Here is a term paper on ‘Working Capital Management’ for class 11 and 12. Find paragraphs, long and term papers on ‘Working Capital Management’ especially written for school and management students.

Term Paper on Working Capital Management

Term Paper Contents:

- Term Paper on the Meaning and Definition of Working Capital Management

- Term Paper on the Classification of Working Capital

- Term Paper on the Working Capital Cycle

- Term Paper on the Working Capital Forecasts

- Term Paper on the Issues in Working Capital Management

- Term Paper on the Estimating Working Capital Needs

- Term Paper on Optimum Working Capital

- Term Paper on the Factors to be taken into Consideration while Determining the Requirement of Working Capital

- Term Paper on the Working Capital Management Policies

Term Paper # 1. Meaning and Definition of Working Capital Management:

One of the most important areas in the day-to-day management of the firm is the management of working capital. Working capital management is the functional area of finance that covers all the current accounts of the firm. It is concerned with the management of the level of individual current assets as well as the management of total working capital. Procurement of funds is firstly concerned for financing working capital requirement of the firm, secondly for financing fixed assets.

ADVERTISEMENTS:

Working capital refers to the funds invested in current assets, i.e., investment in stocks, sundry, debtors, cash and other current assets. Current assets are essential to use fixed assets profitably.

Working capital management is concerned with the problems that arise in attempting to manage the current assets, the current liabilities and interrelationship that exist between them. The term current assets refer to those assets which in the ordinary cause of business can be, or will be converted into cash within one year, without undergoing a diminution in value and without disrupting the operations of the firm.

The major current assets are cash, marketable securities, accounts receivable and inventory. Current liabilities are those liabilities which are intended at their inception to be paid in the ordinary course of business, within a year, out of the current assets or earnings of the concern. The basic current liabilities are accounts payable, bills payable, bank overdraft and outstanding expenses.

“The goal of working capital management is to manage the firm’s current assets and liabilities in such a way that a satisfactory level of working capital is maintained.” This is so because if the firm cannot maintain a satisfactory level of working capital. It is likely to become investment and may even be forced into bankruptcy.

ADVERTISEMENTS:

The current assets should be large enough to cover its current liabilities in order to ensure a reasonable margin of safety. Each of the current assets must be managed efficiently in order to maintain the liquidity of firm while not keeping too high a level of any one of them.

Each of the short-term sources of financing must be continuously managed to ensure that they are obtained and used in the best possible way.

“The interaction between current assets and current liabilities is therefore the main theme of the theory of working capital management.”

The basic ingredient of the theory of working capital management may be said to include its definition, need, optimum level of current assets, the tradeoff between profitability and risk which is associated with the level of current assets and liabilities, financing-mix strategies and so on.

ADVERTISEMENTS:

Note:

The requirements of current assets are usually greater than the amount of funds payable through current liabilities. In other words, the current assets are to be kept at a higher level than the current liabilities.

Term Paper # 2. Classification of Working Capital:

There are many classifications in use out of which a few important areas are as below:

ADVERTISEMENTS:

1. From the point of view of concept

2. From the point of view of time.

1. From the Point of View of Concept:

From the point of view of concept the term working capital can be used in two different ways:

ADVERTISEMENTS:

(a) Gross Working Capital (GWC).

(b) Net Working Capital (NWC).

(a) Gross Working Capital (GWC):

The term gross working capital refers to investment in all the current assets taken together. The total of investments in all current assets is known as gross working capital.

ADVERTISEMENTS:

The term net working capital can be defined in following two ways:

1. The most common definition of net working capital (NWC) is the difference between current assets and current liabilities.

NWC = CA — CL

Where,

ADVERTISEMENTS:

CA = Current Assets

CL = Current Liabilities

(b) Net Working Capital (NWC):

The alternate definition of NWC is that portion of current assets which is financed with long-term funds. (Means part of those current assets whose liability does not lie with current liabilities).

NWC is commonly defined as the difference between current assets and current liabilities. Efficient working capital management requires that firms should operate into same amount of NWC, the exact amount varying from firm to firm and depending among other things, on the nature of industry.

The justification for the use of NWC to measure liquidity is based on the premise that the greater the margin by which the current assets cover the short-term obligations, the more is the ability to pay obligations when they become due for payment.

ADVERTISEMENTS:

The NWC is necessary because the cash outflows and inflows do not coincide. In other words, it is the non-synchronous nature of cash flows that makes NWC necessary.

In general, the cash outflows resulting from payment of current liabilities are relatively predictable. The cash inflows are, however, difficult to predict.

Notes:

a. The more predictable the cash inflows are the less -NWC will be required.

b. Where cash inflows are uncertain, it will be necessary to maintain current assets at a level adequate to cover current liabilities that are there must be NWC.

The task of the financial manager in managing working capital efficiently is to ensure sufficient liquidity in the operations of the enterprise. The liquidity of a business firm is measured by its ability to satisfy short-term obligations as they become due.

ADVERTISEMENTS:

The three basic measures of a firm’s overall liquidity are:

(i) Current ratio.

(ii) Acid test ratio.

(iii) Net working capital.

The first two measures are very useful in inter-firm comparison of liquidity. Net Working Capital (NWC) as a measure of liquidity is not very useful for comparing the performance of different firms but it is quite useful for internal control.

