In this article we will discuss about the cost and types of hedging adopted by companies to mitigate exchange rate risk.

Cost of Hedging:

Companies use contractual and non-contractual methods to hedge exchange rate risk. Transaction exposure is hedged through contractual and non-contractual methods. Translation exposure can be hedged through contractual methods. Operating exposure is difficult to hedge given the long time horizon and the difficulty of forecasting exchange rate movements far into the future.

The decision to undertake a cash flow hedge of a foreign currency position is preceded by several steps. The first step is to assess probability of occurrence, and the second is to assess its impact on cash flows. An exchange rate risk is hedged when probability of adverse exchange rate movements is high and this is likely to have a significant impact on cash flows. The manager is now faced with several alternatives- should he hedge the exchange rate risk, or leave it un-hedged? If he chooses to hedge, should he choose a partial hedge or a total hedge?

In either case, what are the contractual and non-contractual hedges available, and what is the basis for selecting an appropriate hedging method? As with any other corporate decision, the decision to hedge is not without costs. A careful cost-benefit analysis is necessary before deciding on a hedge and selecting the most appropriate hedge. Hedging involves direct costs and indirect costs. Direct costs are incurred in financial hedges, and consist of brokerage cost and the bid-ask spread. Indirect costs are incurred in financial hedges and in non-financial hedges. They are more difficult to identify and measure, and are calculated ex post.

ADVERTISEMENTS:

They include:

i. The losses suffered as a result of not hedging;

ii. Losses suffered by not choosing the appropriate aspect to hedge; suppose an Indian company sources two raw materials from overseas, and payments are denominated in US dollars. Material A is purchased only twice a year. Material B is purchased every two weeks. The company hedges purchases of B because of the higher frequency of purchase. A closer analysis reveals that currency risk on purchase of A is higher—there is a much greater impact on the rupee cash outflows and on the company’s profitability due to purchase of A than the purchase of B. Therefore, the company would be better off hedging purchases of A. The indirect cost is the incremental rupee cash outflows (sum of A’s cash outflows minus sum of B’s cash outflows).

iii. The inability to take advantage of favourable price movements because of entering into a hedge; when a company enters into a one month forward contract for purchase of a foreign currency (such as the US dollar), the purchase is made at the forward rate (for example INR 43/USD), so it is protected against domestic currency depreciation (the spot rate one month hence may be INR 43.70/USD). But one month hence if the domestic currency appreciates instead (INR 39/USD), the company cannot buy foreign currency in the spot market, because of its commitment to purchase the same at the price specified in the forward contract (INR 43/USD).

ADVERTISEMENTS:

iv. The opportunity cost of margin money in a futures contract; since a futures contract is marked to market, when the price volatility of the product (and therefore of the price of the futures contract) is greater, the company will be required to post higher margin money.

v. Losses from a steep fall in asset values due to not hedging against systemic risk—the losses are bankruptcy cost, reputational risk, and litigation risk. Assets can be a loan portfolio (in the case of a lending institution), or a portfolio of securities (for an investment firm, a hedge fund, or a financial institution). Systemic risk is a failure of the entire market, due to which asset prices collapse, investment values plummet, and models such as VaR (value at risk) and CaR (cash flow at risk) are rendered meaningless.

Reputational risk is suffered from making unsound investment decisions, leading to the risk of facing litigation, and in an extreme case, to bankruptcy. Since systemic risk is relatively rare and difficult to predict, hedging the entire portfolio value is not only expensive but unnecessary.

vi. Loss due to frauds by in-house derivatives traders; when the system of internal checks and balances on currency derivatives trading are either absent, inadequate, or not enforced, the company is affected by severe losses, as well as reputational risk. Financial services companies, especially banks (National Australia Bank, Barings Bank, Societe Generale, Sumitomo) have suffered tremendous losses due to the activities of ‘rogue’ traders of currency derivatives.

ADVERTISEMENTS:

In the absence of internal controls, currency traders at National Australia Bank lost AUD 252 million through trading in currency options contracts. They breached their trading limits and eventual losses on their currency trading reached AUD 252 million. A few traders were fired and the Chief Executive of the bank was forced to step down. In 2010, employees at Societe Generale in Singapore were found guilty of making wrong decisions with respect to currency values that caused huge losses to the bank’s client.

Illustration:

The contracted price for purchase of 1,000 tons of iron ore, in a two-month forward contract is Rs. 10,000 per ton. Calculate the upside loss and downside protection when the price of iron ore per ton, at the end of two months, is (a) Rs. 9,400 (b) Rs. 10,200. Would the option not to hedge the purchase have been a better choice?

Solution:

ADVERTISEMENTS:

The forward contract must be honoured on the maturity date. The price payable on maturity is (Rs. 10,000) (1,000 tons) = Rs. 100,00,000

Spot price of iron ore on the maturity date = Rs. 9,400/ton

Total cash outflow for spot purchase of 1,000 tons = (Rs. 9,400) (1000) = Rs. 94,00,000

Upside loss = Rs. 100,00,000 – Rs. 94,00,000 = Rs. 6,00,000

ADVERTISEMENTS:

Spot price of iron ore on the maturity date = Rs. 1,02,000

Total cash outflow for spot purchase of 1,000 tons =(Rs. 102,000) (1000) = Rs. 1,02,00,000 Downside gain = Rs. 1,02,00,000 – Rs. 100,00,000 = Rs. 2,00,000

Since the gain from a potential decrease in iron ore price, is higher than the loss from a potential increase in iron ore price, an un-hedged position would have been more beneficial to the company.

Types of Hedges:

There are two types of hedges—natural hedges and financial (or contractual) hedges. Natural hedges are methods available to a firm due to the nature of its operations, the global distribution of its supply chain, cash flows, assets and liabilities. They do not involve the purchase (or sale) of currency derivatives. Financial hedges are contracts entered into by the firm to hedge risks that are not covered (or cannot be covered) by natural hedges. Companies must explore and use both.

ADVERTISEMENTS:

Natural hedges arise in the supply chain (local sourcing and production and multiple markets) and in cash management (currency diversification, pooling, leading and lagging, borrowing in local currency and shifting currency risk to another party). Contractual hedges take the form of forward contracts, futures and options contracts besides money market hedges.

i. Natural Hedges:

When an MNC locates production in the overseas market where it sells its product, and sources some or all of the inputs in the same market, exchange rate movements will have a limited impact on profitability. Hyundai exports cars from India. The rupee appreciation against the dollar does not affect Hyundai’s short- run export competitiveness due to the import content of its cars.

Examples of natural hedges are:

ADVERTISEMENTS:

i. Setting up production facilities in a number of countries

ii. Sourcing raw materials from the country in which the finished product is sold; Siemens, the German MNC, buys material from the countries in which it sells its products. This reduces its foreign exchange risk.

iii. Selling products/services in multiple markets; a company that sells its products in a number of countries may find that its domestic currency depreciates against some of the foreign currencies, and appreciates against others. The probability that all the currencies will move in the same direction (either collectively appreciating or depreciating against the company’s domestic currency) decreases as the company diversifies across more countries. Therefore, invoicing sales in the currency of each country offers a natural hedge.

iv. Borrowing in host country (local) currencies; this is especially profitable when the local currency is expected to depreciate. Suppose an Indian MNC sells its product in the USA, and has a plant in Milwaukee for which it needs debt funding. The dollar has been depreciating against the Indian rupee and this trend is expected to persist over the tenor of the loan. It makes sense to borrow in dollars and service the debt through dollar revenues. This strategy of local currency borrowing also helps the company to avoid currency mismatch, by borrowing in the currency in which it generates revenues.

ii. Financial Hedges:

Also known as contractual hedges, they are contractual positions in currency derivatives— currency forward, options, futures and a currency swap. They are used for cash flow hedges, balance sheet hedges, money market hedges, cross-hedges and swaps. They reduce or offset translation exposure and transaction exposure. What about economic exposure? This depends upon the availability of financial hedges over a long period.

ADVERTISEMENTS:

Hedging protects an open position in foreign currency that is likely to experience price fluctuation. An Open position refers to the existence of assets and/or liabilities denominated in foreign currency. Assets can be current assets (foreign currency, short-term investment in foreign currency-denominated securities, foreign currency-denominated receivables) or fixed assets (plant, equipment held overseas) and long-term loans given in foreign currency.

Liabilities can be current liabilities (foreign currency-denominated payables) or long-term liabilities (long-term loan denominated in foreign currency).

Use of contractual hedges has a significant impact on the firm’s performance. Empirical evidence has shown that the performance of companies that used derivatives was better than those that did not. Performance was also linked to the type of derivative policy in place— companies with a comprehensive derivatives policy recorded better performance. The extent to which a company is willing to hedge depends upon its risk appetite. Spinard, Faris, Culp and Nunes (2010) defined risk appetite as ‘the stated willingness to accept exposures to uncertain events’. The higher the risk appetite, the more likely is the company to let the exposure go un-hedged.

There are also regional differences in the methods used to hedge foreign exchange exposure. Research has found that netting was popular among UK and US MNCs. Non-contractual and contractual hedging methods are equally important for dealing with translation exposure among UK and US MNCs. But MNCs in the Asia-Pacific region preferred non-contractual methods. American and British MNCS preferred the forward contract as a hedging device. Non-contractual and contractual methods minimize fluctuation of earnings, and achieve certainty of cash flows.

iii. Money Market Hedge:

A money market hedge refers to the simultaneous borrowing and lending in two different currencies on a short-term basis in order to hedge transaction exposure. The chief virtue of the hedge is that the domestic currency value of future cash flows is certain.

ADVERTISEMENTS:

Financial Derivatives in Corporate Financial Management:

Using derivatives has become a part of corporate financial management. Details of the types of derivatives used, and the extent to which foreign exchange was not hedged during a financial year, are now mentioned in annual reports. Tata Tea’s annual report (2008-09) stated that the company took a ‘cautious approach’ to hedging and fully hedged all ‘known’ exposures. It hedged its currency risk exposure is with respect to purchases in US dollars, sales in Canadian dollars and euros.

It hedged economic exposure for a maximum of 18 months using forward contracts and options contracts. It entered into cash flow hedges ‘to hedge risks associated with foreign currency fluctuations relating to certain firm commitments, and highly probable transactions’. Any gain or loss from hedging was shown in the Profit and Loss account. Its fair value hedges were marked to market on the balance sheet date.

A Cash flow hedge is used to protect from foreign exchange exposure due to:

i. A known future payment (sundry creditors, interest payable) or receipt (sundry debtors)

ii. A highly probable transaction involving foreign exchange (purchase of raw material from overseas).

ADVERTISEMENTS:

Hedging Translation Risk:

With the exception of the current method used in the USA, other translation methods use a number of different exchange rates to convert items in the financial statements into the parent company’s reporting currency. This results in exchange difference. Exchange difference may be hedged through financial hedges.

Hedges for Cash Management:

Affiliates of an MNC forecast, hold, invest, and manage cash to meet their day-to-day requirements (transaction motive), to take advantage of a profitable opportunity (speculative motive) and for sudden requirements (precautionary motive). When they are given full freedom to do so, cash management is decentralized. The advantage of decentralization is that local managers are more familiar with the unique (and distinct) political/corporate/legal/financial/cultural environment within which the affiliate operates, and make cash management decisions within this framework.

When the affiliate is located in a country where funds transfer mechanisms are rudimentary, due to which there may be a delay in cash remittances from the parent MNC, decentralized cash management gives the affiliate the ability to meet its payment obligations without impairing its reputation.

When the parent MNC undertakes the cash management function for its overseas affiliates, cash management is centralized. Centralization allows a parent company to take a holistic view of the entire group of companies. The parent company can advise each affiliate on which currency it should denominate receipts and/or payments based on trends in exchange rates, when to undertake a contractual hedge, and regulate the timing of inter-affiliate payments. Centralization enables the MNC to minimize its exchange rate risk are currency diversification, pooling, leading and lagging, and netting.

