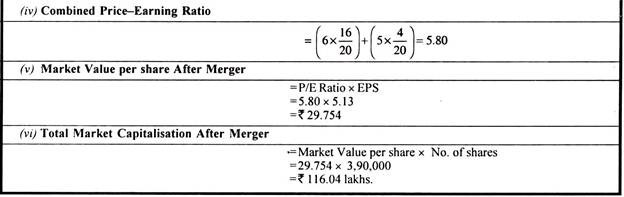

(iv) Combined P/E ratio;

(v) Market value per share; and

ADVERTISEMENTS:

(vi) Total market capitalisation after the merger.

Solution: