After reading this article you will learn about:- 1. Concepts of Working Capital 2. Objectives of Working Capital 3. Factors.

Concepts of Working Capital:

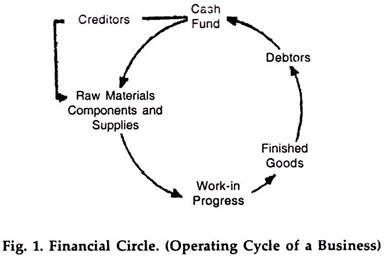

Working capital or circulating capital indicates circular flow, of cash (cash-flow cycle), i.e., a sort of a revolving fund starting with cash used to pay for raw materials, labour and operating expenses and when finished products are ready for sale, the cash is recovered through sale of these, goods (on cash or on credit).

Thus, we have a circular cash-flow from cash to inventories to receivables and back to cash. There are two concepts of working capital.

1. Net Working Capital:

It represents the excess of total current assets over total current liabilities. It is a qualitative concept indicating the soundness of current financial position. It is of major importance to investors and lenders. On the basis of this concept, the management will also get an idea about the ease and cost of raising working capital.

ADVERTISEMENTS:

Net working capital is measured by the current ratio, viz. Current assets/Current liabilities. Normally, the current ratio should be 2:1, a larger ratio indicates greater solvency and vice versa. Of course, excessive current ratio would point out poor financial planning and it would reduce income.

Net working capital

= Current assets – Current liabilities

= (cash+ marketable securities+ accounts receivables + notes and bills receivable + inventories)

ADVERTISEMENTS:

Minus (accounts payable + notes and bills payable + expenses + temporary loans)

2. Gross Working Capital:

It is also called the circulating capital. It is equal to the total sum of current assets only and it may represent both owned capital as well as loan capital used for financing the current assets.

The concept of gross capital is a financial concept whereas that of net concept is an accounting concept. Management is interested more in the amount of current assets with which it has to operate. If it can balance receipts and disbursements perfectly, the business would operate with maximum efficiency.

ADVERTISEMENTS:

To the management of a company, the source of the working capital owned/borrowed resources is immaterial However, in an ever-changing economy, it is very difficult to secure perfect equilibrium between inflow and outflow of cash, hence, it is the objective of sound financial management to always maintain enough supply of working capital.

Chart:

Note:

ADVERTISEMENTS:

1. Current assets may be really fixed assets in the sense that they never disappear from the balance sheet.

2. Working capital finances marketing, i.e., purchase and sale of inventories and all other associated marketing functions and services.

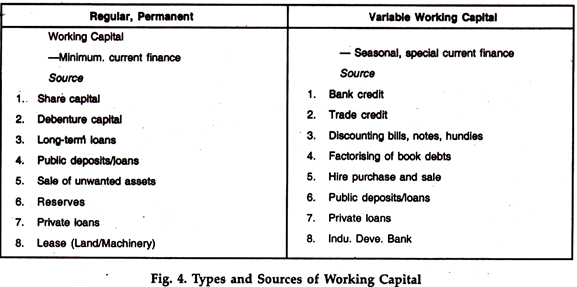

3. Public deposits/loans offer attractive interest, 15% per year. They are unsecured loans for one to three years. They are a good source of working capital in India. They are now controlled by the Reserve Bank of India.

Working Capital and Debentures:

ADVERTISEMENTS:

At present a company has at its disposal debentures as a better source of finance, better than public deposits or preference shares, for financing permanent part of working capital on a long-term basis.

Interest rate on public deposits and debentures is now similar, 15% Investors would prefer their investment in debentures instead of public deposits due to following advantages:

1. Debentures are fully secured by mortgage on fixed assets.

2. They are listed on the stock exchange and hence they have marketability and liquidity.

ADVERTISEMENTS:

3. They may have buy-back provision.

4. They can act as security for borrowing.

5. They can have convertibility privilege.

Since 1980, the investors in general have preferred to go in for debentures. Many companies have succeeded in issuing debentures. Telco is expected to enter the market for raising Rs.55 crores by debentures through private placement in 1984-85.

Objectives of Working Capital:

1. The management wants maximum productivity and profits in the employment of capital. This is possible by striving to maintain a correct ratio between working capital and fixed capital.

ADVERTISEMENTS:

2. The management has another objective and that is to maintain a smooth and rapid flow of funds in order to enhance the efficiency of working capital or profitability of the firm.

3. If cash receipts and cash outlay synchronize, there is no need to maintain a cash reserve. In business; it would be a miracle to have perfect coincidence and co-ordination between receipts and payments. Hence, firms must have sufficient cash reserve to meet all normal as well as abnormal cash needs.

Factors Governing Working Capital:

1. General Type of Business:

A trading Company requires large working capital. Industrial concerns may require relatively lower working capital. A banking company, of course requires maximum amount of working capital. Basic and key industries, public utilities, businesses dealing in staple products, e.g., necessaries, require low working capital because they have a steady demand and continuous cash-inflow enough for current liabilities.

2. Size of the Business Unit:

The amount of working capital depends directly upon the volume of business. The greater the size of a business unit, the larger will be the requirements of working capital.

3. Terms of Purchase and Terms of Sale:

Use of trade credit may lead to lower working capital, while cash purchases will demand large working capital. Similarly, credit sales will require larger working capital, while cash sales will require lower working capital.

4. Turnover of Inventories:

ADVERTISEMENTS:

If inventories are large and their turn-over is slow we shall require larger capital but if inventories are small and their turnover is quick we shall require lower working capital.

5. Process of Manufacture:

Long period, complex and round about process of production will require larger working capital, while simple, short period process of production will require lower working capital.

6. Importance of Labour:

Capital intensive industries, i.e., mechanised and automated industries, will require lower working capital, while labour intensive industries such as small-scale and cottage industries will require larger working capital.

7. Proportion of Raw Material to Total Costs:

If our raw materials are costly, we shall have larger working capital while if raw materials are cheaper and constitute a small part of the total cost of production, we shall require lower working capital.

8. Cash Requirements:

If a corporation has demand for larger cash needs, we shall have larger working capital, e.g., at the time of dividend payment, taxation, interest charges, wages and salaries, we require enough cash. There is a close connection between the dividend policy and the working capital. If a company has shortage of working capital, it may have to skip payment of cash dividends or reduce the dividend rate or issue stock dividends.

9. Seasonal Variations:

During the busy season, a business requires larger working capital while during the slack season a company requires lower working capital. In sugar industry the season is December to April; while in the woolen industry the season is the winter season. Usually the seasonal or variable needs of working capital are financed by temporary borrowing.

10. Banking Connections:

ADVERTISEMENTS:

If the corporation has good banking connections and bank credit facilities, it may have minimum margin of regular working capital over current liabilities. But in the absence of the availability of bank finance, it should have relatively larger amount of net working capital.

11. Growth and Expansion:

For normal rate of expansion in the volume of business, we may have greater and greater proportion of retained profits to provide for more working capital; but for fast-growing concerns, we shall require larger and larger amount of working capital. A plan of working capital should be formulated with an eye to the future as well as present needs of a corporation. Permanent working capital must be secured on a long-term basis.