ADVERTISEMENTS:

Currency Diversification:

It refers to the holding of different currencies with the objective of neutralizing the effects of exchange rate movements. Since currencies do not move up or down together (their movements are not perfectly correlated) the appreciation of some currencies against the parent company’s home currency will be compensated by the depreciation of others in the portfolio. The variance in the value of a portfolio of different currencies is lower than the sum of the variances in the value of each currency. Therefore, currency diversification reduces exchange rate risk. It also enables the parent company to decide whether or not to hedge the receivables and payables of its affiliates.

Pooling:

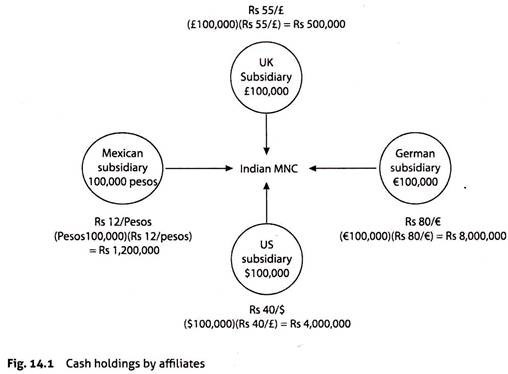

This refers to the practice of the parent company holding and managing cash on behalf of all its affiliates, which reduces the total cash holding of the entire group. (Fig. 14.1). When the cash requirements of each subsidiary are not synchronized, the parent can hold a lower cash balance and still meet the requirements of each subsidiary as an when they arise.

The figure shows that each subsidiary held 100,000 units of cash in its local currency. The current exchange rate is given outside each circle. At these exchange rates, the rupee holdings of the four subsidiaries were Rs. 18.70 million (Rs. 500,000 + Rs 1,200,000 + Rs. 8,000,000 + Rs. 4,000,000). If the Indian MNC held cash on their behalf, it may be able to successfully meet subsidiaries cash requirements with holdings of only Rs. 10 million.

Pooling is possible under centralized cash management. If an MNC has 160 overseas affiliates then there are an equal number of cash balances being maintained around the world. But pooling reduces this to one cash balance. In addition, lower cash balances are held on behalf of the entire group of companies, thereby reducing idle cash balances. The second advantage of pooling is that the parent company takes money market investment decisions on behalf of the entire group of subsidiaries.

ADVERTISEMENTS:

By doing so, it can increase the return on assets by choosing to invest in a money market that is deep and liquid. It may invest surplus cash of the entire group in its own money market, which may be relatively more developed, deeper, more liquid, and offers more money market instruments than in the countries of the affiliates.

The third advantage of pooling is that the parent company can choose the currency in which cash balances should be held so as to take advantage of exchange rate movements for the entire group of companies. The Indian parent company may decide to hold all cash balances in US dollars because it believes that the rupee will depreciate against the US dollar over the next 12 months.

Since the US dollar is a strong currency, chances are that the currencies of the overseas affiliates will also depreciate against the dollar. When the Mexican subsidiary makes a request for cash, the Indian parent remits dollars, which on conversion will give more pesos since depreciation of the peso against the dollar was greater than that of the rupee. Holding cash balances in appreciating currencies is a strategy that benefits the entire group.

Pooling has four disadvantages. They are – higher conversion costs, delays in remitting cash to subsidiaries, denial of cash management opportunities to local affiliates, and unanticipated movements in exchange rates. Conversion costs increase because currency conversion happens for every remittance within the group. In the above example, pounds, euros, dollars and pesos have to be converted into rupees (if the parent company holds cash is held in rupees), and reconverted into four currencies as and when requests are met. Every conversion involves costs. The costs can be avoided under decentralized cash management, under which affiliates maintain their own cash balances.

Delay in the transmission of funds from the parent company to the concerned subsidiary may lead to the subsidiary losing out on an important business opportunity, or delaying a payment that affects its reputation and credit standing in its country. Pooling does not allow the management of the overseas subsidiary to be held accountable for cash management, and learn effective cash management.

It prevents an adequate assessment of the capabilities of the management team in charge of the affiliate. Lastly, exchange rate movements may reduce or eliminate the benefits of pooling. If the parent company’s currency depreciates against those of its overseas affiliates’ subsidiaries’ currencies, then pooling may cause the whole group to be worse off.

Leading and Lagging of Hedges:

Leading refers to the speeding up of receivables. Lagging refers to delaying payables. Leading and lagging permit synchronization of cash flows so that exchange rate risk is reduced. Suppose an Indian company has receivables of $50,000 receivable from a Malaysian importer, due on June 15. It requests its customer to pay on June 1. This is called leading of exports. The Indian company has payables of $85,000 to an American firm, due on June 30. It tells its customer that it will pay on July 10. This is called lagging of imports. Leading enables the firm to speed up its cash inflows, and lagging enables it to delay cash outflows.

When there are inter-affiliate transactions between two affiliates located in different countries, receivables of the first affiliate are the payables of the second affiliate, and payables of the first affiliate are the receivables payables of the second affiliate. When the first affiliate leads its export, the other subsidiary is forced to pay earlier than expected. Similarly, when the first affiliate lags its import, the other subsidiary is forced to wait for payment.

Netting refers to the process by which a company uses leading and lagging so as to reduce its foreign exchange risk, and reduce (or eliminate) hedging as well as hedging costs. Netting reduces the total amount of money moving between subsidiaries. The benefits from netting can be enormous when there are many affiliates and numerous inter-affiliate receivables and payables, each designated in a number of currencies. Given autonomy in cash management, each affiliate would prefer to lag its imports and lead its exports wherever possible, so as to improve the timing of its cash flows. Only the parent company can understand the benefits of netting to the group, and can persuade affiliates to cooperate.

Centralized cash management, therefore, enables the parent company to take cash management decisions in the interests of the entire group of companies. The parent company uses leading, lagging, netting, pooling, and currency diversification to reduce the group’s overall foreign exchange risk, transaction costs, and inter-subsidiary funds movement.

Centralization involves a cost-benefit analysis, where the pros (lower cash balances, lower conversion costs, fewer hedges) should be periodically weighed against the cons (unpredictable exchange rate movements, higher conversion costs, delay in remitting cash to affiliates). Centralization makes sense when the parent company has reason to believe that there is likely to be an increase in political risk in countries where the affiliates are located. If the overseas country is likely to freeze assets or impose repatriation restrictions the parent company may feel it is better to pool affiliates’ cash because the home jurisdiction is perceived as being more friendly and predictable.

Shifting Currency Risk:

When a part of a company’s revenues are generated from overseas, it can completely avoid currency risk by invoicing all sales in domestic currency. This however depends upon the company’s freedom in choosing the invoicing currency. Another alternative is an agreement between the company and the other party to bear the currency risk depending upon the extent of exchange rate movements.

Centralized Versus Decentralized Cash Management:

Cash pooling, leading, lagging, and netting are regularly practiced by MNCs. But regulations in some countries do not permit pooling, leading, lagging and netting. In others, a ceiling is imposed on the number of days by which a payable can be lagged and a receivable can be lead. In Taiwan prepayment and delayed payment can be extended up to 360 days.

In some countries such as China, leading and lagging is used to pay cash poor entities early and cash-rich entities later though cross-border netting is not permitted. Given the different regulatory regimes in different countries, an MNC cannot enforce centralized cash management on those affiliates located in countries with restrictions.

When Not to Hedge:

As with any business decision, hedging involves a cost. Affiliates of an MNC may be undertaking unnecessary hedges. The parent company’s overall view of global operations can reduce the number of hedges, and the risks hedged by affiliates. The parent company is in the unique position of being able to assess the overall level of a specific risk, either translation risk, economic risk, or transaction risk, as well as industry practices and competitors pricing policies.