The NWC helps in comparing the liquidity of the same firm overtime. For the working capital management, NWC can be said to measure the liquidity of the firm. In other words, the goal of working capital management is to manage the current assets and current liabilities in such a way that an acceptable level of NWC is maintained.

ADVERTISEMENTS:

2. From the Point of View of Time:

From the point of view of time, working capital can be divided into following two categories:

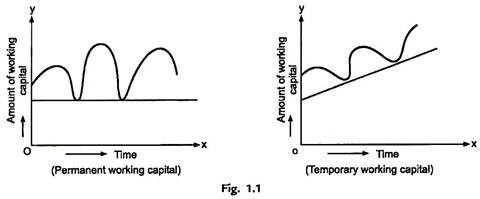

(a) Permanent working capital.

(b) Temporary working capital.

(a) Permanent Working Capital:

It also refers to the hard core working capital. It is that minimum level of investment in the current assets that is carried by the business at all times to carry out minimum level of its activities.

ADVERTISEMENTS:

(b) Temporary Working Capital:

It refers to that part of total working capital which is required by a business over and above permanent working capital. It is also called variable working capital.

Note:

Since the volume of temporary working capital keeps on fluctuating from time to time according to the business activities it may be financed from short-term services.

Term Paper # 3. Working Capital Cycle:

ADVERTISEMENTS:

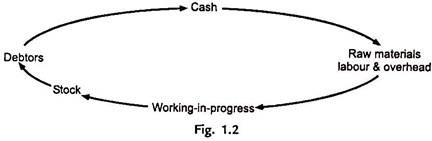

Working capital cycle refers to the length of time between the firms paying cash for materials, etc., entering into the production process/stock and the inflow of cash from debtors i.e., sales.

Suppose a company has a certain amount of cash it will need raw materials. Some raw materials will be available on credit but, cash will be paid out from the other part immediately. Then it has to pay labour costs and incurs factory overheads. These three combined together will constitute work-in-progress. After the production cycle is complete, work-in-progress will get converted into finished products.

The finished products when sold on credit get converted into sundry debtors. Sundry debtors will be realized in cash after the expiry of credit period. This cash can again be used for financing of raw materials, work-in-progress etc.

Thus there is a complete cycle from cash to cash wherein cash gets converted into raw materials, work-in-progress, finished goods, debtors and finally into cash again.

Notes:

a. Short-term funds are required to meet the requirements of funds during this time period.

b. This time period is dependent upon the length of time within which the original cash gets converted into cash again.

c. This cycle is also known as operating cycles or cash cycle.

Working capital cycle indicates the length of time between a company’s paying for materials, entering into stock and receiving the cash from sales of finished goods. It can be determined by adding the number of days required for each stage in the cycle.

Example 1:

A company holds raw-material on an average for 60 days, it gets credit from the supplier for 15 days, production process needs 15 days, finished goods are held for 30 days and 30 days credit is entered to debtors.

Then, total no. of days = 60 – 15 + 15 + 30 + 30 = 120 days means 120 days is the total working capital cycle.

The determination of working capital cycle helps in the forecast, control and management of working capital. It indicates the total time lag and the relative significance of its constituent parts. The duration of working capital cycle may vary depending on the nature of the business.

The operating cycle (working capital cycle) consists of the following events which are continuing throughout the life of business:

1. Conversion of cash into raw materials.

2. Conversion of raw materials into work-in-progress.

3. Conversion of work-in-progress into finish stock.

4. Conversion of finished stock into account receivables through sales.

5. Conversion of accounts receivables into cash.

The duration of the operating cycle for the purpose of estimating working capital is equal to the sum of the durations of each of the above said events, less (-) the credit period allowed by the supplier.

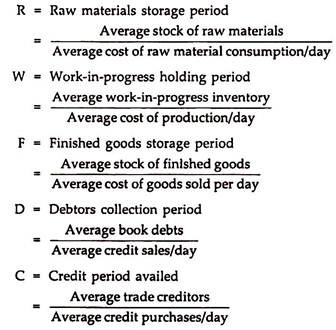

In the form of an equation, the operating cycle process can be expressed as follows:

Operating cycle = R + W + F + D – C

Where,

R = Raw material storage period

W = Work-in-progress holding period

F = Finished goods store period

D = Debtors collection period

C = Credit period availed

Various components of the operating cycle can be calculated:

Term Paper # 4. Working Capital Forecasts:

An adequate amount of working capital is essential for the smooth running of a business enterprise. The finance manager should forecast working capital requirements carefully to determine an optimum level of investment in working capital.

Note:

While forecasting working capital requirements, it should be borne is mind that working capital requirements are to be determined on an average basis not at any specific point of time.

Following are the methods for forecasting of working capital requirements:

(a) On the basis of operating cycles.

(b) On the basis of current assets and current liabilities.

(c) On the effect of double shift working.

(d) On the basis of cash cost.

(a) On the Basis of Operating Cycles:

One of the methods for forecasting working capital requirement is based on the concept of operating cycle.

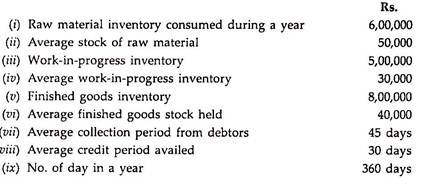

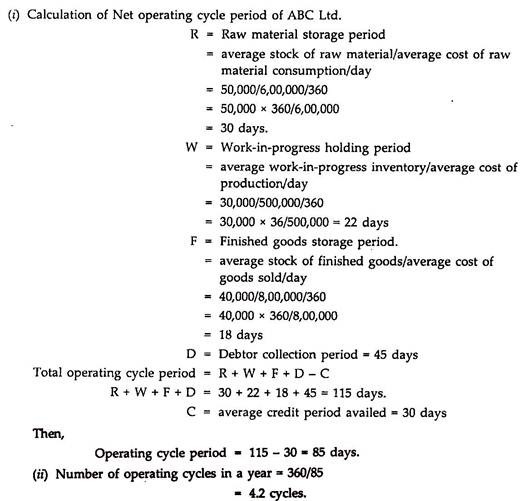

The calculation of operating cycle and the formula for estimating working capital on its basis has been determined with the help of following example.

Example 2:

From the following information of ABC Ltd. calculate (a) Net operating cycle period (b) Number of operating cycles in a year:

Solution:

(b) On the Basis of Current Assets and Current Liabilities:

The estimation of future working capital can be made if the amount of current assets and current liabilities can be estimated as below.

Various components of current assets and current liabilities have a direct bearing on the computation of working capital and its operating cycle. The holding period of various constituents of operating cycle may contract or expand the net operating cycle period.

Note:

Shorter the operating cycle period will lower the requirement of working capital and vise-versa.

Estimation of Current Assets:

The estimates of various components of working capital may be made as below:

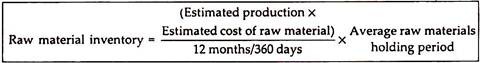

(i) Raw Materials Inventory:

The fund to be invested in raw materials inventory may be estimated on the basis of production budget.

The estimated cost per unit and average holding period of raw material inventory by using the following formula:

Note:

If the number of days are not given generally 360 days is taken to facilitate calculation.

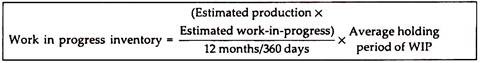

(ii) Work-In-Progress Inventory:

The funds to be invested in work-in-progress can be estimated by the following formula:

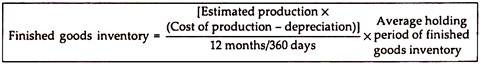

(iii) Finished Goods:

The funds to be invested in finished goods inventory can be estimated with the help of following formula:

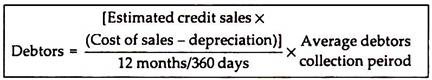

(iv) Debtors:

Funds to be invested in trade debtors may be estimated with the help of following formula:

(v) Minimum Desired Cash and Bank balances to be maintained by the firm has to be added in the current assets for the computation of working capital.

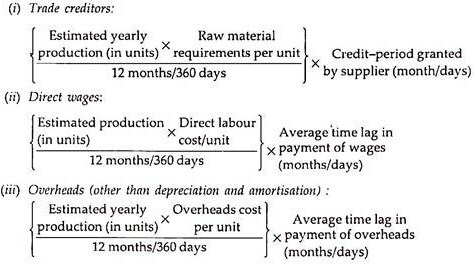

Estimation of Current Liabilities:

Current liabilities generally effect computation of working capital. Hence, the amount of working capital in lowered to the extent of current liabilities (other than bank credit) arising in the normal cause of business.

The important current liabilities like trade creditors, wages and salaries, overhead etc., can be estimated as below:

Note:

a. The amount of overheads may be separately calculated for different types of overheads.

b. In case of selling overheads, the relevant item would be sales volume instead of production volume.

(c) On the Effect of Double Shift Working:

Increase in the number of hours of production has an effect on the working capital requirements. The greatest economy in introducing double shift is the greater use of fixed assets.

Note:

Very little as marginal funds may be required for additional assets.

It is obvious that in double shift working, an increase in stock will be required as the production rises. However, it is quite possible that the increase may not be proportionate to the rise in production since the minimum level of stocks may not be very much higher. Thus, it is quite likely that the level of stocks may not be required to be doubled as the production goes up-two fold.

The amount of materials in process will not change due to double shift working since work started in the 1st shift will be completed in the second. Hence, capital tied up in materials in process will not change unless the 2nd shift workers are paid at the higher rate.

Notes:

a. Fixed overheads will remain forced whereas variable overheads will increase in proportion to the increased production.

b. Semi-variable overheads will increase according to the variable element in them.

c. Unless specified in a situation, generally stock of raw materials is presumed to be increased proportionality.

(d) On the Basis of Cash Cost:

Working capital is the difference between current assets to current liabilities hence while estimating the requirement of working capital it is essential to forecast the amount or cash requirement for each item of current assets and current liabilities.

However, in practice another approach may also be useful in estimating working capital requirements. This approach is based on the fact that in the case of current assets like sundry debtors and finished goods etc. the exact amount of fund blocked is less than the amount of such current assets.

Example 3:

If sundry debtors worth 1 lakh and cost of production is Rs.75,000 then actual amount of fund blocked with sundry debtors is Rs. 75,000 and the rest Rs.25,000 is profit.

Again some of the cost items also are non-cash costs as depreciation is non-cash.

In the above example if the depreciation amount is Rs.5000 then actual sum of amount blocked is Rs. 70,000.

In other words, it can be said that to finance sundry debtors of Rs. One lakh only Rs. 70,000 is required.

Similarly, in case of finished goods which are valued at cost, non-cash cost may be excluded to work out the amount of fund blocked.

Many experts therefore calculate the working capital requirements by working out the cash cost of finished goods and sundry debtors.

Notes:

a. In this approach the debtors are calculated not as a percentage of sales value but as a percentage of cash cost.

b. Finished goods are valued according to cash cost.

Term Paper # 5. Issues in Working Capital Management:

Working capital management refers to the administration of all aspects of current assets, namely cash, marketable securities, debtors and stock i.e., inventories and current liabilities. The financial manager must determine levels and composition of current assets. He must see that right sources are tapped to finance current assets, and that current liabilities are paid in time.

There are many aspects of working capital management which make it an important function of the finance manager:

(1) Time:

Working capital management requires much of the financial manager’s time.

(2) Investment:

Working capital represents a large portion of the total investment in assets.

(3) Criticality:

Working capital management has greater significance for all firms but it is very critical for small firms.

(4) Growth:

The need for working capital is directly related to the firm’s growth.

Empirical observations show that the financial managers have to spend much of their time to the daily internal operations, relating to current assets and current liabilities of the firm. As the largest portion of the financial manager’s valuable time is devoted to working capital problems, it is necessary to manage working capital in best possible way to get the maximum benefit.

Investment in current assets represents a very significant portion of the total investment in assets. The financial manager should pay special attention to the management of current assets on the continuing basis. Action should be taken to curtail unnecessary investment in assets.

Working capital management is critical for all firms but particularly for small firms. A small firm may not have much investment in fixed assets, but it has to invest in current assets.

Notes:

a. Small firms in India face a severe problem of collecting their debtors (book debts or receivables).

b. Role of current liabilities in financing current assets is for more significant in case of small firms, as, unlike large firms, they face difficulties in raising long-term finances.

There is a direct relationship between a firm’s growth and its working capital needs. As sales grow, the firm needs to invest more in inventories and debtors. These needs become very frequent and fast when sales grow continuously. The financial manager should be aware of such needs and finance them quickly.

Note:

Continuous growth in sales may also require additional investment in fixed assets.

Current Assets to Fixed Asset Ratio:

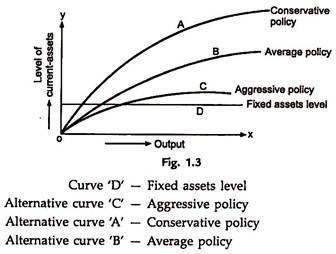

The financial manager should determine the optimum level of current assets so that the wealth of shareholders is maximized. A firm needs fixed and current assets to support a particular level of output. However, to support the same level of output, the firm can have different levels of current assets.

As the firm’s output and sales increases, the need for current assets increases. Generally, current assets do not increase in direct proportion to output, current assets may increase at a decreasing rate with output. The relationship is based upon the notion that it takes a greater proportional investment in current assets when only a few units of output are produced than it does later on when the firm can use its current assets more efficiently.

The level of the current assets can be measured by relating current assets to fixed assets.

CA/FA = Current assets/Fixed assets.

Note:

a. Assuming a constant level of fixed assets, a higher CA/FA indicates a conservative current assets policy. When other factors be constant.

b. A lower CA/FA indicates an aggressive current assets policy when other factors be constant.

c. A conservative policy implies greater liquidity and lower risk.

d. An aggressive policy implies poor liquidity and higher risk.

e. The current assets policy of most of the firms may lie between these two extreme policies.

i. At an alternative curve A — CA/FA ratio is high means more liquidity and less risk. CA/FA ratio is greatest at every level of output.

ii. At an alternative curve C — CA/FA ratio is low means more risk less liquidity. CA/FA ratio is lowest at every level of output.

iii. At an alternative curve B — CA/FA ratio is in between the highest and lowest or moderate means neither high liquidity nor high risk. Hence called as average policy.

Liquidity Vs. Profitability: Risk-Return Trade Off:

A firm would make first enough investment in current assets if it were possible to estimate working capital needs exactly.

i. Under perfect certainty, current assets holdings would be at the minimum level.

ii. A larger investment in current assets under certainty would means a low rate of return on investment for the firm, as excess investment in current assets will not earn enough return.

iii. A smaller investment in current assets would mean interrupted production and sales, because of frequent stock-outs and inability to pay to creditors in time due to restrictive policy.

As it is not possible to estimate including needs accurately, the firm must decide about levels of current assets to be carried. Given a firm’s technology and production policy, sales and demand conditions, operating efficiency etc., its current assets holdings will depend on its working capital policy.

It may follow a conservative or an aggressive policy. These policies involve risk return trade off.

i. A conservative policy means lower return and risk.

ii. An aggressive policy produces higher return and risk.

Hence, there are two important aim/objectives of the working capital management.

These are:

(a) Profitability.

(b) Solvency.

Solvency, used in the technical sense, refers to the firm’s continuous ability to meet maturing obligations. Lenders and creditors except prompt settlement of their claims as and when due. To ensure solvency the firm should be very liquid which means larger current assets holding. If the firm maintains a relatively large investment in current assets, it will have no difficulty in paying claims of creditors when they become due and will be able to fill all sales orders and ensure smooth production. Thus, a liquid firm has less risk of insolvency. That is, it will hardly experience a cash shortage or a stock-out situation.

However, there is a cost associated with maintaining a sound liquid position. A considerable amount of the firm’s funds will be tied up in current assets, and to the extent this investment is idle, the firm’s profitability will suffer.

To have high profitability, the firm may sacrifice solvency and maintain a relatively low level of current assets, but its solvency would be threatened and would be exposed to greater risk of cash shortage and stockouts.

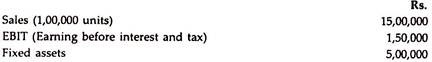

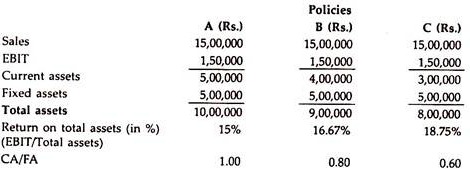

Example 4:

Suppose, a firm has the following data for some future year.

There are three possibility of current assets holdings, i.e., Rs.5,00,000, Rs.4,00,000 and Rs.3,00,000. Assumed that fixed assets level is constant and profits do not vary with current assets levels. Calculate the effect of alternative working capital policies.

Solution:

From the above calculation, it reveals that the alternative A, is most conservative policy, provides greatest liquidity (solvency) to the firm but at the same time lowest return on total assets.

Alternative C, is most aggressive policy, yields highest return but provides lowest liquidity, thus is very risky to the firm.

Alternative B demonstrates a moderate policy and generates a return higher than alternative A but lower than alternative C and is less risky than alternative C but more risky than alternative A.

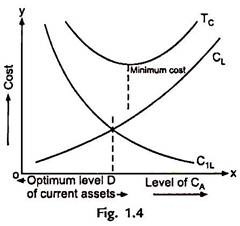

Cost Trade-Off:

A different way to risk-return trade-off is in terms of the cost of maintaining a particular level of current assets.

There are two types of costs associated i.e.:

1. Cost of liquidity.

2. Cost of illiquidity.

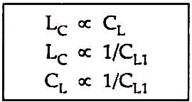

If the firm’s level of current assets is too high, it has excessive liquidity. It return on assets will be low, as funds tied up in idle cash and stocks earn nothing and high levels of debtors reduce profitability. Thus, the cost of liquidity increases with the level of current assets through low rates of returns.

Cost of liquidity [CL]∝ Level of current assets [LC]

Cost of liquidity [CL]∝ 1/ [RR] Rate of returns

The cost of illiquidity is the cost of holding insufficient current assets. The firm will not be in a position to honour its obligations, if it carries too little cash. This may force the firm to borrow at high rate of interest. This will also adversely affect the credit-worthiness of the firm and it will face difficulties in obtaining funds in future. All this lead to insolvency of the firm.

Similarly, low level of stocks will result in loss of sales, as customers will shift to competitors. There will be low level of debtors due to light credit policy which will further impair sales. Thus, the low level of current assets involves costs which increase as this level falls.

In determining the optimum level of current assets, the firm should balance the profitability solvency tangle by minimizing total cost—cost of liquidity and cost of illiquidity.

Above figure illustrates:

1. Level of current assets and cost of liquidity increases while cost of it illiquidity decreases.

The firm should maintain its current assets at that level where the sum of these two costs i.e., total cost are minimized. The minimum cost point indicates the optimum level of current assets.

Term Paper # 6. Estimating Working Capital Needs:

There are many methods in the determination of working capital needs.

These are as below (which are practically in use):

(a) Current assets holding period.

(b) Ratio of sales.

(c) Ratio of fixed investment.

(a) Current Assets Holding Period:

To estimate working capital requirements on the basis of average holding period of current assets and relating them to cost based on the firm’s experience in the previous years. This method is essentially based on the operating cycle concept.

(b) Ratio of Sales:

To estimate working capital requirements, as a ratio of sales on the assumption that current assets change with rules.

(c) Ratio of Fixed Investment:

To estimate working capital requirements as a percentage of fixed investment.

Term Paper # 7. Optimum Working Capital:

Current ratio along with acid test ratio has traditionally been considered the best indicators of the working capital situation. It has been stated by many accountants that a current ratio of 2 (two) for a manufacturing firm implies that the firm has an optimum amount of working capital.

Thus, if the current assets (CA) are twice the amount of current liabilities (CL), a manufacturing concern is supposed to be having an adequate amount of working capital. This is supplemented by Acid Test Ratio which is supposed to be 1 (one) means liquid current assets are equal to current liabilities.

Note:

Bankers, financial institutions, financial analysts, investors and other people interested in financial statements have for years, considered. The current ratio at ‘2’ and acid test ratio at ‘1’ as indicators of a good working capital situations.

As a thumb rule, this may be quite adequate. However, it cannot be over emphasised that optimum working capital can be determined only with reference to the particular circumstances of a specific situation. Thus, in a company where the inventories are easily saleable and the sundry debtors are as good as liquid cash, the current ratio may be lower than ‘2’ and yet firm may be sound.

An optimum working capital ratio is dependent upon the business situation as such and the nature and composition of various current assets. A company having short conservation cycle (from cash to cash) may have lower current ratio. Thus in the case of Vanaspati manufacturing company, enjoying high reputation and credit terms in the market, a current ratio of 1.6 has been serving as ideal.

This is because the firm with its reputation can buy oil and other supplies on credit. The production period of Vanaspati is short and the demand position is such that immediate cash in realisable against sale of Vanaspati. Therefore it is not essential for this company to maintain high current ratio. Its inventories are low and its debtors are also low. On the other hand, creditors are high. Its acid test ratio is 0.8 and the current ratio is 1.6 both of these reflect a sound working capital position.

In the case of company engaged in manufacturing heavy electrical equipment and machinery, it takes long time to assemble one piece of machinery. It has to carry large inventories. It customers being mostly Govt., department, it cannot realise it dues quickly then in this case the requirement of working capital is high. Company may have to maintain a current ratio more than ‘3’. It does not mean that it has idle funds. It is very important, therefore, to work out the requirements of working capital specifically in a given situation.

Term Paper # 8. Factors to be taken into Consideration while Determining the Requirement of Working Capital:

Following are the important factors in the determination of the working capital requirements:

1. Production policies,

2. Nature of the business,

3. Credit policy,

4. Inventory policy,

5. Abnormal factors,

6. Market conditions,

7. Conditions of supply,

8. Business cycle,

9. Growth and expansion,

10. Level of taxes,

11. Dividend policy,

12. Price level changes, and

13. Operating efficiency.

1. Production Policies:

A sugar factory which belongs to a seasonal industry would obviously have its working capital needs affected by the length of the crushing season.

The production schedule, i.e., the plan for production, has great influence on the level of inventories. In some cases raw materials can be procured only in a particular season and have to be stocked for the production of the whole year. In many others, the production cycle is limited to a part of the year and raw materials have to be accumulated throughout the year. In all such cases the need for working capital will vary according to the production plans.

Similarly, the decisions of the management regarding automation etc., also affect working capital requirements.

Notes:

a. In a labour intensive process, the requirements of working capital will be higher.

b. In the case of highly automatic plants the requirements of long-term funds would be greater.

2. Nature of Business:

The shorter the manufacturing process, the lower is the requirements of the working capital.

This is because, in such a case, inventories have to be maintained at a low level. Longer the manufacturing process the higher would be the requirements of working capital.

This is the reason why highly capital intensive industries require a large amount of working capital to run their sophisticated and long production process. Similarly, a trading concern requires lower working capital than a manufacturing concern.

3. Credit Policy:

The credit policy of the company also determines the requirements of working capital. This is because, in such a case, inventories have to be maintained at a high level. A company which allows liberal credit to its customers may have higher sales but consequently will have large amount of funds tied up in sundry debtors.

Similarly, a company which has a very efficient debt collection machinery and offense strict credit terms, may require lesser amount of working capital than the one where debt collection system is not so efficient or where the credit terms are liberal.

Tight credit policy — Lower working capital requirements

Liberal credit policy — More working capital requirements

The credibility of a company in a market also has an impact on the working capital requirements. Reputed and established concerns can purchase raw materials on credit and enjoy many other services also like door delivery, after sales services etc. This would mean that they can easily have large current liabilities therefore the required working capital may not be very high.

4. Inventory Policy:

Inventory policy of a company also an impact on the working capital requirements since a large amount of funds is normally locked up in inventories. An efficient firm may stock raw material for a smaller period and may therefore require lesser amount of working capital.

5. Abnormal Factors:

Abnormal factors like strikes and lockouts also require additional working capital. Recessionary conditions necessitate a higher amount of stock of finished goods remaining in stock. Similarly inflationary conditions necessitate more funds for working capital to maintain the same amount of current assets.

6. Market Conditions:

Working capital requirements are also affected by market conditions like degree of competition. Large inventory is essential as delivery has to be off the shelf or credit has to be extended on liberal terms when market competition is fierce or market is not very strong or is a buyer’s market.

7. Conditions of Supply:

If prompt and adequate supply of raw materials, spares, stores etc. is available it is possible to manage with small investment in inventory or work on Just-In-Time (JIT) inventory principles. However if supply is erratic, scant, seasonal, channelised through government agencies etc., it is essential to keep larger stocks increasing working capital requirements.

8. Business Cycle:

Business fluctuations lead to cyclical and seasonal changes in production and sales and effect the working capital requirements.

9. Growth and Expansion:

The growth in volume and growth in working capital go hand in hand. However, the change may not be proportionate and the increased need for working capital is felt right from the initial stages of growth.

10. Level of Taxes:

The amount of taxes depends upon taxation laws. These amounts usually have to be paid in advance. Thus need for working capital varies with tax rates and advance tax provisions.

11. Dividend Policy:

Payment of dividend utilises cash while retain earnings/profits act as a source of working capital. Thus working capital gets affected by dividend policies.

12. Price Level Changes:

Inflationary trends in the economy necessitate more working capital to maintain the same level of activity.

13. Operating Efficiency:

Efficient and co-ordinated utilization of capital reduces the amount required to be invested in working capital.

Term Paper # 9. Working Capital Management Policies:

Working capital management policies have a great effect on the firms profit ability, liquidity and its structural health. Gross working capital consists of cash, receivables and inventories. If a firm has relatively high investment in these assets in comparison to a firm which is transacting the same volume of sale, it will have lower profitability in comparison to the latter.

Therefore, a firm which has high working capital turnover will have higher profitability.

This may require the reduction of investment in working capital but, if it is reduced disproportionally. It will affect the liquidity of the firm.

Generally, the current ratio and the quick ratio indicate liquidity aspect of a firm. If current assets are reduced beyond a limit, the current and quick ratios will be adversely affected leading the firm to poor liquidity.

Therefore, it is essential that finance manager lays down such working capital management policies that a proper balance is stuck between profitability and liquidity. As profitability and liquidity are inversely related, when one increases other decreases.

Working capital management policies also have a great impact on the structural health of the organization. If different components of working capital are not properly balanced, then in spite of the fact that current ratio and quick ratios may indicate satisfactory financial position in respect to the liquidity of the firm, it may not in fact be as liquid as indicated by the current and quick ratios.

For example:

If the proportion of inventory is very high in the total current assets or greater proportion is appropriated by slow moving or absolute inventory, then this cannot provide the cushion of liquidity.

Similarly, high investments in debtors and failure of the firm to collect them in time will also adversely affect the real liquidity of the firm, thereby adversely affecting the structural health of the organization.

If a firm carries higher cash and bank balances, it would mean that the firm is not making profitable use of its resources. Idle cash does not give any return to the firm but it has carrying cost.

It is therefore, important that the finance manager should chalk out such working capital management policies in respect of different components of working capital i.e., cash, receivables, inventories, debtors etc. to ensure higher profitability, proper liquidity and structural health of the organization. A proper and efficient management of working capital can ensure all above.

Apart from the profitability—risk trade off; another important ingredient of the theory of working capital management is determining the financing mix.

One of the most important decisions, in other words, involved in management of working capital is how current assets will be financed.

There are broadly speaking two sources from which funds can be raised for current assets financing:

i. Short-term sources i.e., current liabilities.

ii. Long-term sources such as share capital, long-term borrowings, internally generated resources like retained earnings and so on.

What proportion of current assets should be financed by current liabilities and how much by long-term resources, will determine the financing mix.

There are three basic approaches to determine an appropriate financing mix:

1. Hedging approach.

2. Conservative approach.

3. Trade-off between these two.

1. Hedging Approach:

It is also called as matching approach. The term hedging is often used in the sense of a risk-reducing investment strategy involving transactions of a simultaneous but opposing nature so that the effect of one is likely to counter balance the effect of the other. With reference to an appropriate financing mix, the terms hedging can be said to refer to the process of matching of debt with the maturities of financial need. This approach to the financing decision to determine an appropriate financing fix is therefore a matching approach.

According to this approach, the maturity of the source of funds should match the nature of the assets to be financed.

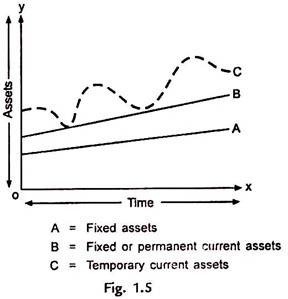

For this purpose of analysis, the current assets to be financed into following two classes:

(i) Those which are required in a certain amount for a given level of operations and hence, do not vary overtime.

(ii) Those which fluctuate overtime.

This approach suggests that long-term funds should be used to finance the fixed portion of current assets requirement as spelt out in above (i) class, in a manner similar to the financing of fixed assets.

The purely temporary requirements that is the seasonal variations over and above the permanent financing needs should be appropriately financed with short-term funds i.e., current liabilities.

This approach therefore divides the requirements to total funds into permanent and seasonal components, each being financial by a different service.

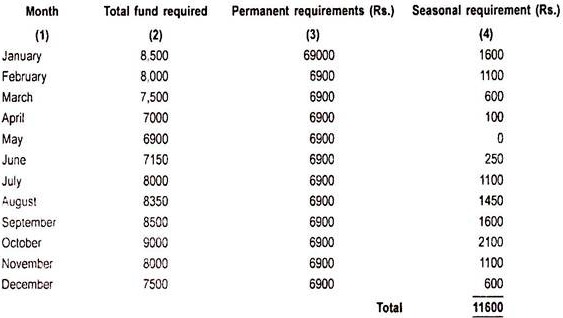

Example 5:

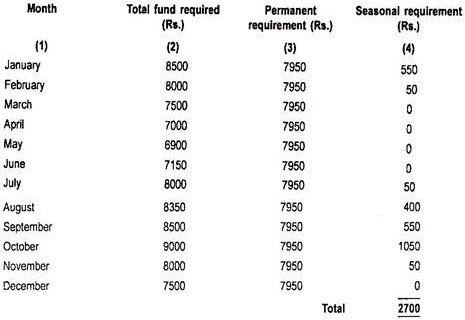

Estimated total fund requirement of ABC Ltd.

In the above e.g., total fund requirement in Rs. is given in col (2). Permanent fund requirement in Rs.in col (3) which should be financed with long-term funds and the seasonal portion in Rs.is given in col (4). which should be financed with short-term funds i.e., current liabilities.

Means current assets would be equal to the short-term financing available i.e., current liabilities.

Note:

There would be no Net working capital (NWC).

Note:

i. A and B are financed by long-term financing.

ii. C are financed by short-term financing,

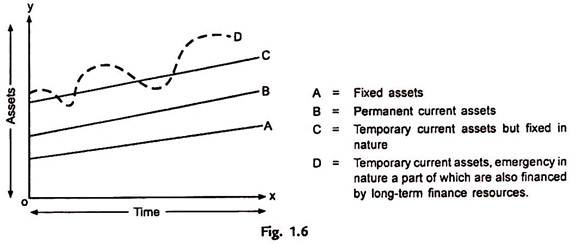

2. Conservative Approach:

This approach suggests that the estimated requirement by total funds should be met from long-term sources, the use of short-term funds should be restricted to only emergency situation or when there is an unexpected outflow of funds. In other words, under this approach a firm finances its permanent assets and also a part of temporary current assets with long-term financing. If relies heavily on long-term financing and is less risky so far as solvency is concerned, however the funds may be invested in such investment which fetch small returns to build up liquidity. Thus deviously affecting profitability.

Aggressive Approach:

The firm uses more short-term financing than is justified in this approach. The firm finances a part of its permanent current assets with short-term financing. This is more risky but may add to the return on assets.

Comparison of Hedging Approach with Conservative Approach:

The comparison of these two approaches can be done on the basis of following two attributes:

(a) Cost consideration

(b) Risk consideration

(a) Cost Consideration:

The cost of these financing plans has a bearing on the profitability of the enterprise. If in the previous example, the cost of short-term funds and long-term funds be 3% and 8% respectively.

Then,

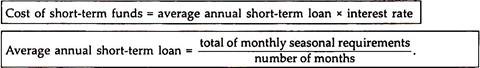

Cost of financing under hedging plan can be estimated as:

(i) Cost of Short-Term Funds:

The cost of short-term funds is equal to average annual short- term loan × interest rate.

Average annual short-term loan = 11,600/12 = Rs.966.66

Short-term cost = 966.67 × 0.03 = Rs.29

(ii) Cost of Long-Term Funds:

It is equal to average annual long-term funds requirements × annual interest rate

= 6,900 × 0.08 = Rs.552

(iii) Total cost under hedging plan = total of (i) + (ii)

= 29 + 552 = Rs.581

Conservative Plan:

The cost of financing under the conservative plan is equal to the cost of long-term funds that is annual average loan multiplied by long-term rate of interest

= 900 × 0.08 = Rs.720

Thus, the cost of financing under the conservative plan is Rs.720, which is higher than the cost using the hedging approach i.e., Rs.581.

Note:

The conservative plan for financing is more expensive because the available funds are not fully utilised during certain period. Moreover, interest has to be paid for funds which are not actually needed.

(b) Risk Consideration:

Hedging Approach:

The hedging approach is more risky in comparison to the conservative approach.

There are two reasons for this:

(i) There is an already observed, no NWC with hedging approach because no long-term funds are used to finance short-term seasonal needs that is current assets are just equal to current liabilities.

(ii) The hedging plan is risky because it involves at most full utilization of the capacity to use short-term funds and in emergency situations it may be difficult to satisfy the short-term needs.

Conservative Approach:

With the conservative approach in contrast the company does not use any of its short-term borrowings. Therefore, the firm has sufficient short-term borrowing capacity and avoids technical insolvency.

Note:

i. Hedging approach is a high profit, low cost—high risk, no NWC approach to determine an appropriate financing mix.

ii. Conservative approach is low profit, high cost—low risk, high NWC approach.

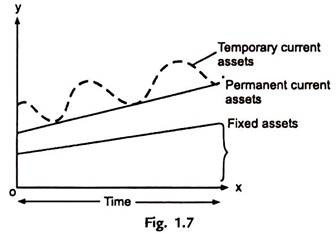

3. Trade-Off between Hedging and Conservative Approaches:

Hedging approach is associated with high profit as well as high risk while the conservative approach provides low profit and low risk. Obviously, neither approach by itself would serve the purpose of efficient working capital management.

A trade-off between two extremes would give an acceptable financing strategy and provides a financing plan that lies between these two extremes.

The exact trade-off between risk and profitability will differ from case to case depending on risk perception of the decision makers.

One possible trade-off could be assumed to be equal to the average of the minimum and maximum monthly requirements of funds during a given period of time. This level of requirement of funds may be financed through long-term services and for any additional financing need, short-term funds may be used.

Trade-off between hedging and conservative approaches in ABC Ltd.

Maximum fund requirement = 9000 in October

Minimum funds requirement = 6900 in May

Average = 9000 + 6900/2 = Rs.7950

In other words the company should use Rs.7950 each month in the form of long-term funds and raise additional funds, if needed, through short-term resources i.e., current liabilities.

The above table reveals that:

(i) No short-term funds are required during 5 months i.e., March, April, May, June and

December because long-term funds available exceed the total requirements for funds.

(ii) In the remaining 7 months the company will have to use short-term funds amounting to Rs.2700.

Cost of financing plan under trade-off approach:

(i) Cost of short-term funds = average annual short-term funds required × rate of short-term interim

= 2700/12 × 0.03 = Rs.6.75

(ii) Cost of long-term funds = 7950 × 0.08

= Rs.636.

(iii) Total cost of trade-off plan = Rs.6.67 + Rs.636

= Rs.642.75

Risk consideration = 7950 – 6900 = Rs.1050

Means NWC under this plan would be Rs.1050.