After reading this article you will learn about:- 1. Meaning of Bonus Issue 2. Effects of Bonus Issue 3. Advantages 4. Disadvantages.

Meaning of Bonus Issue:

A company can pay bonus to its shareholders either in cash or in the form of shares. Many a times, a company is not in a position to pay bonus in cash inspite of sufficient profits because of unsatisfactory cash position or because of its adverse effects on the working capital of the company.

In such cases, if the company so desires and the articles of association of the company provide, it can pay bonus to its shareholder in the form of shares by making partly paid shares as fully paid or by the issue of fully paid bonus shares.

The dictionary meaning of bonus shares is: ‘a premium or gift, usually of stock, by a corporation to shareholders’ or “an extra dividend paid to shareholders in a joint stock company from surplus profit.” However, in legal context the meaning is not the same. A bonus share is neither dividend nor a gift.

ADVERTISEMENTS:

It is governed by so any regulations that it can neither be declared like a dividend nor gifted away. Issue of bonus shares in lieu of dividend is not allowed as according to Section 205 of the Companies Act, 1956, no dividend can be paid except in cash. It cannot be termed as a gift also because it only represents the past sacrifice of the shareholders.

Effects of Bonus Issue:

When a company accumulates huge profits and reserves, its balance sheet does not reveal a true picture about the capital structure of the company and the shareholders do not get fair return on their capital. Thus, if the Articles of Association of the company so permit, the excess amount can be distributed among the existing shareholders of the company by way of issue of bonus shares.

The effect of bonus issue is two-fold, viz.:

(i) It amounts to reduction in the amount of accumulated profits and reserves.

ADVERTISEMENTS:

(ii) There is a corresponding increase in the paid up share capital of the company.

By the issue of bonus shares, the accumulated profits and reserves of the company are converted into share capital which is used permanently in the business and hence it is also known as Capitalisation of Profits and Reserves.

The following circumstances warrant the issue of bonus shares:

(1) When a company has accumulated huge profits and reserves and it desires to capitalise these profits so as use them on permanent basis in the business.

ADVERTISEMENTS:

(2) When the company is not able to declare higher rate of dividend on its capital, in spite of sufficient profits, due to restrictions imposed by the Government in regard to payment of dividend.

(3) When higher rate of dividend is not advisable for the reason that the shareholder may expect the same higher rate of dividend in future also.

(4) When the company cannot declare a cash bonus because of unsatisfactory cash position and its adverse effects on the working capital of the company.

(5) When there is a large difference in the nominal value and market value of the shares of the company.

ADVERTISEMENTS:

Hence, the bonus issue is made to achieve the following objects:

(1) To bring the amount of issued and paid up capital in line with the capital employed so as to depict more realistic earning capacity of the company.

(2) To bring down the abnormally high rate of dividend on its capital so as to avoid labour problems such as demand for higher wages and to restrict the entry of new entrepreneurs due to the attraction of abnormal profits, as illustrated below:

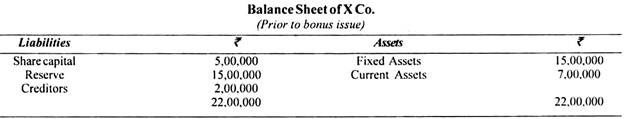

Assume that the company earns a profit of Rs. 4,00,000 in the year. It will mean 4,000 × 100/5,00,000 i.e., 80% returns on its capital and it may attract many new entrepreneurs into the business and may also create other problems from labour.

ADVERTISEMENTS:

But in reality the profit of 74,00,000 has been earned not on a capital of Rs 5,00,000 but on the actual investment of Rs 20,00,000, i.e. Rs 5,00,000 capital plus Rs 15,00,000 Reserves, making a return on its actual investments to

4,00,000 × 100/20,00,000 = 20% only

Hence, to bring down abnormally high rate of dividend, it is advisable that the company should issue shares:

ADVERTISEMENTS:

(3) To pay bonus to the shareholders of the company without affecting its liquidity and the earning capacity of the company.

(4) To make the nominal value and the market value of the shares of the company comparable.

(5) To correct the balance sheet so as to give a realistic view of the capital structure of the company.

