There are four methods for estimating the working capital requirements of a firm. The methods are: 1. Percentage of Sales Method 2. Regression Analysis Method 3. Operating Cycle Method 4. Individual Components Method.

1. Percentage of Sales Method:

It is a traditional and simple method of determining the level of working capital and its components. In this method, working capital is determined on the basis of past experience. If, over the years, the relationship between sales and working capital is found to be stable, then this relationship may be taken as a base for determining the working capital for future.

This method is simple, easy to understand and useful for projecting relatively short-term changes in working capital. However, this method cannot be recommended for universal application because the assumption of linear relationship between sales and working capital may not hold good in all cases.

Problem 1:

ADVERTISEMENTS:

Meraz Ltd. is engaged in large scale customer retailing.

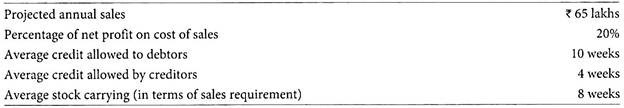

From the following information, you are required to forecast its working capital requirements for the year 2016-17:

Add 10% to computed figures to allow for contingencies.

ADVERTISEMENTS:

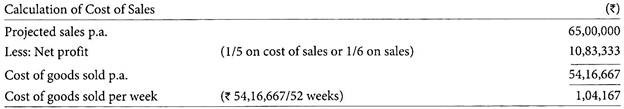

Solution:

2. Regression Analysis Method:

It is a useful statistical technique applied for forecasting working capital requirements. It helps in making working capital requirement projections after establishing the average relationship between sales and working capital and its various components in the past years. The method of least squares is used in this regard.

ADVERTISEMENTS:

The relationship between sales and working capital is given by the equation:

Y = a + bx

Where, x = Sales (independent variable)

ADVERTISEMENTS:

y = Working capital level (dependent variable)

a = Intercept of least square line with vertical axis

b = Slope of the line

Linear regression model is used to judge the relationship of two variables. By using the mode we can estimate level of working capital needed for given amount of sales. The data relating to level of working capital and its corresponding sales during past 5 – 6 years is used in establishment of trend relationship.

ADVERTISEMENTS:

The value of ‘a’ and ‘b’ are obtained by the solution of simultaneous linear equations given below:

Problem 2:

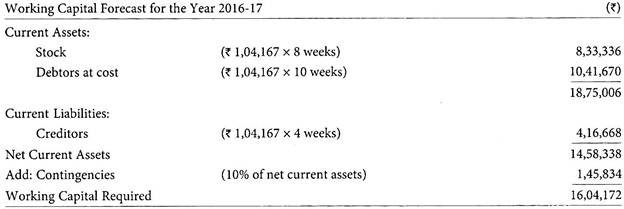

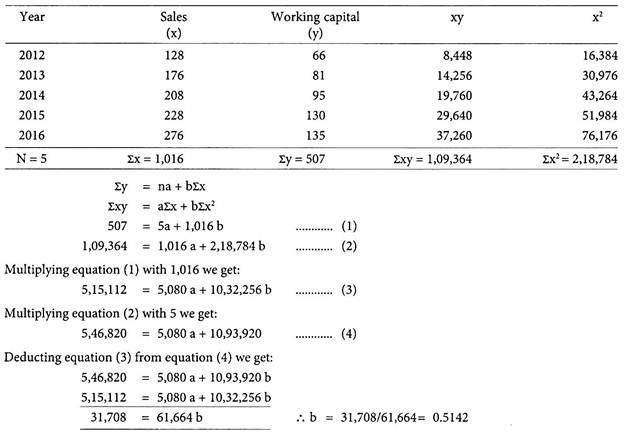

The sales and working capital of Gammon Ltd. for a period of 5 years are given below:

Estimate working capital requirement for the year 2017, if anticipated sales is Rs. 290 crores.

Solution:

Finding value of ‘a’

ADVERTISEMENTS:

507 = 5a + (1,016 x 0.5142)

507 = 5a+ 522.43

5a = -15.43

∴ a = -3.086

The relationship between sales and working capital can now be expressed as follows:

y = a + bx

ADVERTISEMENTS:

where, x = Sales y = Working capital

y = -3.086 + 0.5142x

When sales (x) is Rs. 290 crores, what would be the requirement of working capital (y)

Working capital (y) = -3.086 + (0.5142 x 290) = -3.086 + 149.118 = Rs. 146.03 crores

3. Operating Cycle Method:

The operating cycle concept can be used in estimation of working capital. The longer the length of operating cycle, the higher the requirement for working capital and vice versa.

For estimation of working capital, the following formula can be used:

For proper management of working capital it is required that a proper assessment of its requirement is made. Working capital should be such that it is commensurate with the production needs of the company. For computation of working capital under this method, the estimation of sales or the activity level is need to determine the levels of individual components of working capital. Expected increase or decrease in sales over the existing level is to be considered for estimation of sales for the next period. Once the assessment is made, every element of working capital has to be monitored.

Problem 3:

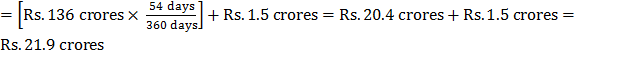

Manchester Ltd. expects its cost of goods sold for 2017 to be Rs.136 crores. The operating cycle for the planned year is expected to be 54 days. The company wants to maintain a desired cash balance of Rs.1.5 crores to meet the contingencies. What is the expected working capital requirement for the year 2017. (Assume 360 days in a year).

Solution:

Estimation of working capital for the year 2017 based on operating cycle

4. Individual Components Method:

ADVERTISEMENTS:

Under this method each individual items of current assets and current liabilities are estimated as follows:

a. Raw Material Stock:

It is to be ensured that there is no excess holding of raw material inventory over the required level of quantity. The proper level of stock holding is determined taking into consideration the rate of production, safety stock level, economic order quantity, stock holding costs, lead time for material supplies, amount of working capital required for maintaining stock of raw materials, availability of material etc.

The level of investment in raw material stock is determined taking into consideration the average period for which it is held in stock, e.g., raw materials are held in stock, on an average, for 2 months.

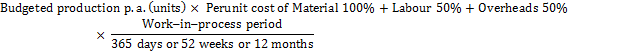

b. Work-in-Progress Stock:

ADVERTISEMENTS:

In process industries there is likely to be partly completed units lying in stocks, which require working capital. The production cycle should be reduced to the most optimum level to reduce the level of investment in work-in-progress. In partly completed items, some portion of raw material, labour and overhead costs are incurred, the balance is to be incurred for conversion of it into finished item.

If the information is not available, it is assumed that 100% of material cost is incurred on the item of WIP, but labour and overhead costs are assumed to be incurred to the extent of 50%, e.g., every unit of production remains in the process for 1 month, work-in-process involves use of full unit of raw materials in the beginning of manufacturing process and other conversion costs equivalent to 50%.

c. Finished Goods Stock:

At the end of production process, the units are converted into finished products, which are held in stock for sometime until it is dispatched to the customers on sale. The reduction in time lag between completion of production and its sale to ultimate customer should be minimum and production planning should be done to achieve the goal. To meet the seasonal demand, it might be necessary to hold more stocks of finished goods. The investment in stock of finished goods is determined at cost of goods sold, e.g., finished goods remain in warehouse, on an average, for 2 months.

d. Investment in Debtors:

The cash sales does not require working capital. But the credit sales will tied-up the funds for some time, until the debtors balance is realized. A proper credit policy has to be established based on creditworthiness of customer. An effective administration of debtors has to be established and properly monitored. The economics of cash sales, credit sales, cash discounts, trade discounts, factoring etc. should be considered.

The actual funds locked-up in debtors balances is only to the extent of cost of goods sold. It would be more practical, if investment in debtors balances is ascertained at cost of sales, not at selling price, e.g., credit allowed to debtors is 2 months from the date of dispatch, 20% of sales are on cash basis.

e. Cash Balances:

The required cash balance can be determined with the help of preparation of cash budget. Proper cash budget should be prepared and continuous monitoring of the same is required. It should be kept in view that cash balances are the most liquid assets and temporary cash surplus should be properly invested in short-term marketable investments to maximize the return on capital employed. For meeting the day to day expenses it is necessary to maintain certain amount of cash balances for smooth flow of operations, e.g., the estimated balance of cash to be held Rs.2,00,000.