Advantages of Bonus Issue of Shares:

(A) Advantages from the viewpoint of the company:

ADVERTISEMENTS:

(1) It makes available capital to carry an a larger and more profitable business.

(2) It is felt that financing helps the company to get rid of market influences.

(3) When a company pays bonus to its shareholders in the value of shares and not in cash, its liquid resources are maintained and the working capital of the company is not affected.

(4) It enables a company to make use of its profits on a permanent basis and increases creditworthiness of the company.

(5) It is the cheapest method of raising additional capital for the expansion of the business.

(6) Abnormally high rate of dividend can be reduced by issuing bonus shares which enables a company to restrict entry of new entrepreneurs into the business and thereby reduces competition.

ADVERTISEMENTS:

(7) The balance sheet of the company will reveal a more realistic picture of the capital structure and the capacity of the company.

(B) Advantages from the viewpoint of investors or shareholders:

(Impact of bonus issue on proportionate ownership, earnings per share and share price):

It is generally said that an investor gains nothing from the issue of bonus shares. It is so because the shareholder receives nothing except some additional share certificates. But his proportionate ownership in the company remains unchanged.

For example, say, a company has 10,000 equity shares of Rs. 10 each, out of which Mr. A owns 1,000 shares. Now the company issues bonus shares at the rate of 1 share for every 2 shares held in the company.

After the bonus issue, the total share capital of the company shall be 10,000+5,000=15,000 shares of Rs 10 each of which Mr. A shall own 1,000+500=1,500 shares. His proportionate ownership prior to the bonus issue was 1,000/10,000 × 100 = 10%

ADVERTISEMENTS:

And after the bonus issue, his proportionate ownership shall be 1,500/15,000 × 100 = 10%

Hence, the proportionate ownership remains the same and on this account, he does not gain anything. But in any case, he should be happy as he owns 1,500 shares now against 1,000 shares owned prior to bonus issue as he is the gainer by 500 shares received free of cost, which he should be able to sell in the market.

But what happens is that generally, a company is not able to maintain the same rate of dividend on its shares in future and the prices of the shares fall in the market as a result of bonus issue. Therefore, practically, the shareholder gains nothing. This can be illustrated with the help of the following example.

Equity Share Capital

10,000 Equity Shares of Rs. 10 each = Rs. 1,00,000

Say, the company’s average profit prior to bonus issue is Rs. 20,000

ADVERTISEMENTS:

That income return on capital is 20,000/1,00,000 × 100 = 20%

After the bonus issue of 5,000 equity shares, the capital of the company shall be 15,000 shares of Rs. 10 each i.e. Rs. 1,50,000.

But the earning capacity of the company does not increase because the assets of the company remain the same. And hence there is every possibility that the average profit shall remain the same, Rs. 20,000 making return on 20,000/1,50,000 =13.33%. It is clear that the return on capital has fallen from 20% to 13.33%.

So the prices of the shares in the market shall fall accordingly, making the value of 1,500 shares nearly the same as it was for 1,000 shares prior to bonus issue, which proves that there is no gain to the investor. But in case the company is able to maintain or increase the rate of dividend on its shares after the issues of bonus shares, the prices of its shares will not fall and the investor will gain substantially.

To sum up, the advantages to the shareholders are:

(1) The bonus shares are a permanent source of income to the investors.

ADVERTISEMENTS:

(2) Even if the rate of dividend falls, the total amount of dividend may increase as the investor gets dividend on a larger number of shares.

(3) The investors can easily sell these shares and get immediate cash, if they so desire.

Disadvantages of Bonus Issue of Shares:

Inspite of many advantages, the issue of bonus shares suffers from the following disadvantages:

(1) The issue of bonus shares leads to a drastic fall in the future rate of dividend as it is only the capital that increases and not the actual resources of the company. The earnings do not usually increase with the issue of bonus shares.

Thus, if a company earns a profit of Rs. 2,00,000 against a share capital of Rs. 5,00,000 and the capital of the company is raised by the issue of bonus shares to Rs. 8,00,000, the rate of dividend falls from 40% to 25%.

(2) The fall in the future rate of dividend results in the fall of the market price of shares considerably, this may cause unhappiness among the shareholders.

ADVERTISEMENTS:

(3) The reserves of the company after the bonus issue decline and leave lesser security to investors.