f. Prepaid Expenses:

Sometimes, the expenses are to be paid in advance, which require the working capital, e.g., sales promotion expenses paid quarterly in advance.

g. Sundry Creditors:

Generally the suppliers of raw materials, consumables, stores etc. will allow credit period for payment called as ‘trade credit’. Creditors provide the company with working capital requirement. The company should negotiate with the suppliers maximum credit period at lowest overall cost. Credit period should be negotiated for purchases in such a manner that the timings of cash availability is taken into account. The trade credit reduces the level of working capital requirement, e.g., suppliers of materials extend a month credit, cash purchases are 25%.

h. Creditors for Wages and Expenses:

The wages and expenses may not be required to pay immediately, which will also ease the working capital requirement e.g., there is a time lag in payment of wages of a month and half-a-month in case of overheads.

i. Advances:

Advances received along with purchase orders for products, reduces requirement for working capital.

The individual components method of estimation of working capital involves the following steps:

Step 1:

Identify the various items of current assets and current liabilities which consist in determination of working capital. The current assets include inventory of raw materials, WIP and finished goods, sundry debtors, prepaid expenses, desired cash balance etc. The current liabilities include creditors for raw materials, stores and consumables, creditors for wages, creditors for expenses, etc.

Step 2:

(a) Estimate the holding period of each item stock i.e. raw materials, WIP and finished goods.

(b) Estimate the collection period of sundry debtors.

(c) Estimate the desired cash balance for meeting the requirements of day to day operations.

(d) Estimate the payment deferral period of creditors for raw materials.

(e) Estimate the lag in payment of wages and expenses.

Step 3:

(i) Determine the raw material, labour and overheads cost per unit.

(ii) Determine the operating level.

(iii) Determine the percentage of conversion cost incurred on WIP.

(iv) Determine the cost of sale and selling price per unit.

Step 4:

Ascertain the value of each item of current assets and current liabilities taking into account the information in step (2) and step (3).

Step 5:

Put the values of current assets and current liabilities in a statement form and ascertain the net working capital (i.e. current assets – current liabilities) after adding up the desired cash balance and amount needed for meeting contingencies.

Problem 4:

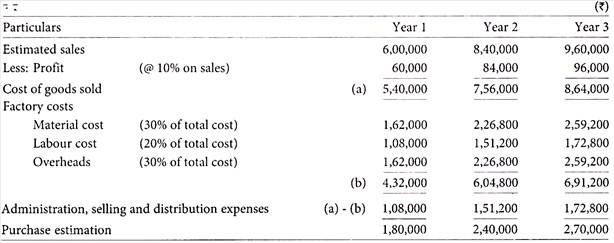

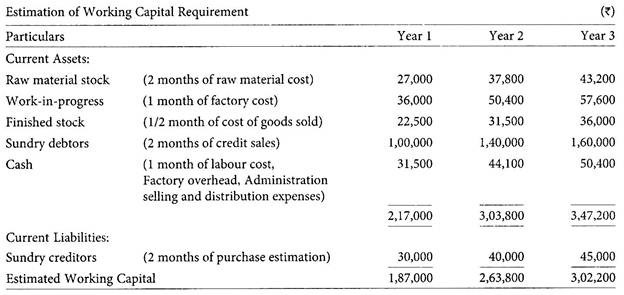

The W.M. Ltd. proposes to raise its turnover from Rs.6,00,000 to Rs.8,40,000 next year and to Rs.9,60,000 in the succeeding year. It is expected that the purchases will go up from Rs.1,80,000 to Rs.2,40,000 and then to Rs.2,70,000 in the next two years. A steady profit of 10% on turnover is estimated over the years; and the materials, labour and factory overheads are expected uniformly to be 30%, 20% and 30% respectively of total cost of goods sold.

At the end of each year the raw materials stock would amount to two months’ consumption, work-in-progress to one month’s factory cost and finished goods to half a month’s total cost. There is a two months’ credit period allowed to customers and received from suppliers.

The company has a policy of carrying costs equivalent to one month’s requirement for payment of labour and other overhead cost. Ignoring prepayments and accrued charges as they normally offset each other, work out an estimate of working capital requirement for all the three years separately. State assumptions, if any.

Solution: